Europe Wire and Cable Market Size, Share, Trends & Growth Forecast Report By Voltage (Low, Medium, High, Extra-High), Installation, End-use, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Wire and Cable Market Size

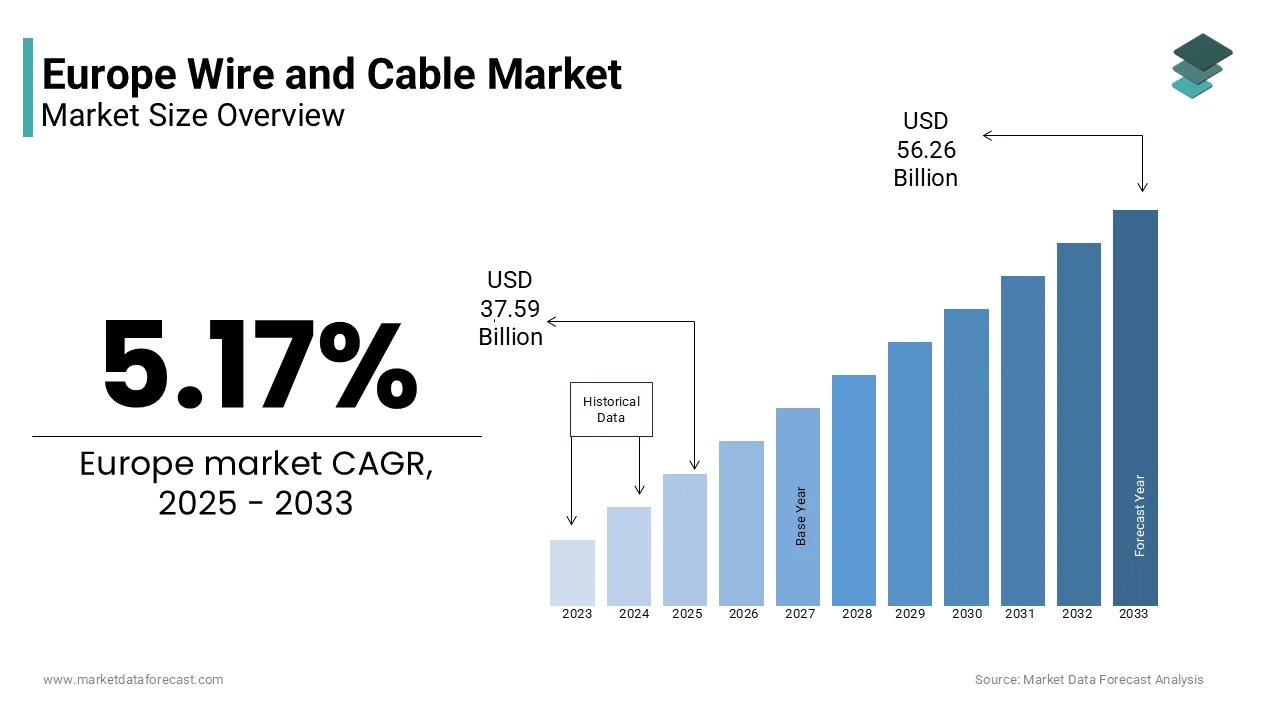

The Europe Wire and Cable market size was valued at USD 35.74 billion in 2024. The European market size is estimated to be worth USD 56.26 billion by 2033 from USD 37.59 billion in 2025, growing at a CAGR of 5.17% from 2025 to 2033.

The Europe wire and cable market is a cornerstone of the region’s industrial and infrastructure development, underpinning sectors such as energy, construction, and telecommunications. Also, the European electrical equipment industry, which includes wire and cable manufacturing, contributes substantially each year to the EU economy. Germany, France, and Italy collectively account for a significant portion of the market and is driven by their robust manufacturing bases and advanced infrastructure projects. In addition, the demand for low-voltage cables dominates due to their widespread use in residential and commercial buildings. The rise of renewable energy projects has further bolstered the market. Additionally, government initiatives like the EU Green Deal have spurred demand for eco-friendly cables, ensuring steady growth despite economic uncertainties.

MARKET DRIVERS

Expansion of Renewable Energy Infrastructure

The rapid expansion of renewable energy projects across Europe is a key driver propelling the wire and cable market. According to the European Environment Agency, renewable energy sources accounted for 38% of electricity generation in 2022, up from 34% in 2020. This growth has created substantial demand for specialized cables used in wind turbines, solar panels, and grid connections. A report by BloombergNEF indicates that offshore wind farms alone require significant kilometers of high-voltage cables per gigawatt of installed capacity. Moreover, the EU’s commitment to achieving carbon neutrality by 2050 has led to increased funding for renewable energy projects, further boosting demand for durable and efficient cables.

Urbanization and Smart City Development

Urbanization and the development of smart cities are driving significant demand for wire and cable solutions in Europe. Also, smart city initiatives, such as those in Barcelona and Amsterdam, rely heavily on IT and telecommunication cables to support IoT devices, smart grids, and connected transportation systems. Additionally, the growing adoption of electric vehicles (EVs) and charging stations has amplified demand for specialized cables, reinforcing the market’s upward trajectory.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

Fluctuating raw material prices pose a significant challenge for the wire and cable market. Copper, a primary material used in cable manufacturing, has experienced price volatility, with costs increasing in recent years. This instability impacts production costs and profit margins, particularly for small and medium-sized enterprises (SMEs). A report by Deloitte highlights that 40% of wire and cable manufacturers in Europe cite raw material costs as a primary concern. Besides, geopolitical tensions and supply chain disruptions have exacerbated shortages, leading to delays in project timelines.

Stringent Environmental Regulations

Stringent environmental regulations governing the production and disposal of cables have emerged as a restraint for the market. Like, manufacturers must comply with REACH regulations, which restrict the use of hazardous substances like PVC and halogenated flame retardants. Meeting these requirements necessitates significant R&D investments. Smaller players often struggle to keep pace, leading to consolidation and reduced competition. Furthermore, recycling mandates add to operational complexities, undermining profitability and market responsiveness.

MARKET OPPORTUNITIES

Adoption of Eco-Friendly Cables

The growing emphasis on sustainability presents a transformative opportunity for the wire and cable market. Eco-friendly cables, such as those made from recyclable materials or free of hazardous chemicals. These products align with the EU Green Deal objectives, which aim to reduce carbon emissions and promote circular economies. Moreover, government incentives for green infrastructure projects provide strong impetus for adopting sustainable cables.

Growth in Electric Vehicle (EV) Infrastructure

The surge in electric vehicle adoption is creating lucrative opportunities for the wire and cable market. Similarly, EV registrations in Europe grew considerably, accounting for a noticeable share of total car sales. Charging stations and EV components require specialized cables capable of handling high currents and voltages. BloombergNEF forecasts that EVs will constitute 50% of new car sales in Europe by 2030, driving demand for advanced wiring solutions. Also, government policies mandating the installation of EV chargers in public spaces and residential complexes further amplify this growth.

MARKET CHALLENGES

Intense Competition and Price Wars

Intense competition among manufacturers has led to price wars, undermining profitability in the wire and cable market. A notable number of companies operate in the region, creating a highly fragmented landscape. Larger players often leverage economies of scale to offer competitive pricing, squeezing out smaller firms. Additionally, the influx of low-cost imports from Asia exacerbates the issue, forcing domestic manufacturers to either innovate or consolidate. This challenge shows the need for differentiation through quality and innovation.

Supply Chain Disruptions

Supply chain disruptions have emerged as a persistent challenge for the wire and cable market. Like, logistical bottlenecks caused by geopolitical tensions and the COVID-19 pandemic led to a decline in raw material availability. Copper and aluminum, essential for cable manufacturing, faced shipping delays and price volatility, impacting production schedules. These disruptions not only increase lead times but also undermine long-term contracts, forcing companies to explore localized sourcing options despite higher costs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.17% |

|

Segments Covered |

By Voltage, Installation, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Nexans (France), Prysmian Group (Italy), General Cable (Spain), Lapp Group (Germany), Southwire Company, LLC (United States), Acome (France), Encore Wire Corporation (United States), TSI Cable Technologies (Germany), Copenhagen Cable (Denmark), Hengtong Group (China), Wuxi Jiangnan Cable Co., Ltd. (China), Kabelwerk Eupen AG (Belgium), RPG Group (India), and others. |

SEGMENT ANALYSIS

By Voltage Insights

Low voltage cables commanded the Europe wire and cable market, holding a 45.5% share in 2024. This leading position is due to their widespread use in residential, commercial, and industrial applications, including lighting, power distribution, and HVAC systems. A significant portion of new construction projects in Europe utilize low voltage cables due to their cost-effectiveness and ease of installation. Besides, stringent safety regulations have driven the adoption of flame-retardant and eco-friendly low voltage cables, reinforcing their dominance.

The extra-high voltage cables segment is moving ahead quickly, with a CAGR of 9.5%. This progress is propelled by the expansion of renewable energy projects, particularly offshore wind farms and cross-border grid connections. A study by the European Environment Agency emphasizes that extra-high voltage cables are essential for transmitting electricity over long distances with minimal losses, making them critical for integrating renewable energy into the grid.

By Installation Insights

The underground cables accounted for the largest share of the Europe wire and cable market by representing 60.2% in 2024. This dominance is attributed to their reliability and aesthetic advantages, particularly in urban areas where overhead lines are impractical. Similarly, underground cables are used in a notable number of new infrastructure projects in densely populated regions like Germany and France. Additionally, government mandates promoting underground installations for safety and environmental reasons have further solidified this segment's leadership.

The overhead cables segment is the swiftest expanding installation category, with a CAGR of 7.8%. This growth is driven by the expansion of rural electrification projects and the need for cost-effective solutions in remote areas. Like, overhead cables are ralatively cheaper to install than underground alternatives, making them ideal for connecting isolated communities. Moreover, advancements in materials, such as high-strength aluminum conductors, have improved durability and performance, enhancing their appeal. This trend positions overhead cables as a key driver of rural development and energy access.

By End-use Insights

The energy and power sector segment dominated the Europe wire and cable market by accounting for 35.3% of the total share in 2024. This is driven by the sector’s critical role in supporting renewable energy projects, grid modernization, and electrification initiatives. According to BloombergNEF, investments in renewable energy infrastructure exceeded €40 billion in 2022, creating substantial demand for specialized cables. A report notes that energy and power applications require durable and high-performance cables capable of withstanding extreme conditions, reinforcing their dominance. Additionally, government policies mandating carbon neutrality by 2050 provide strong impetus for sustained growth.

The segment of IT and telecommunication is the fastest-growing application with a CAGR of 11.2% during the forecast period. This growth is fueled by the rapid expansion of 5G networks, data centers, and IoT devices across Europe. Moreover, smart city initiatives, such as those in Barcelona and Amsterdam, rely heavily on advanced wiring solutions to support connected systems. This trend exhibits the segment’s potential to capitalize on digital transformation and connectivity trends.

REGIONAL ANALYSIS

Germany remained the top performer in the Europe wire and cable market by commanding a 25.6% share in 2024. This growth is credited to the country’s advanced industrial base and robust infrastructure development. Also, Germany accounts for a major portion of Europe’s manufacturing output, with sectors like automotive, renewable energy, and construction driving demand for specialized cables. The country’s focus on sustainability has further solidified its position, with government incentives promoting eco-friendly solutions. Additionally, Germany’s strategic investments in smart city initiatives, such as Berlin’s IoT-driven urban development, have amplified the need for advanced wiring solutions, reinforcing its dominance.

Spain is emerging as the fastest-growing market for wire and cable solutions, with a projected CAGR of 8.5%. This growth is driven by significant investments in renewable energy, particularly solar and wind power. A report by BloombergNEF highlights that Spain added 7.5 GW of renewable energy capacity in 2022 alone, accounting for 20% of Europe’s total additions. This expansion has created substantial demand for specialized cables used in grid connections and energy transmission. Moreover, Spain’s urbanization drive, coupled with EU funding programs like the Recovery and Resilience Facility, has accelerated infrastructure development.

France, Italy, and the UK are also poised for steady growth, albeit at slower rates compared to Spain. France, with its focus on nuclear energy and smart grid modernization. Italy, renowned for its manufacturing excellence, continues to drive demand for industrial and automotive cables. Meanwhile, the UK benefits from its expanding EV infrastructure, supported by government policies mandating the installation of charging stations.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Nexans (France), Prysmian Group (Italy), General Cable (Spain), Lapp Group (Germany), Southwire Company, LLC (United States), Acome (France), Encore Wire Corporation (United States), TSI Cable Technologies (Germany), Copenhagen Cable (Denmark), Hengtong Group (China), Wuxi Jiangnan Cable Co., Ltd. (China), Kabelwerk Eupen AG (Belgium), RPG Group (India), SAB Cable (Germany), Wieland Electric GmbH (Germany), Sumitomo Electric Industries Ltd. (Japan), TF Kable (Turkey), and Volex Group (United Kingdom) are the key players in the Europe wire and cable market.

The Europe wire and cable market is characterized by intense competition, driven by technological advancements, regulatory pressures, and evolving consumer demands. Leading players such as Prysmian Group, Nexans, and Leoni AG dominate the market by leveraging their expertise in high-performance and sustainable solutions to differentiate themselves. However, smaller players and regional firms are also gaining traction by offering cost-effective solutions and focusing on niche applications.

The shift toward sustainable manufacturing has intensified competition, with companies investing heavily in R&D to develop eco-friendly alternatives to traditional cables. Moreover, the rise of renewable energy and digital transformation has created new opportunities for differentiation, with players competing to provide innovative solutions for smart grids and EV infrastructure.

Strategic partnerships and collaborations with energy and infrastructure firms ensure long-term contracts and enhance brand reputation. Despite economic uncertainties and supply chain disruptions, the market remains resilient, with innovation and customer-centric strategies driving sustained growth.

TOP PLAYERS IN THIS MARKET

Prysmian Group

Prysmian Group, headquartered in Milan, Italy. The company specializes in high-voltage and submarine cables, which are critical for renewable energy projects and cross-border grid connections. Prysmian’s focus on innovation is evident in its development of eco-friendly cables made from recyclable materials, aligning with the EU Green Deal objectives. Its global presence and strong distribution network enable it to serve diverse industries, including energy, telecommunications, and infrastructure, reinforcing its leadership position.

Nexans

Nexans, based in Paris, France, and is recognized for its high-performance cables used in energy, transportation, and telecommunications. The company leverages advanced technologies to offer sustainable and durable solutions, such as flame-retardant and halogen-free cables. Its commitment to sustainability is evident in its development of lightweight cables for electric vehicles, aligning with EU policies promoting electrification. Nexans’ ability to adapt to evolving market demands ensures its continued growth in the competitive European landscape.

Leoni AG

Leoni AG, headquartered in Nuremberg, Germany, and specializes in automotive and industrial cables. The company invests heavily in R&D to develop innovative solutions, such as lightweight wiring harnesses for electric vehicles (EVs). Additionally, Leoni’s partnerships with major automakers, including BMW and Volkswagen, ensure a steady demand for its products. Its focus on quality and reliability has made it a preferred supplier in the automotive sector, driving its growth in the European market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe wire and cable market employ a variety of strategies to maintain their competitive edge and capitalize on emerging opportunities:

Product Innovation: Companies like Prysmian and Nexans invest heavily in R&D to develop next-generation cables, such as eco-friendly and lightweight solutions. These innovations not only enhance performance but also address environmental concerns, aligning with EU regulations.

Strategic Partnerships: Collaborations with energy firms, automakers, and technology providers are a cornerstone of market strategies.

Acquisitions and Expansions: To expand their geographic footprint and product portfolios, companies pursue mergers and acquisitions. Prysmian completed the acquisition of Encore Wire, a major US producer of copper and aluminum wire and cables exemplifies this strategy, enabling it to tap into new markets and strengthen its supply chain capabilities.

Customer-Centric Solutions: Tailoring products to meet specific customer needs is another key strategy. For example, Leoni offers modular wiring solutions that can be adapted for both small-scale and large-scale applications, ensuring flexibility and scalability for its clients.

RECENT HAPPENINGS IN THE MARKET

- April 2024 - Prysmian Launches Eco-Friendly Cable Line: Prysmian introduced a new line of recyclable cables designed to reduce environmental impact. This innovation aligns with EU Green Deal objectives, reinforcing its leadership in sustainability.

- June 2024 - Nexans Partners with Renewable Energy Firms: Nexans announced a partnership with wind energy companies to develop specialized high-voltage cables, ensuring cutting-edge solutions for Europe’s energy transition.

- September 2024 - Leoni Invests €50 Million in R&D: Leoni invested €50 million to develop lightweight automotive cables, enhancing efficiency and supporting the EV revolution.

- January 2025 - Prysmian Acquires Submarine Cable Firm: Prysmian acquired a firm specializing in submarine cables, expanding its geographic footprint and bolstering its product portfolio.

- March 2025 - Nexans Launches Smart Grid Solutions: Nexans launched advanced cables for smart grid applications, enhancing connectivity and supporting Europe’s digital transformation.

MARKET SEGMENTATION

This research report on the Europe Wire and Cable market is segmented and sub-segmented into the following categories.

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

By Installation

- Overhead

- Underground

By End-use

- Aerospace & Defense

- Building & Construction

- Oil & Gas

- Energy & Power

- IT & Telecommunication

- Automotive

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key opportunities in the Europe Wire and Cable Market?

The market is driven by increasing investments in renewable energy projects, electric vehicle (EV) infrastructure, smart grid development, and the rapid expansion of 5G and fiber-optic networks across the region.

2. What are the major challenges facing the Europe Wire and Cable Market?

Key challenges include volatile raw material prices, stringent environmental regulations, and supply chain disruptions that affect the availability and cost of essential components like copper and aluminum.

3. Who are the major players in the Europe Wire and Cable Market?

Leading companies include Prysmian Group, Nexans, NKT A/S, Leoni AG, and LS Cable & System, known for their strong R&D, extensive distribution networks, and focus on sustainable cabling solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]