Global Fish Feed Market Size, Share, Trends & Growth Forecast Report – Segmented By Ingredient (Corn, Soybean, Fish Oil, Fish Meal, Additives, Other Ingredients), Additive (Vitamins, Antibiotics, Amino Acids, Antioxidants, Feed Acidifiers, Feed Enzymes, Other Additives), End Users (Fish, Molluscs, Crustaceans, Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis (2024 to 2032)

Global Fish Feed Market Size (2024 to 2032)

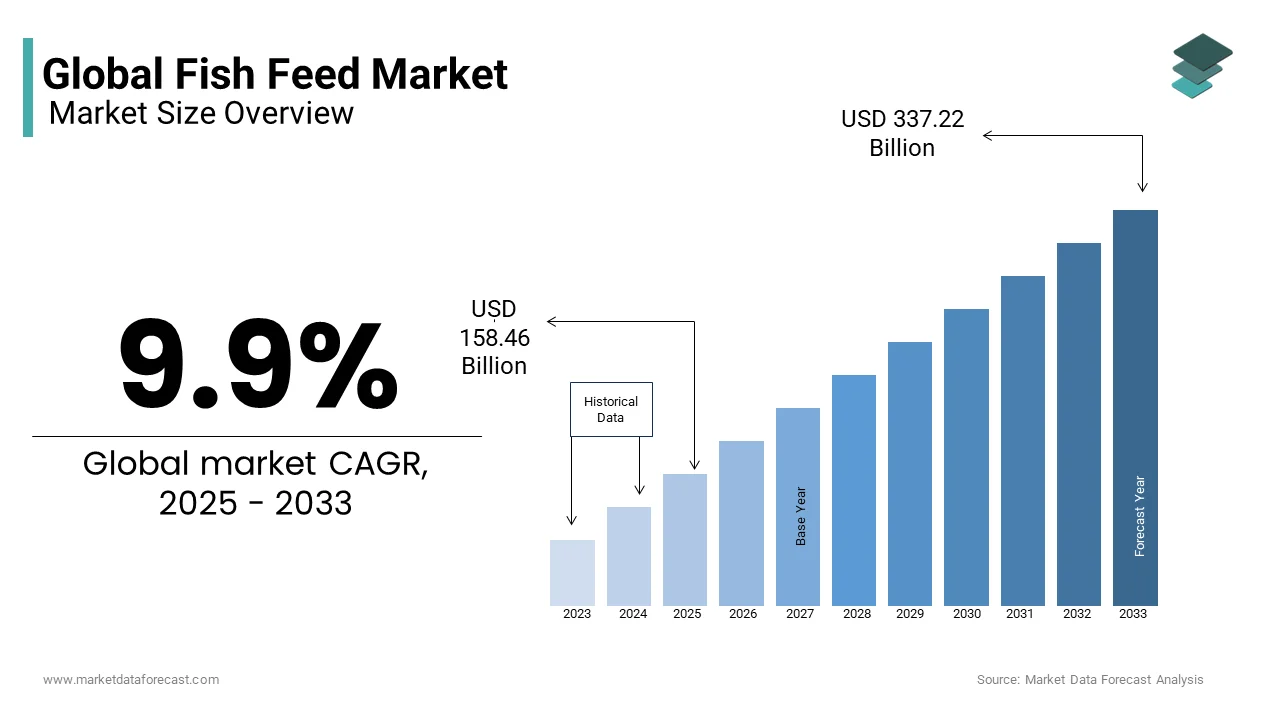

The global fish feed market will be at USD 131.2 billion in 2023, it is expected to reach USD 141.88 billion in 2024 and it is anticipated to reach USD 306.84 billion by 2032, growing at a CAGR of 9.9% from 2024 to 2032.

Current Scenario Of The Global Fish Feed Market

The fish feed market is an essential element in global food security and supply chain, economic development, and employment. As of 2024, the overall worldwide production in aquaculture and fisheries is around 214 million tons. This includes algae (36 million tons) and aquatic animals (178 million tons). Hence, this industry is a major contributor to securing food security around the world. Besides this, it is also a key employment generator for many individuals, expressly or impliedly, and creates greater assets. However, to address the market challenges, the on-ground implementation of conservation and sustainable practices, community engagement and stakeholder partnership, policies and governance, and mitigation and adoption strategies for climate change need to be done.

Region-wise, European aquaculture farming produced close to 1.1 million tons of marine organisms of value 4.8 billion euros in 2022. Over two-thirds of the European Union’s production quality of aquaculture in 2022 was yielded by Italy, France, Greece, and Spain. Combined. The EU aquaculture output is primarily based on finfish mollusks and species. The yield in the region between 2010 and 2022 continued to be stable. But, between 2020 and 2022, the production volume surged because of the spike in prices. Thus, there was around a 75 percent increase in the worth of aquaculture production between 2010 and 2022.

In Asia Pacific, India’s fish cultivation stood at a record 175 lakh tons in season 2022-2. This ranked the nation at the third stop on the largest fish-producing country globally. It covers 8 percent of the world's output, which is approximately 1.09 percent of India’s Gross Value Added (GVA) and more than 6.724 percent of the agricultural GVA. Meanwhile, in North America, Canadian fishers are examining a new sort of salmon feed with algal oil. The objective is to lower dependence on aquatic fish oils.

MARKET DRIVERS

The growing aquaculture production and rising consumption of seafood products worldwide drive the global fish feed market growth.

The driving factors of the global fish feed market are population growth, rising income, and rapid urbanization, and is facilitated by the strong expansion of fish production and more efficient distribution channels. The yield which is obtained from the wild catch cannot be increased sustainably, therefore, in the opinion of observers such as the Food and Agriculture Organization of the United Nations, aquaculture must fill the gap.

Fish feed is among the most crucial elements of aquaculture to offer wholesome nutrition that comprises proteins, vitamins, minerals, fats, and carbohydrates needed for the healthy growth of fish. The rising population and their demand for seafood as a part of dietary requirements are contributing significantly to the fish feed market expansion worldwide. Fish, being a protein-rich food, is in extensive demand from all demographics to balance the daily protein intake. Also, this need for seafood has promoted the aquaculture industry as the levels of wild fish stock are being depleted. In addition, the globalization of the industry increased the exports and imports of seafood, focusing mainly on the quality of the product. Therefore, to meet the quality requirements, more emphasis has been placed on the formulations of fish feed that promote the health of fish. This focus on quality is directly benefiting the fish feed market across the world.

Several governments are offering supportive incentives for aquaculture farmers, which are positively influencing fish cultivation practices.

The recent advances in technology have impacted the sector by introducing new breeding methods, disease identification and control techniques, and water quality management, which is encouraging the production of fish with the highest quality. Adding to this, sustainable practices to decrease environmental impacts have promoted the use of eco-friendly feed formulations, encouraging their adoption in the fish feed market. Moreover, the rising consumer awareness about the benefits of fish consumption coupled with the expanding e-commerce network is supposed to create immense growth opportunities for the fish feed market in the following years.

MARKET RESTRAINTS

The outbreak of diseases that impact the health of fish, along with the uncertain climatic conditions that influence the efficiency of the feed, is a significant restraint to the fish feed market.

Also, the high volatility associated with the prices of raw materials used in the feed ingredients, like soy, grains, etc., is affecting the final product costs for the end users. In addition, the concerns related to the harvest of wild fish for fishmeal and fish oil products are creating more concerns about the sustainability of fish feed. Therefore, several alternative sources are being researched to replace wild fish that are affordable and more effective. Although globalization has opened several new doors, it also brought additional international regulations and compliances for the manufacturing of fish feed. Adding to this, the unexpected events globally are affecting the supply chain and logistics related to the raw materials used in feed production. The technological complexities involved in the making of customized feed according to the variety of seafood also restrain the global fish feed market. Moreover, the intense competition among the local and foreign players is pushing toward more concentration on quality to sustain the business for the long term.

MARKET CHALLENGES

The global fish feed market is facing environmental risks, economic issues, and social problems, which are restricting the growth of the fish feed market.

Overfishing, climate change, and habitat destruction are the ecological challenges the industry is encountering. This has resulted in a drop in fish population and there is even a probability of extinction of some species. All these constraints are throwing a dark light on the market’s future. All the ecological, social, and economic challenges are interrelated. So, a holistic approach is required to solve these. From an environmental point of view, the problem of overfishing comes into view, which has caused a drastic decline in its population because of rising consumption and unsustainable methods. Also, the destruction of habitat is propelled by the development activities in the coastal areas along with industrial fishing activities. This has worsened the issue and disturbed the aquatic ecosystem. Climate change has aggravated these challenges, such as changes in water temperature, fish migration patterns, and ocean acidification. So, it is inflicting heavy damage to both fish inventories and societies and people who are dependent on this industry. In Economic terms, the fish and fisheries industry’s progress is limited by a wide range of obstacles, including unfair access and availability of resources, the growing incidence of illegal, unregulated, and unreported (IUU) fishing, and market instability. The fishers and stakeholders are facing financial volatility due to market fluctuations and changes in customer choices, and at the same time, IUU practices are purely profit-making groups or entities that are reducing the sector’s revenue and surging resource depletion. Moreover, the restricted availability of fishing permission, rights, sources, and assets disproportionately and unreasonably is impacting the small fishers and domestic societies, therefore further extending the economic challenges.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

9.9% |

|

Segments Covered |

By Ingredient, Additive, End-user and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ridley Corporation Limited, Archer Daniels Midland Company, Nutreco N.V., Cargill, Avanti Feeds Limited, Purina Animal Nutrition, Biostadt India Limited, Alltech, Nutriad and Biomar. |

SEGMENTAL ANALYSIS

Global Fish Feed Market Analysis By Ingredient

The plant-based ingredients such as soybean and corn are likely to record the highest demand in the global fish feed market in the forecast period due to the surging demand for alternative sources to wild fish extracts. Soybean products are high in unsaturated fats, proteins, and omega-3 fatty acids that promote fish health. Also, the affordable options of soybeans compared to traditional fishmeal and fish oil products support the expansion of the segment. The spike in consumer awareness towards sustainability and reduced environmental impact is driving the adoption of plant-based ingredients in feed manufacturing.

Global Fish Feed Market Analysis By Additive

The feed enzymes segment is anticipated to register the highest growth rate in the fish feed market in the coming years. These enzymes are pivotal in the healthy growth and sustenance of fish, creating more productivity and profit margins for aquaculture farmers. Similarly, other additives like antioxidants, vitamins, and amino acids are also crucial for the timely development of fish.

Global Fish Feed Market Analysis By End-User

The fish segment recorded the highest share in the market owing to the increasing demand for healthy protein. The Molluscs segment is also expected to witness a considerable growth rate in the foreseen period because of the popularity of foods with oysters and clams in international cuisines.

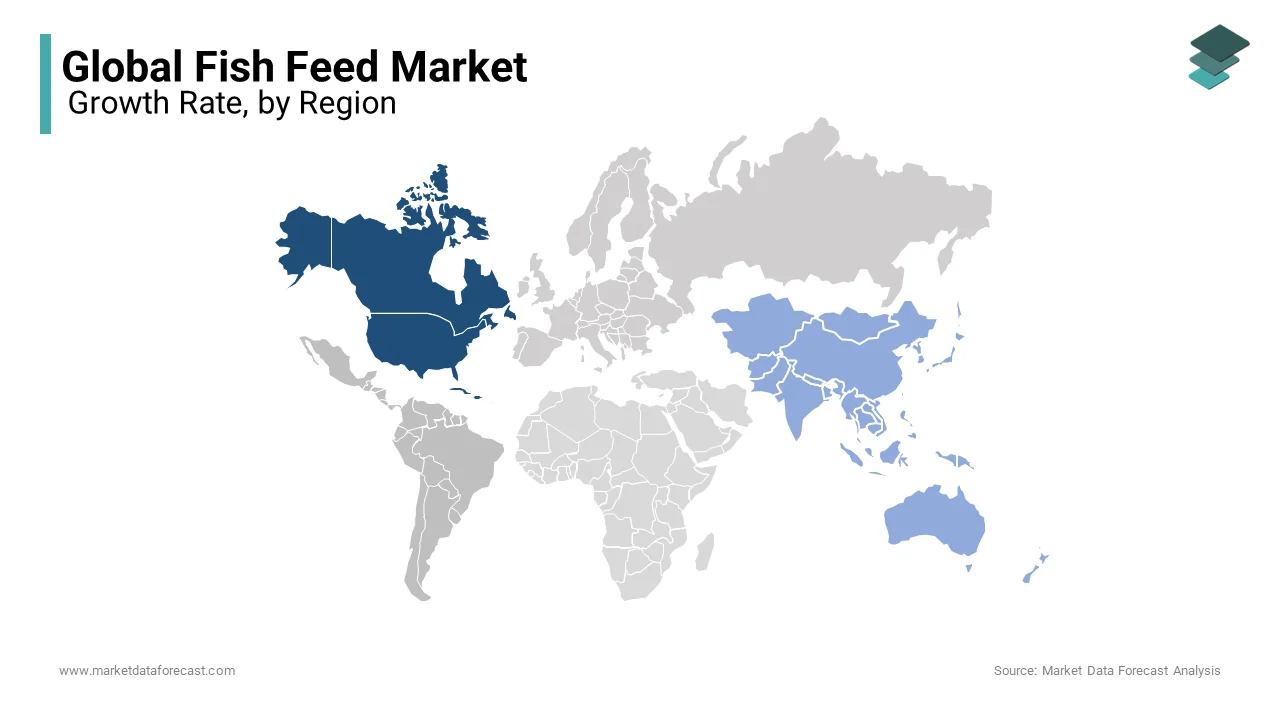

REGIONAL ANALYSIS

North America is predicted to hold the dominant portion of the global fish feed market during the forecast period. The United States is the leading nation in this region because of the extensive coastline and use of fish in daily consumer food intake. The rising urbanization, coupled with the purchasing power of the population, is driving the demand for more seafood, which supports the fish feed business.

The Asia Pacific region is likely to flourish with the highest growth rate in this market, with the increasing emphasis on aquaculture developments in nations like India, China, and Japan. China is among the top nations with the highest volumes in terms of seafood intake and the largest exporter of seafood. These high stats clearly show a positive outlook for the fish feed market in this locale. Similarly, India is another prominent player in the aquaculture industry and the second-largest seafood supplier in the world. The supportive government framework for fish cultivation and immense population growth are supporting the fish feed business in this subcontinent. The recent transitions in terms of fish production with the use of new technologies are touted to create more opportunities for the key players in the market to invest in India. Furthermore, Japan is also an important area in the APAC market that registers high seafood consumption. The surging demand for fish as a part of healthy living and the new government-launched fish farming modernization initiatives are pushing the fish feed market upwards in this nation. Similarly, Australia is also a lucrative market for investments in the fish feed business, with a long coastline and large fish consumption.

Europe is also a prominent player in this market, with the aquaculture industry established in nations like the United Kingdom, Norway, and Spain. Fish is among the most popular protein choices in the European nations, which is a supporting element for the feed business in this region. Besides, the rise in demand for sustainable environmental practices is also benefitting the fish feed market in the European nations.

Latin America with the nations like Brazil and Chile, is a crucial player in the global fish feed market. The government-regulated aquaculture and the increasing need for fish and seafood are driving the business in this locale.

Middle East and Africa are comparatively smaller markets for fish feed. However, there is a huge untapped opportunity as most African countries like Egypt, Nigeria, Congo, and others offer needed resources, climate, and workforce for the fish feed business.

KEY MARKET PLAYERS

Cargill, Inc., Aller Aqua A/S, BioMar Group, Ridley Corporation Ltd, Altech Inc., BASF, Biomin GmbH, Archer Daniel Midland Co., Zeigler Bros Inc., Sonac B.V., Nutreco N.V., Avanti Feeds, AngelYeast Co, Adisseo, Purina Animals Nutrition, Nutriad International, and Biostadt India Limited.

RECENT HAPPENINGS IN THE GLOBAL FISH FEED MARKET

- In 2023, De Heus, a leading animal nutrition company in the Netherlands, started its Can Tho Aqua feed mill in Vietnam to manufacture Pangasius fish feed.

- In 2023, MiAlgae, a biotech company based in Scotland introduced NaturAlgae, an omega-3 feed powder with DHA and other essential oils to offer complete nutrition for fish.

- In 2023, Royal De Heus extended its operations to Uganda and East Africa, providing cost-effective and quality feed solutions to local farmers.

DETAILED SEGMENTATION OF THE GLOBAL FISH FEED MARKET INCLUDED IN THIS REPORT

This research report on the global fish feed market has been segmented and sub-segmented based on ingredient, additive, end-user, and region.

By Ingredient

- Corn

- Soybean

- Fish Oil

- Fish Meal

- Additives

- Others

By Additive

- Vitamins

- Antibiotics

- Amino Acids

- Antioxidants

- Feed Acidifiers

- Feed Enzymes

- Other Additives

By End-User

- Fish

- Salmon Feed

- Carp Feed

- Tilapia Feed

- Catfish Feed

- Mollusks

- Oyster Feed

- Mussel Feed

- Crustaceans

- Crab Feed

- Shrimp Feed

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the global fish feed market?

The global fish feed market was valued at USD 117.55 billion in 2022.

What factors contribute to the growth of the fish feed market?

The growing aquaculture activities, rising demand for seafood, and advancements in feed technology are majorly driving the growth of the global fish feed market.

What challenges does the fish feed market face?

Fluctuating raw material prices, regulatory constraints, and the need for continuous research and development to enhance feed efficiency are some of the major challenges to the growth of the fish feed market.

What is the impact of the COVID-19 pandemic on the fish feed market?

The COVID-19 pandemic initially disrupted supply chains, but the market has shown resilience, with a rebound in demand and increased focus on food security.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]