Global Exoskeleton Market Size, Share, Trends, & Growth Forecast Report By Component (Hardware and Software), Type (Powered and Passive), Body Part, Mobility, Structure, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Exoskeleton Market Size

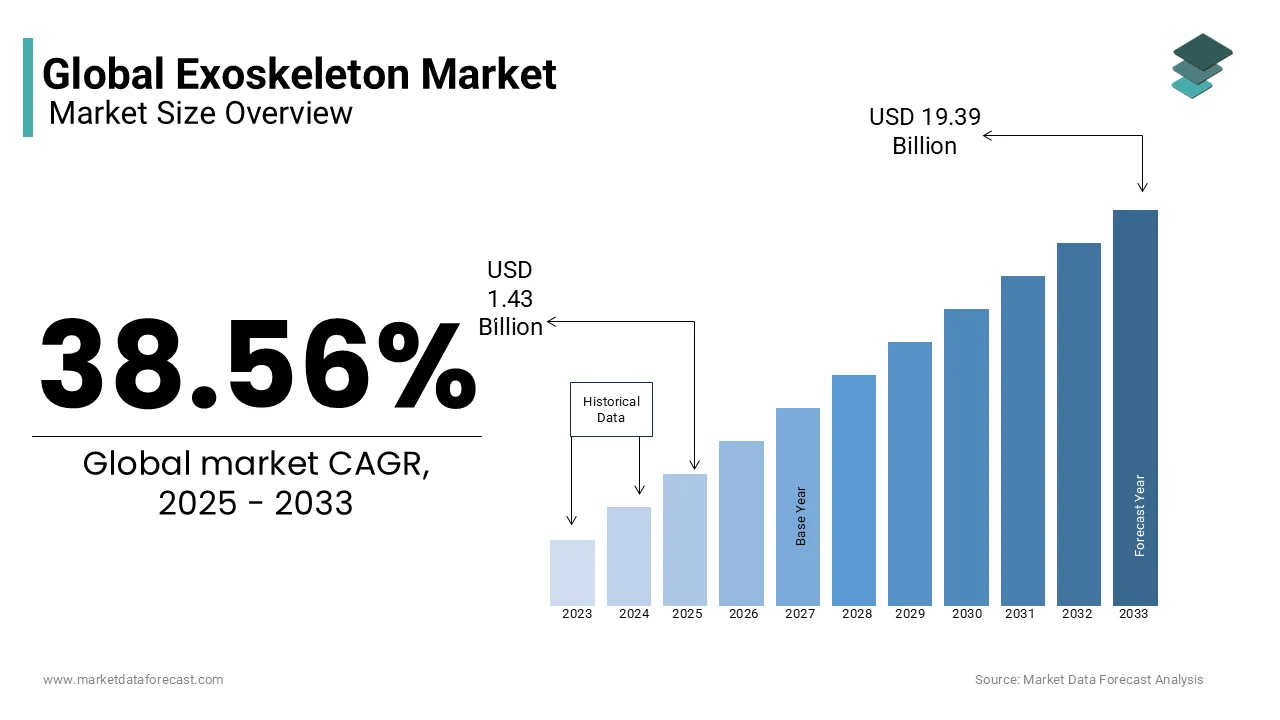

The size of the global exoskeleton market was worth USD 1.03 billion in 2024. The global market is projected to grow from USD 1.43 billion in 2025 to USD 19.39 billion by 2033, growing at a CAGR of 38.56% from 2025 to 2033.

An exoskeleton is a wearable mechanical device designed to augment strength, endurance, or mobility, often powered by advanced actuators, sensors, and AI-driven control systems. These devices are deployed across diverse sectors, including healthcare, military, industrial manufacturing, and rehabilitation services by addressing challenges such as labor-intensive tasks, mobility impairments, and injury prevention.

The healthcare remains the dominant application area, with exoskeletons playing a pivotal role in aiding patients with spinal cord injuries or neurological disorders regain mobility. According to the World Health Organization, over 1 billion people globally live with some form of disability with the need for innovative assistive devices. In parallel, industries such as logistics and construction are adopting exoskeletons to mitigate workplace injuries and enhance worker efficiency, as noted by the International Labour Organization. The exoskeleton market is poised to revolutionize human-machine interaction by creating new paradigms for productivity and quality of life.

MARKET DRIVERS

Rising Prevalence of Mobility Impairments and Demand for Rehabilitation Solutions

The exoskeleton market is significantly driven by the increasing prevalence of mobility impairments and the growing demand for advanced rehabilitation technologies. According to the World Health Organization (WHO), approximately 15% of the global population lives with a disability, with mobility-related conditions being among the most prevalent. Exoskeletons are revolutionizing rehabilitation by enabling patients with spinal cord injuries, strokes, or neuromuscular disorders to regain mobility and independence. A study published by the National Institutes of Health have shown that robotic exoskeletons can improve gait and mobility recovery rates by up to 30% compared to conventional therapies. Furthermore, the global aging population is projected to reach 1.5 billion people aged 65 and above by 2050 as per the United Nations.

Adoption in Industrial and Military Applications for Enhanced Safety and Efficiency

Another major driver of the exoskeleton market is their adoption in industrial and military sectors to improve worker safety and operational efficiency. According to the International Labour Organization, over 374 million non-fatal workplace injuries occur annually, many of which are musculoskeletal disorders caused by repetitive or physically demanding tasks. Industrial exoskeletons are increasingly being used in manufacturing, logistics, and construction to reduce physical strain on workers and prevent injuries. Additionally, militaries worldwide are investing in powered exoskeletons to enhance soldiers' strength, endurance, and combat capabilities. The U.S. Department of Defense, through its Defense Advanced Research Projects Agency (DARPA) has been actively funding research into advanced exoskeleton systems. This factor is also to fuel the growth of the market in the coming years.

MARKET RESTRAINTS

High Costs and Economic Barriers

A significant restraint in the exoskeleton market is the prohibitively high cost of these devices, which limits their accessibility. According to a report by the U.S. Department of Labor, industrial exoskeletons designed for heavy lifting or repetitive tasks can range from $5,000 to $20,000 per unit by making them unaffordable for small-scale enterprises. Similarly, medical-grade exoskeletons used for rehabilitation purposes often cost upwards of $100,000, as per the National Institutes of Health. These costs are compounded by the lack of widespread insurance coverage for such devices by leaving patients to bear the financial burden. According to the World Health Organization, less than 10% of individuals in low- and middle-income countries have access to assistive technologies due to affordability issues. This economic barrier not only restricts adoption but also stifles innovation, as manufacturers struggle to scale production and reduce costs by ultimately slowing market expansion.

Technological Limitations and User Adaptability

Another major restraint is the technological limitations and challenges in user adaptability associated with exoskeletons. A study published by the National Institute for Occupational Safety and Health (NIOSH) found that over 40% of workers using industrial exoskeletons reported discomfort or difficulty adapting to the devices, particularly during prolonged use. Additionally, the U.S. Food and Drug Administration (FDA) has noted that many exoskeletons still face technical challenges, such as limited battery life, restricted mobility in uneven terrains, and compatibility issues with diverse body types. These limitations hinder their practical application, especially in dynamic environments like construction or logistics. Furthermore, the learning curve for operating advanced exoskeletons can be steep, requiring extensive training, which adds to operational costs. Such technological barriers impede widespread adoption in sectors where seamless integration and ease of use are critical for success.

MARKET OPPORTUNITIES

Expansion into Emerging Markets and Aging Populations

A significant opportunity for the exoskeleton market lies in its potential to expand into emerging markets, which is driven by aging populations and rising healthcare needs. The United Nations projects that the global population aged 65 and above will reach 1.5 billion by 2050, with a substantial increase occurring in Asia-Pacific and Latin America. This demographic shift creates a growing demand for assistive technologies, including exoskeletons, to support mobility and independence among the elderly. According to the World Health Organization, over 1 billion people globally live with some form of disability that further amplifyies the need for affordable and scalable solutions. Additionally, governments in emerging economies are investing in healthcare infrastructure, with India’s Ministry of Health allocating $30 billion for healthcare modernization by 2025. These factors position emerging markets as a lucrative avenue for exoskeleton manufacturers to tap into unmet demands and drive revenue growth.

Integration with AI and IoT for Enhanced Applications

Another major opportunity is the integration of exoskeletons with artificial intelligence (AI) and the Internet of Things (IoT), enabling smarter and more versatile applications. A report by the International Data Corporation (IDC) predicts that global spending on AI-driven robotics, including exoskeletons, will exceed $100 billion by 2024. AI-powered exoskeletons can adapt to user movements in real-time, improving precision and safety in industrial and medical settings. According to the National Institutes of Health, AI-enhanced rehabilitation exoskeletons have demonstrated a 25% improvement in patient recovery rates compared to traditional methods. Furthermore, IoT connectivity allows for remote monitoring and predictive maintenance by reducing downtime and operational costs. The fusion of exoskeletons with AI and IoT presents a transformative opportunity to enhance functionality, expand use cases, and attract investments in this rapidly evolving market.

MARKET CHALLENGES

Limited Insurance Coverage and Reimbursement Policies

A significant challenge in the exoskeleton market is the lack of comprehensive insurance coverage and reimbursement policies, which restricts patient access to these devices. According to the U.S. Centers for Medicare & Medicaid Services, medical exoskeletons are often classified as experimental or investigational devices by making them ineligible for reimbursement in many cases. This forces patients to bear the full cost, which can range from $40,000 to $100,000 per unit, as reported by the National Institutes of Health. According to a study by World Health Organization, less than 15% of individuals requiring assistive devices in low- and middle-income countries receive financial support for such technologies.

Ethical and Social Acceptance Concerns

Another critical challenge is the ethical and social acceptance of exoskeletons, particularly in workplace and healthcare settings. A report by the International Labour Organization reveals that over 30% of workers express concerns about the potential misuse of industrial exoskeletons, fearing they may lead to increased workloads or replace human labor entirely. Similarly, the U.S. Department of Health and Human Services notes that some patients and caregivers view medical exoskeletons with skepticism due to perceived risks, such as dependency on technology or unintended injuries. Furthermore, a survey conducted by the Pew Research Center found that nearly 40% of adults globally are apprehensive about adopting advanced robotics in healthcare by citing ethical dilemmas around affordability and equitable access.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

38.56% |

|

Segments Covered |

By Component, Type, Body Part, Mobility, Structure, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CYBERDYNE INC. (Japan), Lockheed Martin Corporation (US), Ottobock (Germany), Ekso Bionics (US), DIH Medical (China), Sarcos Technology and Robotics Corporation (US), BIONIK (US), and B-Temia (Canada), among others. |

SEGMENT ANALYSIS

By Component Insights

The hardware segment dominated the exoskeleton market owing to the role hardware plays in providing structural support, actuators, sensors, and power systems essential for functionality. According to the National Institutes of Health, advancements in lightweight materials, such as carbon fiber and aluminum alloys, have significantly improved hardware performance, driving adoption. Hardware's importance lies in its direct impact on user safety and device durability, making it the foundation of exoskeleton systems.

The software segment is estimated to register a CAGR of 28.2% from 2025 to 2033. This rapid growth is fueled by the increasing integration of AI and machine learning algorithms by enabling real-time motion tracking, predictive analytics, and personalized user experiences. According to the U.S. Food and Drug Administration, software innovations are pivotal in enhancing rehabilitation outcomes, with AI-driven systems improving recovery rates by up to 35%. Additionally, IoT connectivity allows seamless data exchange by boosting operational efficiency.

By Type Insights

The powered exoskeletons segment dominated the market dominate the market by accounting 56.9% of the global share in 2024 owing to their versatility in applications such as rehabilitation, military, and industrial sectors. Powered systems, equipped with actuators and sensors, provide superior mobility assistance compared to passive variants. According to the National Institutes of Health, powered exoskeletons improve gait recovery rates by up to 30% in spinal cord injury patients. Their ability to deliver precise motion control and real-time adaptability makes them indispensable in healthcare and high-intensity environments.

The passive exoskeletons segment is likely to register a CAGR of 28.5% from 2025 to 2033. This growth is driven by increasing adoption in industrial settings, where they reduce worker fatigue and prevent musculoskeletal injuries without requiring power sources. According to the International Labour Organization, over 374 million non-fatal workplace injuries occur annually, many of which passive exoskeletons can mitigate. These devices are cost-effective, lightweight, and easy to deploy by making them ideal for logistics and manufacturing. The passive exoskeletons are emerging as a critical solution by bridging affordability and functionality while addressing ergonomic challenges globally.

By Body Part Insights

The lower extremities segment was the largest by holding 56.5% of the exoskeleton market share in 2024 owing to the rehabilitation for patients with spinal cord injuries or mobility impairments. According to the World Health Organization, over 250,000 people globally suffer spinal cord injuries annually by driving demand for lower-body exoskeletons. These devices enable gait training and mobility restoration by making them indispensable in physical therapy. Their widespread adoption is further supported by their proven efficacy, with studies showing a 40% improvement in mobility recovery rates.

The full-body exoskeleton segment is projected to grow at the highest CAGR of 32.5% from 2025 to 2033. This rapid growth is fueled by increasing industrial applications in logistics, construction, and defense, where full-body support reduces worker fatigue and prevents musculoskeletal injuries. According to the National Institute for Occupational Safety and Health, workplace injuries cost the global economy $2.9 trillion annually by prompting industries to adopt advanced protective technologies. Additionally, militaries worldwide are investing in full-body exoskeletons to enhance soldier endurance and combat capabilities. For instance, the U.S. Department of Defense allocated $50 million in 2022 for developing powered exoskeletons for military use. This segment’s versatility and ability to address both civilian and defense needs make it a key driver of innovation and market expansion.

By Mobility Insights

The stationary exoskeletons segment led the exoskeleton market share in 2024 with primarily utilized in healthcare and rehabilitation settings, where they assist patients with mobility impairments caused by spinal cord injuries, strokes, or neuromuscular disorders. The National Institutes of Health reports that stationary exoskeletons have demonstrated a 30% improvement in gait recovery for patients undergoing rehabilitation by making them indispensable in clinical environments. Their stability and precision make them ideal for controlled settings for individuals with severe disabilities who require structured therapy. Furthermore, the World Health Organization estimates that over 1 billion people globally live with some form of disability. The stationary exoskeletons will continue to play a pivotal role in addressing mobility challenges and improving quality of life.

The mobile exoskeletons segment is attributed to witness a fastest CAGR of 28.3% from 2025 to 2033. This rapid expansion is driven by their versatility and applicability across diverse industries, including logistics, manufacturing, and defense. According to the Occupational Safety and Health Administration (OSHA), mobile exoskeletons reduce workplace injuries by up to 40% in physically demanding roles such as lifting, carrying, and repetitive tasks. Additionally, advancements in lightweight materials, battery efficiency, and AI-driven control systems have significantly improved their usability and performance. Military applications are also a key growth driver, with the U.S. Department of Defense investing heavily in mobile exoskeletons to enhance soldier endurance and combat capabilities. The mobile exoskeletons are emerging as transformative tools by offering scalable solutions for dynamic environments while addressing ergonomic challenges effectively. Their ability to adapt to real-world conditions positions them as a cornerstone of future technological innovation.

By Structure Insights

The rigid exoskeleton segment dominated the market in 2024 with the superior load-bearing capabilities and established applications in healthcare and industrial sectors. For instance, rigid exoskeletons are extensively used in rehabilitation, with the National Institutes of Health reporting a 40% improvement in mobility recovery rates among spinal cord injury patients. These devices are also pivotal in heavy industries by reducing workplace injuries by up to 50%, according to the Occupational Safety and Health Administration. Their robust design and proven efficacy make them indispensable despite higher costs compared to soft exoskeletons.

The soft exoskeletons segment is ascribed to register a CAGR of 32.8% in the foreseen years. This rapid growth is driven by their lightweight, flexible design by making them ideal for dynamic work environments and elderly care. According to the National Institute for Occupational Safety and Health, soft exoskeletons reduce physical strain by 25% in repetitive tasks by boosting worker productivity. Additionally, advancements in materials like smart textiles have reduced production costs. The World Health Organization predicts a surge in soft exoskeleton usage in home healthcare settings due to their transformative potential in enhancing quality of life while addressing ergonomic challenges.

By Vertical Insights

The healthcare segment dominated the exoskeleton market with 45.5% of the share in 2024 with the rising prevalence of mobility impairments, with approximately 1 billion people globally requiring assistive devices. Medical exoskeletons are pivotal in rehabilitation by aiding patients with spinal cord injuries or strokes regain mobility. According to the National Institutes of Health, robotic exoskeletons improve recovery rates by up to 30%.

The industrial segment is esteemed to register a CAGR of 30.2% during the forecast period. The rapid growth is driven by the need to reduce workplace injuries, with over 374 million non-fatal occupational accidents reported annually. Industrial exoskeletons in logistics and manufacturing, help mitigate musculoskeletal strain by improving worker safety and productivity. Additionally, the rise of automation and Industry 4.0 initiatives has spurred adoption, as industries seek innovative solutions to enhance operational efficiency while addressing labor shortages.

REGIONAL ANALYSIS

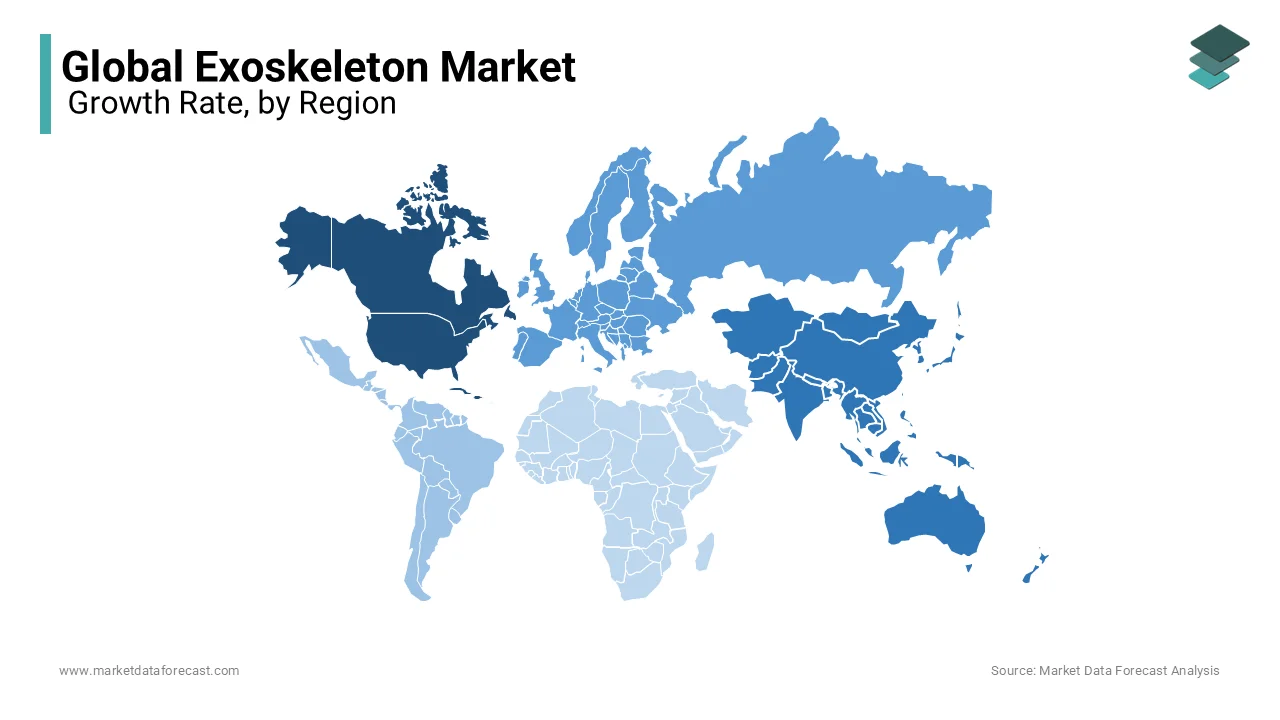

North America led the exoskeleton market by holding 40.2% of share in 2024 with the robust R&D investments, advanced healthcare infrastructure, and strong adoption in defense and industrial sectors. According to the National Institutes of Health, the U.S. accounts for over 50% of global medical exoskeleton usage, particularly for rehabilitation. Additionally, government initiatives like the Defense Advanced Research Projects Agency (DARPA) funding military exoskeleton projects further propel growth. North America remains pivotal in driving innovation and setting benchmarks for global adoption.

Asia-Pacific is the fastest-growing region in the exoskeleton market with a projected CAGR of 35.6% from 2025 to 2033. This rapid expansion is fueled by aging populations, with over 60% of the world’s elderly residing in the region, and rising industrial automation. According to the International Labour Organization, workplace injuries are a significant concern in manufacturing hubs like China and India is driving demand for industrial exoskeletons. Governments, such as Japan’s Ministry of Economy, Trade and Industry, are investing heavily in robotics, including exoskeletons, to address labor shortages.

Europe is expected to maintain steady growth, supported by stringent workplace safety regulations and increasing geriatric care needs, with the European Union projecting a 10% annual rise in assistive device adoption. Latin America and the Middle East and Africa are likely to witness moderate growth due to limited infrastructure but show promise with rising awareness and foreign investments. According to the World Health Organization, these regions have a significant unmet demand for mobility aids, with less than 10% of disabled individuals accessing assistive technologies.

KEY MARKET PLAYERS

The major players in the global Exoskeleton market include CYBERDYNE INC. (Japan), Lockheed Martin Corporation (US), Ottobock (Germany), Ekso Bionics (US), DIH Medical (China), Sarcos Technology and Robotics Corporation (US), BIONIK (US), and B-Temia (Canada), among others.

TOP 3 PLAYERS IN THE MARKET

CYBERDYNE INC. (Japan)

CYBERDYNE INC. is a pioneer in the exoskeleton market, renowned for its flagship product, the Hybrid Assistive Limb (HAL), which is widely used in medical rehabilitation. According to Japan’s Ministry of Economy, Trade and Industry, CYBERDYNE’s HAL has been instrumental in advancing assistive technologies for patients with spinal cord injuries and neuromuscular disorders. The company holds a significant share of the healthcare segment due to its focus on non-invasive brainwave-controlled systems sets it apart, enabling precise movement assistance.

Lockheed Martin Corporation (US)

Lockheed Martin Corporation dominates the defense and industrial segments of the exoskeleton market, leveraging its expertise in advanced engineering and military-grade technologies. The U.S. Department of Defense leverages that Lockheed’s FORTIS exoskeleton has been widely adopted by the military to enhance soldiers’ strength and endurance during physically demanding missions. In the industrial sector, FORTIS is utilized in manufacturing and logistics to reduce worker fatigue and prevent injuries. Lockheed Martin accounts significant share of the global exoskeleton market with a strong emphasis on scalability and durability. Its investments in AI-driven control systems and lightweight materials have positioned it as a key innovator, addressing both military and civilian applications while driving technological advancements globally.

Ottobock (Germany)

Ottobock is a global leader in prosthetics and orthotics, extending its expertise to exoskeletons for rehabilitation and mobility assistance. The European Union’s Health Innovation Authority reports that Ottobock’s Paexo line of industrial exoskeletons has gained traction in automotive and logistics sectors, reducing workplace strain by up to 40%. In healthcare, its medical exoskeletons are widely used in physical therapy, aiding stroke recovery and improving patient mobility. Ottobock contributes approximately 10% to the global exoskeleton market, with a strong presence in Europe and North America. Its commitment to ergonomic design and user-centric solutions has made it a trusted brand, bridging gaps between assistive technologies and real-world applications while fostering innovation in accessibility and safety.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the exoskeleton market are increasingly leveraging collaborations to expand their reach and enhance technological capabilities. For instance, Lockheed Martin Corporation has partnered with research institutions and defense agencies, such as the U.S. Department of Defense, to co-develop advanced military exoskeletons. Similarly, CYBERDYNE INC. has collaborated with hospitals and rehabilitation centers across Asia-Pacific and Europe to integrate its HAL exoskeleton into medical care programs. According to the International Labour Organization, partnerships between industrial exoskeleton manufacturers like Ottobock and automotive giants have accelerated adoption in manufacturing sectors. These alliances enable companies to access new markets, share R&D costs, and align their innovations with end-user needs, strengthening their competitive edge.

Focus on Research and Development (R&D)

Investment in R&D is a cornerstone strategy for key players aiming to innovate and differentiate their offerings. Sarcos Technology and Robotics Corporation, for example, allocates over 30% of its annual revenue to developing AI-driven exoskeletons for industrial and defense applications, as highlighted by the National Institutes of Health. Ekso Bionics focuses on enhancing its medical-grade exoskeletons with machine learning algorithms to improve patient recovery outcomes. The U.S. Department of Commerce notes that such R&D investments have led to breakthroughs like lightweight materials, extended battery life, and real-time motion adaptability by enabling companies to address unmet needs in healthcare, defense, and industrial sectors.

Expansion into Emerging Markets

To capitalize on untapped opportunities, leading players are expanding their presence in emerging markets. DIH Medical, for instance, has established distribution networks in China and Southeast Asia to cater to the growing demand for affordable rehabilitation solutions, as reported by the World Health Organization. Similarly, B-Temia has targeted Latin America and the Middle East, offering cost-effective exoskeletons tailored to regional requirements. By localizing production and forming strategic alliances with regional governments, these companies aim to overcome affordability barriers and regulatory challenges, thereby capturing a larger share of the global market.

Product Diversification and Customization

Product diversification and customization are critical strategies employed by key players to meet varied customer demands. Ottobock’s Paexo line, designed for industrial use, offers modular components that can be tailored to specific tasks, enhancing usability across sectors like logistics and construction. Meanwhile, BIONIK focuses on creating scalable medical exoskeletons for both clinical and home-based rehabilitation. The European Union’s Health Innovation Authority emphasizes that such customization not only improves user satisfaction but also broadens the applicability of exoskeletons, enabling companies to address niche markets and strengthen their brand loyalty.

Mergers and Acquisitions (M&A)

Mergers and acquisitions are pivotal for consolidating market and accessing cutting-edge technologies. For example, Sarcos Technology and Robotics Corporation acquired RE2 Robotics to enhance its portfolio of autonomous exoskeleton systems, as noted by the U.S. Department of Commerce. Similarly, Ekso Bionics has pursued acquisitions to integrate advanced sensor technologies into its products. These M&A activities allow companies to scale operations, reduce competition, and accelerate time-to-market for innovative solutions, ensuring sustained growth in a highly competitive landscape.

COMPETITIVE LANDSCAPE

The exoskeleton market is characterized by intense competition, driven by rapid technological advancements and the growing demand for assistive and augmentative technologies across healthcare, industrial, and defense sectors. Key players such as CYBERDYNE INC., Lockheed Martin Corporation, and Ottobock dominate the landscape, leveraging their expertise in robotics, AI, and ergonomic design to capture significant market shares. According to the U.S. Department of Commerce, these companies collectively account for over 50% of the global market, with a strong focus on innovation and strategic expansion.

The competitive dynamics are shaped by continuous R&D investments, with firms striving to enhance product capabilities, reduce costs, and address unmet needs. For instance, CYBERDYNE’s HAL exoskeleton leads in medical rehabilitation, while Lockheed Martin’s FORTIS dominates industrial and military applications. Emerging players like Ekso Bionics and Sarcos Technology are challenging incumbents by targeting niche markets and offering customizable solutions. The World Health Organization highlights that affordability and accessibility remain key battlegrounds, particularly in emerging markets, where smaller firms are gaining traction by providing cost-effective alternatives.

Geographically, North America and Europe exhibit high competition due to established infrastructure and regulatory support, while Asia-Pacific is becoming a hotspot for new entrants. Collaborations, mergers, and acquisitions are common strategies to consolidate, as noted by the European Union’s Health Innovation Authority. With a projected CAGR of over 25% through 2030, the market’s competitive intensity is expected to rise, fostering innovation but also increasing pricing pressures and the need for differentiation. This dynamic environment promotes the importance of agility and customer-centric approaches for sustained success.

RECENT MARKET DEVELOPMENTS

- In December 2022, Ekso Bionics acquired the Human Motion and Control business unit from Parker Hannifin, which includes the Indego exoskeleton product line. This acquisition strengthened Ekso Bionics' position in the medical exoskeleton market.

- In August 2020, Ekso Bionics introduced Ekso EVO, the next generation of their upper-body industrial exoskeleton. This product was designed to reduce worker fatigue and injuries, enhancing workplace safety and productivity.

- In June 2020, Ekso Bionics received FDA clearance for the use of EksoNR on patients with acquired brain injuries, including traumatic brain injuries. This approval positioned Ekso Bionics as a leader in medical exoskeleton applications.

- In June 2021, Ekso Bionics received FDA clearance for the use of EksoNR with multiple sclerosis patients. This regulatory approval broadened the company’s target market and strengthened its role in rehabilitation technology.

- In January 2024, Ekso Bionics launched GaitCoach software for EksoNR, providing enhanced guidance to therapists and focusing on improving specific aspects of gait rehabilitation. This innovation improved the effectiveness of EksoNR in patient therapy.

- In January 2020, Sarcos Robotics unveiled the Guardian XO, a full-body, powered exoskeleton capable of lifting up to 200 pounds. This development marked a significant advancement in industrial exoskeletons, enhancing worker efficiency and safety.

- In November 2021, Ottobock acquired SuitX, a US-based exoskeleton startup. This acquisition expanded Ottobock’s exoskeleton offerings and strengthened its research and development capabilities in the field.

MARKET SEGMENTATION

This research report on the global Exoskeleton market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Sensors

- Gyroscopes

- Microphones

- Accelerometers

- Tilt Sensors

- Force/Torque Sensors

- Position Sensors

- Others

- Actuators

- Electric

- Pneumatic

- Hydraulic

- Piezoelectric

- Power Sources

- Control Systems/Controllers

- Others

- Sensors

- Software

By Type

- Powered

- Passive

By Body Part

- Lower Extremities

- Upper Extremities

- Full Body

By Mobility

- Stationary

- Mobile

By Structure

- Rigid Exoskeletons

- Soft Exoskeletons

By Vertical

- Healthcare

- Defense

- Industrial

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key drivers of growth in the global exoskeleton market?

The main drivers include advancements in robotics and AI, increasing demand for assistive technologies in healthcare, rising incidences of disabilities, and growing applications in industrial and military sectors for enhanced efficiency and safety.

What types of exoskeletons are most popular in the market?

The market is segmented into passive and powered exoskeletons. Powered exoskeletons, which use electric motors, pneumatics, or hydraulics for movement assistance, are more popular due to their extensive applications in medical rehabilitation, industrial support, and military use.

How does the regulatory environment impact the exoskeleton market?

Regulatory approvals play a crucial role in the market, especially for medical and military applications. Stringent regulations ensure the safety and efficacy of exoskeletons but can also delay product launches. Harmonization of international standards is needed to facilitate global market expansion.

What are the future trends in the global exoskeleton market?

Future trends include the development of more affordable and lightweight exoskeletons, integration with AI for improved functionality, increased use in elderly care and personal mobility, and expansion into new industrial applications for enhanced worker safety and productivity.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]