European UPS Market Research Report – Segmented By Product Type ( Online/Double Conversion , Line-Interactive ) Capacity ( Up to 50KVA ,51-200KVA ) Application ( Residential ,Industrial ) and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033

European UPS Market Size

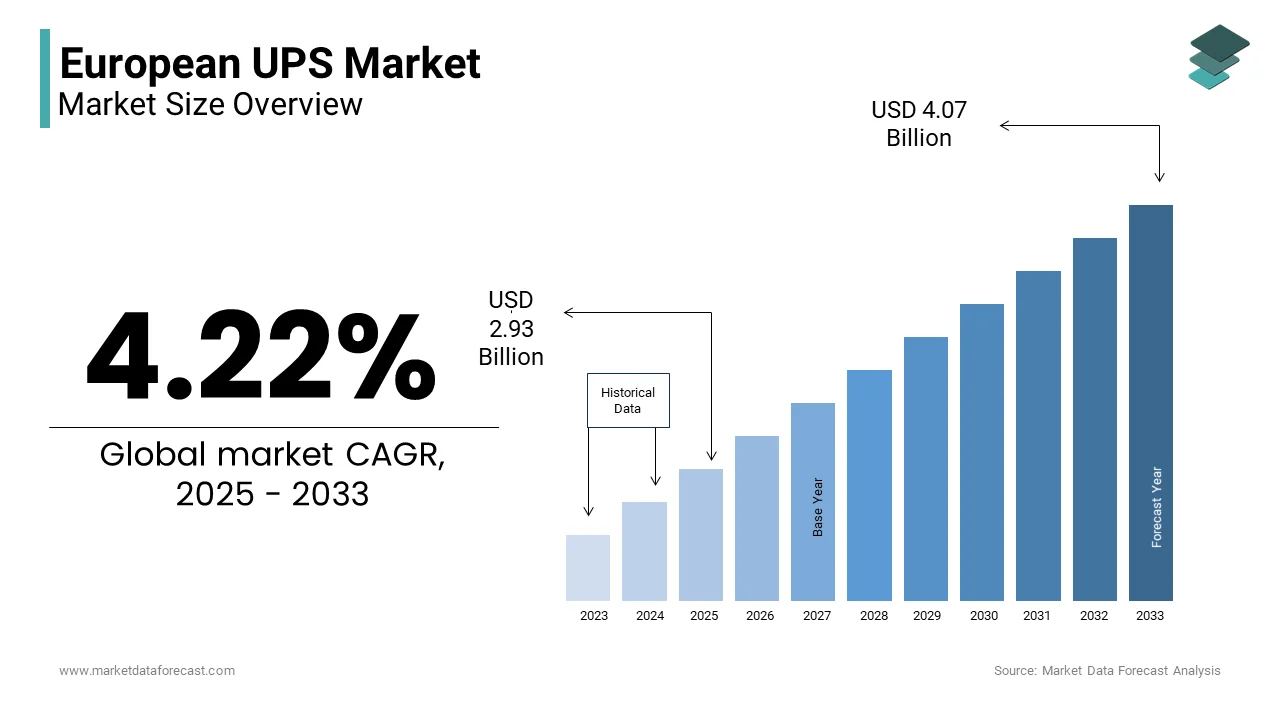

The european ups market Size was valued at USD 2.81 billion in 2024. The european ups market size is expected to have 4.22 % CAGR from 2025 to 2033 and be worth USD 4.07 billion by 2033 from USD 2.93 billion in 2025.

Uninterruptible Power Supply (UPS) systems ensure that essential equipment, ranging from servers to medical devices, remain operational during power interruptions. These systems are designed to prevent data loss, hardware damage, and operational downtime, making them indispensable in industries such as telecommunications, healthcare, manufacturing, and finance. As Europe increasingly relies on digital infrastructure and data centers, the demand for reliable and efficient UPS solutions has grown substntially.

The market's growth is also driven by the expanding adoption of renewable energy sources and the push for energy-efficient technologies. UPS systems that incorporate lithium-ion batteries, for example, are becoming more popular due to their higher energy density and longer lifespan compared to traditional lead-acid batteries. These advancements contribute to a more sustainable and cost-effective approach to power backup. Additionally, as the European Union continues to prioritize sustainability, UPS technology has been increasingly integrated with smart capabilities, allowing for real-time monitoring and optimization of energy use.

MARKET DRIVERS

Expansion of Data Centers and Cloud Computing

The increasing reliance on digital services, driven by the expansion of data centers and the rise of cloud computing, is a major driver of the UPS market in Europe. As businesses and governments move towards more digitized infrastructures, ensuring uninterrupted power has become crucial. Data centers, which house vast amounts of sensitive information, must operate continuously to prevent data loss or service disruption. According to the European Commission, the digital economy in the EU has been growing at a rate of 5% per year, further driving the need for reliable power systems. UPS systems are essential in these environments to maintain operational integrity during power failures and to support the seamless delivery of digital services.

Increasing Frequency of Power Interruptions

Another key driver for the European UPS market is the increasing frequency of power disruptions across the region. While Europe traditionally has a stable power grid, climate change and extreme weather events have led to more frequent power outages in recent years. The European Environment Agency reports that extreme weather conditions, such as storms and flooding, are becoming more common and have caused notable power disruptions. UPS systems are essential in mitigating the effects of these outages, particularly in sectors like healthcare, finance, and telecommunications, where even brief interruptions can have serious consequences. This growing demand for reliable power backup has spurred an increase in UPS system adoption across Europe.

MARKET RESTRAINTS

High Initial and Maintenance Costs

High initial investment and maintenance costs associated with UPS systems is a crucial factor restricting the rise of the European uninterrupted power supply market. While UPS solutions offer crucial protection against power interruptions, their installation and upkeep can be costly. The European Commission notes that the cost of deploying UPS systems for industrial and commercial applications can be as much as 10-15% of the total operational costs, especially when incorporating high-capacity or advanced systems. Additionally, regular maintenance, battery replacements, and energy consumption for large UPS systems contribute to long-term financial burdens, particularly for small and medium-sized enterprises. These financial challenges often deter organizations from investing in comprehensive UPS systems, limiting their widespread adoption.

Regulatory Compliance and Technological Integration

Another key restraint for the European UPS market is the complexity of adhering to ever-evolving regulatory standards and integrating advanced technologies. As the European Union tightens environmental regulations, UPS systems must comply with increasingly stringent energy efficiency and environmental guidelines. The EU’s Ecodesign Directive, which governs the energy efficiency of electrical products, includes stringent criteria for UPS systems. According to the European Environment Agency, meeting these regulations can increase manufacturing costs by up to 20%. Furthermore, integrating newer technologies such as lithium-ion batteries or IoT-enabled monitoring systems into existing UPS infrastructure can be complex and costly, making it challenging for some businesses to keep pace with rapid technological advancements and regulatory demands.

MARKET OPPORTUNITIES

Adoption of Renewable Energy and Sustainable Solutions

A key opportunity for the European UPS market lies in the growing shift toward renewable energy sources and sustainable solutions. As the European Union accelerates its efforts to reduce carbon emissions under the European Green Deal, industries are increasingly turning to renewable energy and energy-efficient backup systems. The integration of UPS systems with renewable energy sources such as solar and wind power provides an opportunity to reduce reliance on grid electricity and lower carbon footprints. The European Commission has reported that renewable energy consumption in the EU is expected to account for 40% of the total energy mix by 2030, creating substantial demand for UPS systems that can support these energy transitions and ensure uninterrupted power during periods of low renewable generation.

Growth of Smart Infrastructure and IoT Integration

The growing demand for smart infrastructure and the integration of IoT technologies is a promising opportunity for the uninterrupted power supply market. As cities and industries become more digitized and connected, the need for intelligent, real-time monitoring and management of power systems is on the rise. The incorporation of IoT into UPS systems allows for advanced features such as predictive maintenance, energy optimization, and remote monitoring. The European Commission has spotlighted that smart cities and infrastructures are expected to grow rapidly. This growth presents substantial opportunities for the UPS market as businesses look for systems that can provide seamless integration with their smart technologies while ensuring reliability and energy efficiency.

MARKET CHALLENGES

Supply Chain and Raw Material Constraints

Supply chain disruptions and constraints in raw materials obstructs the expansion of the European uninterrupted power supply market. The ongoing global supply chain crisis, compounded by the COVID-19 pandemic and geopolitical tensions, has led to shortages in essential components like lithium, semiconductors, and batteries used in UPS systems. According to the European Commission, global supply chain disruptions have increased lead times for UPS manufacturers by 20-30%, causing delays in production and delivery. The cost of key raw materials, such as lithium for batteries, has also surged by over 40% in recent years, which impacts the overall cost structure of UPS systems. These disruptions limit the market's growth potential and can hinder the timely expansion of UPS infrastructure.

Stringent Regulatory Standards and Compliance Costs

The increasing stringency of regulatory standards around energy efficiency and environmental impact is another major challenge for the European UPS market. As the EU tightens its Ecodesign regulations and sets ambitious sustainability goals, UPS manufacturers must invest heavily in redesigning systems to meet these new standards. For instance, the European Union's Ecodesign Directive for energy-related products mandates that UPS systems must meet specific energy efficiency thresholds, leading to higher manufacturing costs. According to the European Environment Agency, compliance with these regulations can increase product development and manufacturing costs by as much as 15-20%, which may slow down the adoption of more advanced UPS technologies. These additional costs pose a barrier for smaller businesses and organizations looking to upgrade their power systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.22 % |

|

Segments Covered |

By Product Type, Capacity , Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

Schneider Electric, General Electric Company, Panduit Corp., ABB, AEG, Delta Electronics, Inc., Eaton, Mitsubishi Electric Corporation, |

SEGMENT ANALYSIS

By Product Type Insights

The Online/Double Conversion segment commanded the market and accounted for 43.5% of the market in 2024. This prominence is driven by the critical need for uninterrupted power in sectors like data centers and healthcare. Notably, data centers in the European Union consumed an estimated 45–65 terawatt-hours (TWh) of electricity in 2022, representing about 1.8–2.6% of the region's total electricity consumption. This substantial energy usage underscores the reliance on robust UPS systems to ensure continuous operation and protect sensitive equipment.

The Line-Interactive segment is witnessing impactful growth in the European UPS market with a estimated CAGR of 5.3% from 2025 to 2033. This growth is largely attributed to the increasing prevalence of remote work, which has surged in recent years. As of 2023, 22% of employed individuals in the European Union worked from home at least occasionally, a notable increase from previous years. This shift has led to a heightened demand for reliable power solutions in home offices and small businesses where Line-Interactive UPS systems offer a cost-effective means to manage power fluctuations and ensure operational continuity.

By Capacity Insights

The Up to 50 kVA capacity segment held the dominant share and possessed 47.1% of the market in 2024. This dominance is driven by the widespread adoption of UPS systems in small to medium-sized enterprises (SMEs) and residential applications, where power requirements typically fall within this range. Notably, SMEs constitute over 99% of all businesses in the European Union, drawing attention to a substantial market for UPS systems in this capacity bracket.

The Above 200 kVA segment is expected to see the highest growth in the European UPS market at a CAGR of 7.8% during the forecast period. This rise is mainly because of the expansion of hyperscale data centers and large industrial facilities requiring high-capacity power backup solutions. Data centers in Europe are expected to reach a total installed power capacity of approximately 13,100 megawatts by 2027, reflecting a 21% increase from previous years. This growth necessitates robust UPS systems exceeding 200 kVA to ensure uninterrupted operations and safeguard critical data.

By Application Insights

The Commercial segment captured the biggest portion and held 34.7% in 2024. This prominence is driven by the critical need for reliable power solutions across sectors such as banking, financial services, and insurance (BFSI). The increasing digitization of financial services has heightened the demand for uninterrupted power to maintain seamless operations and data integrity. Additionally, the expansion of data centers to support these services further amplifies the need for robust UPS systems in the commercial sector. The International Renewable Energy Agency (IRENA) reports that renewable energy sources account for 29% of global electricity generation as of 2022. However, the intermittent nature of renewables increases the need for backup power systems like UPS to stabilize supply.

The Data Centre segment is projected to experience the fastest growth in the European UPS market, with a CAGR of 9.8% from 2025 to 2033. This surge is primarily attributed to the rapid expansion of hyperscale data centers, driven by the increasing adoption of cloud computing, artificial intelligence (AI), and Internet of Things (IoT) applications. As of February 2024, Germany leads Europe with 522 data centers which is signifying the region's notable digital infrastructure. The continuous growth in data generation and storage requirements underscores the critical need for advanced UPS systems to ensure operational continuity and safeguard against power disruptions.

Country Level Analysis

Germany held a leading position in the European UPS market and accounted for 23.6% market share due to its robust industrial base, extensive data center infrastructure, and strong focus on sustainability. The country's industrial sectors, including automotive, manufacturing, and technology, require reliable and continuous power, making UPS systems essential. Germany’s ambitious energy transition, or "Energiewende," which seeks to reduce carbon emissions and transition to renewable energy, has driven the demand for energy-efficient UPS solutions. According to the German Energy Agency, the push toward green technologies and the growing reliance on data centers have solidified Germany’s position as a leader in the UPS market. The country's focus on innovation and green energy also encourages widespread adoption of advanced UPS systems.

The UK holds a significant and growing position in the European Uninterruptible Power Supply (UPS) market with a projected CAGR of 7.6% which is driven by its increasing reliance on digital infrastructure and the growing demand for backup power in critical sectors. The UK has one of the largest and most advanced telecommunications and financial sectors in Europe, both of which require uninterrupted power to ensure service continuity. As part of its decarbonization efforts, the UK is also adopting more energy-efficient UPS solutions, which has propelled market growth. The UK government’s commitment to achieving net-zero emissions by 2050 and its focus on expanding data centers and digital services has boosted demand for UPS systems that can offer reliable backup power. According to the UK Department for Business, Energy & Industrial Strategy, UPS systems play a key role in supporting critical industries during power disruptions.

France’s position as a key player in the European UPS market is underpinned by its high demand for reliable power systems, particularly in industries such as telecommunications, healthcare, and energy. The country’s push for digitalization and the expansion of smart infrastructure has further amplified the need for UPS solutions. Additionally, France has made notable strides toward sustainability, with the French Agency for Ecological Transition reporting that the adoption of energy-efficient technologies, including UPS systems, is a priority for the country. France’s commitment to renewable energy and sustainability has accelerated the demand for energy-efficient and environmentally friendly UPS solutions, making it one of the top performers in Europe.

KEY MARKET PLAYERS

Key players operating in the European UPS Market profiled in this report are Schneider Electric, General Electric Company, Panduit Corp., ABB, AEG, Delta Electronics, Inc., Eaton, Mitsubishi Electric Corporation, Siemens, Vertiv Group Corp., Toshiba International Corporation, Norden, Langley Holdings plc, Shenzhen Kstar Science&Technology Co.,Ltd.

MARKET SEGMENTATION

This research report on the European UPS Market has been segmented and sub-segmented into the following categories.

By Product Type

- Online/Double Conversion

- Line-Interactive

- Off-line/Standby

By Capacity

- Up to 50KVA

- 51-200KVA

- Above 200KVA

By Application

- Residential

- Industrial

- Commercial

- Telecom

- Data Centre

- Marine

- Medical

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

Which segment is expected to grow the fastest?

The modular UPS segment is projected to grow nearly twice as fast as traditional UPS systems.

What are the main challenges for UPS manufacturers in Europe?

Differentiating from competitors and keeping up with new technologies and industry trends.

Why is energy efficiency important in the UPS market?

Energy saving is crucial due to rising energy bills and environmental constraints, especially in data centers.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]