Global Flight Simulator Market Size, Share, Trends & Growth Forecast Report By Platform, Solution, Type & Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) - Industry Analysis on (2025 to 2033)

Global Flight Simulator Market Size

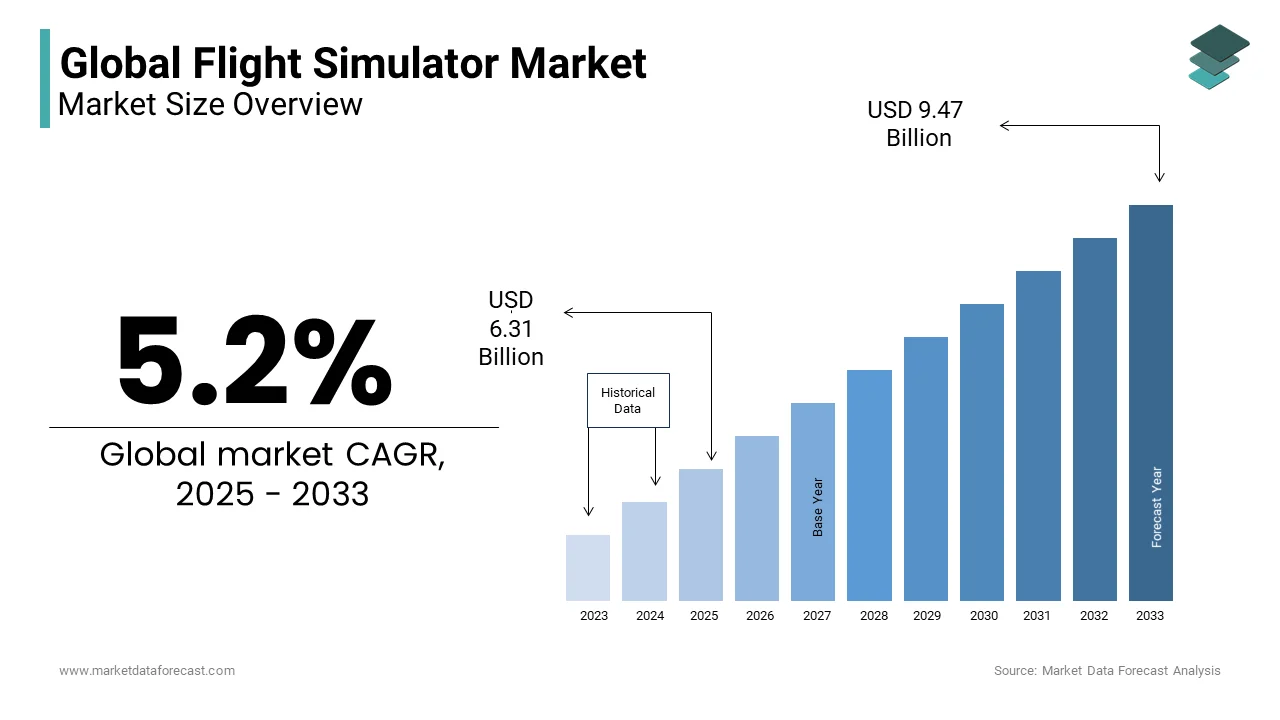

The global flight simulator market size was valued at USD 6 billion in 2024. The flight simulator market Size is expected to have 5.2 % CAGR from 2025 to 2033 and be worth USD 9.47 billion by 2033 from USD 6.31 billion in 2025.

The Flight Simulator market is being shaped by key technological advancements and the increasing reliance on simulation for both training and entertainment. Flight simulators play a vital role in aviation safety, with over 80% of flight training for professional pilots conducted on simulators, according to the International Civil Aviation Organization (ICAO). This has allowed for more efficient training, significantly reducing the number of in-flight accidents. Notably, pilots using simulators have been shown to improve emergency response times and decision-making, a crucial factor in reducing aviation risks. In the realm of consumer entertainment, flight simulation technologies contribute to enhancing gaming experiences. For instance, over 50% of gamers report a preference for immersive, realistic simulation games, often supported by advanced motion-capture technology and VR integration, which improves spatial awareness and user interaction. Furthermore, research indicates that simulated flight training is five times more cost-effective than traditional training, emphasizing the growing importance of simulators in both commercial and private aviation training.

MARKET DRIVERS

Advancements in Virtual Reality (VR) and Augmented Reality (AR)

Integrating VR and AR technologies into flight simulators is revolutionizing the training experience. These immersive technologies provide pilots with a more lifelike, interactive environment, enhancing both procedural training and emergency response drills. Studies show that VR training can improve retention rates by up to 75% compared to traditional methods. As of 2024, 43% of aviation training centers have incorporated VR into their programs, demonstrating its growing impact. The ability to simulate real-world scenarios without risk of injury or equipment damage drives adoption, offering more efficient and cost-effective training solutions.

Cost-Effective Pilot Training

Flight simulators provide significant cost savings compared to traditional flight training. Simulated flight hours are substantially cheaper—often up to 90% less than actual flight time. This is especially crucial for airlines and flight schools facing rising operational costs. For instance, using simulators for 80% of training can reduce fuel costs, aircraft wear and tear, and insurance expenses. With the global aviation industry facing a pilot shortage, simulators are increasingly seen as an effective way to rapidly and affordably train new pilots, ensuring the industry can meet growing demand while maintaining safety and efficiency.

MARKET RESTRAINTS

High Initial Setup and Maintenance Costs

One of the major restraints in the flight simulator market is the high initial setup cost and ongoing maintenance expenses. Advanced flight simulators, especially full-motion systems, can cost anywhere between $1 million and $15 million, depending on the complexity and realism. Additionally, simulators require frequent updates and maintenance to ensure they accurately represent current aircraft models and flight conditions. For example, simulator maintenance costs can range from $100,000 to $300,000 annually. These high costs can be a significant barrier for smaller flight schools and regional airlines, limiting their ability to invest in advanced simulation technology.

Limited Realism in Simulations

Despite advancements in technology, flight simulators still face challenges in achieving complete realism, particularly in replicating real-world flight conditions such as weather, turbulence, or pilot stress responses. While simulated scenarios can mimic emergency situations, they cannot fully replicate the complex physiological and psychological factors that a pilot experiences in actual flight. According to industry experts, 30-40% of pilots report that simulators do not effectively train them for real-world psychological pressures, which can lead to discrepancies in emergency decision-making. This limitation hinders the full acceptance of simulators as a complete replacement for live flight training in some aviation sectors.

MARKET OPPORTUNITIES

Growth in Commercial Pilot Training Demand

The global pilot shortage is a significant opportunity for the flight simulator market. The International Air Transport Association (IATA) projects that the aviation industry will need to train over 550,000 new pilots by 2035, driven by fleet expansion and retirements. Flight simulators are crucial in addressing this demand by enabling cost-effective, high-volume training. With flight simulators capable of reducing the need for expensive live flight hours by up to 80%, the growing reliance on simulation technology offers a scalable solution for airlines and flight schools to meet training targets and maintain flight safety standards.

Expansion in Military and Defense Simulations

The use of flight simulators in military and defense sectors continues to rise. The U.S. Department of Defense (DoD) allocated approximately $4 billion to flight simulation technology in 2022, reflecting its importance in training and mission rehearsal. Simulators enable military personnel to safely practice complex scenarios without the risks associated with live operations. Additionally, the integration of AI and machine learning is enhancing the realism of simulations, creating new opportunities for advanced training solutions, particularly in high-stakes defense environments. This trend is expected to grow as militaries globally seek cost-effective alternatives to traditional flight training.

MARKET CHALLENGES

Technological Complexity and Integration Challenges

As flight simulators become increasingly advanced, integrating new technologies such as virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) poses a significant challenge. These technologies require constant updates to hardware and software to ensure compatibility and accuracy. The complexity of maintaining such sophisticated systems can lead to operational disruptions. For instance, 45% of simulator operators report issues with system integration, particularly when upgrading older models to incorporate the latest technological advancements. This presents both a technical and financial barrier for organizations looking to remain competitive and provide high-quality training experiences.

Regulatory and Certification Hurdles

Achieving regulatory approval for flight simulators is a lengthy and complicated process, particularly for high-fidelity systems used in pilot training. Organizations must comply with strict aviation regulations set by bodies like the Federal Aviation Administration (FAA) or the European Union Aviation Safety Agency (EASA). For example, simulators used in commercial pilot training require Level D certification, the highest level, which mandates rigorous testing to ensure the simulator’s accuracy. This process can take years and requires significant investment in both time and resources. Delays in certification may hinder market entry for new players or innovations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.2% |

|

Segments Covered |

By Platform, Solution, Type, And Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Collins Aerospace (US), Flight Safety International (US), L-3 Communications (US), CAE (Canada), Boeing Company (US), SIMCOM Aviation Training (US), Frasca International (US), TRU Simulation + Training (US), Raytheon Company (US), Precision Flight Controls (US), and Others. |

SEGMENTAL ANALYSIS

By Platform Insights

The narrow-body aircraft segment led the market by capturing 40.4% of the global market share in 2024. These simulators are designed to replicate the flight dynamics and cockpit configurations of single-aisle aircraft, which are predominant in short- to medium-haul commercial flights. Aircraft like the Boeing 737 and Airbus A320, extensively used worldwide, drive the demand for narrow-body simulators, which are critical for pilot training and operational efficiency. Their dominance is attributed to the large fleet of narrow-body aircraft in operation, which accounts for a significant portion of global passenger air travel. The narrow-body aircraft segment is essential for maintaining safety standards in commercial aviation, with regular training needed for pilots to adapt to various flight conditions and scenarios.

The UAV simulator segment is expected to experience rapid growth and is predicted to witness a CAGR of 8% over the forecast period. The growth of the UAV simulator segment is primarily driven by an expanding global interest in drone technology and unmanned systems. This UAV simulator is increasingly used to train operators of drones, which are employed in various sectors such as defense, agriculture, and logistics. Their importance is amplified by the rise of autonomous systems and the need for effective, cost-efficient training to ensure safe operation in complex environments. With increasing investment in UAV applications and the growing number of UAV missions worldwide, this segment is projected to expand rapidly.

By Solution Insights

In 2024, the hardware segment dominated the flight simulator market. This dominance is primarily driven by the growing demand for Full Flight Simulators (FFS) and Flight Training Devices (FTD), which are essential for realistic pilot training. The aviation industry heavily relies on advanced simulators to replicate emergency situations and various flight conditions, making products a critical component of pilot training programs across commercial, military, and civilian sectors.

The services segment includes maintenance, training, software upgrades and hardware services and is the fastest-growing segment in the flight simulator market. This growth is driven by the increasing demand for continuous simulator support, customization, and upgrades to keep pace with new technologies and evolving aviation standards. The expansion of the services segment is further driven by the increasing need for tailored training solutions and system maintenance to ensure the optimal performance of flight simulators.

By Type Insights

The full flight simulators (FFS) segment captured 40.8% of the global market share in 2024. Full Flight Simulators are the most advanced type of flight simulator, providing high-fidelity, fully immersive training environments that replicate the flight experience with precise motion and visual systems. They are critical for commercial and military pilot training, offering the most accurate representation of an aircraft's behavior under various conditions. Due to their importance in ensuring pilot safety and proficiency, especially for complex scenarios like emergency landings and system failures, FFS systems are in high demand by both airline operators and military institutions worldwide.

The virtual flight training segment is predicted to be the fastest-growing segment in the global market and is estimated to exhibit the fastest CAGR of 8.22% over the forecast period. Virtual flight training leverages technologies such as virtual reality (VR) and augmented reality (AR), which are becoming increasingly important for providing cost-effective, scalable, and immersive training experiences. This segment is expanding rapidly due to the growing adoption of VR and AR technologies in aviation training, which allow for greater flexibility in training scenarios and improved accessibility. Virtual flight training can significantly reduce costs associated with traditional flight simulators and live flight training, making it an attractive solution for pilot schools and airlines.

REGIONAL ANALYSIS

North America remains the dominant region in the global flight simulator market and held 40.7% of the global market share in 2024. The United States, in particular, drives much of this growth due to its extensive aviation industry, comprising both commercial aviation giants like Boeing and major defense contractors like Lockheed Martin. The U.S. also leads in military aviation, with the Department of Defense investing heavily in advanced flight simulators for pilot training and defense readiness. Moreover, regulatory bodies such as the Federal Aviation Administration (FAA) strongly support the use of flight simulators in commercial and military training programs to enhance safety and reduce operational costs. The growth of the North American market is also driven by technological advancements in simulation software, the expansion of training facilities, and rising investments in new aviation technologies. The U.S. Navy and Air Force's reliance on flight simulators for training complex missions further contributes to market demand. Additionally, the growing focus on enhancing pilot safety through simulation, especially for handling emergency scenarios and extreme weather conditions, ensures a steady growth trajectory. Key players in the region include Boeing, CAE Inc., and FlightSafety International, who continuously innovate to maintain their leadership position in the market.

On 02 May 2024, Sim-U-Tech signed an agreement to purchase Avion A320 Full flight simulators at WATS (World Aviation Training Summit). Texas-based training organization is set to acquire a full flight simulator from Avion that enables the company to create a milestone mark toward global expansion. This flight simulator emerged with the most advanced technologies that emit very low carbon emissions, which is a predominant factor for the global expansion of the full flight simulator. The companies are optimized to deliver world-class training sessions for the new pilots with high efficiency.

The Asia-Pacific region is witnessing the fastest growth in the flight simulator market. This growth is driven primarily by the rapid expansion of aviation industries in countries like China, India, Japan, and Australia, as well as significant government investments in air travel infrastructure. China, the world’s second-largest aviation market, is rapidly modernizing its civil aviation fleet, which is creating a significant demand for flight training simulators. The country’s large-scale aviation initiatives, such as the development of new airports and airlines, are fueling the demand for both commercial and military flight simulators. Additionally, the growing emphasis on pilot safety and the need for cost-effective training solutions are further promoting the adoption of simulators. India is also emerging as a major growth market due to increasing air traffic and the establishment of new flight schools and training centers. The region’s aviation market is projected to see continued expansion, with Asia-Pacific potentially surpassing North America in market share by the end of the forecast period. Key players in the region, such as Thales Group and L-3 Communications, are capitalizing on this growth by forming strategic partnerships with local training institutions and investing in advanced simulation technologies.

In 2024, Simaero gained EASA certification for Changsha-based A320 full flight simulator in China. China Simulation Sciences (CSS) and Simaero collaborated together to launch innovative local aviation training with the full flight simulator, which received certification. This is the first in Hunan province to receive the certification from EASA, which eventually met the standards in aviation industries.

The aviation industry in China specializes in launching innovative applications with the most advanced technology, which is ascribed to boost the growth rate of the market. India's flight simulator is gaining huge traction in terms of market growth during the forecast period. The increasing support from government organizations through investments in the aviation industry subsequently elevates the growth rate of the market.

Europe holds a significant share of the global flight simulator market. The region is characterized by a strong presence of established aviation manufacturers, such as Airbus and Dassault, which are major drivers of demand for advanced flight simulators. Countries like Germany, France, and the UK are leaders in the market, particularly in military and defense applications. The European Union has also been supportive of simulation technologies, especially for training commercial pilots, in line with its focus on improving aviation safety. The region’s market is projected to grow at a CAGR of 6.5% through 2030, driven by the increasing use of flight simulators for commercial and military pilot training, as well as the development of new technologies like virtual reality and augmented reality that enhance training realism. Military spending, especially in nations like Germany and France, continues to contribute to this growth, with significant investments in advanced training simulators for combat aircraft and UAVs (Unmanned Aerial Vehicles). Furthermore, Europe’s aviation market benefits from a high level of collaboration between commercial flight schools, military institutions, and simulator manufacturers. CAE and Indra Sistemas are key players in the region, contributing to the development of new flight simulation platforms. With growing air travel and increasing demand for pilot training across Europe, the region is expected to maintain steady growth.

In 2024, AirBus Helicopters gave the contract to the Thales to support German armed forces with 8 Full Flight Simulators Reality H. These flight simulators train H145M helicopter pilots along with the preparations for the missions. The largest European helicopter training center, Buckeburg International Helicopter Training Centre, shall provide full support for an initial three years with a dedicated team that helps pilots seek the highest level of realism and flexibility in FFS solutions.

Latin America represents a smaller segment of the global flight simulator market. However, the region is experiencing steady growth, driven by the expansion of aviation infrastructure and increasing air traffic in countries like Brazil, Mexico, and Argentina. Brazil, with its growing aviation sector and established aircraft manufacturers like Embraer, is a key player in the region, leading the adoption of advanced training simulators. As Latin American airlines and military forces modernize their fleets, there is an increasing need for cost-effective flight training solutions, which flight simulators provide. Additionally, Latin America is benefiting from international collaborations with flight training institutions and simulator manufacturers, particularly in Brazil and Mexico, to enhance pilot training programs. The rise of virtual flight training and the adoption of UAV simulators in military applications are also contributing to the region's growth. FlightSafety International and Thales are actively involved in the Latin American market, expanding their presence in the region through local partnerships and training solutions.

In 2024, Airbus Chile Training Centre (ACTC) welcomed its second A320 full-flight simulator with advanced training equipment. The ACTC was inaugurated in 2021 and has trained more than 100 pilots from Chilean carriers, such as LATAM Airlines, SKY JetSMART, and others.

The Middle East & Africa region holds a smaller share of in the global flight simulator market, but it is showing a steady increase in adoption. The demand for flight simulators in the Middle East is largely driven by the defense sector, with countries like the United Arab Emirates (UAE), Saudi Arabia, and Israel investing heavily in advanced military simulators. These simulators are essential for training pilots and military personnel for complex combat and reconnaissance missions. In addition, the region’s aviation industry, particularly in the UAE, Saudi Arabia, and Qatar, is expanding rapidly. Major airline companies such as Emirates, Qatar Airways, and Etihad Airways are modernizing their fleets and focusing on improving pilot training, further contributing to the demand for flight simulators. The region’s strategic position as a global air travel hub also promotes the use of simulators for airline training programs. The Middle East has seen an increasing trend toward virtual flight training and UAV simulation, making it an attractive market for simulator providers. Moreover, the establishment of specialized flight training centers and partnerships between simulator manufacturers and airlines is driving the market's growth. Companies such as CAE, FlightSafety International, and Thales are prominent in the Middle East, capitalizing on these growing trends.

KEY MARKET PLAYERS

Companies playing a prominent role in the global flight simulator market include Collins Aerospace (US), Flight Safety International (US), L-3 Communications (US), CAE (Canada), Boeing Company (US), SIMCOM Aviation Training (US), Frasca International (US), TRU Simulation + Training (US), Raytheon Company (US) and Precision Flight Controls (US).

The global flight simulator market is highly competitive, with several leading players vying for market share across both commercial and military aviation sectors. Competition is driven by technological advancements, such as the integration of virtual reality (VR) and augmented reality (AR) into flight simulation systems, as well as increasing demand for realistic and cost-effective training solutions. The market is characterized by significant investment in research and development (R&D) by key players like CAE Inc., FlightSafety International, Thales Group, and L3Harris Technologies, who focus on enhancing simulator fidelity, creating more immersive training environments, and expanding their product offerings.

Market leaders are also differentiating themselves by providing comprehensive services, including simulator maintenance, software upgrades, and hardware solutions. Companies like Frasca International and Collins Aerospace have gained prominence by offering modular training systems, allowing for scalable solutions that cater to both small and large aviation operations. Additionally, military contracts and government funding play a critical role in the competition, with defense-focused players like Saab AB and Indra Sistemas securing long-term contracts for advanced military flight simulators.

Strategic partnerships and acquisitions are also a key competitive strategy. As the aviation sector grows in regions like Asia-Pacific and Latin America, companies are increasingly focusing on regional expansion through local collaborations. This competition is expected to intensify as demand for flight simulators rises in emerging markets and new technological innovations continue to shape the industry.

RECENT MARKET HAPPENINGS

- In 2024, Collins Aerospace announced its new release of the Arcus training image generator that elevates the best training programs for the aircrew. The image generator is a combination of Collin’s advanced rendering and processing tools that deliver highly modular Training to pilots. It is generated by gaming technology that provides a realistic, complex synthetic environment.

- In 2024, Flight Safety International, Ohio Learning Centre, and TRU Simulation + Training Inc. jointly built a third Cessna Citation Longitude Full Flight simulator (FFS) that forwards realistic training experience for pilots. These two companies are committed to delivering strong and excellent innovative flight simulations with advanced technology that empowers new pilots to reach the skies confidently.

- In 2024, Akasa Air and CAE signed an agreement for Boeing 737MAX pilot training in India. For the next 15 years, CAE is going to deliver training facilities, instructors, and full-flight simulators.

- In 2024, TRU Simulation + Training unveiled the cutting-edge VERIS VR Flight Simulator to train pilots. This new flight simulator is an innovative solution to promote cost-effective training solutions for pilots. The Veris Simulator was unveiled in HAI Heli-Expo and was designed with the innovative feature of a full-flight simulator. The company also announced that soon the Bell Training Academy (BTA) will be using this simulator later this year.

- February 2024, CAE Inc., a global leader in simulation technologies, acquired TRU Simulation + Training from Textron. This acquisition is expected to expand CAE’s product portfolio, particularly in commercial aviation and military sectors, and enhance its position as a provider of integrated training solutions, including advanced flight simulators.

- January 2024, Frasca International entered into a partnership with Western Michigan University to provide customized flight training devices. This collaboration is expected to strengthen Frasca’s market presence in educational institutions and enhance its reputation for offering affordable, high-quality simulators for pilot training.

MARKET SEGMENTATION

This research report on the global global flight simulator market has been segmented and sub-segmented based on platform, solution, type, and region.

By Platform

- Commercial Aircraft Simulator

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Aircraft

- Regional Transport Aircraft

- Military Aircraft Simulator

- Combat Aircraft

- Transport/Tanker Aircraft

- Training Aircraft

- Special Mission Aircraft

- Helicopter Simulator

- Unmanned Aerial Vehicles (UAVs) Simulator

By Solution

- Products

- Hardware

- Software

- Services

- Hardware Upgrade

- Software Upgrade

By Type

- Flight Simulators

- Full Flight Simulators

- Flight Training Devices

- Flight Mission Simulators

- Fixed Base Simulators

- Flight Simulator Training

- Line Flight Training

- Virtual Flight Training

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

How big is the global flight simulator market?

The global flight simulator market is expected to be as big as the USD 9.47 billion market by 2033.

What is the region growing at the fastest CAGR in the global flight simulator market?

Geographically, the Asia-Pacific regional segment is estimated to grow at the fastest CAGR in the worldwide market over the forecast period.

Which segment by platform is leading the flight simulator market?

The commercial aircraft simulator segment is dominating the flight simulator market currently.

Who are the major players in the flight simulator market?

Collins Aerospace (US), Flight Safety International (US), L-3 Communications (US), CAE (Canada), Boeing Company (US), SIMCOM Aviation Training (US), Frasca International (US), TRU Simulation + Training (US), Raytheon Company(US), Precision Flight Controls (US) are some of the notable companies in the global flight simulator market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]