Global Feeder Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Overview, Private Sports Clubs, Institutes), Product, And Region (Latin America, North America, Asia Pacific, Europe, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Feeder Market Size

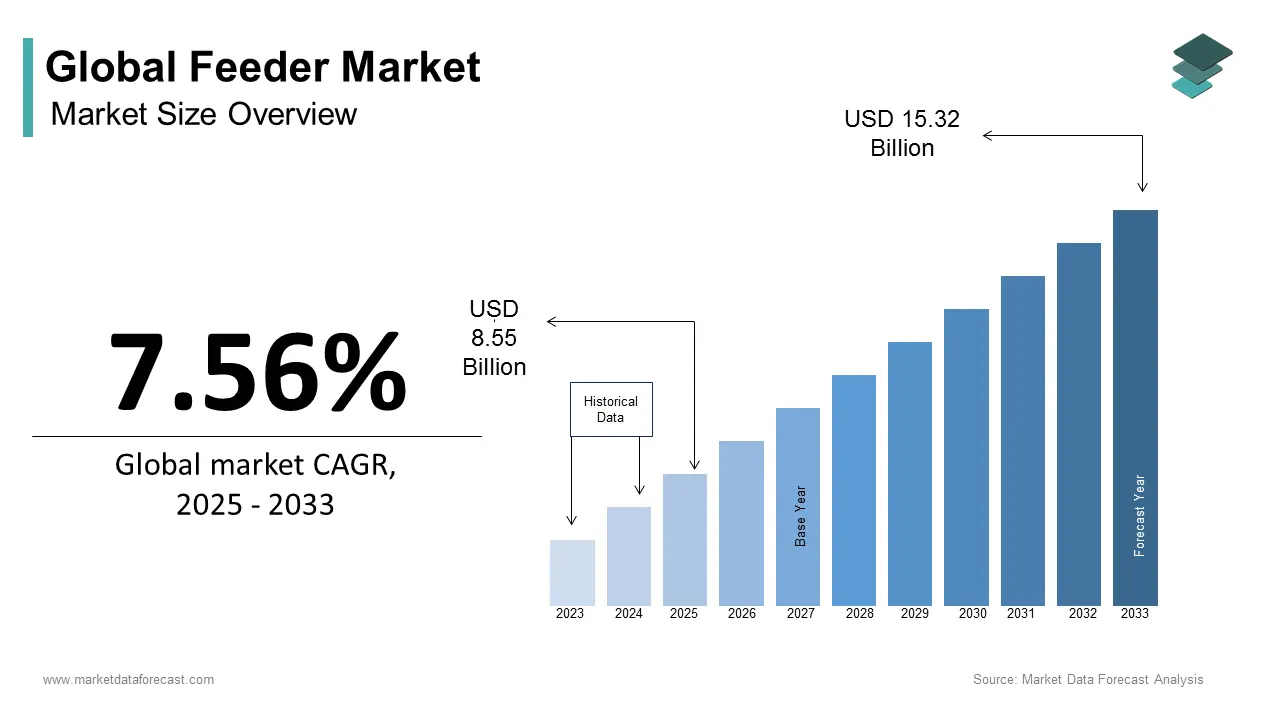

The global feeder market size was valued at USD 7.95 billion in 2024 and is expected to reach USD 15.32 billion by 2033 from USD 8.55 billion in 2025. The market is projected to grow at a CAGR of 7.56%.

Current Scenario of the Global Feeder Market

The feeder market pertains to the young animals raised for eventual sale as meat. This market serves as a crucial link between breeding operations and meat production facilities, facilitating the transition of feeder animals primarily cattle, pigs, and sheep into the finishing phase before slaughter. The dynamics of the feeder market are influenced by various factors, including feed prices, consumer demand for meat, and overall economic conditions.

In recent years, the global demand for meat has surged, with the Food and Agriculture Organization (FAO) projecting that global meat consumption will increase by 14% from 2020 to 2030. This rising demand is accompanied by a growing awareness of the environmental impact of livestock farming. According to the World Resources Institute, livestock production accounts for approximately 14.5% of global greenhouse gas emissions, highlighting the need for sustainable practices within the feeder market.

Moreover, the American Society of Animal Science indicates that the average weight of feeder cattle has increased over the past decade, reflecting advancements in breeding and feeding practices. This trend underscores the importance of efficiency in the feeder market, as producers strive to meet the growing demand for high-quality meat while addressing environmental concerns.

MARKET DRIVERS

Consumer Trends Towards Organic and Grass-Fed Products

A significant driver of the feeder market is the growing consumer preference for organic and grass-fed meat products. As health consciousness rises, consumers are increasingly seeking meat that is perceived as healthier and more sustainable. According to the Organic Trade Association, organic meat sales in the United States reached approximately USD 1.5 billion in 2020, reflecting a 20% increase from the previous year. This trend is prompting producers to adapt their feeding practices, focusing on organic feed and pasture-based systems for feeder animals. As a result, the demand for feeder animals raised under these conditions is expected to grow, encouraging farmers to invest in practices that align with consumer preferences for quality and sustainability.

Integration of Vertical Farming Techniques

The integration of vertical farming techniques into livestock production is emerging as a driver of the feeder market. Vertical farming, traditionally associated with crop production, is now being explored for growing feed crops in controlled environments. This method can significantly reduce land use and water consumption while providing a consistent supply of high-quality feed. A study by the National Renewable Energy Laboratory indicates that vertical farming can yield up to 10 times more produce per square foot compared to traditional farming methods. As this technology becomes more accessible, it could alleviate some of the feed supply challenges faced by the feeder market, ultimately supporting its growth.

MARKET RESTRAINTS

Market Fragmentation and Lack of Standardization

A notable restraint in the feeder market is the fragmentation and lack of standardization across the industry. The feeder market comprises numerous small-scale producers, each with varying practices and quality standards. This fragmentation can lead to inconsistencies in product quality and pricing, making it difficult for buyers to establish reliable supply chains. According to a report by the International Livestock Research Institute, the lack of standardized practices can result in inefficiencies and increased costs, as producers may struggle to meet the diverse requirements of different markets. This inconsistency can deter larger buyers from engaging with smaller producers, limiting market access and growth opportunities for many in the feeder market.

Environmental Sustainability Concerns

Environmental sustainability concerns represent another significant restraint on the feeder market. As awareness of climate change and its impacts grows, consumers and regulators are increasingly scrutinizing livestock farming practices. The livestock sector is responsible for a substantial portion of greenhouse gas emissions, with the FAO estimating that it contributes about 14.5% of total emissions. This scrutiny has led to calls for more sustainable practices, such as reduced antibiotic use and improved waste management. Producers who fail to adapt to these expectations may face reputational risks and potential regulatory penalties, which can hinder their competitiveness in the feeder market.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

One significant opportunity for the feeder market lies in the expansion into emerging markets, particularly in Asia and Africa. As these regions experience rapid urbanization and economic growth, the demand for meat is projected to rise substantially. The FAO estimates that meat consumption in Asia is expected to increase by 30% by 2030, driven by a growing middle class and changing dietary preferences. This shift presents a lucrative opportunity for feeder market participants to supply young livestock to meet the increasing demand. Additionally, investments in infrastructure and supply chain improvements in these regions can facilitate better access to markets, enhancing profitability for producers and creating a more robust feeder market.

Adoption of Sustainable Practices

The growing emphasis on sustainability presents another opportunity for the feeder market. As consumers become more environmentally conscious, there is an increasing demand for sustainably raised meat products. Producers who adopt sustainable practices, such as regenerative agriculture and improved animal welfare standards, can differentiate their products and capture a share of this expanding market. Furthermore, government incentives and consumer support for sustainable practices can provide financial benefits to those in the feeder market who prioritize environmentally friendly methods, ultimately enhancing their competitiveness.

MARKET CHALLENGES

Supply Chain Disruptions

One of the major challenges facing the feeder market is the vulnerability of supply chains to disruptions. Events such as natural disasters, pandemics, and geopolitical tensions can significantly impact the availability of feed and livestock. For instance, the COVID-19 pandemic caused widespread disruptions in the livestock supply chain, leading to increased feed prices and reduced availability of feeder animals. According to the USDA, feed costs rose by approximately 20% during the pandemic, straining the profitability of many producers. Such disruptions can create uncertainty in the market, making it difficult for producers to plan and manage their operations effectively, ultimately hindering growth in the feeder market.

Animal Health Issues

Animal health challenges represent another significant hurdle for the feeder market. Diseases such as foot-and-mouth disease and avian influenza can have devastating effects on livestock populations, leading to substantial economic losses. The World Organisation for Animal Health reported that outbreaks of such diseases can result in the culling of thousands of animals, disrupting supply chains and increasing costs for producers. Additionally, the rising prevalence of antibiotic resistance poses a threat to animal health management, complicating treatment options.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.56% |

|

Segments Covered |

By Application, Product, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

|

Market Leaders Profiled |

Badenko, Dksportbot, and SIBOASI |

SEGMENTAL ANALYSIS

By Application Insights

The largest segment in the feeder market is private sports clubs by holding 60.6% of the market share in 2024 due to the increasing popularity of sports and fitness activities among individuals. According to the International Health, Racquet & Sportsclub Association (IHRSA), the global health club industry generated around USD 96 billion in revenue in 2020. Private sports clubs provide specialized training and facilities, attracting more members who are willing to invest in their fitness. This growth is essential as it promotes healthier lifestyles and encourages community engagement through sports.

The fastest-growing segment in the feeder market is institutes, with a CAGR of 8.5%. This growth is driven by the rising number of educational institutions focusing on sports and physical education. According to the National Center for Education Statistics, enrollment in U.S. colleges and universities reached 19.7 million in 2020, shocasing the increasing emphasis on sports programs. Institutes are investing in better facilities and training programs, which attract more students. This segment is important as it fosters talent development and encourages youth participation in sports, contributing to a healthier future generation.

By Product Insights

The 200 shuttlecocks category accounted for 45.3% of the market share in 2024 This segment is leading because it offers a balance of quality and affordability, making it popular among both amateur and professional players. According to the Badminton World Federation, there are over 220 million badminton players worldwide, which drives demand for shuttlecocks. The 200 shuttlecocks are favored for training and competitive play, making them essential for clubs and individuals. This segment's importance lies in its ability to support the growing badminton community and enhance the overall playing experience.

The quickly thriving segment in the feeder market is the 150 shuttlecocks, with a compound annual growth rate of 9.2% and is attributed to the increasing interest in badminton as a recreational sport, especially among younger players. The Badminton World Federation reported a 15% increase in participation rates in youth badminton programs in recent years. The 150 shuttlecocks are often seen as a more accessible option for beginners, making them popular in schools and community programs. This segment's growth is important as it encourages more people to engage in physical activity, promoting health and fitness in the community.

REGIONAL ANALYSIS

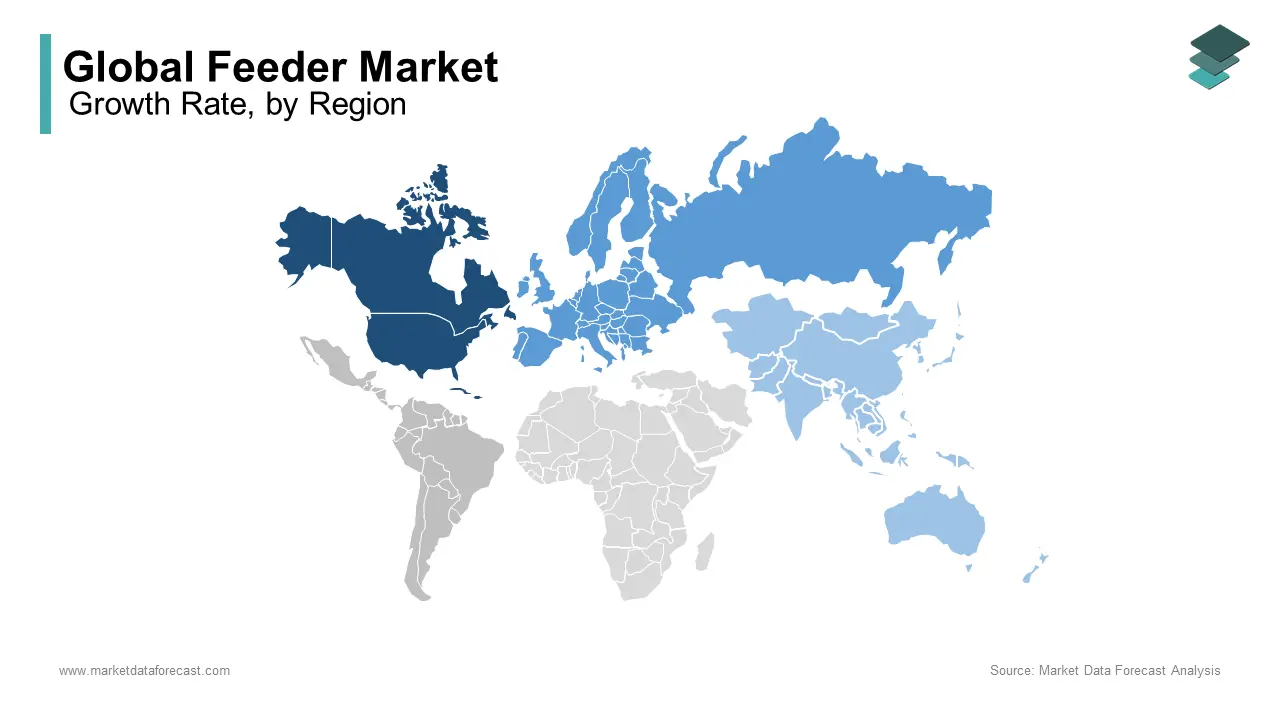

North America dominated the feeder market and held 35.4% of the global market share in 2024 due to its advanced agricultural infrastructure and high demand for livestock products. The United States is the largest producer of feeder cattle, with approximately 14.5 million head reported in 2022, according to the USDA. The region benefits from a well-established supply chain, efficient feed production, and technological advancements in farming practices. Additionally, the growing consumer preference for high-quality beef and pork drives demand for feeder animals. The North American market is also characterized by significant investments in research and development, enhancing productivity and sustainability. This leadership position is crucial for meeting both domestic and global meat consumption needs.

Europe captured a significant position in the feeder market and is driven by stringent regulations on animal welfare and sustainability. The European Union has implemented policies that promote environmentally friendly farming practices, leading to a growing demand for organic and grass-fed livestock. According to the European Commission, organic meat sales in the EU reached approximately USD 1.5 billion in 2020, reflecting a 20% increase from the previous year. The region's focus on quality over quantity ensures that European feeder animals meet high standards, appealing to health-conscious consumers. This commitment to sustainability and quality positions Europe as a leader in the global feeder market, influencing trends worldwide.

The Asia Pacific region is experiencing rapid growth in the feeder market, driven by increasing livestock production and rising consumer demand for meat. The region is expected to witness a CAGR of 6.5% in the coming years. The FAO projects that meat consumption in Asia will increase by 30% by 2030, primarily due to urbanization and a growing middle class. Countries like China and India are significant players, with China being the largest consumer of pork globally. The region is also witnessing advancements in farming practices and feed technology, enhancing productivity. As the demand for high-quality protein sources rises, the Asia Pacific region's feeder market is poised for substantial expansion, making it a critical area for investment and development.

Latin America is a key player in the global feeder market, benefiting from its vast agricultural resources and favorable climate for livestock production. Countries like Brazil and Argentina are among the top beef exporters, with Brazil alone exporting over 2 million tons of beef in 2021, according to the USDA. The region's extensive pasturelands and established cattle ranching practices contribute to its competitive advantage. Additionally, Latin America is increasingly adopting sustainable practices and improving feed efficiency, which enhances profitability.

The Middle East and Africa represent emerging markets in the feeder market, with significant potential for growth. The region is witnessing an increase in livestock production driven by rising population and urbanization. According to the FAO, meat consumption in Africa is expected to grow by 25% by 2030. Countries like South Africa and Egypt are leading the way in livestock farming, focusing on improving feed quality and animal health. Additionally, there is a growing interest in feed innovation and technology adoption to enhance productivity.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Diversification

Key players in the exercise equipment market often pursue product diversification to cater to a wide range of consumer needs and preferences. By expanding their product lines to include various types of fitness equipment such as treadmills, stationary bikes, strength training machines, and accessories companies can attract a broader customer base, from casual users to serious athletes. This strategy not only helps in meeting the diverse demands of different market segments but also mitigates risks associated with relying on a single product category.

Strategic Partnerships

Strategic partnerships are a vital strategy for key players in the exercise equipment market, as they enhance brand credibility and expand reach. Collaborating with fitness influencers, trainers, and health professionals allows companies to leverage their expertise and establish trust with potential customers. Additionally, partnerships with gyms and fitness centers provide opportunities for product testing and customer feedback, leading to improved offerings. These collaborations can also facilitate co-marketing efforts, increasing visibility and attracting new customers.

Market Expansion

Market expansion is a crucial strategy employed by leading companies in the exercise equipment market to increase their customer base and drive growth. By exploring new geographical markets, especially in emerging economies where fitness trends are gaining traction, companies can capitalize on untapped opportunities. This strategy often involves adapting products to meet local preferences and regulatory requirements, ensuring a successful entry into new regions. Additionally, establishing distribution channels and partnerships with local retailers can enhance market penetration.

LEADING PLAYERS IN THE MARKET

Icon Health & Fitness

Icon Health & Fitness is a leader in the fitness equipment market, offering a diverse range of products, including treadmills, stationary bikes, and strength training equipment. The company has significantly contributed to the market by integrating technology into their equipment, allowing users to track workouts and connect with fitness apps. Their innovative approach not only enhances user engagement but also captures a substantial market share, making them a key player in the industry. Icon's commitment to providing high-quality, user-friendly fitness solutions has positioned them as a frontrunner in the global exercise equipment market.

Johnson Health Tech Co., Ltd.

Johnson Health Tech is recognized for its high-quality fitness equipment designed for both commercial and home use. The company invests heavily in research and development, resulting in advanced products that meet the needs of fitness enthusiasts and professionals alike. Their focus on durability and performance has solidified their position in the market, contributing to the overall growth of the exercise equipment sector. By offering a wide range of innovative and reliable fitness solutions, Johnson Health Tech plays a crucial role in shaping the future of the exercise equipment market.

Technogym S.p.A.

Technogym is known for its premium fitness solutions that combine high-quality equipment with digital technology. The company promotes a wellness lifestyle, offering products that cater to both fitness and health. Their innovative digital platforms enhance user experience and engagement, setting a benchmark in the industry. Technogym's commitment to quality and technology has made it a significant contributor to the global exercise equipment market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global feeder market include Badenko, Dksportbot, and SIBOASI

The competition in the feeder market is growing as more companies enter the industry. This market includes businesses that sell young animals, like cattle, pigs, and sheep, which are raised for meat. Major players in the market focus on quality, efficiency, and sustainability to attract customers. They are constantly improving their breeding techniques and feeding practices to produce healthier animals that grow faster.

One fresh perspective on competition in the feeder market is the rise of technology. Many companies are now using data analytics and smart farming techniques to monitor animal health and optimize feeding. This helps farmers make better decisions and improve their profits. Additionally, there is a growing trend towards organic and grass-fed products, which appeals to health-conscious consumers. Companies that can offer these options may gain a competitive edge.

Another thing is the importance of local sourcing. As consumers become more interested in where their food comes from, local feeder markets can thrive by providing fresh, high-quality animals. This trend encourages smaller farms to compete with larger operations by emphasizing their commitment to animal welfare and sustainable practices. Overall, the competition in the feeder market is dynamic, with innovation and consumer preferences shaping the landscape.

RECENT MARKET DEVELOPMENTS

- In March 2025, China increased trading margin requirements for certain rapeseed meal futures contracts from 7% to 9% following Canada's 100% tariff on its imports. This move aims to stabilize price fluctuations in the livestock and aquaculture feed supply chains.

- In January 2025, the European Commission introduced a five-year plan to enhance industrial competitiveness, including reducing energy costs and streamlining regulatory processes for feed production. The plan is expected to benefit feed mills by fast-tracking permits for energy-intensive industries.

- In March 2025, U.S. Senator John Kennedy urged the FDA to reassess the self-affirmed GRAS rule for feed ingredients, citing concerns over companies self-approving additives without FDA review. This review could lead to stricter oversight of feed ingredients and their impact on livestock health.

- In February 2025, the Indian government announced an Investment Friendliness Index to rank states based on business climate improvements, benefiting feed producers and agricultural enterprises. Additionally, the Jan Vishwas Bill 2.0 will decriminalize over 100 business laws, easing compliance for feed manufacturers.

- In February 2025, the European Union planned new import restrictions on key feeder crops to protect domestic feed producers and promote sustainability within EU agricultural supply chains. This move may impact global feed ingredient sourcing.

DETAILED SEGMENTATION OF GLOBAL FEEDER MARKET INCLUDED IN THIS REPORT

This research report on the global feeder market has been segmented and sub-segmented based on application, product & region.

By Application

- Overview

- Private Sports Clubs

- Institutes

By Product

- Overview

- 200 Shuttlecocks

- 150 Shuttlecocks

- 30 Shuttlecocks

- Others

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. What are the key factors driving the growth of the feeder market?

Factors include increasing demand for processed food, advancements in food distribution, and globalization of supply chains.

2. Which challenges affect the feeder market?

Challenges include supply chain disruptions, fluctuating raw material costs, and stringent food safety regulations.

3. How do technological advancements influence the feeder market?

Automation, AI-driven logistics, and smart packaging improve efficiency and reduce costs in feeder market operations.

4. Who are the main consumers of feeder market products?

Food manufacturers, retailers, restaurants, and consumers who rely on processed and packaged food.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]