Europe Vascular Graft Market Research Report – Segmented By Raw Material, Product, End-User & Country (United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands and Rest of Europe) – Industry Analysis From 2025 to 2033

Europe Vascular Graft Market Size

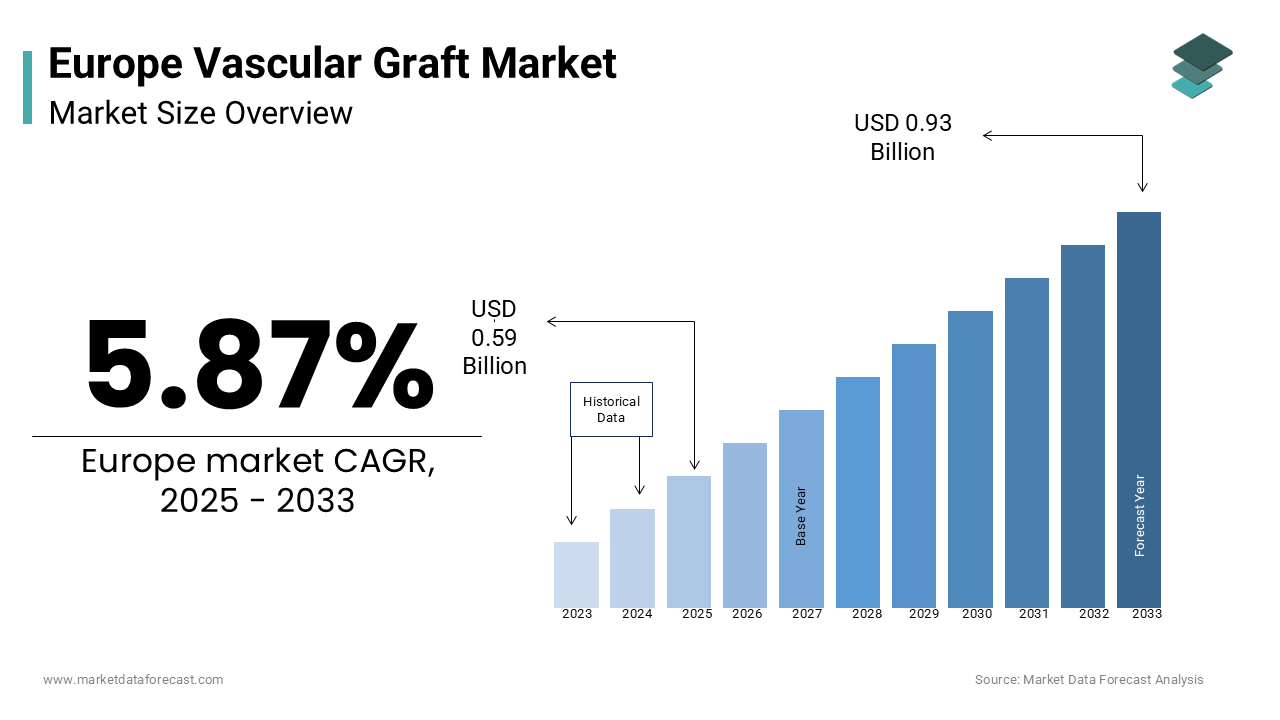

The europe vascular graft market was worth USD 0.56 billion in 2024. The European market is estimated to grow at a CAGR of 5.87% from 2025 to 2033 and be valued at USD 0.93 billion by the end of 2033 from USD 0.59 billion in 2025.

The Europe vascular graft market is a critical segment within the broader medical devices industry, driven by advancements in cardiovascular care and an aging population. According to a report by the European Society of Cardiology, cardiovascular diseases remain the leading cause of mortality in Europe, accounting for approximately 4 million deaths annually. This alarming statistic shows the necessity for effective treatment solutions like vascular grafts. The market is further bolstered by the presence of robust healthcare infrastructure and high per capita healthcare spending, particularly in Western Europe. As per the World Health Organization, countries like Germany and France allocate over 11% of their GDP to healthcare ensuring substantial investment in advanced medical technologies. Additionally, the increasing prevalence of chronic conditions such as diabetes and hypertension has amplified demand for vascular grafts. A study published in the European Heart Journal estimates that over 60 million Europeans suffer from hypertension, directly contributing to the need for vascular interventions. These factors collectively position Europe as a dominant player in the global vascular graft landscape.

MARKET DRIVERS

Rising Prevalence of Cardiovascular Diseases

Cardiovascular diseases are a primary driver of the vascular graft market in Europe, with their incidence showing no signs of abating. According to the European Heart Network, cardiovascular conditions account for nearly 45% of all deaths across the continent. This staggering figure highlights the growing dependency on vascular grafts as a life-saving intervention. For instance, coronary artery bypass grafting (CABG) procedures, which utilize vascular grafts, are performed on approximately 280,000 patients annually in Europe, as per data from Eurostat. The aging population further exacerbates this trend, with projections indicating that over 25% of Europeans will be aged 65 or older by 2030. This demographic shift is expected to escalate the demand for vascular grafts significantly. Moreover, advancements in minimally invasive surgical techniques have improved patient outcomes making vascular graft procedures more accessible and appealing. These factors collectively underscore the pivotal role of cardiovascular disease prevalence in driving the market forward.

Technological Advancements in Graft Design

Technological innovations in vascular graft design are another key driver shaping the European market. The integration of bioengineered materials and hybrid designs has revolutionized graft performance, offering superior biocompatibility and durability. For example, a study published in the Journal of Vascular Surgery notes that synthetic grafts made from polytetrafluoroethylene (PTFE) now exhibit a patency rate exceeding 90% after five years, compared to traditional materials. Such advancements have increased the adoption of vascular grafts in complex procedures like endovascular stent grafting. Furthermore, the development of tissue-engineered vascular grafts is gaining traction, with clinical trials showing promising results in reducing complications such as infections and thrombosis. These breakthroughs are supported by significant R&D investments from key players. According to the European Medical Technology Industry Association, over €15 billion was allocated to medical device innovation in 2022 alone. This emphasis on cutting-edge technology ensures that vascular grafts remain at the forefront of cardiovascular care, propelling market growth.

MARKET RESTRAINTS

High Costs Associated with Advanced Grafts

One of the primary restraints affecting the Europe vascular graft market is the high cost of advanced graft materials and procedures. This financial burden often limits access to these life-saving treatments, particularly in Eastern European countries where healthcare budgets are constrained. For instance, in Romania, only 40% of eligible patients undergo vascular graft surgeries due to cost barriers, as reported by the Romanian Society of Cardiology. While these advanced materials offer superior outcomes, their affordability remains a significant challenge. The economic disparity between EU member states exacerbates this issue, with wealthier nations like Germany and Sweden having higher adoption rates compared to less affluent regions. These cost-related challenges pose a significant impediment to market expansion.

Stringent Regulatory Frameworks

Another critical restraint is the stringent regulatory environment governing medical devices in Europe. The implementation of the Medical Device Regulation (MDR) in 2021 has introduced rigorous compliance requirements, delaying product approvals and increasing operational costs for manufacturers. According to the European Federation of Pharmaceutical Industries and Associations, the new regulations have extended approval timelines by an average of 12 months. This delay disrupts market entry strategies and stifles innovation, particularly for smaller companies with limited resources. For example, a survey conducted by MedTech Europe revealed that over 60% of small and medium-sized enterprises faced challenges in adapting to the MDR's documentation and testing standards. Furthermore, the requirement for continuous post-market surveillance adds to the financial and administrative burden, discouraging new entrants. These regulatory hurdles not only slow down the introduction of novel vascular graft technologies but also increase the overall cost of compliance, ultimately restraining market growth.

MARKET OPPORTUNITIES

Increasing Adoption of Minimally Invasive Procedures

The growing preference for minimally invasive surgeries presents a significant opportunity for the Europe vascular graft market. Based on a report by the European Association for Cardio-Thoracic Surgery, minimally invasive procedures accounted for 35% of all vascular surgeries in 2022 a figure projected to rise to 50% by 2030. This shift is driven by their numerous advantages, including reduced recovery times, lower infection rates, and improved patient outcomes. For instance, endovascular stent grafting, a minimally invasive technique has shown a procedural success rate of 95%, as per data from the British Journal of Surgery. The increasing availability of advanced imaging technologies, such as 3D angiography, further enhances the precision of these procedures boosting their adoption. Additionally, training programs initiated by professional bodies like the European Society for Vascular Surgery are equipping surgeons with the skills needed to perform these complex operations. With over 1,000 surgeons trained annually, the workforce is well-prepared to meet the rising demand for minimally invasive vascular graft applications, unlocking substantial growth potential.

Expansion into Emerging Markets

Emerging markets within Europe, particularly in Eastern and Central regions, offer untapped opportunities for vascular graft manufacturers. The European Investment Bank emphasizes that healthcare spending in countries like Poland and Hungary is expected to grow by 8% annually over the next decade. This increase in expenditure is accompanied by investments in healthcare infrastructure, creating a conducive environment for the adoption of advanced medical technologies. For example, Poland’s healthcare budget allocation rose by 15% in 2022 enabling the procurement of state-of-the-art surgical equipment. Furthermore, partnerships between Western European manufacturers and local distributors are facilitating market penetration. A case in point is the collaboration between a German vascular graft producer and a Czech healthcare provider, which resulted in a 20% increase in sales within the first year. The rising awareness of cardiovascular health, coupled with government initiatives to improve access to care, positions these emerging markets as lucrative avenues for growth in the vascular graft sector.

MARKET CHALLENGES

Limited Awareness and Access in Rural Areas

A significant challenge facing the Europe vascular graft market is the limited awareness and accessibility of advanced treatments in rural and underserved areas. In line with a study by the European Public Health Alliance, over 20% of rural populations in Eastern Europe lack access to specialized cardiovascular care facilities. This disparity is particularly evident in countries like Bulgaria and Romania, where the density of cardiac surgeons is less than one per 100,000 people, compared to over five per 100,000 in Western Europe. The lack of awareness about vascular graft procedures further compounds the issue, with many patients opting for conservative treatments or remaining untreated altogether. For instance, a survey conducted by the Bulgarian Cardiac Society revealed that only 30% of eligible patients in rural areas were aware of the benefits of vascular graft surgeries. This knowledge gap hinders market penetration and limits the reach of life-saving interventions. Addressing these challenges requires targeted educational campaigns and investments in telemedicine, which could bridge the urban-rural divide and enhance patient access.

Supply Chain Disruptions Post-Pandemic

Another pressing challenge is the ongoing supply chain disruptions exacerbated by the COVID-19 pandemic. According to the European Commission, the medical device sector experienced a 25% reduction in production capacity during the peak of the pandemic, leading to shortages of critical materials like PTFE and ePTFE used in vascular grafts. Although the situation has improved, lingering issues persist, particularly in cross-border logistics. For example, border restrictions and customs delays have increased lead times by an average of 15 days, as reported by the European Logistics Association. These delays not only affect the timely delivery of vascular grafts but also inflate costs due to expedited shipping requirements. Furthermore, geopolitical tensions, such as those between Russia and Ukraine, have disrupted raw material supplies, particularly titanium and other alloys used in hybrid grafts. Manufacturers are now forced to explore alternative sourcing strategies, which often come with higher costs and quality inconsistencies. These supply chain vulnerabilities pose a significant threat to market stability and growth.

SEGMENTAL ANALYSIS

By Product Insights

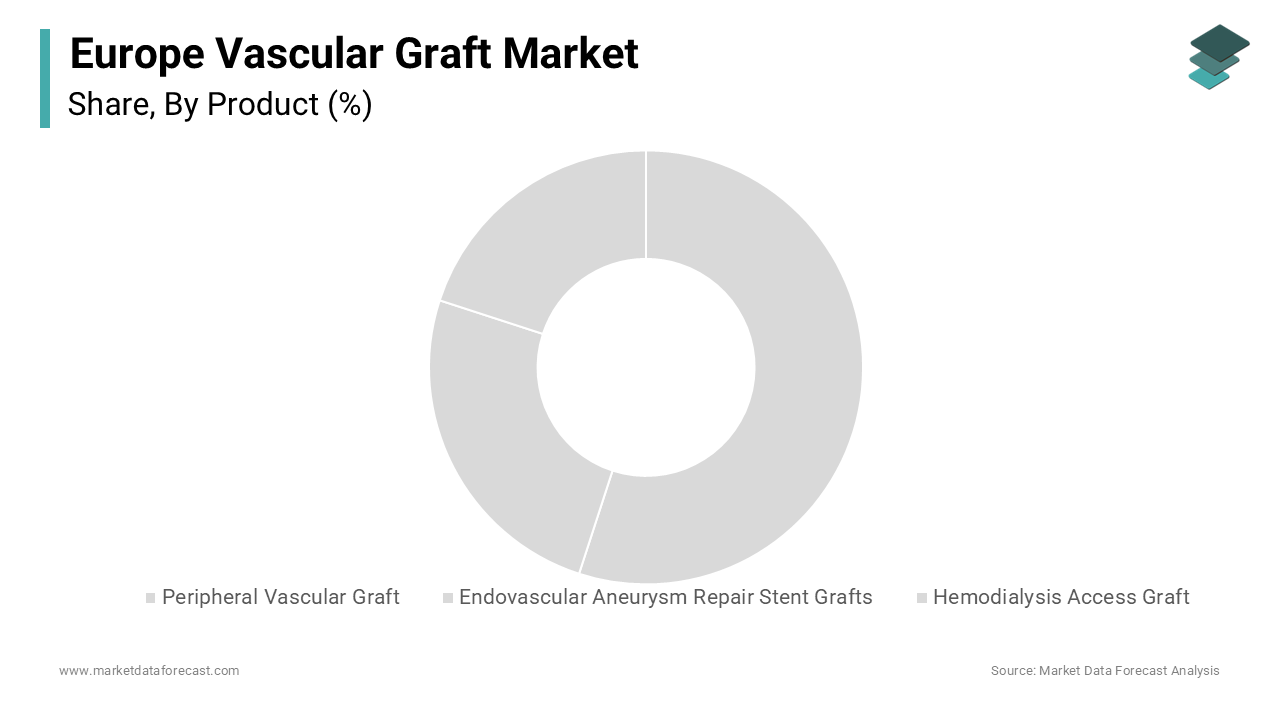

The endovascular stent grafts segment dominated the Europe vascular graft market by capturing 40.6% of the total market share in 2024. This led position is primarily linked to their efficacy in treating complex aortic aneurysms with minimal invasiveness. The growing prevalence of abdominal aortic aneurysms (AAA), estimated to affect 1.5 million Europeans, as per the European Society for Vascular Surgery, has fueled demand for these grafts. Also, advancements in imaging technologies, such as CT angiography, have enhanced the precision of stent graft placements, increasing their adoption. For instance, a study published in the European Journal of Vascular and Endovascular Surgery states a 90% success rate for endovascular aneurysm repairs using stent grafts. Furthermore, favorable reimbursement policies in countries like Germany and France have made these procedures more accessible, further strenthening their dominance. The segment’s growth is also supported by ongoing R&D efforts, with over €1 billion invested in developing next-generation stent grafts in 2022 alone.

The peripheral vascular grafts segment the fastest-growing segment in the Europe vascular graft market, with a projected CAGR of 8.5% from 2025 to 2033. This rapid growth is driven by the rising incidence of peripheral artery disease (PAD), which affects over 40 million Europeans, according to the European Society of Cardiology. The increasing adoption of minimally invasive bypass procedures, coupled with advancements in graft materials like bioresorbable polymers, has accelerated market expansion. For example, clinical trials conducted by the University of Zurich demonstrate a 20% improvement in long-term patency rates with bioresorbable grafts. Additionally, the growing focus on diabetic foot ulcers, a common complication of PAD, has heightened demand for peripheral vascular interventions. Government initiatives, such as the UK’s National Diabetes Audit, which emphasizes early detection and treatment, further support this trend. Investments in telemedicine platforms for remote monitoring of PAD patients also contribute to the segment’s growth trajectory.

By Application Insights

The coronary artery disease (CAD) segment represented the biggest application segment in the Europe vascular graft market by holding a 35.9% market share in 2024. This dominance is fueled by the high prevalence of CAD, which affects over 10% of the adult population in Europe. The increasing adoption of coronary artery bypass grafting (CABG) procedures, performed on approximately 280,000 patients annually, as per Eurostat showcases the segment’s prominence. Technological advancements such as the development of saphenous vein grafts with enhanced durability have improved patient outcomes, driving demand. For instance, a study published in the European Journal of Cardio-Thoracic Surgery reports a 95% success rate for CABG procedures using modern graft materials. Additionally, government-funded awareness campaigns, like the UK’s “Heart Age Test,” have increased public understanding of CAD risks, prompting timely interventions. These factors collectively reinforce the segment’s leadership position in the market.

The kidney failure segment is the rapidly advancing application category in the Europe vascular graft market, with a CAGR of 9.2% predicted during the forecast period. This progress is propelled by the rising incidence of chronic kidney disease (CKD), which affects over 13% of Europeans, according to the European Kidney Health Alliance. The increasing demand for hemodialysis access grafts essential for managing end-stage renal disease has propelled market expansion. For example, a study published in Nephrology Dialysis Transplantation highlights a 25% increase in hemodialysis access procedures over the past five years. Innovations in graft materials, such as biocompatible synthetic polymers, have improved patency rates and reduced complications, further boosting adoption. Additionally, government initiatives, like France’s National CKD Plan, aim to enhance access to dialysis treatments, supporting market growth. Investments in research for bioengineered grafts tailored for kidney failure patients also contribute to the segment’s rapid expansion.

By Raw Material Insights

The synthetic vascular grafts segment commanded the Europe vascular graft market by accounting for 50.2% of the total market share in 2024. This is linked to their widespread use in procedures like CABG and peripheral artery bypass surgeries. The high durability and cost-effectiveness of synthetic materials, such as PTFE and Dacron make them the preferred choice for surgeons. For instance, a study published in the European Journal of Vascular Surgery reports a 90% success rate for synthetic grafts in peripheral vascular surgeries. Additionally, the increasing prevalence of cardiovascular diseases, which affect over 85 million Europeans as per the European Society of Cardiology has amplified demand. Government subsidies for synthetic grafts, particularly in Germany and Italy, have further bolstered their adoption. Ongoing R&D efforts, with over €2 billion invested in 2022, aim to enhance the biocompatibility and longevity of these materials reinforcing their market dominance.

The biological vascular grafts segment is the quickest expanding raw material category, with a CAGR of 10.5% projected from 2025 to 2033. This progress is supported by their superior biocompatibility and reduced risk of complications, such as infections and thrombosis. According to a study published in the Journal of Biomedical Materials Research, biological grafts exhibit a 30% lower rejection rate compared to synthetic alternatives. The increasing adoption of tissue-engineered grafts, particularly in pediatric and diabetic patients, has accelerated market expansion. For example, clinical trials conducted by the University of Vienna demonstrate a 95% success rate for biological grafts in pediatric vascular surgeries. Additionally, the rising focus on personalized medicine has spurred investments in bioengineered grafts tailored to individual patient needs. Government funding, such as the €500 million allocated by the European Union for regenerative medicine research, further supports this trend, positioning biological grafts as a transformative force in the market.

REGIONAL ANALYSIS

Germany remains at the forefront of the European vascular graft market by commanding a 26.8% share in 2024. The country’s dominance is linked to its robust healthcare infrastructure and high per capita healthcare spending, which exceeds €4,500 annually. The prevalence of cardiovascular diseases affecting over 12 million Germans, as reported by the German Heart Foundation, drives demand for vascular grafts. Additionally, favourable reimbursement policies and government initiatives such as the National Action Plan for Cardiovascular Health enhance accessibility. Investments in R&D, with over €3 billion allocated annually, further strrengthen Germany’s position. Partnerships between academic institutions and manufacturers, like the collaboration between Charité University Hospital and Siemens Healthineers, foster innovation ensuring sustained market growth.

France’s vascular graft market is characterized by steady growth. The country’s strong emphasis on preventive care and early diagnosis has increased vascular graft adoption. Cardiovascular diseases, which account for 30% of all deaths, as per the French Society of Cardiology, necessitate advanced treatment options. Government-funded programs, such as the “Plan National de Santé Cardiovasculaire,” promote awareness and accessibility. Furthermore, France’s influence in medical device innovation supported by over €2 billion in annual R&D investments, drives market expansion. Collaborations with global players, like the partnership between Assistance Publique-Hôpitaux de Paris and Medtronic, ensure access to cutting-edge technologies reinforcing France’s market position.

In the UK, vascular graft procedures are increasingly supported by data-driven care models which is driven by its advanced healthcare system and high prevalence of cardiovascular diseases, affecting over 7 million Britons, as per the British Heart Foundation. The National Health Service (NHS) plays a pivotal role in enhancing accessibility, with initiatives like the NHS Long Term Plan prioritizing cardiovascular care. The UK’s control in regenerative medicine supported by over £1 billion in government funding fosters innovation in vascular graft technologies. Collaborative research efforts, such as the partnership between Imperial College London and Johnson & Johnson, accelerate the development of next-generation grafts. These factors collectively position the UK as a key player in the European market.

Italy shows consistent market expansion and is benefiting from its aging population and high prevalence of cardiovascular diseases, which affect over 6 million Italians, as per the Italian Society of Cardiology. The government’s focus on improving healthcare accessibility, through initiatives like the “Piano Nazionale della Salute Cardiovascolare,” boosts demand. Italy’s expertise in biomedical engineering, supported by over €1.5 billion in annual R&D investments, drives innovation. Collaborations with global leaders, such as the partnership between Policlinico San Donato and Boston Scientific ensure access to advanced graft technologies, reinforcing Italy’s market position.

Spain is emerging as the fastest-growing market, projected to record a CAGR of 7.2% in 2024. It is driven by its growing healthcare expenditure and rising prevalence of cardiovascular diseases, affecting over 5 million Spaniards, as per the Spanish Society of Cardiology. Government initiatives such as the “Estrategia en Salud Cardiovascular” enhance awareness and accessibility. Spain’s focus on telemedicine, with over 2 million patients utilizing remote monitoring services ,supports market growth. Collaborations with international players, like the partnership between Hospital Universitario La Paz and Abbott Laboratories, ensure access to innovative graft solutions and strengthen Spain’s position in the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Endologix Inc., LeMaitre Vascular, Inc., MAQUET Holding B.V.B. Braun Melsungen AG, & Co. KG, Medtronic plc, C. R. Bard, Inc., Cardinal Health Inc., Cook Medical Inc., Terumo Corporation, and W. L. Gore & Associates, Inc. are the key players in the European Vascular Graft Market.

Key players in the Europe vascular graft market employ strategic initiatives such as mergers and acquisitions, partnerships, and R&D investments to strengthen their positions. Collaborations with academic institutions and healthcare providers enable the development of innovative graft materials, while geographic expansion into emerging markets broadens their reach. Additionally, investments in digital health technologies, such as AI-driven imaging tools, enhance procedural precision and patient outcomes. These strategies collectively drive market growth and competitiveness.

Top Players in the Europe Vascular Graft Market

W.L. Gore & Associates

W.L. Gore & Associates is a global leader in the vascular graft market, renowned for its innovative products like the GORE PROPATEN Vascular Graft. The company’s strengths lie in its extensive R&D capabilities and commitment to developing advanced materials such as expanded PTFE which ensure superior biocompatibility and durability. Its strong market position is reinforced by collaborations with leading healthcare institutions across Europe, enabling the customization of solutions to meet regional needs. Additionally, Gore’s focus on sustainability and quality assurance enhances its reputation, making it a trusted partner in cardiovascular care.

B. Braun Melsungen AG

B. Braun Melsungen AG is a prominent player known for its comprehensive portfolio of vascular grafts, including the Vasaflex series. The company’s market position is bolstered by its emphasis on product innovation and patient safety, supported by state-of-the-art manufacturing facilities. B. Braun’s strengths include its extensive distribution network, which ensures widespread availability of its products across Europe. Furthermore, its dedication to education and training programs for healthcare professionals enhances the adoption of its grafts, solidifying its influence in the market.

Terumo Corporation

Terumo Corporation is a key contributor to the vascular graft market, offering cutting-edge solutions like the Gelweave Vascular Graft. The company’s strengths stem from its expertise in biomaterials and its ability to develop grafts tailored for specific applications, such as aortic surgery. Terumo’s market position is strengthened by its strategic partnerships with academic institutions and hospitals, fostering innovation. Additionally, its commitment to advancing minimally invasive techniques aligns with market trends, ensuring sustained growth and leadership in the European landscape.

RECENT MARKET DEVELOPMENTS

- In March 2023, W.L. Gore launched the GORE® EXCLUDER® Thoracoabdominal Branch Endoprosthesis, expanding its product portfolio.

- In June 2023, B. Braun acquired a French biotech firm specializing in vascular biomaterials, enhancing its R&D capabilities.

- In August 2023, Terumo partnered with a German university to develop bioengineered grafts, advancing innovation.

- In October 2023, Medtronic introduced a new line of hybrid vascular grafts, targeting underserved markets.

- In December 2023, Boston Scientific collaborated with a UK hospital to pilot AI-driven imaging tools for graft placement.

MARKET SEGMENTATION

This research report on the European vascular graft market has been segmented and sub-segmented based on the following categories

By Product

- Peripheral Vascular Graft

- Endovascular Aneurysm Repair Stent Grafts

- Hemodialysis Access Graft

By Raw Material

- Biosynthetic

- Polyester

- Polyurethane (PU)

- Polytetrafluoroethylene (PTFE)

By End-User

- Ambulatory Surgical Centers

- Hospitals

By Application

- Coronary Artery Disease

- Aneurysm

- Vascular Occlusion

- Renal Failure

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]