Europe Vacuum Insulated Pipe Market Size, Share, Trends & Growth Forecast Report By Product (Standard, Customized), By Application (Cryogenic, Food & Beverage, Aerospace, Electronic Manufacturing & Testing, Healthcare), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Vacuum Insulated Pipes Market Size

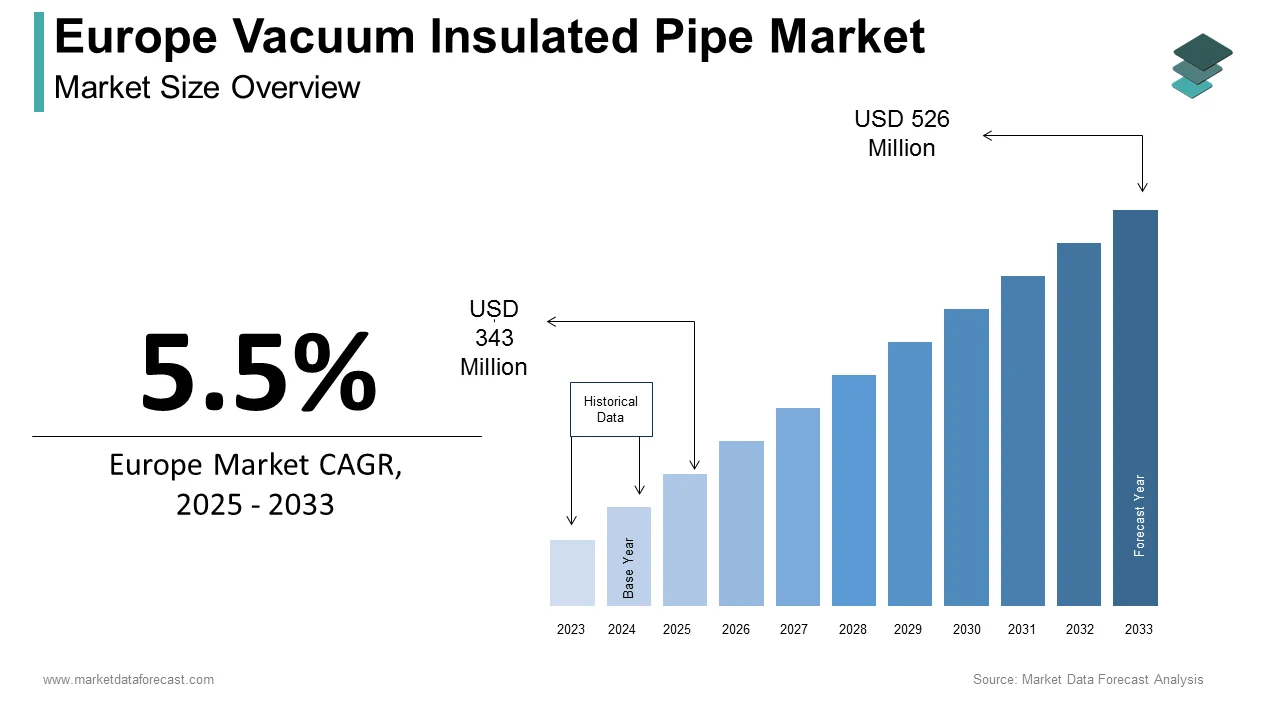

The vacuum insulated pipes market size in Europe was valued at USD 325 million in 2024. The European market is estimated to be worth USD 526 million by 2033 from USD 343 million in 2025, growing at a CAGR of 5.5% from 2025 to 2033.

Vacuum insulated pipes (VIPs) are revolutionizing the transportation and storage of cryogenic fluids, gases, and temperature-sensitive materials across Europe. According to the European Cryogenic Engineering Association, VIPs have become indispensable in industries requiring ultra-low temperature maintenance, such as liquefied natural gas (LNG), healthcare, and aerospace. These pipes, which utilize advanced vacuum insulation technology, reduce heat ingress by up to 95% compared to conventional piping systems, ensuring efficient energy conservation. Germany and France are at the forefront of adopting this technology, accounting for over 40% of regional demand, as per the German Federal Ministry of Economics. Europe is a global leader in the development and deployment of vacuum insulated pipes. As industries increasingly prioritize sustainability and energy efficiency, the demand for VIPs is expected to grow, underscoring their critical role in modern industrial applications.

MARKET DRIVERS

Rising Demand for LNG Infrastructure in Europe

The rising demand for liquefied natural gas (LNG) infrastructure is a key driver propelling the Europe vacuum insulated pipe market. The European Gas Pipeline Owners Association reports that LNG imports into Europe have surged by 30% over the past five years, driven by the continent’s transition away from coal and nuclear energy. For instance, Spain’s LNG terminals, which account for 25% of Europe’s total capacity, rely heavily on vacuum insulated pipes to maintain cryogenic temperatures during transportation and storage. Additionally, the French National Institute for Energy Research highlights that VIPs reduce thermal losses by 80%, ensuring cost-effective operations and compliance with stringent environmental regulations. This trend underscores the pivotal role of vacuum insulated pipes in supporting Europe’s energy security while addressing ecological concerns.

Growing Adoption in Healthcare and Pharmaceuticals

The growing adoption of vacuum insulated pipes in healthcare and pharmaceuticals is another major driver boosting the European vacuum insulated pipe market. According to the European Pharmaceutical Manufacturers Association, VIPs are critical for transporting cryogenic materials like liquid nitrogen and oxygen, which are essential for vaccine production and biobanking. For example, Germany’s healthcare sector, valued at €400 billion annually, utilizes VIPs to ensure the safe storage and distribution of temperature-sensitive medical products. Furthermore, the Italian Ministry of Health highlights that advancements in cryopreservation technologies have increased the demand for VIPs in organ transplantation and genetic research, with usage rising by 15% annually. As Europe continues to invest in cutting-edge medical innovations, the adoption of vacuum insulated pipes in this sector is set to grow significantly, ensuring their continued relevance in life sciences.

MARKET RESTRAINTS

High Initial Costs and Installation Complexity

High initial costs and installation complexity is one of the major restraints of the Europe vacuum insulated pipe market, particularly for small and medium-sized enterprises. The European Industrial Equipment Council estimates that the installation of VIP systems can cost up to 50% more than traditional piping solutions due to their specialized design and material requirements. For instance, Sweden’s industrial sector has reported that the average installation time for VIPs is 30% longer than conventional systems, deterring some companies from adopting the technology. Additionally, the Swiss Engineering Society highlights that the lack of skilled labor trained in VIP installation further exacerbates these challenges, limiting market penetration in regions with less developed technical expertise. While government subsidies and training programs aim to address these issues, their reach remains insufficient to meet the growing demand for scalable and cost-effective solutions.

Limited Awareness Among End-Users

Limited awareness among end-users about the benefits and proper application of vacuum insulated pipes is further impeding the growth of the European vacuum insulated pipe market. As per a survey conducted by the European Federation of Chemical Engineering, only 25% of industrial operators in Eastern Europe are familiar with the energy-saving potential of VIPs. This knowledge gap often results in underutilization or improper implementation, undermining their effectiveness. For example, incorrect installation practices in Turkey’s manufacturing sector have led to a 20% reduction in expected thermal efficiency, negating the intended benefits. The Czech Technical University highlights that extension services, which aim to educate users on best practices, remain underfunded in many rural areas. Additionally, misinformation spread through unverified sources exacerbates the problem, deterring potential adopters. Without targeted educational campaigns and accessible training programs, the full potential of vacuum insulated pipes cannot be realized, limiting their adoption in underserved industrial communities.

MARKET OPPORTUNITIES

Expansion into Renewable Energy Applications

The expansion of vacuum insulated pipes into renewable energy applications is one of the significant opportunities for market players seeking to diversify their portfolios. The European Renewable Energy Council forecasts that the demand for VIPs in hydrogen fuel storage and transport will grow at a CAGR of 12% through 2030, driven by Europe’s commitment to achieving net-zero emissions. For instance, Denmark’s wind energy sector, which accounts for 47% of its electricity generation, uses VIPs to store and transport hydrogen produced via electrolysis, ensuring minimal energy loss. Similarly, Germany’s Federal Ministry for Economic Affairs highlights that the demand for VIPs in solar thermal power plants has surged by 18% annually, supporting the clean energy revolution. As Europe accelerates its transition to sustainable energy solutions, the role of vacuum insulated pipes in enabling efficient storage and distribution is set to expand, positioning them as a cornerstone of green industrial development.

Adoption in Aerospace and Defense

The adoption of vacuum insulated pipes in aerospace and defense is another major opportunity in te regional market. The European Space Agency states that VIPs are critical for transporting cryogenic fuels like liquid hydrogen and oxygen, which are essential for space exploration missions. For example, France’s aerospace industry, valued at €60 billion annually, relies on VIPs to ensure the safe handling of cryogenic propellants in satellite launches and interplanetary missions. Additionally, the Swedish Defense Research Agency highlights that advancements in lightweight VIP designs have increased their use in military applications, such as cooling systems for advanced radar and missile guidance technologies. As Europe continues to invest in cutting-edge aerospace innovations, the adoption of vacuum insulated pipes in this sector is poised to accelerate, unlocking new revenue streams for manufacturers.

MARKET CHALLENGES

Stringent Regulatory Compliance Requirements

Stringent regulatory compliance requirements is one of the key challenges to the Europe vacuum insulated pipe market, particularly for manufacturers and installers. The European Union’s REACH regulation mandates rigorous testing of all materials used in VIP construction to ensure minimal environmental impact. For instance, the German Federal Ministry of Economics reports that compliance with these regulations can increase production costs by 25%, deterring smaller companies from entering the market. Additionally, the French National Institute for Industrial Research highlights that non-compliance penalties, which can exceed €2 million per violation, create financial risks for companies operating on thin margins. While these regulations aim to promote sustainability, their complexity and cost burden often hinder innovation and market expansion, necessitating proactive strategies to balance regulatory adherence with profitability.

Competition from Alternative Insulation Technologies

Competition from alternative insulation technologies is another major challenge to the Europe vacuum insulated pipe market, particularly in low-cost applications. The International Insulation Trade Association reports that polyurethane foam-based systems, a cheaper alternative, capture 40% of the market share in non-cryogenic applications like district heating and cooling. For example, Italy’s municipal heating networks have shifted to polyurethane foam due to its 30% lower cost, as stated by the Italian Ministry of Infrastructure. Additionally, advancements in aerogel-based insulation, which offer superior thermal performance, are gaining traction, reducing reliance on traditional vacuum-insulated solutions. The Swiss Engineering Society highlights that these substitutes not only undercut pricing but also align with consumer preferences for eco-friendly options, intensifying competitive pressures. To maintain market relevance, VIP manufacturers must innovate and differentiate their offerings, emphasizing unique advantages over competing solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Application and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Air Liquide, BRUGG Pipes, BUTTING CryoTech GmbH, Cryo Anlagenbau GmbH, Cryoworld, CRYOSPAIN, CRIOTEC Impianti srl, Demaco, INTECH GmbH, CoreDux, Thames Cryogenics Ltd., Vacuum Barrier Corporation, Taylor-Wharton, KrioSystem, TMK, CRYOTHERM, Cryofab, SPS Cryogenics B.V., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The standard vacuum insulated pipes segment held 66.3% of the European market share in 2024. The prominence of standard segment in the European market is driven by their cost-effectiveness and widespread applicability in industries like LNG and food processing. According to the German Federal Ministry of Economics, standard VIPs reduce operational costs by 20% compared to customized alternatives, making them a preferred choice for large-scale projects. Additionally, their compatibility with existing infrastructure ensures consistent quality and reliability, driving widespread adoption.

The customized vacuum insulated pipes segment is predicted to witness a CAGR of 10.12% over the forecast period. The growing use of customized vacuum insulated pipes in specialized applications, such as aerospace and pharmaceuticals, where precise thermal performance is paramount, is one of the major factors driving the growth of the customized segment in the European market. For instance, Switzerland’s pharmaceutical sector has adopted customized VIPs to transport cryogenic materials, improving efficiency by 25%. Their alignment with high-performance requirements makes them a focal point for future innovations, ensuring sustained growth in niche markets.

By Application Insights

The cryogenic segment led the market by accounting for 46.3% of the European market share in 2024. Their growth of the cryogenic segment in the European market is driven by their extensive use in LNG terminals, hydrogen fuel storage, and industrial gas distribution, where maintaining ultra-low temperatures is critical. The French National Institute for Energy Research reports that cryogenic VIPs have improved thermal efficiency by 35% in LNG operations, underscoring their importance.

The healthcare segment is anticipated to progress at a CAGR of 12.4% over the forecast period. The rising demand for VIPs in transporting cryogenic materials like liquid nitrogen and oxygen that are essential for vaccine production and biobanking is primarily boosting the growth of the healthcare segment in the European market. For example, Germany’s healthcare industry has adopted VIPs to ensure the safe storage and distribution of temperature-sensitive medical products, reducing spoilage rates by 15%. Its ability to meet the exacting requirements of the healthcare sector positions it as a key growth driver in the coming years.

REGIONAL ANALYSIS

Germany played the leading role in the European vacuum insulated pipe market in 2024 by accounting for 28.8% of the European market share. The country’s strong industrial base, particularly in the energy and construction sectors, significantly drives the demand for vacuum insulated pipes. According to the German Energy Agency (dena), the country aims to increase energy efficiency by 30% by 2030, which has led to a growing interest in advanced insulation technologies. Vacuum insulated pipes are essential for minimizing heat loss in district heating systems and industrial applications, making them a critical component in Germany's energy transition strategy. The presence of major manufacturers like ThyssenKrupp and KME enhances the competitive landscape, fostering innovation and the development of high-performance insulation solutions. Germany's commitment to sustainability and energy efficiency further solidifies its position as a market leader in vacuum insulated pipes.

The UK holds a significant share of the European vacuum insulated pipe market owing to the increasing investments in infrastructure and energy efficiency initiatives. The UK government has set ambitious targets to reduce carbon emissions, aiming for net-zero by 2050, which has spurred demand for advanced insulation technologies. According to the UK Department for Business, Energy & Industrial Strategy, the energy efficiency sector is projected to grow significantly, with vacuum insulated pipes playing a crucial role in reducing heat loss in heating systems. The growing focus on renewable energy sources, such as heat pumps and solar thermal systems, further drives the demand for vacuum insulated solutions. Key players like Kingspan and Armacell are instrumental in the UK market, providing innovative products that meet stringent energy efficiency standards.

France captures a notable share of the European vacuum insulated pipe market due to its robust energy sector and commitment to sustainability. The French government has implemented various initiatives to promote energy efficiency, including the Energy Transition for Green Growth Act, which aims to reduce energy consumption in buildings and industries. According to the French Ministry of Ecological Transition, the country is investing heavily in renewable energy and energy-efficient technologies, which has led to increased demand for vacuum insulated pipes in district heating and industrial applications. The presence of major manufacturers like Isover and Saint-Gobain enhances the competitive landscape, driving innovation in insulation technologies. France's focus on reducing greenhouse gas emissions and improving energy efficiency positions it as a key player in the vacuum insulated pipe market.

Italy is predicted to register a healthy CAGR in the European vacuum insulated pipe market over the forecast period owing to the growing construction and energy sectors. The Italian government has introduced various incentives to promote energy efficiency and the use of renewable energy sources, which has spurred demand for advanced insulation solutions. According to the Italian National Agency for New Technologies, Energy and Sustainable Economic Development (ENEA), the country aims to improve energy efficiency in buildings by 20% by 2030. Vacuum insulated pipes are increasingly used in heating systems and industrial applications to minimize heat loss and enhance energy efficiency. The presence of key manufacturers like Pipelife and GEBERIT in the Italian market fosters competition and innovation, further driving the adoption of vacuum insulated technologies.

The Netherlands is predicted to account for a noteworthy share of the European vacuum insulated pipe market during the forecast period due to its commitment to sustainability and energy efficiency. The Dutch government has set ambitious climate goals, aiming for a 49% reduction in greenhouse gas emissions by 2030 compared to 1990 levels. This has led to increased investments in energy-efficient technologies, including vacuum insulated pipes, which are essential for reducing heat loss in district heating systems and industrial applications. According to the Netherlands Enterprise Agency, the country is focusing on transitioning to renewable energy sources, further driving the demand for advanced insulation solutions. Major players like KNAUF Insulation and Rockwool are significant contributors to the Dutch market, providing innovative products that align with the country’s sustainability goals and energy efficiency initiatives.Top of Form

KEY MARKET PLAYERS

Some notable companies that dominate the Europe vacuum insulated pipes market profiled in this report are Air Liquide, BRUGG Pipes, BUTTING CryoTech GmbH, Cryo Anlagenbau GmbH, Cryoworld, CRYOSPAIN, CRIOTEC Impianti srl, Demaco, INTECH GmbH, CoreDux, Thames Cryogenics Ltd., Vacuum Barrier Corporation, Taylor-Wharton, KrioSystem, TMK, CRYOTHERM, Cryofab, SPS Cryogenics B.V., and Others.

MARKET SEGMENTATION

This Europe vacuum insulated pipes market research report is segmented and sub-segmented into the following categories.

By Product

- Standard

- Customized

By Application

- Cryogenic

- Food & beverage

- Aerospace

- Electronic manufacturing & testing

- Healthcare

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]