Europe Wooden Furniture Market Size, Share, Trends, & Growth Forecast Report By Product Type (Hardwood, Softwood), Application, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Wooden Furniture Market Size

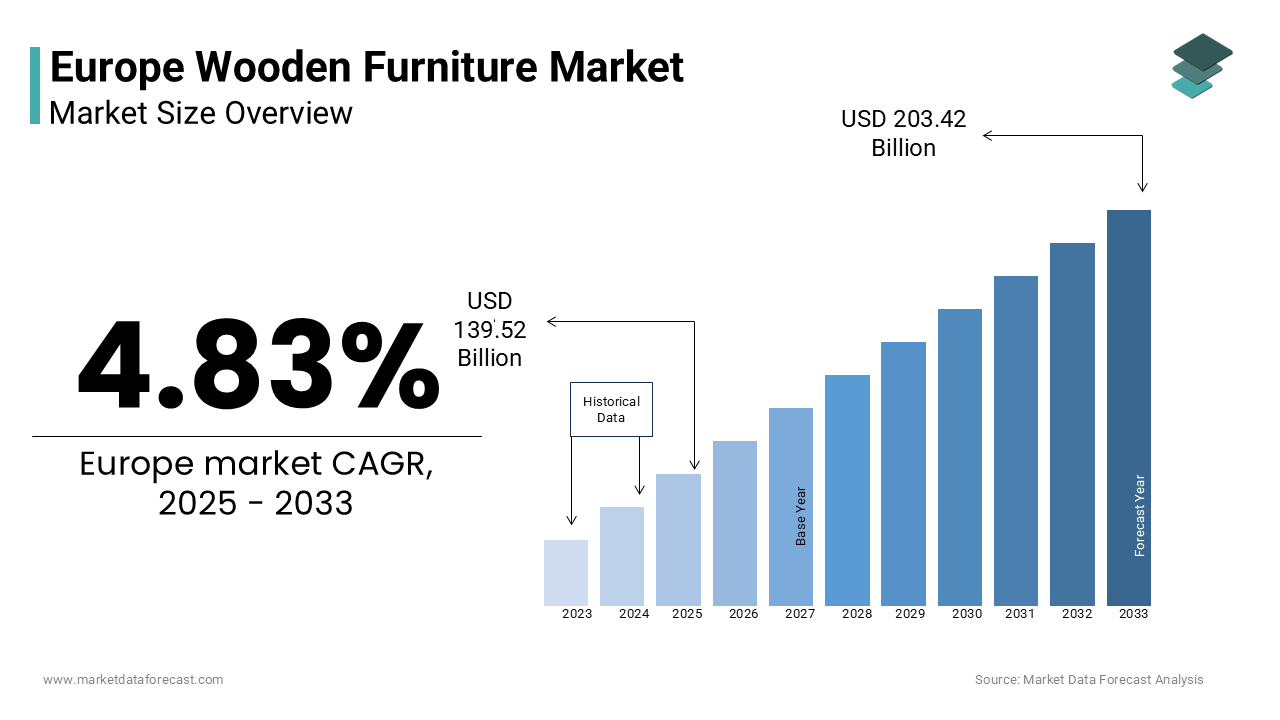

The europe wooden furniture market was worth 133.09 billion in 2024. The europe market is expected to reach USD 203.42 billion by 2033 from USD 139.52 billion in 2025, rising at a CAGR of 4.83 % from 2025 to 2033.

The wooden furniture plays an important role in the home decor and interior design industries. The growth of the Europe wooden furniture market is driven by evolving consumer preferences and sustainability trends. The growing demand for eco-friendly products has positioned wooden furniture as a preferred choice among environmentally conscious buyers. As per a study by the European Federation of Woodworking Industries, over 60% of consumers prioritize sustainable materials when purchasing furniture. Additionally, urbanization trends have fueled demand for compact yet aesthetically pleasing wooden furniture in metropolitan areas. The rise of online retail platforms has further expanded accessibility by enabling smaller brands to compete with established players.

MARKET DRIVERS

Increasing Demand for Sustainable Products

Sustainability is a pivotal driver for the Europe wooden furniture market, with consumers increasingly prioritizing eco-friendly materials. The material’s popularity is also being drivne with the growing scale of construction and furniture industries in both developed and developing countries. Governments across the region are promoting sustainable forestry practices by ensuring a steady supply of responsibly sourced timber. The Forest Stewardship Council (FSC) reports that FSC-certified wood now accounts for 25% of all wood products sold in Europe, reflecting heightened awareness about environmental impact. Additionally, the European Green Deal incentivizes businesses to adopt circular economy principles, driving innovation in wooden furniture design. This trend is further amplified by millennials and Gen Z consumers, who are willing to pay a premium for sustainable products. As per Nielsen, 73% of European consumers are willing to alter their purchasing habits to reduce environmental impact.

Urbanization and Compact Living Trends

Urbanization has significantly influenced the Europe wooden furniture market through the demand for space-saving designs. According to Eurostat, over 75% of Europe’s population resides in urban areas by necessitating innovative solutions for small living spaces. Wooden furniture, known for its versatility and aesthetic appeal, is increasingly being designed to maximize functionality without compromising on style. Cities like London, Paris, and Berlin are witnessing a surge in demand for compact yet stylish wooden furniture, particularly among young professionals. Additionally, the rise of co-living spaces and micro-apartments has created opportunities for manufacturers to develop customized solutions.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

Fluctuating costs of raw materials, particularly timber, pose a significant challenge to the Europe wooden furniture market. According to the European Timber Trade Federation, timber prices surged by 20% in 2022 due to supply chain disruptions and geopolitical tensions. These price fluctuations increase production costs, squeezing profit margins for manufacturers, especially smaller players. Additionally, the scarcity of high-quality hardwoods, such as oak and walnut, has led to a reliance on imported materials, further escalating expenses. As a result, manufacturers face difficulties in maintaining competitive pricing while ensuring product quality. This economic uncertainty hinders investment in innovation and limits market growth in cost-sensitive segments.

Intense Competition from Alternative Materials

The Europe wooden furniture market faces stiff competition from alternative materials such as metal, plastic, and engineered wood, which offer cost advantages and durability. According to a study by the European Furniture Industries Confederation, non-wood furniture accounted for 40% of total furniture sales in 2022. These materials are often perceived as more affordable and resistant to wear and tear are appealing to budget-conscious consumers. Additionally, advancements in technology have enabled the development of high-quality engineered wood products, such as MDF and plywood, which mimic the appearance of solid wood at a fraction of the cost. This competition forces wooden furniture manufacturers to differentiate themselves through value-added features and sustainability claims, straining resources.

MARKET OPPORTUNITIES

Growth of E-commerce Platforms

The proliferation of e-commerce platforms presents a significant opportunity for the Europe wooden furniture market. According to Eurostat, online furniture sales grew by 25% in 2022, driven by convenience and accessibility. Platforms like Amazon, Wayfair, and local retailers enable smaller brands to reach a wider audience by reducing dependency on traditional brick-and-mortar stores. Additionally, the integration of augmented reality (AR) tools allows customers to visualize wooden furniture in their homes before purchasing, enhancing user experience. This trend is further amplified by social media influencers and home decor blogs, which promote sustainable wooden furniture designs.

Customization and Personalization Trends

Customization and personalization are gaining prominence in the Europe wooden furniture market, driven by evolving consumer preferences. According to a report by Deloitte, 36% of European consumers are willing to pay a premium for personalized products. Wooden furniture, with its natural aesthetic and versatility, lends itself well to bespoke designs tailored to individual tastes. Manufacturers are increasingly offering modular systems and customizable finishes by allowing customers to create unique pieces that align with their lifestyles. Additionally, the rise of co-creation platforms enables customers to collaborate with designers to foster brand loyalty. This focus on personalization not only enhances customer satisfaction but also differentiates wooden furniture from mass-produced alternatives.

MARKET CHALLENGES

Economic Uncertainty and Consumer Spending Constraints

Economic uncertainty remains a significant challenge for the Europe wooden furniture market, as fluctuating disposable incomes impact consumer spending. According to Eurostat, household savings rates in the EU dropped to 12.5% in 2022, which is reflecting reduced discretionary expenditure. This trend has slowed the adoption of premium wooden furniture, which often commands higher prices compared to alternatives. Additionally, inflationary pressures have constrained budgets, particularly among middle-income households. A report by the UK Office for National Statistics reveals that furniture purchases declined by 8% in 2022 with the impact of economic headwinds.

Supply Chain Disruptions and Logistical Bottlenecks

Supply chain disruptions and logistical bottlenecks have emerged as critical challenges for the Europe wooden furniture market. According to the European Logistics Association, transport-related delays increased by 30% in 2022 by impacting production timelines and delivery schedules. These disruptions are exacerbated by geopolitical tensions and rising fuel costs, which escalate shipping expenses. Additionally, the reliance on imported raw materials, particularly from Asia and North America, has compounded these challenges. As per a study by the Dutch Transport and Logistics Association, lead times for timber imports have doubled since 2021. These logistical hurdles force manufacturers to explore localized sourcing options, which may limit material variety and quality. Addressing these vulnerabilities is crucial for sustaining market growth.

SEGMENTAL ANALYSIS

By Product Type Insights

The hardwood furniture segment was the largest and dominates the Europe wooden furniture market by capturing 65.5% of total revenue in 2024. The growth of the segment is driven by the durability and aesthetic appeal of hardwoods like oak, walnut, and cherry, which are favored for high-end residential and commercial applications. According to Eurostat, over 40% of premium furniture purchases in Europe involve hardwood products by reflecting their association with luxury and longevity. Additionally, the growing emphasis on sustainability has bolstered demand for FSC-certified hardwood furniture, as consumers prioritize responsibly sourced materials. As per a report by the German Timber Trade Association, FSC-certified hardwoods account for 30% of all wood furniture sales in Germany alone.

The softwood furniture segment is likely to experience a CAGR of 7.8% throughout the forecast period. This growth is fueled by its affordability and widespread availability by making it an attractive option for budget-conscious consumers. Softwoods like pine and spruce are increasingly used in modular and space-saving designs by aligning with urbanization trends. According to the European Furniture Industries Confederation, softwood furniture accounts for 50% of all online furniture sales, driven by its lightweight nature and ease of customization. Additionally, advancements in finishing techniques have enhanced the durability and aesthetic appeal of softwood products is broadening their application in residential settings.

By Application Insights

The residential furniture segment led the Europe wooden furniture market by accounting for prominent share in 2024 with the growing trend of home renovation and interior decoration, particularly among millennials and Gen Z consumers. According to Eurostat, over 60% of European households undertook home improvement projects in 2022, which is creating robust demand for wooden furniture. Additionally, the rise of remote work has increased the need for functional yet stylish home office furniture, further boosting demand.

The commercial furniture segment is projected to witness a CAGR of 9.2% throughout the forecast period. The growth of the market is fueled by the expansion of co-working spaces, cafes, and boutique hotels, which favor wooden furniture for its warm and inviting aesthetic. According to the European Hospitality Association, the hospitality sector grew by 12% in 2022, driving demand for durable yet stylish wooden furniture. Additionally, the focus on biophilic design principles, which emphasize natural materials, has accelerated adoption in offices and retail spaces. A report by the French Chamber of Commerce highlights that wooden furniture accounts for 40% of all commercial furniture purchases in France.

By Distribution Channel Insights

The retail stores segment was the largest with 45.3% of the Europe wooden furniture market share in 2024. The growth of the segment is driven by the tactile shopping experience they offer by allowing customers to assess quality and craftsmanship firsthand. According to the European Retail Federation, over 60% of wooden furniture purchases are made in physical stores in countries like Italy and Spain, where traditional retail remains strong. Additionally, local retailers often collaborate with artisans to offer bespoke designs, enhancing customer engagement.

The online platforms segment is expected to exhibit a noteworthy CAGR of 12.5% throughout the forecast period. This growth is fueled by convenience and accessibility among younger consumers. According to Eurostat, online furniture sales grew by 25% in 2022, driven by platforms like Amazon, Wayfair, and local e-commerce sites. Additionally, the integration of AR tools allows customers to visualize wooden furniture in their homes before purchasing by enhancing user experience.

REGIONAL ANALYSIS

Germany was the top performer in the Europe wooden furniture market by accounting for 25.4% of total share in 2024. The growth of the market in this country is driven by the country’s robust manufacturing base and emphasis on sustainability. According to Eurostat, Germany produces over 30% of Europe’s wooden furniture, with a strong focus on FSC-certified products. The rise of urbanization and home renovation trends further propels demand in cities like Berlin and Munich. Additionally, Germany’s stringent environmental regulations have encouraged manufacturers to adopt eco-friendly practices that is to enhance their global reputation. As per a study by the Fraunhofer Institute, German consumers prioritize durability and craftsmanship is creating steady demand for high-quality hardwood furniture.

France is esteemed to grow with a CAGR of 8.5% in the next coming years. This growth is fueled by urbanization and government incentives for sustainable living. According to the European Environment Agency, France leads in adopting eco-friendly furniture, with a 20% annual increase in demand. Cities like Paris and Lyon are witnessing a surge in demand for modular and customizable wooden furniture, driven by compact living trends. Additionally, the hospitality sector’s expansion has boosted demand for commercial wooden furniture in boutique hotels and cafes. A report by the French National Institute for Industrial Environment and Risks highlights that wooden furniture accounts for 45% of all furniture purchases in urban areas, reflecting its popularity among younger consumers.

The UK benefits from home renovation trends, with over 60% of households undertaking improvement projects in 2022, according to the UK Office for National Statistics. This trend has created robust demand for wooden furniture, particularly in suburban areas. Italy’s artisanal craftsmanship drives exports, with Italian brands like Poltrona Frau gaining international recognition for luxury hardwood designs, as per the Italian Ministry of Economic Development. Spain’s tourism sector boosts demand for commercial wooden furniture in hospitality settings by ensuring steady growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

IKEA, Hülsta-Werke Hüls GmbH & Co. KG, Poltrona Frau Group, Smeg, Hermle AG, Ligne Roset, Meble Wójcik, Scavolini, Kinnarps AB, Tvilum. Are some of the key market players in the europe wooden furniture market.

The Europe wooden furniture market is highly competitive, characterized by the presence of global leaders like IKEA, Poltrona Frau, and Häcker Kitchens, alongside regional players offering cost-effective solutions. Global players leverage innovation, offering advanced designs and sustainable materials. For example, IKEA’s affordable modular furniture and Poltrona Frau’s luxury hardwood designs set benchmarks for affordability and exclusivity. Regional players compete on price and customization, targeting niche segments like low-rise residential projects. The market’s fragmentation intensifies competition, prompting manufacturers to differentiate through value-added services like extended warranties and rapid installation timelines. Stringent environmental regulations and the rise of e-commerce have shifted focus toward sustainable and accessible solutions, creating opportunities for innovation.

Top Players in the Europe Wooden Furniture Market

1. IKEA

IKEA dominates the Europe wooden furniture market. Its affordable yet stylish designs cater to urban consumers by enhancing its global presence. IKEA’s commitment to sustainability is evident in its use of FSC-certified wood and circular economy principles, as highlighted by the Forest Stewardship Council. The company’s extensive retail network and e-commerce platform ensure accessibility across Europe, while its focus on modular designs aligns with compact living trends. IKEA’s collaborations with local artisans and designers enable it to offer unique, region-specific products, strengthening its competitive edge.

2. Poltrona Frau

Poltrona Frau targets high-end residential and commercial segments, offering bespoke designs tailored to individual tastes. Poltrona Frau’s partnerships with luxury hotel chains and co-working spaces have expanded its presence in the commercial furniture segment. According to Deloitte, 36% of European consumers are willing to pay a premium for personalized products, which is amplifying the appeal of Poltrona Frau’s offerings. The company’s focus on craftsmanship and innovation ensures consistent demand, particularly in affluent markets like France and Switzerland.

3. Häcker Kitchens

Häcker Kitchens is known for its customizable kitchen solutions, the company leverages advanced technology to enhance product quality and functionality. Häcker Kitchens’ acquisition of a Polish manufacturer in 2023 expanded its production capacity in Eastern Europe, enabling it to meet growing demand in emerging markets. According to McKinsey & Company, customization is a key trend in the furniture industry, and Häcker Kitchens capitalizes on this by offering modular systems and personalized finishes. Its focus on sustainability, including the use of recycled materials, aligns with Europe’s green building initiatives.

Strategies Used by Key Players

Key players in the Europe wooden furniture market employ diverse strategies to maintain their competitive edge. Product innovation remains a cornerstone, with companies investing heavily in sustainable materials, modular designs, and smart technologies. For instance, IKEA’s focus on circular economy principles and Poltrona Frau’s emphasis on luxury customization exemplify this trend. Geographic expansion is another critical strategy, with manufacturers targeting emerging markets in Eastern Europe to capitalize on urbanization trends. Strategic partnerships with governments and hospitality sectors ensure compliance with environmental regulations and expand commercial applications. Companies also invest in digital platforms, such as AR-enabled tools, to enhance customer engagement and streamline online sales. Mergers and acquisitions consolidate market positions by enabling access to new technologies and customer bases.

RECENT MARKET DEVELOPMENTS

- In March 2023, IKEA launched a new line of FSC-certified wooden furniture in Germany, reducing its carbon footprint by 15%. This initiative strengthened its position in the sustainability segment by aligning with Europe’s green building initiatives.

- In June 2023, Poltrona Frau partnered with a French luxury hotel chain to supply custom hardwood furniture, enhancing its presence in the commercial segment. This collaboration expanded its customer base and reinforced its reputation for high-end craftsmanship.

- In September 2023, Häcker Kitchens acquired a Polish manufacturer, expanding its production capacity in Eastern Europe. This move enabled the company to meet growing demand in emerging markets while reducing logistical bottlenecks.

- In November 2023, BoConcept introduced an AR-enabled online platform in Spain, allowing customers to visualize furniture in their homes before purchasing. This innovation enhanced user experience and increased online sales by 20%.

- In January 2024, Muuto launched a monobrand store in Italy, focusing on Scandinavian-inspired wooden furniture to target urban consumers. This strategic expansion solidified its presence in Southern Europe and appealed to design-conscious buyers.

MARKET SEGMENTATION

This research report on the europe wooden furniture market is segmented and sub-segmented into the following categories.

By Product Type

- Hardwood

- Softwood

By Application

- Residential

- Commercial

By Distribution Channel

- Retail

- Mass Market Players

- Furniture Store

- Monobrand Furniture Stores

- Online

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What trends are shaping the wooden furniture market in Europe?

Trends include rising demand for sustainable and eco-friendly furniture, minimalistic Scandinavian designs, modular solutions, and customization options.

What challenges does the wooden furniture industry face in Europe?

Challenges include rising raw material costs, supply chain disruptions, environmental regulations, and competition from low-cost manufacturers outside Europe.

What is the future growth outlook for the European wooden furniture market?

The market is expected to grow steadily due to increasing demand for sustainable, stylish, and multifunctional furniture across residential and commercial sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]