European Robot Sensor Market Research Report - Segmented By Vertical (Manufacturing, Logistics) By Type (Force (Torque) Sensor, Proximity Sensor) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts (2025 to 2033)

European Robot Sensor Market Size

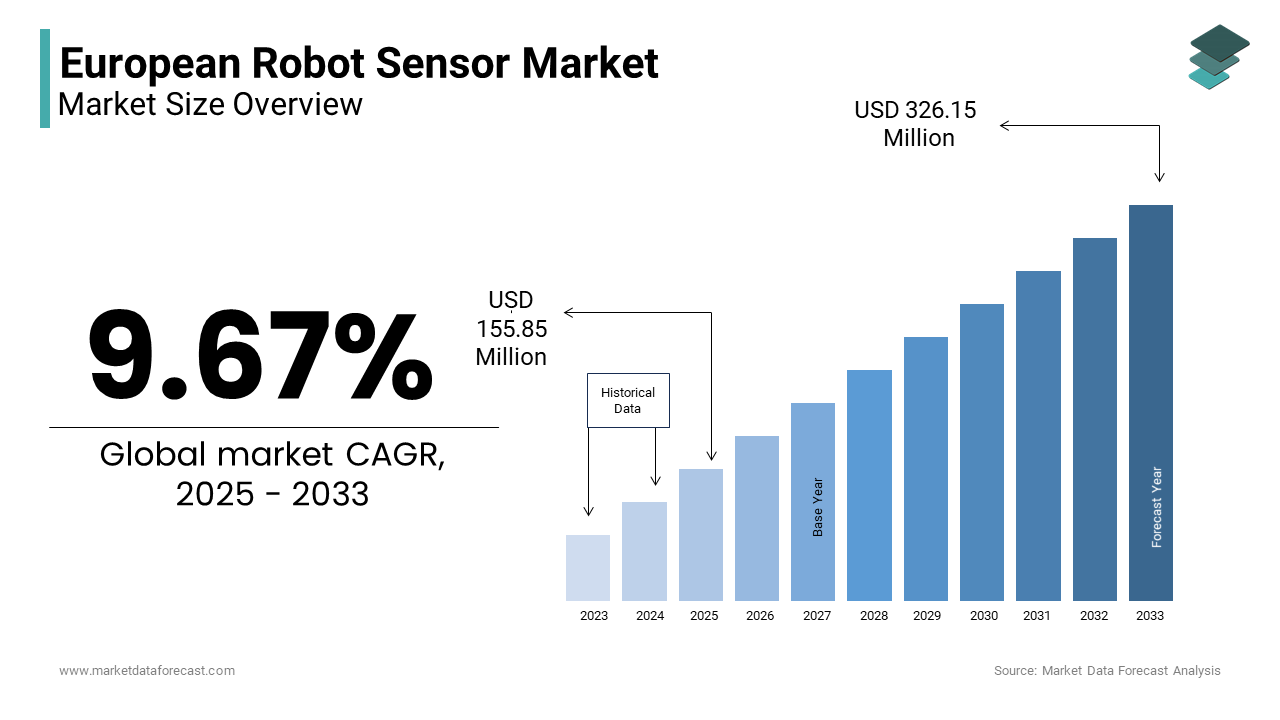

The european robot sensor market Size was valued at USD 142.11 million in 2024. The european robot sensor market size is expected to have 9.67 % CAGR from 2025 to 2033 and be worth USD 326.15 million by 2033 from USD 155.85 million in 2025.

Robot sensors are sophisticated devices that enable robots to perceive and interact with their environment, providing functionalities such as object detection, navigation, force measurement, and environmental monitoring. Germany, France and Italy are leading contributors to European market due to their robust industrial bases and strong emphasis on Industry 4.0 initiatives. The International Federation of Robotics stated that Europe accounts for over 30% of global robot installations with sensors playing a pivotal role in enabling advanced functionalities. Furthermore, the rise of collaborative robots (cobots) in manufacturing has spurred demand for high-precision sensors, with Eurostat reporting a 20% increase in cobot adoption across SMEs in 2022. Environmental and safety regulations, coupled with advancements in artificial intelligence and machine learning, are further propelling innovation in sensor technologies. As industries increasingly prioritize automation to address labor shortages and enhance productivity, the European robot sensor market is poised for sustained growth, supported by technological breakthroughs and strategic investments in smart infrastructure.

MARKET DRIVERS

Acceleration of Industrial Automation and Industry 4.0 Initiatives

The rapid adoption of industrial automation is driven by Industry 4.0 initiatives and is a key driver of the European robot sensor market. The European Commission reports that over 60% of manufacturing firms in Europe have integrated smart technologies into their operations, with sensors being critical for real-time data collection and process optimization. According to Eurostat, the industrial robotics sector grew by 15% in 2022, fueled by increased demand for precision and efficiency in production lines. Germany alone accounts for 40% of Europe’s industrial robot installations, as pointed out by the International Federation of Robotics. Sensors enable functionalities such as predictive maintenance and quality control, reducing downtime by 25%. This technological shift is further supported by EU funding programs like Horizon Europe, which allocated €95 billion for digital innovation, reinforcing the importance of sensors in achieving smarter, more sustainable manufacturing ecosystems.

Rising Demand for Collaborative Robots in SMEs

The growing popularity of collaborative robots (cobots) among small and medium-sized enterprises (SMEs) is another major driver of the European robot sensor market. Eurostat reveals that cobot adoption in European SMEs surged by 20% in 2022, driven by their affordability and versatility in tasks like assembly and packaging. The International Federation of Robotics estimates that cobots now account for 10% of all robot sales in Europe, with sensors playing a vital role in ensuring safety and precision during human-robot interactions. France and Italy are leading this trend, with government incentives promoting automation in SMEs. For instance, France’s “France Relance” plan allocated €4 billion to support digital transformation in smaller businesses. Sensors enhance cobot capabilities, such as force detection and spatial awareness, making them indispensable for industries seeking flexible and scalable automation solutions.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints for SMEs

A significant restraint in the European robot sensor market is the high initial cost of advanced sensors, which poses a challenge for small and medium-sized enterprises (SMEs). The European Investment Bank reported that over 60% of SMEs cite budget limitations as a barrier to adopting advanced robotic technologies, with sensors accounting for up to 30% of the total cost of robotic systems. According to Eurostat, only 40% of SMEs in Europe have integrated automation solutions into their workflows, primarily due to financial constraints. While larger corporations can absorb these costs, smaller firms struggle to justify the investment despite long-term benefits. Additionally, the United Nations Industrial Development Organization notes that retrofitting existing machinery with sensors can increase costs by 25%, further deterring adoption. This financial burden limits the widespread deployment of robot sensors, particularly in labor-intensive industries where cost sensitivity is high.

Complexity in Integration and Lack of Skilled Workforce

The complexity of integrating robot sensors into existing systems compounded by a shortage of skilled professionals is another major restraints for the European robot sensors market.. The European Centre for the Development of Vocational Training reports that 45% of companies face challenges in finding workers with expertise in robotics and sensor technologies. According to the European Commission, the skills gap in digital technologies could leave up to 1 million positions unfilled by 2025. This issue is particularly acute in Eastern Europe, where industrial modernization is still underway. Furthermore, according to the International Labour Organization, improper integration of sensors can lead to system inefficiencies, with 20% of automation projects failing due to technical complexities. These factors hinder the seamless adoption of robot sensors, slowing market growth and limiting the potential for innovation across various sectors.

MARKET OPPORTUNITIES

Expansion of Smart Manufacturing and IoT Integration

A significant opportunity in the European robot sensor market lies in the expansion of smart manufacturing and the integration of sensors with the Internet of Things (IoT). The European Commission reports that smart manufacturing is expected to grow at a CAGR of 10% through 2027, with IoT-enabled sensors playing a pivotal role in enhancing connectivity and data-driven decision-making. According to Eurostat, over 50% of European manufacturers are investing in IoT technologies, driving demand for high-precision sensors that enable real-time monitoring and predictive maintenance. Germany leads this trend, with the Federal Ministry for Economic Affairs allocating €50 billion to Industry 4.0 initiatives. Additionally, as per the International Federation of Robotics, IoT-integrated sensors can reduce operational costs by 30%, making them attractive for industries seeking efficiency. This convergence of robotics, sensors, and IoT presents immense growth potential for the market.

Growing Adoption of Autonomous Systems in Healthcare and Logistics

the growing adoption of autonomous systems in healthcare and logistics, where robot sensors are indispensable presents a substantial opportunity for the European robot sensor market. The European Health Technology Association states that robotic systems equipped with advanced sensors are projected to account for 25% of medical device innovations by 2025, driven by aging populations and increased healthcare automation. Similarly, Eurostat reports that automated guided vehicles (AGVs) in logistics, powered by sensors, grew by 20% in 2022, particularly in France and Italy. The United Nations Economic Commission for Europe notes that autonomous systems in warehouses can improve efficiency by 40%, reducing labor costs and errors. Furthermore, EU funding programs like Horizon Europe have earmarked €15 billion for robotics in critical sectors, fostering innovation. These trends shows the transformative potential of robot sensors in addressing key societal and industrial challenges.

MARKET CHALLENGES

Stringent Regulatory Standards and Compliance Costs

A key obstacle in the European robot sensor market is the rigorous regulatory framework covering safety, data privacy, and environmental sustainability. The European Environment Agency found that compliance with regulations such as the General Data Protection Regulation (GDPR) and the Restriction of Hazardous Substances Directive (RoHS) increases development costs by up to 25%. According to Eurostat, over 40% of robotics companies report difficulties in aligning their products with these complex standards, particularly for sensors used in healthcare and autonomous systems. Additionally, the International Electrotechnical Commission notes that certification processes for advanced sensors can take up to 18 months, delaying market entry. These challenges are particularly pronounced for smaller firms, which lack the resources to navigate regulatory hurdles. As a result, compliance costs and lengthy approval timelines hinder innovation and market expansion, limiting the pace of technological adoption.

Dependence on Global Supply Chains and Geopolitical Risks

The European robot sensor market is exposed to geopolitical risks and disruptions because it depends heavily on global supply chains for vital components which presents another significant challenge. The European Commission reports that over 70% of semiconductor components, essential for advanced sensors, are imported from Asia, making the industry vulnerable to trade tensions and logistical bottlenecks. According to Eurostat, supply chain disruptions caused a 15% decline in sensor production capacity in 2022, impacting industries reliant on automation. Furthermore, the United Nations Conference on Trade and Development warns that geopolitical instability has increased raw material prices by 30%, further straining manufacturers. This reliance on external suppliers undermines Europe’s strategic autonomy in robotics and sensor technologies, creating uncertainties in meeting domestic demand and scaling innovations. Addressing these vulnerabilities remains a pressing concern for market stakeholders.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.67% |

|

Segments Covered |

By Vertical, Type and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

TE Connectivity Ltd.,Infineon Technologies AG,Omron Corporation, Honeywell International. |

SEGMENT ANALYSIS

By Vertical Insights

The manufacturing vertical dominated the European robot sensor market and held a 45.2% share in 2024 due to the rapid adoption of Industry 4.0 technologies, with sensors enabling predictive maintenance and reducing downtime by 25%, according to Eurostat. Germany, Europe’s industrial hub, accounts for 30% of this segment’s growth, supported by EU funding like Horizon Europe’s €10 billion allocation for digital transformation. The International Federation of Robotics revealed that over 60% of manufacturers use sensor-enabled robots, enhancing precision and scalability. This segment's importance lies in its role as the backbone of smart factories, driving innovation and economic growth across Europe.

The healthcare vertical segment is predicted to witness the highest CAGR of 10.5% from 2025 to 2033. This rapid growth is fueled by aging populations and chronic disease prevalence, with Eurostat reporting a 20% annual increase in robotic-assisted surgeries. Sensors enable critical functionalities like force feedback, improving surgical precision and patient outcomes. The World Health Organization notes that over 25% of European hospitals now use medical robotics, particularly in Germany and Sweden. This segment's importance lies in revolutionizing patient care and addressing workforce shortages, making it a key area for innovation and investment in life-saving technologies.

By Type Insights

The Force (Torque) Sensors segment led the European robot sensor market and captured a 25.2% share in 2024. Their dominance is driven by their critical role in precision-based applications such as robotic assembly, material handling, and surgical procedures. Eurostat stated that force sensors reduce operational errors by 30%, with a 25% increase in adoption for collaborative robots (cobots) in 2022. Germany’s automotive and healthcare sectors are key contributors, leveraging these sensors for safety and accuracy. Their importance lies in enabling human-robot collaboration and ensuring high precision, making them indispensable for industries prioritizing efficiency and reliability.

The Vision Sensors segment is estimated to register the fastest CAGR of 12.4%. This growth is fueled by their use in healthcare diagnostics, quality inspection, and autonomous systems. Eurostat reports a 20% annual increase in vision sensor adoption for robotic surgeries, improving accuracy and patient outcomes. In manufacturing, these sensors enhance defect detection, reducing errors by 25%. Their ability to interpret visual data in real-time supports automation and decision-making, positioning them as transformative technologies. As Europe invests in AI and IoT, vision sensors are pivotal for driving innovation and enhancing operational efficiency across industries.

Country Level Analysis

Germany dominated the European robot sensor market and held a 25.6% share. Its robust industrial base, particularly in automotive and manufacturing, where sensors are integral to automation is mainly driving the segment foreward. According to the International Federation of Robotics, Germany accounts for 40% of Europe’s industrial robot installations, driving demand for advanced sensors. Eurostat reports that over 60% of German manufacturers have adopted Industry 4.0 technologies, with sensors enabling predictive maintenance and precision. Government initiatives like the €50 billion AI and digitalization fund further bolster innovation. This strong ecosystem of technological advancement and industrial integration solidifies Germany’s position as a leader in the robot sensor market.

France is a key contributor to the European robot sensor market with a CAGR of 9.2%. Its growth is driven by advancements in logistics and healthcare, where sensors are critical for automation and diagnostics. The European Logistics Association notes that France leads in adopting automated guided vehicles (AGVs), with a 20% increase in sensor-equipped systems in 2022. Additionally, France’s “France Relance” plan allocated €4 billion to digital transformation, promoting robotics in SMEs. The World Health Organization stated that robotic surgeries using vision sensors grew by 25% annually in France. These factors, combined with a focus on innovation, position France as a dynamic player in the market.

Italy holds a notable share of the European robot sensor market and is supported by its thriving manufacturing and aerospace sectors. The country’s leadership is fueled by its expertise in high-precision machinery and robotics, with sensors playing a vital role in enhancing efficiency. Eurostat stated that Italy’s adoption of collaborative robots (cobots) increased by 30% in 2022, driven by small and medium-sized enterprises. The European Aerospace and Defence Industries Association notes that Italy is a leader in UAV production, with sensors accounting for 25% of component innovations. Government incentives for smart manufacturing further accelerate growth, making Italy a pivotal market for robot sensor technologies.

KEY MARKET PLAYERS

Key players operating in the European Robot Sensor Market profiled in this report are TE Connectivity Ltd.,Infineon Technologies AG,Omron Corporation, Honeywell International, Inc.,ATI Industrial Automation, Inc.,FANUC Corporation,Sensata Technologies Holdings PLC.

MARKET SEGMENTATION

This research report on the European Robot Sensor Market has been segmented and sub-segmented into the following categories.

By Vertical

- Manufacturing

- Logistics

- Aerospace & Defense

- Healthcare

- Others

By Type

- Force (Torque) Sensor

- Proximity Sensor

- Position Sensor

- Vision Sensor

- Temperature Sensor

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What is the current trend in the European robot sensor market?

The market is experiencing significant growth due to increased adoption of industrial automation across various industries.

Which industries are driving the demand for robot sensors in Europe?

Manufacturing and production sectors are the primary drivers, employing robots to enhance efficiency and productivity.

What types of sensors are most commonly used in European robotics?

Common sensors include proximity sensors, vision systems, force-torque sensors, and ultrasonic sensors, each serving specific functions in robotic applications.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]