Global Feed Yeast Market Size, Share, Trends & Growth Forecast Report, Segmented Type (Live Yeast, Spent Yeast, Yeast Derivatives), Livestock (Ruminants, Swine, Poultry, Aquatic Animals, Pets, Equine), Genus (Saccharomyces spps, Kluyveromyces spp, Torula spp, Pichia spp), Form (Dry, Instant, Fresh), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Feed Yeast Market Size

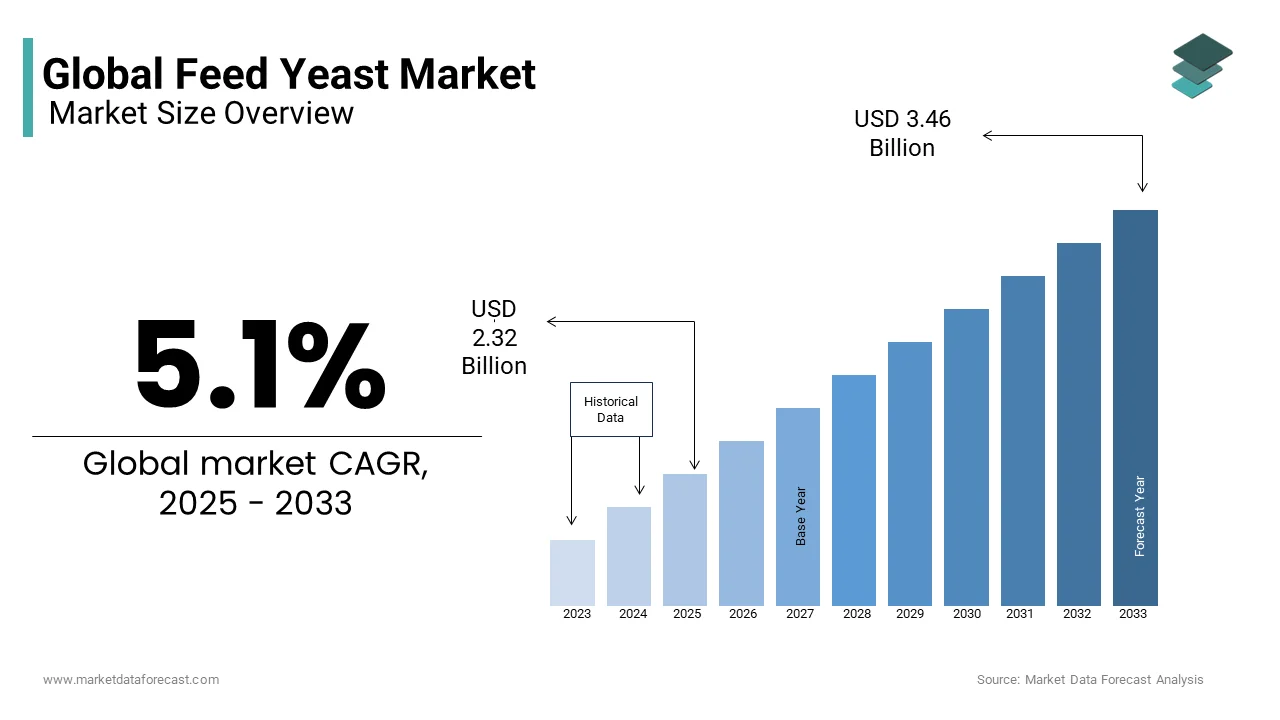

The size of the global feed yeast market was valued at USD 2.21 billion in 2024 and is anticipated to reach 2.32 billion in 2025 from USD 3.46 billion by 2033, expanding at CAGR of 5.1% between 2025 to 2033.

Yeast is used as an additive in animal feed. It helps improve animal health and increases cattle productivity. Feed yeast products are not solely made from yeast cells, it is a yeast fermented product which is designed to provide fermented metabolites resulting from a specific fermentation process. Feed yeast is nutritional yeast that is used as a supplement in animal feeds as it contains a high amount of protein and amino acid, energy, and micronutrient content as compared to common grains and oilseed meals when given to animals. The most common yeast used in dairy diets is Saccharomyces cerevisiae also called brewers or bakery yeast. The yeast helps in increasing milk production, helps in improving the digestive system of animals, increasing platter size, helping in gaining weight, particularly in chickens, preventing various diseases, and improving gut health and performance of the farm animal.

MARKET DRIVERS

The growing demand for protein-rich foods produced from animals, such as dairy products, eggs, animal meat, and meat products, is majorly boosting the feed yeast market's growth worldwide.

The population of various regions around the globe has shifted their concern towards the consumption of protein, particularly animal-derived protein; therefore, the demand for feed yeast is increasing to meet the surging demand. Also, the increasing number of feed mills and production around the globe, particularly in India, China, the U.S., UK, is fuelling the growth of the market. Furthermore, livestock farmers are also becoming aware of the yeast benefits in animal feed, such as enhancement of digestion, increasing appetite, preventing various types of diseases, and improving the gut health and performance of the animals. Moreover, there is high consumer awareness about the effects of antibiotic use in the animal husbandry industry on human health, and the ban on antibiotics in Europe & US has enlarged the adoption of Yeast-based feed by farm owners.

MARKET RESTRAINTS

High demand of molasses from food and pharmaceutical industry corners Feed Yeast market with less raw material procurement options and with changing environmental situations like La-Nina and El Nino, sugarcane production varies in different regions and in such situations, raw material procurement problem arises before Feed yeast market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.1% |

|

Segments Covered |

Type, Livestock, Genus, Form, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Associated British Foods Inc. (UK), Archer Daniels Midland Company (US), Alltech Inc. (US), Cargill (US), Angel Yeast Company (China), Chr. Hansen (Denmark), Lesaffre (France), Nutreco N.V. (Netherlands), Lallemand Inc. (Canada) |

SEGMENTAL ANALYSIS

By Type Insights

The live yeast segment is estimated to lead the market growth as live yeasts are used as the supplements because it helps in preventing the digestive problems in the farm animals, stabilize the microflora in the gut and improve fiber digestion to help in better feed utilization and improved gut as animal requires high fiber diet for enhanced health vitality.

By Livestock Insights

The poultry segment is expected to have the highest growth rate of the global feed yeast market over the forecast period due to increasing demand for poultry meat and eggs, and also, the price of poultry meat is lower as compared to other types of meat. Therefore, poultry producers use feed yeast in order to improve the quality of the meat, enhance poultry weight gain, and enhance feed utilization.

By Genus Insights

The saccharomyces SPP segment is anticipated to dominate the market during the forecast period because it is highly used in various types of yeast applications including feed.

By Form Insights

The dry form of yeast is expected to dominate the market over the forecast period as the active dry yeast is usually used only or in mixture with helpful bacteria in probiotics products. The active dry yeast supplements enhanced the huge appetite of farm animals and helped increase their weight.

REGIONAL ANALYSIS

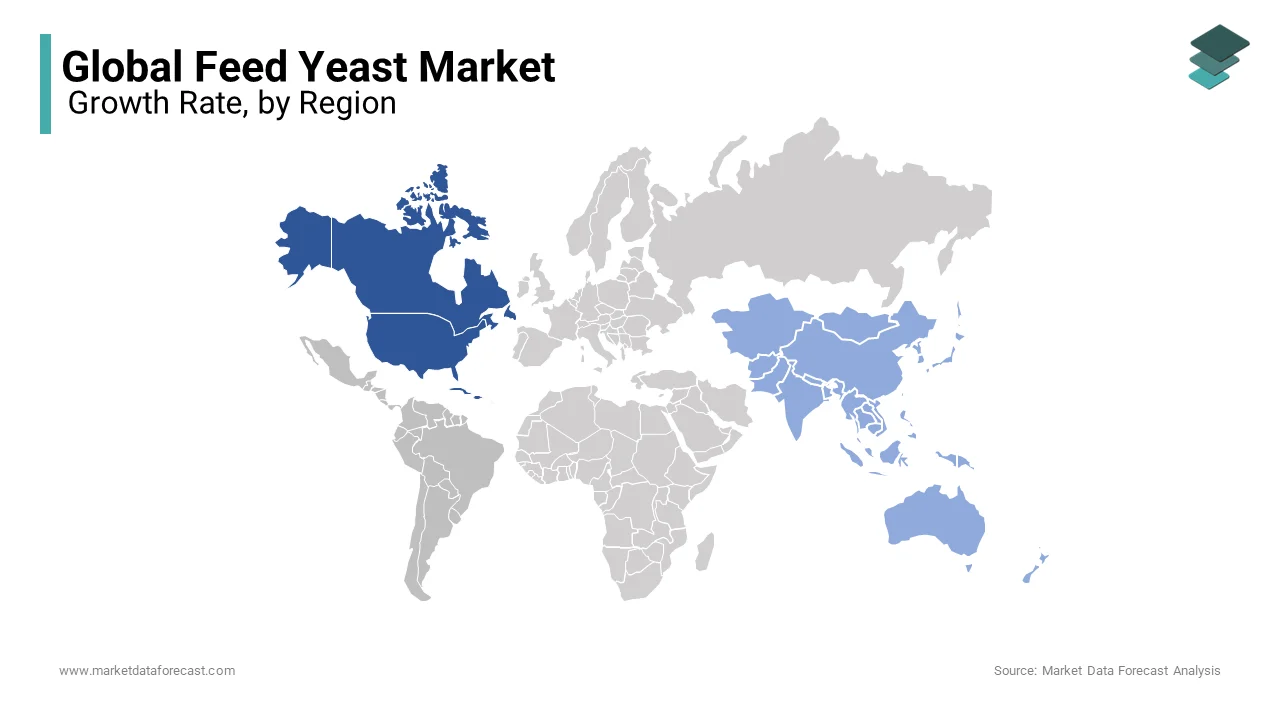

North America is expected to hold a notable share in the global feed yeast market during the projected period. The reason for this growth, the region has well-established technology along with the presence of major players such as Archer Daniels Midland Company, Altech Inc, etc, Moreover, the increasing demand of premium and high-quality meat and the shift of the population towards the consumption of more protein-rich animal-based food products is boosting the growth of the market.

Asia-Pacific is estimated to hold a significant share of the global feed yeast market during the forecast period. The rising number of feed mills and feed production in countries like India, China, and Indonesia are the major drivers that propel the growth of the market. Also, the demand for animal-based protein products such as eggs, meat, milk, and other meat products is increasing in this region, coupled with a large population, which is another factor that drives the demand for feed yeast. Furthermore, the increasing demand for poultry meat and the growing awareness among livestock farmers regarding the benefits of yeast in animal feed is boosting the growth of the feed yeast market in this region.

Europe is also anticipated to have a steady growth rate over the foreseen period because stringent regulations imposed by the European Union to ban the use of antibiotics in animal feed, coupled with the increasing demand for meat, are fuelling the growth of the market.

KEY MARKET PLAYERS

Associated British Foods Inc. (UK), Archer Daniels Midland Company (US), Alltech Inc. (US), Cargill (US), Angel Yeast Company (China), Chr. Hansen (Denmark), Lesaffre (France), Nutreco N.V. (Netherlands) and Lallemand Inc. (Canada) are some of the major players in the worldwide feed yeast market.

RECENT HAPPENINGS IN THIS MARKET

- In October 2021, BASF and Cargill announced that they are expanding their partnership in order to develop and market innovative enzyme-based solutions for the animal feed industry.

- In February 2021, ADM announced that it going to make a leading equity investment in Acies Bio, (which is a Slovenia-based biotechnology company. Acies Bio specializes in R&D and manufacturing services for developing and scaling synthetic biology and precision fermentation technology, which is used in food, agriculture, and industrial applications.

MARKET SEGMENTATION

This research report on the global feed yeast market has been segmented and sub-segmented based on type, livestock, genus, form and region.

By Type

- Live Yeast

- Spent Yeast

- Yeast Derivatives

By Livestock

- Ruminants

- Swine

- Poultry

- Aquatic Animals

- Pets

- Equine

By Genus

- Saccharomyces SPP

- Kluyveromyces SPP

- Torula SPP

- Pichia SPP

By Form

- Instant

- Dry

- Fresh

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the size of the feed yeast market?

The feed enzyme market size was estimated at USD 2.1 billion in 2023 and estimated to reach USD 2.7 billion in 2028.

What is the feed yeast market growth?

The feed enzyme market is expected to grow at a compound annual growth rate of 5.1% from 2023 and 2028 to reach USD$ 2.7 billion in 2028.

Which are the major opportunity areas of the feed yeast market?

The growing concern regarding animal health and the demand for an increase in the nutrient uptake of feed.

What is the competitive scenario of the top players in feed enzyme market?

There is an increase in new product developments, expansions and mergers & acquisitions by the key players such as Cargill, Altech.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]