Global Fighter Aircraft Market Size, Share, Trends, & Growth Forecast Report – Segmented by Type (Fixed-wing and Rotary-wing), Take-off and Landing (Vertical Take-off and Landing, Short Take-off and Landing and Conventional Take-off and Landing), & Region - Industry Forecast From 2024 to 2032

Global Fighter Aircraft Market Size (2024 to 2032)

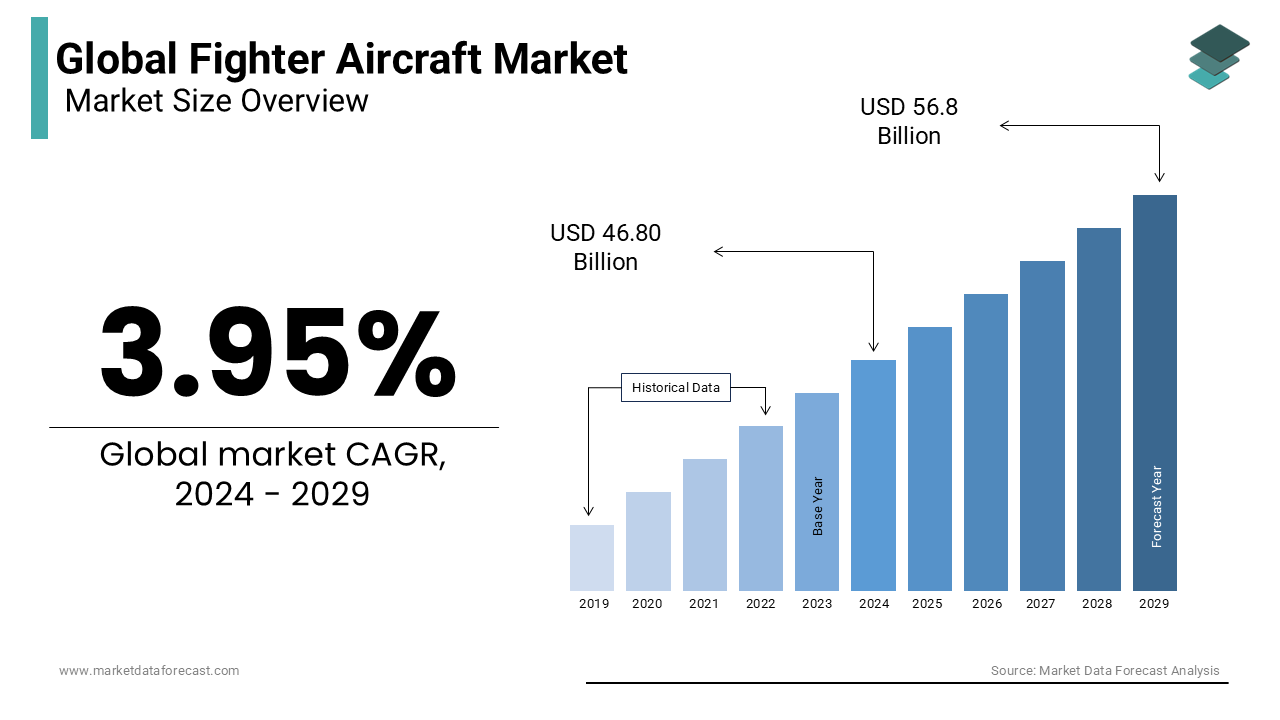

The global fighter aircraft market was worth USD 45.02 billion in 2023. The global market is expected to reach USD 46.80 billion in 2024 to USD 63.80 billion by 2032, rising at a CAGR of 3.95% during the forecast period.

A fighter aircraft is a high-speed military plane designed with one combat, dogfights, and stealth mode against enemy planes. Growing technological advancements in fighter aircraft, particularly in stealth mode, hypersonic speed, and armory precision, combined with rising demand for fighter aircraft, backed by an increase in production of fighter aircraft in the following years, and a growing need among nations to improve their aerial combat capabilities are some of the factors predicted to drive the global fighter aircraft market. Even though many countries' defense resources are being decreased, the forecast for fighters remains constant. The world's industrialized countries are undergoing a significant re-equipment cycle, and the long-term structure of fighter acquisition plans will protect fighter manufacturing from the financial crisis.

MARKET DRIVERS

The growing geopolitical rift between states has prompted the deployment of advanced fighter aircraft to upgrade the existing fleet and strengthen their conventional aerial forces.

A fighter aircraft is considered s a high-speed military aircraft that can fight in air-to-air combat. Fighter planes are characterized by their great speed, maneuverability, and small size. These planes can also carry heavy payloads and engage in electronic warfare, ground attack, and air-to-air combat. Growing technological advancements in fighter aircraft, particularly in stealth mode, hypersonic speed, and armory precision, combined with rising demand for fighter aircraft, backed by an increase in fighter aircraft production in the next decade compared to the previous decade, and the growing need among nations to improve their aerial combat capabilities are the primary factors expected to drive the growth of the global fighter aircraft market.

MARKET RESTRAINTS

Observation and surveillance, target acquisition, and intelligence are all made by unmanned aerial vehicles (UAVs). In addition, battle damage management, distribution and transportation, and combat operations are all provided. The safety of the crew members is driving an increase in demand for UAVs. Nonetheless, increased UAV usage will stifle the fighter jet aircraft market's growth. However, despite the growing need for fighter aircraft, financial constraints may prohibit emerging countries from selecting next-generation fighter aircraft, forcing them to continue upgrading existing old fighters to save money and increase aircraft market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.95% |

|

Segments Covered |

By Type, Take-Off and Landing, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

HAL, Lockheed Martin Corporation, Saab AB, The Boeing Company, United Aircraft Corporation, Chengdu Aircraft Industrial Co. Ltd., Russian Aircraft Corporation MIG, Dassault Aviation, Sukhoi, KAI. |

SEGMENTAL ANALYSIS

Global Fighter Aircraft Market Analysis By Type

Based on type, the Fixed-wing segment is anticipated to have the largest share in the fighter jet market during foreseen period, owing to a rise in demand for the expansion of the fighter fleet and an increase in military expenditure for combat aircraft.

The Rotary-wing segment is expected to be the fastest-growing fighter jet market over the forecast period. According to the Leonardo Company, over the next 20 years, 14,000 fighter jets are scheduled to be constructed globally. Fighter jets are in higher demand in Asia, the Middle East, Africa, and Eastern Europe. As a result, the market is being driven by the increasing number of fighter jet aircraft deliveries around the globe.

Global Fighter Aircraft Market Analysis By Take-Off and Landing

The conventional Takeoff and Landing segment is anticipated to register the highest CAGR in the fighter jet aircraft market over the forecast period. Two of the major drivers in the fighter aircraft industry are technological innovation and lower procurement costs associated with aircraft that conduct conventional takeoff and landing. These aircraft can also carry a bigger payload of weapons and equipment and have a longer combat range. Over the projection period, new fighter aircraft initiatives such as the F-35A, China's J-20, Su-37, Mig-35, Su-57, and India's Tejas MK2 are expected to replace aging fourth-generation fighter aircraft with 4.5 and 5th generation. In addition, aircraft modernization efforts for the F-16, F-15, and F/A-18 are expected to keep users motivated by enhancing aircraft capabilities and extending aircraft life. Some countries, like Canada, India, Brazil, Saudi Arabia, the United Arab Emirates, and Taiwan, have chosen to fly improved current aircraft platforms rather than the more expensive stealth aircraft, which also have a longer delivery lead time. As a result of this improvement, the conventional takeoff and landing segment has a great demand during the predicted period.

REGIONAL ANALYSIS

Asia-Pacific region is anticipated to register the highest share of the fighter aircraft market during the forecast period. Political rifts exist in Asia-Pacific, affecting countries such as China, India, Japan, and South Korea. This has aided regional countries' efforts to modernize their fighter aircraft fleets, whether through foreign procurement or local manufacture of sophisticated combat aircraft. China has attempted to compete with the United States in designing and producing newer generation fighter aircraft in recent years. China has built a range of modern fighter aircraft, including the stealth fighter J-20, despite being behind in developing aircraft engines. After a series of disasters and mechanical issues, China is also developing a new carrier-based fighter plane to replace its J-15 fighter. China decided to build at least four aircraft carrier groups to achieve its naval aspirations. The new aircraft is planned to make its first flight in 2021, and it might enter service between 2024 to 2029.

North America is projected to experience the highest share of the fighter aircraft market over the forecast period. Various advances in fighter aircraft are likely to contribute to substantial growth in the North American region. Since the end of the Second World War, the US air force has been regarded as the world's supreme air force. The United States now has approximately 2,000 fighter aircraft, and the US department of defense is concentrating its efforts on improving the fighter aircraft industry. To deal with China's and Russia's expanding military strength, the US Air Force aims to raise its fighter aircraft squadrons from 55 to 65 in the next years. The F-22 Raptor Hybrid is Lockheed Martin's idea to combine the best elements of the F-35 and the F-22 aircraft. As a result, many ongoing innovations in fighter aircraft are projected to drive its rise in the near future in North America.

Europe region is predicted to have a significant fighter aircraft market share over the forecast period. Due to increased security risks and geopolitical tensions, European defense spending will rise.

KEY MARKET PLAYERS

- HAL

- Lockheed Martin Corporation

- Saab AB

- The Boeing Company

- United Aircraft Corporation

- Chengdu Aircraft Industrial Co. Ltd.

- Russian Aircraft Corporation MIG

- Dassault aviation

- Sukhoi

- KAI

RECENT HAPPENINGS IN THE MARKET

- Canada has barred Boeing from the fighter contest, claiming that the airliner row will harm its proposal in November 2021. Canada Boeing Co (BA.N) has been eliminated from a multibillion-dollar competition to supply 88 new fighter jets, citing a historical feud between the US Corporation and a Canadian aircraft manufacturer as a factor in the decision.

- BEL and Lockheed Martin have signed an agreement to investigate the potential of the F-21 fighter jet program. In February 2020, Lockheed Martin signed an agreement with BEL to examine the F-21 fighter jet program prospects. In addition, Lockheed Martin has made an exclusive offer to India for its F-21 military aircraft, hoping to win an $ 18 billion contract to provide 114 fighters to the Indian Air Force. To promote Lockheed Martin's F-21 proposal for the Indian Air Force, the corporation stated it is strengthening and expanding its partnerships with the Indian industry.

DETAILED SEGMENTATION OF THE GLOBAL FIGHTER AIRCRAFT MARKET INCLUDED IN THIS REPORT

This research report on the global fighter aircraft market has been segmented and sub-segmented based on the type, take-off and landing, and region.

By Type

- Fixed-wing

- Rotary-wing

By Take-Off and Landing

- Vertical Take-off and Landing Aircraft

- Short Take-off and Landing Aircraft

- Conventional Takeoff and Landing Aircraft

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle-East-Africa

Frequently Asked Questions

What are the key drivers of growth in the fighter aircraft market?

Key drivers include increasing defense budgets, rising geopolitical tensions, ongoing military modernization programs, and the need for replacing aging fleets. Technological advancements in aircraft design and capabilities also contribute to market growth.

How is technology influencing the fighter aircraft market?

Technological advancements such as stealth technology, artificial intelligence, advanced avionics, and improved propulsion systems are significantly influencing the market. These technologies enhance the capabilities, survivability, and efficiency of fighter aircraft.

How are emerging markets impacting the fighter aircraft industry?

Emerging markets, particularly in Asia-Pacific and the Middle East, are significantly impacting the industry. These regions are increasing their defense spending to modernize their air forces and enhance their strategic capabilities, leading to more orders and partnerships.

What is the future outlook for the global fighter aircraft market?

The future outlook is positive, with steady growth expected due to ongoing modernization efforts, technological advancements, and rising defense budgets. The development of next-generation aircraft and increased focus on unmanned aerial vehicles (UAVs) will also shape the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]