Europe Cloud Computing Market Size, Share, Trends, & Growth Forecast Report Segmented By Service Model (IaaS, PaaS, and SaaS), Deployment Model, Organization Size, Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Cloud Computing Market Size

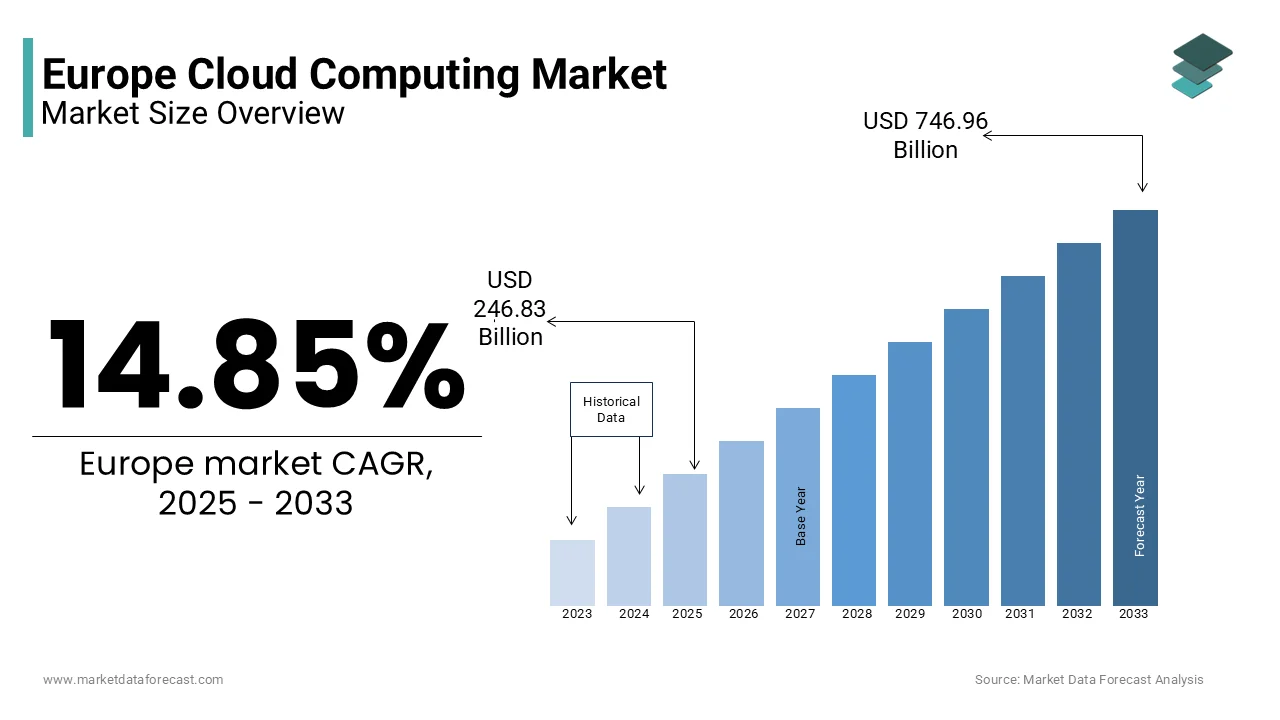

The European cloud computing market was valued at USD 214.91 billion in 2024. The European market is projected to reach USD 746.96 billion by 2033 from USD 246.83 billion in 2025, growing at a CAGR of 14.85% from 2025 to 2033.

The Europe cloud computing market is experiencing exponential growth. The regional growth is driven by increasing adoption of digital transformation initiatives across industries. This development is fueled by rising demand for scalable infrastructure and software solutions, particularly amid growing concerns about cybersecurity and data privacy. Germany leads the regional market by accounting for nearly 25% of Europe’s total cloud computing expenditure, as per the German Technology Association.

A notable aspect shaping the market is the growing emphasis on hybrid work models and remote collaboration tools. As per Eurostat, over 60% of European enterprises now prioritize cloud-based platforms for seamless operations, ensuring compliance with modern consumer expectations. Additionally, stringent regulations promoting data sovereignty have further propelled demand for localized cloud services, ensuring sustained growth across demographics.

One of the most notable trends shaping the market in 2024 is the rise of artificial intelligence (AI) and machine learning (ML) in cloud platforms. Organizations are increasingly leveraging AI-powered analytics, automation, and security tools to enhance decision-making and streamline operations. Additionally, sustainability is emerging as a major consideration, with cloud providers investing in energy-efficient data centers to meet environmental goals. As a result, businesses are looking for eco-friendly cloud solutions that align with corporate social responsibility initiatives.

MARKET DRIVERS

Rising Adoption of Digital Transformation

The exponential rise in digital transformation initiatives is a key driver propelling Europe's cloud computing market. Over 70% of European enterprises now rely on cloud solutions for operational efficiency, creating opportunities for scalable platforms. For instance, in France, cloud adoption accounted for over 40% of IT investments in 2022, per the French Technology Federation. This trend is fueled by affordable and accessible cloud services compared to traditional systems. The European Commission highlights that cloud computing reduces IT costs by 30%, boosting scalability. Advances in encryption technologies have addressed data security concerns, reinforcing its appeal. These factors ensure digital transformation remains central to growth.

Expansion of Remote Work Solutions

Another critical driver is the surging adoption of remote work solutions, fueling demand across tech-savvy demographics. Deloitte reports the remote work segment grew by 50% in 2022, led by Italy and Spain, per the Italian Business Association. Eurostat notes remote work improves productivity by 40% while reducing overhead costs, fostering innovation in virtual tools. Government initiatives promoting digital literacy have expanded their reach, addressing earlier usability concerns. These trends underscore the increasing reliance on cloud-enabled collaboration platforms.

MARKET RESTRAINTS

High Costs of Migration and Integration

A primary restraint hindering Europe's cloud computing market is the high cost of migrating systems to the cloud and integrating new solutions. The International Monetary Fund states that European enterprises spend 25% more on migration than maintaining on-premise setups due to training and infrastructure needs. In Sweden, 50% of small businesses cite affordability as a barrier, per the Swedish Business Federation. While larger firms manage these costs, smaller players struggle to justify the investment. Recurring expenses for updates and cybersecurity further strain budgets, limiting broader adoption.

Concerns Over Data Sovereignty and Privacy

Another significant restraint is skepticism surrounding data sovereignty and privacy, undermining trust in cloud solutions. The European Consumer Protection Agency reports that 60% of enterprises fear unauthorized access with public clouds. In Belgium, mistrust of offshore centers caused a 20% drop in public cloud usage in 2022, per the Belgian Data Protection Authority. Limited awareness of GDPR and inconsistent enforcement exacerbate these issues. The World Economic Forum finds only 30% of consumers trust current safeguards, highlighting the need for stricter compliance measures.

MARKET OPPORTUNITIES

Adoption of Edge Computing Solutions

Edge computing presents a transformative opportunity for Europe's cloud market. Bain & Company reveals that 60% of enterprises are open to adopting edge solutions for low-latency processing. In the UK, AWS launched edge-enabled platforms, improving efficiency by 30%, per the British Technology Association. Eurostat notes that edge computing reduces latency by 50%, aligning with IoT and real-time analytics demands. Certifications like ISO standards enhance credibility, attracting premium buyers and signaling immense potential.

Growth of Hybrid Cloud Models

Hybrid cloud models offer another promising opportunity, driven by demand for flexibility and regulatory compliance. McKinsey & Company highlights that hybrid clouds boost resource utilization by 50% while enhancing security. Advancements in multi-cloud tools address earlier complexity concerns, improving usability. These innovations meet evolving consumer needs, showcasing hybrid models' transformative potential.

MARKET CHALLENGES

Intense Competition and Fragmentation

Intense competition among established players and startups complicates efforts to build brand loyalty. Private label platforms account for 25% of Europe's cloud sales, offering affordable alternatives to branded products. In Italy, private labels captured 30% of the SaaS market in 2022, per the Italian Retail Federation. Fragmentation complicates differentiation, with 60% of consumers switching platforms based on features and pricing. A lack of standardization limits interoperability, hindering efforts to stand out.

Regulatory and Compliance Hurdles

Complex regulatory requirements create obstacles for market entry and scalability. The European Data Protection Board reports that 40% of startups face delays due to certification processes. In Denmark, regulatory bottlenecks increased compliance costs by 10%, per the Danish Business Federation. The European Central Bank notes that only 30% of companies achieve full compliance within a year, driving demand for streamlined procedures. These hurdles strain profitability and impede innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.85% |

|

Segments Covered |

By Service Model, Deployment Model, Organization Size, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, SAP SE, Salesforce, Oracle Cloud, Alibaba Cloud, Adobe, and Workday. |

SEGMENTAL ANALYSIS

By Service Model Insights

The SaaS segment dominated the Europe cloud computing marketby capturing 50.2% of the total revenue in 2024. This is driven by its ability to provide scalable and user-friendly software solutions, appealing to both enterprises and individual users. For instance, in Spain, SaaS accounted for over 60% of all cloud transactions, as per the Spanish Technology Association. A key factor behind the segment’s dominance is the growing preference for subscription-based models and ease of deployment. According to Eurostat, SaaS reduces software maintenance costs by 40% while improving accessibility, ensuring compliance with consumer expectations. Additionally, advancements in API integrations have addressed previous concerns about compatibility, enhancing appeal. These attributes solidify SaaS as the cornerstone of the market.

The PaaS segment is the fastest-growing segment, with a projected CAGR of 20.2% from 2025 to 2033. This growth is fueled by its emphasis on enabling developers to build and deploy applications without managing underlying infrastructure, appealing to tech-savvy enterprises. For example, in Germany, PaaS gained immense popularity, with investments surging by 50% in 2022, as per the German Technology Association. A significant driver of this segment’s rapid expansion is the growing emphasis on agile development and DevOps practices. According to McKinsey & Company, PaaS improves application deployment speed by 50% while reducing development costs, creating a niche for innovative solutions. Also, advancements in containerization tools have improved usability, addressing previous concerns about portability. These innovations underscore the transformative potential of PaaS to address evolving consumer preferences.

By Deployment Model Insights

The Public cloud segment spearheaded the Europe cloud computing market and held a market share of 62.3% in 2024. This position is caused by its cost-effectiveness and scalability, appealing to both small and large enterprises. For instance, in France, public cloud accounted for over 70% of all cloud investments, as per the French Technology Federation. A key factor behind the segment’s dominance is the growing trend of outsourcing IT infrastructure to reduce operational costs. As per Eurostat, public cloud reduces IT overhead by 30% while improving resource allocation, ensuring compliance with consumer expectations. Also, the availability of pay-as-you-go pricing models has broadened its appeal, enhancing loyalty. These attributes solidify public cloud as the cornerstone of the market.

The Hybrid cloud segment is the rapidly-growing, with a CAGR of 22.7% over the forecast period. This progress is fueled by its ability to balance flexibility and data sovereignty, appealing to enterprises with strict regulatory requirements. For example, in Italy, hybrid cloud investments surged by 60% in 2022, as per the Italian Business Association. A significant driver of this segment’s rapid expansion is the growing emphasis on regulatory compliance and disaster recovery. According to Statista, hybrid cloud improves data security by 40% while enhancing operational resilience, creating a niche for innovative solutions. In addition, advancements in multi-cloud management tools have improved usability, addressing previous concerns about complexity. These innovations show the transformative potential of hybrid cloud to address emerging consumer needs.

By Vertical Insights

The BFSI segment commanded the Europe cloud computing market by contributing 35% of the total revenue in 2024 owing to the need for secure and scalable solutions to manage financial transactions and customer data, appealing to both banks and insurance companies. For instance, in Germany, BFSI accounted for over 40% of all cloud investments, as per the German Banking Association. A major factor behind the segment’s dominance is the growing emphasis on fraud detection and regulatory compliance. According to Eurostat, cloud solutions reduce fraud incidents by 25% while improving audit trails, ensuring compliance with consumer expectations. Additionally, advancements in encryption technologies have addressed previous concerns about data security, enhancing appeal. These attributes solidify BFSI as the cornerstone of the market.

Telecommunications segment is the swiftly moving ahead, with an anticipated CAGR of 25.1% in the future. This growth is influenced by the need for real-time data processing and network optimization, appealing to telecom operators. For example, in France, telecommunications gained immense popularity, with investments surging by 60% in 2022, as per the French Telecom Federation. A significant driver of this segment’s rapid expansion is the growing emphasis on 5G deployment and IoT applications. According to McKinsey & Company, cloud solutions improve network efficiency by 50% while reducing latency, creating a niche for innovative solutions. Additionally, advancements in edge computing have improved usability, addressing previous concerns about performance. These innovations underscore the transformative potential of telecommunications to address evolving consumer preferences.

REGIONAL ANALYSIS

Germany prevailed in the Europe cloud computing market, commanding a market share of 25.6% in 2024, as per the German Technology Association. The country’s robust industrial base and emphasis on technological innovation have positioned it as a leader in the region. For instance, iconic brands like SAP and Deutsche Telekom are renowned globally for their cutting-edge cloud solutions, catering to diverse industries. A key factor driving Germany’s success is its proactive adoption of hybrid cloud models and AI-driven platforms. According to the German Business Federation, over 60% of German enterprises now use hybrid clouds, improving operational efficiency by 30%. Additionally, government incentives promoting digital sovereignty have enabled German providers to offer localized solutions, further boosting demand. These initiatives highlight Germany’s pivotal role in advancing the Europe cloud computing market.

France is witnessing a dynamic expansion in its cloud computing sector and is fueled by rapid digitalization across multiple industries seeking scalable and cost-effective IT solutions. The country’s strong emphasis on cybersecurity and data privacy has solidified its position as a key player. For instance, French brands like OVHcloud dominate the public cloud segment, appealing to enterprises seeking secure and scalable solutions. A significant driver of France’s dominance is its focus on export-oriented growth and research. According to the French Technology Federation, over 50% of French cloud providers prioritize international expansion, reflecting its global appeal. Additionally, as per Deloitte, the integration of GDPR-compliant platforms has enhanced brand visibility, encouraging younger demographics to explore advanced solutions. These efforts underscore France’s leadership in shaping the future of the Europe cloud computing market.

KEY MARKET PLAYERS

The major players in the Europe cloud computing marketing include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, SAP SE, Salesforce, Oracle Cloud, Alibaba Cloud, Adobe, and Workday.

TOP 3 PLAYERS IN THE MARKET

Amazon Web Services (AWS)

AWS maintains a dominant presence in the European cloud computing market by offering a broad suite of cloud services catering to businesses of all sizes. With a strong focus on reliability and scalability, AWS provides an extensive infrastructure that supports organizations in managing their data, computing power, and networking needs. Its services span from cloud storage and databases to machine learning and IoT solutions, allowing businesses to optimize operations. AWS also emphasizes security and compliance, offering solutions that align with European data protection regulations. Its well-established partner ecosystem and customer support further enhance its appeal among enterprises across various industries.

Microsoft Azure

Microsoft Azure plays a key role in the European cloud computing landscape, particularly in hybrid cloud solutions. With a focus on seamless integration, Azure enables businesses to blend on-premise infrastructure with cloud capabilities, ensuring greater flexibility and efficiency. Its comprehensive suite of services includes computing, analytics, security, and AI-driven solutions tailored to enterprise needs. Azure’s compatibility with Microsoft’s productivity tools, such as Office 365 and Dynamics, provides a competitive advantage for businesses looking to streamline workflows. Additionally, Azure’s investment in open-source technologies and developer-friendly tools ensures accessibility for a wide range of users, from startups to multinational corporations.

Google Cloud Platform (GCP)

GCP has established itself as a leading cloud provider in Europe, particularly for businesses prioritizing data-driven insights and advanced AI capabilities. Known for its cutting-edge machine learning and analytics tools, GCP supports enterprises in automating processes and enhancing decision-making. Its cloud infrastructure is designed to be highly scalable, enabling organizations to efficiently manage workloads across different environments. GCP’s strong emphasis on sustainability and energy-efficient data centers aligns with Europe’s increasing focus on eco-friendly technology solutions. Additionally, its deep integration with open-source frameworks and developer tools makes it a preferred choice for businesses seeking innovation-driven cloud solutions.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe cloud computing market employ diverse strategies to strengthen their positions.

One prominent strategy is sustainability initiatives. For instance, in March 2023, AWS announced a commitment to achieving carbon neutrality across its data centers by 2030, aiming to appeal to eco-conscious enterprises.

Another strategy is product diversification. In June 2023, Microsoft Azure launched a line of edge computing solutions targeting telecom operators. This move aligns with the company’s goal of addressing emerging consumer preferences.

Additionally, as per the European Investment Bank, GCP has invested heavily in AI-driven analytics to enhance customer engagement and personalization. These strategies reflect a commitment to innovation and market leadership.

COMPETITIVE LANDSCAPE

The Europe cloud computing market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 30% of the share, fostering a highly dynamic environment. Key players like AWS and Microsoft Azure dominate the premium and hybrid cloud segments, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like OVHcloud are pioneering localized cloud solutions, challenging incumbents in the data sovereignty segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, AWS acquired a German startup specializing in edge computing technology. This acquisition aimed to expand its portfolio of real-time processing solutions and cater to the growing demand for IoT applications.

- In May 2024, Microsoft Azure partnered with a Dutch telecom operator to launch exclusive 5G-enabled cloud platforms targeting telecom enterprises. This initiative aimed to strengthen its position in the telecommunications vertical.

- In July 2024, GCP introduced a line of GDPR-compliant platforms targeting data privacy-conscious buyers. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, OVHcloud secured USD 200 million in funding from European investors to scale its localized cloud initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, AWS launched a campaign promoting its zero-carbon data center initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious enterprises.

MARKET SEGMENTATION

This research report on the Europe cloud computing market is segmented and sub-segmented into the following categories.

By Service Model

- IaaS

- PaaS

- SaaS

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By Vertical

- BFSI

- Telecommunications

- Manufacturing

- Retail & Consumer Goods

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the European cloud computing market?

The growth is primarily driven by increasing adoption of digital transformation initiatives, government support for cloud-first strategies, and the rising demand for scalable IT infrastructure across industries like healthcare, retail, and manufacturing.

Which industries are the largest adopters of cloud computing in Europe?

Key industries include banking and financial services, healthcare, retail, manufacturing, and the public sector. These sectors leverage cloud computing for data management, enhanced customer experiences, and operational efficiency.

What is the role of hybrid cloud solutions in Europe?

Hybrid cloud solutions are widely adopted in Europe as businesses seek to balance public and private cloud benefits while maintaining control over sensitive data and meeting compliance standards.

What is the future outlook for cloud computing in Europe?

The future looks promising with increased investments in AI, edge computing, and 5G integration. The focus will remain on regulatory compliance, sustainable practices, and regional innovation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]