Global Fire Suppression Equipment And Consumables Market Size, Share, Trends, & Growth Forecast Report - Segmented By Technology (Fire Suppression Equipment, Fire Suppression Consumables), Application, and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

Global Fire Suppression Equipment and Consumables Market Size

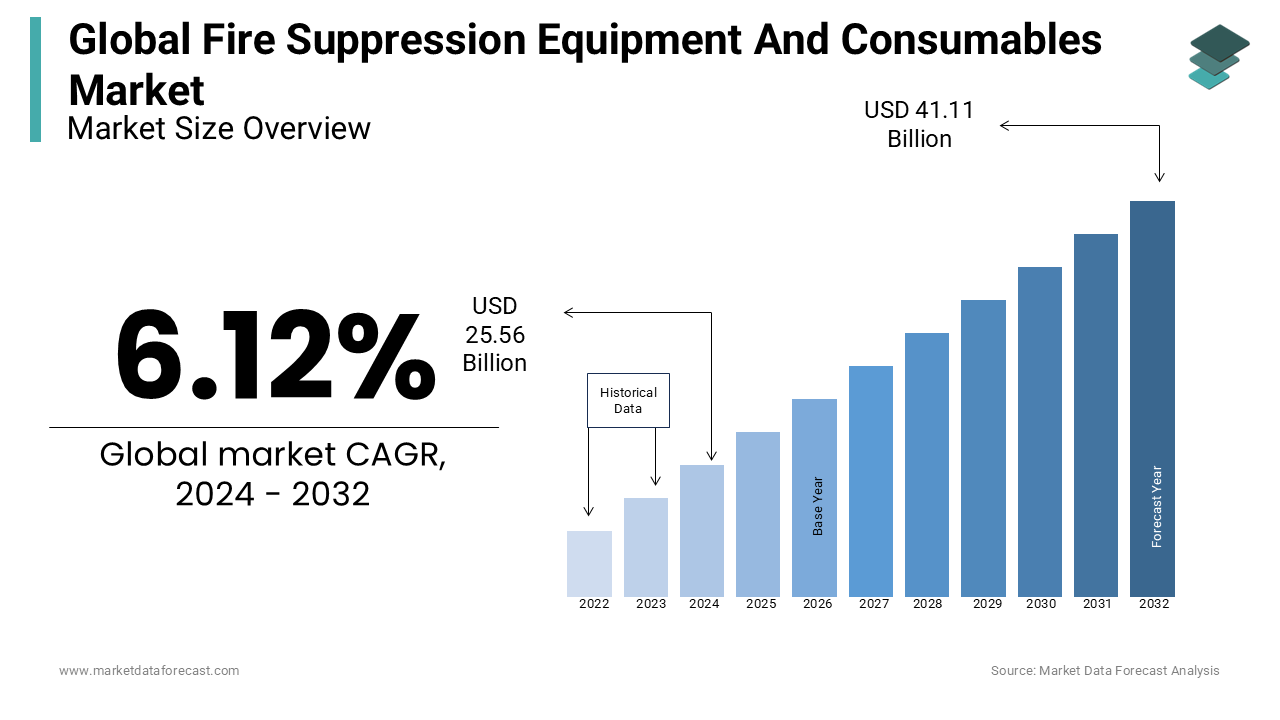

The global fire suppression equipment and consumables market size was valued at USD 24.09 billion in 2023 and is expected to reach USD 41.11 billion by 2032, growing from USD 25.56 billion in 2024. The market is projected to grow at a CAGR of 6.12%.

Fire suppressing equipment and consumables are essential in safeguarding lives and property, with applications across residential, commercial, and industrial sectors. Fire incidents globally have seen an upward trend due to urbanization, industrial expansion, and climate-related hazards. According to the National Fire Protection Association (NFPA), there were over 1.35 million fire incidents in the U.S. in 2021 and cause damages worth $15.9 billion. Similarly, fire accidents in Europe cost €126 billion annually as reported by the European Fire Safety Alliance. Advancements in fire suppression technologies, such as environmentally friendly extinguishing agents, are crucial in minimizing environmental impact while ensuring safety. The increased adoption of smart fire detection systems enhances real-time response and thereby reduce fatalities and damages.

MARKET DRIVERS

Stringent Fire Safety Regulations

Government-mandated fire safety standards are a key driver for the market. Regulations such as NFPA standards in the U.S. and EN standards in Europe require the installation of certified fire suppression systems in buildings and industrial facilities. Non-compliance results in penalties, spurring investment in advanced fire suppression solutions. For instance, global fire safety compliance is expected to achieve an estimated 85% in developed regions by 2025. Industries with high fire risks, such as oil and gas, face stricter audits is fueling the demand for specialized suppression equipment and consumables.

Urbanization and Infrastructure Development

Rapid urbanization and growth in commercial and residential construction are driving the need for robust fire safety measures. Smart city projects and high-rise buildings require advanced suppression systems tailored for complex environments. For example, global urban population growth is projected to reach 68% by 2050, increasing demand for fire protection systems. Coupled with insurance mandates, new infrastructure is prioritizing fire safety equipment such as sprinkler systems, automated gas suppression units, and readily available consumables.

Growing Awareness of Workplace Safety

Increased focus on employee safety and operational risk mitigation has led industries to adopt comprehensive fire suppression systems. Sectors like manufacturing and healthcare are implementing systems with high reliability to protect workers and critical assets. According to OSHA, workplace fires cause over 5,000 injuries annually in the U.S. is amplifying the demand for robust fire protection solutions. Enhanced awareness campaigns and corporate ESG initiatives further support investments in sustainable and efficient fire safety technologies.

MARKET RESTRAINTS

High Initial Installation Costs

The upfront cost of installing advanced fire suppression systems especially in large industrial facilities is a significant restraint. Complex systems, such as automated gas suppression or misting systems, require substantial investment in equipment, design, and professional installation. For example, large-scale systems can cost upwards of $20,000 per facility is making it challenging for small and medium enterprises (SMEs) to adopt. Additionally, periodic maintenance expenses add to the total cost of ownership is discouraging budget-conscious buyers in developing regions.

Technical Challenges and Complexity

Fire suppression systems require precise calibration and compatibility with diverse environments, creating technical hurdles. Systems tailored for specific industries, such as oil and gas or data centers, demand specialized engineering. Inadequate technical expertise often leads to improper installation or system failures which is an increasing liability for businesses. A 2022 industry survey reported that 30% of users experienced equipment malfunctions due to installation errors is a deterring adoption in sectors unfamiliar with advanced fire safety technologies.

Environmental and Health Concerns

Certain fire suppression agents pose risks to the environment and human health despite advancements. For example, halocarbon-based agents can deplete ozone or contribute to global warming which is leading to stringent restrictions or bans in some regions. Similarly, inhalation risks from chemical agents deter their use in occupied spaces. Regulatory scrutiny on agent toxicity has increased compliance costs and restricted the market reach of traditional solutions that is compelling manufacturers to develop safer alternatives.

MARKET OPPORTUNITIES

Adoption of Eco-Friendly Fire Suppression Agents

The demand for eco-friendly fire suppression agents is on the rise with growing environmental concerns. Traditional agents like halon are being phased out due to their high ozone depletion potential as regulated by the Montreal Protocol. Replacements such as HFC-227ea and Novec 1230 are gaining traction for their low global warming potential (GWP) and high efficacy. The European Union’s F-Gas Regulation mandates industries to adopt greener alternatives by creating significant opportunities in industrial and commercial sectors. According to the Environmental Protection Agency (EPA), eco-friendly agents have shown a 30% increase in adoption rates since 2020 which indicates a robust growth potential.

Integration of IoT and AI in Fire Suppression Systems

The integration of IoT and AI in fire suppression systems is transforming fire safety management by enabling real-time monitoring and automated response mechanisms. Smart systems equipped with AI-based predictive analytics can detect potential fire risks before they escalate that reduce damages by up to 40%, according to a study by the NFPA. IoT-enabled fire extinguishers and sprinklers allow remote management and monitoring, crucial in large facilities like data centers and manufacturing plants. This technology not only enhances safety but also reduces operational downtime, making it a lucrative opportunity for manufacturers and end-users alike in industries with critical safety requirements.

MARKET CHALLENGES

High Initial Costs of Advanced Fire Suppression Systems

The adoption of advanced fire suppression technologies, such as smart detection systems and eco-friendly extinguishing agents is hindered by high upfront costs. These systems require significant investment in equipment, installation, and integration with existing infrastructure. According to a report by National Fire Protection Association (NFPA), the average cost of installing advanced fire suppression systems in industrial facilities is 20-30% higher than traditional systems. This poses a barrier for small and medium enterprises (SMEs) with limited budgets. Additionally, the maintenance of these systems, such as refilling environmentally friendly agents adds to operational expenses which is deterring widespread adoption across cost-sensitive markets.

Lack of Awareness and Training in Developing Regions

In developing regions, limited awareness and insufficient training in fire safety protocols pose a significant challenge to market growth. According to a study by the International Labour Organization (ILO), workplace fires in low-income countries are 40% more frequent due to inadequate fire safety knowledge and lack of trained personnel. The absence of regulations mandating fire safety standards exacerbates the issue. The most advanced fire suppression systems may remain underutilized or improperly maintained without proper training shall reduce their effectiveness. Bridging this gap requires investment in awareness campaigns and specialized training programs to improve fire safety preparedness.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.12% |

|

Segments Covered |

By Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson Controls International, Honeywell International Inc., Siemens AG, United Technologies Corporation (Carrier), Tyco Fire Products, Halma plc, Robert Bosch GmbH, Minimax Viking GmbH, Ansul Incorporated (A Tyco Company), The Chemours Company, and others. |

SEGMENTAL ANALYSIS

By Technology Insights

The fire extinguishers segment led the market in 2023 by accounting for 35.5% of the global market share in 2023. According to the National Fire Protection Association (NFPA), fire extinguishers are present in over 95% of U.S. households and required in commercial and industrial buildings under fire safety regulations. The U.S. Occupational Safety and Health Administration (OSHA) mandates fire extinguishers in workplaces which is driving the market’s growth rate. The segment's growth is also influenced by increasing fire safety standards in developing regions. In India, for instance, 15 million fire extinguishers were sold in 2021 by marking a 15% year-on-year increase. The low cost and universal applicability of fire extinguishers, alongside government mandates for fire safety in residential and industrial buildings is contributing to their leadership in the market. The growth is also boosted by the rising frequency of fire-related incidents globally as highlighted by the U.S. Fire Administration (USFA) which reported over 1.3 million fires in 2021.

The specialty suppressants segment is expected to have steady pace and register a CAGR of 6.5% from 2024 to 2032. These suppressants are critical in protecting sensitive areas such as data centers, telecommunication hubs, and museum collections where water or traditional chemical agents could cause significant damage. According to U.S. Fire Administration (USFA), fire incidents involving data centers rose by 10% from 2019 to 2021with the adoption of non-damaging fire suppression solutions. Specialty suppressants are also seen as a solution to meet environmental sustainability goals as many of these agents have low global warming potential (GWP) compared to older chemical agents. The European Union's F-Gas Regulation further drives the demand for these agents by restricting high-GWP substances in fire suppression systems and accelerating the market shift toward specialty suppressants. These advanced fire suppression agents are particularly popular in critical infrastructure with industries increasingly adopting them for their efficiency, minimal environmental impact, and effectiveness in enclosed spaces.

By Application Insights

The residential segment dominated the market and held 409% of the global fire surpressing equipment and consumables market share in 2023. According to the National Fire Protection Association (NFPA), home fires accounted for more than 350,000 incidents in the U.S. in 2021 which resulted in $7 billion in property damage. This widespread risk drives demand for residential fire suppression solutions like fire extinguishers, sprinklers, and smoke detectors. Increasing awareness about fire safety, coupled with stricter fire safety regulations in residential buildings globally is contributing to the dominance of this segment. The growing number of residential buildings, particularly in urban areas and emerging markets like India, saw a 17% rise in new housing in 2021 that inclined in elevating the demand for fire suppression products. Residential fire safety is further emphasized by regulations like the International Fire Code (IFC) and local mandates requiring fire suppression systems in homes.

The Energy and Fuels/Oil and Gas segment is esteemed to grow with a projected CAGR of 7.5% from 2024 to 2032. Fire safety in the oil and gas sector is a critical concern, with fires and explosions being one of the highest risks in energy production. According to the U.S. Department of Energy, the oil and gas industry experiences an average of 1,500 fire-related incidents annually which often leads to significant environmental damage and loss of life. Fire suppression technologies including foam and gas delivery systems are becoming more vital with the global demand for energy continues to rise in offshore and remote operations. The need to comply with stringent fire safety regulations set by bodies like the Occupational Safety and Health Administration (OSHA) and European Commission’s Seveso Directive is also propelling the adoption of advanced fire suppression solutions in the sector.

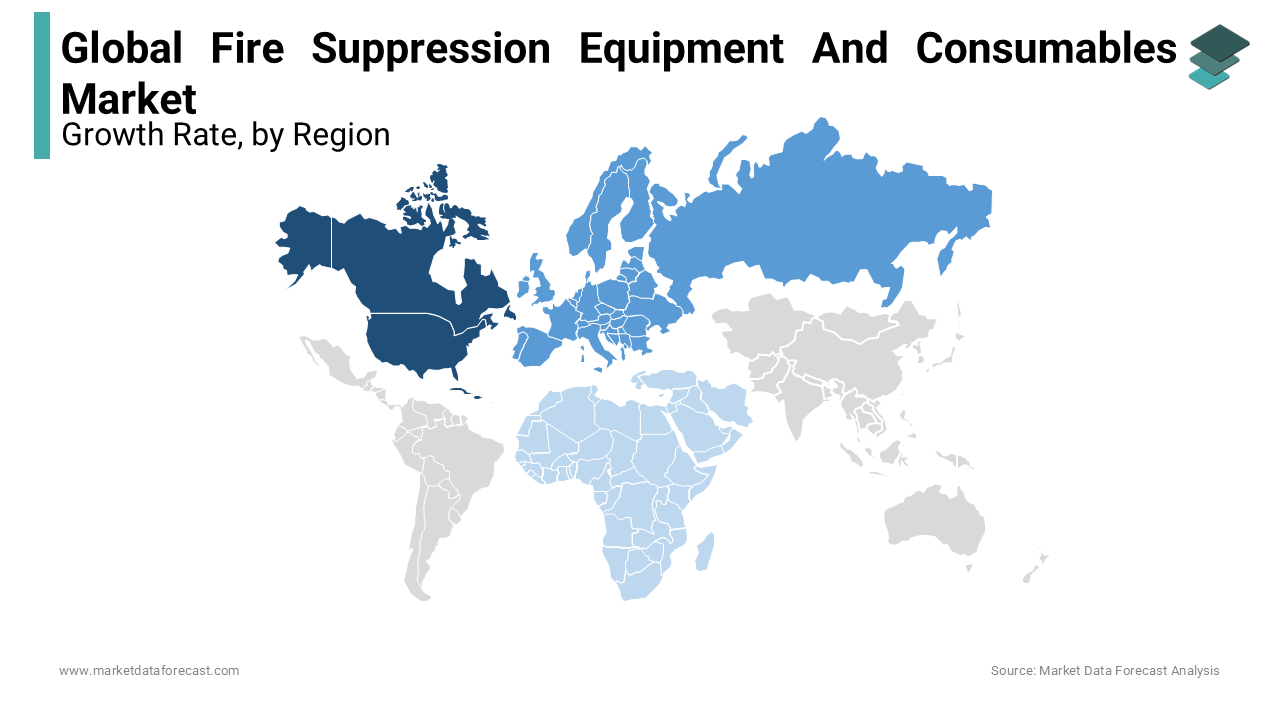

REGIONAL ANALYSIS

North America Fire Suppression Equipment and Consumables Market was leading the dominant share with 35% of the global market share in 2024. The market in this region is expected to grow at a CAGR of 5% from 2024 to 2032. The growth is driven by stringent fire safety regulations in the U.S. and Canada, as well as the widespread adoption of advanced fire suppression systems in residential, commercial, and industrial sectors. According to the U.S. Fire Administration (USFA), the U.S. alone accounted for 1.3 million fire incidents in 2021 which is attributed in contributing to the demand for fire suppression solutions. Additionally, government-backed initiatives, such as the National Fire Protection Association (NFPA) standards and insurance policies mandating fire protection that further boost the market. Leading countries in the region include the U.S. and Canada where commercial and industrial facilities continue to prioritize fire safety technologies.

Europe is positioned second in the global market in holding the leading market share. The market growth in Europe is primarily fueled by the increasing adoption of environmentally friendly fire suppression solutions which is driven by regulations such as the European Union's F-Gas Regulation that promotes the use of low-GWP fire suppression agents. The region has also witnessed rising investments in data centers, manufacturing facilities, and energy plants where all of which require advanced fire suppression systems. The U.K., Germany, and France are the leading countries in Europe, with significant growth in demand from industrial and commercial sectors. Additionally, fire safety regulations and standards set by organizations like NFPA and BSI (British Standards Institution) ensure continued growth and innovation within the European market.

The Asia-Pacific region is anticipated to experience the fastest growth rate in the fire suppression equipment and consumables market. Rapid urbanization, industrialization, and increasing investments in infrastructure projects such as commercial real estate, data centers, and manufacturing facilities significantly contribute to the demand for fire suppression solutions. China and India are leading the market share due to their large-scale infrastructure development. As reported by India's National Disaster Management Authority (NDMA), industrial fire incidents in India alone have increased by 15% over the last decade is increasing the need for fire protection systems. Additionally, rising awareness of fire safety and stricter regulations in countries like Japan and South Korea will continue to boost market growth.

Latin America is witnessing steady growth. Key factors driving this growth include increasing urbanization, industrialization, and investments in infrastructure in Brazil, Mexico, and Argentina. According to the National Fire Protection Association (NFPA), Latin America has seen a rise in fire-related fatalities by creating an urgent demand for enhanced fire suppression solutions. The region is also adopting new technologies in fire suppression, such as foam and specialty suppressants which is driven by the growing focus on fire safety regulations and government policies. Brazil is the largest market within the region in the commercial and industrial sectors.

The Middle East and Africa fire suppressing equipment and consumables market is more likely to expand rapidly over the forecast period. This region's growth is propelled by large-scale infrastructure projects, particularly in the UAE, Saudi Arabia, and South Africa which are investing heavily in fire safety technologies. The demand for fire suppression systems in energy and oil & gas industries is significant with high fire risks due to volatile environments. The Gulf Cooperation Council (GCC) nations are also implementing stricter fire safety regulations in line with global standards, thus accelerating market growth. Additionally, the construction of commercial and residential buildings and the expansion of manufacturing sectors are contributing to the rising demand for fire suppression equipment across the region.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

The major key players in the global fire suppression equipment and consumables market are Johnson Controls International, Honeywell International Inc., Siemens AG, United Technologies Corporation (Carrier), Tyco Fire Products, Halma plc, Robert Bosch GmbH, Minimax Viking GmbH, Ansul Incorporated (A Tyco Company), The Chemours Company, and others.

The competition in the Fire Suppression Equipment and Consumables Market is highly fragmented, with several global and regional players vying for market share in different product segments. Major players like Johnson Controls, Honeywell, and Tyco Fire Products lead the market due to their extensive product portfolios, brand recognition, and global distribution networks. These companies focus on innovation by offering environmentally friendly fire suppression solutions that comply with stringent regulations such as NFPA and UL standards. Smaller niche players provide specialized products like clean agents and specialty suppressants tailored to sectors such as data centers, oil & gas, and energy. As demand grows for advanced fire suppression systems, companies are expanding through strategic acquisitions, partnerships, and technological advancements. Regional players are also gaining momentum in emerging markets by offering cost-effective solutions tailored to local needs.

RECENT HAPPENINGS IN THE MARKET

- July 2024, Marmic Fire & Safety, a fire and life safety services company, was acquired by KKR, a global investment firm. This acquisition aims to leverage KKR's expertise to accelerate Marmic's growth and expand its service offerings.

- July 2024, Sentinel Capital Partners completed the acquisition of the industrial fire business from Carrier Global Corporation, forming Spectrum Safety Solutions. This move aims to create a standalone platform, including Marioff’s high-pressure water mist solutions, to strengthen the firm's market presence.

- August 2024, Carrier Global Corporation sold its commercial and residential fire business to Lone Star Funds for $3 billion. This divestiture allows Carrier to focus on its core heating and cooling equipment businesses.

- July 2024, Sentinel Capital Partners carved out Carrier’s industrial fire business, forming a standalone platform. This action focuses on bolstering their portfolio with specialized fire protection solutions.

- June 2023, Guardian Fire Protection Services, a fire and life safety services provider, acquired Harris Fire Protection. This acquisition is expected to enhance Guardian's presence in the Mid-Atlantic region and expand its service capabilities.

- January 2022, APi Group Inc. acquired the Chubb Fire & Security Business from Carrier Global. This acquisition aims to expand APi’s service offerings and global market reach in fire and security solutions.

MARKET SEGMENTATION

This research report on the global fire suppression equipment and consumables market has been segmented and sub-segmented based on technology type, ballast water capacity, vessel type, installation, and region.

By Technology

- Fire Suppression Equipment

- Fire extinguishers

- Fire sprinklers (water and mist/fog)

- Gas delivery systems

- Chemical and foam delivery systems

- Specialty delivery systems

- Fire Suppression Consumables

- Dry chemical/dry powder

- Foams

- Wet chemical

- Gases

- Specialty suppressants

By Application

- Residential

- Commercial

- Vehicle/Transportation

- Mining

- Energy and fuels/oil and gas

- Manufacturing

- Other industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth rate of the Fire Suppression Equipment and Consumables Market?

The report provides insights into the market's CAGR during the forecast period, highlighting key growth factors and market drivers.

2. Which regions dominate the Fire Suppression Equipment and Consumables Market?

The report outlines regional analysis, including leading regions in terms of market share and potential growth opportunities in emerging markets.

3. What are the major drivers influencing the growth of this market?

Key drivers such as advancements in fire safety technologies, increasing industrialization, and stringent safety regulations are covered in the report.

4. Who are the key players in the Fire Suppression Equipment and Consumables Market?

The report includes a comprehensive competitive analysis of major companies, their market strategies, and recent developments.

5. What are the main types of fire suppression equipment and consumables covered in the report?

The report provides detailed segmentation by product type, including fire extinguishers, fire sprinklers, suppression agents, and other consumables.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]