Global Financial Analytics Market Size, Share, Trends, & Growth Forecast Report By Solution (Financial Functions Analytics and Financial Market Analytics), Application (Wealth Management, Transaction Monitoring, and Customer Management), Deployment (Cloud-based, and On-premises), Organisation (SMEs, and Large enterprise), Vertical (Education, Healthcare, Media, and Government, etc.) & Region - Industry Forecast From 2025 to 2033

Global Financial Analytics Market Size

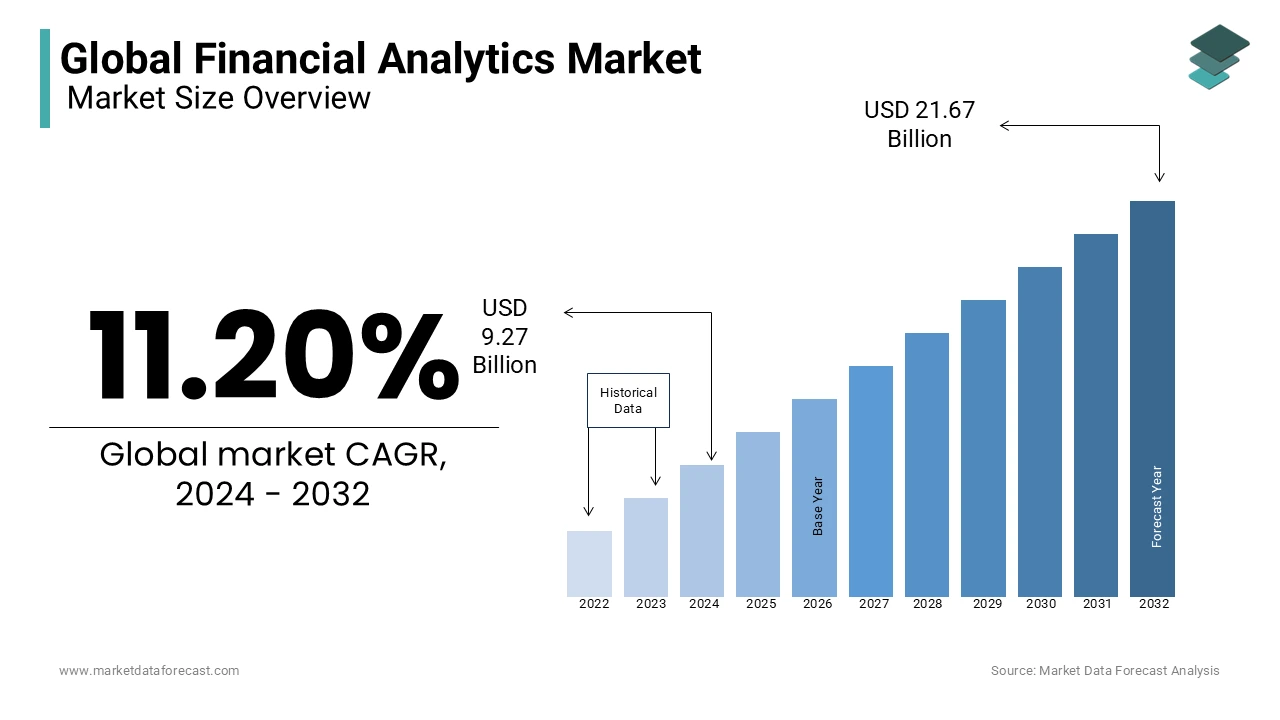

The global financial analytics market was worth USD 9.27 billion in 2024. The global market size is expected to reach USD 10.31 billion in 2025 and USD 24.10 billion by 2033, growing at a CAGR of 11.20% during the forecast period.

Financial analytics is an important tool in any organization that helps improve its business performance. These analytics will give a complete analysis of financial data that enables the user to view the business analytics and create broader insights. A financial analysis can do a lot more than expected for the organization. It can simply evaluate the economic trends from various data and plan the long-term goals for business activity accordingly, which can also bring out the companies for investment. The specific objective of financial analytics is to forecast the financial status of the company in the future, which helps in the expansion of investments and has a positive impact on the growth graph. In every organization, it is highly important to perform in-depth analysis, especially on financial data that accounts for profitability with good financial status.

MARKET DRIVERS

The financial analytics market size is driven by the growing number of IT companies and the rising prominence of the adoption of new tools for the better growth of the organization in finance.

The rising risk factors due to increasing concern over the economic crisis leverage the growth rate of the market to the next level. Financial analytics helps in evaluating the future period of the company's growth and gives information about the investments, which is the most important for an organization. Companies focus on financial planning and management, which are also prominent factors in market growth. Forecasting the future of the organization's growth activities is highly important in dealing with uncertainty and risk factors. In the hectic schedule, the need to get all the financial datasets in one graph that accomplishes the brief analysis from various systems makes the user the view for better outcomes. The value of data-driven decision-making in every organization is growing, which is a key factor for the growth rate of the market.

In today's world, storing data is a big challenge for companies, and the need to deploy cloud-based services is accelerating, which further enhances the share of the financial analytics market. The use of cloud computing made it a little bit easier to analyze financial data sets by acquiring data from various systems into one that regulates the customer's experience in using the financial analytics tool.

MARKET RESTRAINTS

However, the lack of skilled professionals to analyze the data due to the lack of knowledge of the newly launched technical systems is limiting the growth rate of the financial analytics market.

People in undeveloped countries are less aware of the new technologies emerging in the world, which acts as a barrier to expanding companies in these countries, slowly degrading the market size. Accordingly, the rising concern over privacy can hinder the market's growth rate. The data privacy concern arises due to the frequent implementation of new technologies and huge data collection from social media at regular intervals, which limits the usage of cloud computing, especially in financial analytics. The challenges often persist in companies where regulating the protection of data privacy is very tough, but IT professionals are seamlessly working to combat the risks in the coming years.

MARKET OPPORTUNITIES

The launch of innovative technological developments in the IT industry is posing huge growth opportunities for the financial analytics market.

The Internet of Things is the most common word we hear in today's world. In general, IoT is a crucial part of the IT sector where a user can perform tasks from anywhere at any time. Financial analytics is also one of the internet-connected devices that allows users to get all the useful data from other systems. Cloud computing helps businesses to have this flexibility to analyze and make quick decisions, that are attributed to bolstering the share of the financial analytics market. High investments from both private and public organizations in the IT sector are also likely to fuel the growth rate of the market. In addition, the rising focus on the development of various research activities by analyzing all the aspects that promote opportunities for organizations to the next level is gearing up the market size.

MARKET CHALLENGES

Cybersecurity threats have been increasing in the past couple of years. Increasing the ability to hack systems with the latest technology is posing serious challenges for organizations in protecting their data from breaches.

There is no point where the penetration of advanced technologies like artificial intelligence and machine learning does wonders in the financial sector, but providing massive data with high quality gives accurate and desired outputs. Failing to provide highly accurate data will pose a big challenge for the finance analytics systems that directly impose a big challenge on the market's key players.

Lack of huge support from the government through funds may inhibit the growth rate of the market. The high-quality decision in the organization needs quality support from the government authorities. Failing to get that support may quietly degrade the market share to some extent in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.20% |

|

Segments Covered |

By Solution, Application, Deployment, Organisation, vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Oracle (US), IBM (US), Teradata (US), TIBCO Software (US), SAP (Germany), SAS Institute (US), Alteryx (US), Qlik (US), FICO (US), GoodData (US), Birst (US), Google (US), Information Builders (US), Zoho Corporation (US), Domo (US), and others. |

SEGMENTAL ANALYSIS

By Solution Insights

Financial functions analytics is leading with the dominant share of the market, whereas financial market analytics is set to hold the highest CAGR throughout the forecast period. The priority is to analyze the financial data based on the historical records of the organization to focus highly on the future aspects that reflect the growth rate of the market in the coming years. Financial marketing analytics solutions focus on emphasizing marketing campaigns. These two solutions have the potential to forecast and analyze the future of organizations easily.

By Application Insights

The wealth management segment is likely to have the state's growth rate during the forecast period. In the present scenario, the need to reach the goals in the financial status can be achieved by developing effective strategies in financial management. Wealth management provides effective financial management services for individuals to grow and preserve their wealth. Growing digital transactions impel the growth rate of the transaction monitoring segment. The customer management segment is likely to grow at a steady pace in the foreseeable years. Creating customized and effective financial analytics to ensure long-term growth can be manifested by customer management, which fuels the growth rate of the market.

By Deployment Insights

The cloud-based deployment segment is undoubtedly achieving the highest CAGR over the past few years. The rapid adoption of cloud storage facilities by every IT company is propelling the growth rate of this segment. Cloud-based deployment mode facilitates many advantageous features for financial analytics that are inclined to show positive growth opportunities for the market in the coming period. The on-premises segment is expected to have a substantial share of the market. Small-scale industries rely on on-premises deployment due to a lack of funds from the higher authorities, especially in undeveloped countries.

By Organisation Insights

The large enterprises segment is gaining huge traction over the share of the market share, whereas the SME segment is likely to have the dominant growth opportunities in the next foreseeable years. Large-scale enterprises look for innovative strategies to sustain themselves in the competitive world and adopt new technological developments at a higher pace, which is anticipated to accelerate the growth rate of the market. Transformation of business into digitalization using various technologies can surge the financial analytics market size.

By Vertical Insights

The healthcare segment is one of the major verticals that showcases the highest growth opportunities for the financial analytics market. Finance management in healthcare has huge importance in collecting revenue, paying bills, and analyzing the complete transactions more accurately. This tool will enhance the healthcare organization's viability and future growth. The education segment is expected to have a substantial growth rate during 2025-2033.

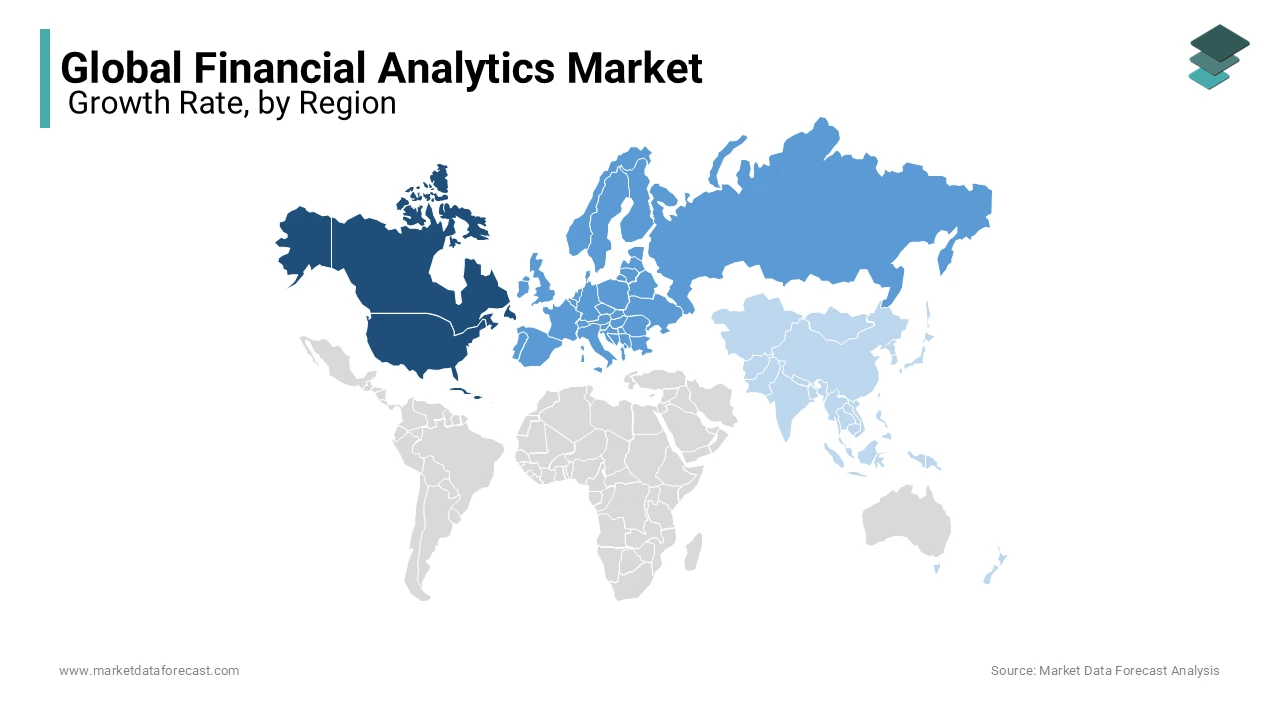

REGIONAL ANALYSIS

North America's financial analytics market is gearing up with the highest share from the past few years and shall continue the same flow throughout the forecast period. High capital income and the presence of key companies in developed countries like the US and Canada are impelling the growth rate of the market in this region. The potential growth of the IT sector in North America promotes growth opportunities for the financial analytics market. A growing number of digital transactions through ATMs, internet banking, and online shopping, among others, make the banking sector use the best of the financial analytics that evolve in leveraging the growth rate of the market in the US and Canada.

Asia Pacific is expected to have a significant growth rate in the foreseeable period. Emerging countries like India and China are forecasted to have a high economic growth rate. Many companies are investing hugely in these countries, eventually creating growth opportunities for the financial analytics market in Asia Pacific. Estimating the possibilities of the organization's financial growth by tracking all the records and taking steps forward in investments, surging the market size, especially in emerging countries. China is evolving hugely in various sectors by launching highly advanced technologies that dominantly seek future aspects of the organization's growth.

The financial analytics market size in Europe is next to North America, owing to the rising per capita income. Quick adoption of the latest technologies like AI and Machine learning by the firms, especially in consumer goods and services, to deliver better insights, enhances the growth rate of the market in European countries.

KEY MARKET PARTICIPANTS

The major companies operating in the global financial analytics market include Oracle (US), IBM (US), Teradata (US), TIBCO Software (US), SAP (Germany), SAS Institute (US), Alteryx (US), Qlik (US), FICO (US), GoodData (US), Birst (US), Google (US), Information Builders (US), Zoho Corporation (US), Domo (US), and others.

RECENT MARKET HAPPENINGS

-

In February 2019, Oracle Financial Services Global Business Unit collaborated with Blue Prism, a robotic process automation (RPA) software vendor, to integrate the Financial Crime Management and Compliance Suite Services into Digital Workforce from Blue Prism.

-

In January 2019, SAP announced the release of its new S / 4 Hana Large Ledger for Financial Products. The solution provides a central hub for managing data between operational and financial systems, streamlining accounting flows, and supporting increased transparency and control. It also helps organizations analyze data for financial steering.

MARKET SEGMENTATION

This global financial analytics market research report has been segmented and sub-segmented based on the solution, application, deployment, organisation, vertical, and region.

By Solution

- Financial Functions Analytics

- Financial Market Analytics

By Application

- Wealth Management

- Transaction Monitoring

- Customer Management

By Deployment

- Cloud-based

- On-premises

By Organisation

- SMEs

- Large enterprise

By Vertical

- Education

- Healthcare

- Media

- Government etc.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the emerging trends in the global Financial Analytics Market in terms of solution offerings?

Emerging trends include the integration of advanced visualization tools, the development of real-time analytics capabilities, and the adoption of AI-driven predictive modeling techniques, catering to the evolving needs of businesses worldwide.

What are the key challenges hindering the adoption of financial analytics in certain regions?

Some regions face challenges related to data privacy concerns, lack of skilled professionals, and infrastructure limitations, which may hinder the adoption of financial analytics solutions.

How are artificial intelligence and machine learning technologies revolutionizing financial analytics globally?

Artificial intelligence and machine learning technologies are enabling organizations to automate routine tasks, detect anomalies, and extract actionable insights from large datasets, driving efficiency and accuracy in financial analysis on a global scale.

How are financial institutions leveraging analytics to mitigate risks and enhance security globally?

Financial institutions globally are utilizing advanced analytics techniques such as fraud detection algorithms, risk modeling, and cybersecurity analytics to identify and mitigate potential threats, safeguarding sensitive financial data and maintaining trust among stakeholders.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]