Europe Warm Edge Spacer Market Size, Share, Trends, & Growth Forecast Report By Product (Flexible spacers, Plastic/metal hybrid spacers, and Stainless steel spacers), End Use, Glazing Window, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Warm Edge Spacer Market Size

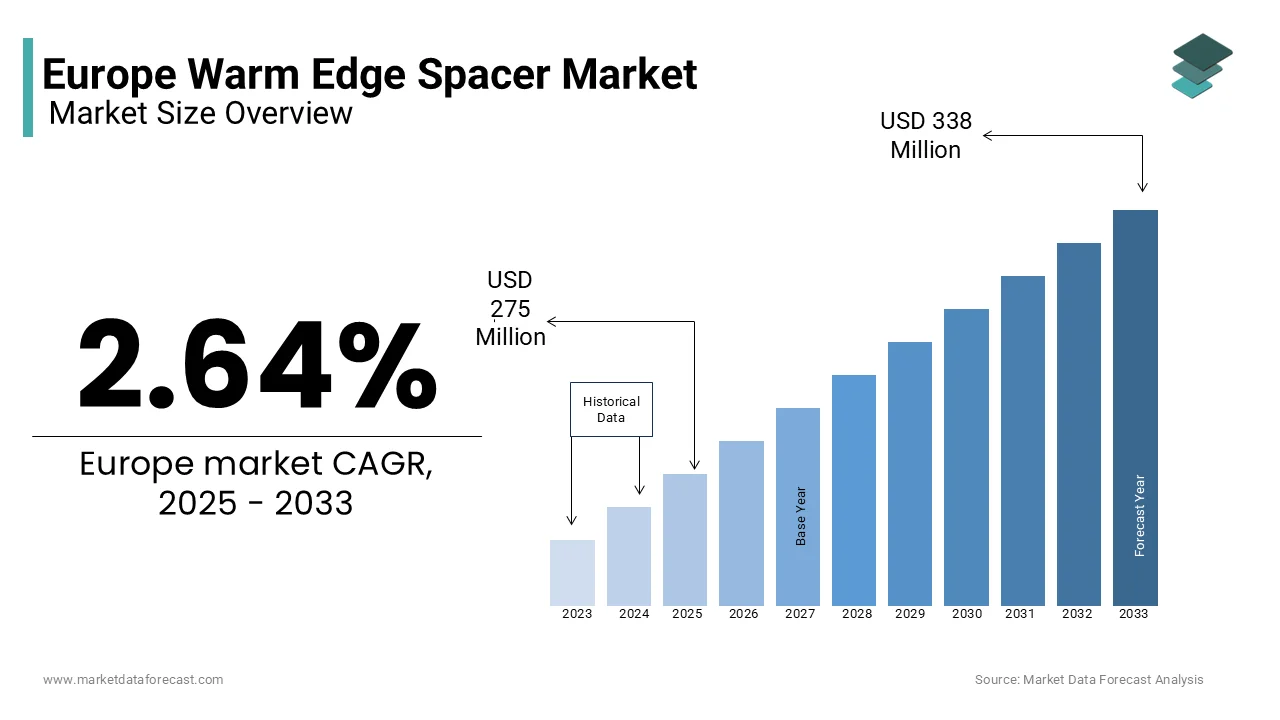

The Europe warm edge spacer market was worth USD 268 million in 2024. The European market is projected to reach USD 338 million by 2033 from USD 275 million in 2025, rising at a CAGR of 2.64% from 2025 to 2033.

Warm edge spacers are specialized components used in insulated glass units (IGUs) to reduce thermal bridging, improve energy efficiency, and enhance condensation resistance. These spacers are typically made from low-conductivity materials such as stainless steel, thermoplastics, or composite materials. As of 2023, the market is experiencing steady growth, driven by stringent energy efficiency regulations across Europe. According to the European Insulating Glass Manufacturers Association, over 60% of new residential buildings in Europe now incorporate warm edge spacers. Furthermore, as per the International Energy Agency, the construction sector accounts for approximately 40% of Europe's total energy consumption, underscoring the importance of energy-efficient solutions like warm edge spacers.

MARKET DRIVERS

Energy Efficiency Regulations in Europe

Stringent energy efficiency mandates imposed by the European Union are propelling the demand for warm edge spacers in Europe. The EU’s Energy Performance of Buildings Directive (EPBD) mandates that all new buildings must be nearly zero-energy by 2030. This has led to a surge in demand for high-performance IGUs, with warm edge spacers playing a pivotal role. According to Eurostat, the adoption of energy-efficient windows has increased by 15% annually since 2020. Additionally, the German Energy Agency reports that warm edge spacers can reduce heat loss by up to 20% compared to traditional aluminum spacers. These statistics underscore how regulatory frameworks are driving innovation and adoption in the market.

Rising Awareness of Sustainable Construction

Growing awareness about sustainable construction practices is another key driver. A report by the Confederation of European Window Industries reveals that eco-friendly building materials witnessed a 12% year-on-year growth in 2022. Consumers are increasingly prioritizing energy savings and environmental impact when selecting building materials. For instance, the UK Green Building Council estimates that incorporating warm edge spacers can reduce carbon emissions by 10% per household annually. Moreover, a survey conducted by the European Federation of Building and Woodworkers found that 78% of homeowners prefer energy-efficient windows. This shift in consumer behavior is significantly boosting the warm edge spacer market.

MARKET RESTRAINTS

High Initial Costs

One of the primary restraints of the warm edge spacer market is the relatively high initial cost compared to conventional spacers. According to a study published by the European Construction Industry Federation, warm edge spacers are 25-30% more expensive than traditional aluminum spacers. This price differential often deters smaller contractors and budget-conscious developers from adopting these advanced materials. Furthermore, a report by the European Aluminium Association highlights that despite long-term energy savings, upfront costs remain a significant barrier, particularly in Eastern European markets where economic constraints are more pronounced. These financial challenges hinder widespread adoption, especially in regions with limited access to subsidies or incentives.

Limited Awareness Among End Users

Limited awareness among end users regarding the benefits of warm edge spacers is further restraining the growth of the European warm edge spacer market. A survey conducted by the European Window Federation revealed that only 45% of homeowners in rural areas understand the advantages of using warm edge technology. This lack of knowledge leads to lower demand, particularly in non-urban regions. Additionally, a report by the European Insulation Manufacturers Association states that misconceptions about the complexity of installation further exacerbate this issue. Without proper education campaigns, many consumers opt for cheaper alternatives, impeding market growth. Bridging this awareness gap remains a critical challenge for manufacturers and policymakers alike.

MARKET OPPORTUNITIES

Expansion into Retrofit Projects

The growing emphasis on retrofitting existing buildings is a significant opportunity for the European warm edge spacer market. According to the European Commission, approximately 75% of Europe’s building stock is energy inefficient, creating a vast potential for upgrades. Retrofit projects accounted for 40% of the total construction activity in 2022, as reported by the European Construction Sector Observatory. Warm edge spacers play a crucial role in enhancing the thermal performance of older windows, reducing energy bills by an estimated 15-20%. This trend is particularly prominent in countries like Germany and France, where government incentives support retrofit initiatives. By targeting this segment, manufacturers can unlock substantial revenue streams.

Technological Advancements in Materials

Advancements in material science offer another promising opportunity for the European warm edge spacer market. Innovations in composite materials, such as thermoplastic and fiberglass-based spacers, are gaining traction due to their superior thermal performance. A report by the European Plastics Converters Association highlights that the use of advanced composites in construction grew by 18% in 2023. These materials not only improve energy efficiency but also extend the lifespan of IGUs. Furthermore, research by the Fraunhofer Institute indicates that next-generation spacers can reduce U-values by up to 30%, making them highly attractive for premium applications. By investing in R&D, companies can capitalize on these innovations to gain a competitive edge.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions is a major challenge to the warm edge spacer market in Europe. The European Association of Construction Product Manufacturers reports that raw material shortages caused production delays in 30% of construction projects in 2022. For instance, the global semiconductor shortage indirectly affected the availability of advanced composite materials used in warm edge spacers. Additionally, geopolitical tensions have led to fluctuations in raw material prices, with stainless steel costs increasing by 22% in 2023, according to Metal Bulletin. These disruptions not only raise operational costs but also hinder timely delivery, impacting customer satisfaction and market growth.

Intense Market Competition

The market faces intense competition from both established players and emerging regional manufacturers. A study by the European Fenestration Industry Alliance reveals that the top five companies account for 60% of the market share, leaving smaller firms struggling to compete. Price wars and aggressive marketing tactics further exacerbate the situation. Moreover, the entry of low-cost imports from Asia-Pacific regions has intensified competition, with Statista reporting a 15% increase in imports between 2021 and 2023. This saturation makes it challenging for companies to differentiate their products, forcing them to invest heavily in branding and innovation to maintain market relevance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.64% |

|

Segments Covered |

By Product, End Use, Glazing Window, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Alu-Pro, Avery Dennison, Bieber Windows, Edgetech, Fenzi, H.B. Fuller, Helima, LiSEC, Press Glass Holding, Quanex Building Products, Swisspacer, Technoform, Termoprofi, and Thermoseal Group. |

SEGMENTAL ANALYSIS

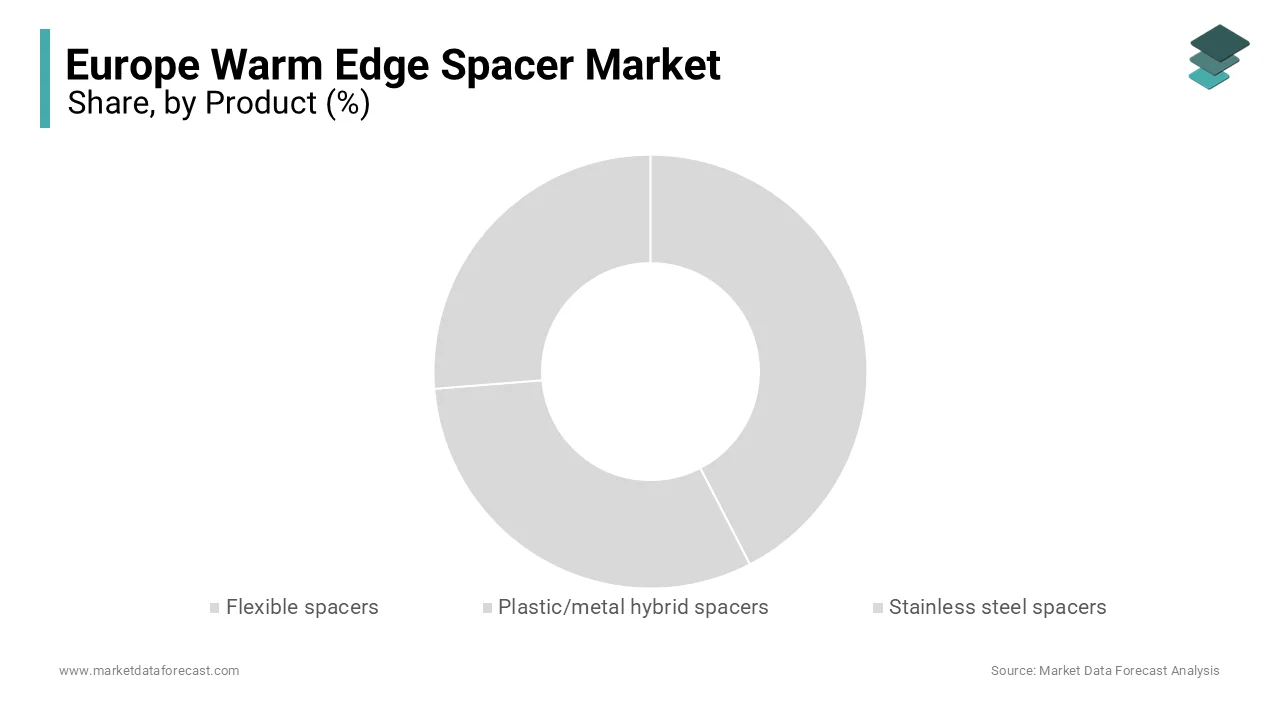

By Product Insights

Largest Segment: Flexible Spacers

The flexible spacers segment had the leading share of 60.6% of the Europe warm edge spacer market in 2024. The leading position of flexible spacer segment in the European market is driven by their superior thermal efficiency and adaptability to various window designs, making them indispensable in energy-efficient glazing systems. The European Union’s stringent energy performance standards, such as the Energy Performance of Buildings Directive (EPBD), have fueled demand for products that enhance insulation. Flexible spacers reduce heat transfer significantly, with studies showing they can improve window U-values by up to 20%, according to the International Journal of Sustainable Built Environment. Furthermore, flexible spacers are compatible with both double and triple glazing units, which account for over 85% of the European window market, as stated by Glass for Europe. Their ease of installation and ability to mitigate condensation also make them popular among manufacturers and installers. With the residential sector driving demand—accounting for nearly 70% of installations, per Eurostat—the importance of flexible spacers cannot be overstated.

The plastic/metal hybrid spacers segment is estimated to grow at a CAGR of 9.1% over the forecast period. The unique combination of durability and thermal performance of plastic or metal hybrid spacers is majorly driving the growth of the segment in the European market. Unlike stainless steel spacers, hybrids reduce thermal bridging by up to 40%, as highlighted in a study published in Building and Environment. Additionally, these spacers offer enhanced structural integrity, which is critical for large commercial windows increasingly used in modern architecture. The rise of green building certifications like BREEAM and LEED has further propelled demand, with certified buildings growing by 15% annually across Europe, reports World Green Building Council. Moreover, the hybrid spacer market benefits from technological advancements, including improved polymer coatings that extend product lifespan by 30%. As urbanization accelerates—with the European Environment Agency predicting a 10% increase in urban populations by 2030—commercial construction projects are surging, creating fertile ground for hybrid spacers to thrive.

By End Use Insights

The residential segment commanded the largest share of the Europe warm edge spacer market, accounting for 70.4% of the European market share in 2024. The growth of the residential segment in the European market is driven by increasing focus of homeowners on energy savings amid rising utility costs. A report by the European Commission reveals that households consume about 40% of all energy in the EU, with heating and cooling representing the bulk of this usage. Warm edge spacers play a pivotal role in reducing energy loss, with research from Fraunhofer Institute indicating that they can lower heating bills by up to 15% in colder climates. Government incentives, such as tax rebates for energy-efficient home upgrades, have further spurred adoption. For instance, Germany’s KfW program offers subsidies of up to €5,000 for retrofitting old windows with high-performance glazing. Additionally, the aging housing stock in countries like Italy and Spain—where over 60% of homes were built before 1980, per Eurostat—creates a vast retrofitting opportunity. These factors underscore the residential segment's centrality to market dynamics.

The commercial segment is predicted to exhibit an impressive CAGR of 8.7% over the forecast period owing to the burgeoning trend of sustainable office spaces and smart buildings. According to JLL, eco-friendly offices command rental premiums of up to 10% compared to conventional ones, incentivizing developers to adopt advanced glazing solutions. Warm edge spacers contribute significantly to achieving LEED certification, which requires a minimum 10% improvement in energy efficiency over baseline standards. Moreover, the proliferation of glass facades in skyscrapers—expected to grow by 12% annually in major cities like London and Paris, per Savills—has heightened demand for spacers that minimize thermal bridging while maintaining aesthetic appeal. Another driver is the post-pandemic shift toward healthier workspaces, with natural light being a key consideration; a Harvard T.H. Chan School of Public Health study found that employees in well-lit environments report 15% higher productivity. Collectively, these trends position the commercial segment as a high-growth area within the market.

By Glazing Window Insights

The double glazing segment represented the lion’s share of the Europe warm edge spacer market, capturing 77.4% of the European market share in 2024. The domination of double glazing segment in the European market is attributed to its cost-effectiveness and proven energy-saving capabilities. A report by the UK Department for Business, Energy & Industrial Strategy shows that double-glazed windows reduce heat loss by up to 50% compared to single-pane alternatives. This makes them particularly attractive in regions with harsh winters, such as Scandinavia and Eastern Europe, where heating accounts for over 60% of household energy consumption. Additionally, double glazing aligns with regulatory mandates like the EU’s Nearly Zero-Energy Buildings (NZEB) directive, which requires new constructions to meet strict energy efficiency criteria. The affordability of double-glazed units—typically costing 30-40% less than triple-glazed options—also broadens accessibility, especially among middle-income households. With retrofitting projects gaining momentum—accounting for 60% of glazing installations, per Renovate Europe—the continued dominance of double glazing seems assured.

The triple low-emissivity (Low-E) glazing is witnessing explosive growth and likely to register a CAGR of 9.89% over the forecast period due to the rising demand for ultra-energy-efficient solutions capable of meeting ambitious climate goals. The European Climate Foundation estimates that upgrading to triple Low-E glazing could cut carbon emissions from buildings by up to 25%. These units feature advanced coatings that reflect infrared light, reducing heat transfer by an additional 20% compared to double glazing, according to a study in Applied Energy. Moreover, triple glazing is gaining traction in passive house designs, which aim for near-zero energy consumption. Passive House Institute data indicates that triple-glazed windows are now standard in over 90% of certified passive homes. Rising awareness of indoor air quality and noise reduction—triple glazing reduces external noise by up to 45 dB—is another catalyst. As nations strive to achieve net-zero targets by 2050, triple Low-E glazing stands out as a transformative solution poised for sustained expansion.

REGIONAL ANALYSIS

Germany held the leading share of the Europe warm edge spacer market in 2024 due to its robust construction sector and stringent energy efficiency regulations. The Federal Ministry for Economic Affairs and Energy reports that Germany accounts for 25% of the region’s total market share. With over 1.5 million new energy-efficient homes built annually, the demand for warm edge spacers remains high. Additionally, the German Energy Agency highlights that the country’s commitment to achieving climate neutrality by 2045 drives innovation in sustainable building materials, solidifying its leadership position.

France is another regional market for warm edge spacers in Europe. The growth of French market is driven by its focus on retrofitting existing buildings. The French Environment and Energy Management Agency states that retrofit projects contributed to 40% of the market growth in 2022. France’s Renovation Wave initiative aims to renovate 500,000 homes annually, boosting demand for warm edge spacers. Furthermore, a report by the French Construction Federation reveals that the adoption of energy-efficient windows increased by 18% in urban areas, underscoring the country’s pivotal role in the market.

Italy holds a significant position in the European market due to its large residential construction sector. According to the Italian National Institute of Statistics, the country’s construction output grew by 8% in 2023, with warm edge spacers accounting for 20% of window component sales. Italy’s emphasis on preserving historical architecture while integrating modern energy solutions creates unique opportunities. The Italian Green Building Council highlights that 65% of new projects incorporate sustainable materials, reinforcing Italy’s importance in the market.

Spain is likely to account for a notable share of the European warm edge spacer market over the forecast period owing to its rapid urbanization and renewable energy initiatives. The Spanish Ministry of Transport, Mobility, and Urban Agenda reports that 35% of new buildings comply with near-zero energy standards. A study by the Spanish Construction Confederation reveals that warm edge spacers reduce energy consumption by 15%, making them indispensable. Spain’s strategic investments in green infrastructure further enhance its market standing.

The United Kingdom is anticipated to witness a notable CAGR in the European market over the forecast period supported by its ambitious net-zero goals. The UK Green Building Council states that energy-efficient windows reduced household emissions by 10% in 2022. With over 200,000 new homes constructed annually, the demand for warm edge spacers is surging. Additionally, government incentives encourage retrofitting, ensuring sustained market growth and highlighting the UK’s leadership in sustainable construction.

KEY MARKET PLAYERS

The major players in the Europe warm edge spacer market include Alu-Pro, Avery Dennison, Bieber Windows, Edgetech, Fenzi, H.B. Fuller, Helima, LiSEC, Press Glass Holding, Quanex Building Products, Swisspacer, Technoform, Termoprofi, and Thermoseal Group.

MARKET SEGMENTATION

This research report on the Europe warm edge spacer market is segmented and sub-segmented into the following categories.

By Product

- Flexible spacers

- Plastic/metal hybrid spacers

- Stainless steel spacers

By End Use

- Residential

- Commercial

By Glazing Window

- Double glazing

- Triple low-E

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Warm Edge Spacer Market?

The market is growing due to increasing demand for energy-efficient windows, stringent EU regulations on building insulation, and rising awareness about reducing carbon footprints.

What materials are commonly used in warm edge spacers in Europe?

The most commonly used materials include stainless steel, thermoplastic spacers, and hybrid composite spacers, which offer improved thermal insulation compared to traditional aluminum spacers.

What role do warm edge spacers play in reducing carbon emissions?

By improving the thermal efficiency of windows, warm edge spacers help lower energy consumption in buildings, leading to reduced carbon emissions from heating and cooling systems.

What are the future trends in the Europe Warm Edge Spacer Market?

Future trends include increased adoption of smart glazing technologies, further innovation in materials for improved insulation, and growing demand for sustainable building solutions across residential and commercial sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com