Europe Vacation Rental Market Size, Share, Trends & Growth Forecast Report By Accommodation Type (Home, Apartment, Resort/Condominium, Others), Booking Mode (Online, Offline), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Vacation Rental Market Size

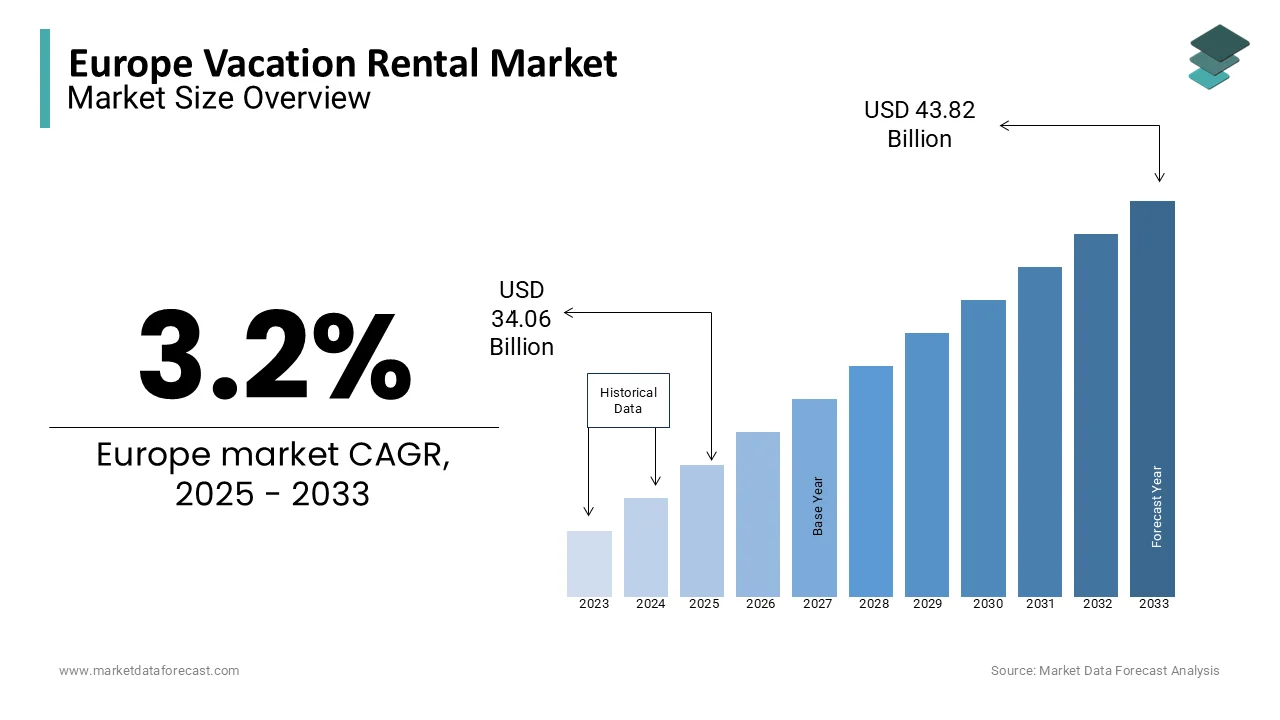

The vacation rental market size in Europe was valued at USD 33 billion in 2024. The European market is estimated to be worth USD 43.82 billion by 2033 from USD 34.06 billion in 2025, growing at a CAGR of 3.2% from 2025 to 2033.

Unlike traditional hotel stays, vacation rentals offer a home-like experience, appealing to families, groups, and solo travelers alike. The vacation rental market in Europe has witnessed significant growth over the past decade due to the rise of digital platforms, changing consumer preferences, and the increasing demand for unique and localized travel experiences. France, Spain, Italy, and the United Kingdom are playing a pivotal role in the European market owing to their robust tourism infrastructure and popularity among international visitors. Additionally, the COVID-19 pandemic accelerated the shift towards vacation rentals, as travelers prioritized privacy, space, and safety. Platforms like Airbnb, Vrbo, and Booking.com have played a pivotal role in shaping the market, facilitating seamless bookings and expanding inventory across urban and rural destinations.

MARKET DRIVERS

Changing Consumer Preferences and Demand for Unique Experiences in Europe

The Europe vacation rental market is significantly driven by evolving consumer preferences, particularly the growing demand for unique and personalized travel experiences. Travelers are increasingly seeking accommodations that offer a sense of authenticity, cultural immersion, and flexibility, which traditional hotels often cannot provide. According to the European Travel Commission, over 60% of travelers in 2022 expressed a preference for vacation rentals due to their ability to cater to specific needs, such as larger spaces and home-like amenities. This shift is further supported by Eurostat data, which indicates a 25% year-on-year increase in bookings for non-traditional accommodations in 2023. The desire for localized experiences has also fueled the growth of rural and off-the-beaten-path destinations, contributing to the market's expansion.

Technological Advancements and Digital Platform Penetration

The proliferation of digital platforms and technological innovations has been a critical driver of the Europe vacation rental market. Online booking platforms such as Airbnb, Vrbo, and Booking.com have revolutionized the way travelers search for and book accommodations, offering user-friendly interfaces, extensive property listings, and secure payment options. The European Commission's Digital Economy and Society Index (DESI) 2023 report highlights that over 75% of European travelers now use digital platforms to plan and book their stays. Additionally, advancements in artificial intelligence and data analytics have enabled personalized recommendations, enhancing user experience. This digital transformation has not only increased accessibility but also boosted market.

MARKET RESTRAINTS

Regulatory Challenges and Legal Restrictions

One of the primary restraints facing the Europe vacation rental market is the increasing regulatory scrutiny and legal restrictions imposed by local governments. Many European cities, including Barcelona, Paris, and Amsterdam, have introduced stringent regulations to curb the proliferation of short-term rentals, citing concerns over housing shortages and community displacement. According to Eurostat, over 40% of urban areas in the EU have implemented some form of restriction on vacation rentals as of 2023. For instance, the French government reported a 15% decline in available vacation rental properties in Paris following the introduction of a cap on rental days. These regulations often require hosts to obtain permits, limit rental durations, or pay additional taxes, creating operational challenges for property owners and platforms alike.

Economic Uncertainty and Inflationary Pressures

Economic instability and rising inflation have emerged as significant restraints on the Europe vacation rental market. The European Central Bank's 2023 report highlights that inflation rates in the Eurozone reached 5.5%, leading to increased costs for property maintenance, utilities, and services. This has forced many hosts to raise rental prices, making vacation rentals less affordable for budget-conscious travelers. Additionally, Eurostat data reveals a 10% decline in discretionary spending on travel and leisure activities in 2023, as households prioritize essential expenses. The economic uncertainty has also impacted international tourism, with a 12% drop in cross-border bookings reported by the European Travel Commission. These factors collectively hinder market growth, particularly in regions heavily reliant on tourism revenue.

MARKET OPPORTUNITIES

Rising Demand for Sustainable and Eco-Friendly Accommodations

The growing emphasis on sustainability presents a significant opportunity for the Europe vacation rental market. Travelers are increasingly prioritizing eco-friendly accommodations that align with their environmental values. According to the European Environment Agency, 65% of European tourists in 2023 expressed a preference for staying in properties with sustainable practices, such as energy-efficient systems and waste reduction measures. Governments are also incentivizing green initiatives; for example, the European Commission's Green Deal has allocated €1 billion to support eco-tourism projects. This trend is driving property owners to adopt sustainable practices, such as using renewable energy sources and obtaining eco-certifications. By catering to this demand, the vacation rental market can attract environmentally conscious travelers and differentiate itself in a competitive landscape.

Expansion into Emerging and Underserved Destinations

The Europe vacation rental market has immense potential to expand into emerging and underserved destinations, particularly in Eastern and Southern Europe. According to the European Travel Commission, countries like Croatia, Bulgaria, and Romania have seen a 20% increase in tourist arrivals in 2023, driven by their affordability and unspoiled natural beauty. These regions offer untapped opportunities for vacation rental growth, as they often lack sufficient hotel infrastructure. Additionally, the European Union's Cohesion Policy has invested €2.5 billion in developing tourism infrastructure in less-visited areas, enhancing accessibility and appeal. By targeting these markets, vacation rental platforms and property owners can diversify their offerings, reduce dependency on saturated urban hubs, and capitalize on the growing interest in off-the-beaten-path travel experiences.

MARKET CHALLENGES

Intensified Competition and Market Saturation

A major challenge for the Europe vacation rental market is the heightened competition and saturation in popular tourist destinations. Cities like Barcelona, Paris, and Rome have seen a significant influx of vacation rental properties, leading to an oversupply that drives down prices and reduces profitability for hosts. According to Eurostat, the number of listed vacation rentals in urban areas increased by 35% between 2020 and 2023, outpacing demand growth. The European Travel Commission reports that occupancy rates in these cities dropped by 12% in 2023, as travelers spread their stays across alternative destinations. This saturation forces hosts to invest heavily in marketing and amenities to remain competitive, increasing operational costs and squeezing profit margins in an already crowded market.

Impact of Seasonal Demand Fluctuations

Seasonal demand fluctuations pose a significant challenge to the Europe vacation rental market, particularly in regions heavily reliant on tourism. Data from the European Commission reveals that coastal and mountain destinations experience a 40% decline in bookings during off-peak seasons, leading to inconsistent revenue streams for property owners. For instance, the Greek National Tourism Organization reported that vacation rental occupancy in the Aegean Islands drops to below 20% during winter months. This seasonality forces hosts to rely on short-term income spikes, making it difficult to maintain year-round profitability. Additionally, the unpredictability of weather patterns, exacerbated by climate change, further complicates demand forecasting, creating financial instability for stakeholders in the vacation rental ecosystem.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.2% |

|

Segments Covered |

By Accommodation Type, Booking Mode, and Country. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Countries Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Airbnb Inc., 9flats.com Pte Ltd., Booking Holdings Inc., Expedia Group Inc., Hotelplan Holding AG, Vrbo, NOVASOL A/S, Wimdu, TripAdvisor Inc., Wyndham Destinations Inc., and Others.

|

SEGMENT ANALYSIS

By Accommodation Type Insights

The apartments segment dominated the market by accounting for 50.8% of the European market share in 2024. The dominance of the apartments segment is majorly attributed to affordability, central locations, and flexibility, making them ideal for urban travelers and short-term stays. According to Eurostat, 60% of vacation rental bookings in Berlin and Barcelona are for apartments, appealing to solo travelers, couples, and small groups.. The segment’s importance lies in its ability to cater to budget-conscious tourists while offering amenities like kitchens and laundry facilities, aligning with the growing preference for self-catering accommodations.

The other segment, which includes treehouses, houseboats, and glamping sites, is the fastest-growing segment and is likely to register a CAGR of 12.4% over the forecast period. The rising demand for unique and experiential travel, particularly among millennials and Gen Z is driving the expansion of other accommodation segment in the European market. The European Travel Commission reports a 20% increase in bookings for such accommodations in 2023, driven by their appeal to eco-conscious travelers seeking sustainable and memorable stays. The segment’s importance lies in its ability to diversify the market, attract niche audiences, and promote rural tourism, contributing to the overall resilience and innovation of the vacation rental industry.

By Booking Mode Insights

The online booking segment dominated the market by capturing 80.4% of the European market share in 2024. The convenience, transparency, and accessibility offered by digital platforms like Airbnb, Booking.com, and Vrbo is primarily driving the online booking segment in the European market. The European Commission's Digital Economy and Society Index (DESI) 2023 highlights that over 75% of European travelers prefer online bookings due to features such as real-time availability, user reviews, and competitive pricing. The segment’s importance lies in its ability to streamline the booking process, cater to tech-savvy consumers, and support the growing trend of last-minute and mobile-based reservations.

The online booking segment is also predicted to be the fastest growing segment and is predicted to register a CAGR of 8.5% over the forecast period due to the increasing smartphone penetration, improved internet connectivity, and the rise of AI-driven personalized recommendations. Eurostat data reveals that mobile bookings alone grew by 25% in 2023, reflecting the shift towards on-the-go travel planning. The segment’s importance is underscored by its role in enhancing user experience, expanding market reach, and driving innovation in the vacation rental industry. As digital adoption continues to rise, online booking is set to further solidify its position as the preferred mode for travelers across Europe.

REGIONAL ANALYSIS

France is a top-performing country in the Europe vacation rental market and held 21.9% of the European market share in 2024. The growth of the French market is majorly driven by its diverse tourism offerings, from Parisian apartments to Provencal villas and Alpine chalets. The French government’s focus on sustainable tourism, as highlighted in the European Environment Agency’s 2023 report, has further boosted demand for eco-friendly vacation rentals. The robust tourism infrastructure of France and the popularity of both urban and rural destinations among international and domestic travelers are further anticipated to continue to drive the vacation rental market growth in France.

Spain is one of the leading players in the European market and captured a notable share of the European market in 2024. The growth of the Spanish market is attributed to its sunny coastal destinations like Costa del Sol and the Balearic Islands, which attract millions of tourists annually. The increasing demand for long-term stays and family-friendly accommodations, the affordability, cultural appeal, and government initiatives to promote off-season tourism are further promoting the vacation rental market in Spain.

Italy is looking promising and is estimated to play a pivotal role in the European market. The rich cultural heritage of Italy, iconic cities like Rome and Florence, and picturesque countryside destinations such as Tuscany are driving the Italian vacation rental market growth. The Italian National Tourism Agency reported a 20% rise in vacation rental bookings in 2023, driven by the growing preference for authentic and localized travel experiences. Italy’s focus on preserving historical properties and promoting sustainable tourism has also contributed to its strong performance, making it a preferred destination for travelers seeking unique and immersive stays.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe vacation rental market profiled in this report are Airbnb Inc., 9flats.com Pte Ltd., Booking Holdings Inc., Expedia Group Inc., Hotelplan Holding AG, Vrbo, NOVASOL A/S, Wimdu, TripAdvisor Inc., Wyndham Destinations Inc., and Others.

MARKET SEGMENTATION

This Europe vacation rental market research report is segmented and sub-segmented into the following categories.

By Accommodation Type

- Home

- Apartments

- Resort/Condominium

- Others

By Booking Mode

- Offline

- Online

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth of the Europe vacation rental market?

The Europe vacation rental market was valued at USD 33 billion in 2024 and is projected to reach USD 43.82 billion by 2033, growing at a CAGR of 3.2% from 2025 to 2033.

2. Which countries are leading the vacation rental market in Europe?

France, Spain, Italy, and the United Kingdom are pivotal players in the European vacation rental market, owing to their robust tourism infrastructure and popularity among international visitors.

3. What factors are driving the growth of vacation rentals in Europe?

Key drivers include changing consumer preferences for unique and personalized travel experiences, technological advancements, and the proliferation of digital booking platforms like Airbnb, Vrbo, and Booking.com.

4. What technological advancements are driving the growth of vacation rentals in Europe?

Technological innovations such as mobile apps for booking, AI-driven recommendations, and seamless payment solutions are making vacation rentals more accessible and convenient for travelers.

5. How is the rise of eco-friendly travel influencing vacation rentals in Europe?

With increasing awareness of environmental issues, many vacation rental properties in Europe are adopting sustainable practices like energy-efficient appliances, waste reduction, and eco-friendly amenities, attracting eco-conscious travelers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]