Global Fetal Bovine Serum Market Size, Share, Trends & Growth Forecast Report By Application (Drug discovery, In-vitro fertilization, Vaccine production, Cell-based research, Diagnostics, Others), End-user (Pharmaceutical & biotechnology companies, Contract Research Organizations (CRO), Academic and research organizations, Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Fetal Bovine Serum Market Size

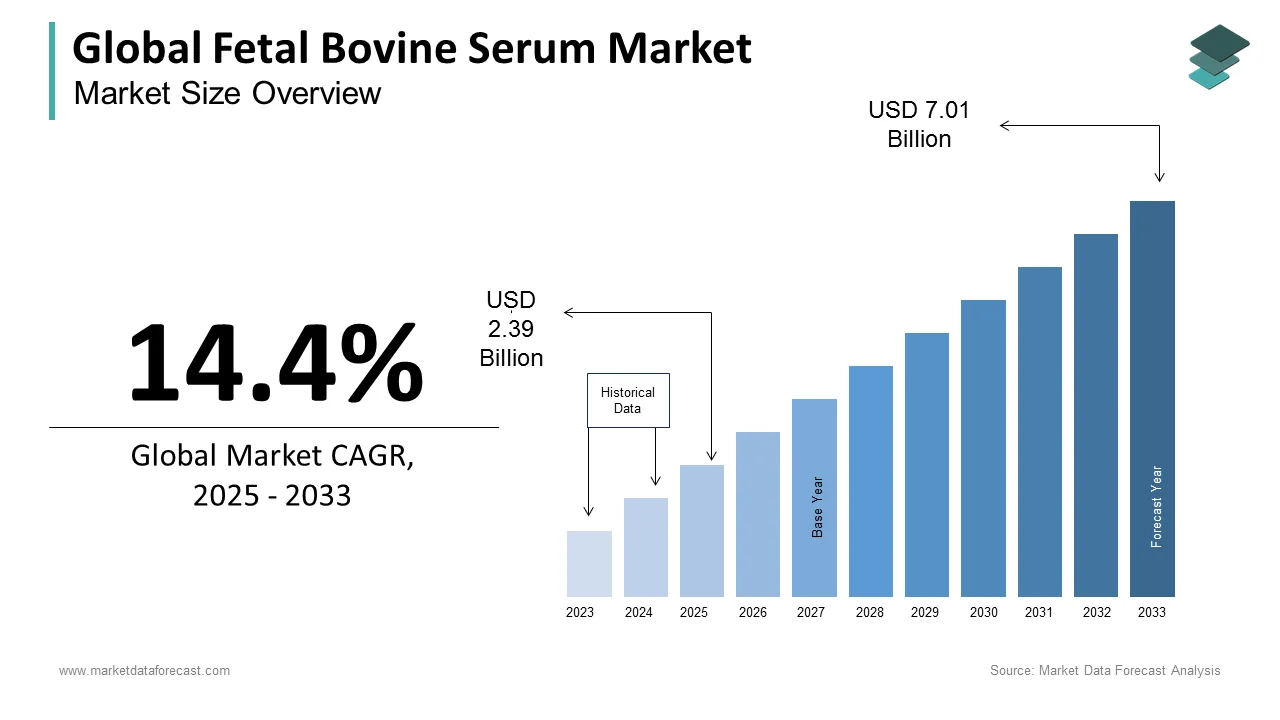

The size of the global fetal bovine serum market was worth USD 2.09 billion in 2024. The global market is anticipated to grow at a CAGR of 14.4% from 2025 to 2033 and be worth USD 7.01 billion by 2033 from USD 2.39 billion in 2025.

Fetal Bovine Serum (FBS) remains a major component in cell culture, especially in biomedical research and biopharmaceutical production. FBS is rich in essential nutrients, hormones, and growth factors that aid in the growth and maintenance of cells. It is used in vaccine development, cell therapy, and tissue engineering, supporting the growth of primary cells and cell lines. The global demand for FBS is driven by the rising number of clinical trials in regenerative medicine, with approximately 70% of clinical trials involving cell-based therapies relying on FBS. In the production of vaccines, FBS is integral, with more than 80% of vaccine manufacturers using it to culture viral agents. However, ethical concerns about animal welfare have led to increased interest in alternatives. For instance, research on synthetic and human-derived serum alternatives is growing, with funding for alternatives increasing by over 15% annually, indicating a shift toward reducing reliance on animal-derived products. Despite this, FBS remains essential in many drug discovery processes and biopharmaceutical applications, particularly in preclinical research, where accurate modeling of human physiology is crucial.

MARKET DRIVERS

Advancing Regenerative Medicine and Stem Cell Research

One of the key drivers of the Fetal Bovine Serum (FBS) market is the growing demand for biopharmaceuticals and biologic therapies. The global pharmaceutical industry is increasingly focusing on biologics due to their potential to treat chronic diseases, cancer, and rare conditions. According to the U.S. Food and Drug Administration (FDA), biologics represented 38% of new drug approvals in 2020. These therapies rely heavily on cell culture systems supported by FBS for the development and production of therapeutic proteins and monoclonal antibodies. This surge in biologic drug production significantly boosts the demand for high-quality FBS, as it is essential in the creation and scaling of cell-based products that serve as the backbone of modern medicine.

Another major driver is the advancement in cell-based research and regenerative medicine. As research in stem cell therapy, gene therapy, and tissue engineering progresses, the need for optimal cell culture environments has escalated. The National Institutes of Health (NIH) reports that funding for stem cell research reached over USD 2.5 billion in recent years. These therapies require robust cell growth mediums like FBS to ensure the viability and differentiation of stem cells. Furthermore, the application of FBS is critical in preclinical trials, supporting the development of new treatments and helping bring innovative therapies to market more efficiently, thus driving its continuous demand in the scientific community.

MARKET RESTRAINTS

Ethical Concerns Restraining FBS Market Growth

The ethical concerns surrounding the sourcing of Fetal Bovine Serum (FBS) are a significant restraint on its market growth. The process of obtaining FBS from fetal cattle has led to growing animal welfare concerns, influencing public perception and regulatory policies. According to the U.S. Department of Agriculture (USDA), animal welfare advocacy has resulted in stricter regulations and rising calls for more ethical alternatives in the research community. In response, over 30% of research institutions and biotech companies have already moved toward or are actively investigating alternatives to FBS, such as synthetic and human-derived serum, reflecting a 15-20% shift in purchasing behavior. Ethical considerations are now central to procurement processes, with about 25% of global research institutions indicating they prioritize animal-free alternatives in their research protocols. This societal pressure, along with regulations pushing for more ethical practices, is driving a shift away from FBS, influencing market dynamics and slowing growth in the traditional FBS sector.

Inconsistent FBS Quality Hindering Market Growth

The variability in the quality of Fetal Bovine Serum (FBS) is a significant restraint on its market growth, as inconsistencies in serum batches can directly affect the reproducibility and reliability of research outcomes. A study by the National Institutes of Health (NIH) revealed that up to 30% of FBS batches exhibit batch-to-batch variability, leading to inconsistent results in cell culture experiments. This inconsistency complicates the reproducibility of experiments, a critical aspect of scientific research and development. Additionally, the FDA has expressed concerns about the variability in serum quality, particularly in sensitive applications like gene therapy, where 10-15% of clinical trials have faced setbacks due to unreliable FBS. The increasing focus on reproducibility has driven approximately 20% of biotech companies to explore alternatives, contributing to a rising shift away from FBS in research and therapeutic development. These challenges have reinforced the need for more standardized and consistent alternatives to FBS.

MARKET OPPORTUNITIES

Stem Cells & Vaccine Development

A major opportunity for the Fetal Bovine Serum (FBS) market lies in the growing field of regenerative medicine, particularly stem cell therapy. The global stem cell market is projected to reach USD 24.5 billion by 2027, according to a report by the National Institutes of Health (NIH). As stem cell-based therapies continue to show promise in treating a variety of conditions, including neurological diseases, heart disease, and injuries, the demand for high-quality cell culture media like FBS will rise. The ability of FBS to support the growth and differentiation of stem cells positions it as a key resource in the development of cutting-edge regenerative treatments, further expanding its role in this burgeoning healthcare segment.

The increasing investment in vaccine development, particularly due to global health threats like COVID-19, presents a significant opportunity for the Fetal Bovine Serum (FBS) market. During the pandemic, over $100 billion was invested in vaccine production, with the WHO estimating that 9 billion vaccine doses were required globally. FBS was essential in propagating viruses for vaccine production, and its usage surged by 25% during this period. With a continued focus on pandemic preparedness and emerging diseases, the demand for FBS is expected to rise. As vaccine production is projected to grow by 7-10% annually over the next decade, FBS remains a critical component in vaccine research and manufacturing.

MARKET CHALLENGES

Cost and Regulatory Challenges

The rising cost of raw materials and production is a major challenge for the Fetal Bovine Serum (FBS) market. According to the U.S. Department of Agriculture (USDA), droughts have led to a 5-15% decline in cattle populations in certain regions, affecting FBS availability. Additionally, feed prices have surged by 10-20% in recent years, directly impacting FBS production costs. The source of FBS often comes from countries with stringent regulations like Australia, where production costs are up to 30% higher than in less-regulated regions. This leads to increased prices for FBS, with some biopharma companies reporting up to a 40% rise in procurement costs, limiting accessibility for smaller research firms and biotech companies.

Increasing regulatory pressure on animal-derived products is a significant challenge for the FBS market. The U.S. Department of Agriculture (USDA) reports that regulations surrounding animal welfare have led to 20-25% higher costs for FBS producers due to the need for certification and compliance with stricter guidelines. For instance, the EU has imposed rules that require FBS suppliers to adhere to specific welfare standards, resulting in 10-15% cost increases. Additionally, the increased advocacy for animal-free alternatives, such as human-derived and synthetic media, has gained traction, with 40% of research institutions actively exploring these options. These ethical concerns and regulatory changes are leading to higher production costs, slowing down innovation and limiting market expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, HiMedia Laboratories, Bio-Techne, PAN-Biotech, Atlas Biologicals, Inc., Rocky Mountain Biologicals, Biowest, and Others. |

SEGMENT ANALYSIS

By Application Insights

The cell-based research segment held the major share of 41.3% in the global market in 2024. The demand for FBS in this segment is driven by its critical role in supporting cell cultures used in drug development, stem cell research, and tissue engineering. According to the National Institutes of Health (NIH), $25 billion is spent annually in the U.S. alone on biomedical R&D, with a significant portion dedicated to cell-based therapies. Furthermore, 70-80% of global drug discovery programs rely on cell cultures supported by FBS. The significant focus on R&D in both academic and industrial sectors continues to drive the growth of this segment, maintaining its dominance.

The vaccine production segment is estimated to expand at a CAGR of 9.1% from 2025 to 2033. The segment's rapid growth is mainly attributed to the increasing demand for vaccines, especially in response to emerging diseases and global health crises such as the COVID-19 pandemic. The World Health Organization (WHO) reports that over 13 billion COVID-19 vaccine doses were administered worldwide by mid-2022, significantly increasing the demand for FBS in viral propagation. This growth is driven by the need for high-quality cell cultures to produce vaccines, with FBS playing a key role in cultivating viruses for vaccine development. As vaccination programs expand globally, the demand for FBS in vaccine production is expected to continue rising.

By End-user Insights

The pharmaceutical and biotechnology companies segment led the market by capturing 45.6% of the global market. The growth of the pharmaceutical and biotechnology companies segment is majorly attributed to the continuous demand for FBS in drug development, biologics production, and therapeutic research. Pharmaceutical and biotechnology companies heavily rely on FBS for cell culture in preclinical and clinical research. The U.S. Food and Drug Administration (FDA) reported that biologics represented 38% of new drug approvals in 2020, reinforcing the importance of this segment in the overall FBS market as it supports the development of novel treatments and vaccines.

The contract research organizations (CROs) segment is progressing rapidly and is anticipated to register a CAGR of 8.9% over the forecast period due to the increasing outsourcing of research and development activities by pharmaceutical and biotechnology companies. According to the National Institutes of Health (NIH), global spending on contract research services is growing at a rate of 7-8% annually. CROs are crucial for conducting preclinical and clinical trials, and the rising demand for outsourced research services is propelling the need for FBS in cell culture and clinical trial applications. This trend is expected to continue as pharmaceutical companies look for cost-effective solutions.

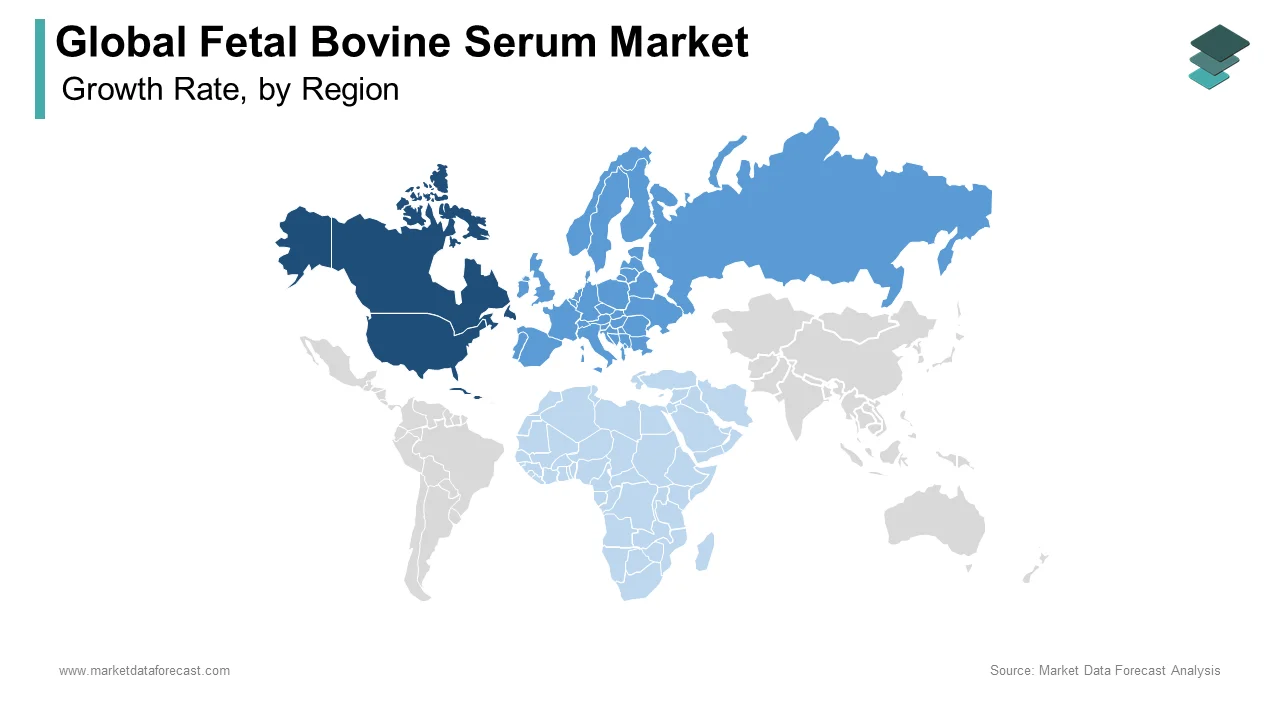

REGIONAL ANALYSIS

North America led the fetal bovine serum market by commanding 45.3% of the global market share in 2024. The robust growth of the biotechnology and pharmaceutical industries, particularly in the U.S., where there is heavy investment in research and development is propelling the domination of North America in the global market. According to the National Institutes of Health (NIH), the U.S. alone spent over USD 40 billion on biomedical research in 2022, driving demand for high-quality FBS in drug development, stem cell research, and vaccine production. North America's advanced healthcare infrastructure and ongoing innovation in therapeutic development further solidify its position as the market leader.

The Asia-Pacific region is the most promising region for fetal bovine serum worldwide currently and si estimated to witness a robust CAGR of 9.4% from 2025 to 2033. According to the Asian Development Bank (ADB), China's life sciences market grew by nearly 20% in the past five years, with a significant portion of investments directed toward biologics and vaccine production. In India, the biotechnology industry is projected to reach $150 billion by 2025, driven by government initiatives and increasing healthcare demand. Japan, known for its advanced research infrastructure, invested over $5 billion in biotechnology R&D in 2022 alone. This robust investment and demand for biologics and vaccines are key factors driving FBS market growth in the region.

In Europe, the FBS market is expected to experience steady growth, driven by an increasing focus on personalized medicine and stem cell research. According to the European Commission, the EU biopharmaceutical industry was valued at over USD 40 billion in 2022 and is forecast to grow steadily due to ongoing advancements in regenerative medicine.

In Latin America, the Fetal Bovine Serum (FBS) market is expected to grow steadily, driven by increasing investments in the biotechnology and pharmaceutical sectors. The region’s market is likely to expand as a result of rising demand for biologics, personalized medicine, and vaccine production. According to the Pan American Health Organization (PAHO), healthcare spending in Latin America is projected to grow at 5.3% annually over the next decade, with biotechnology becoming a focal point for innovation. Additionally, nations like Brazil and Mexico are investing in advanced healthcare infrastructure, which will enhance the demand for high-quality FBS in research and drug development, fostering a positive market outlook.

The Middle East and Africa (MEA) region is poised for moderate growth in the Fetal Bovine Serum (FBS) market, driven by increasing investments in healthcare infrastructure, particularly in the United Arab Emirates (UAE) and Saudi Arabia. For instance, the UAE's healthcare sector has seen investments exceeding $10 billion in recent years, with a focus on biotechnology and regenerative medicine. Similarly, Saudi Arabia's healthcare expenditures are expected to reach $47 billion by 2026, spurring growth in the biologics sector. The King Abdullah University of Science and Technology in Saudi Arabia recently launched several stem cell research initiatives, which are expected to increase the demand for high-quality FBS as the need for biologic products and clinical research grows in the region.

KEY MARKET PLAYERS

Companies playing a prominent role in the global fetal bovine serum market include Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, HiMedia Laboratories, Bio-Techne, PAN-Biotech, Atlas Biologicals, Inc., Rocky Mountain Biologicals, Biowest, and Others.

TOP 3 PLAYERS IN THE MARKET

Thermo Fisher Scientific is a leading player in the global FBS market, holding a significant share due to its comprehensive range of high-quality cell culture products. Thermo Fisher's FBS is widely used in academic research, vaccine production, and the biopharmaceutical industry. The company is known for its consistent supply of FBS, which is essential in stem cell research, drug development, and other critical therapeutic applications. Their global presence and continuous focus on research and development make Thermo Fisher Scientific a key contributor to the market's growth. The company’s acquisition of various biotechnology firms has strengthened its position in the market by enhancing its product portfolio and distribution network.

BioWest is another prominent player in the FBS market, specializing in the production and distribution of high-quality FBS. The company’s offerings are tailored to meet the needs of cell culture applications in pharmaceutical research, biotechnology, and diagnostics. BioWest has established a strong reputation for providing FBS that meets stringent quality standards, a key factor that has positioned it as a leader in the field. The company’s commitment to ensuring ethical sourcing of FBS and offering alternative solutions has helped it expand its market presence in both developed and emerging regions. BioWest’s contribution lies in supplying high-quality, reliable FBS for researchers and pharmaceutical companies worldwide.

GE Healthcare Life Sciences, now part of Cytiva, is a significant player in the global FBS market, with a focus on providing innovative solutions for biomanufacturing and cell culture. The company’s FBS products are integral to various applications, including vaccine production, drug development, and cell therapy. GE Healthcare Life Sciences has invested heavily in bioprocessing technologies, supporting the global demand for FBS in the rapidly growing regenerative medicine and biologics sectors. The company’s comprehensive range of cell culture media and additives, including FBS, contributes to the efficiency and scalability of biopharmaceutical production, making GE Healthcare Life Sciences an essential player in driving growth within the FBS market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Diversification: Leading companies like Thermo Fisher Scientific and GE Healthcare Life Sciences focus heavily on innovation to meet the growing and evolving needs of the biotechnology and pharmaceutical sectors. These players continually invest in the development of high-quality FBS and alternative products, such as chemically defined media, to cater to the demand for more reproducible and ethical cell culture solutions. Thermo Fisher, for instance, offers FBS derived from different geographic regions, which allows it to meet specific customer requirements related to serum performance, consistency, and sourcing preferences.

Mergers and Acquisitions: To expand their product portfolios and strengthen market presence, key players in the FBS market frequently pursue mergers and acquisitions. For example, Thermo Fisher's acquisition of Life Technologies and other smaller firms has helped the company significantly broaden its FBS product offerings and enhance its global distribution capabilities. This strategy also allows companies to tap into new markets and customer bases, particularly in emerging regions where the demand for biopharmaceutical products is growing.

Strategic Partnerships: Establishing partnerships with research institutions, pharmaceutical companies, and biotechnology firms is another key strategy used by FBS market leaders to foster growth. For example, BioWest collaborates with several universities and research labs, ensuring a steady demand for its high-quality FBS products. These partnerships help companies gain access to cutting-edge research, enhance their market reach, and drive product improvements.

COMPETITIVE LANDSCAPE

The competition in the Fetal Bovine Serum (FBS) market is intense, driven by the growing demand for high-quality cell culture products used in a range of applications such as biotechnology, pharmaceutical research, vaccine production, and regenerative medicine. The market is characterized by the presence of several well-established players, such as Thermo Fisher Scientific, BioWest, and GE Healthcare Life Sciences, who dominate the space through their expansive product portfolios, advanced manufacturing capabilities, and global distribution networks. These companies maintain a competitive edge by consistently innovating, expanding their product offerings, and forming strategic partnerships with key stakeholders in research and development.

Smaller regional players also contribute to the competitive landscape, often offering specialized or cost-effective alternatives to FBS from larger manufacturers. However, these companies face challenges in competing with the established leaders, particularly when it comes to ensuring consistent quality, meeting regulatory standards, and securing a reliable supply of raw materials.

Additionally, the increasing ethical concerns surrounding the use of animal-derived products and the subsequent push for alternative serum solutions has added a layer of competition, as more companies explore plant-based, synthetic, or human-derived media alternatives. This shift in consumer preference is reshaping the competitive dynamics, as companies focus on providing more ethical and sustainable options while maintaining the high performance of their products.

RECENT MARKET DEVELOPMENTS

- In November 2024, Gemini Bioproducts, LLC acquired selected fetal bovine serum (FBS) product rights and inventory from Bio-Techne. This acquisition includes Bio-Techne's R&D Systems FBS product brands: Optima, Premium Select, and Premium.

MARKET SEGMENTATION

This research report on the global fetal bovine serum market has been segmented and sub-segmented based on application, end-user, and region.

By Application

- Drug discovery

- In-vitro fertilization

- Vaccine production

- Cell-based research

- Diagnostics

- Others

By End-user

- Pharmaceutical & biotechnology companies

- Contract Research Organizations (CRO)

- Academic and research organizations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the fetal bovine serum market?

The fetal bovine serum market is expected to grow from USD 2.39 billion in 2025 to USD 7.01 billion by 2033, at a CAGR of 14.4%.

2. What are the main applications of fetal bovine serum market?

Fetal bovine serum is crucial in cell culture for drug discovery, vaccine production, in-vitro fertilization, and cell-based research.

3. How does fetal bovine serum support biopharmaceuticals and biologics?

Fetal bovine serum is essential for producing therapeutic proteins, monoclonal antibodies, and in the development of biologic therapies.

4. What ethical concerns impact the fetal bovine serum market?

Concerns about animal welfare have led to increasing interest in alternatives like synthetic or human-derived serum.

5. What opportunities exist for the fetal bovine serum market?

The growing fields of regenerative medicine and vaccine development are key growth drivers for fetal bovine serum demand.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]