Europe Video Management Software (VMS) Market Size, Share, Trends, & Growth Forecast Report By Technology (Analog-Based and IP-Based), Deployment, Vertical, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Video Management Software (VMS) Market Size

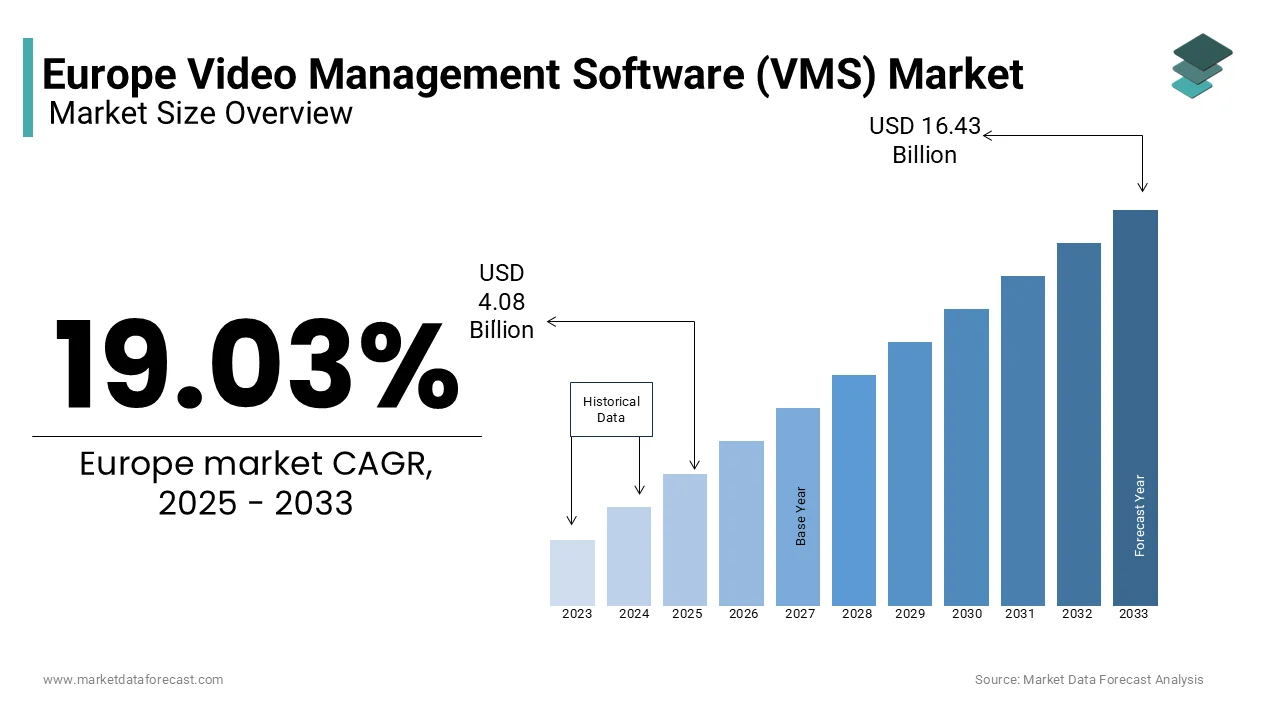

The Europe video management software (VMS) market was worth USD 3.43 billion in 2024. The European market is projected to reach USD 16.43 billion by 2033 from USD 4.08 billion in 2025, growing at a CAGR of 19.03% from 2025 to 2033.

In Europe, advancements in digital transformation, rising concerns over public safety, and the increasing adoption of Internet of Things (IoT)-enabled devices have driven substantial demand for video management services in the recent years. Video management software refers to a sophisticated suite of tools designed to manage, store, analyze, and retrieve video footage captured by networked cameras and other surveillance systems. These platforms enable end-users to monitor live feeds, conduct forensic investigations, and integrate with artificial intelligence (AI) technologies for enhanced analytics such as facial recognition and anomaly detection.

The demand for VMS in Europe is further expected to be driven by the stringent regulatory frameworks governing data privacy and cybersecurity, particularly under the General Data Protection Regulation (GDPR). Organizations are increasingly prioritizing secure and scalable video management systems that comply with these regulations. Furthermore, the proliferation of smart city initiatives across major European economies like Germany, France, and the United Kingdom has significantly bolstered the deployment of VMS in urban infrastructure projects.

MARKET DRIVERS

Smart City Initiatives Accelerating VMS Adoption

The proliferation of smart city initiatives across Europe stands as a major driver for the video management software (VMS) market. Governments are increasingly investing in smart infrastructure to improve urban safety, sustainability, and operational efficiency. According to the European Commission’s Smart Cities Marketplace, over 300 cities in Europe are actively deploying smart technologies, many of which rely on advanced surveillance systems powered by VMS. These platforms enable functionalities such as real-time traffic monitoring, crowd management, and crime prevention, making them indispensable for modern urban environments. The European Investment Bank has allocated approximately EUR 1.5 billion annually to fund smart city projects, further fueling the adoption of VMS solutions. Additionally, the integration of AI-driven analytics into these systems allows municipalities to derive actionable insights, enhancing public safety while optimizing resource allocation.

Cybersecurity and GDPR Compliance Boosting VMS Demand

The growing emphasis on cybersecurity and compliance with data privacy regulations, particularly the General Data Protection Regulation (GDPR), is another key driver of the Europe VMS market. With cyberattacks targeting surveillance systems rising by 40% in recent years, as reported by the European Union Agency for Cybersecurity (ENISA), organizations are prioritizing secure VMS solutions. These platforms offer features like end-to-end encryption, access controls, and audit trails to protect sensitive video data. Eurostat highlights that over 60% of businesses in the EU have enhanced their cybersecurity measures since GDPR's implementation in 2018. This regulatory push has created a strong demand for advanced VMS platforms that ensure compliance while maintaining operational efficiency. As a result, enterprises and government entities are increasingly adopting secure VMS solutions to safeguard data and adhere to stringent privacy standards.

MARKET RESTRAINTS

High Implementation Costs Hindering Widespread Adoption

The high initial costs associated with implementing video management software (VMS) solutions pose a significant restraint to market growth in Europe. According to Eurostat, small and medium-sized enterprises (SMEs), which constitute approximately 99% of all businesses in the EU, often face budgetary constraints that limit their ability to invest in advanced VMS platforms. The total cost of ownership includes not only software licensing but also hardware infrastructure, installation, and ongoing maintenance expenses. A report by the European Investment Bank highlights that nearly 40% of SMEs cite financial barriers as a primary challenge in adopting cutting-edge technologies. Additionally, the need for specialized training to operate these systems further escalates costs, making it difficult for smaller organizations to justify the investment. This financial burden disproportionately affects industries with limited IT budgets, thereby slowing the overall market expansion.

Data Privacy Concerns and Regulatory Complexity

Stringent data privacy regulations, while driving compliance-focused innovations, also act as a restraint for the Europe VMS market due to the complexity and cost of adherence. The General Data Protection Regulation (GDPR), enforced by the European Data Protection Board, imposes strict requirements on how video data is collected, stored, and processed. Non-compliance can result in fines of up to EUR 20 million or 4% of global annual turnover, as stated by the European Commission. These stringent rules create hesitancy among organizations, particularly smaller entities, to adopt VMS solutions without guaranteed compliance. Furthermore, the European Union Agency for Cybersecurity (ENISA) reports that over 50% of organizations struggle with aligning their surveillance systems to GDPR standards. This regulatory complexity not only increases operational challenges but also raises concerns about potential legal repercussions, deterring some stakeholders from fully embracing VMS technologies.

MARKET OPPORTUNITIES

Technological Advancements

The integration of artificial intelligence (AI) and machine learning (ML) into video management software presents a transformative opportunity for the European market. The European Commission’s Digital Economy and Society Index highlights that AI adoption across industries grew by 30% in 2022, with video analytics emerging as a key beneficiary. AI-powered video management systems enable advanced functionalities such as facial recognition, anomaly detection, and predictive maintenance, which are critical for sectors like retail, transportation, and public safety. According to Eurostat, businesses leveraging AI-driven video solutions reported a 25% improvement in operational efficiency. Furthermore, the European Union’s investment of €20 billion in AI research and development underscores the region's commitment to fostering innovation. By incorporating AI/ML capabilities, video management software providers can cater to evolving enterprise needs while capitalizing on Europe’s digital transformation initiatives.

Cloud-based VMS

The rising demand for cloud-based video management solutions offers another significant growth avenue. The European Cloud Industry Forum reports that cloud adoption in Europe surged by 40% in 2023, driven by remote work trends and the need for scalable infrastructure. Cloud-based video management systems provide cost-effective storage, real-time access, and enhanced cybersecurity, addressing the limitations of traditional on-premise solutions. A study by the European Network and Information Security Agency reveals that 65% of organizations prefer cloud platforms for their flexibility and disaster recovery capabilities. Additionally, the European Investment Bank forecasts that the cloud services market will expand at a CAGR of 18% through 2030. By prioritizing cloud integration, video management software vendors can tap into this burgeoning demand while ensuring compliance with stringent data protection regulations like GDPR.

MARKET CHALLENGES

Interoperability Issues Across Diverse Systems

One of the major challenges facing the Europe video management software (VMS) market is the lack of interoperability between VMS platforms and other security systems. According to the European Union Agency for Cybersecurity (ENISA), over 45% of organizations report difficulties in integrating VMS with existing hardware and software infrastructure, such as access control systems or IoT devices. This fragmentation often leads to inefficiencies and increased costs, as businesses are forced to invest in additional middleware or replace legacy systems. The European Commission’s Digital Transformation Monitor highlights that interoperability issues are particularly pronounced in cross-border projects, where varying standards and protocols hinder seamless data sharing. Furthermore, the absence of unified industry standards exacerbates the problem, leaving organizations reliant on proprietary solutions. These challenges not only slow down adoption but also limit the scalability of VMS deployments across industries.

Cybersecurity Vulnerabilities in Surveillance Systems

Another significant challenge is the rising threat of cyberattacks targeting video management software, which undermines user confidence and adoption. The European Union Agency for Cybersecurity (ENISA) reports a 60% increase in cyber incidents involving surveillance systems over the past two years, with attackers exploiting vulnerabilities in VMS platforms to gain unauthorized access to sensitive footage. A study by Eurostat reveals that nearly 30% of European businesses have experienced at least one cybersecurity breach related to their surveillance infrastructure. Additionally, the complexity of securing large-scale VMS deployments, especially in smart city projects, poses further risks. The European Network and Information Security Directive emphasizes that inadequate cybersecurity measures can lead to severe reputational and financial damages. As a result, organizations are increasingly hesitant to adopt VMS solutions without robust, end-to-end security features, creating a barrier to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.03% |

|

Segments Covered |

By Technology, Deployment, Vertical, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Honeywell International, Inc., Axis Communications AB (Canon, Inc.), Hangzhou Hikvision Digital Technology Co., Ltd., Panasonic Holdings Corporation, Robert Bosch GmbH, Teledyne FLIR LLC, Zhejiang Dahua Technology Co., Ltd., Verint Systems, Inc., Genetec, Inc., and Salient Systems. |

SEGMENTAL ANALYSIS

By Technology Insights

The IP-based ruled the market by holding 70.7% of the Europe VMS market share in 2024. The domination of IP-based technology segment is driven by their superior scalability, high-definition video capabilities, and seamless integration with IoT and AI-driven analytics. The European Investment Bank highlights that IP-based systems are pivotal in smart city projects, where interconnected devices and real-time data analysis are critical. This segment's importance lies in its ability to enhance operational efficiency and security, making it indispensable for industries like transportation and healthcare.

By Deployment Insights

The on-premise segment accounted for the leading share of 55.8% of the European market share in 2024 owing to the growing demand for data sovereignty and stringent compliance with GDPR, which requires localized data storage. The European Data Protection Board highlights that on-premise solutions are critical for industries like banking and government, where security and control over sensitive data are non-negotiable. Despite higher upfront costs, these systems ensure minimal reliance on third-party providers, reducing cybersecurity risks. Their importance lies in providing robust, reliable surveillance infrastructure, making them indispensable for organizations prioritizing privacy and regulatory adherence.

The cloud segment is anticipated to register the fastest CAGR of 20.8% over the forecast period owing to factors such as the increasing adoption of IoT devices and the demand for scalable, cost-effective solutions. As per the Eurostat, over 65% of European businesses are transitioning to cloud-based systems due to their flexibility, remote accessibility, and integration with AI-driven analytics. The European Commission emphasizes that cloud-based VMS supports digital transformation and sustainability goals by reducing energy consumption. Its importance lies in enabling real-time monitoring and advanced analytics, making it ideal for smart cities and SMEs seeking innovative, future-ready surveillance technologies.

By Vertical Insights

The government and law enforcement segment led the market by holding 25.9% of the European market share in 2024. The growth of the government and law enforcement segment is driven by the rising demand for public safety, crime prevention, and smart city initiatives. The European Commission highlights that over 300 cities in Europe are integrating VMS into urban infrastructure projects, enabling real-time monitoring and data-driven decision-making. Its importance lies in ensuring GDPR compliance, enhancing national security, and supporting large-scale surveillance needs, making it indispensable for governments and law enforcement agencies across Europe.

The retail and e-commerce segment is estimated to register a promising CAGR of 18.4% over the forecast period owing to the increasing adoption of AI-driven analytics for customer behavior analysis, loss prevention, and warehouse surveillance. The European Investment Bank reports a 30% annual increase in warehouse automation projects, further boosting VMS adoption. Its importance lies in enabling retailers to optimize operations, enhance customer experiences, and comply with data privacy regulations, positioning it as a key driver of innovation in the Europe VMS market.

By Application Insights

The video analytics had the largest share of 40.3% of the European market share in 2024. The growth of the video analytics segment is driven by the integration of AI and machine learning, enabling functionalities like facial recognition, object detection, and anomaly identification. The European Commission highlights that over 300 smart city projects across Europe rely on video analytics for traffic management and public safety. This application is critical for industries like retail and law enforcement, where real-time insights enhance decision-making. Its importance lies in transforming raw video data into actionable intelligence, making it indispensable for modern surveillance systems.

The cloud storage and management is estimated to witness the highest CAGR of 22.8% over the forecast period owing to the increasing adoption of cloud-based solutions, which offer scalability, cost savings, and remote accessibility. The European Investment Bank reports that over 65% of new VMS installations now utilize cloud storage, driven by the demand for flexible and secure data management. Its importance lies in supporting digital transformation and enabling compliance with GDPR while reducing reliance on on-premise infrastructure. This makes it a key driver of innovation in the Europe VMS market.

REGIONAL ANALYSIS

Germany dominated the market by accounting for 25.9% of the European market share in 2024. The strong industrial base of Germany is primarily propelling the German VMS market growth. The European Investment Bank highlights that Germany’s smart city initiatives, particularly in urban centers like Berlin and Munich, are driving demand for AI-integrated VMS solutions. Additionally, stringent data protection laws under GDPR have encouraged organizations to adopt secure and compliant VMS platforms. Germany’s robust infrastructure, technological advancements, and high investment in IoT and AI further solidify its dominance in the regional market.

The United Kingdom accounted for a promising share of the European VMS market in 2024. The domination of the UK market is majorly attributed to its rapid adoption of cloud-based VMS solutions, driven by the growing emphasis on remote monitoring and digital transformation. The British Security Industry Association reports that over 60% of businesses in the UK have upgraded their surveillance systems to comply with GDPR and enhance cybersecurity. London’s status as a global financial hub has also spurred demand for advanced VMS in banking, retail, and transportation sectors. Furthermore, government-funded smart city projects, such as those in Manchester and Birmingham, are integrating VMS for public safety and traffic management, making the UK a pivotal player in the Europe VMS market.

France is projected to witness a promising CAGR over the forecast period in the European market. The growing emphasis of France on enhancing public safety and combating urban crime is significantly boosting the VMS adoption, particularly in cities like Paris and Lyon, which is majorly driving the French market growth. The European Commission reports that France’s investment in smart city technologies, including intelligent transportation and crowd management systems, has created a strong demand for AI-driven VMS platforms. Additionally, the implementation of the country’s national cybersecurity strategy has encouraged organizations to prioritize secure and scalable VMS solutions. France’s strategic emphasis on innovation, coupled with its robust regulatory framework, positions it as a key contributor to the Europe VMS market’s growth.

KEY MARKET PLAYERS

The major players in the Europe video management software (VMS) market include Honeywell International, Inc., Axis Communications AB (Canon, Inc.), Hangzhou Hikvision Digital Technology Co., Ltd., Panasonic Holdings Corporation, Robert Bosch GmbH, Teledyne FLIR LLC, Zhejiang Dahua Technology Co., Ltd., Verint Systems, Inc., Genetec, Inc., and Salient Systems.

MARKET SEGMENTATION

This research report on the Europe video management software (VMS) market is segmented and sub-segmented into the following categories.

By Technology

- Analog-Based

- IP-Based

By Deployment

- On-premise

- Cloud

By Vertical

- Retail & E-Commerce

- Government & Law Enforcement

- Banking, Financing, Services & Insurance (BFSI)

- Transportation & Logistics

- Healthcare

- Other Vertical

By Application

- Video Analytics

- Cloud Storage & Management

- Access Control Integration

- Perimeter Protection

- Remote Monitoring

- Other Application

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Video Management Software (VMS) market?

The growth is driven by increased adoption of IP-based surveillance, rising security concerns, smart city initiatives, and advancements in AI-powered video analytics.

What role does AI and analytics play in the European VMS market?

AI-driven analytics enhance VMS capabilities with real-time threat detection, facial recognition, object tracking, and automated alerts, improving overall security efficiency.

How are smart cities influencing the demand for VMS in Europe?

Smart city projects require VMS for traffic monitoring, public safety, and infrastructure management, significantly increasing demand for intelligent surveillance solutions.

What future trends are expected in the European VMS market?

Trends include increased adoption of cloud-based VMS, AI-powered automation, IoT integration, cybersecurity enhancements, and compliance-driven innovations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]