Europe Used Cars Market Size, Share, Trends & Growth Forecast Report By Vehicle Type, Vendor Type Fuel Type, Distribution Channel, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Used Cars Market Size

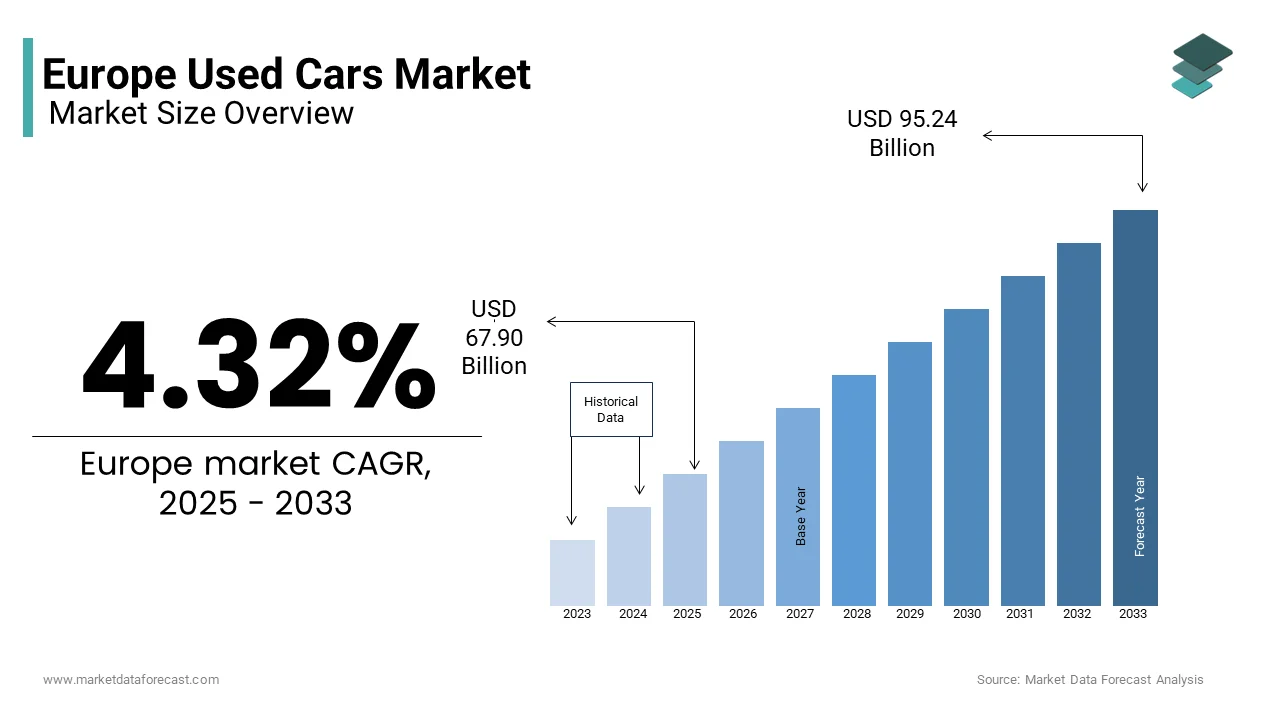

The Europe used cars market size was valued at USD 65.09 billion in 2024 and is anticipated to reach USD 67.90 billion in 2025 from USD 95.24 billion by 2033, growing at a CAGR of 4.32% during the forecast period from 2025 to 2033.

The European used car market offers a diverse array of pre-owned vehicles to meet the varied preferences and budgets of consumers. This market thrives on the principle of providing affordable mobility solutions while extending the lifecycle of automobiles, contributing to economic activity and environmental sustainability.

Key drivers of the used car market include affordability compared to new vehicles, availability of diverse models, and evolving consumer behavior toward cost-efficient and sustainable mobility. Buyers often find value in pre-owned cars due to lower initial costs, slower depreciation rates, and access to premium models at reduced prices. The market also aligns with sustainability goals by promoting the reuse of vehicles and reducing waste associated with the manufacturing of new cars.

The European used car sector operates through multiple channels, including professional dealerships, online platforms, and private sales. Professional dealers typically dominate the space, focusing on vehicles with newer model years and robust condition, while private transactions often involve older models.

Western Europe stands out as a leading region within the market, with established automotive infrastructures, high vehicle ownership rates, and consumer trust in the pre-owned vehicle sector. Technological advancements, such as online marketplaces and digital financing options, further enhance the accessibility and efficiency of transactions, reinforcing the market's growth trajectory. The European used car market, thus, represents a dynamic and essential part of the automotive industry.

Market Drivers

Rising Affordability and Cost-Effectiveness

The affordability of used cars compared to new vehicles is a primary driver of the European used car market. Consumers are increasingly opting for pre-owned vehicles due to their greatly lower depreciation rates. In Europe, new cars lose about 20-30% of their value within the first year, making used cars an attractive alternative. According to a report by the European Automobile Manufacturers' Association (ACEA), pre-owned vehicles often provide a 40-60% cost-saving advantage over their new counterparts. This trend resonates particularly with cost-conscious buyers and those seeking premium models at reduced prices. The affordability factor continues to drive robust sales, particularly in middle-income households across key markets like Germany, France, and Italy.

Shift Toward Sustainability and Circular Economy

Sustainability goals and the push toward a circular economy are reshaping the European used car market. The European Environment Agency emphasizes that reusing vehicles considerably reduces the environmental footprint associated with the production of new cars. Pre-owned cars reduce raw material extraction and manufacturing emissions which is aligning with the EU's 2050 climate neutrality goals. Furthermore, sales of used electric and hybrid vehicles are growing, with the European Alternative Fuels Observatory noting a 15% year-on-year increase in 2023. Consumers are increasingly drawn to eco-friendly options, making sustainability a critical factor influencing the growth of the pre-owned vehicle segment.

Market Restraints

Limited Transparency and Fraud Risks

A grave restraint in the European used car market is the lack of transparency in vehicle history and potential fraud. Issues such as odometer tampering, undisclosed accidents, and misrepresentation of vehicle condition deter buyers from trusting pre-owned car transactions. According to the European Commission, odometer fraud affects nearly 50% of cross-border used car sales within the EU is causing economic losses of up to €9.6 billion annually. This challenge is compounded by inconsistent reporting standards across European countries, leaving consumers vulnerable to deceptive practices. Efforts to enhance transparency, such as implementing digital vehicle history tracking systems, are ongoing but remain insufficiently widespread to mitigate the issue fully.

Impact of Regulatory and Emission Standards

Strict regulatory and emission standards across Europe pose challenges to the used car market. Vehicles with older engines, particularly those non-compliant with Euro 6 emission norms, face restrictions in low-emission zones across cities like Paris, Berlin, and Madrid. As reported by the European Environment Agency, vehicles exceeding emission standards contribute disproportionately to pollution, leading governments to incentivize the purchase of newer, cleaner models. This regulatory pressure decreases the desirability of older cars in the market, reducing their resale value and limiting options for cost-sensitive buyers. These factors create hurdles for the used car market, particularly in transitioning to eco-friendly models amidst evolving compliance requirements.

Market Opportunities

Growing Demand for Electric and Hybrid Vehicles in the Used Car Market

The increasing adoption of electric and hybrid vehicles presents a potential opportunity in the European used car market. As more consumers transition to sustainable mobility, pre-owned electric vehicles (EVs) and hybrids have seen rising demand. According to the European Alternative Fuels Observatory, the availability of used EVs grew by 20% in 2023 due to an increase in fleet turnovers and early adopters upgrading to newer models. Moreover, government incentives for electric mobility, such as subsidies for zero-emission vehicles in countries like Norway and the Netherlands, indirectly promote the resale market for EVs. The affordability of pre-owned EVs compared to new ones offers an accessible pathway for environmentally conscious buyers, strengthening the sector's growth potential.

Expansion of Digital Sales Channels

The rapid digitization of the automotive industry offers unparalleled growth opportunities for the European used car market. Online platforms provide a seamless buying experience, offering transparency, competitive pricing, and broader access to inventory. According to the European Commission's 2022 Digital Economy and Society Index, over 74% of European households are connected to high-speed internet, facilitating a growing reliance on online marketplaces for used car purchases. Platforms like AutoScout24 and mobile.de have revolutionized the sector, with features like detailed vehicle histories and AI-powered recommendations. As digital transactions become more sophisticated, they address traditional pain points like fraud and limited access, making them a transformative force in the market's evolution.

Market Challenges

Cross-Border Trade Complexities

Cross-border trade within the European used car market faces serious challenges due to regulatory inconsistencies and logistical hurdles. While the European Union promotes free movement of goods, differing national policies regarding taxes, registration, and vehicle standards complicate transactions. The European Commission reports that approximately 35% of used cars sold in Europe involve cross-border trade, but administrative barriers, such as varying VAT rules, lead to increased costs and delays. Additionally, language differences and lack of standardized vehicle history records make it harder for consumers to verify the condition and compliance of vehicles purchased internationally. These factors create friction in cross-border transactions and is restricts market efficiency and growth potential.

Shortage of Quality Used Vehicles

A notable challenge in the European used car market is the shortage of high-quality pre-owned vehicles. Supply chain disruptions, including the global semiconductor crisis, have limited new car production, indirectly affecting the availability of used vehicles. According to the European Automobile Manufacturers’ Association (ACEA), new car registrations in the EU declined by 2.4% in 2022, reducing the inflow of relatively new models into the used market. Furthermore, fleet operators and lease companies are holding onto their vehicles longer, further constraining supply. This scarcity leads to increased prices for desirable used cars, making affordability a concern for many buyers and potentially stalling market growth in cost-sensitive segments.

COUNTRY ANALYSIS

Germany

Germany led the European used car market and held a 25.9% market share in 2024 due to its robust automotive industry and a big vehicle ownership rates. The Federal Motor Transport Authority (KBA) reported over 7 million used car transactions in 2022, driven by the country's preference for quality engineering and well-maintained vehicles. Germany's extensive dealer network and regulatory framework ensure transparency and trust, enhancing consumer confidence. Additionally, the strong demand for German-made vehicles like BMW and Volkswagen in the pre-owned segment underscores the market's prominence. The country's importance lies in setting quality standards and serving as a hub for cross-border trade, bolstering the broader European market.

United Kingdom

The United Kingdom secured strong position in the European used car market and is expected to grow at a CAGR of 5.4% during the forecast period through elevated consumer demand and a mature automotive sector. According to the Society of Motor Manufacturers and Traders (SMMT), over 6.5 million used car transactions occurred in 2022. The popularity of online platforms, such as Auto Trader, further streamlines the buying process, offering transparency and convenience. The UK's emphasis on sustainable mobility, evidenced by increased sales of pre-owned electric and hybrid vehicles, also contributes to its market leadership. Its importnace lies in pioneering digital sales models and supporting the shift to greener automotive options, influencing regional trends.

France

France excels in the European used car market due to its well-established dealership networks and towering demand for cost-effective mobility. Data from the National Council of Automotive Professions (CNPA) indicates over 5.9 million used car sales in 2022, with Peugeot, Renault, and Citroën dominating the segment. France's strong vehicle inspection policies ensure quality standards, boosting buyer confidence. Additionally, government incentives for low-emission vehicles promote the resale of hybrids and EVs. France's importance lies in driving sustainable practices and maintaining a steady supply of reliable vehicles, reinforcing its position as a top-performing country in the regional used car market.

KEY MARKET PLAYERS

Volkswagen AG, Renault Group, PSA Group (Stellantis), BMW Group, Lookers Plc, Emil Frey AG, Autorola Group Holding, Pendragon Plc, AUTO1.com. These are the market players that are dominating the Europe used cars market.

MARKET SEGMENTATION

This research report on the Europe used cars market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Hybrid

- Conventional

- Electric

By Vendor Type

- Organized

- Unorganized

By Fuel Type

- Petrol

- Diesel

By Distribution Channel

- Online

- Offline

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe Used cars market?

The current market size of the Europe used car market size was valued at USD 67.90 billion in 2025

How big is the Europe Used cars market?

The Europe used car market size was valued at USD 65.09 billion in 2024 and is anticipated to reach USD 67.90 billion in 2025 from USD 95.24 billion by 2033, growing at a CAGR of 4.32% during the forecast period from 2025 to 2033.

What are the market drivers that are driving the Europe Used cars market?

The Rising affordability and cost-effectiveness and the Shift toward sustainability and circular economy are the major market drivers that are driving the europe used cars market.

Who are the market players that are dominating the Europe used cars market?

Volkswagen AG, Renault Group, PSA Group (Stellantis), BMW Group, Lookers Plc, Emil Frey AG, Autorola Group Holding, Pendragon Plc, AUTO1.com. These are the market players that are dominating the Europe used cars market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]