Global Feed Amino Acids Market Size, Share, Trends, & Growth Forecast Report, Segmented By Livestock (Swine, Cattle, Poultry, Aquaculture, and Others), Amino Acids (Tryptophan, Lysine, Methionine, Threonine and Others), And Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa), Industry Analysis from 2025 to 2033

Global Feed Amino Acids Market Size

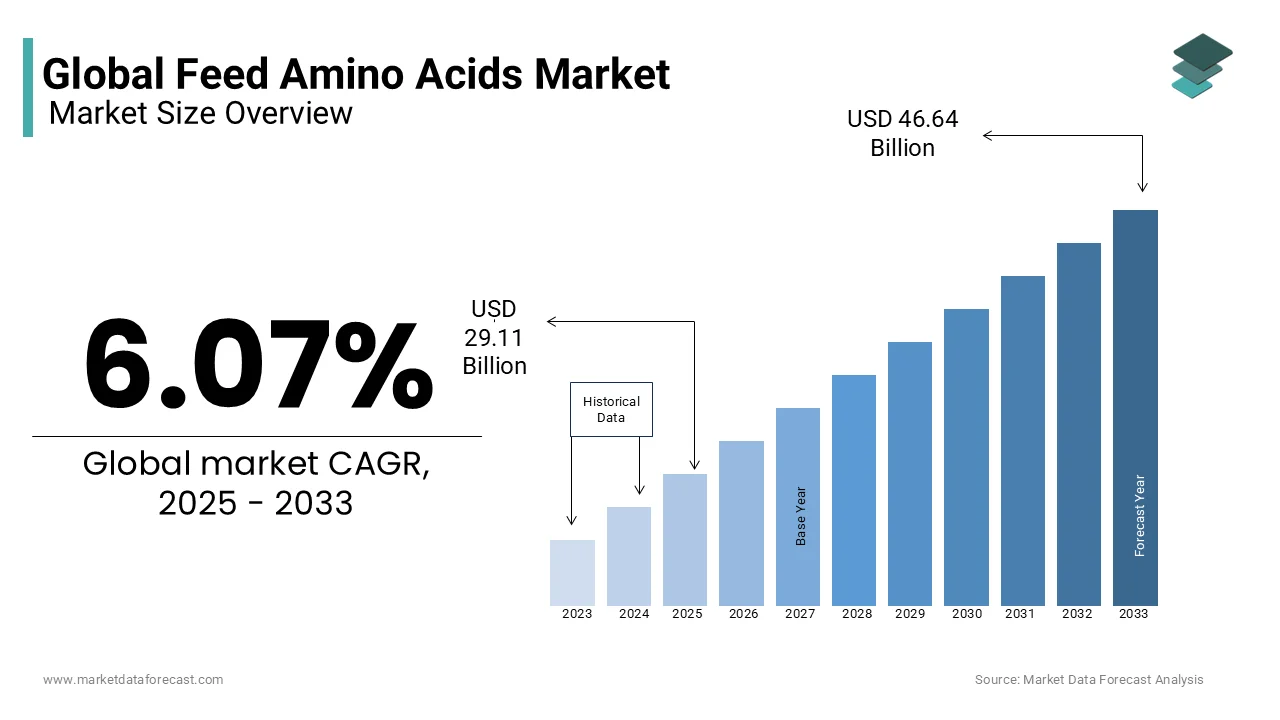

The global feed amino acids market was valued at USD 27.44 billion in 2024 and is anticipated to reach USD 29.11 billion in 2025 from USD 46.64 billion by 2033, growing at a CAGR of 6.07% during the forecast period from 2025 to 2033.

Feed amino acids are generally used as feed additives for various types of livestock. They are being used to increase the productivity of the livestock to meet the rising demand for animal products. The nutritional value of amino acids helps avoid health problems like allergies, autism, fatigue, dermatitis, etc.

Current Scenario of The Global Feed Amino Acids Market

The Feed Amino Acids Market size continues to grow with the increase in demand for animal-derived products. The breeders have been taking more interest in the market and their will to increase their profitability has led the market to showcase significant growth in the coming years. The market gave a positive performance in 2023-24, with China emerging as the dominant player in the world.

- In China, throughout October 2024, feed prices witnessed a steady decrease, with soybean and corn meal attaining their lowest rates in four years.

The Chinese market benefited from the decrease in feed prices, which is advantageous for livestock producers because it boosts profitability and lowers operational costs. On the other hand, the market in the United States also grew notably in recent years. However, lately, the strike in the port increased difficulties for the supply of animal food in the US.

- As per the American Feed Industry Association (AFIA), the U.S. animal food industry would encounter decreased supplies of important packaging, equipment, ingredients, and other products utilized in the production of pet and livestock food after the unsuccessful outcome in reaching a compromise between International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX).

Furthermore, the European market till now in 2024 had a decent year, which is significantly better than the challenging 2023.

MARKET DRIVERS

The rise in the demand for meat and dairy products and increasing feed costs have fuelled the feed amino acids market growth.

With the dramatic rise in disposable income and global human population, growing customer demand for animal-derived proteins, particularly meat items, is one of the most crucial elements encouraging the progress of the market. This demand results in a surge in livestock farming activities and, therefore, feed appeal. Besides this, the significance of amino acids, especially important ones that cannot be generated by animal metabolism, for their well-being and performance assists their application in feed formulations and adds to the expansion of the market.

Moreover, the rising cognizance of animal farmers and nutritionists, emphasizing more on efficiency in order to fulfil the escalating demand for animal-based protein, the necessity to increase feed productivity at lower expenditure, animal welfare issues, and the requirement to decrease the application of antibiotics are regarded as other essential supporting drivers that will add to the growth of this market.

Other driving factors for Amino Acids include the Industrialization of the livestock industry, expansion of the animal meat market, changing demographics in the Asia Pacific and South America, and livestock disease outbreaks.

MARKET RESTRAINTS

Besides drivers, the Feed Amino Acids market faces some challenges and restraints as well, some of these are the availability of alternative protein sources, competition for raw materials with other industries, price volatility of Agri-commodities and Regulatory framework. These few factors have been holding back the market from reaching its potential. So, because of the effect of animal husbandry on ecological sustainability, food security and similar factors, the number of legal rules for livestock farmers is rising day by day.

Apart from this, advancements in the alternative protein industry are also expediting owing to the shifting preferences of customers. It is believed that the swift development in the substitute protein market and rigorous regulatory legislation can present a considerable hurdle in front of the growth of the feed amino acids market.

MARKET OPPURTUNITIES

Given the current dynamics and consumer behavior in the United States and Europe, the next huge opportunity is provided by the Asia Pacific region. So, the feed amino acids market is expected to expand significantly in the coming years. One of the reasons supporting its growth is the presence of some of the biggest amino acid-producing countries like China, Japan, India, etc. After COVID-19, the animal feed industry in APAC targets to maximize overall livestock food production within the time frame of the upcoming 5 to 10 years.

Apart from this, innovations in enzymatic and fermentation processes are needed to produce amino acids more effectively. These techniques intend to improve yields while minimizing resource application and making production more sustainable. Therefore, the market is expected to thrive in the forecast period.

MARKET CHALLENGES

Further, the price factor is considered to be a major challenge for the expansion of the feed amino acids market. This is because of the exorbitant cost of these liquids, amino acid-based feeds are more overpriced than traditional feeds. Even though the high cost of these acid-based feeds can provide various advantages, comprising better animal well-being and efficiency, it is anticipated that it can be a considerable obstacle for cultivators and feed makers, particularly in emerging nations where cost consciousness is more noticeable.

Additionally, the supply of raw materials is regarded as another limiting factor. As per the reports, disturbances in the distribution and price variations of input elements like wheat, soya, maize, and other grains needed to make amino acids can hinder the expansion of the market by directly impacting producers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.07% |

|

Segments Covered |

By Livestock, Amino Acid and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company, Cargill Inc, Royal Dsm N.V., Novus International Inc, Adisseo France Sas, Cheil Jedang, Ajinomoto Co. Inc., PHW Group, Evonik Industries Ag, Kemin Europa. |

SEGMENT ANALYSIS

By Livestock Insights

The poultry segment is the leading subsegment in the feed amino acids market and is believed to maintain its position throughout the estimation period. The segment’s market share is driven by the widespread popularity of methionine, lysine, threonine, and tryptophan. Moreover, poultry, eggs, and meat are the most common animal goods around the world, irrespective of religion or culture, which forms the base of this segment’s growth. In addition, worldwide production of eggs and meat stands at 18 percent and 27 percent, respectively, which jointly surpasses the production of aquaculture (18 percent), pork (24 percent), and beef (14 percent) by a long way. Hence, these factors are driving the segment forward.

By Amino Acid Insights

The lysine segment holds the majority of the market share of feed amino acids and is likely to stay dominant during the forecast period. It is an important amino acid that assists animals in growing and synthesizing protein, particularly in poultry, aquaculture, and swine. Also, its cost-effectiveness and improvement are some of the key factors propelling the segment’s market size.

On the other hand, the threonine segment in this category is anticipated to be the rapidly expanding subsegment compared to other types of amino acid types. It is identified as a favored amino acid in the formulation of feed for animals, notably in monogastric livestock nutrition like poultry and pigs, because it enhances weight gain and protein synthesis and assists in keeping intestinal integrity and immunity.

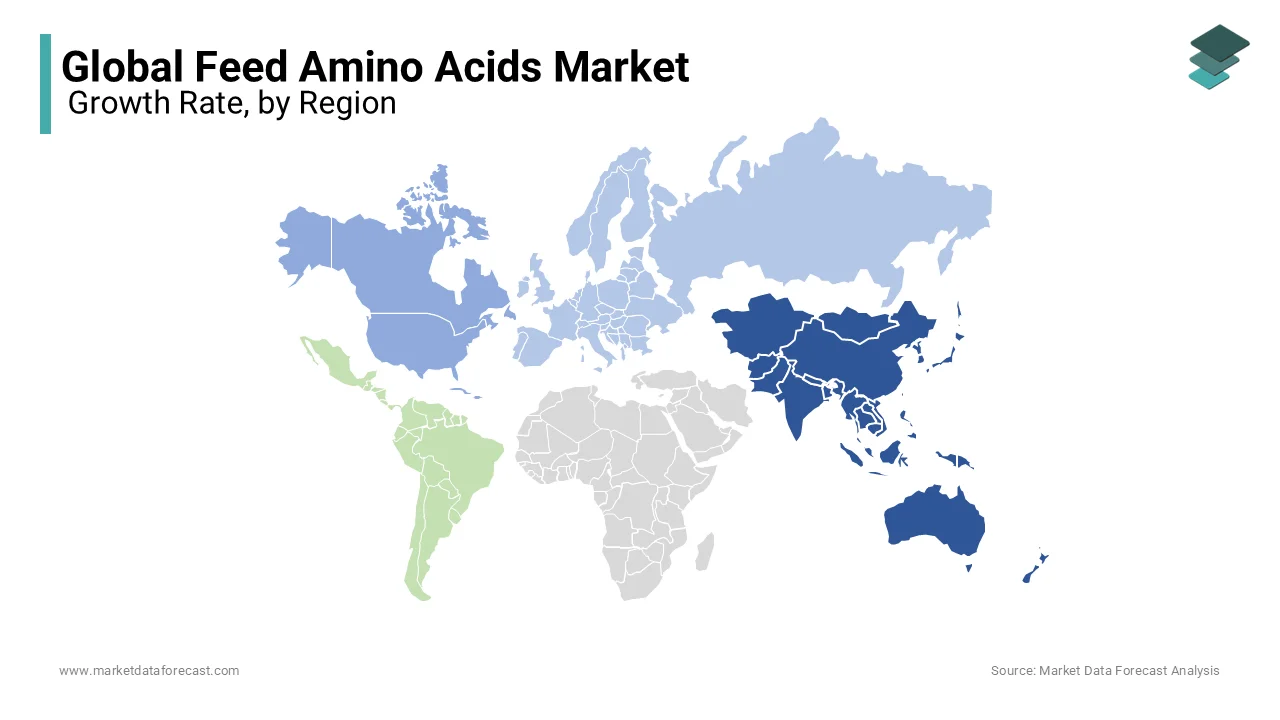

REGIONAL ANALYSIS

The Feed Amino Acids market was dominated by Asia-Pacific, with an overall market share of over 35% globally. The APAC market was followed by Europe and North America, which account for almost half of the market share. Moreover, the market growth of the Asia Pacific region is commanded by China, the biggest consumer and producer of animal feed amino acids.

- According to Welding Group, China is the biggest amino acid producer. It holds 68 percent of the initial five crucial amino acids. In addition, it also leads in the production of vitamins, with 58 percent of vitamin E and 40 percent of vitamin A being made in the country. Furthermore, China manufactures a substantial amount of compound feed, which totals 284 million tons, from 560 premix factories, 3,500 concentrates, and 6,400 feed mixers.

North America is another key player in the feed amino acids market and is expected to steadily move forward during the forecast period. The regional market growth is broadly accelerated by the United States which is one of the largest producers of animal feed in this market. Minnesota, North Carolina, California, Texas, and Iowa gained top positions in the list of animal food-consuming states.

- As per the American Feed Industry Association, there are close to 5,650 food production plants or factories in the United States, manufacturing over 284 million tons of pet food and finished feed every year.

Europe is a significant destination for the feed amino acids market, owing to its huge demand for food for livestock and animals. The future perspective for European Union compound feed manufacturing in 2024 shows a mixed picture, showcasing different trends throughout livestock sectors affected by environmental considerations, regulations, and economic conditions. Moreover, these factors will keep impacting production patterns across the EU, leading to diverse effects on the different segments of the animal feed industry. According to data gathered by FEFAC, the production of industrial compound feed in the EU27 is anticipated to decline by 0.3 percent in 2024 in contrast to 2023, reaching a total of 147 million tons. The manufacturing of poultry feed stands out as the only sector likely to experience growth in the fourth quarter of 2024, with a projected rise of 1.6 percent.

Latin America is expected to grow at a decent CAGR during the estimation period for the feed amino acids market. The region is one of the essential compound feed-producing areas in the world. The market size of this region continues to expand moderately and is spearheaded by Brazil, followed by Chile, Peru, Colombia, and Argentina. The market moves forward from time to time, investments by prominent players in this market.

- For instance, in May 2023, CJ do Brazil, which is a subsidiary company of MNC CJ Bio specializing in the manufacturing of amino acids, announced the conclusion of its factory expansion in Piracicaba. It invested about 1.1 billion dollars and is projected to create 650 jobs along with the establishment of a Research & Development center.

KEY MARKET PLAYERS

Some of the major leaders of the Feed Amino Acids Market include Archer Daniels Midland Company, Cargill Inc., Royal Dsm N.V., Novus International Inc., Adisseo France Sas, Cheil Jedang, Ajinomoto Co. Inc., PHW Group, Evonik Industries Ag, Kemin Europa.

RECENT HAPPENINGS IN THIS MARKET

-

In June 2024, Skretting launched AmiNova, which is a new concept of feed formulation that delivers a higher level of accuracy to fish nutrition. This product is based on an appropriate profile of digestible amino acids, giving fish only the required amount and withdrawing the unnecessary excess. In addition, the foremost AmiNova-formulated feed was scheduled to be accessible by the 3rd quarter of 2024 in the Chilean salmonid market and more varieties and nations to follow in 2025.

- In April 2024, Evonik at the China Feed Industry Expo 2024 showcased its portfolio of amino acids. The company also launched its latest joint venture, Evonik Vland Biotech, which emphasizes functional additive solutions and animal gut health, for the first time ever at an industrial fair in the country. With this, the company aims to strengthen its market position in China.

MARKET SEGMENTATION

The market research report on the global glufosinate market is segmented and sub-segmented into the following categories.

By Livestock

- Swine

- Cattle

- Poultry

- Aquaculture

- Other

By Amino Acid

- Tryptophan

- Lysine

- Methionine

- Threonine

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

Why are feed amino acids essential in animal nutrition?

They support growth, muscle development, immunity, and feed efficiency, reducing nitrogen waste and improving meat quality.

What factors are driving the market growth?

Rising demand for high-quality protein, livestock expansion, feed innovations, and sustainability regulations boost the market.

How does the supply chain impact feed amino acid prices?

Prices fluctuate due to raw material costs, production hubs (China, U.S.), trade policies, and supply disruptions.

Which livestock segment consumes the most feed amino acids?

Poultry dominates, followed by swine, ruminants, and aquaculture, with lysine and methionine being key amino acids.

Who are the major players in the market?

Evonik, ADM, CJ CheilJedang, Ajinomoto, and Meihua Holdings lead, focusing on biotech innovations and sustainability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com