Global Feed Additives Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Amino Acids, Phosphates, Vitamins, and Acidifiers, Carotenoids, Enzymes and Detoxifiers, Flavors & Sweeteners, Minerals, Antioxidants and Others), Livestock (Poultry, Ruminants, and Swine, Aquatic animals & Others), Form Type, Source Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis from 2025 to 2033.

Global Feed Additives Market Size

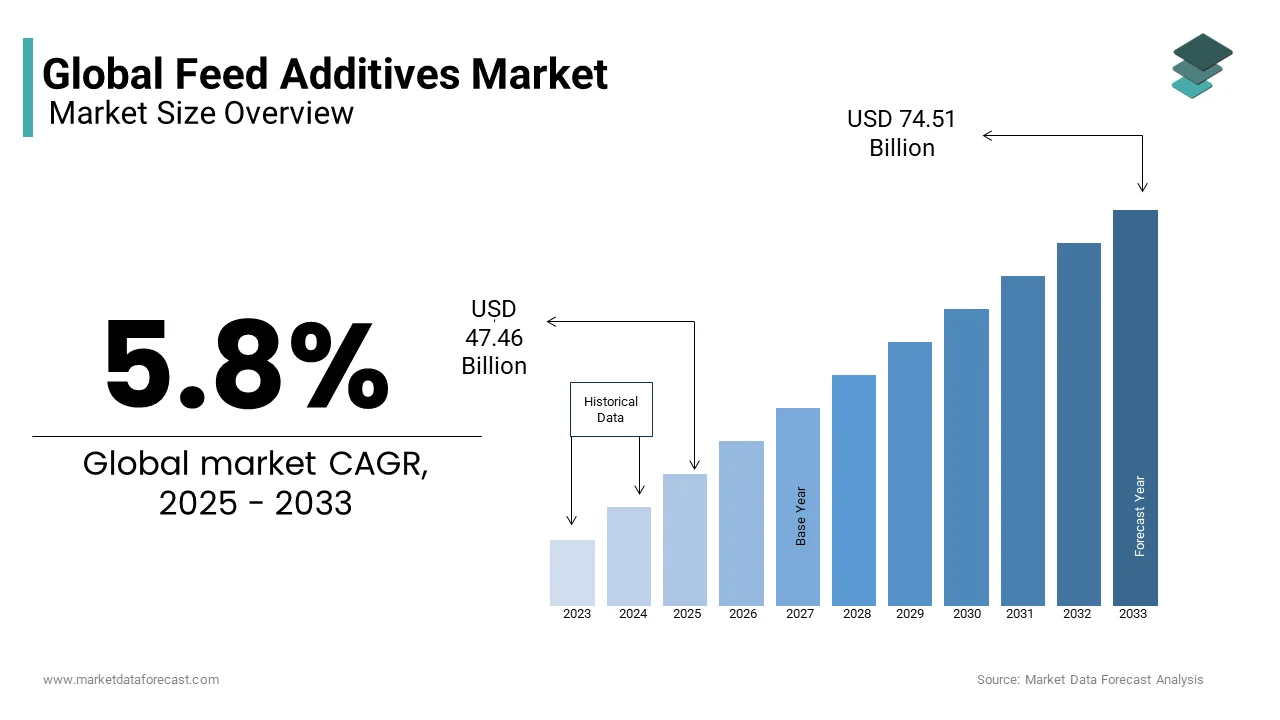

The global feed additives market was valued at USD 44.86 billion in 2024 and is anticipated to reach USD 47.46 billion in 2025 from USD 74.51 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033.

Feed additives are the additional nutritional elements like vitamins, minerals, amino acids, fatty acids, antioxidants, and fungal components to enhance the health of livestock. Feed additives are products used in animal nutrition to improve the quality of feed and food from animal origin, which helps improve animal health. Feed Additives need to be authorized, stating the scientific evaluation demonstrating that the additive has no harmful effects on human and animal health and the environment. These additives can include vitamins, minerals, amino acids, enzymes, and other bioactive compounds. The global feed additives market accounted for significant growth in the past years and is anticipated to grow considerably during the forecast period. The global increase in demand for animal-derived products due to the growing population and rising disposable incomes are significant contributors to the global feed additives market revenue. According to a few reports, 2022 compound feed production increased by 13.1% over the previous year, and fish feed production increased by 46.3% between 2017 and 2022. The animal feed additives market is expected to grow substantially due to ongoing research and development to produce innovative and sustainable feed additives. The escalating demand for organic and natural alternatives and rising technological advancements will provide market growth opportunities to the market players in expanding the market size.

MARKET DRIVERS

The demand for products like milk, eggs, and meat is on the rise, which is also driving the need for feed additives. The primary factors contributing to the demand in the global feed additives market are the rising population and the demand for meat products as a part of daily protein requirements. Also, the consumer shift towards organic food products is pushing farm owners to employ healthy practices like natural feed additives for the growth of poultry animals. In addition, the strict government standards related to the safety of food products and the welfare of animals are supporting growth in the feed additives market.

The recent technological developments have resulted in improved feed additives with more efficiency, quality, and nutrient intake. Besides, to control the spread of diseases in livestock, farmers are turning towards feed additives with antioxidants, antimicrobial features, and immunity boosters. The surge in concerns related to greenhouse gas emissions and environmental pollution created more demand for sustainable and eco-friendly feed additives. Also, with the globalization trend, livestock exports have skyrocketed in recent years, which indirectly promoted the feed additives market as the exported products should follow stringent national and international standards for food safety. Moreover, the boom in the adoption of advanced food processing technologies is supposed to create lucrative opportunities for the food additives market in the coming years.

MARKET RESTRAINTS

The concerns related to antibiotic leftovers that can affect the health of people while consuming meat products are majorly hampering the global market growth. The environmental damage as a result of extracting feed additives from animal sources is creating a negative influence on the rapid development of this business. In addition, the volatility in the international markets for the prices of minerals, vitamins, antioxidants, and others used in the production of feed additives is causing a spike in the expenses for the manufacturers and high prices for the end users.

Although globalization opened doors to new markets, the stringent trade and export regulations are acting as a barrier for multinational companies. Besides, the consumer perceptions related to the use of synthetic additives and emphasis on animal welfare are also pulling the feed additives market down. Also, the economic uncertainties in several parts of the world are affecting the purchasing power of individuals and decreased investments in research and development activities. The geopolitical conditions leading to the supply chain challenges coupled with the intense business competition are acting as a serious threat to the global feed additives market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

3Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Form, Source, Livestock, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cargill, Inc., DSM, BASF, Archer Daniel Midland Co., Ajinomoto, International Flavors & Fragrances, Inc., Evonik Industries AG, Novozymes, CHR Hansen, Tegasa, SHV (Nutreco NV), Kemin Industries, Inc., DuPont, Adisseo, Anova Group, Alltech, Inc., Addison Group, Sumitomo Chemical Co. Ltd., and Megamix LLC. |

SEGMENTAL ANALYSIS

By Type Insights

The amino acids are likely to record the highest demand in the global feed additives market in the forecast period due to their significance in the protein synthesis and growth of livestock products. In particular, the improved performance and flexibility offered by amino acids are propelling their adoption in feed additive manufacturing.

The preservatives segment is likely to increase in the forecast period because of the rising demand for improved product shelf life. Similarly, minerals, acidifiers, binders, antioxidants, and prebiotics are anticipated to witness immense growth in the coming years.

By Source Insights

The synthetic segment recorded the highest share in the market owing to the increasing requirement among manufacturers. The advantages of synthetic feed additives, like enhanced shelf life, reduced wastage and leakage, and cost savings, are promoting the adoption of the synthetic segment. However, with the growing emphasis on decreasing ecological impacts, naturally extracted feed additives are anticipated to find more demand worldwide.

By Livestock Insights

The poultry segment held the lion’s share in the feed additives market owing to the skyrocketed demand for chicken and eggs to meet the nutritional requirements of humans. The rapid growth in the geriatric population coupled with the affordable prices is majorly boosting the sales in the poultry segment. In addition to chicken, turkey, goose, and duck, they are also a part of poultry livestock that have huge demand in all parts of the world. On the other hand, ruminants like cattle and buffalo are finding huge requirements in international cuisines, supporting the growth of the feed additives market. Similarly, swine and seafood types are also predicted to register steady growth in the coming days.

By Form Insights

The dry form segment accounted for a prominent share of the feed additives market because of their stability and ability to be stored for longer times. The benefits of dry form, like easy transportation, measurements, and adaptability in different feeding systems, are fuelling the adoption of this segment globally.

REGIONAL ANALYSIS

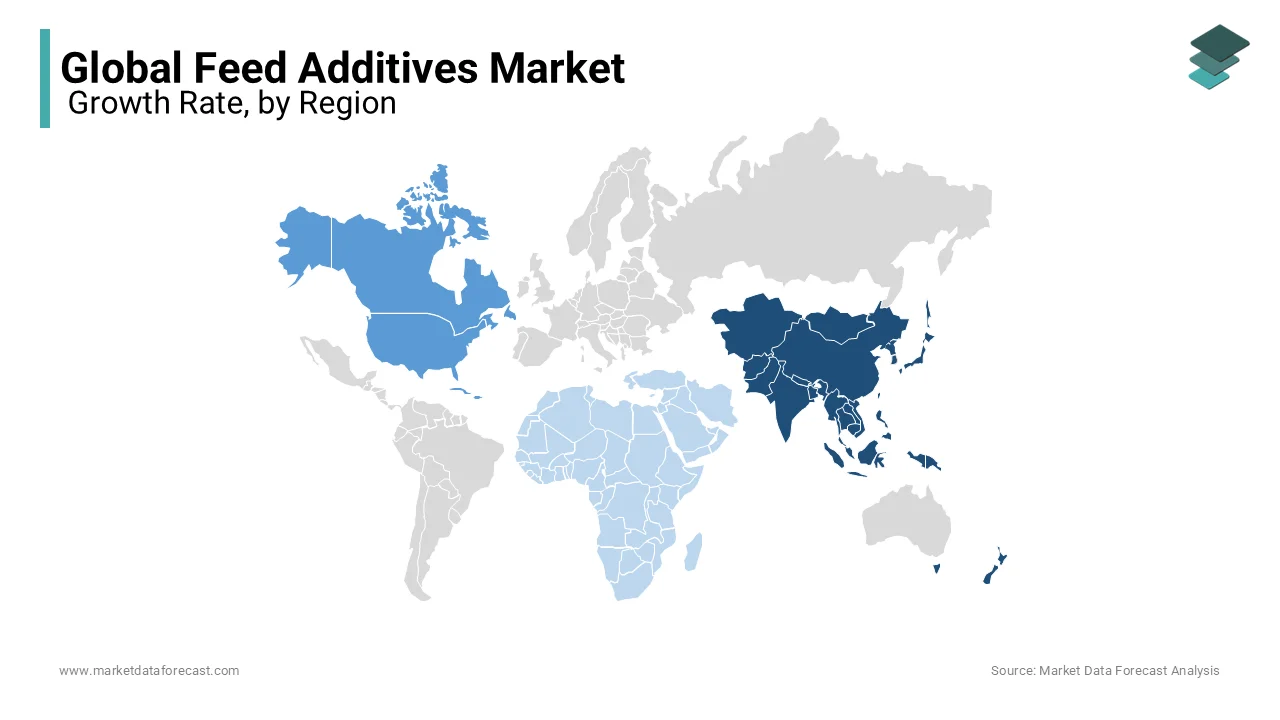

The Asia Pacific region dominated the feed additives market and is expected to have the highest growth rate in this market with the increasing population in nations like India, China, and Japan. The surge in the consumption of meat and dairy products, along with the rising consumer income, are boosting the need for high-quality feed nutrition. China and India are the leading players in this region, with the expanding agriculture sector and implementation of technological processes in the livestock industry.

North America is also a significant region in the global feed additives market. The United States is the leading nation in this region because of the extensive consumption of pork and beef in daily consumer food intake. The rising urbanization coupled with the purchasing power of the population is driving the demand for more different livestock, which supports the feed additives business.

Europe is also a prominent player in this market, with an established feed additives industry in nations like the United Kingdom and Spain. The free trade agreement between the European nations is boosting the exports in the area. Besides, the rise in exports of swine products is also benefitting the feed additives market in the European nations.

Latin America, with nations like Brazil and Mexico, is a crucial player in the global feed additives market. Government-regulated agriculture and the increasing need for meat products are driving the business in this locale. In addition, the availability of corn and soybean to be used in the production of feed additives is supposed to create growth potential in this region.

Middle East and Africa is a comparatively smaller market for the feed additives market. However, there is a huge untapped opportunity in these nations because of the availability of raw materials and augmented consumption of meat.

KEY MARKET PLAYERS

Cargill, Inc., DSM, BASF, Archer Daniel Midland Co., Ajinomoto, International Flavors & Fragrances, Inc., Evonik Industries AG, Novozymes, CHR Hansen, Tegasa, SHV (Nutreco NV), Kemin Industries, Inc., DuPont, Adisseo, Anova Group, Alltech, Inc., Addison Group, Sumitomo Chemical Co. Ltd., and Megamix LLC. These are some of the major players in the global feed additives market.

RECENT HAPPENINGS IN THIS MARKET

- In January 2023, Novus International, a renowned animal and health nutrition company, confirmed its acquirement of Agrivida Inc, a biotech company. Novus strategies to improve its feed additives market share with the complete ownership of Agrivida’s INTERIUS technology that inserts feed additives in grains.

- In February 2023, Nutreco, a leading company in animal nutrition, confirmed its purchase of a minority stake in BiomEdit, a microbiome biotech firm. Utilizing BiomEdit’s advanced microbiome discovery platform, Nutreco aims to enhance its livestock health solutions.

- In June 2023, Evonik Industries introduced its updated product Biolys, which offers lysine for livestock. Biolys provides the essential amino acid L-lysine to improve the protein content of livestock with reduced carbon emissions.

MARKET SEGMENTATION

This research report on the global feed additives market has been segmented and sub-segmented into the following categories.

By Type

- Amino Acids

- Vitamins

- Acidifiers

- Enzymes

- Antibiotics

- Minerals

- Antioxidants

- Probiotics

- Preservatives

- Phosphates

- Carotenoids

- Mycotoxin Detoxifiers

- Flavors & Sweeteners

- Binders

- Phytogenics

By Source

- Natural

- Synthetic

By Livestock

- Poultry

- Swine

- Aquatic Animals

- Ruminants

- Others

By Form

- Dry

- Liquid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global feed additives market?

The feed additive market size was estimated to be USD 47.46 billion in 2025.

What are the driving factors that boost the growth of the market?

There was a huge spike in the elderly population's demand for products like milk, eggs, and meat, which is also driving the need for feed additives.

Which segment is dominating in the market based on livestock?

Cargill, Inc., DSM, BASF, Archer Daniel Midland Co., Ajinomoto, International Flavors & Fragrances, Inc., Evonik Industries AG, Novozymes, CHR Hansen, Tegasa, SHV (Nutreco NV), Kemin Industries, Inc., DuPont, Adisseo, Anova Group, Alltech, Inc., Addcon Group, Sumitomo Chemical Co. Ltd., and Megamix LLC. Are some of the major players in the global feed additives market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com