Global Factoring Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (International and Domestic), Organization Size (Small and Medium Enterprises and Large Enterprises), Application (Transportation, Healthcare, Construction, Manufacturing, and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Factoring Market Size

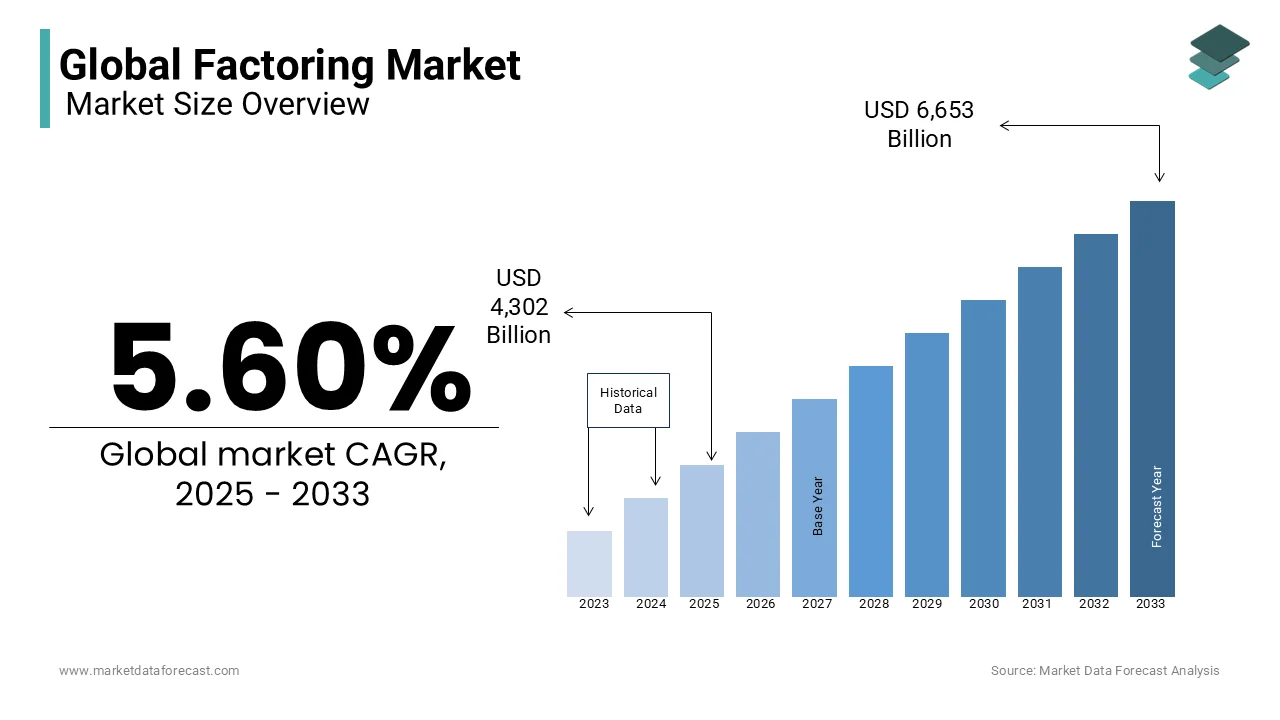

The global factoring market was worth USD 4074.8 billion in 2024. The global market is projected to reach USD 6,653.98 billion by 2033 from USD 4,302.99 billion in 2025, growing at a CAGR of 5.60% from 2025 to 2033.

Factoring is a crucial component of global trade finance facilitating liquidity and operational efficiency for businesses particularly small and medium-sized enterprises (SMEs). According to the World Trade Organization (WTO), approximately 80% of global trade is supported by trade finance mechanisms including factoring. Factoring allows businesses to sell their accounts receivable to financial institutions at a discount providing immediate cash flow. This is especially beneficial for SMEs which often face challenges in securing traditional financing due to limited credit histories or collateral. The World Bank highlights that factoring is particularly advantageous for high-risk informationally opaque borrowers as underwriting is based on the risk of the accounts receivable rather than the borrower’s creditworthiness.

MARKET DRIVERS

Increasing Demand for Alternative Financing Among SMEs

Small and Medium-sized Enterprises (SMEs) account for nearly 90% of businesses globally, as reported by the World Bank. Many SMEs face challenges accessing traditional bank loans due to strict credit criteria and limited collateral. Factoring provides an alternative by enabling these businesses to convert accounts receivable into immediate cash flow, ensuring smooth operations and stability. The European Factoring Association states that factoring in Europe reached €2 trillion in volume in 2022, with SMEs contributing significantly to this growth. The flexibility and accessibility of factoring make it a critical financial tool for SMEs.

Growth in International Trade Activities

Global trade reached a total value of $32 trillion in 2022, according to UNCTAD, driving demand for factoring services to facilitate cross-border transactions. Factoring addresses risks like currency fluctuations, payment delays, and defaults, enabling businesses to secure upfront cash for receivables. This trend is particularly strong in emerging markets like Asia-Pacific, where trade volumes are rapidly increasing. The International Factors Group notes that export factoring grew by 25% in 2022, reflecting its importance in supporting global trade operations and driving the factoring market's growth.

MARKET RESTRAINTS

High Cost of Factoring Services

Factoring services often involve fees between 1% and 5% of invoice value, which can erode profitability for businesses, particularly those operating on thin margins. SMEs are heavily reliant on factoring for liquidity with a cite cost as a major deterrent. A survey by the European Factoring Association highlighted that high fees prevent 30% of SMEs from adopting factoring services. This issue is further exacerbated in regions with limited competition among factoring providers, where fees remain high due to monopolistic practices. Such cost-related barriers limit the accessibility of factoring, especially for smaller businesses.

Regulatory and Legal Challenges

Factoring markets are constrained by legal complexities and inconsistent regulations across countries. In some emerging markets, restrictions on receivables assignment, stamp duty taxes, and limited access to foreign currency transactions create obstacles for businesses seeking factoring services. For example, the African Export-Import Bank reports that regulatory barriers significantly hamper the adoption of factoring in several African nations. Cross-border factoring is also affected by currency fluctuation risks and compliance issues, which discourage international trade financing. These regulatory challenges increase operational burdens for providers, restraining the market's potential in underserved regions.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

Emerging economies offer significant growth opportunities for the factoring market due to increasing globalization and trade activity. In regions like Asia-Pacific and Latin America, factoring penetration remains below 5% of GDP, compared to 10-15% in developed countries, according to the World Trade Organization (WTO). Governments in countries such as India and Brazil are introducing regulatory reforms to promote factoring services, creating a favorable business environment. Additionally, the rapid growth of SMEs in these regions, driven by rising exports and trade agreements which presents a significant opportunity for factoring providers to expand their services and tap into underserved markets.

Digital Transformation and Fintech Integration

The adoption of digital platforms and fintech solutions is revolutionizing the factoring market by improving efficiency, reducing transaction costs, and expanding accessibility. Technologies like blockchain and artificial intelligence (AI) are enabling real-time credit assessments and secure transactions by streamlining the factoring process. A report by PricewaterhouseCoopers, highlights that fintech-driven factoring platforms increased transaction volumes by 35% year-over-year in 2022, particularly among SMEs. The growing demand for digital solutions in developed countries allows factoring companies to attract a broader client base and enhance operational scalability which makes fintech integration a key growth driver in the industry.

MARKET CHALLENGES

Credit Risk and Non-Payment

Factoring companies face significant credit risks when clients’ customers fail to pay invoices on time or default entirely. This challenge is more pronounced in industries with volatile cash flows or unstable markets. According to the International Factoring Association, non-payment risks account for up to 25% of the total operational challenges faced by factoring firms. Such risks not only impact profitability but also require factoring providers to implement stringent credit assessment processes which increases operational costs. The unpredictability of client defaults often discourages providers from engaging with high-risk businesses solely limits the market accessibility for some sectors.

Lack of Awareness in Emerging Markets

In many emerging economies, businesses are unfamiliar with factoring as a financing option. For instance, factoring accounts for less than 1% of GDP transactions in parts of Africa, according to the African Export-Import Bank. A lack of understanding about how factoring works and its benefits often leads SMEs to rely on traditional banking loans despite higher costs and longer approval times. This knowledge gap hinders market growth in these regions, requiring factoring companies to invest heavily in education and outreach initiatives to expand their client base and overcome adoption barriers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.60% |

|

Segments Covered |

By Type, Organization Size, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BNP Paribas, HSBC Holdings plc, Deutsche Factoring Bank, Citibank, Mizuho Financial Group, China Construction Bank Corporation (CCB), Santander Bank, Crédit Agricole Leasing & Factoring, Hitachi Capital Corporation, and Eurobank are leading players in the global factoring market. |

SEGMENTAL ANALYSIS

By Type Insights

The domestic factoring segment held 60.3% of the global market share in 2024 owing to the relative simplicity of domestic transactions which involve dealing with familiar legal frameworks which established customer relationships and reduced risks associated with currency fluctuations and cross-border regulations. The World Bank highlights that factoring has become an important source of financing, especially short-term working capital, for small and medium-sized enterprises (SMEs) and corporations reached a worldwide volume of €760 billion in 2003.

On the other hand, the international factoring segment is esteemed to have fastest CAGR of 9.2% during the forecast years in factoring market. It is driven by the expansion of global trade and the increasing need for flexible financing solutions across borders. The International Monetary Fund (IMF) notes that an estimated 80% of world trade relies on trade finance mechanisms which also includes factoring. The rising demand for international factoring services is propelled by businesses seeking to mitigate risks associated with cross-border transactions, such as differing legal systems and payment uncertainties. This growth underscores the importance of international factoring in facilitating global trade and supporting the financial needs of exporters and importers.

By Organization Size Insights

The small and medium-sized enterprises (SMEs) segment accounted for 77.4% of global factoring market share in 2024. Factoring provides SMEs with immediate working capital by converting accounts receivable into cash, which is particularly beneficial for businesses that may face challenges in securing traditional financing due to limited credit histories or collateral. The World Bank highlights that factoring is especially advantageous for high-risk, informationally opaque borrowers as underwriting is based on the risk of the accounts receivable rather than the borrower’s creditworthiness.

The large enterprise segment is expected to experience a CAGR of 5.4% throughout the forecast period. This reflects an ongoing demand for factoring services as these organizations seek to optimize their cash flow and manage working capital effectively. Moreover, these enterprises generate significant accounts receivable making them attractive clients for factoring companies.

By Application Insights

The manufacturing segment commanded for 40.9% of the global market share in 2024. This prominence is due to the sector's substantial contribution to global trade and its consistent need for working capital solutions. According to the World Bank, the manufacturing industry's value added as a percentage of GDP has been significant which expels its economic importance. Manufacturers often rely on factoring to maintain liquidity, manage cash flows, and mitigate risks associated with accounts receivable making it a vital financial tool in this industry.

The construction sector is witnessing a rapid rise in factoring adoption, with an increasing CAGR of 6.1%. This surge is driven by the industry's expansion and the inherent need for substantial upfront capital. The World Bank data indicates that the industry, including construction, contributes significantly to GDP which is reflecting its growth trajectory. Construction companies utilize factoring to bridge payment gaps between project milestones by ensuring smooth operations and financial stability. The flexibility and immediacy of funds provided by factoring make it an attractive financing option for the construction industry supporting its rapid development and addressing its unique financial challenges.

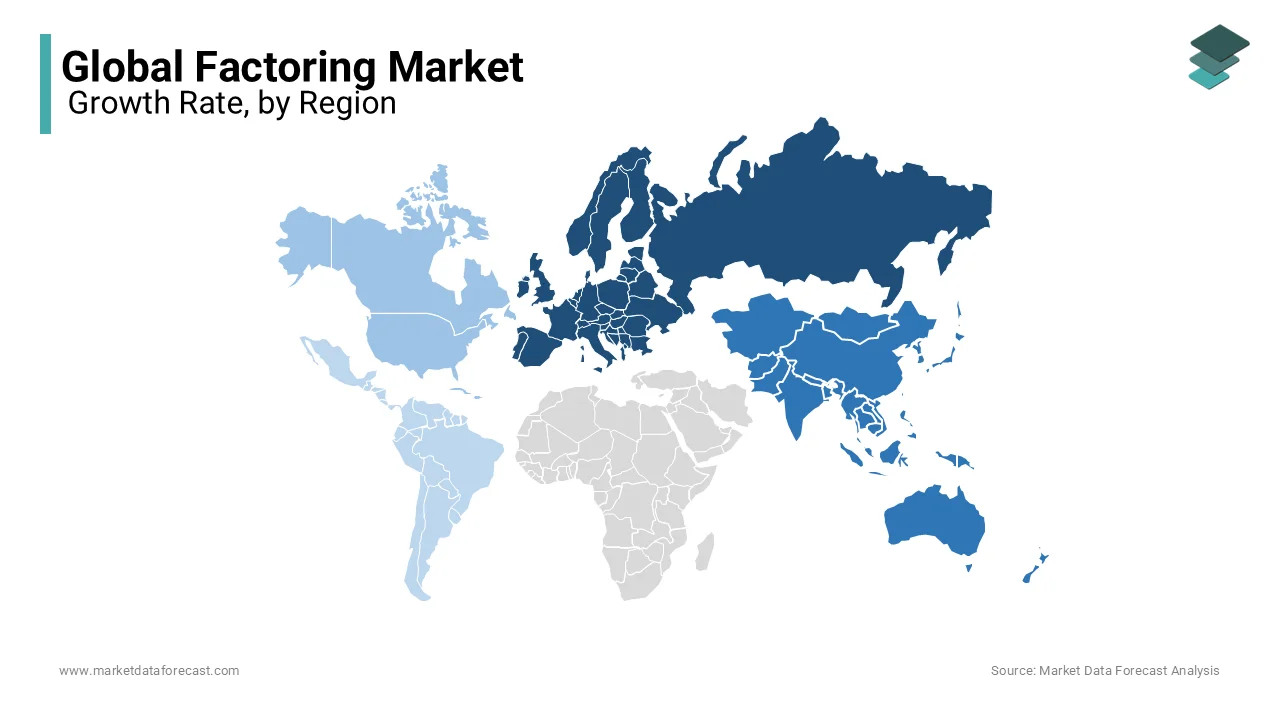

REGIONAL ANALYSIS

Europe is the largest regional player in the global factoring market and occupied 61.8% of the global market share in 2024. The dominance is attributed to its strong industrial base, including manufacturing, automotive, and food processing sectors which drive high demand for factoring services. Germany, France, and Italy are the key contributors due to advanced financial infrastructures and extensive B2B trade. According to the EU Federation for Factoring and Commercial Finance, the factoring turnover in Europe exceeded €2 trillion in 2022, showcasing its widespread adoption. The region is expected to grow with increasing regulatory support, digitalization of financial processes, and the rising need for liquidity management.

Asia-Pacific is gearing up to have prominent growth rate with a projected CAGR of 6.05% over the forecast period. This growth is fueled by the rapid economic expansion and increasing international trade activities in countries such as China, India, and Japan. China leads the region, with its large manufacturing exports and the government’s promotion of supply chain financing tools like factoring. India’s initiatives, such as the Trade Receivables Discounting System (TReDS) shall encourage SMEs to adopt factoring for working capital needs. The rise of e-commerce and the growing participation of SMEs in global supply chains further contribute to the strong growth trajectory in this region.

The factoring market in North America is expected to grow at a CAGR of 6.4% from 2025 to 2033, with the United States leading the region. The adoption of factoring services is particularly prominent in transportation, manufacturing, and healthcare sectors. According to the U.S. Factoring Association, over $150 billion in invoices were factored in 2022, reflecting its established role in financing operations. The region’s growth is supported by advancements in fintech platforms that streamline factoring processes, as well as the increasing demand for receivables financing to maintain liquidity in highly competitive industries.

The Latin American factoring market is projected to be a noteworthy regional segment in the worldwide market. The region is witnessing rising adoption of factoring services, particularly in Brazil and Mexico where SMEs are looking for alternative financing solutions to mitigate cash flow challenges. Factoring penetration remains relatively low, at approximately 2-3% of GDP, offering significant growth potential. Brazil’s large-scale manufacturing and construction industries are major drivers, while Mexico benefits from its position as a logistics hub for North American trade. Government reforms to modernize financial regulations are expected to further boost market adoption.

The market in Middle East and Africa region is anticipated to grow at steady pace during the forecast period, as businesses increasingly adopt factoring services to address delayed payment cycles and cash flow challenges. Countries such as the UAE and South Africa are driving regional growth through government-backed trade finance initiatives and economic diversification programs. In South Africa, factoring turnover exceeded $5 billion in 2022 by reflecting its gradual adoption in the region. The expansion of international trade partnerships and the development of financial infrastructure in the Middle East are key contributors to market growth.

COMPETATIVE LANDSCAPE

The factoring market is highly competitive with key players vying to capture market share by offering tailored solutions leveraging technology and expanding their geographical presence. The competition is driven by factors such as the demand for innovative financing solutions the growth of small and medium-sized enterprises (SMEs) and globalization which has increased cross-border trade.

Major global players include BNP Paribas HSBC Deutsche Factoring Bank and Citibank alongside regional specialists catering to specific markets. These companies compete on service offerings pricing technology integration and customer support. Advancements in digital platforms and data analytics have become critical differentiators enabling providers to streamline operations and enhance client experiences.

In mature markets like Europe and North America competition is intense due to the presence of well-established players and high market penetration. Meanwhile emerging markets in Asia-Pacific Latin America and Africa are seeing new entrants including fintech companies capitalizing on the untapped potential of SMEs and underdeveloped financial infrastructures.

Consolidation trends are evident with larger firms acquiring smaller entities to expand their portfolios and reach. Regulatory changes such as those fostering transparency and efficiency further influence the competitive landscape. Overall the factoring market's competition fosters innovation and drives the adoption of cutting-edge solutions to meet evolving business needs.

KEY MARKET PLAYERS

BNP Paribas, HSBC Holdings plc, Deutsche Factoring Bank, Citibank, Mizuho Financial Group, China Construction Bank Corporation (CCB), Santander Bank, Crédit Agricole Leasing & Factoring, Hitachi Capital Corporation, and Eurobank are leading players in the global factoring market.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BNP Paribas signed an agreement to acquire HSBC's private banking activities in Germany, aiming to position BNP Paribas Wealth Management among the top players in the German market and increase its assets under management to over €40 billion.

- In July 2024, Citibank launched a blockchain-based trade finance platform to enhance transparency and efficiency in cross-border factoring transactions, positioning itself at the forefront of technological innovation in the financial sector.

MARKET SEGMENTATION

This research report on the global factoring market is segmented and sub-segmented into the following categories.

By Type

- International

- Domestic

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Application

- Transportation

- Healthcare

- Construction

- Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What industries benefit the most from factoring?

Industries such as manufacturing, transportation, wholesale trade, construction, and staffing agencies frequently use factoring to maintain cash flow.

What factors influence the cost of factoring?

Costs depend on invoice value, client creditworthiness, payment terms, and the risk level associated with the receivables.

How does factoring impact a company’s balance sheet?

Factoring improves liquidity by converting receivables into cash but reduces the value of outstanding invoices on the balance sheet.

How is technology shaping the future of the factoring market?

Digital platforms, blockchain, and AI-driven risk assessment are making factoring more accessible, efficient, and transparent worldwide.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]