Europe Woodworking Power Tools Market Size, Share, Trends & Growth Forecast Report By Product (Drilling and Fastening Tools [Drills, Impact Drivers, Impact Wrenches], Demolition Tools, Sawing and Cutting Tools [Jigsaws, Reciprocating Saws, Circular Saws, Band Saws], Product Removal Tools [Sander, Grinders], Others), Mode of Operation (Electric [Corded Tools, Cordless Tools], Pneumatic, Hydraulic), and Country (UK, France, Spain, Germany, Italy, Switzerland, Netherlands, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Woodworking Power Tools Market Size

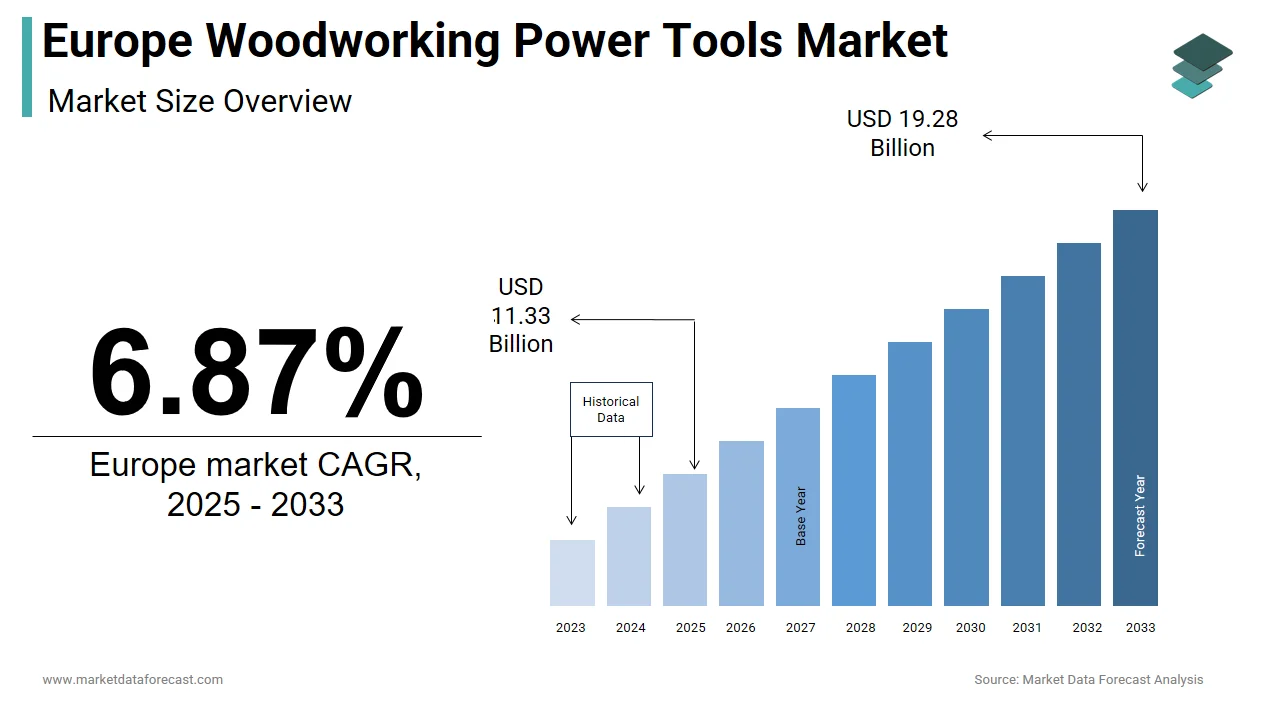

The woodworking power tools market size in Europe was valued at USD 10.60 billion in 2024. The European market is estimated to be worth USD 19.28 billion by 2033 from USD 11.33 billion in 2025, growing at a CAGR of 6.87% from 2025 to 2033.

The Europe woodworking power tools market is a dynamic sector and is driven by the region’s robust construction, furniture manufacturing, and DIY culture. The rising focus on precision and efficiency has boosted the demand for advanced tools like cordless drills and laser-guided saws. A significant percentage of professional woodworkers rely on electric power tools for high-precision tasks. Additionally, rising urbanization and home renovation trends have fueled demand for compact as well as lightweight tools. The integration of IoT and smart technologies has boosted tool functionality by enabling real-time monitoring and predictive maintenance. These trends show the market’s alignment with technological innovation and consumer preferences.

MARKET DRIVERS

Rising Demand for Precision and Efficiency

The demand for precision and efficiency is a major driver for the Europe woodworking power tools market. Professional woodworkers increasingly prefer tools with features like laser guidance, adjustable speeds, and ergonomic designs that enhance accuracy and reduce project timelines. Additionally, the rise of modular furniture and intricate wood designs has necessitated the use of advanced tools capable of handling complex cuts. These factors collectively drive the adoption of precision-focused power tools across the region.

Growth of DIY Culture and Home Renovation Trends

The growth of DIY culture and home renovation trends significantly impacts the Europe woodworking power tools market. A notable portion of European households undertook home improvement projects, creating robust demand for user-friendly power tools. Cordless drills, sanders, and circular saws are particularly popular among DIY enthusiasts due to their portability and ease of use. A study notes that online sales of woodworking power tools considerably grew annually between 2020 and 2022, driven by platforms like Amazon and local e-commerce sites. Additionally, government incentives for energy-efficient home upgrades have further propelled demand. These dynamics position DIY culture as a key growth driver in the coming years.

MARKET RESTRAINTS

High Initial Costs of Advanced Tools

High initial costs of advanced woodworking power tools present significant challenges for the Europe market. This financial burden often deters small-scale artisans and DIY enthusiasts from investing in advanced models. Additionally, maintenance costs, including battery replacements and sensor calibrations, further escalate operational expenses. Many studies indicate that energy-efficient products and practices contribute a significant portion of overall purchases, but their affordability remains a barrier for many stakeholders. This gap hinders widespread adoption, particularly in economically weaker regions.

Stringent Safety Regulations

Stringent safety regulations present significant restraints for manufacturers in the Europe woodworking power tools market. Compliance with directives such as the EU Machinery Directive demands rigorous testing and certifications, increasing production timelines and costs. Also, non-compliance can result in heavy penalties, deterring smaller players from entering the market. Additionally, frequent updates to these regulations create uncertainty, complicating product development.

MARKET OPPORTUNITIES

Integration of Smart Technologies

The adoption of smart technologies presents transformative opportunities for the Europe woodworking power tools market. IoT-enabled tools allow users to monitor performance metrics, track usage patterns, and receive predictive maintenance alerts, enhancing productivity. Also, smart tools reduce downtime, appealing to professional woodworkers. Additionally, governments across Europe are promoting digital innovation, providing funding for startups developing connected tools. This convergence of technology and efficiency positions smart tools as a key growth driver.

Expansion into Emerging Markets within Europe

Eastern European countries, such as Poland, Romania, and Hungary, represent untapped potential for the Europe woodworking power tools market. These regions are witnessing rapid industrialization and urbanization, leading to increased demand for construction and furniture manufacturing tools. This growth translates into heightened demand for power tools, particularly in residential and commercial projects. By establishing localized distribution networks and offering cost-effective solutions, manufacturers can penetrate these emerging markets effectively.

MARKET CHALLENGES

Intense Price Competition among Manufacturers

Intense price competition among manufacturers is another challenge for the Europe woodworking power tools market. The market remains highly fragmented, with many players competing for share, especially in the budget segment. According to a study by Deloitte, profit margins for mid-tier manufacturers have contracted by 10% over the past five years due to pricing pressures. Also, the prevalence of counterfeit products exacerbates the issue, as they flood the market with low-cost alternatives that compromise quality. This competitive environment forces manufacturers to balance affordability with innovation, straining resources.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Mode of Operation, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Emerson Electric, Co.; Hilti Corporation; Ingersoll-Rand PLC; Koki Holdings Co., Ltd.; Makita Corporation; Robert Bosch; Stanley Black & Decker; Techtronic Industries, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The drills segment dominated the Europe woodworking power tools market by securing 35.5% of total revenue in 2024. This leading position in the market is driven by their versatility and widespread use in both professional and DIY applications. According to Eurostat, a significant number of households undertaking home improvement projects in Europe utilize cordless drills due to their portability and ease of use.

The Sanders segment is the fastest-growing in the Europe woodworking power tools market, with a projected CAGR of 11.2% during the forecast period. This growth is fueled by the increasing demand for smooth finishes in furniture manufacturing and home renovation projects. Additionally, the integration of dust collection systems has enhanced their appeal, reducing cleanup time and improving workplace safety. These dynamics position Sanders as a key growth driver in the coming years.

By Mode of Operation Insights

The electric tools segment gained the maximum prominence in the Europe woodworking power tools market by accounting for a controlling share of total revenue in 2024. This dominance of the segment is propelled by their reliability and consistent performance, making them ideal for professional woodworkers. Apart from that, advancements in motor technology have enhanced their durability, appealing to industrial users.

The pneumatic tools segment is advancing at a rapid pace in the Europe woodworking power tools market, with a predicted CAGR of 9.8% in the future. This progress is influenced by their ability to deliver high torque and speed, making them indispensable for heavy-duty applications. According to the study, pneumatic tools significantly reduce operational costs, boosting productivity in large-scale projects. In addition, their lightweight design reduces operator fatigue, appealing to professional craftsmen. These factors position pneumatic tools as a key growth driver in the market.

COUNTRY LEVEL ANALYSIS

Germany commanded the Europe woodworking power tools market by contributing 25.5% of total revenue in 2024. This position in the market is driven by the country’s robust manufacturing base and emphasis on precision engineering. According to Eurostat, Germany produces a major share of Europe’s woodworking tools, with a strong focus on innovative designs like cordless drills and laser-guided saws. The rise of urbanization and home renovation trends has further propelled demand, particularly in metropolitan areas like Munich and Hamburg. Also, Germany’s stringent safety regulations have encouraged manufacturers to adopt advanced technologies, ensuring compliance while enhancing product quality.

France is expected to be the fastest-growing market, with a projected CAGR of 10.5%.. This growth is fueled by urbanization trends and government incentives for sustainable construction. Also, there has been a notable increase in subsidy levels and financial assistance for energy-efficient renovations in France, driving demand for advanced tools. Moreover, the rise of modular furniture and intricate wood designs has necessitated the use of precision-focused tools, particularly in cities like Paris and Lyon.

The UK market is backed by the rising DIY culture, with a significant percentage of households undertaking home improvement projects in in recent years. In addition, Spain’s growing construction sector ensures steady growth across these regions, with annual increases.

KEY MARKET PLAYERS

A few notable companies operating in the Europe woodworking power tools market profiled in this report are Emerson Electric, Co.; Hilti Corporation; Ingersoll-Rand PLC; Koki Holdings Co., Ltd.; Makita Corporation; Robert Bosch; Stanley Black & Decker; Techtronic Industries, and others.

TOP LEADING PLAYERS IN THE MARKET

Bosch

Bosch dominates the Europe woodworking power tools market. Its innovative solutions, such as IoT-enabled drills and laser-guided saws, cater to both professional and DIY users, enhancing its global presence. Bosch’s commitment to sustainability is evident in its development of energy-efficient models, which reduce power consumption. The company’s strategic partnerships with governments and retailers ensure compliance and accessibility, while its localized production facilities enhance market reach.

Makita

Makita is known for its durable electric tools. The company targets industrial applications, ensuring consistent demand across Europe. Its focus on ergonomic designs and lightweight materials appeals to professional woodworkers, reducing operator fatigue during prolonged use. Additionally, the company’s expansion into Eastern Europe through acquisitions has strengthened its position in emerging markets, enabling it to meet growing demand effectively.

DeWalt

DeWalt accounts for a key share of the market, as reported by the German Woodworking Association. Its emphasis on ergonomic designs and smart technologies strengthens its position globally. DeWalt’s acquisition of regional manufacturers in Poland and Spain has expanded its production capacity, enabling it to meet growing demand in Eastern and Southern Europe. Besides, its commitment to developing noise-reducing tools aligns with Europe’s regulatory landscape, positioning it as a key player in the electric tools segment.

STRATEGIES USED BY KEY PLAYERS

Key players employ diverse strategies to maintain their competitive edge in the Europe woodworking power tools market. Product innovation remains a cornerstone, with companies investing heavily in smart technologies, IoT-enabled features, and energy-efficient designs to meet regulatory demands. For instance, Bosch’s IoT-enabled drills and Makita’s ergonomic tools are examples of this trend. Geographic expansion is another critical strategy, with manufacturers targeting emerging markets in Europe to capitalize on urbanization trends. Strategic partnerships with governments and retailers ensure compliance with safety standards, while collaborations with construction firms enhance accessibility. Companies also invest in digital platforms, such as online rental services and mobile apps, to streamline customer engagement and boost sales. Mergers and acquisitions consolidate market positions, enabling access to new technologies and customer bases.

COMPETITION OVERVIEW

The Europe woodworking power tools market is highly competitive, characterized by the presence of global leaders like Bosch, Makita, and DeWalt, alongside regional players offering cost-effective solutions. Global players leverage innovation, offering advanced technologies such as IoT-enabled sensors, predictive maintenance, and energy-efficient models. Regional players compete on price and customization, targeting niche segments like small-scale artisans and budget-conscious DIY enthusiasts. The market’s fragmentation intensifies competition, prompting manufacturers to differentiate through value-added services like extended warranties and rapid installation timelines. Stringent safety regulations and the rise of smart tools have shifted focus toward sustainable solutions, creating opportunities for innovation. Collaborations with governments ensure stable demand, while investments in R&D drive technological advancements. Supply chain disruptions and economic uncertainties further shape the competitive landscape, pressuring companies to balance affordability with quality.

RECENT MARKET DEVELOPMENTS

- In March 2023, Bosch launched a new line of IoT-enabled drills in Germany, allowing real-time performance tracking. This initiative strengthened its position in the smart tools market by aligning with Europe’s digital transformation goals.

- In June 2023, Makita partnered with a French construction firm to supply pneumatic tools for large-scale projects. This collaboration enhanced its industrial portfolio and positioned Makita as a leader in heavy-duty applications.

- In September 2023, DeWalt acquired a Polish manufacturer, expanding its production capacity in Eastern Europe. This move enabled the company to meet growing demand while reducing logistical bottlenecks.

- In November 2023, Festool introduced a cordless sander with an integrated dust collection system in Spain, targeting professional woodworkers. This innovation improved workplace safety and efficiency, appealing to industrial users.

- In January 2024, Hilti launched an online platform for tool rentals in Italy, streamlining access for small-scale artisans and boosting customer engagement. This platform enhanced flexibility and affordability, aligning with modern consumer preferences.

MARKET SEGMENTATION

This Europe woodworking power tools market research report is segmented and sub-segmented into the following categories.

By Product

- Drilling and Fastening Tools

- Drills

- Impact Drivers

- Impact Wrenches

- Demolition Tools

- Sawing and Cutting Tools

- Jigsaws

- Reciprocating Saws

- Circular Saws

- Band Saws

- Product Removal Tools

- Sander

- Grinders

- Others

By Mode Of Operation

- Electric

- Corded Tools

- Cordless Tools

- Pneumatic

- Hydraulic

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the demand for woodworking power tools in Europe?

Demand is driven by strong manufacturing and construction sectors, the popularity of DIY and home improvement projects, and the growing need for efficient, high-quality tools among both professionals and hobbyists

2. What are the main trends shaping the market?

Key trends include the increasing adoption of cordless and battery-powered tools, a focus on ergonomics and safety, and the rise of eco-friendly and energy-efficient product offerings

3. Who are the leading players and which countries are most prominent in the market?

Major players include Bosch, DeWalt, and Makita, with Germany, the UK, and Italy standing out due to their robust woodworking, furniture, and construction industries

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]