Global Exercise Equipment Market Size, Share, Trends & Growth Forecast Report By Type (Cardiovascular Training Equipment [Treadmills, Stationary Cycles, Elliptical Trainers], Strength Training Equipment), End-User (Home Consumers, Fitness Centers/Gyms), Distribution Channel (Offline, Online), and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa) Industry Analysis From 2025 to 2033.

Global Exercise Equipment Market Size

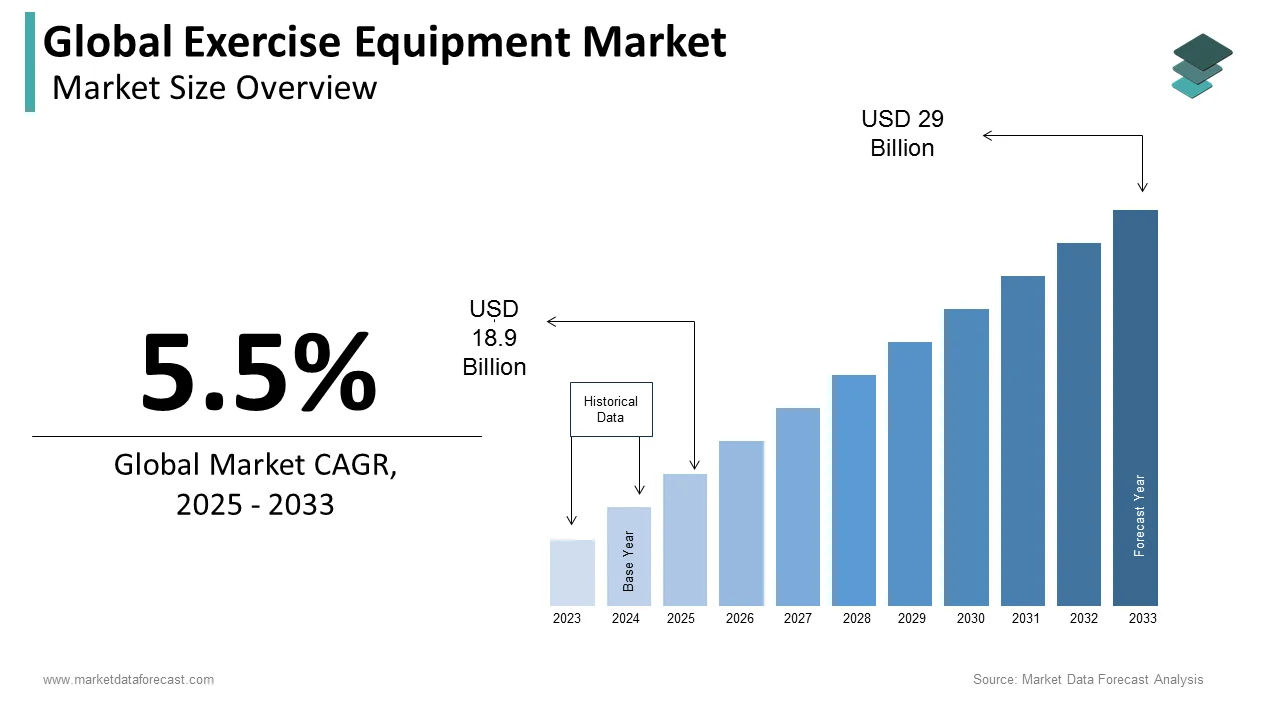

The size of the global exercise equipment market was worth USD 17.9 billion in 2024. The global market is anticipated to grow at a CAGR of 5.5% from 2025 to 2033 and be worth USD 29 billion by 2033 from USD 18.9 billion in 2025.

The Exercise Equipment Market is experiencing significant growth and is indicating a robust expansion trajectory through 2033. The rise in obesity rates and related health issues has catalyzed a shift in consumer behavior towards fitness and wellness. In the United States, the CDC reported that about 33% of adults were classified as obese in 2021, showcasing the urgent need for effective fitness solutions. This growing health consciousness has led to a surge in both commercial and residential exercise equipment adoption, with traditional manufacturers diversifying their offerings to include innovative products that cater to various consumer needs.

The market is increasingly leaning towards hybrid fitness solutions that integrate traditional equipment with digital capabilities. For instance, in Europe, approximately 68% of individuals aged 16 and above engaged in fitness activities in 2022, showcasing a strong inclination towards maintaining an active lifestyle. The integration of smart features in fitness equipment has become commonplace, with manufacturers focusing on products that seamlessly connect with fitness apps and platforms, enhancing user experience and engagement.

In Latin America, particularly Mexico, the fitness equipment market is witnessing robust growth, with around 73.6% of young men being physically active in 2022. This trend is further supported by technological advancements in home fitness equipment, making it more accessible and appealing to a broader audience. Overall, the Exercise Equipment Market is poised for continued growth, driven by evolving consumer preferences and a heightened focus on health and wellness.

MARKET DRIVERS

Increasing Health Awareness

The growing awareness of health and fitness among consumers is a significant driver of the Exercise Equipment Market. According to a survey conducted by the International Health, Racquet & Sportsclub Association (IHRSA), approximately 73% of Americans believe that regular exercise is essential for maintaining good health. This heightened awareness has led to a surge in gym memberships and home fitness equipment purchases. The COVID-19 pandemic further accelerated this trend, as individuals sought to maintain their fitness routines at home, resulting in a 170% increase in online fitness equipment sales in 2020, according to Statista.

Technological Advancements

Technological innovations in exercise equipment are transforming the market landscape, making fitness more engaging and accessible. Features such as real-time performance tracking, virtual coaching, and connectivity with mobile applications enhance user experience and motivation. For instance, Peloton reported a 172% increase in subscribers in 2020, driven by its interactive platform that combines exercise with social engagement. This trend towards smart fitness solutions is reshaping consumer expectations and driving demand for advanced exercise equipment.

MARKET RESTRAINTS

High Cost of Equipment

One of the primary restraints affecting the Exercise Equipment Market is the high cost associated with purchasing quality fitness equipment. Many consumers are deterred by the initial investment required for high-end machines, which can range from several hundred to several thousand dollars. This financial barrier is particularly pronounced in developing regions, where disposable income levels are lower. As a result, many potential buyers opt for lower-cost alternatives or choose to forgo purchasing equipment altogether, limiting market growth in these areas.

Market Saturation

Market saturation poses another significant challenge for the Exercise Equipment Market. With numerous brands and products available, consumers often face overwhelming choices, leading to indecision and reduced purchasing frequency. Additionally, many consumers are shifting towards alternative fitness solutions, such as outdoor activities and digital fitness classes, which can diminish the demand for traditional exercise equipment. This shift in consumer preferences necessitates that manufacturers innovate and differentiate their products to capture market share effectively.

MARKET OPPORTUNITIES

Expansion of E-commerce Platforms

The rapid growth of e-commerce presents a significant opportunity for the Exercise Equipment Market. As consumers increasingly prefer online shopping for convenience and variety, fitness equipment sales through digital channels have surged. According to a report by the U.S. Department of Commerce, e-commerce sales in the United States grew by 32.4% in 2020, reaching USD 791.7 billion. This shift allows manufacturers and retailers to reach a broader audience, including those in remote areas where physical stores may be limited. Additionally, the COVID-19 pandemic has accelerated this trend, with many consumers opting for online purchases due to safety concerns. The convenience of home delivery and the ability to compare products easily further solidify the importance of e-commerce in the fitness equipment landscape.

Growing Interest in Home Fitness

The increasing interest in home fitness solutions represents a substantial opportunity for the Exercise Equipment Market. The pandemic has fundamentally altered consumer behavior, with many individuals investing in home gym setups. A survey conducted by the American Council on Exercise found that 80% of respondents intended to continue exercising at home even after gyms reopened. Furthermore, this trend is driven by the convenience of exercising at home and the desire for personalized fitness experiences, prompting manufacturers to innovate and offer versatile, space-saving equipment.

MARKET CHALLENGES

Rapid Technological Advancement

The rapid pace of technological advancement presents a significant challenge for the Exercise Equipment Market. As consumers increasingly demand smart, connected devices that offer features like real-time tracking, virtual coaching, and integration with fitness apps, manufacturers must continuously innovate to meet these expectations. This constant need for technological upgrades can strain resources and increase development costs. Companies that fail to keep pace risk losing market share to competitors who offer more advanced and user-friendly products. Furthermore, the integration of technology requires ongoing software updates and customer support, adding another layer of complexity to product management and customer satisfaction.

Growing Emphasis on Sustainability

The growing emphasis on sustainability poses a challenge for the Exercise Equipment Market as consumers become more environmentally conscious. Brands are increasingly pressured to adopt eco-friendly practices, such as using sustainable materials and reducing carbon footprints in manufacturing processes. While these initiatives can enhance brand reputation, they often lead to increased production costs and require significant investment in research and development. Additionally, sourcing sustainable materials can complicate supply chains, potentially leading to delays and higher prices for consumers. Companies that do not prioritize sustainability may find themselves at a competitive disadvantage, as consumers increasingly favor brands that align with their values regarding environmental responsibility.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, End-User,Distribution Channel and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Precor Incorporated, Life Fitness (KPS Capital), Shandong EM Health Industry Group Co., Ltd., Icon Health & Fitness, Johnson Health Tech, Nautilus, Inc., TRUE, Technogym, Torque Fitness, Core Health & Fitness, Impulse Health Technology Co., Ltd., and Others. |

SEGMENT ANALYSIS

By Type Insights

The Cardiovascular training equipment segment was the largest segment in the Exercise Equipment Market by holding a market share of 45.3% as of 2024. This segment includes popular items like treadmills, stationary cycles, and elliptical trainers. The demand for cardiovascular equipment is high because many people want to improve their heart health and lose weight. According to the American Heart Association, regular cardiovascular exercise can reduce the risk of heart disease by 30-40%. The convenience of using this equipment at home or in gyms makes it essential for fitness enthusiasts, contributing to its leading position in the market.

The Strength training equipment is the fastest-growing segment in the Exercise Equipment Market, with a projected CAGR of 7.5% from 2025 to 2033. This growth is driven by an increasing awareness of the benefits of strength training, such as improved muscle mass and bone density. The World Health Organization states that strength training can help reduce the risk of falls in older adults by 40%. As more people recognize the importance of building strength for overall health, the demand for strength training equipment continues to rise. This segment's growth reflects a broader trend towards comprehensive fitness routines that include both cardio and strength training.

By End-user Insights

The biggest segment by end-user is fitness centers and gyms which accounted for 50.4% of the market share in 2024. This segment is prevailing because gyms provide access to a wide range of exercise equipment and professional trainers, attracting many fitness enthusiasts. According to the International Health, Racquet & Sportsclub Association (IHRSA), there were over 41,000 health clubs in the U.S. in 2021, serving around 60 million members. The social aspect of working out in a gym also encourages people to maintain their fitness routines, making this segment crucial for the overall growth of the exercise equipment market.

The home consumers segment is the quickly expanding in the Exercise Equipment Market, with a CAGR of 8.2%. This growth is largely due to the increasing trend of home workouts, especially after the COVID-19 pandemic. A survey by the American Council on Exercise found that 80% of people who exercised at home planned to continue doing so even after gyms reopened. The convenience of working out at home and the availability of affordable fitness equipment are driving this trend. As more individuals prioritize fitness in their daily lives, the demand for home exercise equipment continues to rise.

By Distribution Channel Insights

The offline distribution channel was the dominant segment in the Exercise Equipment Market by capturing a market share of 60.5% in 2024 as many consumers prefer to see and test equipment before purchasing. According to the U.S. Department of Commerce, physical retail sales accounted for 85% of total retail sales in 2021. Consumers often seek expert advice from sales staff, which enhances their buying experience. The ability to physically inspect the quality and functionality of exercise equipment makes offline retail a vital channel for many buyers, contributing to its dominant market position.

The online distribution channel is the fastest-growing segment in the Exercise Equipment Market, with a CAGR of 9.5%. This expansio is driven by the increasing popularity of e-commerce and the convenience of shopping from home. The ability to compare prices, read reviews, and access a wider range of products online makes this channel appealing to consumers.

REGIONAL ANALYSIS

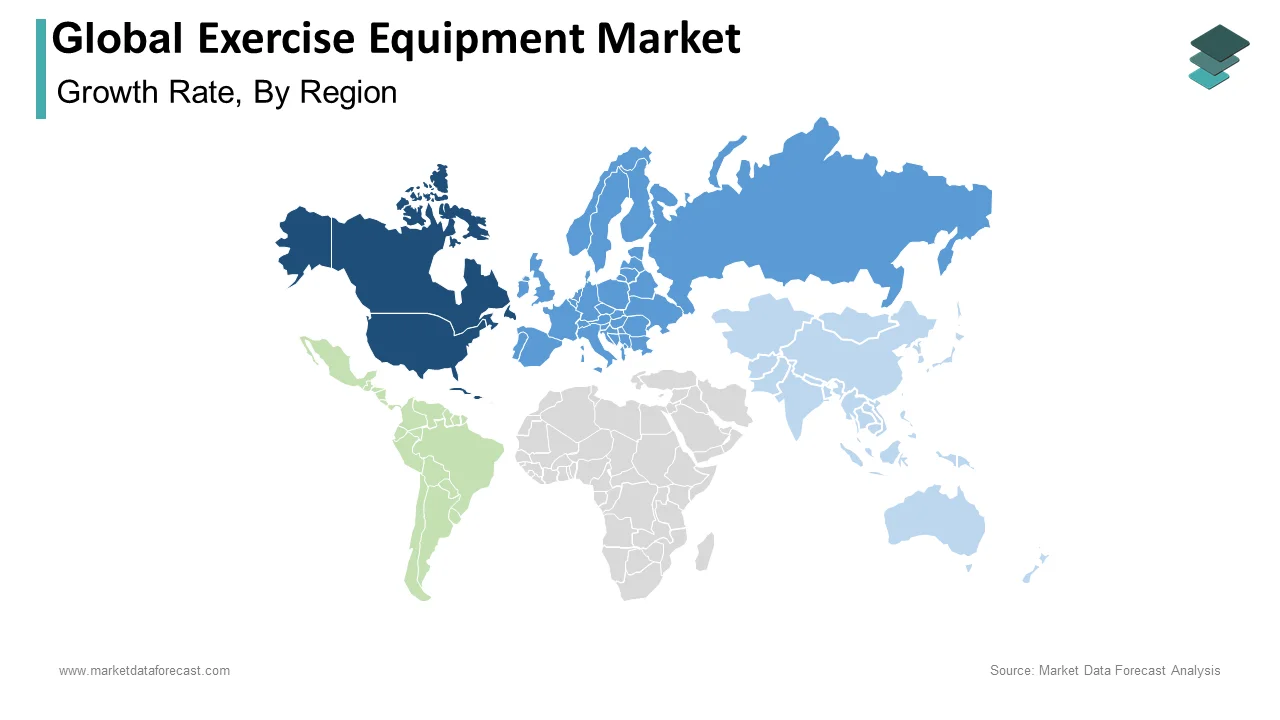

North America held the largest market share in the Exercise Equipment Market and accounted for 35.1% as of 2024. This dominance is attributed to high disposable income and a strong fitness culture. It is a leading region in the Exercise Equipment Market, primarily driven by a strong fitness culture and high disposable income. The prevalence of health clubs and gyms, with over 41,000 facilities in the U.S., further fuels demand for both commercial and home fitness equipment. Additionally, the COVID-19 pandemic has accelerated the trend of home workouts, leading to a 170% increase in online fitness equipment sales in 2020. This combination of factors solidifies North America's dominant position in the market.

Europe ranks as a significant player in the Exercise Equipment Market, with a growing emphasis on health and wellness among its population. Countries like Germany and the UK spearhead in fitness participation, with around 10 million gym members in Germany alone. The rise of boutique fitness studios and the increasing popularity of home workouts have further contributed to market growth. Additionally, the European Union's focus on public health initiatives encourages physical activity, making the region a vital market for exercise equipment manufacturers.

The Asia Pacific region is the fastest-growing, projected to grow at a CAGR of 8.5% and is driven by a rising middle class and increasing health awareness. This region is emerging as a powerhouse in the Exercise Equipment Market, propelled by a rapidly growing middle class and increasing health awareness. Countries like China and India are witnessing a surge in fitness trends, with gym memberships increasing by over 20% annually in urban areas. The rise of digital fitness solutions and home workout equipment is also gaining traction, making Asia Pacific a crucial region for future market expansion and innovation.

Latin America is witnessing a burgeoning interest in fitness, positioning it as a growing market for exercise equipment. Countries like Brazil and Mexico are leading the charge, with a significant increase in gym memberships and fitness awareness. Approximately 73% of young adults in Mexico engage in regular physical activity, showcasing the region's potential. The rise of affordable fitness solutions and the increasing popularity of home workouts further contribute to market growth, making Latin America an important area for exercise equipment manufacturers.

The Middle East & Africa region is gradually emerging in the Exercise Equipment Market, driven by a growing focus on health and fitness. The UAE and South Africa are at the forefront, with increasing investments in fitness infrastructure and wellness initiatives. The rise of lifestyle diseases has prompted governments to promote physical activity, resulting in a growing number of fitness centers and gyms. Additionally, the popularity of home fitness solutions is on the rise, making this region an important area for future growth in the exercise equipment sector.

KEY MARKET PLAYERS

Some of the notable companies dominating the global exercise equipment market profiled in this report are Precor Incorporated, Life Fitness (KPS Capital), Shandong EM Health Industry Group Co., Ltd., Icon Health & Fitness, Johnson Health Tech, Nautilus, Inc., TRUE, Technogym, Torque Fitness, Core Health & Fitness, Impulse Health Technology Co., Ltd., and Others.

TOP LEADING PLAYERS IN THE MARKET

Icon Health & Fitness

As a dominant player in the global exercise equipment market, Icon Health & Fitness boasts a diverse portfolio that includes well-known brands like NordicTrack and ProForm. The company prioritizes innovation, integrating cutting-edge technology into its products to enhance user experience. With a robust distribution network and effective marketing strategies, Icon has successfully captured a significant market share of approximately 35% in the industry. Their commitment to quality and customer satisfaction has solidified their reputation, making them a key contributor to the industry's growth and evolution.

Johnson Health Tech Co., Ltd

Johnson Health Tech is recognized for its high-quality fitness equipment, catering to both commercial and residential markets. The company invests heavily in research and development, resulting in innovative products that meet diverse fitness needs. Their focus on sustainability and user-friendly designs has helped them gain a substantial market share of around 15%. By offering a wide range of equipment, from cardio machines to strength training solutions, Johnson Health Tech plays a vital role in shaping the global exercise equipment landscape and promoting healthier lifestyles.

Technogym S.p.A

Technogym is an Italian leader in the premium fitness equipment sector, known for its commitment to wellness and innovation. The company emphasizes creating a connected fitness experience, integrating technology into its products to enhance user engagement and motivation. Technogym's focus on design, functionality, and user experience has attracted a loyal customer base, contributing to its growth in the exercise equipment market, where it holds a market share of approximately 10%. Their dedication to promoting a healthy lifestyle aligns with global fitness trends, further establishing Technogym as a key player in the industry.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Integration of Technology and Smart Features

Key players in the exercise equipment market are increasingly integrating technology into their products, offering smart features such as app connectivity, real-time performance tracking, and virtual coaching. This trend not only enhances user experience but also provides personalized training solutions, making workouts more engaging and effective.

Sustainability and Eco-Friendly Practices

A growing number of companies are adopting sustainability as a core strategy, focusing on eco-friendly materials and manufacturing processes. By promoting environmentally responsible practices, these brands appeal to environmentally conscious consumers and differentiate themselves in a competitive market, fostering brand loyalty and trust.

Customization and Personalization

Customization is becoming a significant trend, with companies offering personalized equipment options tailored to individual user preferences and fitness goals. This strategy enhances customer satisfaction and engagement, as users feel more connected to products that reflect their unique needs and aspirations.

Community Building and Social Engagement

Building a strong community around fitness brands is a key strategy for engagement. Companies are leveraging social media platforms and online forums to create spaces for users to share experiences, challenges, and successes. This sense of community not only fosters loyalty but also encourages word-of-mouth marketing, driving brand awareness.

COMPETITIVE LANDSCAPE

The Exercise Equipment Market is currently experiencing a transformative phase driven by innovation and changing consumer preferences. A notable trend is the integration of smart technology, with brands incorporating AI and IoT into their products to offer personalized workout experiences. This shift allows users to track their progress in real-time and receive tailored recommendations, enhancing engagement and motivation.

Moreover, the rise of hybrid fitness models, combining in-person and virtual workouts, is reshaping competition. Companies are investing in versatile equipment that caters to both home and gym environments, appealing to a broader audience. Sustainability is also becoming a critical factor, as consumers increasingly favor brands that prioritize eco-friendly materials and practices.

Additionally, the market is witnessing a surge in community-driven platforms, where users can connect, share experiences, and participate in challenges. This social aspect not only fosters loyalty but also encourages consistent usage. Subscription services are gaining traction, providing users with access to diverse workout programs and fostering long-term relationships with brands. Overall, the competition in the Exercise Equipment Market is characterized by technological advancements, a focus on sustainability, and an emphasis on community engagement, driving brands to innovate continuously.

RECENT MARKET DEVELOPMENTS

- In January 2025, Technogym adopted enhanced voting rights to strengthen shareholder engagement and support long-term investment strategies.

- In December 2024, the UK Government announced a fast-track review of the Internal Market Act, set to launch in January 2025. This aims to strengthen the single market and EU competitiveness, impacting various sectors, including the exercise equipment market.

MARKET SEGMENTATION

This research report on the global exercise equipment market has been segmented and sub-segmented based on the type, end-user, distribution channel and region.

By Type

- Cardiovascular Training Equipment

- Treadmills

- Stationary Cycles

- Elliptical Trainers & Others

- Strength Training Equipment

- Others

By End-user

- Home Consumers

- Fitness Centers/Gyms

- Others

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current market size of the exercise equipment market?

The exercise equipment market was valued at USD 17.9 billion in 2024 and is expected to grow at a CAGR of 5.5%, reaching USD 29 billion by 2033.

2. What factors are driving the growth of the exercise equipment market?

The exercise equipment market is growing due to rising health awareness, increasing obesity rates, technological advancements, and the popularity of home fitness solutions.

3. Which segment dominates the exercise equipment market?

The cardiovascular training equipment segment holds the largest share of the exercise equipment market, with popular products like treadmills, stationary cycles, and elliptical trainers.

4. What challenges does the exercise equipment market face?

The exercise equipment market faces challenges like the high cost of advanced equipment, market saturation, and the rising preference for alternative fitness solutions.

5. How is technology impacting the exercise equipment market?

The exercise equipment market is shifting towards smart fitness solutions, integrating real-time tracking, virtual coaching, and mobile connectivity to enhance user experience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]