Europe Welding Consumables Market Size, Share, Trends & Growth Forecast Report By Product (Stick Electrodes, Solid Wires, Flux Cored Wires, SAW Wires and Fluxes, and Others), Welding Technique, End Use Industries, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Welding Consumables Market Size

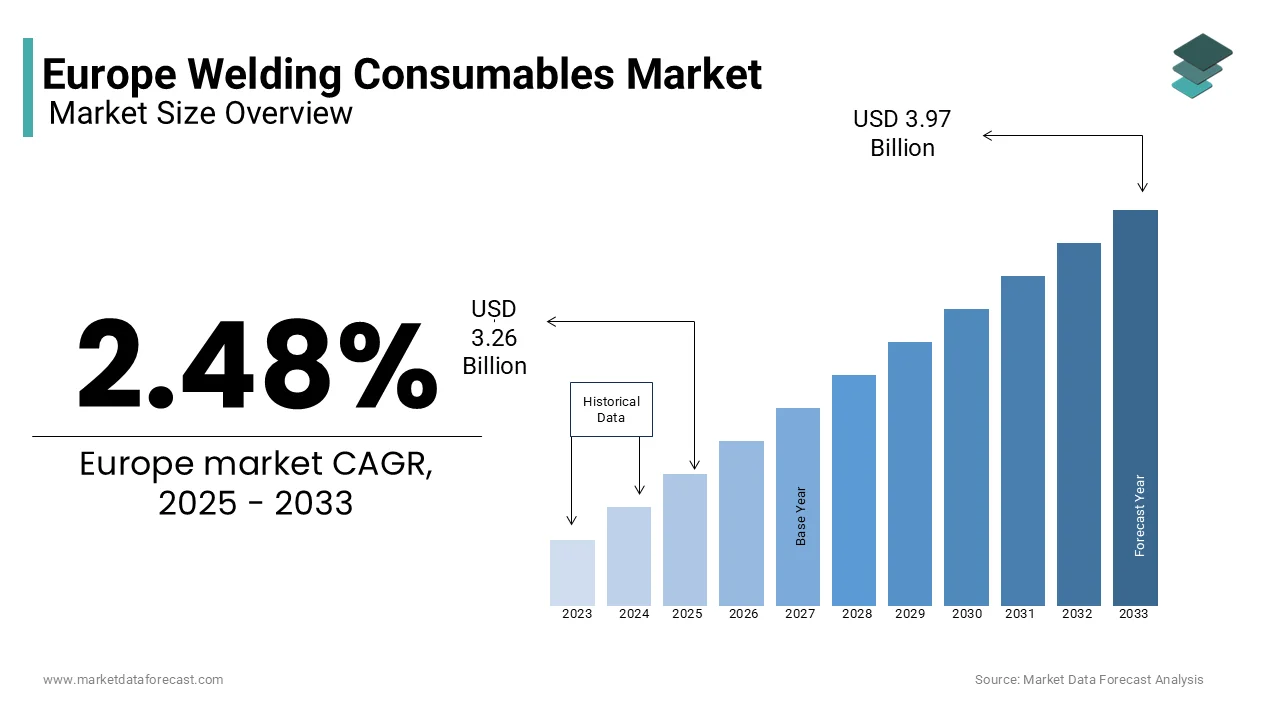

The Europe welding consumables market size was valued at USD 3.18 billion in 2024. The European market is estimated to be worth USD 3.97 billion by 2033 from USD 3.26 billion in 2025, growing at a CAGR of 2.48% from 2025 to 2033.

Welding consumables, including electrodes, wires, and fluxes, are essential for joining metals in various applications such as automotive, shipbuilding, and energy production. As per the European Federation for Welding, Joining and Cutting, over 70% of welding consumables are utilized in the automotive and construction sectors, underscoring their importance in these industries. Additionally, advancements in welding technologies, such as automated and robotic systems, have improved efficiency and precision, reducing material wastage by 15%, as highlighted by the German Welding Society. With increasing emphasis on sustainable practices, such as eco-friendly fluxes and recyclable materials, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern industries.

MARKET DRIVERS

Rising Demand from the Automotive Industry in Europe

The escalating demand from the automotive industry that heavily relies on welding technologies for vehicle assembly and component fabrication is primarily driving the European welding consumables market growth. According to the European Automobile Manufacturers’ Association, automobile production in Europe reached 18 million units in 2022, with welding processes accounting for over 40% of metal joining operations. This trend is particularly evident in Germany, where the automotive sector contributes approximately 20% to the national GDP, as reported by the German Federal Ministry of Economic Affairs. For instance, a study by the French National Institute for Automotive Research highlights that the adoption of advanced welding consumables, such as gas-shielded wires, has increased by 25% in recent years, driven by the need for lightweight and durable vehicle designs. Additionally, the growing emphasis on electric vehicles (EVs) has further amplified demand, with EV production requiring specialized welding solutions. By ensuring consistent quality and enhancing structural integrity, welding consumables have become indispensable for modern automotive manufacturing, driving market growth across the continent.

Expansion of Infrastructure Development Projects

The expansion of infrastructure development projects that need robust welding solutions for construction and maintenance activities is further fuelling the growth of the European welding consumables market. According to the European Construction Industry Federation, infrastructure spending in Europe exceeded €200 billion in 2022, with welding consumables playing a vital role in bridge construction, pipeline installation, and renewable energy projects. This trend is particularly pronounced in countries like France and Spain, where government initiatives aim to modernize aging infrastructure and transition to sustainable energy systems. According to a report by the Italian Ministry of Infrastructure, welding wire consumption grew by 18% in 2022 due to investments in high-speed rail networks and offshore wind farms. Additionally, the Swedish Transport Administration notes that automated welding technologies have reduced project timelines by 20%, enhancing operational efficiency. By addressing the demands of large-scale projects and ensuring durability, welding consumables are unlocking immense growth potential in the infrastructure sector.

MARKET RESTRAINTS

High Costs of Advanced Welding Materials

The high cost associated with advanced welding materials that often deter small and medium-sized enterprises (SMEs) from adopting them, which is one of the key factors hindering the growth of the European welding consumables market. According to the German Welding Society, the average price of premium welding wires and fluxes exceeds €10 per kilogram, creating financial barriers for businesses operating on tight budgets. This issue is particularly pronounced in Eastern Europe, where over 60% of SMEs lack access to financing options or subsidies, as reported by the Czech Ministry of Industry and Trade. As per a study by the Italian National Institute of Statistics, only 35% of surveyed companies in rural areas have transitioned to advanced welding consumables, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of these materials. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Stringent Environmental Regulations

The stringent environmental regulations governing the production and use of welding consumables that create additional compliance burdens for manufacturers is further inhibiting the growth of the European welding consumables market. According to the European Environment Agency, over 50% of welding consumable producers face delays in obtaining permits due to emissions and waste management requirements, leading to reduced operational capacity. This issue is compounded by ongoing debates over the use of hazardous materials, such as chromium and nickel-based fluxes, which have been linked to health risks, as highlighted by the French National Institute for Health and Safety. Furthermore, as per a study by the University of Hohenheim demonstrates that inconsistent regulatory frameworks often result in material losses of up to 25%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Adoption of Automation and Robotics

The growing adoption of automation and robotics that enhance precision and efficiency in welding processes is one of the promising opportunities for the European welding consumables market. According to the European Robotics Association, the market for automated welding systems grew by 25% in 2022, with over 50,000 units installed across Europe. These systems rely heavily on advanced welding consumables, such as flux-cored wires and solid wires, to achieve seamless metal joining. For instance, as per a study by the Dutch Ministry of Economic Affairs, robotic welding systems achieved a 30% reduction in material wastage, making them an attractive option for industries like automotive and aerospace. Additionally, partnerships between academic institutions and private enterprises are accelerating innovation, ensuring scalability and affordability. The Horizon Europe program has allocated €1 billion for smart manufacturing projects, including welding technologies, as noted by the European Commission. By fostering breakthroughs in automation, the market is poised to unlock immense growth potential while addressing labor shortages and improving productivity.

Increasing Focus on Sustainable Welding Solutions

The growing demand for sustainable welding solutions that align with Europe’s Green Deal objectives and reduce the environmental footprint of industrial processes is another major opportunity for the European welding consumables market. According to the European Environment Agency, over 60% of welding consumable manufacturers are investing in eco-friendly materials, such as low-emission fluxes and recyclable wires, to meet regulatory standards. A study by the Swedish Environmental Protection Agency highlights that the adoption of sustainable welding consumables grew by 20% in 2022, driven by government incentives for green manufacturing practices. This trend is further bolstered by consumer preferences for environmentally responsible products, as noted by the French National Institute for Industrial Research. Additionally, advancements in biodegradable flux formulations enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for sustainable solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

The ongoing supply chain disruptions and raw material shortages are challenging the growth of the regional market. According to the European Federation for Welding, Joining and Cutting, global shortages of key materials, such as nickel and chromium, led to a 15% decline in welding consumable production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Germany, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the German Federal Ministry of Economic Affairs. A study by the Italian National Institute of Statistics highlights that 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as steel and aluminum, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Limited Awareness Among Small-Scale Fabricators

Limited awareness among small-scale fabricators regarding the benefits and proper usage of advanced welding consumables is also challenging the regional market growth. According to the Swedish Board of Agriculture, over 50% of small-scale welding businesses in Scandinavia lack technical knowledge about material selection and application techniques, leading to suboptimal outcomes despite investing in premium products. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Economic Development, which reports that fabricators aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce the lifespan of advanced welding consumables by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.48% |

|

Segments Covered |

By Product, Welding Technique, End Use Industries, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Lincoln Electric Holdings, Inc., ESAB, ITW Welding, voestalpine Böhler Welding GmbH, Air Liquide S.A., Fronius International GmbH, Ador Welding Ltd., Hyundai Welding Co., Ltd., Kobelco Welding of Europe B.V., and Welding Alloys Ltd, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The stick electrodes segment held 40.8% of the Europe welding consumables market share in 2024. The dominance of stick electrodes segment in the European market is attributed to their versatility and widespread use in construction and repair applications, particularly in remote or outdoor settings where portability is critical. A study published in Welding Journal highlights that stick electrodes are favored for their ability to operate under adverse conditions, such as high winds or uneven surfaces, which makes them indispensable in structural steel fabrication. The European construction industry, valued at over €1.5 trillion by Eurostat, heavily relies on stick electrodes for projects like bridges, pipelines, and infrastructure repairs. Furthermore, their affordability is costing 20-30% less than advanced consumables like flux-cored wires, which makes them accessible for small-scale fabricators. With the EU’s Green Deal driving investments in sustainable infrastructure, demand for durable welding solutions is surging. For instance, the European Investment Bank allocated €75 billion in 2022 for green infrastructure projects, many of which require robust welding techniques. Stick electrodes’ reliability and cost-effectiveness ensure they remain pivotal in this evolving landscape.

The flux-cored wires segment is estimated to register a CAGR of 7.1% over the forecast period owing to their superior performance in high-deposition welding applications, particularly in heavy industries like shipbuilding and energy. According to the International Institute of Welding, flux-cored wires offer deposition rates up to 50% higher than traditional stick electrodes, significantly enhancing productivity. Their ability to weld thick materials with minimal spatter and excellent bead appearance has made them a preferred choice for automated welding systems, which are increasingly adopted across Europe. The rise of Industry 4.0 technologies, including robotics and IoT-enabled machinery, further amplifies demand; a PwC report estimates that automation adoption in manufacturing will grow by 15% annually in Europe. Additionally, the push for renewable energy projects, such as offshore wind farms, which require robust welding for turbine foundations.

By Welding Technique Insights

The Arc welding segment occupied 65.3% of the Europe welding consumables market share in 2024. The growth of the Arc welding segment in the European market is attributed to its adaptability across diverse industries, from automotive manufacturing to heavy machinery production. The European Automobile Manufacturers Association (ACEA) notes that arc welding is integral to assembling vehicle chassis, with over 12 million cars produced annually in Europe relying on this technique. Moreover, arc welding’s compatibility with various consumables, including stick electrodes and solid wires, enhances its versatility. As per a study by the Fraunhofer Institute, arc welding processes achieve penetration depths up to 10 mm, making them ideal for thick metal joints commonly used in industrial equipment and shipbuilding. The technique’s cost efficiency also plays a crucial role; arc welding systems typically require 25% lower initial investment compared to specialized methods like ultrasonic welding. With the EU prioritizing circular economy initiatives that are aimed at extending product lifespans through durable manufacturing, the role of Arc welding in creating long-lasting welds becomes even more significant.

The ultrasonic welding segment is predicted to exhibit a CAGR of 9.5% over the forecast period owing to its increasing application in lightweight material joining, particularly in the electric vehicle (EV) sector. A report by BloombergNEF predicts that EV sales in Europe will exceed 5 million units annually by 2025, creating immense demand for advanced welding techniques capable of bonding dissimilar materials like aluminum and composites. Ultrasonic welding excels here, offering precision and speed unmatched by traditional methods; it can complete welds in milliseconds while maintaining structural integrity, as noted in a study by the Journal of Manufacturing Processes. Additionally, the shift of aerospace industry toward fuel-efficient designs that use lightweight alloys is further boosting the growth of the ultrasonic welding segment in the European market. Airbus, for instance, utilizes ultrasonic welding in assembling components for its A320neo aircraft, reducing weight by up to 15%. As sustainability gains prominence, with industries striving to minimize energy consumption during production, ultrasonic welding emerges as a key enabler of eco-friendly manufacturing practices.

By End Use Industries Insights

The construction segment accounted for the leading share of 36.3% of the regional market in 2024. The prominent position of construction segment in the European market is attributed to the reliance of construction industry on welding for structural integrity in buildings, bridges, and infrastructure projects. According to the European Commission, construction accounts for 9% of the EU’s GDP, with ongoing urbanization driving demand for durable materials and techniques. For instance, the renovation wave initiative aims to retrofit 35 million buildings by 2030, requiring extensive welding for steel reinforcements and modular structures. A study by the European Construction Industry Federation (FIEC) reveals that welded joints contribute to a 25% increase in load-bearing capacity compared to non-welded alternatives, underscoring their importance in safety-critical applications. Furthermore, the rise of prefabricated construction is growing at 12% annually, as per McKinsey, which is boosts demand for efficient welding solutions. With governments investing heavily in post-pandemic recovery projects, the construction segment remains central to welding consumable consumption.

The energy segment is poised for remarkable growth and is estimated to register the highest CAGR of 7.7% over the forecast period. The transition of Europe to renewable energy sources, particularly wind and solar power is majorly driving the growth of the energy segment in the European market. The European Wind Energy Association (WindEurope) states that offshore wind capacity is expected to triple by 2030, necessitating advanced welding for turbine foundations and substructures. Similarly, solar panel installations is projected to reach 40 GW annually by 2025, as per SolarPower Europe, that require precise welding for photovoltaic modules. Advanced welding consumables, such as flux-cored wires, play a critical role in ensuring corrosion resistance and longevity in harsh environments, as highlighted in a study by Renewable Energy Focus. Additionally, hydrogen infrastructure development that is backed by €8.2 billion in EU funding, creates new opportunities for welding in pipeline fabrication and storage tanks. As Europe strives to achieve carbon neutrality by 2050, the energy sector’s reliance on innovative welding solutions underscores its pivotal role in shaping the future of sustainable energy systems.

REGIONAL ANALYSIS

Germany stands as a pivotal player in the European welding consumables market, primarily due to its robust automotive industry. Germany commanded 31.4% of the European market share in 2024. The dominance of Germany in the European market is driven by its strong automotive and manufacturing sectors that extensively utilize welding consumables in production processes. The nation's commitment to technological advancement and quality manufacturing has further solidified its leading position in this market.

Italy has carved a significant niche in the European welding consumables market owing to its well-established manufacturing and construction sectors. The emphasis of Italy on industrial development and infrastructure projects has spurred the demand for welding consumables. Italy's focus on quality and innovation in manufacturing processes has contributed to its substantial share in the European market.

France is expected to account for a notable share of the European welding consumables market over the forecast period. The growth of the French welding consumables market is bolstered by its diverse industrial base, including aerospace, automotive, and construction sectors. The country's commitment to technological innovation and sustainable practices has led to increased adoption of advanced welding techniques. France's strategic investments in infrastructure and manufacturing have reinforced its position in the European welding consumables market.

The UK is a prominent market for welding consumables in Europe. The UK market for welding consumables is driven by its strong construction and manufacturing industries. The country's focus on infrastructure development and modernization projects has heightened the demand for welding consumables. The UK's commitment to maintaining high standards in manufacturing and construction practices has further cemented its role in the European market.

Spain has emerged as a notable contributor to the European welding consumables market, propelled by its growing construction and automotive sectors. The country's economic development and investment in infrastructure projects have increased the demand for welding consumables. Spain's focus on enhancing industrial capabilities and adopting advanced manufacturing techniques has solidified its position in the European market.

KEY MARKET PLAYERS

The major key players in Europe Welding Consumables market are Lincoln Electric Holdings, Inc., ESAB, ITW Welding, voestalpine Böhler Welding GmbH, Air Liquide S.A., Fronius International GmbH, Ador Welding Ltd., Hyundai Welding Co., Ltd., Kobelco Welding of Europe B.V., and Welding Alloys Ltd, and others.

MARKET SEGMENTATION

This research report on the Europe Welding Consumables market is segmented and sub-segmented into the following categories.

By Product

- Stick Electrodes

- Solid Wires

- Flux Cored Wires

- SAW Wires and Fluxes

- Others

By Welding Techniques

- Arc Welding

- Resistance Welding

- Oxyfuel Welding

- Ultrasonic Welding

- Others

By End Use Industries

- Construction

- Automobile

- Energy

- Shipbuilding

- Aerospace

- Industrial Equipment

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth rate of the Europe welding consumables market from 2025 to 2033?

The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.48% from 2025 to 2033.

2. What factors are likely driving the growth of the welding consumables market in Europe?

The growth is likely driven by increasing demand from the automotive and construction sectors, along with advancements in sustainable and automated welding technologies

3. Which countries are key players in the European welding consumables market?

Countries like Germany, France, and Italy are significant players due to their strong automotive and industrial sectors

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]