Global Failure Analysis Market Size, Share, Trends, & Growth Forecast Report - Segmented By Equipment (Optical Microscope, SEM, TEM, FIB, Scanning Probe Microscope and Dual Beam), Application (Electronics & Semiconductor, Industrial Science, Material Science and Bioscience) & Region - Industry Forecast From 2024 to 2032

Global Failure Analysis Market Size (2024 to 2032)

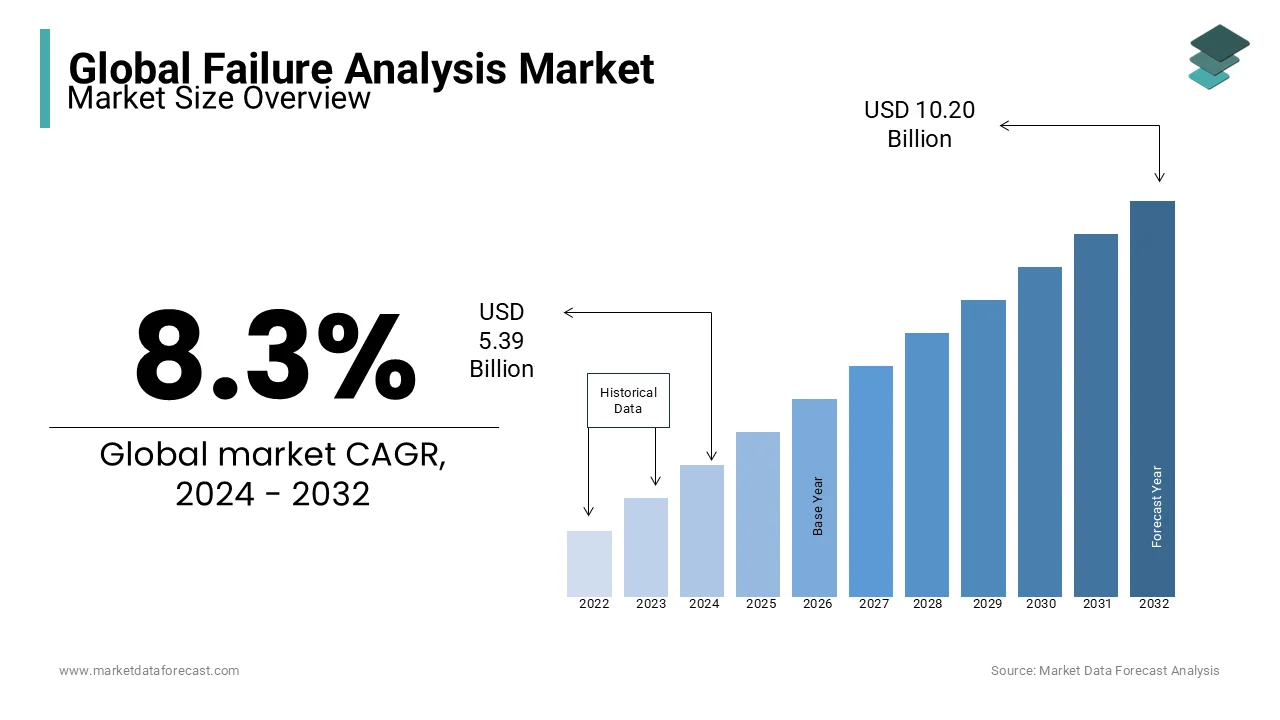

The global failure analysis market was worth USD 4.98 billion in 2023. The global market is expected to grow at a CAGR of 8.3% from 2024 to 2032 and the global market size is estimated to be worth USD 10.20 billion by 2032 from USD 5.39 billion in 2024.

Failure analysis is a procedure to determine the foundation explanation for a failure and helps in making product improvements. Failure analysis primarily covers component, structure and assembly errors and this process is disbursed by professionals in those fields who can identify the matter and make appropriate product adjustments. Failure detection is a multi-step procedure that features a physical examination of the product or service.

MARKET DRIVERS

The rising industrialization worldwide, particularly in emerging economies is one of the major factors propelling the global failure analysis market growth.

The growing acceptance of failure analysis for material science applications is further fuelling the growth rate of the global market. For the mineralogical and structural examination of materials such as metals, polymers, alloys, biomaterials, and ceramics, optical and scanning electron microscopes are utilized to perform failure analysis. An increase in the demand for failure analysis equipment from the wireless communication and electronics manufacturing industries is favoring the market’s growth rate. The ever-increasing size and complexity of semiconductor and embedded system circuit design requirements have led to the widespread use of failure analysis equipment during the computer circuit development process (ICs).

The rising usage of failure analysis equipment in industries such as oil & gas and mining is a supportive factor to the global market growth. The failure analysis market is seeing new growth opportunities due to the event of latest and advanced technologies such as correlative light and microscopy (CLEM) and super-resolution microscopy,

MARKET RESTRAINTS

High costs associated with the equipment used to perform failure analysis are one of the key factors hampering the global market growth. Transmission electron microscopes (TEM), scanning electron microscopes (SEM), and focused ionic beam systems are all pricey failure analysis tools, which act as the major restraint for the global failure analysis market. Optical microscopes, on the other hand, are more cost-effective than electron microscopes, despite the latter's greater features and uses. End users in Asia Pacific have a limited amount of such equipment, which is projected to slow the expansion of the worldwide failure analysis market throughout the forecast period. The scarcity of skilled workers who can perform accurate failure analysis is another notable factor impeding global market growth. Skilled workers are required to work and manage failure analysis equipment. Individuals in this position must have proper training and knowledge of the equipment. Although competent experts are plentiful in affluent countries, rising regions like geographic areas, the center East, Asia Pacific, and Africa are in brief supply. As a result, these factors are projected to limit the worldwide failure analysis market's growth over the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.3% |

|

Segments Covered |

By Equipment, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Thermo Fisher Scientific, Inc., Hitachi High-Technologies Corporation, Carl Zeiss, JOEL Ltd, TESCAN OSRAY HOLDING, Bruker, Semilab, A&D Company Ltd, HORIBA Ltd, Leica Microsystems GmbH and Others. |

SEGMENTAL ANALYSIS

Global Failure Analysis Market Analysis By Equipment

Based on equipment, the focused particle beam system (FIB) segment dominated the market in 2023 and is also predicted to be the fastest-growing segment in the global market during the forecast period. FIB systems are increasingly employed in material science and bioscience applications, which is one of the major factors propelling segmental growth. The usage of FIB systems in the field of fabric sciences has increased considerably and this trend is expected to fuel in the coming years and boost the growth rate of the FIB system segment in the global market. FIBs can now be utilized for microstructural investigation and prototyping nano machining additionally to circuit editing and sample preparation for Transmission microscopy (TEM).

Global Failure Analysis Market Analysis By Application

Based on application, the electronics and semiconductor segment is anticipated to account for the largest share of the global market during the forecast period. The growth of the electronics and semiconductor segment in the global failure analysis market is majorly driven by the increased need for small transistor chips, nanoelectronics, quantum dots, and optoelectronics. Due to the growing use of robotics and automation to make electronics products, the electronics and semiconductor segment is also estimated to register the highest CAGR among all segments in the global market. High-density, integrated, and tiny devices are required in the electronics and semiconductor industries.

REGIONAL ANALYSIS

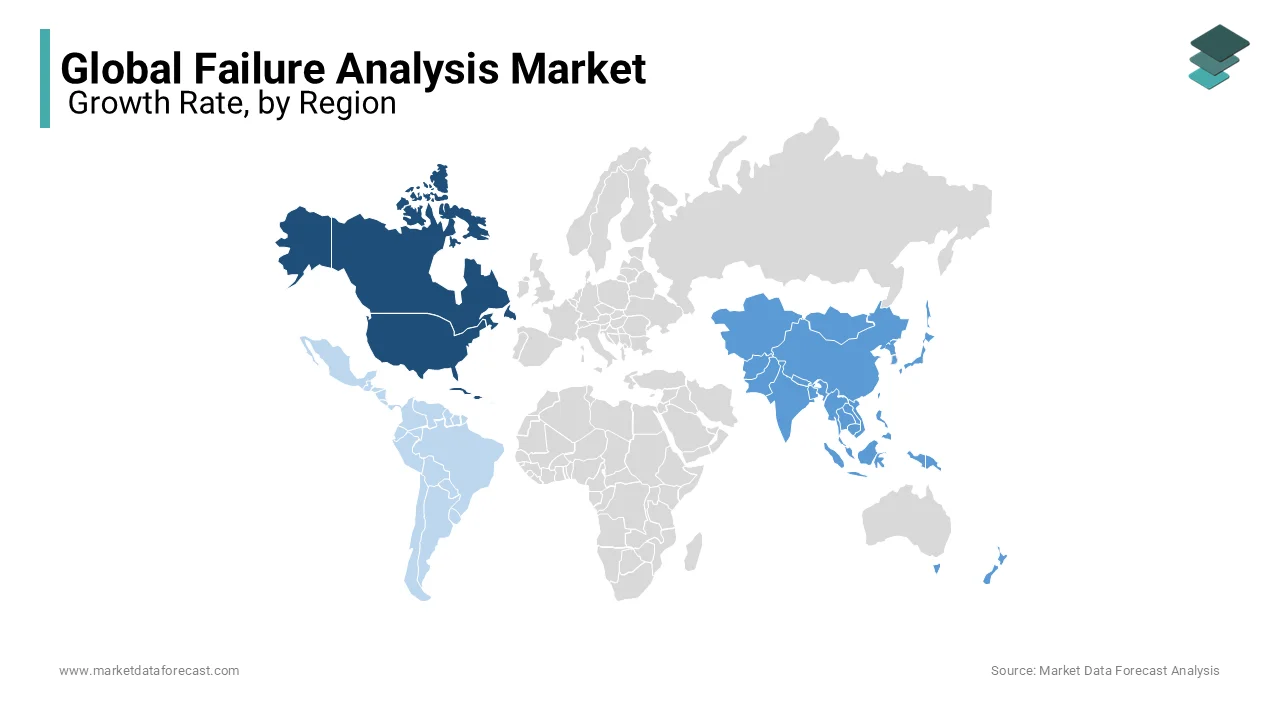

North America held the major share of the global market in 2023 and the lead of the North American region in the global market is estimated to continue throughout the forecast period. North America, owing mostly to the United States, was one of the first to use failure analysis tools, which were developed to ensure that established business models were not disrupted significantly. The region is home to most of the world's most influential organizations. General Motors and Ford, for example, dominate the country's automobile industry, which is extensively automated. Furthermore, the United States is one of the world's leading producers of crude oil, with many oil rigs strewn across the continent. The need for failure analysis approaches is becoming more apparent after the destructive effects of many oil rig mishaps, the most noteworthy of which is the Deepwater Horizon oil disaster in 2010, which spilled over 4.5 million barrels of oil into the sea due to a mechanical failure. For the past few years, the country has seen severe infrastructural problems. Significant elements of US infrastructure collapsed three times in 2021: the Texas power grid, the East Coast's main petroleum pipeline, and a Mississippi River freeway bridge. The disasters wreaked havoc on businesses and families, costing billions of dollars and leaving 150 Texans dead.

The Asia-Pacific region market is another dominating regional market in the global market and is expected to register promising growth during the forecast period. The rapid growth of semiconductor and electronics industries, along with increasing manufacturing activities is primarily propelling the APAC market growth. The rise in automotive manufacturing in the Asia-Pacific region is further promoting regional market growth. China, Japan and South Korea are leading the failure analysis market in the Asia-Pacific region.

Europe is a prominent regional market for failure analysis and is expected to witness steady growth during the forecast period. Factors such as the presence of a mature industrial base, growing emphasis on quality assurance, increasing adoption of failure analysis in manufacturing processes, well-established manufacturing sector, stringent regulatory standards and rising focus on reducing production defects are driving the growth of the failure analysis market in Europe. Germany, France, and the United Kingdom are major players in the European region and the trend is likely to continue during the forecast period.

Regions such as Latin America, Middle East and Africa are expected to witness moderate growth in the worldwide market during the forecast period. In Brazil, failure analysis is being extensively used in the aerospace industry to ensure the structural integrity of components.

KEY PLAYERS IN THE GLOBAL FAILURE ANALYSIS MARKET

Companies playing a leading role in the global failure analysis market include Thermo Fisher Scientific, Inc. (US), Hitachi High-Technologies Corporation (Japan), Carl Zeiss (Germany), JOEL Ltd. (Japan), TESCAN OSRAY HOLDING (Czech Republic), Bruker (US), Semilab (Hungary), A&D Company Ltd. (Japan), HORIBA Ltd. (Japan) and Leica Microsystems GmbH (Germany).

RECENT HAPPENINGS IN THE MARKET

- The JEOL Beam Tracer's great spatial resolution and flexibility make it possible to exactly find and pinpoint fault spots in multi-layer semiconductor devices. Through several complex layers, the Beam Tracer images marginal and failed interconnects and junctions. It features a patented Voltage Distribution Contrast approach for devices created under the 65nm design rule, furthermore as individual transistor measurement and electrical characterization.

- LSL-2500 Bulk Micro Defect Inspection System, primarily for patterned wafers in failure analysis. New product release This one-of-a-kind IR light scattering-based inspection metrology system are often accustomed analyse the failure of produced wafers. It identifies BMDs produced by the warmth impacts of assorted device manufacturing processes. Its unique dual light unit detects BMD in Standard mode (for bare wafers) and Tilted mode (for patterned wafers), with perfect correlation between the 2 measurement modes.

DETAILED SEGMENTATION OF THE GLOBAL FAILURE ANALYSIS MARKET INCLUDED IN THIS REPORT

This research report on the global failure analysis market has been segmented and sub-segmented based on equipment, application and region.

By Equipment

- Optical Microscope

- Scanning Microscope (SEM)

- Transmission Microscope (TEM)

- Scanning Probe Microscope

- Focused Particle Beam System (FIB)

- Dual-Beam System (FIB-SEM)

By Application

- Electronics & Semiconductor

- Industrial Science

- Material Science

- Bioscience

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key industries contributing to the demand for failure analysis globally?

Key industries driving demand globally include aerospace and defense, automotive, electronics and semiconductors, healthcare, and energy. For instance, the electronics industry relies heavily on failure analysis to improve semiconductor design and manufacturing, while aerospace and defense sectors use it to ensure reliability and safety in mission-critical systems.

What types of failure analysis techniques are most commonly used?

The most common techniques include Scanning Electron Microscopy (SEM), Transmission Electron Microscopy (TEM), Focused Ion Beam (FIB), X-ray Diffraction (XRD), and Energy Dispersive X-ray Spectroscopy (EDX). These methods help analyze microstructural properties, identify defects, and determine root causes of failure in various materials and components.

How are environmental and sustainability factors impacting the failure analysis market?

Environmental regulations and sustainability initiatives are driving the need for more eco-friendly failure analysis techniques and materials. Industries are seeking ways to reduce waste and energy consumption while maintaining high standards of analysis. This is pushing for innovation in less hazardous methods and recycling of test samples, especially in the electronics and automotive sectors.

How is AI and automation influencing the failure analysis market globally?

AI and automation are increasingly being integrated into failure analysis processes to enhance accuracy, reduce analysis time, and improve predictive capabilities. Automated systems can detect patterns, analyze large datasets, and even predict potential failures before they occur. This is particularly beneficial in complex industries like aerospace and semiconductors, where even minor defects can have significant impacts.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]