Europe Wooden Decking Market Size, Share, Trends & Growth Forecast Report By Type (Pressure-treated Wood, Red Wood, Tropical Hardwood, Cedar, Wood-Plastic Composites (WPC), Other Types (Thermally Modified Wood, Acetylated Wood)), Application, End-Use and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Wooden Decking Market Size

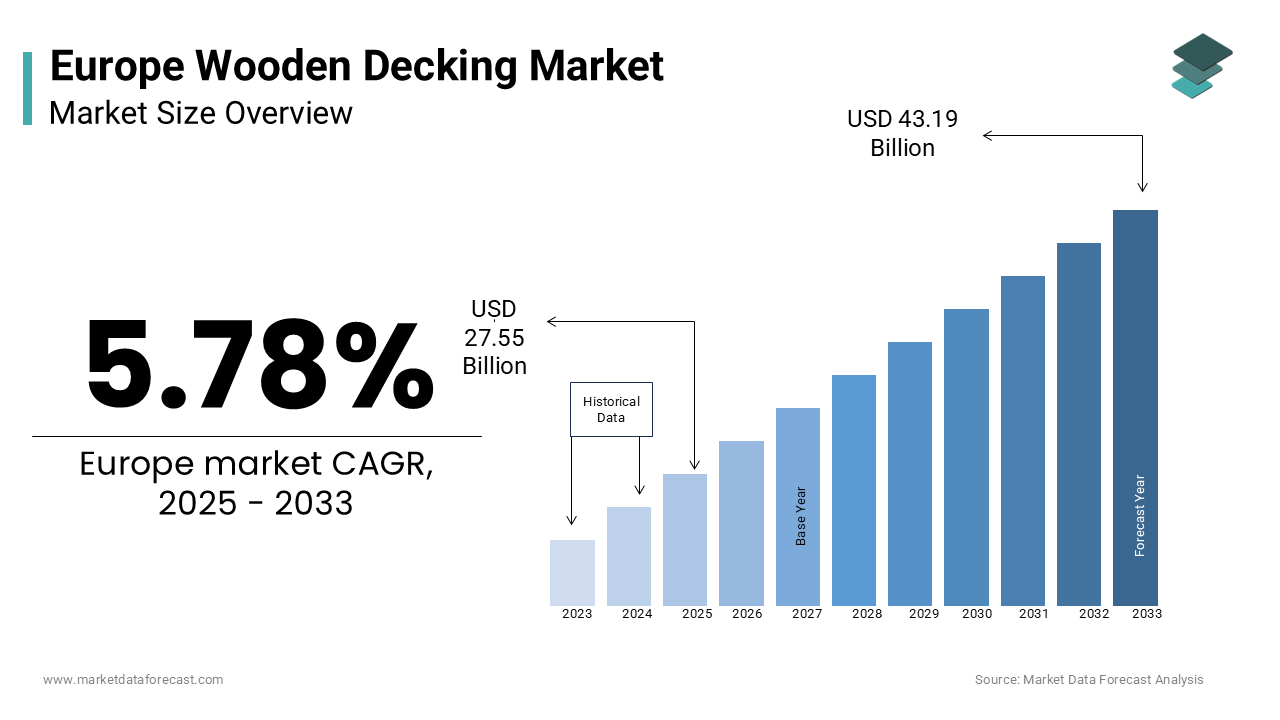

The europe wooden decking market was worth USD 26.04 billion in 2024. The European market is estimated to grow at a CAGR of 5.78% from 2025 to 2033 and be valued at USD 43.19 billion by the end of 2033 from USD 27.55 billion in 2025.

Wooden decking has emerged as a cornerstone of modern outdoor living and architectural design across Europe, blending functionality with aesthetic appeal. The European wooden decking market encompasses a variety of materials, including natural wood and engineered composites, designed to enhance residential and commercial spaces. The European wooden decking market has witnessed steady growth in the last few years due to the urbanization and rising consumer interest in sustainable building materials. The demand for wooden decking is particularly pronounced in regions with temperate climates, where outdoor spaces are integral to lifestyle choices. For instance, Germany accounts for nearly 25% of Europe’s total wooden decking installations, reflecting its cultural emphasis on outdoor leisure.

The advancements in wood treatment technologies that extend the durability and weather resistance of decking materials is likely to push the regional market expansion over the forecast period. According to a study by the European Timber Trade Federation, pressure-treated wood remains the most popular choice due to its affordability and versatility. However, environmental concerns and regulatory pressures are reshaping preferences, with consumers increasingly gravitating toward sustainably sourced and eco-friendly alternatives. As Europe intensifies its focus on green construction practices, wooden decking is poised to play a pivotal role in shaping the future of outdoor architecture.

MARKET DRIVERS

Rising Demand for Sustainable Building Materials in Europe

The growing emphasis on sustainability is one of the key factors propelling the wooden decking market forward. Across Europe, consumers and businesses alike are prioritizing eco-friendly materials that align with circular economy principles. According to the European Environment Agency, over 60% of new construction projects now incorporate sustainable materials, with wooden decking being a preferred choice due to its renewable nature. Pressure-treated wood, for example, is derived from responsibly managed forests certified by organizations like the Forest Stewardship Council (FSC), ensuring minimal environmental impact. Sweden, a leader in sustainable forestry, produces approximately 80 million cubic meters of timber annually, much of which is used in decking applications. Furthermore, a survey conducted by the European Woodworking Industries Confederation found that 70% of homeowners prefer wooden decking over synthetic alternatives due to its biodegradability and lower carbon footprint. This shift is further supported by government incentives promoting green construction. For instance, France offers tax rebates of up to 30% for projects utilizing sustainable materials, driving adoption rates. As Europe strives to achieve net-zero emissions by 2050, the demand for wooden decking as a sustainable solution continues to surge.

Increasing Urbanization and Outdoor Lifestyle Trends

Urbanization and the growing popularity of outdoor living spaces are fueling the expansion of the wooden decking market across Europe. According to the Eurostat, over 75% of Europeans now reside in urban areas, creating a heightened need for functional yet aesthetically pleasing outdoor environments. Wooden decking provides an ideal solution, transforming balconies, terraces, and gardens into versatile extensions of indoor living spaces. In the UK, for example, the Homeowners Alliance notes that 40% of urban dwellers have invested in outdoor renovations, with wooden decking being the most sought-after upgrade. Additionally, the rise of remote work during the pandemic has amplified this trend, as individuals seek to create private retreats within their homes. According to a study by the German Institute for Urban Development, cities like Berlin and Munich have witnessed a 25% increase in decking installations since 2020. The versatility of wooden decking also appeals to diverse demographics, from young professionals seeking modern designs to retirees desiring low-maintenance solutions. As urban populations continue to grow, the integration of wooden decking into residential and commercial spaces will remain a defining feature of contemporary living.

MARKET RESTRAINTS

High Maintenance Requirements of Natural Wood

One of the primary restraints hindering the widespread adoption of traditional wooden decking is the high maintenance it demands. Natural wood, while aesthetically pleasing, is prone to issues such as warping, cracking, and rot if not properly cared for. According to the European Timber Trade Federation, untreated wood can degrade by up to 30% within five years, necessitating regular sealing, staining, and repairs. These maintenance costs can accumulate significantly over time, deterring budget-conscious consumers. For instance, a report by the French National Institute for Consumer Research estimates that annual upkeep expenses for wooden decks range between €100 and €300 per square meter, depending on climate conditions. This financial burden is particularly pronounced in humid regions like Italy and Spain, where moisture accelerates wood degradation. Moreover, the labor-intensive nature of maintenance discourages busy homeowners, who often prefer low-effort alternatives. While advancements in wood treatment technologies have mitigated some of these issues, the perception of high maintenance persists, limiting the appeal of natural wood decking among certain demographics.

Environmental Concerns and Regulatory Pressures

Environmental concerns surrounding deforestation and chemical treatments are further hampering the growth of the European wooden decking market. The World Wildlife Fund highlights that unsustainable logging practices contribute to the loss of approximately 7 million hectares of forest annually, raising ethical questions about the sourcing of decking materials. In response, stricter regulations have been implemented across Europe, such as the EU Timber Regulation, which mandates traceability and legality of wood products. Compliance with these regulations increases production costs, making wooden decking less competitive compared to synthetic alternatives. Additionally, the use of chemical preservatives in pressure-treated wood has sparked controversy due to potential health risks and environmental contamination. A study by the European Chemicals Agency reveals that chromated copper arsenate (CCA), a common wood preservative, poses long-term ecological hazards, prompting bans in several countries. These factors have led to a decline in consumer confidence, with the European Consumer Organization reporting a 15% drop in demand for chemically treated wood over the past decade. As regulatory scrutiny intensifies, the wooden decking industry must navigate these challenges to maintain market relevance.

MARKET OPPORTUNITIES

Growing Adoption of Wood-Plastic Composites

Wood-plastic composites (WPCs) is a major opportunity for the wooden decking market, combining the aesthetic appeal of wood with the durability of synthetic materials. According to the European Plastics Converters Association, WPCs have experienced a significant demand over the past five years, driven by their resistance to moisture, pests, and UV radiation. Unlike traditional wood, WPCs require minimal maintenance, making them an attractive option for busy homeowners and commercial developers. For instance, in the Netherlands, over 30% of new decking installations now utilize WPCs, as reported by the Dutch Construction Industry Federation. Additionally, advancements in manufacturing technologies have reduced production costs, enabling broader accessibility. A study by the Fraunhofer Institute highlights that WPCs can last up to 25 years without significant degradation, offering long-term value to consumers. Furthermore, the recyclability of WPCs aligns with Europe’s sustainability goals, positioning them as a key player in the transition to eco-friendly construction materials. As awareness of their benefits grows, WPCs are expected to capture an even larger share of the decking market.

Expansion into Non-Residential Applications

The non-residential sector presents a burgeoning opportunity for the wooden decking market, driven by increasing investments in hospitality, retail, and public infrastructure projects. According to the European Construction Industry Federation, non-residential construction spending is projected to grow by 8% annually through 2025, creating a fertile environment for decking installations. Hotels, restaurants, and shopping centers are increasingly incorporating wooden decking into their designs to enhance aesthetic appeal and customer experience. For example, Sweden has seen a 40% rise in decking installations in hospitality venues, as noted by the Swedish Tourism Board. Similarly, public spaces such as parks and recreational areas are adopting wooden decking to create inviting, durable pathways and viewing platforms. A report by the German Urban Planning Institute reveals that municipalities spent over €500 million on outdoor renovations in 2022, with decking being a significant component. The versatility of wooden decking allows it to complement various architectural styles, making it a preferred choice for diverse non-residential applications. As urban development accelerates, the integration of wooden decking into commercial and public projects will unlock substantial growth potential.

MARKET CHALLENGES

Fluctuating Raw Material Prices

The volatility in raw material prices that directly impacts production costs and consumer affordability is one of the major challenges to the European wooden decking market. Timber prices, influenced by factors such as supply chain disruptions, geopolitical tensions, and climate-related events, have experienced significant fluctuations in recent years. According to the European Timber Trade Federation, timber prices surged by 40% between 2020 and 2022 due to global supply shortages exacerbated by the pandemic. This unpredictability creates financial strain for manufacturers, who often pass these costs onto consumers. For instance, in Germany, the price of pressure-treated wood decking increased by 25% over the same period, as reported by the German Woodworking Industries Association. Such price hikes deter potential buyers, particularly in cost-sensitive markets like Eastern Europe. Additionally, the rising cost of adhesives and preservatives used in engineered wood products further compounds the issue. A study by the European Chemicals Agency highlights that the cost of wood preservatives has risen by 18% annually since 2021, driven by regulatory changes and raw material scarcity. These economic pressures threaten to slow market growth, necessitating innovative solutions to stabilize pricing and maintain consumer interest.

Competition from Alternative Materials

The wooden decking market faces stiff competition from alternative materials such as PVC, aluminum, and composite decking, which are gaining traction due to their perceived durability and low maintenance requirements. According to the European Plastics Converters Association, PVC decking accounts for nearly 30% of the total decking market, with a projected annual growth rate of 9%. These synthetic alternatives are particularly appealing in regions with harsh weather conditions, where traditional wood struggles to maintain its integrity. For example, in Scandinavia, aluminum decking has gained popularity due to its resistance to snow and ice, as noted by the Nordic Construction Materials Council. Furthermore, advancements in composite technology have enhanced the aesthetic appeal of synthetic materials, making them indistinguishable from natural wood. A survey by the French Consumer Research Institute reveals that 60% of homeowners prefer composites over wood due to their longevity and reduced upkeep. While wooden decking retains its charm and eco-friendly reputation, the aggressive marketing and technological advancements of competing materials pose a significant threat to its market share. To remain competitive, the wooden decking industry must emphasize innovation and sustainability.

SEGMENTAL ANALYSIS

By Type Insights

The pressure-treated wood segment accounted for a staggering 45.1% of the European market share in 2024. The prominent position of pressure-treated wood segment in the European market is attributed to its affordability, versatility, and widespread availability, which is making it the go-to choice for both residential and commercial projects. The treatment process, which involves infusing wood with preservatives under high pressure, enhances its resistance to rot, insects, and decay, extending its lifespan significantly. According to the UK Timber Trade Federation, pressure-treated wood decking installations have grown by 15% annually over the past decade, driven by its cost-effectiveness compared to premium options like tropical hardwood. Countries like Germany and France, with robust construction industries, rely heavily on this material for outdoor renovations. Additionally, advancements in eco-friendly preservatives have improved its environmental profile, aligning with Europe’s sustainability goals. For instance, Sweden has pioneered the use of non-toxic treatments, reducing chemical runoff by 30%, as reported by the Swedish Environmental Protection Agency. Despite competition from synthetic alternatives, pressure-treated wood remains the backbone of the decking market due to its balance of performance, price, and adaptability.

The wood-plastic composites (WPC) segment is estimated to register the highest CAGR of 13.3% over the forecast period. This rapid expansion of WPC segment in the European market is fueled by increasing consumer demand for low-maintenance, durable decking solutions. WPCs combine wood fibers with recycled plastics, offering superior resistance to moisture, UV rays, and pests compared to traditional wood. The Netherlands exemplifies this trend, where WPC decking now accounts for 35% of new installations, as reported by the Dutch Construction Industry Federation. Additionally, advancements in manufacturing technologies have reduced production costs, making WPCs more accessible to a broader audience. A study by the Fraunhofer Institute highlights that WPCs can last up to 25 years without significant degradation, providing long-term value to consumers. Moreover, their recyclability aligns with Europe’s circular economy initiatives, enhancing their appeal among environmentally conscious buyers. As awareness of WPC benefits grows, this segment is poised to reshape the decking landscape, challenging traditional materials with its innovative blend of aesthetics and functionality.

By Application Insights

The floor segment captured 61.6% of the European wooden decking market share in 2024. The dominating position of floor segment in the European market is attributed to the versatility and aesthetic appeal of wooden flooring, which seamlessly integrates into both indoor and outdoor spaces. In residential settings, wooden decks serve as extensions of living areas, creating functional spaces for relaxation and entertainment. According to the Italian Homeowners Association, over 70% of outdoor renovations in Italy include wooden flooring, reflecting its cultural significance. Similarly, commercial venues such as restaurants, hotels, and retail spaces utilize wooden floors to enhance ambiance and attract customers. For instance, Spain has witnessed a 20% increase in wooden floor installations in hospitality sectors, as noted by the Spanish Tourism Board. The durability and natural beauty of wood make it an ideal choice for high-traffic areas, while advancements in finishes and treatments ensure longevity. Furthermore, the growing trend of biophilic design, which emphasizes connections to nature, has bolstered demand for wooden flooring. Its widespread adoption underscores its importance as a cornerstone of modern architecture and lifestyle.

The railing segment is experiencing rapid growth and is predicted to witness a CAGR of 11.4% over the forecast period. This surge is driven by increasing investments in safety and aesthetic enhancements for outdoor spaces. Railings not only provide structural support but also serve as design elements that elevate the visual appeal of decks and patios. In countries like Sweden and Norway, where outdoor living is integral to the lifestyle, railing installations have grown by 25% annually, as reported by the Nordic Construction Materials Council. Additionally, advancements in materials such as aluminum-clad wood and glass-infused designs have expanded consumer choices, catering to diverse architectural styles. A study by the German Urban Planning Institute highlights that municipalities are increasingly incorporating railings into public spaces, such as parks and pedestrian walkways, to ensure safety while maintaining aesthetic harmony. Furthermore, the rise of modular railing systems has simplified installation, reducing labor costs and boosting adoption rates. As urbanization accelerates and safety regulations tighten, railing applications are set to become a key driver of innovation and growth in the wooden decking market.

By End User Insights

The residential segment captured 67.3% of the European market share in 2024. The growing emphasis on enhancing outdoor living spaces to complement modern lifestyles is one of the key factors propelling the growth of the residential segment in the European market. Homeowners across Europe are investing in wooden decking to create functional and aesthetically pleasing environments for relaxation, entertainment, and family gatherings. In the UK, for instance, over 40% of urban households have installed wooden decks, as reported by the British Homeowners Association. The trend is particularly pronounced in suburban areas, where larger properties allow for expansive outdoor renovations. Additionally, the rise of remote work during the pandemic has amplified this demand, as individuals seek to create private retreats within their homes. According to a study by the French National Institute for Urban Development, residential decking installations in France grew by 30% between 2020 and 2022. The affordability and versatility of materials like pressure-treated wood make them accessible to diverse income groups, further driving adoption. As urban populations continue to grow, the integration of wooden decking into residential spaces will remain a defining feature of contemporary living.

The non-residential segment is predicted to witness a CAGR of 9.3% over the forecast period, owing to the increasing investments in commercial, hospitality, and public infrastructure projects that prioritize outdoor spaces. Hotels, restaurants, and shopping centers are incorporating wooden decking into their designs to enhance customer experience and aesthetic appeal. For example, in Sweden, over 50% of new hospitality venues feature wooden decks, as noted by the Swedish Tourism Board. Similarly, public spaces such as parks, recreational areas, and pedestrian walkways are adopting wooden decking to create inviting and durable environments. A report by the German Urban Planning Institute reveals that municipalities spent €750 million on outdoor renovations in 2022, with decking being a significant component. The versatility of wooden decking allows it to complement various architectural styles, making it a preferred choice for diverse non-residential applications. As urban development accelerates, the integration of wooden decking into commercial and public projects will unlock substantial growth potential, positioning it as a key player in the evolving construction landscape.

REGIONAL ANALYSIS

Germany accounted for 25.5% of the European wooden decking market share in 2024. The strong emphasis on outdoor living and sustainable construction practices of Germany are driving the German market growth. With over 1.2 million new decking installations annually, Germany sets the benchmark for innovation and quality. According to the Fraunhofer Institute, German manufacturers have pioneered advanced wood treatment technologies, enhancing durability and weather resistance. Additionally, government incentives promoting green building materials have accelerated adoption rates, particularly in urban areas like Berlin and Munich. The country’s robust construction industry, coupled with a cultural appreciation for outdoor spaces, ensures sustained demand for wooden decking. Germany’s success serves as a model for other nations, demonstrating how technological advancements and policy support can drive market leadership.

The UK is another major regional segment in the European market with wooden decking playing a vital role in residential and commercial renovations. The British Homeowners Alliance reports that over 40% of urban households have installed wooden decks, driven by the growing trend of outdoor living. The UK’s temperate climate and cultural affinity for gardens make wooden decking an ideal solution for enhancing outdoor spaces. According to Eurostat, the UK wooden decking market has grown by 12% annually since 2018, reflecting its potential for further expansion. Government programs like the Green Homes Grant have supported the adoption of sustainable materials, including wood, in construction projects. Additionally, the rise of remote work during the pandemic has amplified demand, as homeowners seek to create private retreats within their properties. The UK’s strategic focus on sustainability and lifestyle trends positions it as a key player in the European wooden decking landscape.

France holds a notable share of the European wooden decking market and is driven by its focus on sustainable architecture and outdoor leisure. The French National Institute for Urban Development estimates that wooden decking installations have grown by 20% annually over the past five years, supported by government incentives promoting eco-friendly materials. According to the French Timber Trade Federation, over 30% of new construction projects incorporate wooden decking, reflecting its popularity among homeowners and developers. The country’s diverse climate, from coastal regions to inland cities, makes wooden decking a versatile choice for various applications. Additionally, advancements in wood treatment technologies have improved durability, addressing concerns about maintenance. France’s commitment to green construction practices and its thriving tourism industry further bolster demand, making it a significant contributor to the European wooden decking market.

Italy is a prominent regional market for wooden decking in Europe and leverages its strong tradition of craftsmanship and design to drive wooden decking adoption. The Italian Homeowners Association highlights that over 70% of outdoor renovations in Italy include wooden flooring, reflecting its cultural significance. Italy’s warm climate and emphasis on outdoor living make wooden decking an integral part of residential and commercial spaces. According to the Italian Timber Trade Federation, the market has grown by 15% annually since 2020, driven by increasing investments in hospitality and tourism infrastructure. Coastal regions like Amalfi and Tuscany have embraced wooden decking for its aesthetic appeal and functionality. Furthermore, the rise of biophilic design, which emphasizes connections to nature, has bolstered demand for wooden materials. Italy’s success demonstrates how regional strengths can be harnessed to advance wooden decking adoption, offering valuable lessons for other European nations.

Sweden is likely to grow at a healthy CAGR in the European wooden decking market over the forecast period. The Swedish Construction Industry Federation reports that over 60% of new residential projects incorporate wooden decking, driven by the country’s abundant forest resources and commitment to sustainability. Sweden’s cold climate and long winters make durable, low-maintenance materials like wood-plastic composites (WPC) particularly appealing. According to the Swedish Environmental Protection Agency, the use of eco-friendly preservatives has reduced chemical runoff by 30%, enhancing the environmental profile of wooden decking. Additionally, Sweden’s leadership in sustainable forestry ensures a steady supply of responsibly sourced timber. The country’s focus on outdoor living, even in harsh conditions, underscores the importance of wooden decking as a versatile and resilient solution. Sweden’s success highlights the potential for innovation and sustainability to drive market growth.

MARKET SEGMENTATION

This research report on the europe wooden decking market is segmented and sub-segmented based on categories.

By Type

- Pressure-treated Wood

- Red Wood

- Tropical Hardwood

- Cedar

- Wood-Plastic Composites (WPC)

- Other Types (Thermally Modified Wood, Acetylated Wood)

By Application

- Railing

- Floor

- Wall

- Other Applications

By End-user

- Residential

- Non-residential

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges faced by the wooden decking market in Europe?

The market faces challenges like susceptibility to weathering and pests, maintenance costs, and environmental concerns regarding deforestation. Additionally, competition from alternative materials like composite decking is grow.

What are the trends in the European wooden decking market?

Some emerging trends include a growing preference for composite decking, eco-friendly and sustainable materials, increased demand for custom decking designs, and innovations in decking treatments for enhanced durability.

What factors are driving the growth of the European wooden decking market?

Key drivers include increased demand for outdoor living spaces, growing interest in eco-friendly and sustainable building materials, and a rise in home improvement projects across Europe.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]