Global Fertilizer Additives Market Research Size, Share, Trends, & Growth Forecast Report - Segmented By Function (Anticaking Agents, Dedusting Agents, Antifoaming Agents, Hydrophobic Agents, Corrosion Inhibitors), Application (Urea, Ammonium Nitrate, Diammonium Phosphate, Monoammonium Phosphate, Ammonium Sulphate, Triple Super Phosphate), Form Of Application (Granular Fertilizers, Prilled Fertilizers, and Powdered Fertilizers) And Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Fertilizer Additives Market Size

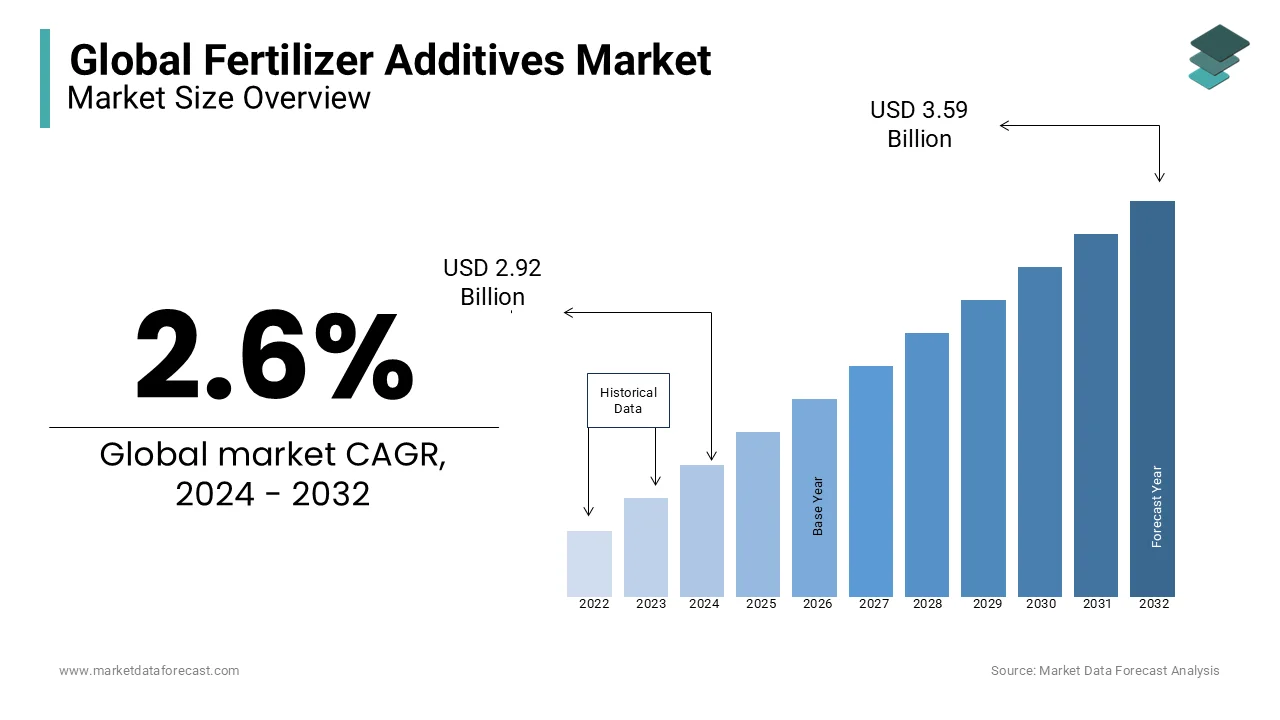

The global fertilizer additives market was valued at USD 2.92 billion in 2024 and is anticipated to reach USD 3 billion in 2024 from USD 3.68 billion by 2033, growing at a CAGR of 2.6% from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL FERTILIZERS ADDITIVES MARKET

The fertilizer additives market has been steadily growing. Today, some of the common types of enhancers and additives are biostimulants (fulvic and humic acids, seaweed extracts, and microbials), micronutrient blends, and nitrogen stabilizers. Moreover, in the last few years, the overall awareness in the market has increased considerably. The development is projected to continue. As per industry experts, the current market is displaying loads of prospects for growth.

- According to research by Our World in Data, growers around the world utilize about 115 million tons of nitrogen to harvest each year. Just around 35 percent of this is applied by users, revealing that 75 million tons of nitrogen goes into lakes, rivers, and natural environments.

The market continues to gain momentum with the increase in demand for fertilizers due to increasing pressure on global food production and development in technologies of fertilizer production. Fertilizer Additives are chemicals added to the fertilizers to enhance their productivity. The demand for high agricultural yields is met with the subsequent demands for high-quality fertilizers and primary nutrients, which in turn is responsible for the rise in the demand for Fertilizer additives.

However, the market players expressed concern about the potential loss of nitrogen loss, despite farmers being progressively enthusiastic about splitting nitrogen applications. This concern is grounded in the desire to maximize the return on investment (ROI) from nitrogen fertilizers. Moreover, the market is also affected by ongoing geopolitical issues, armed conflicts, and wars.

MARKET DRIVERS

The dilemma of fulfilling the heightening demand for grains and protein and the necessity to provide climate-friendly products for the applied nutrient requirements are a joint force driving the growth of the fertilizer additives market.

The prime source of plant proteins, carbohydrates, and energy in the world is cereal grains.

- As per a study published in the National Library of Medicine, presently, only 41 percent of grains are utilized for human consumption, and as far as 35per cent are applied for animal feed.

They have been ignored as a source of ecologically tenable and healthy plant proteins and could play a key part in shifting to a more sustainable food system for wholesome diets. Transitioning grain application from feed to conceptionally novel ingredients and foods, as well as conventional ones, can enhance protein security and mitigate climate change. Rapid advancements in new food ingredients based on grain and the application of grains in modern food contexts, like meat analogs and dairy replacements, can speed up the change. Hence, it contributes to the market growth.

Another factor propelling the market for these additives and enhancers is the rising demand for agricultural commodities.

This is because of ethical sourcing and sustainable agriculture. So far in 2024, the market has seen an increase in the need for agro commodities made using ethical and sustainable means. Consumers are progressively acknowledging the effect of their food decisions on society and the environment, which is why organic and bio-fertilizer additives and enhancers are needed. Besides organic certification, this market trend comprises measures that hold up and promote biodiversity, soil health, and ethical labor standards. Therefore, ethical sourcing has turned into a major element in determining market dynamics.

Additionally, the greater inflow of investments for research and development in the field of fertilizer manufacturing technology has resulted in evident growth of the fertilizer additives market.

This can be attributed to the blend of global trade policies, supply chain disruptions, increased costs of production, and multiple armed conflicts and wars.

- For instance, according to agricultural commodities data released by NASDAQ, the wheat market is anticipated to have a reduction of 10 million tons in global stock. This narrowing supply, along with revived purchasing interest from established or customary importers.

Other key factors driving the Fertilizer Additives Market include rising demand for agricultural commodities, ease of application and handling of fertilizers, and demand for higher-yield crops.

MARKET RESTRAINTS

The fertilizer additives market also faces some restraints and challenges. Some of these factors are the growth of the organic fertilizer industry, the environmental impact of chemical fertilizers, the adverse effects of agrochemicals on human health, and stringent government regulations.

Traditional additives generally inherit ecological side effects, involving the discharge of greenhouse gases, the dumping of chemicals into water bodies, and the deterioration of soil health. In addition, the market encounters various limitations in satisfying crop demand at the same time keeping low its negative effect on the environment. These problems emerge from several factors, comprising expanding population, changing food preferences, resource constraints, and environmental worries, affecting the progress of the market. In various regions, the imbalance in levels of soil nutrients also affects the growth of crops. This can be credited to the mismatch in determining the required crop nutrient and nutrition application, which ultimately affects the market expansion.

Supply chain issues in potassium (P), phosphorous (P), and Nitrogen (N) is another factor restricting the growth of the market.

All these are the main nutrients in commercially available fertilizers that face unique problems. Like in Potassium, the problem is present in the concentration of delivery. There are only a handful of nations that manufacture potash, and even fewer are the exporters. Canada is the top global producer of potash, making 1/3rd of the world’s potash. Other major suppliers are Belarus and Russia, which jointly command 40 percent of the potash supply worldwide. Considering the ongoing global geopolitical scenario, the situation has become even more grave.

MARKET OPPORTUNITIES

The biggest opportunity for the fertilizer additives market is to keep engaged in innovating solutions and products that offer the maximum value to farmers and their activities.

There is a growing inclination towards improving human health and environmental sustainability, which requires adopting plant-based foods in place of animal-sourced foods. This change has begun in Western countries by making the transition to grains from feed to individual consumption, and an extra advantage would be a lower environmental footprint.

Moreover, one of the massive growth prospects will be sources or origins of conventional fertilizers that possess enhancers or additives integrated into the fertilizer granule, water-friendly, or liquid mix creation or composition at the point of production.

MARKET CHALLENGES

One of the pressing concerns impeding the growth of the fertilizer additives market is volatility in its prices.

In the last two years, the prices of fertilizer and other associated items have increased exorbitantly with both demand and supply taking hits by external factors, ranging from COVID-19 to plenty of geopolitical and supply chain challenges.

For instance, as of May 2022, the price of fertilizers increased by 30 percent from the beginning of the year. On the other hand, in September 2024, multiple average retail prices of fertilizers displayed a significant drop throughout the 2nd week of this month. This happened for the 1st time in the last 8 weeks.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.6% |

|

Segments Covered |

By Function, Application, Form of Application, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Clariant, KAO Corporation, Novochem Group, Amit Trading Ltd., Arrmaz, Filtra Catalysts & Chemicals Ltd., Chemipol, Forbo Technology, Michelman, Tolsa Group. |

SEGMENT ANALYSIS

Global Fertilizers Additives Market By Function

The anticaking agents segment gained the maximum share of the fertilizer additives market and is expected to move further during the forecast period. The growth of the segment’s market size can be attributed to the combination of several factors, including higher efficiency, reduction in losses because of caking, maintaining the quality of products processed with anticaking agents over longer storage, the exposure to accidents in managing and distributed is decreased due to evading problems in product flow, and reduces costs by mitigating waste and greater operational productivity. Apart from these, the market share of this segment is believed to be elevated owing to the development of novel water-based anticaking agents for nitrogen (N), phosphorous (P) and potassium (K) fertilizers. This is done to achieve high performance in anticaking through response surface methodology (RSM) with Box Behnken Design (BBD).

Global Fertilizers Additives Market By Application

The urea segment is the most dominant category of the fertilizer additives market and is expected to experience key developments over the estimation period. The demand for urea in the world for the year 2024 is anticipated to be around 183 million tons (Mt). Moreover, it is manufactured across the world at an industrial level through the Basarov Reaction using the reaction of carbon dioxide (CO2) and ammonia (NH3) at pressure and temperature between 125 to 250 bar and 170 to 200 degrees Celsius, respectively. Besides this, the segment’s market size is likely to expand because of the surge in demand for decarbonization of the fertilizer industry. Leading nitrogen-based fertilizers, like urea and ammonium nitrate and urea, are projected to maintain pace with the world population and add further to carbon dioxide discharge worldwide.

Global Fertilizers Additives Market By Form of Application

The granular fertilizer segment is the most preferred form of application in the fertilizer additives market and is estimated to advance at a decent growth rate during the forecast period. This dominance can be because of the ease of handling and application, wide usage in farming practices, and controlled nitrogen release. Further, granules have a bigger size and power in contrast to prills. Hence, these are favored when urea is to be transported in the majority.

REGIONAL ANALYSIS

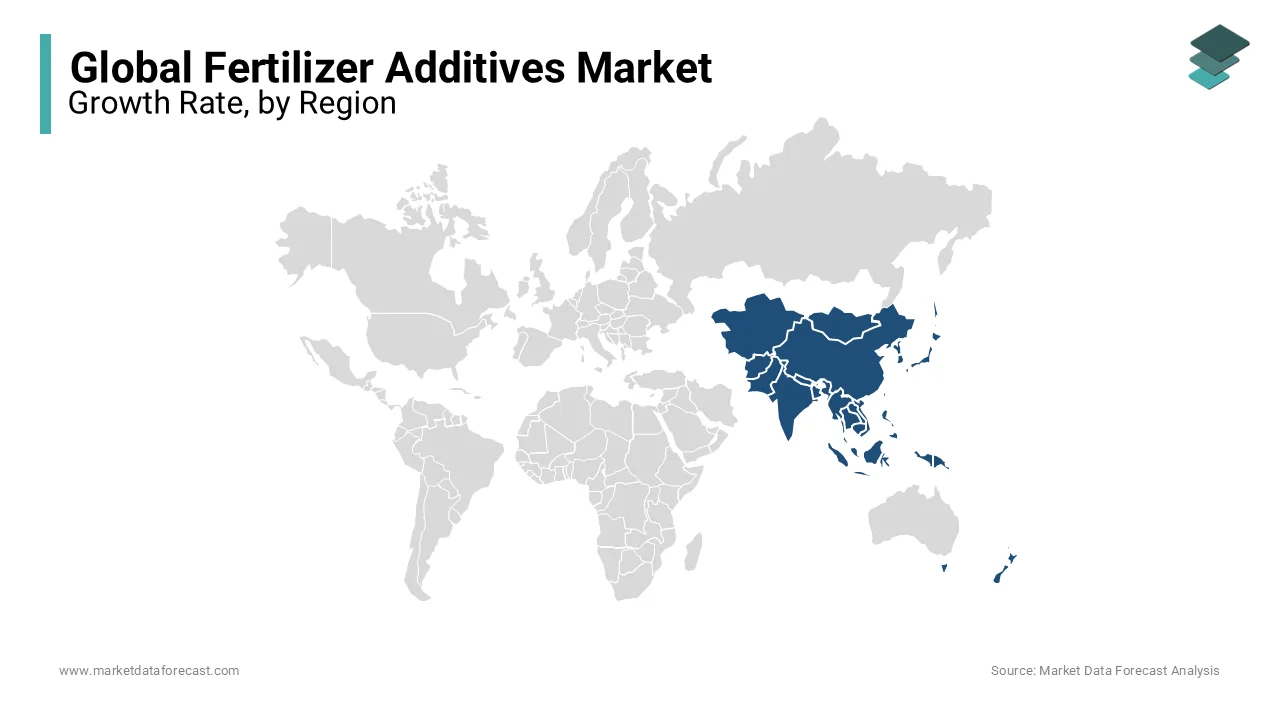

The overall market share is over 40% globally. Asia-Pacific was followed by North America. The reason behind the growth in these regions is the high rate of adoption of new technologies in fertilizer production. The regional market is expanding due to the strong agricultural sector, with nations such as Indonesia, India, and China being key manufacturers of several crops. Moreover, the shift towards sustainable agriculture is expected to drive the market forward. Growers are becoming more ecologically aware and are searching for fertilizers that only enhance crop products and also promote soil health. However, the region is also a major contributor to greenhouse gas emissions from the fertilizer industry.

KEY MARKET PLAYERS

Some of the major companies dominating the Fertilizer Additives market by their products and services include Clariant, KAO Corporation, Novochem Group, Amit Trading Ltd., Arrmaz, Filtra Catalysts & Chemicals Ltd., Chemipol, Forbo Technology, Michelman, Tolsa Group, are playing a dominated role in global fertilizer additives market.

RECENT MARKET DEVELOPMENTS

- In September 2024, Annova Ag announced that it developed strong additives or enhancers for chemical fertilizers to considerably increase the profitability of the agricultural industry and encourage its sustainability.

DETAILED SEGMENTATION OF THE GLOBAL FERTILIZERS ADDITIVES MARKET INCLUDED IN THIS REPORT

This market research report on the global fertilizer additives market is segmented and sub-segmented into the following categories.

By Function

- Anticaking Agents

- Dedusting Agents

- Antifoaming Agents

- Hydrophobic Agents

- Corrosion Inhibitors

By Application

- Urea

- Ammonium Nitrate

- Diammonium Phosphate

- Monoammonium Phosphate

- Ammonium Sulphate

- Triple Super Phosphate

By Form of Application

- Granular Fertilizers

- Prilled Fertilizers

- Powdered Fertilizers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

what is the size of global fertilizers additives market?

The size of the fertilizer additives market is predicted to be valued at USD 3 billion in 2025.

what is the growth of fertilizer additives market?

The fertilizer additives market is estimated to be growing at a CAGR of 2.6% to reach USD 3.68 billion by 2033.

what are the key market players involved in fertilizer additives market?

Some of the major companies dominating the Fertilizer Additives market by their products and services include Clariant, KAO Corporation, Novochem Group, Amit Trading Ltd., Arrmaz, Filtra Catalysts & Chemicals Ltd., Chemipol, Forbo Technology, Michelman, Tolsa Group, are playing a dominated role in global fertilizer additives market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]