Global Fish Processing Market Size, Share, Trends, & Growth Forecast Report - Segmented By Fish Processing Category (Frozen, Preserved And Others), Application (Food, Non-Food), Source (Marine And Inland), Species (Fish, Crustaceans, Mollusks And Others), Equipment (Slaughtering, Gutting, Scaling, Filleting, Deboning, Skinning, Smoking And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2024 To 2032

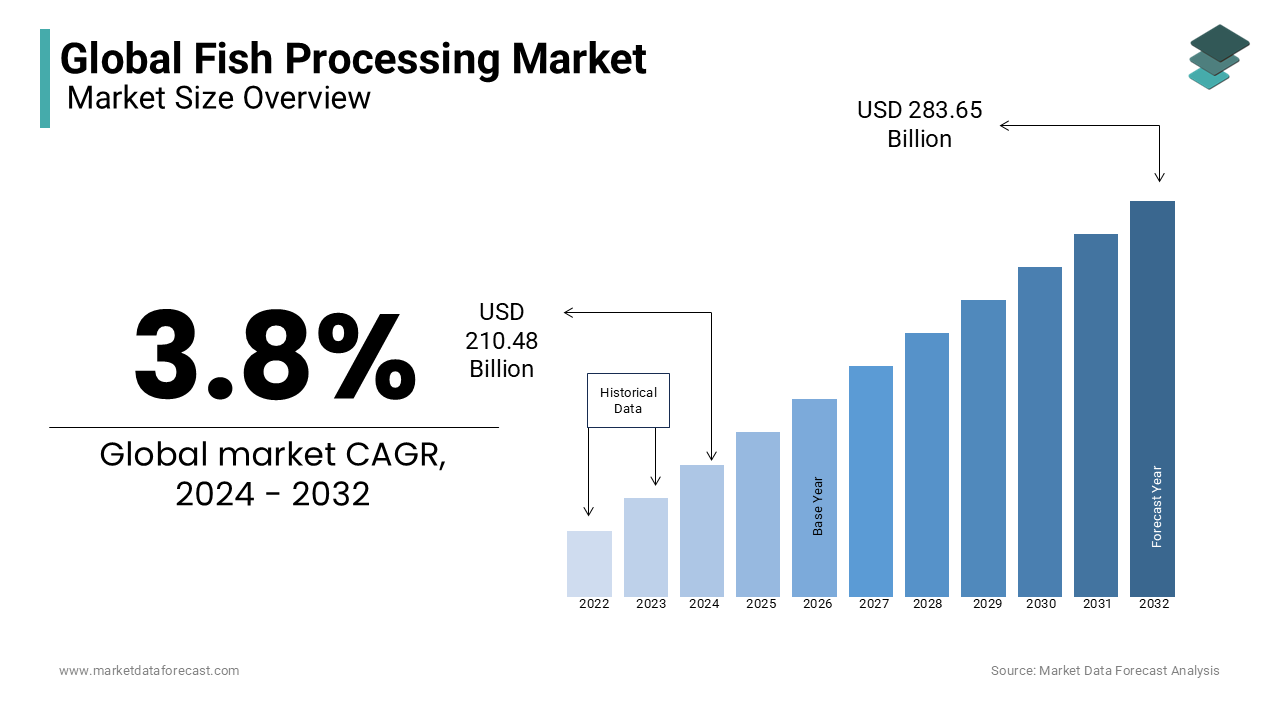

Global Fish Processing Market Size (2024 to 2032)

The fish processing market size is estimated to be USD 210.48 billion in 2024 and is expected to progress and get a valuation of USD 283.65 billion by 2032 at a CAGR of 3.8 per cent during the forecast period.

Fish processing is widely used for conserving and maintaining freshness for a long time with minimal loss of taste, flavor, aroma, and nutritional value. And, practices related to fish and fishery products are called fish processing. It begins with the fish capturing and continues until the final product reaches the consumer. This includes all the aquatic organisms that are processed. We know fish is a highly perishable food, so proper preservation is needed to extend shelf life and maintain nutritional quality. Some dried fish, such as shrimp, octopus, dried oysters, etc., are becoming popular.

Current Scenario of the Global Fish Processing Market

The fish processing market has been experiencing an elevated growth trajectory since COVID-19 due to growing awareness of its high nutritional values and rising aquaculture industry. In the field of fish processing, swiftness is an important element. In addition, the increase in disposable income increases the purchasing power of the consumer. Moreover, rapid urbanization, population growth and health awareness are elevating the growth of the fish processing market.

However, the rise in inflation had a major effect on the costs of food, especially of fish resulting in their prices to grow by over 10 percent from 2021 to 2022. This inflation caused a considerable reduction in back-home fish consumption, which witnessed a quality decline of almost 17 percent, as per a study. The value of the European Union’s exports surged by 19 percent, reaching 8.1 billion euros. However, its number continued the decreasing tendency in 2021 and reduced by 5 per cent to 2 to 3 million tons.

MARKET DRIVERS

The increasing consumer awareness of the nutritional value and health consciousness among the public, and the growth of the aquaculture industry are driving the expansion of the fish processing market.

The growing health problems and the aquaculture industry are contributing to the demand of the non-food processing application market worldwide. So, the meal habits of both urban and rural populations are changing, as per the NSSO data. The expense of fish is growing more rapidly than the expenditure on other food products. According to the NCAER family survey in 24 states and union territories, it was found that the cognizance level of the high-quality protein present in fish is around 55 percent concerning categories. The states like Rajasthan, at 41.94 percent, Telangana, at 41.36 percent, Andhra Pradesh, at 39.9 percent, and Chhattisgarh, at 23.94 percent have lower awareness of providing opportunities for the players. Therefore, the rising consciousness regarding fish-related health and well-being is anticipated to have a positive effect on its consumption in the future.

The introduction of modern technology and the changing dynamics of fishing vessels are expected to strengthen the global market in the future. Fish and seafood are sensitive food items that need safe handling. The fisheries sector has only moderately applied automated robots or systems for seafood manufacturing against other industries. But, due to growing problems of the lack of sufficient manpower, rising costs

Likewise, government initiatives for supporting fish breeding and innovative techniques development are further encouraging the fish-handling industry worldwide.

Also, the rising need for fish oil in various industries is another factor that is expected to propel the worldwide fish processing market growth.

The consumption of seafood around the world is experiencing tremendous growth.

The rise of health-conscious consumers, primarily in North America and Europe, is expected to increase demand for fish processing equipment.

The rising preference for safe, fresh, chemical-free, and nutritious is fuelling the growth of the fish processing market.

Customers nowadays expect safety control information at a minimal metal price or work. Their response puts a great emphasis on fish safety examination but their logical reaction needs to convey this value. The individual standard evaluations reveal that people's choices for both farmed and wild fish are considerably positive. Also, they are most probably to refuse frozen fish and be prepared to get cheaper.

The investment in automation technology for the seafood sector is rising due to the annual increase in consumption of fish and related items. And, coupled with the easy availability of processing equipment is also fuelling the expansion of the equipment market.

Apart from this, emerging industries in India, China and Brazil offer potential growth opportunities to elevate the market share. So, these markets in developing countries will be a big support for seafood producers in the coming years. For example, in 2022, the meat e-commerce platform and subscription application made over 3.6 crore deliveries of all item categories in India with more than 68 orders coming in a minute. And, this is three times more than the population of Bangalore.

In addition, the increased demand for shellfish is also influencing the industry's progress. Research released in February 2024 showed the huge quantity of fish hunted from the wild annually between 2000 and 2019 and the shocking big share of these utilized for fishmeal and oil, and that too for animal consumption most of the time. A staggering 1.1 to 2.2 trillion individual wild fish are captured annually worldwide. Also, the increased fish feed has become a major growth driver for the global fish processing market.

MARKET RESTRAINTS

High raw material prices and stringent environmental regulations protecting fish species are expected to impede market growth.

Fish farming was and is still the greatest in terms of business expense for the farmers, and based on the species, it could vary anywhere from 50 to 70 percent of the overall manufacturing cost. This shows that feed continues to be the main priority as per the analysis of all the types of expenditure. And, there has been a consistent increase in the value of fishmeal by almost 30 percent to the last known 1.8 thousand dollars per metric ton from 1.4k per metric ton. To make things simple global events also had a significant impact on animal food. Like, in the short term, the prices have hiked due to these incidents but in the long run, the effects can diminish on the working of the whole fodder industry. Similarly, COVID-19, multiple regional conflicts, wars, and climate change all more or less happened or happening at the same time, which affected the logistics globally.

Moreover, several countries still have very little knowledge about technological development and progress in the food processing industry due to the unavailability of information. Also, most fish processing equipment requires a large capital investment, which is very expensive for small and medium consumers. The high capital spending and power requirement of recirculating aquaculture systems (RAS) are hindering the absorption of fish farming technology in several developing markets. Also, the lack of knowledge and understanding of advanced and complicated systems is the key obstacle to this costly proposition. This makes it difficult for most emerging economies like Africa. Interestingly, RAS is still considered to be in the innovation stage even in the majority of developed nations such as Scotland, the United States and Norway.

The increased consumption of processed fish of a particular species is decreasing its existence, increasing its market price, and resulting in decreased market growth. It is noticed that there has been a decline in fish catching not due to the changing environment or methods but because of a decrease in the availability of bottom-living fish.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.8% |

|

Segments Covered |

By Category, Application, Source, Species, Equipment, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Charoen Pokphand Foods PCL, Maruha Nichiro Corporation, Pescanova S.A., Royal Greenland A/S, and Norway Pelagic ASA. |

SEGMENT ANALYSIS

Global Fish Processing Market Analysis By Fish Processing Category

The frozen segment is leading under this category of the fish processing market and is expected to continue this pattern in the forecast period. Moreover, Japan consumes the highest number of fishes annually. On average 58.68 kilos of fish per person per year is eaten. And, second on the list is Spain with both frozen and canned.

Global Fish Processing Market Analysis By Application

The food segment holds the majority shares of the fish processing market. Around the world, fish is popularly consumed as a food. There are many fish categories which are eaten as food globally. Apart from this, the expenditure on fishery and aquaculture items in 2022 by families in the European Union increased by 11 per cent than in 2021.

Global Fish Processing Market Analysis By Source

The marine segment is the dominant subcategory of the fish processing market. This is because of the application of the latest fish breeding methods and access to a broad range of fish. According to the Food and Agriculture Organization of the United States, 112 million tons, or about 63 percent of total output, was sourced from marine waters and 37 percent, or 66 million tons, in inland waters.

Global Fish Processing Market Analysis By Species

The fish segment accounted for the maximum share and is anticipated to drive further throughout the forecast period. Fish consumption has significantly increased after the pandemic. Its health benefits were always there, but the main thing that sparked the demand is the perception among the general public that too much consumption of beef, mutton, and chicken causes health issues. Similarly, the import of seafood by the US was more than its export by 20.3 billion dollars in 2023.

Global Fish Processing Market Analysis By Equipment

The slaughtering segment is a significant contributor to the growing fish processing market. This is attributed to its corrosion-resistant property and is accessible with diverse cut types crafted for different fish categories. As per a 2023 study, the amount of farmed fish slaughtered worldwide had increased sharply to 124 billion in 2029 from 61 billion in 2007.

REGIONAL ANALYSIS

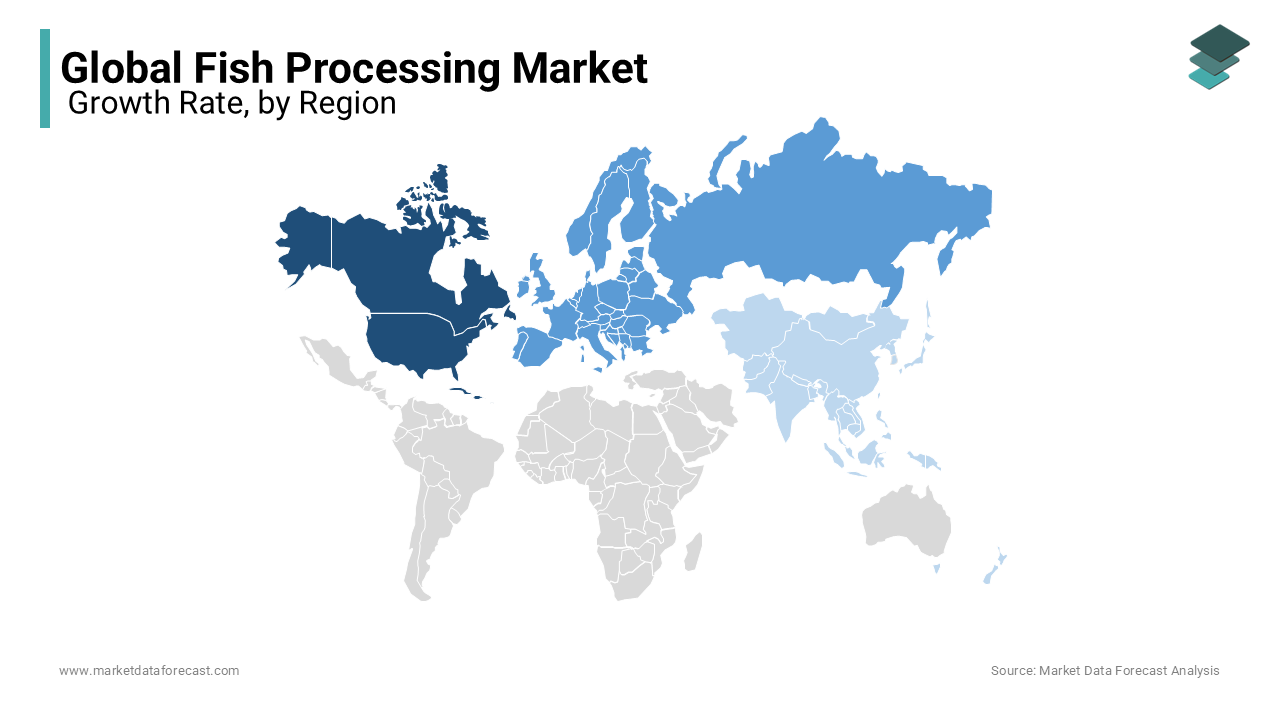

North America, trailed by Asia Pacific and Europe has the highest consumption of processed fish. The United States is the leading nation in the intake of tuna and salmon. Asia Pacific has huge fish processing facilities, with China being the market leader. Other Asian countries such as Japan, Malaysia, and South Korea rely mainly on fish processing. The Asia Pacific market commands the worldwide fish processing market as far as income commitment contrasted with that of different districts. The Asia Pacific market is projected to post comparatively faster growth in terms of revenue over the next 10 years. Changes in people's living standards, along with increased demand for seafood in the countries of the region, are primary factors projected to drive market growth in the region during the forecast period.

Europe is also a prominent region in the worldwide fish processing market. It is accompanied by abundant facilities such as boats, advanced machinery and others that are expected to drive the global fish processing market in the future. In European countries, methods of preserving hot and cold smoked fish are widely used. Importing fish and shrimp varieties from Asian economies will contribute to the growth of the world fish processing market. Portugal is the fastest-growing region in Europe country, with an increasing demand for sardines, turbot, hake, oysters, clams, and cod. Some European countries such as Spain, Portugal, Poland, and Denmark have fishing as their main occupation and, therefore, contribute greatly to GDP growth. They are the main exporters to the countries of North America and Europe.

KEY PLAYERS IN THE GLOBAL FISH PROCESSING MARKET

Companies playing a major role in the global fish processing market include Charoen Pokphand Foods PCL, Maruha Nichiro Corporation, Pescanova S.A., Royal Greenland A/S, and Norway Pelagic ASA.

RECENT HAPPENINGS IN THE MARKET

- In October 2023, Maruha Nichiro Corporation announced the merger of its subsidiaries Maruha Nichiro Retail Service Co., Ltd and Marine Access Corporation.

- In June 2023, Royal Greenland announced that it will construct a new factory for fish in Tasiilaq. It further said that the factory is a crucial step for the development of fish industry as well as generating jobs and business prospects for East Greenland.

- In May 2023, Maruha Nichiro Corporation started a comprehensive alliance with Maruha Nichiro group companies and partner companies in China to manufacture and trade nursing care food menu items in the nation.

DETAILED SEGMENTATION OF THE GLOBAL FISH PROCESSING MARKET INCLUDED IN THIS REPORT

This research report on the global fish processing market has been segmented and sub-segmented based on fish processing category, application, source, species, equipment, and region.

By Fish Processing Category

- Frozen

- Preserved

- Others

By Application

- Food

- Non-food

By Source

- Marine

- Inland

By Species

- Fish

- Crustaceans

- Mollusks

- Others

By Equipment

- Slaughtering

- Gutting

- Scaling

- Filleting

- Deboning

- Skinning

- Smoking

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the main challenges faced in the fish processing industry?

Challenges include maintaining quality and freshness, ensuring food safety standards, managing waste and by-products, complying with regulations, fluctuating market demands, and sustainable fish sourcing.

2. What are the trends driving the fish processing market?

Trends include increased demand for convenience foods, growing consumer awareness of health benefits from seafood consumption, technological advancements in processing equipment, sustainable practices, and innovative product development.

3. How do market trends impact fish processing companies?

Market trends such as changing consumer preferences, globalization of supply chains, price fluctuations of raw materials, and regulatory shifts influence business strategies, product innovation, marketing approaches, and investment decisions in the fish processing industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]