Global Fast Food Market Size, Share, Trends & Growth Forecast Report By Type (Burger/Sandwich, Pizza/Pasta, Chicken & Seafood, Asian/Latin American Food and Others), Distribution Platform (Quick Service Restaurant (QSR), Street Vendors, Food Delivery Services, Online Food Delivery, Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis from 2025 to 2033

Global Fast Food Market Size

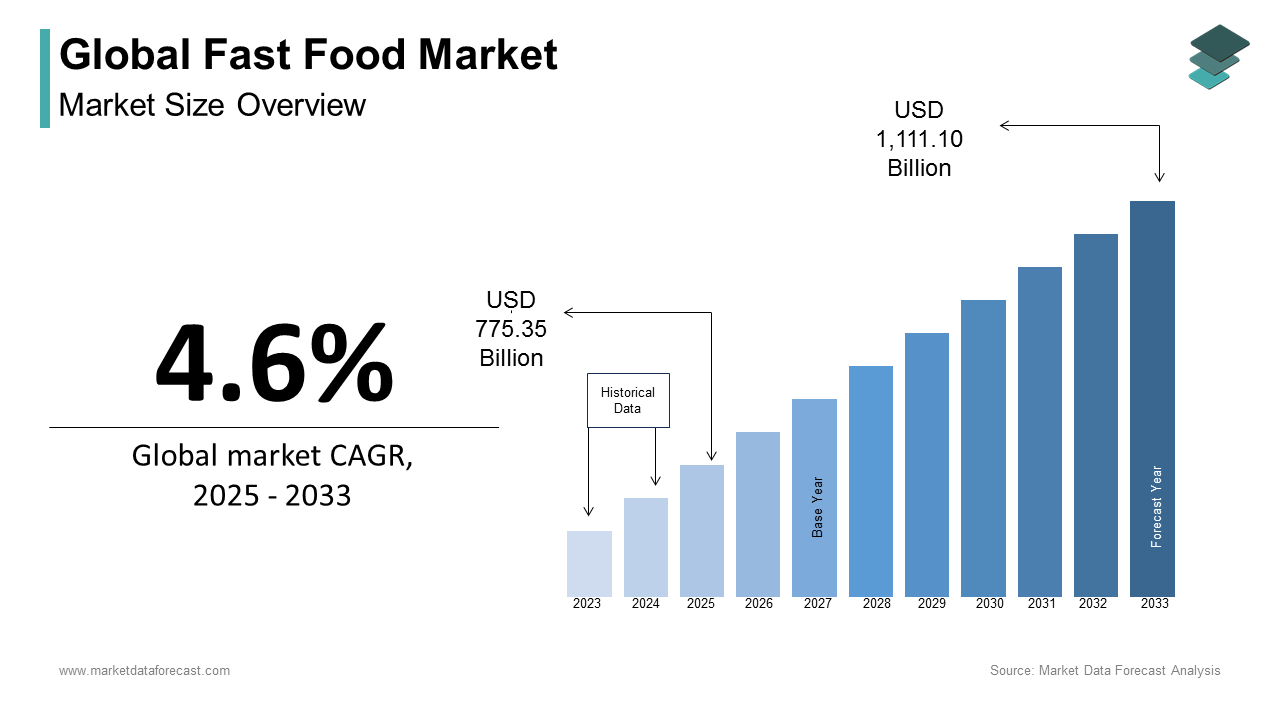

The global fast food market size was calculated to be USD 741.25 billion in 2024 and is anticipated to be worth USD 1,111.10 billion by 2033 from USD 775.35 billion In 2025, growing at a CAGR of 4.6% during the forecast period.

The fast food market is rapidly growing worldwide, and North America is considered the dominant player. Digital innovations and advanced technological breakthroughs have completely transformed the market. This resulted in a year-on-year rise in consumers' fast food expenses, which surged to 349 billion dollars in 2023. People worldwide increased their consumption by 2.5% annually. Apart from this, the companies witnessed higher online traffic on mobile and other digital applications on weekends, i.e., 12%, despite considerably low physical footfall. Also, Quick Service Restaurants (QSR) has seen a tremendous rise in its market share in recent times. It is anticipated to flourish at an accelerated rate in the coming years. In addition, the Asia Pacific region is believed to lead the global market at a rapid pace during the forecast period; however, North America will continue to dominate. With over 40% market share of the QSR industry, McDonald's is the biggest player. Moreover, US residents spend around 10% of their annual income on fast food. On the other hand, high food inflation is a key challenge to the global market. According to a survey, 78% of US citizens consider fast food meals to be a luxury, and 27% skip or directly jump to a one-time meal schedule due to the increase in food prices.

MARKET DRIVERS

Rise in the Consumer Food Service Sector

The increasing number of restaurants and hotels is expected to accelerate the industry’s development due to rapid prohibition and globalization. For instance, according to QSR magazine, McDonald’s, by the end of 2022, had 13,444 restaurants, which is after obtaining a net of 6 locations. Moreover, at the beginning of 2023, the company’s systemwide turnover had increased by close to 20 billion dollars from the start of COVID-19 despite losing about 850 stores in Russia. Additionally, the rise in health awareness among consumers and the growth in demand for gut-friendly and delicious snacks are propelling the expansion of the global fast-food market. As per the 2024 report by SNAC International, there is a greater demand for multi-sensory experiences that surpass taste, scent and visual presentation and add feeling and sounds to food. Customers desire healthier snacking options, and about 39 percent of those who eat salty snacks stated they would like to buy better-for-you snacks if they are available.

Fast food greatly supports the busy lifestyles of the urban population and the need for faster and more affordable options is taking the market forward. The growth of the fast food market is also driven by a lazy population that expects meals to be delivered at home. A report by Uber Eats discloses that 48 percent of Indian customers prefer ordering their favorite dishes online and dining in, in contrast to the 34 percent who like to go out for a meal. The key factor driving people’s decision to opt for doorstep delivery of food is convenience, with close to 28 percent of Indians mentioning this as the cause behind their order-in. It also highlighted that one in three consumers choose either an easy-to-eat or all-in-one meal, and this has become widespread.

Also, the need for tasty with the latest flavors can positively impact the expansion of the market. In addition, app-based companies offering offers and the progressive trend of online orders are predicted to open more opportunities for market participants during the forecast period. Readily available healthy fast food provides customers with options that boost the sales of the QSRs and other food outlets. The rapid surge of the middle-class population in emerging economies and changes in eating habits are influencing the growth of the fast food market.

Rise in Disposable Income and Availability of Convenient and Pocket-friendly Offerings

According to the research, in 2023, the gross disposable income (GDI) of Spain and China increased by 11 percent and 6.3 percent, respectively. Similarly, as per the OECD, in 2024, Poland and Portugal saw the biggest rise in disposable income per capita by 10.2 percent and 6.7 percent, respectively. This progress was primarily propelled by a surge in property income, social advantages apart from in-kind transfers, and growth in employee compensation, which ultimately benefited the market. Most quick bite items are available in both regular and healthy forms to help manage weight with the right mix and proportions of other foods. The urge for these has greatly risen in the last few years owing to new product launches in the various domestic food industries around the world. The overall increase in the volume of quick-service restaurants, hotels, and other establishments is also touted as fuelling the growth of the global fast-food market. As customers prefer different products, the global market will evolve with lucrative opportunities. The industry also allows small players to collaborate with key brands and companies and take advantage of their international and domestic popularity and market share to satisfy the tastes of local consumers and maintain competitive prices.

Africa provides a great opportunity in the quick-service restaurant domain.

The American and European QSR industries are saturated and overflowing with established chains like KFC and Burger King. Meanwhile, demographics and population growth are major propellors for this segment’s expansion in Africa. The region has over 200 million people aged between 18 and 30 years, which remains an untapped consumer base. It has always been modified according to the world pattern of time, money and health management. The industry has grown quickly, and sector studies suggest that QSRs will only thrive as a convenience for routine people. According to experts, the US market will advance further at a CAGR of 5.5% between 2024 and 2029 with the annual addition of more than 2000 restaurants. Also, about 37% of people eat fast food daily.

Companies are also increasing the employment rate for women across their franchisees and this has increased the consumer’s confidence in them. As a result, market participants have included healthier fast food options that contain hormone-free meat, natural vegetables, hormone-free meat and organic ingredients throughout the store. This will open new prospects for market growth during the forecast period.

MARKET RESTRAINTS

Growing Health Awareness Among Users and Increasing Preference for Healthy Food

Faster food product sales declined as consumer awareness of healthy food options increased. There are many concerns about fast food. Studies have shown that eating fast food causes overweight, obesity, and other medical problems. According to the article published by The Economist in May 2024, the “highest person premium” based on the increase in hourly wages is Generation Z given that data gathering started in 1998. Lately, the pay rise of U.S. people aged between 25 to 25 was only 6 percent, whereas those falling under the age bracket of 16 to 24 saw a 13 percent growth. The growth of the global fast food market has been limited due to the presence of unsaturated fats in fast food products and the resulting health problems with food safety regulations. As food safety and animal welfare regulations increase, they are supposed to act as major limiting factors in this market. Furthermore, knowledge of consumer health, especially obesity, is estimated to be another constraint to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.6% |

|

Segments Covered |

By Type, Distribution Platform and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

McDonald’s Corporation (U.S.), Burger King Worldwide, Inc. (U.S.), Domino’s Pizza Inc. (U.S.), Yum! Brands Inc. (U.S.), Jack in the Box Inc. (U.S.), KFC, Wendy’s International Inc. (U.S.), Doctor’s Association Inc. (U.S.) and Others. |

SEGMENTAL INSIGHTS

By Type Insights

The burgers and sandwiches segment captured 37.6% of the fast food market share in 2023 and emerged as the largest category. The segment’s growth is majorly attributed to the widespread popularity of convenient food, the rising focus on adding quality and organic ingredients, and the introduction of more flavor combinations. All these factors are present in today’s emerging fast-casual dining choices that have transformed eating into a seamless experience. The U.S. tops the list in the consumption of burgers and sandwiches worldwide with an approximate share of 30%. Also, the segment is growing strongly because adults and kids between 2 and 19 eat fast food on a routine basis, with 37% and 36%, respectively. Additionally, about 39% prefer fast food locations, which provide healthier options and boost the expansion of the burgers and sandwiches segment in the global market.

The pizzas and pasta segment was the second largest category in 2023 and is predicted to grow at a CAGR of 6.68% during the forecast period. The growing consumption of pizzas and pasta in countries such as Italy, the U.S., India, and China is majorly driving the fast food expansion of this sector of the fast food market. Moreover, U.S. customers spent more than 41 billion dollars on pizza orders in 2023 region-wise. The main reason behind the impressive growth of the segment’s market share in the majority of nations around the global escalation in Quick Service Restaurant’s sales. In addition, as per the World’s Top Exporter, pasta exports from all the nations worldwide in 2023 totaled 15 billion dollars in 2023. Its overall sales for all shippers have risen by 42.8 percent compared to 10.5 billion dollars in 2029.

By Distribution Platform Insights

The quick service restaurants (QSR) segment dominated based on the distribution platform and held 51.9% of the market share in 2023. The growth of the QSR segment is primarily driven by the busy lifestyles of consumers who seek quick and convenient meal options and the rapid adoption of technological advancements in order processing and delivery. The growing focus on international QSR chains in emerging markets significantly contributes to the expansion of the QSR segment in the market. For instance, McDonald's, Subway and KFC are among the top QSR chains globally, accounting for over 30% of the market share. Furthermore, Tropical Smoothie Cafe, a QSR brand, opened outlets at 176 locations and executed 258 franchise agreements recorded by 2023 end.

REGIONAL ANALYSIS

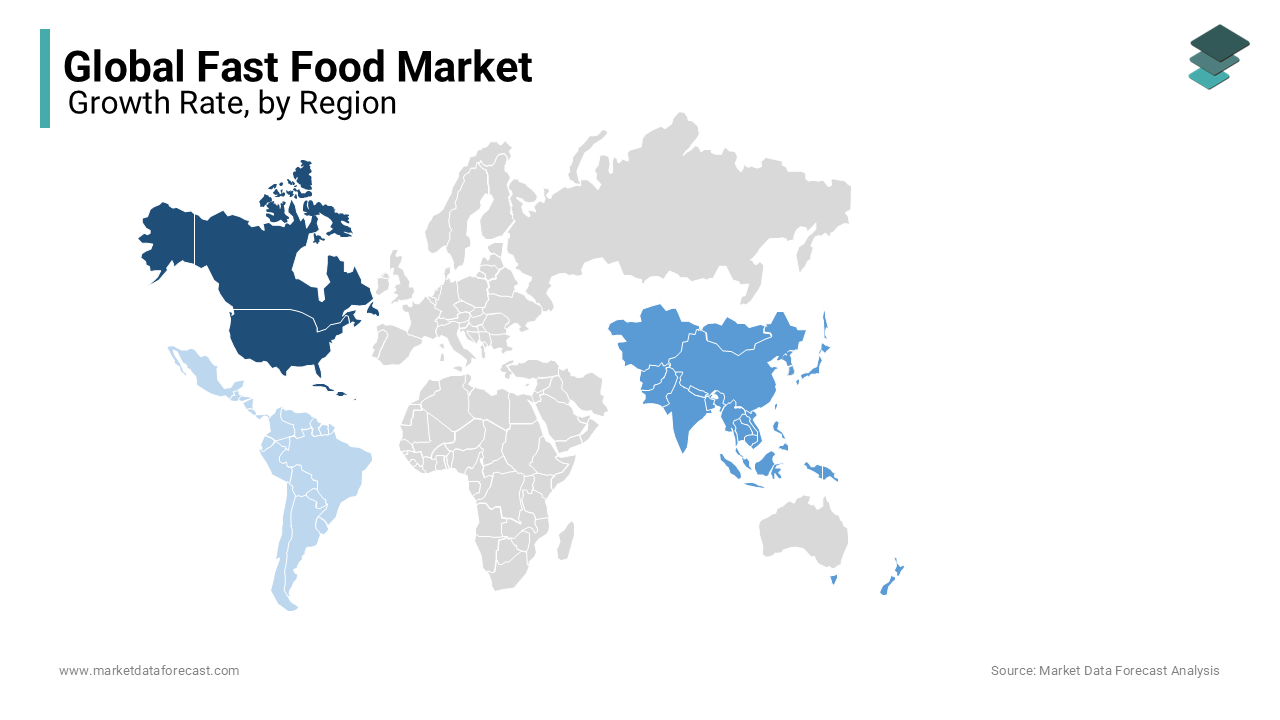

Together, the North American and European regions accounted for close to 60% of the fast food market share in 2023, and the domination of these regions in the worldwide market is anticipated to continue throughout the forecast period. This is due to the presence of notable market participants and the rapid expansion of the major fast-food chains in these regions. North America and Europe had a notable market share in the past because of their high dependence on convenience due to their busy lifestyles and high demand for food in restaurants. Likewise, in 2023, fast food items from restaurants or catering services were the second most-bought product by online consumers, i.e., 19 percent in the European Union as a whole. In addition, healthy changes to the fast food menu and the introduction of raw cheese, organic vegetables, hormone-free meat and natural ingredients contributed to the maturity of this market. Further, in the US industry, Mississippi (US) has the lowest price in total. The average price was 3.91 dollars when combined with the average price of McDonald's Big Mac, Domino’s medium cheese pizza, Chick-fil-A chicken sandwich and a combo meal at Taco Bell. It is 10% lower than the national average.

The Asia-Pacific region is foreseen to experience high growth in the market during the forecast period. The growth of the Asia-Pacific market is primarily due to an increase in urbanization, an expanding service sector, a rise in disposable income, and demand for the Western lifestyle. Moreover, Indian and Chinese populations prefer fast food over traditional restaurant cuisines. Favorable demographics increased disposable income and purchasing power in tire-1 cities in India, increased digitalization and infrastructure and rapid acceptance of American and European lifestyles have vastly improved the industry prospects. With a preference for the proposal, proximity, and affordable price, developing countries are quickly rising in this market. Further, the fast food market in China is one of the biggest globally, showing a consistent upward growth pattern. However, this industry continues to be greatly fragmented.

The Middle East and Africa are quickly rising as lucrative options for several food service brands and are forecasted to expand at a higher CAGR during the projection period. A large number of these brands are closely followed by the United Kingdom and increasingly by Saudi Arabia. Moreover, the United Arab Emirates (UAE) is leading the regional industry and other remarkable players are Kuwait, Qatar, Bahrain, and Oman. Besides this, with the organization of different international events like the FIFA World Cup last year in Doha, EXPO in Dubai, and other sporting tournaments and exhibitions in the rest of Saudi Arabia and Riyadh, there is a shifting trend towards attracting more fast food companies into the region. South Africa is a major industry in the African market, with over 85 thousand restaurants. Also, a large quantity of these are part of the 850 franchise networks in the fast food and restaurant sector. On the other hand, water and power blackouts have severely affected the progress of the South African market. Though the majority of them have generators or a landlord’s power backup electricity, their high operating expenses are creating pressure on franchisees. In addition, Egypt is dominating the North African market, which is the second largest market after South Africa.

Latin America is projected to grow at a notable CAGR during the forecast period. Brazil witnessed significant growth in fast food chains, and the rest of Latin America is presumed to have strengthened its market share during the forecast period. The regional market growth is due to the increased localization of food items and menus and the addition of products with a fusion of prominent companies' offerings and domestic cooking methods. Further, the growth of the travel and tourism sector led to the rise of popular regional foods and meals, including Paraguayan, Peruvian, Ecuadorian, Mexican, Chilean, Bolivian, and Colombian. This is also because of the expanding customer’s interest in international flavors and foods.

KEY PLAYERS IN THE GLOBAL MARKET

Companies playing a major role in the global fast food market include McDonald’s Corporation (U.S.), Burger King Worldwide, Inc. (U.S.), Domino’s Pizza Inc. (U.S.), Wendy’s, Yum! Brands Inc. (U.S.), Jack in the Box Inc. (U.S.), KFC, Wendy’s International Inc. (U.S.) and Doctor’s Association Inc. (U.S.).

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Wendy’s launched the Triple Berry Frosty treat. It integrates three fruit flavors: raspberry, blackberry, and strawberry. Also, it is the largest and juiciest flavor to join Wendy’s popular Frosty product range.

- In June 2024, the Kentucky Fried Chicken press released that it is testing the new KFC tenders and also its signature Comeback Sauce. It is done in West Palm Beach (Florida, USA) and surrounding regions for a specified period.

- In June 2024, Chick-fil-A launched the Maple Pepper Bacon Sandwich. It also made the revival of customers' favorite Peach Milkshake. But both are only available for a short period.

- In April 2024, KFC launched Saucy Nuggets on its menu and replaced Chizza, whose limited-time operation ended on March 31, 2024.

MARKET SEGMENTATION

This research report on the global fast food market has been segmented and sub-segmented based on type, distribution channel and region.

By Type

- Burgers & Sandwiches

- Pizzas & Pasta

- Asian/Latin American Food

- Chicken/Seafood

By Distribution Channel

- Quick Service Restaurant (QSR)

- Street Vendors

- Food Delivery Services

- Online Food Delivery

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the current trends in the fast food market?

Key trends in the fast food market include the rise of plant-based and vegan options, the use of technology for ordering and delivery, the emphasis on sustainability and eco-friendly packaging, and the introduction of healthier menu items. There is also a growing trend towards customization and personalization of meals.

2. What factors are driving the growth of the fast food market?

Key factors include the increasing pace of life, rising disposable incomes, the growing influence of Western culture in emerging markets, technological advancements in food delivery, and the expanding menu offerings to cater to diverse dietary preferences.

3. What is the future outlook for the fast food market?

The future outlook is positive, with continued growth expected. Innovations in menu offerings, technology integration, and sustainability practices will be key drivers. The market will likely see more emphasis on healthy and eco-friendly options, as well as increased customization and convenience for consumers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]