Europe Water Purifier Market Size, Share, Trends & Growth Forecast Report By Technology (Gravity Purifiers, RO Purifiers, UV Purifiers, Sediment Purifiers, Water Softeners, and Others), End-User, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Water Purifier Market Size

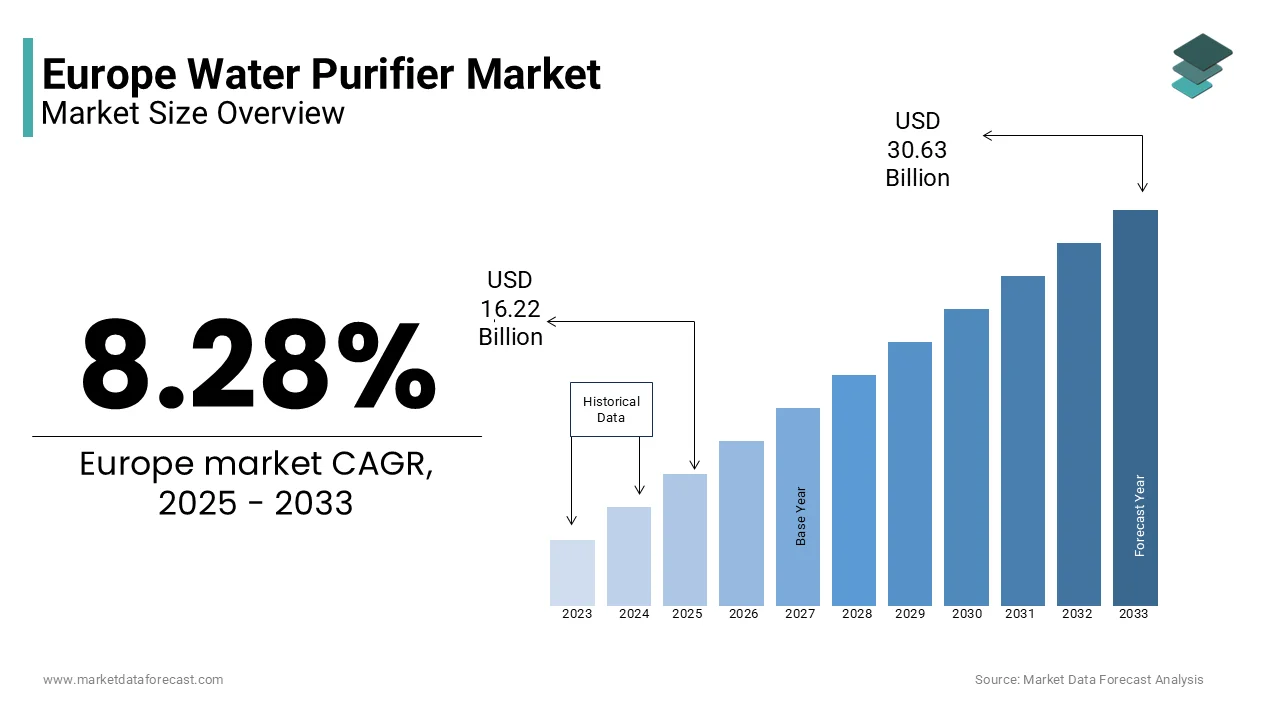

The water purifier market size in Europe was valued at USD 14.98 billion in 2024. The European market is estimated to be worth USD 30.63 billion by 2033 from USD 16.22 billion in 2025, growing at a CAGR of 8.28% from 2025 to 2033.

The European water purifier market involves the development, production, and distribution of devices designed to remove impurities, contaminants and harmful microorganisms from water. These purifiers employ various technologies, including reverse osmosis (RO), ultraviolet (UV) filtration, activated carbon, and ultrafiltration (UF), to deliver clean and safe drinking water. The market serves to residential, commercial, and industrial sectors, addressing growing concerns about water quality and health.

The demand for water purifiers in Europe is driven by increasing awareness of waterborne diseases, environmental pollution, and the deteriorating quality of natural water sources. According to the European Environment Agency, over 30% of surface water bodies in Europe were classified as being in poor ecological status in 2022, pointing out the urgency for effective water treatment solutions. Additionally, stringent regulations under the European Union’s Drinking Water Directive ensure compliance with high water quality standards are further propelling market growth.

Innovations such as smart water purifiers with real-time monitoring and energy-efficient designs are reshaping consumer preferences. Countries like Germany, France, and the United Kingdom are leading in adoption, driven by robust infrastructure and heightened health awareness. Major players like Brita, Culligan, and A. O. Smith dominate the market by offering technologically advanced and sustainable purification solutions.

The European water purifier market is pivotal in addressing water quality challenges and is aligning with the region's commitment to health, safety, and environmental sustainability.

MARKET DRIVERS

Increasing Concerns over Water Quality and Health

Rising concerns about water quality and its impact on health are main drivers of the European water purifier market. According to the European Environment Agency, 30% of Europe’s surface water bodies were classified as having poor ecological status in 2022, raising public awareness about potential contaminants in drinking water. Pollutants such as microplastics, heavy metals, and harmful microorganisms have fueled demand for effective water purification technologies. The World Health Organization brought to attention that unsafe water causes a substantial burden of disease globally, emphasizing the need for advanced water treatment solutions. As consumers prioritize health, residential adoption of water purifiers, particularly reverse osmosis and activated carbon systems, has greatly increased across Europe.

Stringent Regulatory Frameworks Ensuring Water Safety

The European Union’s stringent regulatory frameworks on water quality serve as another major driver for the water purifier market. The EU Drinking Water Directive mandates high-quality standards for public water supplies, addressing contaminants like nitrates, lead, and pesticides. In 2022, the European Commission introduced updated guidelines to monitor emerging pollutants, including pharmaceuticals and endocrine-disrupting chemicals. These regulations compel households and businesses to adopt advanced purification systems to comply with standards. Furthermore, initiatives promoting sustainable water use and infrastructure modernization, such as the EU Water Framework Directive, have encouraged the adoption of water purifiers in both urban and rural areas, driving market growth.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

The high initial costs and maintenance expenses associated with advanced water purifiers act as a critical restraint on the European market. Premium systems, such as reverse osmosis (RO) and ultraviolet (UV) purifiers, are often priced between €300 and €1,000, making them less accessible to price-sensitive consumers. Additionally, maintenance requirements, including filter replacements and system servicing, can cost up to €100 annually, as noted by the European Consumer Organization. These financial barriers are particularly pronounced in regions with lower disposable incomes, limiting widespread adoption. Even in affluent markets, the perception of high ownership costs can deter potential buyers, slowing market penetration despite the evident need for improved water quality.

Availability of High-Quality Municipal Water

The widespread availability of high-quality municipal water in several European countries reduces the perceived necessity for residential water purifiers. According to the European Commission’s 2022 report, over 98% of the EU population had access to safe drinking water that met regulatory standards. This reliable public water supply diminishes the urgency to invest in additional purification systems, especially in countries like Sweden, Denmark, and Germany, where municipal infrastructure is highly developed. The strong confidence in public water utilities creates a market challenge for water purifier manufacturers, requiring them to focus on niche segments or emphasize additional benefits, such as taste enhancement and advanced filtration for specific contaminants.

MARKET OPPORTUNITIES

Rising Demand for Smart and Sustainable Water Purifiers

The increasing demand for smart and sustainable water purifiers presents a promising opportunity for the European market. Consumers are seeking advanced systems that provide real-time water quality monitoring, filter life tracking, and energy-efficient operations. According to the European Commission, the adoption of smart home technologies grew by 25% in 2022, reflecting a shift towards digital solutions in daily living. Water purifiers integrated with IoT and AI technologies align with this trend, offering convenience and precise filtration management. Additionally, eco-friendly designs that minimize plastic waste and reduce energy consumption cater to Europe’s sustainability goals, driven by initiatives like the European Green Deal, creating lucrative opportunities for manufacturers focused on innovation.

Expansion of Industrial and Commercial Applications

The growing use of water purifiers in industrial and commercial sectors is another key opportunity for the European market. Industries such as pharmaceuticals, food and beverage, and electronics require high-purity water for critical processes, driving demand for advanced purification systems. According to Eurostat, the industrial water use in Europe totaled over 230 billion cubic meters in 2022, emphasizing the need for reliable water treatment solutions. Similarly, the hospitality sector, particularly in countries with robust tourism industries like Spain, Italy, and France, increasingly installs commercial water purifiers to meet health standards and enhance customer experience. Manufacturers can capitalize on this trend by offering customized solutions tailored to industrial and commercial requirements.

MARKET CHALLENGES

Low Awareness in Rural Areas

Low awareness about waterborne contaminants and the benefits of water purifiers in rural areas creates a key challenge for the European market. While urban regions have higher adoption rates, rural populations often rely on traditional water sources, assuming them to be safe. According to Eurostat, approximately 25% of rural households in the EU relied on private wells or smaller water systems in 2022, which are less regulated compared to municipal supplies. These sources can contain nitrates, pesticides, or pathogens, yet the lack of education on water quality risks limits the demand for purification systems. Bridging this awareness gap requires targeted outreach and educational initiatives to encourage adoption in underpenetrated rural markets.

Waste Disposal and Environmental Concerns

The disposal of used filters and wastewater from certain purification technologies, such as reverse osmosis (RO), raises environmental concerns are challenging the growth of the market. RO systems, for example, can waste up to three liters of water for every liter purified, as identified by the European Environment Agency in 2022. Additionally, spent filters containing microplastics or heavy metals contribute to environmental pollution if not properly recycled. These issues conflict with Europe’s strong sustainability focus under frameworks like the European Green Deal, making some consumers hesitant to adopt such systems. Manufacturers face the challenge of addressing these environmental impacts by developing eco-friendly technologies and promoting recycling programs for filter components.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.28% |

|

Segments Covered |

By Technology, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Pentair PLC, Kent RO System Ltd., Panasonic Holdings Corporation, A.O. Smith Corporation, Unilever PLC, General Electric Company, Tata Chemicals Ltd., Brita GmbH (Brita Group), Best Water Technology Group, and LG Electronics, Inc. (LG Corporation), and others. |

SEGMENTAL ANALYSIS

By Technology Insights

Reverse Osmosis (RO) purifiers segment was the largest and held 48.2% of the Europe water purifiers market in 2024. This dominance is attributed to RO technology's superior efficiency in removing contaminants, including dissolved solids, heavy metals, and microorganisms, ensuring safe drinking water. According to the European Environment Agency (EEA), the importance of advanced water purification systems like RO purifiers in regions where water sources are contaminated or where consumers are concerned about water quality. According to the EEA's, the necessity for effective water treatment solutions to address pollutants, thereby driving the adoption of RO purifiers across Europe.

The ultraviolet (UV) purifiers are experiencing the fastest growth in the European water purifier market, with a CAGR of 9.2% during the forecast period from 2025 to 2033. This surge is driven by increasing consumer awareness of waterborne pathogens and the demand for chemical-free disinfection methods. UV purification technology effectively inactivates bacteria and viruses, providing an eco-friendly alternative to traditional chlorination methods. The European Commission's initiatives to improve drinking water quality, as outlined in the Drinking Water Directive, have set stringent standards for microbial safety by encouraging the adoption of UV purifiers. These regulations, coupled with technological advancements reducing the cost and enhancing the efficiency of UV systems, are propelling the rapid expansion of this segment in the European market.

By End-User Insights

The household segment dominated the Europe water purifiers market share of 75.4% in 2024. This dominance is driven by increasing consumer awareness of waterborne diseases and the importance of clean drinking water. According totThe European Centre for Disease Prevention and Control (ECDC), ensuring safe drinking water is crucial for preventing health issues, which has led to a surge in the adoption of water purifiers in residential settings. Additionally, rising urbanization and disposable incomes have enabled more households to invest in water purification systems.

The commercial segment is projected to experience a fastest CAGR of 9.8% from 2025 to 2033. This rapid growth is attributed to the increasing demand for purified water in various commercial establishments such as hotels, restaurants, hospitals, and educational institutions. As per European Environment Agency (EEA), businesses are increasingly recognizing the importance of providing safe drinking water to clients and employees, which enhances their service quality and compliance with health regulations. Moreover, stringent European Union directives on water quality standards compel commercial entities to adopt advanced water purification systems, thereby driving the expansion of this segment.

By Distribution Channel Insights

The retail stores segment was the largest and held 45.1% of the Europe water purifiers market share in 2024. This prominence is attributed to consumers' preference for in-person product evaluation and immediate purchase fulfillment. Retail outlets provide a tangible experience, allowing customers to assess various models and brands directly. Additionally, the widespread presence of retail stores across Europe enhances accessibility is catering to a diverse customer base. The convenience of physical stores, coupled with personalized customer service, reinforces their leading position in the market.

The online stores are emerging as the fastest-growing distribution channel in the European water purifier market, with a CAGR of 8.7% from 2023 to 2030. This rapid expansion is driven by increasing internet penetration and the growing trend of e-commerce across Europe. Consumers are increasingly valuing the convenience of online shopping, which offers a broader selection of products, competitive pricing, and home delivery services. The COVID-19 pandemic has further accelerated this shift towards online purchasing with huge number of consumers seek contactless shopping experiences. The flexibility and accessibility of online platforms are reshaping consumer behavior by making online stores a pivotal channel in the water purifier market's growth trajectory.

REGIONAL ANALYSIS

Germany commanded the European water purifier market and captured 27.4% in 2024 due to its robust industrial sector, increasing focus on sustainability, and heightened awareness of water quality. According to the German Environment Agency, over 45% of groundwater resources in Germany were affected by nitrate contamination in 2022, driving demand for advanced purification solutions. The country’s strong environmental policies, such as the Water Framework Directive, encourage residential and commercial adoption of eco-friendly water purifiers. Additionally, major players like Brita, headquartered in Germany, leverage technological innovation to dominate the market by offering energy-efficient and user-friendly products.

The United Kingdom Holds a prominent position in performance and is expected to propel at CAGR of 8.1% during the forecast period because of the growing concerns about aging water infrastructure and rising awareness of waterborne contaminants. The UK’s Consumer Council for Water reported in 2023 that 3.2 billion liters of water were lost daily due to pipe leaks, increasing public reliance on purification systems for safe drinking water. The rise in compact and portable water purifiers for residential use has further bolstered the market. Key brands like A. O. Smith and Aqua Optima cater to diverse consumer preferences with advanced filtration technologies, positioning the UK as a notable player.

France excels in the water purifier market due to its emphasis on health and environmental sustainability. The French Ministry of Health reported in 2022 that pesticide contamination impacted 28% of surface water sources, fueling the demand for purifiers in both urban and rural regions. France’s commitment to reducing single-use plastic bottles has also encouraged residential adoption of water purifiers. Leading manufacturers like Culligan dominate the French market by offering customized solutions that meet stringent regulatory standards and sustainability goals.

KEY MARKET PLAYERS

The major key players in Europe water purifier market are Pentair PLC, Kent RO System Ltd., Panasonic Holdings Corporation, A.O. Smith Corporation, Unilever PLC, General Electric Company, Tata Chemicals Ltd., Brita GmbH (Brita Group), Best Water Technology Group, and LG Electronics, Inc. (LG Corporation).

MARKET SEGMENTATION

This research report on the Europe water purifier market is segmented and sub-segmented into the following categories.

By Technology

- Gravity Purifiers

- RO Purifiers

- UV Purifiers

- Sediment Purifiers

- Water Softeners

- Others

By End-User

- Industrial

- Commercial

- Household

By Distribution Channel

- Retail Stores

- Direct Sales

- Online Stores

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size of the Europe Water Purifier Market?

The market is estimated to reach USD 30.63 billion by 2033, growing from USD 16.22 billion in 2025 at a CAGR of 8.28% from 2025 to 2033.

2. What factors are driving the demand for water purifiers in Europe?

The demand is driven by growing concerns over water contamination, increasing health awareness, advancements in filtration technologies, and the rising adoption of home water purification systems.

3. Which regions in Europe have the highest demand for water purifiers?

Leading regions include Germany, France, the United Kingdom, Italy, and Spain, driven by urbanization, stringent water quality standards, and increasing consumer preference for purified drinking water.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]