Europe Weight Management Market Size, Share, Trends & Growth Forecast Report By Type (Food and Beverage (Meal Replacement, Bars, RTD Products, Soups, Other Meal Replacements, Slimming Teas) and Supplements (Capsule/Softgels, Powder, Tablets )) and Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Specialty Stores, Online Retail Stores, ) and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Weight Management Market Size

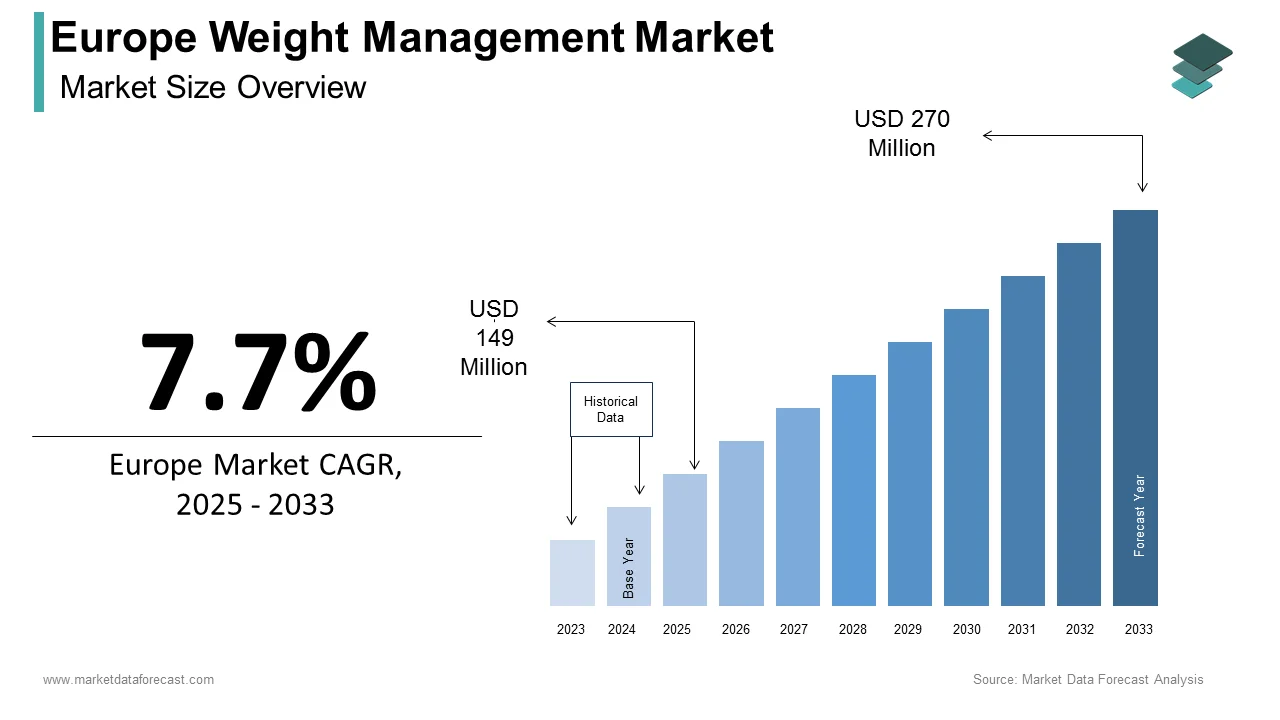

The weight management market size in Europe was valued at USD 138.3 million in 2024. The European market is estimated to be worth USD 270 million by 2033 from USD 149 million in 2025, growing at a CAGR of 7.7% from 2025 to 2033.

Weight management includes products and services such as low-calorie foods, beverages, supplements, fitness programs, and digital health platforms aimed at achieving and maintaining optimal body weight. According to the European Commission’s Health at a Glance report, over 50% of adults in Europe are overweight or obese, with associated healthcare costs exceeding EUR 80 billion annually. This has spurred demand for effective weight management solutions. The demand for weight management services is driven by the government initiatives promoting healthier lifestyles, such as the UK’s National Health Service (NHS) campaigns on obesity prevention. These trends underscore the growing importance of this market in addressing public health challenges.

MARKET DRIVERS

Growing Prevalence of Obesity and Associated Chronic Diseases in Europe

The World Health Organization (WHO) reports that over 52% of adults in Europe are either overweight or obese, leading to a surge in conditions like diabetes, cardiovascular diseases, and hypertension. The European Observatory on Health Systems and Policies estimates that obesity-related healthcare expenditures account for nearly 7% of total healthcare spending in Europe. Governments across the region are implementing policies to combat this issue, such as sugar taxes and public awareness campaigns. For instance, France introduced a sugar tax in 2012, which led to a 6.4% reduction in sugary beverage consumption. These initiatives have heightened consumer awareness about the importance of weight management, driving demand for healthier food options, supplements, and fitness programs.

Rapid Adoption of Digital Health Technologies and Personalized Nutrition Solutions

According to Eurostat, over 60% of Europeans now use mobile health apps to track their fitness and dietary habits, reflecting the shift toward data-driven weight management strategies. The European Investment Bank highlights that investments in digital health startups surged by 35% in 2022, with many focusing on AI-based tools for personalized diet plans and calorie tracking. Additionally, the rise of wearable devices, such as fitness trackers and smartwatches, has enabled individuals to monitor their progress in real-time. These innovations not only enhance user engagement but also provide tailored recommendations based on individual health metrics. As consumers increasingly prioritize convenience and customization, the integration of technology into weight management solutions is expected to propel market growth.

MARKET RESTRAINTS

High Costs

One significant restraint is the high cost associated with premium weight management products and services, which limits accessibility for lower-income populations. Eurostat reports that nearly 25% of households in Europe struggle to afford healthy dietary options or gym memberships, which are often priced at a premium. For instance, meal replacement shakes and organic supplements can cost up to 50% more than conventional alternatives, making them inaccessible for budget-constrained consumers. This economic disparity creates a barrier to widespread adoption, particularly in Eastern European countries where disposable incomes are lower. Additionally, the European Health Insurance Cross-Border Directive notes that not all weight management programs are covered by national healthcare systems, further exacerbating affordability issues. These financial barriers hinder market penetration among certain demographics, slowing overall growth.

Lack of Standardized Regulations

Another restraint is the lack of standardized regulations governing weight management products, leading to consumer skepticism and safety concerns. The European Food Safety Authority (EFSA) highlights that over 30% of weight loss supplements available in the market do not meet safety standards, raising doubts about their efficacy and potential side effects. Misleading marketing claims and unverified health benefits further erode consumer trust, as reported by the European Consumer Organisation (BEUC). Moreover, the absence of harmonized labeling requirements across EU member states complicates cross-border trade and compliance. These regulatory gaps create uncertainty for manufacturers and consumers alike, impeding market expansion and innovation in the weight management sector.

MARKET OPPORTUNITIES

Rising Demand for Plant-Based and Functional Foods

The growing popularity of plant-based and functional foods presents a significant opportunity for the Europe weight management market. According to the European Plant-Based Foods Association, the plant-based food market in Europe grew by 49% between 2018 and 2022, driven by increasing consumer demand for healthier and sustainable dietary options. Products like vegan protein powders, low-calorie snacks, and fortified beverages are gaining traction, particularly among millennials and Gen Z consumers. The European Investment Bank reports that startups specializing in plant-based weight management solutions secured over EUR 1 billion in funding in 2023 alone. Additionally, the rise of clean-label products, which emphasize transparency and minimal processing, aligns with consumer preferences for natural and safe ingredients. This trend offers immense potential for innovation and diversification within the weight management market.

Growing Adoption of Telehealth and Virtual Coaching Platforms

Another promising opportunity lies in the expansion of telehealth and virtual coaching platforms for weight management. Eurostat reveals that over 70% of Europeans aged 16-65 have access to high-speed internet, enabling the widespread adoption of digital health services. The European Observatory on Health Systems and Policies highlights that telehealth consultations for weight management increased by 60% during the COVID-19 pandemic, demonstrating its effectiveness and convenience. Virtual coaching platforms leverage AI and machine learning to provide personalized guidance, from meal planning to exercise routines, enhancing user engagement and outcomes. Furthermore, partnerships between tech companies and healthcare providers are creating integrated ecosystems that combine wearable devices, mobile apps, and remote monitoring. These advancements position telehealth as a transformative force in the weight management market, catering to tech-savvy consumers seeking flexible and scalable solutions.

MARKET CHALLENGES

Stigma Around Weight Management

One major challenge is the persistent stigma surrounding weight management, which discourages individuals from seeking professional help or adopting structured programs. The European Obesity Policy Engagement Network reports that nearly 40% of overweight individuals avoid discussing their weight with healthcare professionals due to fear of judgment or discrimination. This stigma is particularly prevalent in workplace settings, where employees may hesitate to participate in corporate wellness initiatives. The European Agency for Safety and Health at Work highlights that such barriers lead to low participation rates in weight management programs, undermining their effectiveness. Additionally, cultural perceptions of body image vary widely across Europe, complicating efforts to promote standardized solutions. Addressing these social and psychological barriers is crucial to fostering a supportive environment for weight management interventions.

Counterfeit and Unregulated Weight Management Products

Another significant challenge is the proliferation of counterfeit and unregulated weight management products, which pose risks to consumer safety and market integrity. The European Anti-Fraud Office (OLAF) reports that counterfeit dietary supplements account for approximately 10% of all seized goods in Europe, with many containing harmful substances or inaccurate ingredient labels. The European Consumer Centre warns that online platforms, particularly those operating outside EU jurisdiction, are major conduits for these illicit products. Furthermore, the lack of stringent enforcement mechanisms in some regions exacerbates the problem, allowing substandard items to flood the market. These issues not only endanger public health but also damage the reputation of legitimate manufacturers. Strengthening regulatory oversight and enhancing consumer awareness are essential to combating this growing threat.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Distribution Channel, and country. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Glanbia plc, Amway Corp, General Nutrition Centers, Herbalife Nutrition, Evlution Nutrition LLC, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The Food and beverage segment accounted for the leading share of 60.1% of the European market in 2024. The growth of the F&B segment is majorly attributed to the widespread availability and affordability of low-calorie, nutrient-dense products such as meal replacements, protein bars, and fortified drinks. The European Commission highlights that over 40% of consumers prefer food-based solutions for weight management due to their perceived naturalness and ease of integration into daily diets. Its importance lies in providing accessible and sustainable options for weight-conscious individuals, making it a cornerstone of the market.

The supplements segment is another major segment and is estimated to expand at the fastest CAGR of 8.12% over the forecast period. This rapid growth is fueled by increasing consumer interest in vitamins, minerals, and herbal extracts that support metabolism and fat loss. The European Federation of Associations of Health Product Manufacturers reports that supplement sales surged by 25% in 2022, driven by rising awareness of preventive healthcare. Its importance lies in offering convenient and targeted solutions for individuals seeking quick results, positioning it as a key driver of innovation in the weight management market.

By Distribution Channel Insights

The supermarkets and hypermarkets segment captured the largest share of 45.3% in the European market in 2024. The domination of supermarkets and hypermarkets segment in the European market is attributed to widespread accessibility, competitive pricing, and the ability to offer a diverse range of products under one roof. The European Retail Forum highlights that over 60% of consumers prefer purchasing weight management products from physical stores due to the ability to inspect packaging and seek assistance. Its importance lies in providing a trusted and convenient shopping experience for mainstream consumers.

The online retail stores segment is anticipated to witness the highest CAGR of 12.4% over the forecast period due to the increasing penetration of e-commerce platforms and the convenience of home delivery. Eurostat reports that over 70% of Europeans now shop online, with health and wellness products being a top category. Its importance lies in enabling direct-to-consumer sales, personalized recommendations, and access to niche products, making it a transformative force in the market.

REGIONAL ANALYSIS

Germany accounted for the leading share of 25.5% of the European market in 2024. The high obesity rates in Germany is prompting robust government initiatives like the Prevention Act, which is one of the key factors boosting the German market growth. The European Observatory on Health Systems and Policies highlights that Germany’s strong healthcare infrastructure and emphasis on preventive care foster widespread adoption of weight management solutions. Its advanced retail network and high consumer awareness further solidify its position as a market leader.

The UK is anticipated to showcase a promising CAGR in the European market over the forecast period. The focus of the UK on combating obesity through NHS-funded programs and sugar taxes has significantly boosted demand for healthier alternatives. The British Retail Consortium reports that UK consumers spend approximately GBP 2 billion annually on weight management products. Its leadership is supported by a tech-savvy population embracing digital health tools, making it a hub for innovation in the sector.

France is likely to account for a substantial share of the European market over the forecast period. The emphasis of France on gastronomy and healthy eating aligns with the growing demand for plant-based and functional foods is boosting the French weight management market growth. The French Ministry of Health notes that initiatives like the Nutri-Score labeling system have enhanced transparency, driving consumer trust. France’s strong regulatory framework and cultural affinity for wellness contribute to its prominence in the market.

MARKET KEY PLAYERS

Some notable companies that dominate the Europe weight management market profiled in this report are Glanbia plc, Amway Corp, General Nutrition Centers, Herbalife Nutrition, Evlution Nutrition LLC, and Others.

MARKET SEGMENTATION

This Europe weight management market research report is segmented and sub-segmented into the following categories.

By Type

Food and Beverage

- Meal Replacement

- Bars

- RTD Products

- Soups

- Other Meal Replacements

- Slimming Teas

Supplements

- Capsule/ Softgels

- Powder

- Tablets

- Other Supplements

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies

- Specialty Stores

- Online Retail Stores

- Other Distribution Channels

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth of the Europe weight management market?

The Europe weight management market is expected to grow from USD 149 million in 2025 to USD 270 million by 2033, at a CAGR of 7.7%.

2. What factors drive the Europe Weight Management Market?

Increasing obesity rates, government initiatives, and growing use of digital health tools.

3. What challenges affect the Europe Weight Management Market?

High product costs, inconsistent regulations, and social stigma.

4. How is technology shaping the Europe Weight Management Market?

AI-powered nutrition plans and telehealth consultations are improving weight management.

5. What trends are shaping the Europe Weight Management Market?

Rising demand for plant-based foods, functional beverages, and wearable fitness tech.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]