Global Ferrochrome Market Size, Share, Trends, & Growth Forecast Report Segmented By Level of Carbon (High carbon ferrochrome, Charge Chrome, Low carbon ferrochrome, Medium carbon ferrochrome, Ferrochrome silico chrome (FeSiCr)), By Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Ferrochrome Market Size

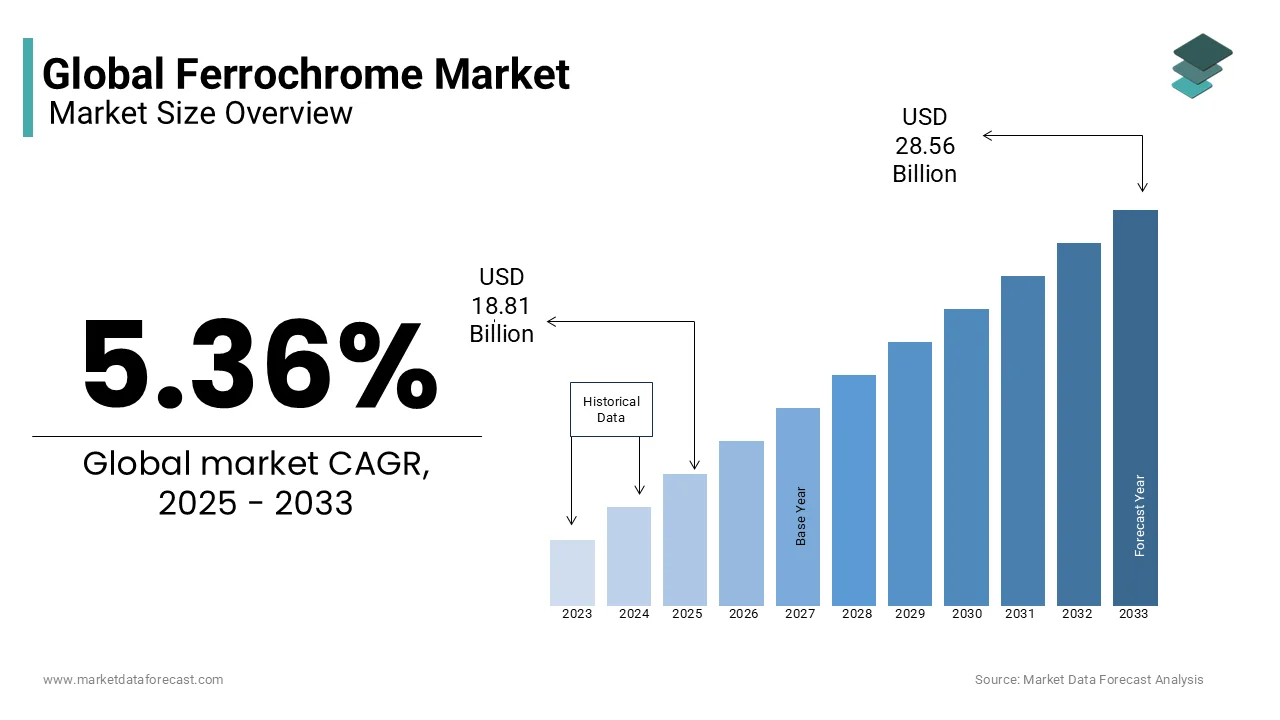

The Global ferrochrome market size was valued at USD 17.85 billion in 2024 and is expected to reach USD 28.56 billion by 2033 from USD 18.81 billion in 2025. The market is projected to grow at a CAGR of 5.36%.

MARKET DRIVERS

The ferrochrome market is steadily rising, with few key producers driving global output. Also, the growing demand for products from developing nations is a major factor propelling the expansion of the industry. Likewise, another key driver boosting the market share is rising stainless steel production for different sectors worldwide. This includes buildings and automobiles. Therefore, these elements will further fuel the market in the coming years.

The ferrochrome market is expanding primarily due to the need for stainless steel. Also, the transportation and construction sectors use stainless steel and chromium manganese grades extensively. So, it will have a favorable effect on market development. Therefore, it is expected to flourish mainly due to the rising need for metallic materials from the construction, transport, and metallurgy industries.

One major factor propelling market expansion is the growing demand for ferrochrome from emerging nations. Growth in the market is anticipated due to factors including the usage of ferrochrome in emerging nations to produce stainless steel and other alloy steel. Zimbabwe, China, South Africa, India, and other countries are becoming the new locations for many ferrochrome suppliers' manufacturing facilities. The anticipated expansion of the market would be aided by the accessibility of raw resources, affordable labor and transportation expenses, and laxer government laws and policies in these nations.

MARKET RESTRAINTS

The availability of alternate products is restricting the growth of the ferrochrome market. Carbon is becoming more popular in the automotive industry because of its ability to absorb considerable energy impact and also increase vehicle safety. These fibers are gradually replacing stainless steel in automobiles. Hence, this will hurt the market. Moreover, it is also utilized in cars to reduce weight and maintain strength to endure the demands of racing. Furthermore, ferrochrome production requires a significant quantity of power, which will be a hurdle for companies in this industry.

Additionally, overproduction and high manufacturing costs are hindering the ferrochrome market. This impact was also due to the rising demand for stainless steel. Moreover, manufacturing requires a massive quantity of power, which further limits the expansion.

MARKET OPPORTUNITIES

Growing production and foreign investment are driving up demand for stainless steel and providing potential opportunities for the global ferrochrome industry. Moreover, the rise of commercial industries, including consumer products, construction, heavy machinery, and automotive, is supported by foreign investments.

Green ferroalloys provide a potential opportunity for the market. Additionally, in February 2023, the China Iron & Steel Association (CISA) and the China Metallurgical Sector Planning & Research Institute declared their intention to work together to perform green certification of the ferroalloys sector to acknowledge the establishment of green manufacturing systems in China.

MARKET CHALLENGES

The growth in the ferrochrome market is hampered by the effects of chromite mining. Its main effects are air and water pollution and local landscape deterioration. Moreover, the market expansion is also affected by the high water consumption during chromite manufacturing. So, several nation's governments have expressed worry about the adverse effects of mining operations. Hence, the demand for ferrochrome manufacturing will be reduced by these issues.

Additionally, workers inhaling chromium compounds during the production process have a significant risk of acquiring cancer. Another main concern in the chromite business is the carcinogenic nature of hexavalent chromium found in friable ores. Furthermore, gastrointestinal cancer and issues related to the nose and throat are also possible side effects. Hence, these factors impede the expansion of the global ferrochrome market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.36% |

|

Segments Covered |

By Level of Carbon, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Samancor Chrome, Jindal Steel & Power Limited, Eurasian Resources Group, Hernic, Vargön Alloys AB, Ferbasa, Yilmaden, Glencore, ALBCHROME, Outokumpu, INFO, Balasore Alloys Limited, Ferro Alloys Corporation Ltd., and Others. |

SEGMENT ANALYSIS

By Level of Carbon Insights

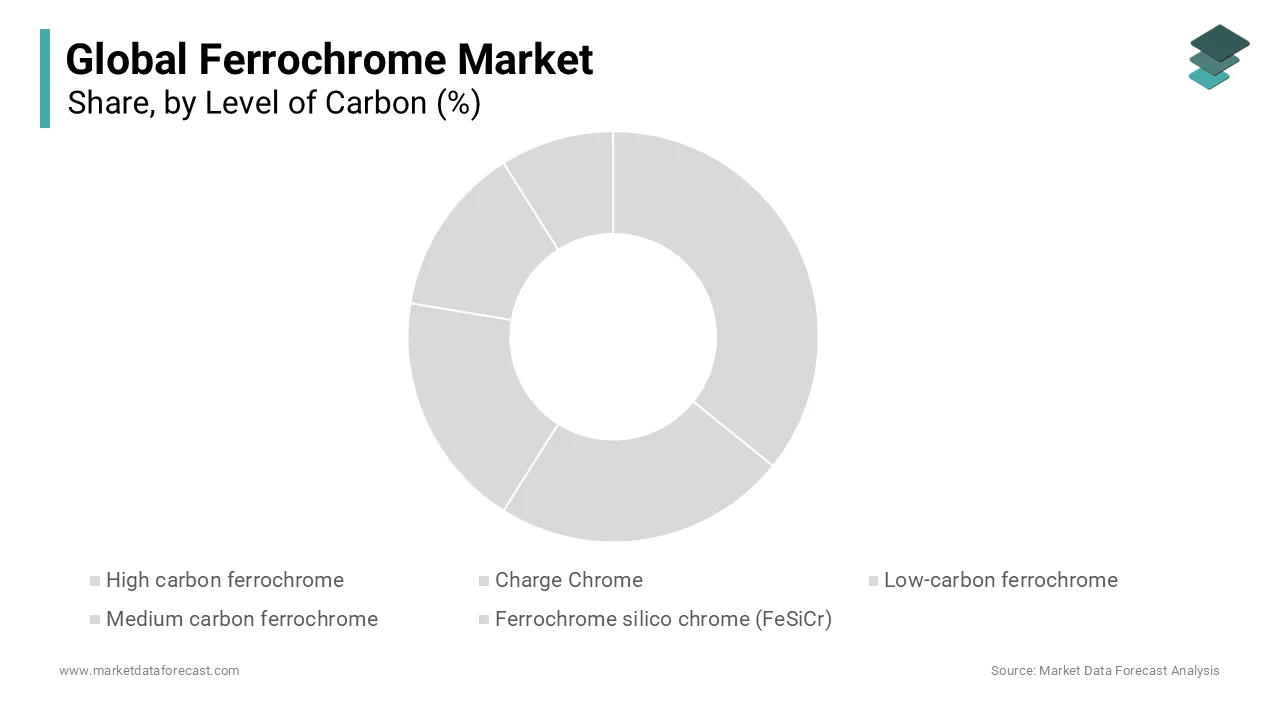

The high carbon segment dominates, with more than 90 % share of the ferrochrome market. This is because it is less expensive and more readily available in bigger reserves than other products. As a result, producers of stainless steel use this product extensively.

Meanwhile, the low-carbon segment is expected to grow at a higher CAGR in the future. Tool steels and carbon and low alloy steels are key applications and are also utilized in stainless steel. Moreover, it is typically used by steel makers in the last phases of manufacturing to add precisely the right quantity of chrome without increasing the carbon levels.

By Application Insights

The stainless-steel segment is expected to lead with the maximum share of the global ferrochrome market during the forecast period. The transportation and building sectors are the prominent users of chromium, manganese, and stainless steel. Furthermore, one of the main factors propelling the market's huge growth will be the construction industry's growing demand for stainless steel. But during the past ten years, technical developments have improved corrosion resistance and endurance while also making this steel more widely available and reasonably priced. Therefore, the demand for stainless steel in the construction industry will increase by the growing number of residential and commercial buildings, the commissioning of more infrastructure projects, and the rise in water leakage issues. In addition, the rising need for stainless steel from the transportation, building, and metallurgical sectors will most likely propel market expansion in the next years.

REGIONAL ANALYSIS

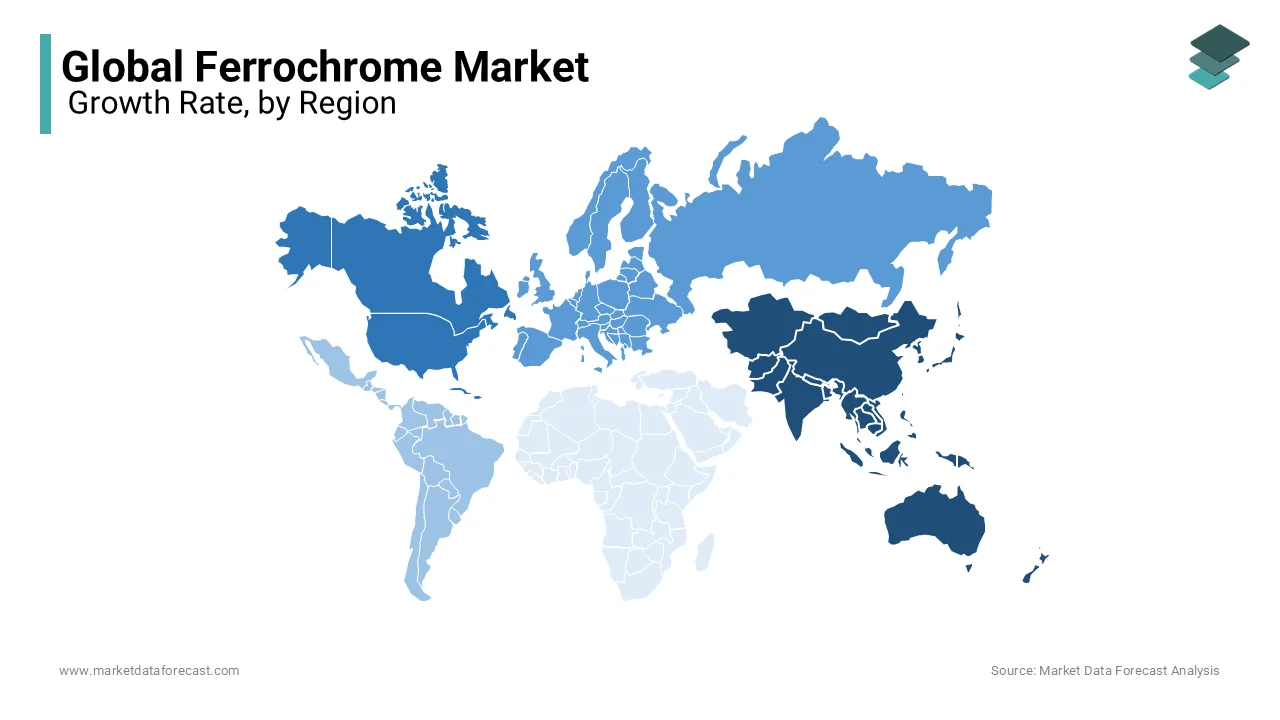

Asia Pacific accounts for the highest share of the global ferrochrome market. This growth is due to rising product demand from Chinese and Indian stainless-steel producers. Also, the need for products is increasing because of the growing production of stainless steel. Thus, it is propelling the regional market value. Moreover, the growing urbanization is driving up demand for stainless steel, which is also contributing to the expansion. Further, Indonesia is emerging as a significant producer of stainless steel. In 2022, the output reached 4.805 million tons, making it a key market for global chrome ore and ferrochrome providers.

North America, The U.S. market is substantially bigger in North America than the Canadian market. It is expected that increased domestic production of stainless steel will decrease metal imports due to the continuing trade spat between China and the United States. However, growing costs for stainless steel because of increased demand from home producers may have a detrimental effect on demand, which would then balance output. It is anticipated that this uncertainty will impact the market dynamics of the nation.

Europe is predicted to move forward at a considerable growth rate in the ferrochrome market in the coming years. The automobile industry's rapid growth and the rise in scientific research and development are the primary reasons for the region's market boom. Stainless steel usage in the area will increase as a result of the product's progress. The area is a significant automaker. Automotive body frames, parts, and components are mostly made of stainless steel. These elements are probably going to make people want the product more.

Latin America is expected to have a steady growth in the ferrochrome market. The growing production of stainless and specialty steel in Brazil is the primary driver of the regional market. Beneficial regulations for local vendors are the main drivers of stainless-steel manufacturing in the Brazilian automobile sector, which in turn drives ferrochrome use.

Middle East and Africa are emerging as potential destinations for the ferrochrome market. Industrialization, infrastructural growth, and urbanization are driving a notable surge in the demand for stainless steel and ferrochrome in rising economies in the MEA.

KEY MARKET PLAYERS

Samancor Chrome, Jindal Steel & Power Limited, Eurasian Resources Group, Hernic, Vargön Alloys AB, Ferbasa, Yilmaden, Glencore, ALBCHROME, Outokumpu, INFO, Balasore Alloys Limited, and Ferro Alloys Corporation Ltd

RECENT HAPPENINGS IN THE MARKET

- In January 2023, Metso and Ferro Alloys Corporation Limited (FACOR) signed an agreement on the design and construction of a ferrochrome facility. The Minerals segment's fourth-quarter 2023 order intake includes the contract value, which is estimated to be worth EUR 80 million.

MARKET SEGMENTATION

This research report on the global ferrochrome market has been segmented and sub-segmented based on level of carbon, application, and region.

By Level of Carbon

- High carbon ferrochrome

- Charge Chrome

- Low-carbon ferrochrome

- Medium carbon ferrochrome

- Ferrochrome silico chrome (FeSiCr)

By Application

- Stainless steel production

- Specialty steel

- Foundry and Casting

- Chemical Industry

- Others

By Region

- North America

- Europe

- Asia-pacific

- Middle East and Africa

- Latin America

Frequently Asked Questions

1. What is the Ferrochrome Market growth rate during the projection period?

The Global ferrochrome market is projected to grow at a CAGR of 5.36%.

2. What can be the global ferrochrome market size by 2033?

The Global ferrochrome market size is expected to reach USD 28.56 Bn by 2033 from USD 18.81 Bn in 2025.

3. Name any three Ferrochrome Market key players?

AB, Ferbasa, and Yilmaden are the three key players in the Ferrochrome Market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]