Europe Wood-Based Panel Market Size, Share, Trends & Growth Forecast Report By Product (Plywood, MDF, HDF, Particleboard, OSB, Softboard, Hardboard), Application (Construction, Packaging, Furniture), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Wood-based Panel Market Size

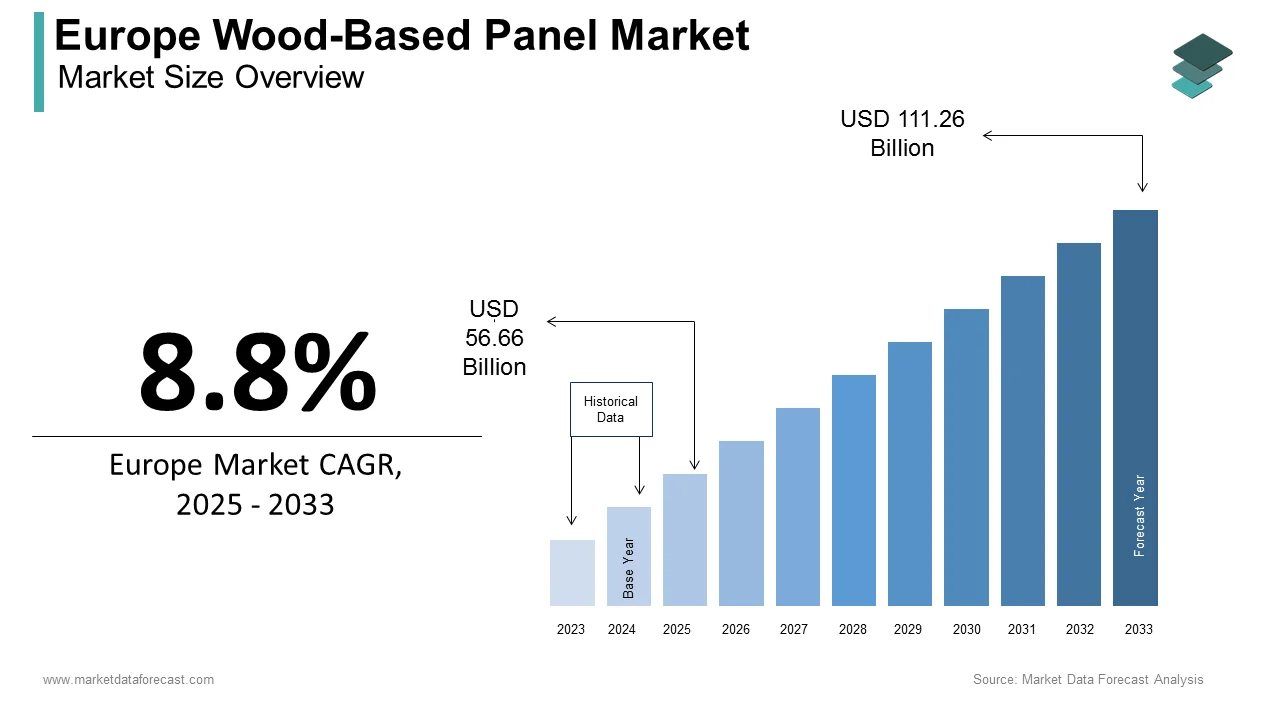

The wood-based panel market size in Europe was valued at USD 52.08 billion in 2024. The European market is estimated to be worth USD 111.26 billion by 2033 from USD 56.66 billion in 2025, growing at a CAGR of 8.8% from 2025 to 2033.

Wood-based panels, including plywood, medium-density fiberboard (MDF), particleboard, and oriented strand board (OSB) and are widely used in applications ranging from residential construction to interior design and industrial packaging. As per the European Panel Federation, over 70% of wood-based panels are utilized in the construction and furniture sectors, underscoring their critical role in these industries. Additionally, advancements in sustainable forestry practices and recycling technologies have improved material efficiency, reducing waste by 15%, as highlighted by the German Federal Ministry of Agriculture. With increasing emphasis on eco-friendly materials, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern industries.

MARKET DRIVERS

Rising Demand from the Construction Industry in Europe

The escalating demand from the construction industry that relies heavily on these materials for structural frameworks, flooring, and insulation is majorly driving the growth of the European wood-based panel market. According to the European Construction Industry Federation, construction spending in Europe exceeded €1.5 trillion in 2022, with wood-based panels accounting for over 30% of raw materials used in residential projects. This trend is particularly evident in Germany, where the government’s energy-efficient building initiatives have increased the adoption of OSB and MDF by 25%, as reported by the German Federal Ministry of Housing. For instance, as per a study by the French National Institute for Building Research, the use of engineered wood panels has grown by 20% in recent years, driven by their lightweight properties and thermal insulation capabilities. Additionally, the growing emphasis on modular construction has further amplified demand, with prefabricated homes requiring specialized wood-based solutions. By ensuring consistent quality and enhancing structural integrity, wood-based panels have become indispensable for modern construction, driving market growth across the continent.

Increasing Focus on Sustainable Building Materials

The growing focus on sustainable building materials is another major factor fuelling the expansion of the European market. According to the European Environment Agency, over 60% of wood-based panel manufacturers are investing in eco-friendly production processes, such as using recycled wood and bio-based adhesives, to meet regulatory standards. A study by the Swedish Environmental Protection Agency highlights that the adoption of sustainable wood-based panels grew by 18% in 2022, driven by government incentives for green building certifications. This trend is further bolstered by consumer preferences for environmentally responsible products, as noted by the Italian National Institute for Industrial Research. Additionally, advancements in formaldehyde-free adhesive formulations enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for sustainable solutions, solidifying their position in the market.

MARKET RESTRAINTS

High Costs of Raw Material Procurement

One of the primary restraints hindering the growth of the European wood-based panel market is the high cost associated with raw material procurement that often limits accessibility and affordability. According to the German Federal Ministry of Agriculture, the average price of timber and wood chips has surged by 40% since 2020, creating financial barriers for small-scale producers. This issue is particularly pronounced in Eastern Europe, where over 60% of manufacturers face logistical challenges due to fluctuating supply chains, as reported by the Czech Forestry Association. As per a study by the Italian National Institute of Statistics, only 35% of surveyed companies in rural areas have adopted advanced procurement strategies, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of wood-based panels. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Stringent Environmental Regulations

Stringent environmental regulations governing the production and use of wood-based panels that create additional compliance burdens for manufacturers is further restraining the growth of the European wood-based panel market. According to the European Environment Agency, over 50% of producers face delays in obtaining permits due to emissions and waste management requirements, leading to reduced operational capacity. This issue is compounded by ongoing debates over the use of formaldehyde-based adhesives, which have been linked to health risks, as highlighted by the French National Institute for Health and Safety. Furthermore, a study by the University of Hohenheim demonstrates that inconsistent regulatory frameworks often result in material losses of up to 25%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Adoption in Modular and Prefabricated Construction

The rising adoption in modular and prefabricated construction that offers cost-effective and time-efficient solutions for urban housing needs is a promising opportunity for the European wood-based panel market. According to the European Modular Building Institute, modular construction projects grew by 25% in 2022, with wood-based panels playing a vital role in creating lightweight and durable structures. This trend is particularly evident in Scandinavian countries like Sweden, where prefabricated homes account for over 30% of new constructions, as noted by the Swedish Construction Federation. For instance, a study by the Dutch Ministry of Infrastructure highlights that the use of engineered wood panels in modular homes achieved a 30% reduction in construction timelines, making them an attractive option for large-scale developments. Additionally, partnerships between academic institutions and private enterprises are accelerating innovation, ensuring scalability and affordability. The Horizon Europe program has allocated €1 billion for sustainable construction projects, including wood-based solutions, as noted by the European Commission. By fostering breakthroughs in modular construction, the market is poised to unlock immense growth potential.

Increasing Focus on Circular Economy Practices

The rising focus on circular economy practices that aim to reduce waste and enhance resource efficiency through recycling and reuse is a major opportunity for this regional market. According to the European Environment Agency, over 60% of wood-based panel manufacturers are investing in recycling technologies to recover materials from industrial waste, aligning with the EU’s Green Deal objectives. A study by the Swedish Environmental Protection Agency highlights that the adoption of recycled wood-based panels grew by 25% in 2022, driven by government incentives for sustainable practices. This trend is further bolstered by consumer preferences for environmentally responsible products, as noted by the French National Institute for Industrial Research. Additionally, advancements in recycling techniques enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for sustainable solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Timber Shortages

The ongoing supply chain disruptions and timber shortages is a major challenge to the European wood-based panel market. According to the European Panel Federation, global shortages of key raw materials led to a 15% decline in wood-based panel production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Germany, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the German Federal Ministry of Agriculture. According to a study by the Italian National Institute of Statistics, 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as timber and adhesives, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Limited Awareness Among Small-Scale Producers

Limited awareness among small-scale producers regarding the benefits and proper usage of advanced wood-based panels is another significant challenge to the European market. According to the Swedish Board of Agriculture, over 50% of small-scale furniture and construction businesses lack technical knowledge about material selection and application techniques, leading to suboptimal outcomes despite investing in premium products. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Economic Development, which reports that producers aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce the lifespan of advanced wood-based panels by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Ante-Group, ARAUCO, Canfor, Dongwha Malaysia Holdings Sdn Bhd, Georgia-Pacific, Idaho Forest Group, LLC, Interfor Corp., KLAUSNER-GROUP, KlenkHolz AG, Kronospan Worldwide, Weyerhaeuser, Dieffenbacher GmbH, Holzindustrie Schweighofer, Shanghai Jechen Group Company Ltd., Sierra Pacific Industries, Sodra, Stora Enso, Timber Products Co., Ltd., Tolko Industries, West Fraser Timber Co., Ltd., Hampton Affiliates, Pfeifer Gruppe, Resolute Forest Products, Rettenmeier Holding AG, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The particleboard segment had the largest share of 34.3% of the Europe wood-based panel market share in 2024. The cost-effectiveness and versatility of particleboard is making it a staple in furniture manufacturing and interior design, which is primarily driving the domination of the particleboard segment in the European market. According to the European Furniture Industries Confederation (EFIC), particleboard accounts for over 60% of all materials used in mass-produced furniture, such as cabinets, shelves, and desks. This widespread adoption is driven by its affordability as particleboard costs 40-50% less than plywood or MDF and its ability to be engineered with laminates or veneers for aesthetic appeal. Additionally, particleboard aligns with sustainability goals; a study by the European Panel Federation highlights that over 80% of particleboard is manufactured using recycled wood waste, reducing landfill contributions. With the EU’s Circular Economy Action Plan emphasizing resource efficiency, particleboard’s eco-friendly profile strengthens its position. Furthermore, the rise of e-commerce has spurred demand for affordable, flat-pack furniture, which predominantly uses particleboard. IKEA, for instance, relies heavily on particleboard for its modular designs, catering to budget-conscious consumers across Europe.

The OSB segment is the fastest-growing segment in the Europe wood-based panel market and is projected to grow at a CAGR of 7.72% over the forecast period owing to increasing use in construction, particularly for structural applications like roof sheathing, wall panels, and flooring. A report by Euroconstruct reveals that residential construction in Europe is expected to grow by 10% annually, driven by urbanization and housing shortages. The superior strength-to-weight ratio of OSB is offering up to 30% higher load-bearing capacity compared to traditional plywood, as noted in a study by the Journal of Building Engineering, which makes it ideal for modern lightweight building designs. Moreover, OSB’s moisture resistance, achieved through advanced resins and coatings, enhances its durability in humid climates. The push for sustainable construction practices also benefits OSB, as it is manufactured from fast-growing softwood species, reducing reliance on slow-growth hardwoods. With governments investing in green infrastructure, the role of OSB in eco-friendly construction is set to expand further.

By Application Insights

The furniture segment accounted for 41.3% of the European wood-based panel market share in 2024. The domination of the furniture segment in the European market is attributed to the reliance of furniture industry on wood-based panels for crafting affordable, durable, and customizable products. The European Furniture Industries Confederation reports that furniture production in Europe reached €90 billion in 2022, with wood-based panels forming the backbone of this output. Particleboard and MDF are particularly favored for their smooth surfaces, which facilitate easy finishing and design flexibility. Additionally, the rise of modular and ready-to-assemble furniture is popularized by brands like IKEA and HAY, which has amplified demand for these materials. A McKinsey study highlights that online furniture sales grew by 25% annually during the pandemic, further boosting panel consumption. Sustainability also plays a key role; wood-based panels reduce reliance on solid timber, addressing deforestation concerns. With the EU’s Green Public Procurement policies encouraging eco-friendly materials, the furniture segment remains pivotal in shaping the market’s trajectory.

The construction segment is experiencing rapid expansion and is expected to register a CAGR of 7.4% over the forecast period. The rising demand for energy-efficient and sustainable building solutions is primarily driving the growth of the construction segment in the European market. According to the European Construction Industry Federation (FIEC), construction activity in Europe is expected to grow by 15% over the next decade, driven by urbanization and government investments in infrastructure. Wood-based panels like OSB and plywood are increasingly used in prefabricated homes, which offer faster construction times and lower carbon footprints. A study by the Fraunhofer Institute highlights that prefabricated housing reduces construction waste by up to 50%, aligning with the EU’s circular economy goals. Additionally, the shift toward passive house designs requires high-performance insulation, which is boosting demand for engineered wood panels. For instance, Austria, a leader in passive housing, mandates the use of OSB in 80% of new builds due to its thermal efficiency. As Europe strives to achieve net-zero emissions by 2050, the construction segment emerges as a critical driver of innovation in the wood-based panel market.

REGIONAL ANALYSIS

Top 5 Leading Countries in the Europe Wood-Based Panel Market

Poland has emerged as the top producer of wood-based panels in Europe, with a production volume of 12.56 million cubic meters in 2023. This remarkable output represents a year-on-year growth of 10.46% and. The ascendancy of Poland in this sector can be attributed to its abundant forest resources and a well-established wood processing industry. The strategic investments of Poland in modern manufacturing facilities and its focus on sustainable forest management have further bolstered its production capabilities. Additionally, Poland's central location in Europe facilitates efficient distribution to various markets, enhancing its competitiveness in the wood-based panel industry.

Germany holds a significant share in the European wood-based panel market, with a production volume of 11.88 million cubic meters in 2023. Although this reflects a slight decrease of 0.74% from the previous year, Germany's robust construction industry continues to drive demand for wood-based panels. The construction sector contributes approximately 6% to Germany's GDP, underscoring its importance to the national economy. The country's emphasis on sustainable building practices and energy-efficient structures has led to increased utilization of wood-based materials. Moreover, Germany's strong tradition in woodworking and engineering excellence ensures the production of high-quality panels, meeting both domestic and international standards.

The Italian wood-based panel production reached 4.88 million cubic meters in 2023, marking a year-on-year growth of 6.01%. The Italian furniture industry's global reputation for design and craftsmanship significantly drives the demand for wood-based panels. Italy's focus on blending traditional woodworking techniques with modern technologies has resulted in innovative panel products. Furthermore, the country's commitment to environmental sustainability has led to the adoption of eco-friendly materials and processes, aligning with global trends and consumer preferences.

Romania produced 4.6 million cubic meters of wood-based panels in 2023, reflecting a year-on-year growth of 2.48%. The country's extensive forest resources provide a solid foundation for its wood processing industry. Romania's strategic location and cost-competitive labor market have attracted investments in wood-based panel manufacturing. Additionally, the government's initiatives to promote sustainable forest management and modernize industrial facilities have enhanced production efficiency and product quality.

France's wood-based panel production stood at 4.59 million cubic meters in 2023, with a marginal decline of 0.097% from the previous year and. The country's diverse applications of wood-based panels span across furniture manufacturing, construction, and packaging industries. France's emphasis on environmental sustainability has led to increased demand for renewable materials, positioning wood-based panels as a preferred choice. Moreover, the recovery of the construction sector and growth in the furniture industry are anticipated to drive future demand for these panels.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe wood-based panel market profiled in this report are Ante-Group, ARAUCO, Canfor, Dongwha Malaysia Holdings Sdn Bhd, Georgia-Pacific, Idaho Forest Group, LLC, Interfor Corp., KLAUSNER-GROUP, KlenkHolz AG, Kronospan Worldwide, Weyerhaeuser, Dieffenbacher GmbH, Holzindustrie Schweighofer, Shanghai Jechen Group Company Ltd., Sierra Pacific Industries, Sodra, Stora Enso, Timber Products Co., Ltd., Tolko Industries, West Fraser Timber Co., Ltd., Hampton Affiliates, Pfeifer Gruppe, Resolute Forest Products, Rettenmeier Holding AG, and others.

MARKET SEGMENTATION

This Europe wood-based panel market research report is segmented and sub-segmented into the following categories.

By Product

- Plywood

- MDF

- HDF

- Particleboard

- OSB

- Softboard

- Hardboard

By Application

- Construction

- Packaging

- Furniture

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth outlook for the Europe wood-based panel market?

The Europe wood-based panel market is expected to grow from USD 56.66 billion in 2025 to USD 111.26 billion by 2033, at a CAGR of 8.8%.

2. What factors drive the Europe wood-based panel market?

The Europe wood-based panel market is driven by construction industry expansion, rising demand for sustainable furniture, and modular housing trends.

3. What challenges does the Europe wood-based panel market face?

The Europe wood-based panel market faces challenges such as high raw material costs, deforestation concerns, and stringent environmental regulations.

4. Which segment dominates the Europe wood-based panel market?

The Europe wood-based panel market is led by plywood and particleboard, primarily used in flooring, furniture, and structural applications.

5. How is sustainability shaping the Europe wood-based panel market?

The Europe wood-based panel market is embracing recycled wood, eco-friendly adhesives, and sustainable forestry practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]