Europe Wood Pellet Heating Systems Market Size, Share, Trends, & Growth Forecast Report Segmented Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Wood Pellet Heating Systems Market Size

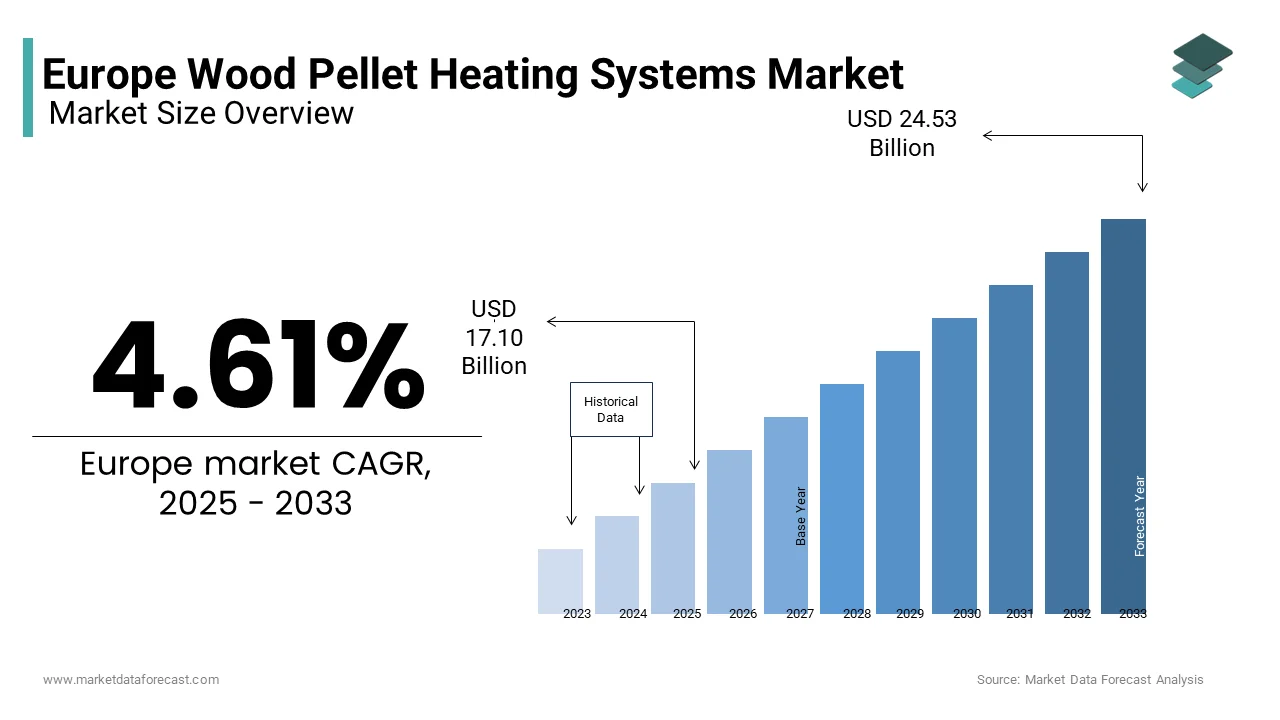

The European wood pellet heating systems market was valued at USD 16.35 billion in 2024 and is anticipated to reach USD 17.10 billion in 2025 from USD 24.53 billion by 2033, growing at a CAGR of 4.61% during the forecast period from 2025 to 2033.

The European wood pellet heating systems market is witnessing steady growth due to a combination of environmental policies, energy security concerns, and consumer interest in renewable energy sources. As per the European Biomass Association, nearly 50% of all renewable heat in Europe is generated from solid biomass, with wood pellets playing a pivotal role. The region's reliance on imported fossil fuels has driven governments to incentivize clean energy solutions. This regulatory push has bolstered demand for wood pellet heating systems in colder regions like Scandinavia and Eastern Europe.

MARKET DRIVERS

Government Policies Promoting Renewable Energy

Government initiatives aimed at reducing carbon emissions have significantly propelled the adoption of wood pellet heating systems. The European Green Deal, introduced in 2019, emphasizes achieving climate neutrality by 2050 by encouraging member states to adopt sustainable heating solutions. For instance, Germany’s Renewable Heat Act mandates that new buildings integrate renewable heating technologies, which is driving demand for wood pellet systems. According to the European Commission, subsidies for renewable heating systems increased by 15% between 2020 and 2022.

Rising Energy Costs and Volatility

Escalating natural gas prices have made wood pellet heating systems an attractive alternative for consumers. Following geopolitical tensions in 2022, natural gas prices surged by over 200%, according to the IEA. This volatility has prompted homeowners and businesses to seek stable, cost-effective heating options. Wood pellets are being locally sourced, offer price predictability, and lower operational costs compared to fossil fuels. The average cost of heating with wood pellets is approximately €4.5 per gigajoule, significantly lower than €12 per gigajoule for natural gas, as reported by the Austrian Energy Agency. Consequently, pellet stove sales rose by 25% in 2022 alone, highlighting affordability as a key driver.

MARKET RESTRAINTS

High Initial Investment Costs

Despite their long-term savings, the upfront costs of installing wood pellet heating systems remain a barrier for many consumers. This high initial expense deters budget-conscious buyers in economically challenged regions. Moreover, retrofitting older homes to accommodate these systems often requires additional investments, further increasing the overall cost burden. According to a survey conducted by the European Consumer Organization, nearly 40% of respondents cited affordability as the primary reason for not adopting wood pellet heating systems.

Logistical Challenges in Supply Chain

Supply chain disruptions pose another significant challenge to market growth. The production and distribution of wood pellets depend heavily on raw material availability and transportation infrastructure. As per the European Biomass Industry Association, logistical bottlenecks caused a 10% decline in pellet supply during peak winter months in 2022. Additionally, geographic disparities in pellet production capacity create regional shortages in Southern Europe, where local manufacturing is limited. For example, Italy imports nearly 70% of its wood pellets by making the market vulnerable to global supply fluctuations, as per the Italian Ministry of Environment.

MARKET OPPORTUNITIES

Technological Advancements Enhancing Efficiency

Technological innovations are creating new avenues for market expansion. Modern wood pellet boilers now achieve efficiencies exceeding 90%, thanks to advancements in combustion technology and automation, as per the Swedish Energy Agency. Smart pellet stoves equipped with IoT capabilities allow users to remotely monitor and adjust heating settings, enhancing convenience and energy savings. The integration of such features has led to a 12% increase in premium product sales in 2023. Furthermore, research into bio-enhanced pellets, which burn cleaner and produce less ash, is expected to attract environmentally conscious consumers, as noted by the Finnish Innovation Fund.

Rural Electrification and Decentralized Heating

Wood pellet heating systems present an ideal solution for rural areas lacking access to centralized heating networks. Approximately 25% of Europe’s population resides in rural regions, where traditional heating methods dominate, according to Eurostat. Governments are increasingly promoting decentralized heating solutions to improve energy access and reduce reliance on imported fuels. For example, France’s “Plan de Relance” provides huge investments to develop renewable heating infrastructure in rural communities. This initiative is projected to boost pellet boiler installations in the coming years to some extent.

MARKET CHALLENGES

Competition from Other Renewable Technologies

The growing popularity of alternative renewable heating technologies, such as heat pumps, poses a formidable challenge. Their ability to provide both heating and cooling makes them a versatile choice for urban dwellers. In contrast, wood pellet systems are primarily suited for heating purposes, limiting their applicability. Moreover, heat pumps benefit from lower maintenance requirements is appealing to tech-savvy consumers. This competitive pressure could hinder the pellet heating market’s growth trajectory unless it adapts through innovation and marketing strategies.

Public Perception and Awareness Gaps

Misconceptions about wood pellet heating systems persist and are affecting their widespread adoption. Many consumers associate wood pellets with traditional firewood is perceive them as inefficient or polluting. Bridging this awareness gap requires targeted educational campaigns. Unfortunately, inadequate promotional efforts have resulted in slower-than-expected market penetration in certain regions, such as Spain, where pellet heating accounts for less than 5% of renewable heating installations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.61% |

|

Segments Covered |

By Application and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe |

|

Market Leaders Profiled |

Stora Enso Oyj, Enviva Partners LP, AS Graanul Invest, Drax Group PLC, Segezha Group PJSC, Svenska Cellulosa Aktiebolaget SCA, German Pellets GmbH, Pure Biofuel Ltd, Pfeifer Group, Erdenwerk Gregor Ziegler GmbH. |

SEGMENTAL ANALYSIS

By Application Insights

The heating segment is expected to hold a dominant share of the Europe wood pellet systems market in 2024, with the region’s harsh winters and rising demand for sustainable residential heating solutions. For example, Sweden attributes 40% of its domestic heating needs to wood pellets by reflecting their critical role in cold climates. The segment’s growth is fueled by government incentives, such as tax rebates and low-interest loans, which encourage households to transition from oil-based systems. Additionally, the affordability of pellets compared to electricity or gas ensures sustained demand in rural areas.

The power generation segment is likely to grow with a prominent CAGR of 18.4% from 2025 to 2033. The growth of the segment is driven by the integration of biomass power plants into national grids. Countries like Finland and Estonia are investing heavily in co-firing technologies, blending wood pellets with coal to reduce emissions. For instance, Estonia plans to phase out coal entirely by 2030, replacing it with biomass-derived energy.

COUNTRY LEVEL ANALYSIS

Germany dominated the European wood pellet heating systems market by holding 28.3% of the share in 2024, with the stringent environmental policies, including the Renewable Energy Sources Act (EEG), which provides substantial subsidies for renewable heating technologies. Additionally, Germany’s robust manufacturing base and advanced logistics infrastructure ensure a steady supply of high-quality pellets. The country’s focus on phasing out coal-fired heating systems by 2038 further propels demand in rural areas where centralized heating networks are unavailable. According to the German Biomass Research Center, pellet heating systems accounted for 15% of all renewable heating installations in 202,2 with the nation’s energy transition.

Poland is swiftly emerging with a CAGR of 12% during the forecast period due to the rapid urbanization and industrialization. The Polish Ministry of Climate reports that pellet boiler installations surged by 30% in 2022 alone, fueled by skyrocketing natural gas prices and government initiatives promoting clean energy. Poland’s National Energy and Climate Plan aims to increase the share of renewable heating solutions to 21% by 2030 by creating a fertile ground for pellet system adoption. Moreover, the country’s strategic location facilitates cost-effective imports of wood pellets from neighboring Baltic states by ensuring affordability for consumers. This combination of favorable policies, economic factors, and regional cooperation positions Poland as a key growth driver in the European market.

France, Italy, and Spain are expected to witness moderate but steady growth in the coming years. Italy, heavily reliant on imported pellets, focuses on improving supply chain efficiency to reduce costs and boost adoption rates. Spain, despite lagging behind other EU nations, is gradually embracing pellet systems in rural areas, which is supported by regional grants and awareness campaigns. These countries collectively contribute to the market’s resilience and long-term sustainability.

KEY MARKET PLAYERS

Stora Enso Oyj, Enviva Partners LP, AS Graanul Invest, Drax Group PLC, Segezha Group PJSC, Svenska Cellulosa Aktiebolaget SCA, German Pellets GmbH, Pure Biofuel Ltd, Pfeifer Group, and Erdenwerk Gregor Ziegler GmbH are the market players that are dominating the Europe wood pellet boilers market.

Top Players In The Market

Viessmann, a German giant, leads with its innovative product portfolio catering to both residential and industrial applications. The company’s pellet boilers are renowned for their high efficiency, often exceeding 90%, and integration with smart home technologies. ÖkoFEN, an Austrian pioneer specializing in eco-friendly solutions, is offering pellet systems with minimal carbon footprints. Its Pelletronic control system allows users to optimize energy consumption remotely, enhancing convenience and sustainability. ETA Heiztechnik, headquartered in Austria, dominates Central and Eastern Europe with its compact yet powerful pellet boilers designed for small-scale applications. These players leverage their strong R&D capabilities and extensive distribution networks to maintain their competitive edge.

Key Strategies Used By Market Participants

The leading players in the European wood pellet heating systems market employ a variety of strategies to consolidate their positions and drive growth. Strategic partnerships with governments and utilities are a cornerstone of these efforts. For example, ÖkoFEN collaborates with Austrian energy providers to offer bundled solutions, combining pellet boilers with renewable electricity tariffs. Investment in research and development is another critical strategy, enabling companies to innovate and stay ahead of consumer demands. Digital marketing campaigns also play a pivotal role by allowing firms to raise awareness about the benefits of pellet heating systems and target environmentally conscious consumers. Finally, mergers and acquisitions are increasingly common, as seen in ETA Heiztechnik’s acquisition of a Czech manufacturer to expand its production capacity and market reach.

COMPETITIVE OVERVIEW

The European wood pellet heating systems market is characterized by moderate fragmentation, with a mix of established multinational corporations and smaller regional players. While large firms like Viessmann and ÖkoFEN dominate due to their technological prowess and brand recognition, niche players such as ETA Heiztechnik cater to specific segments, fostering healthy competition. The market’s competitive dynamics are shaped by continuous innovation, regulatory compliance, and customer-centric approaches. Companies strive to differentiate themselves through unique value propositions, such as smart connectivity features, low-emission designs, and after-sales services. Price wars remain limited, as most players focus on quality and sustainability rather than undercutting competitors. However, the entry of Asian manufacturers offering low-cost alternatives poses a potential threat is compelling incumbents to enhance operational efficiencies and explore untapped markets.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Viessmann launched a new series of smart pellet boilers equipped with IoT-enabled controls, allowing users to monitor and adjust heating settings via smartphone apps. This move reinforced its position as a leader in smart heating solutions.

- In June 2023, ÖkoFEN partnered with Austrian utility providers to promote pellet heating adoption, offering bundled discounts and financing options to attract price-sensitive consumers.

- In September 2023, ETA Heiztechnik invested €5 million in R&D to develop ultra-low-emission pellet boilers, aligning with stricter EU emission standards and appealing to eco-conscious buyers.

- In December 2023, Hargassner, a prominent player, acquired a Czech pellet boiler manufacturer, expanding its production capacity and strengthening its foothold in Eastern Europe.

- In February 2024, Froling introduced AI-driven efficiency optimization tools for its pellet systems, enabling users to achieve up to 15% higher energy savings, thereby enhancing customer satisfaction and loyalty.

MARKET SEGMENTATION

This research report on the Europe wood pellet heating systems market is segmented and sub-segmented into the following categories.

By Application

- Heating

- Power Generation

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the current trends shaping the European wood pellet heating systems market?

The market is shifting towards automation, smart heating integration, and hybrid systems that combine wood pellets with solar or electric power, driven by demand for energy efficiency and carbon neutrality.

How do wood pellet heating systems contribute to environmental sustainability in Europe?

They use renewable biomass, emit lower carbon compared to fossil fuels, and support the EU's climate goals. Pellet sourcing from sustainably managed forests is key to maintaining this eco-friendly cycle.

What’s driving residential adoption of pellet heating systems in Europe?

Rising energy prices, subsidies under EU green energy policies, and consumer preference for clean, cost-effective heating options are making pellet systems increasingly popular for homes.

What technological advancements are improving wood pellet heating systems?

Innovations include automatic feed systems, remote app control, real-time performance monitoring, and integration with smart thermostats, making systems more efficient and user-friendly.

How do EU policies affect the wood pellet heating systems market?

Stringent carbon emission regulations, energy efficiency targets, and financial incentives like tax credits and grants are boosting demand and guiding system design and standards across the EU.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]