Europe Workforce Management Software (WMS) Market Size, Share, Trends, & Growth Forecast Report By Deployment Mode (On-premise and Cloud), Type, End-User Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Workforce Management Software (WMS) Market Size

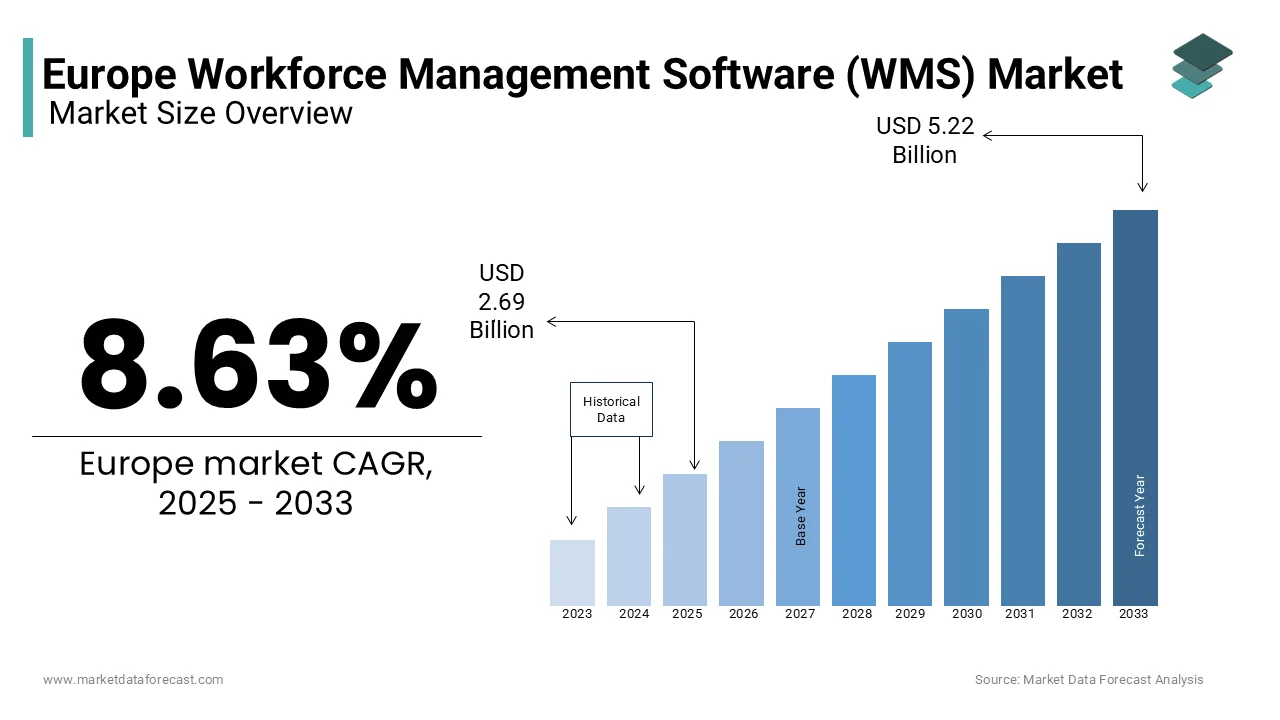

The Europe workforce management software (WMS) market was worth USD 2.48 billion in 2024. The Europe market is estimated to reach USD 5.22 billion by 2033 from USD 2.69 billion in 2025, rising at a CAGR of 8.63% from 2025 to 2033.

Workforce management software refers to integrated platforms that streamline human resource operations, enhance productivity, and ensure compliance with labor regulations. According to Eurostat, over 60% of European businesses have adopted some form of WMS to address workforce challenges, particularly in response to the rise of remote work and hybrid models post-pandemic. The demand for workforce management software in Europe has been gradually from the last few years due to the increasing demand for automation, real-time analytics, and compliance with stringent labor laws such as the EU Working Time Directive. As industries across Europe embrace digitalization, WMS has become indispensable for achieving operational efficiency and workforce agility.

MARKET DRIVERS

Growing Adoption of Remote And Hybrid Work Models

Eurostat reports that over 40% of European employees now work remotely at least part-time, creating a pressing need for tools that facilitate seamless workforce coordination. The European Foundation for the Improvement of Living and Working Conditions highlights that remote work has increased operational complexities, such as managing schedules, tracking productivity, and ensuring compliance with labor laws. Organizations are turning to WMS solutions to address these challenges, with cloud-based platforms enabling real-time collaboration and monitoring. Furthermore, the European Commission notes that industries like IT, finance, and healthcare have seen a 30% increase in WMS adoption since 2020, underscoring its role in supporting flexible work environments. This trend is expected to persist as remote work becomes a permanent fixture in the European labor landscape.

Increasing Emphasis on Regulatory Compliance and Labor Optimization

The European Labour Authority reports that non-compliance with labor laws, such as the EU Working Time Directive, results in penalties exceeding EUR 1 billion annually. To mitigate risks, organizations are adopting WMS solutions that automate compliance tracking, overtime calculations, and leave management. The European Investment Bank highlights that large enterprises account for over 60% of WMS deployments, driven by their need to manage complex workforce structures while adhering to legal requirements. Additionally, advancements in AI and machine learning have enhanced WMS capabilities, enabling predictive analytics and workforce forecasting. These innovations not only reduce administrative burdens but also improve decision-making, making WMS a vital tool for modern businesses.

MARKET RESTRAINTS

High Cost of Implementation and Maintenance

Eurostat reports that nearly 40% of SMEs in Europe cite budget constraints as a primary barrier to adopting advanced WMS solutions. The initial investment required for software licensing, hardware infrastructure, and employee training can be prohibitive, particularly for smaller organizations with limited IT budgets. The European Investment Bank highlights that the total cost of ownership for WMS can exceed EUR 50,000 annually for mid-sized businesses, deterring widespread adoption. Additionally, the complexity of integrating WMS with legacy systems often leads to additional expenses, further exacerbating financial challenges. These barriers hinder market growth, particularly in regions with lower economic development, where affordability remains a critical concern.

Resistance To Change and Lack of Technical Expertise Among End-Users

The European Centre for the Development of Vocational Training reports that over 50% of employees in traditional industries, such as manufacturing and retail, exhibit reluctance to adopt new technologies due to fear of job displacement or unfamiliarity with digital tools. This resistance is compounded by a skills gap, with Eurostat estimating that only 35% of the European workforce possesses advanced digital literacy. Furthermore, inadequate training programs and insufficient support from vendors often lead to underutilization of WMS features, reducing its effectiveness. These cultural and educational barriers slow down the pace of adoption, limiting the market’s potential to achieve widespread penetration across all sectors.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence (AI) and Predictive Analytics

The European Investment Bank reports that AI-driven WMS solutions are projected to grow at a CAGR of 18% through 2030, driven by their ability to enhance workforce planning and decision-making. These platforms leverage machine learning algorithms to forecast staffing needs, identify skill gaps, and optimize shift scheduling, enabling organizations to achieve greater efficiency. The European Commission highlights that industries like healthcare and retail are increasingly adopting AI-enabled WMS to address labor shortages and fluctuating demand. Additionally, predictive analytics helps reduce absenteeism and turnover by identifying patterns in employee behavior. This technological advancement positions AI-integrated WMS as a transformative force, offering innovative solutions to modern workforce challenges.

Expansion of WMS Solutions Tailored for Small and Medium-sized enterprises (SMEs)

According to Eurostat, SMEs account for over 99% of all businesses in Europe, yet their adoption of WMS remains below 30%. The European Small Business Alliance highlights that affordable, scalable, and user-friendly WMS platforms could unlock significant growth potential in this underserved segment. Cloud-based solutions, which eliminate the need for extensive on-premise infrastructure, are particularly appealing to SMEs seeking cost-effective options. Furthermore, the rise of subscription-based pricing models has made WMS more accessible, enabling smaller organizations to benefit from advanced features without upfront costs. By addressing the unique needs of SMEs, WMS providers can tap into a vast and largely untapped market, driving innovation and inclusivity.

MARKET CHALLENGES

Growing Concern Over Data Privacy and Cybersecurity Risks Associated with WMS Platforms

The European Union Agency for Cybersecurity (ENISA) reports a 40% increase in cyberattacks targeting HR and workforce management systems over the past two years, with attackers exploiting vulnerabilities to access sensitive employee data. Non-compliance with GDPR can result in fines of up to EUR 20 million or 4% of global annual turnover, as stated by the European Commission. Organizations face significant pressure to ensure robust data protection measures, which often require additional investments in cybersecurity infrastructure. Furthermore, Eurostat highlights that over 60% of businesses struggle to align their WMS with GDPR standards, creating hesitancy among potential adopters. These challenges not only increase operational risks but also undermine trust in WMS solutions, slowing market growth.

Complexity of Integrating WMS with Existing Enterprise Systems Such as ERP and CRM Platforms

The European Investment Bank notes that over 50% of organizations report difficulties in achieving seamless interoperability between WMS and legacy systems, leading to inefficiencies and higher costs. This issue is particularly pronounced in cross-border projects, where varying standards and protocols hinder data sharing and collaboration. The European Commission’s Digital Transformation Monitor emphasizes that integration challenges disproportionately affect large enterprises with complex IT ecosystems. Additionally, the absence of unified industry standards exacerbates the problem, leaving organizations reliant on proprietary solutions. These technical barriers not only slow down adoption but also limit the scalability of WMS deployments across industries.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.63% |

|

Segments Covered |

By Deployment Mode, Type, End-User Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Active Operations Management International LLP, Oracle Corporation, Kronos Incorporated (Hellman & Friedman), People-Analytix AG, and NICE Systems Ltd. |

SEGMENTAL ANALYSIS

By Deployment Mode Insights

The On-premises segment accounted for the leading share of 55.5% of the European market share in 2024. The domination of the on-premises segment is driven by the high demand for data control and security, particularly among large enterprises and government entities. The European Data Protection Board highlights that on-premises solutions are critical for organizations handling sensitive employee data, as they ensure compliance with GDPR and minimize risks of third-party breaches. Despite higher upfront costs, these systems provide complete control over data storage and processing, making them indispensable for industries requiring localized infrastructure.

The cloud segment is predicted to register the fastest CAGR of 18.8% over the forecast period. Factors such as the increasing adoption of remote work models and the demand for scalable, cost-effective solutions is propelling the growth of the cloud segment in the European market. As per the Eurostat, over 70% of new WMS deployments in Europe are cloud-based, driven by their flexibility and ease of integration with other digital tools. Its importance lies in enabling real-time collaboration and reducing reliance on physical infrastructure, positioning it as a key driver of innovation in the market.

By Type Insights

The time and attendance management accounted for 35.8% of the European market share in 2024. The growth of the time and attendance management segment is attributed to the critical need for accurate tracking of employee hours, compliance with labor laws, and payroll optimization. The European Commission highlights that industries like manufacturing and retail rely heavily on these solutions to manage shift schedules and reduce administrative burdens. Its importance lies in ensuring operational efficiency and regulatory adherence.

The workforce analytics is predicted to expand at a remarkable 20.4% over the forecast period owing to the factors such as the increasing demand for data-driven insights to optimize workforce planning and decision-making. The European Investment Bank reports that industries like healthcare and BFSI are leveraging analytics to address labor shortages and improve productivity. Its importance lies in enabling predictive capabilities and enhancing strategic workforce management.

By End-User Vertical Insights

The healthcare segment dominated the market by occupying a share of 25.4% in the European market in 2024. The growth of the healthcare segment in the European market is driven by the need to manage complex workforce structures, comply with labor regulations, and ensure patient safety. The European Commission highlights that hospitals and clinics rely on WMS to optimize staff scheduling and reduce burnout. Its importance lies in addressing the unique challenges of the healthcare sector, making it a cornerstone of the market.

The retail segment is anticipated to register the highest CAGR of 16.6% over the forecast period due to the increasing adoption of WMS to manage fluctuating demand, optimize staffing levels, and enhance customer experiences. The European Retail Forum reports that over 60% of retailers are investing in WMS to streamline operations and reduce costs. Its importance lies in enabling agility and competitiveness in a rapidly evolving industry.

REGIONAL ANALYSIS

Germany accounted for 25.5% of the European market share in 2024. The strong industrial base of Germany with over 40% of European manufacturing hubs relying on WMS for operational efficiency is driving the German market growth. The European Investment Bank highlights that Germany’s emphasis on Industry 4.0 and digital transformation has accelerated WMS adoption. Its robust infrastructure and focus on innovation further solidify its position as a market leader.

The UK is another prominent regional market workforce management software in the European market. The position of the UK in the European market is fueled by its rapid adoption of cloud-based WMS solutions due to the growing emphasis on remote work and digitalization. The British Chambers of Commerce reports that over 60% of businesses in the UK have upgraded their workforce management systems to enhance productivity and compliance. London’s status as a global financial hub has also spurred demand for advanced WMS in sectors like BFSI and retail.

France held a notable position in the European market in 2024. The focus of France on improving public services and enhancing workforce efficiency has significantly boosted WMS adoption. The European Commission reports that France’s investment in smart city technologies and digital transformation initiatives has created a strong demand for AI-integrated WMS platforms. Additionally, stringent labor laws have encouraged organizations to adopt compliant and scalable solutions, positioning France as a key contributor to the market.

KEY MARKET PLAYERS

The major players in the Europe workforce management software (WMS) market include Active Operations Management International LLP, Oracle Corporation, Kronos Incorporated (Hellman & Friedman), People-Analytix AG, and NICE Systems Ltd.

MARKET SEGMENTATION

This research report on the Europe workforce management software (WMS) market is segmented and sub-segmented into the following categories.

By Deployment Mode

- On-premise

- Cloud

By Type

- Workforce Scheduling and Workforce Analytics

- Time and Attendance Management

- Performance and Goal Management

- Absence and Leave Management

- Other Software (Fatigue Management, Task Management, etc)

By End-User Vertical

- Healthcare

- BFSI

- Manufacturing

- Consumer Goods and Retail

- Other End-user Industries

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe workforce management software market?

The growth is driven by increasing adoption of automation in HR processes, rising demand for remote workforce management, and compliance with labor laws.

Which industries are the biggest users of workforce management software in Europe?

Major industries include healthcare, retail, manufacturing, IT & telecom, and BFSI (Banking, Financial Services, and Insurance).

What are the latest trends in workforce management software in Europe?

Cloud-based solutions, AI-powered workforce analytics, mobile accessibility, and integration with HRMS & ERP systems are trending.

What is the future outlook for the Europe workforce management software market?

The market is expected to grow steadily, driven by digital transformation, increasing adoption of cloud solutions, and the demand for real-time workforce analytics.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]