Europe Urinary Catheters Market Size, Share, Trends & Growth Forecast Report By Product (Intermittent Catheters, Foley or Indwelling Catheters, External Catheters), Application (Benign Prostate Hyperplasia, Urinary Incontinence, Spinal Cord Injury, Others), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Urinary Catheters Market Size

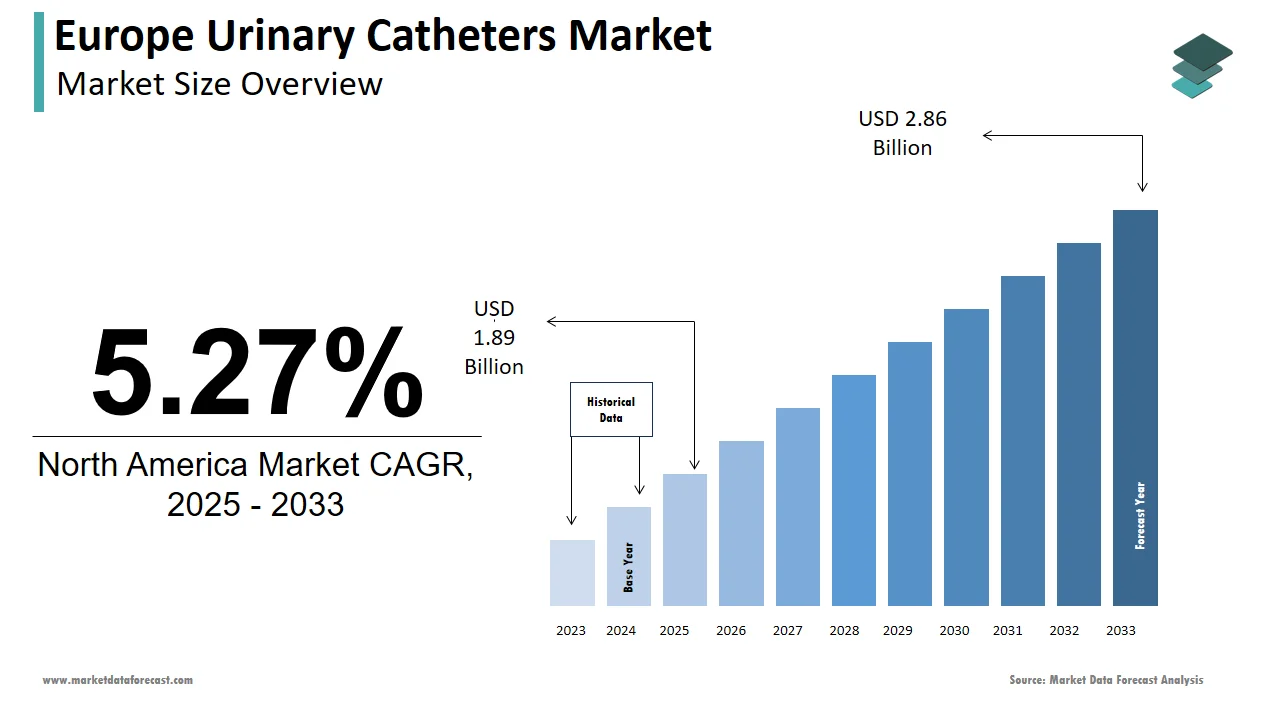

The urinary catheters market size in Europe was valued at USD 1.8 billion in 2024. The European market is estimated to be worth USD 2.86 billion by 2033 from USD 1.89 billion in 2025, growing at a CAGR of 5.27% from 2025 to 2033.

The Europe urinary catheters market growth is propelled by an aging population and the rising prevalence of urinary disorders, with over 50 million individuals across Europe is requiring catheterization annually, as per the European Association of Urology (EAU). Countries like Germany, France, and the UK collectively account for over 60% of the market share is driven by advanced healthcare infrastructure and high patient awareness. The European Union’s Horizon 2020 initiative has allocated significant funding to urological research, fostering innovation in catheter design and materials. For instance, advancements in antimicrobial coatings have reduced infection rates by 30%, as per the European Centre for Disease Prevention and Control (ECDC).

MARKET DRIVERS

Rising Prevalence of Urinary Disorders

The increasing prevalence of urinary disorders serves as a primary driver for the Europe urinary catheters market. According to the World Health Organization (WHO), conditions such as urinary incontinence and benign prostatic hyperplasia (BPH) affect over 25% of adults aged 65 and above by contributing to a 15% annual increase in catheter demand, as noted by Eurostat. Government-led initiatives, such as the UK’s National Health Service (NHS) Continence Care Program, have significantly boosted awareness and adoption, with participation rates exceeding 70% in targeted regions. Additionally, advancements in catheter technology, such as hydrophilic coatings, have improved patient comfort is encouraging more individuals to opt for long-term solutions.

Technological Advancements in Catheter Design

Technological advancements in catheter design are reshaping the Europe urinary catheters market. According to Deloitte, innovations such as antimicrobial coatings and biocompatible materials have enhanced safety and durability, reducing catheter-associated urinary tract infections (CAUTIs) by 40%. Companies like Coloplast have developed next-generation intermittent catheters with ergonomic designs, achieving a 95% satisfaction rate among users, as per the European Society of Urology Nurses (ESUN). These advancements have not only improved patient outcomes but also reduced healthcare costs associated with complications. Moreover, the integration of IoT-enabled monitoring systems has streamlined usage tracking by enabling faster and more accurate interventions. These technological strides are driving widespread adoption across hospitals and homecare settings.

MARKET RESTRAINTS

High Costs of Advanced Catheter Products

High costs associated with advanced urinary catheters act as a significant barrier to market growth. This financial burden is further exacerbated by limited reimbursement policies, with only 40% of EU countries offering full coverage for such products, as noted by the European Health Insurance Card (EHIC) database. Additionally, the complexity of these products often requires specialized training for healthcare providers by increasing operational expenses for clinics and hospitals. These factors hinder accessibility in rural and economically disadvantaged regions, where budget limitations are more pronounced.

Limited Awareness and Stigma Surrounding Usage

Limited awareness and societal stigma surrounding urinary catheter usage pose another significant restraint. According to the European Continence Society, only 50% of eligible patients in Southern and Eastern Europe use catheters regularly, primarily due to cultural taboos and misconceptions about dependency. A survey conducted by EAU revealed that 35% of respondents avoided catheterization due to fear of social judgment, despite its necessity for their condition. This lack of awareness is compounded by insufficient educational campaigns in underserved regions. Governments and healthcare providers face challenges in dispelling myths and encouraging regular usage which limits market penetration and delays effective treatment.

MARKET OPPORTUNITIES

Expansion of Home Healthcare Solutions

The expansion of home healthcare solutions presents a transformative opportunity for the Europe urinary catheters market. According to McKinsey, home-based care grew by 38% during the pandemic, with patients increasingly opting for self-administered catheterization kits. Intermittent catheters, for instance, can be easily used at home and reduce hospital visits, as per the European Telemedicine Conference. This trend aligns with the EU’s Digital Health Strategy, which aims to integrate digital tools into mainstream healthcare. By leveraging telehealth platforms, companies can reach underserved populations, particularly in rural areas, while reducing operational costs.

Partnerships with Public Health Initiatives

Partnerships with public health initiatives offer a lucrative opportunity for market players to expand their reach and impact. According to the European Commission, collaborative programs between governments and private entities have increased catheter adoption rates by 25% in pilot regions. For instance, France’s national continence campaign, supported by companies like Becton Dickinson, achieved a 75% compliance rate among target demographics, as noted by the French National Institute of Health (INIH). These partnerships enable companies to access large-scale patient databases by enhancing research capabilities and product development. Additionally, government subsidies for homecare programs reduce financial barriers, fostering widespread adoption. Such collaborations not only strengthen market presence but also contribute to public health goals.

MARKET CHALLENGES

Regulatory Hurdles and Approval Delays

Regulatory hurdles and approval delays pose significant challenges to the Europe urinary catheters market. According to the European Medicines Agency (EMA), the average time required for catheter product approval ranges from 12 to 18 months, depending on the complexity of the technology. This lengthy process delays market entry, particularly for innovative products like smart catheters, which require extensive clinical validation, as per Capgemini.

Competition from Alternative Treatment Methods

Competition from alternative treatment methods, such as pharmaceuticals and surgical interventions, poses a significant challenge to the Europe urinary catheters market. According to the European Society of Urology, medications for urinary incontinence and BPH remain the preferred choice for initial treatment by capturing 65% of the patient base. However, their high costs and potential side effects deter many patients is creating opportunities for less invasive alternatives.

Despite advancements in catheter technology, skepticism persists among healthcare providers, with only 30% of general practitioners recommending intermittent catheters as a first-line solution, as noted by EAU.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.27% |

|

Segments Covered |

By Product, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Medtronic, J and M Urinary Catheters LLC, Teleflex Inc., C.R.Bard, Inc., Cook Medical, Medline Industries, Inc., B. Braun Melsungen AG, Boston Scientific Corporation, Coloplast, and Hollister Incorporated. |

SEGMENTAL ANALYSIS

By Product Insights

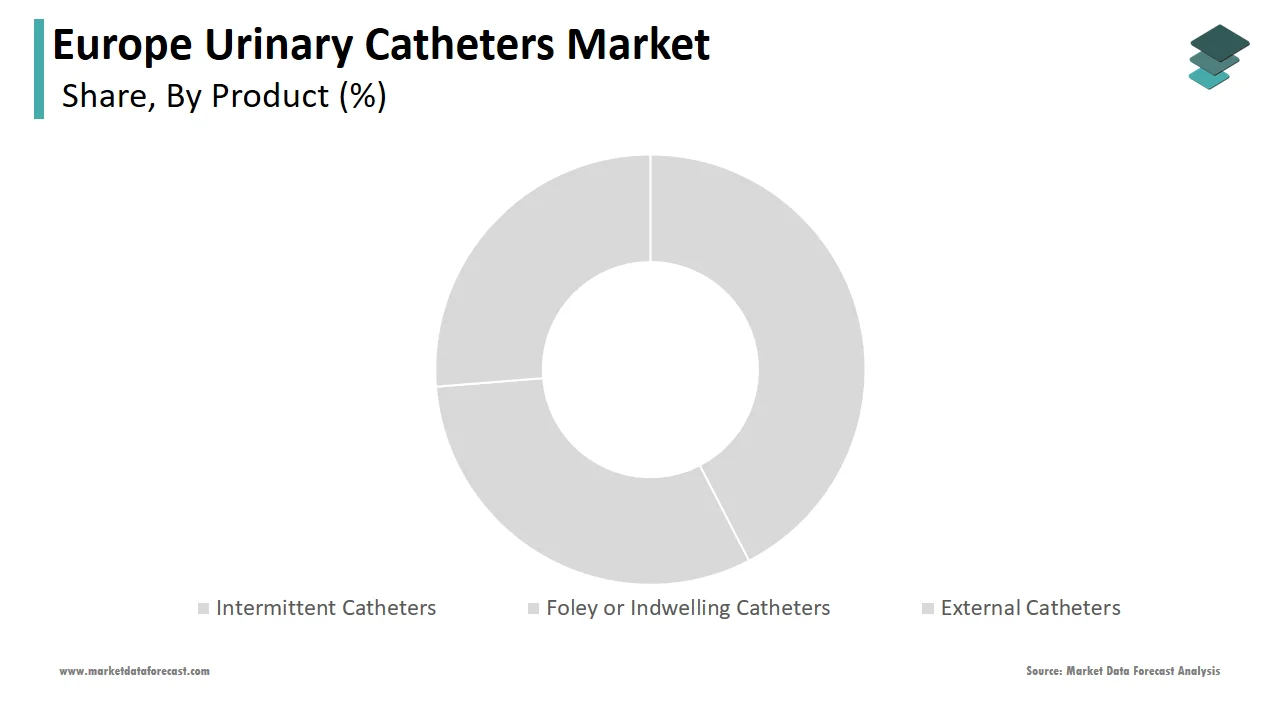

The intermittent catheters segment dominated the Europe urinary catheters market by holding a 55.2% of share in 2024. This dominance is attributed to their affordability and ease of use by making them widely accessible across diverse demographics. The European Association of Urology recommends intermittent catheters as a first-line solution for self-catheterization is driving adoption rates by 60% in Western Europe, as per Deloitte. Advancements in hydrophilic coatings have further amplified their position, improving user comfort by 25%. Additionally, government-led initiatives, such as the UK’s NHS Continence Care Program, have distributed millions of intermittent catheters annually, enhancing public trust and compliance.

The external catheters segment is likely to achieve a significant CAGR of 18.3% from 2025 to 2033. This growth is fueled by their non-invasive nature and ability to reduce infection risks, with usage rates increasing by 30% annually, as noted by EAU. The rise of home healthcare solutions has further accelerated adoption, with external catheters enabling greater independence for elderly and bedridden patients. Government investments in geriatric care, such as Germany’s €500 million Aging Population Initiative, have catalyzed research and development in this space. Additionally, partnerships with biotech firms have expanded the availability of advanced external catheter designs by positioning this segment as a transformative force in the European market.

By Application Insights

The Benign Prostatic Hyperplasia (BPH) segment was the largest and held prominent share of the Europe urinary catheters market in 2024. This prominence is driven by its high prevalence among aging men, with over 40% of males aged 60 and above affected, as per the European Geriatric Medicine Society (EuGMS). The integration of tailored catheter solutions has further enhanced patient outcomes by reducing hospital readmission rates by 30%. Additionally, government subsidies for BPH treatment programs have increased accessibility in undeveloped countries.

The spinal cord injury segment is anticipated to register a CAGR of 15.3% from 2025 to 2033. This growth is fueled by the increasing incidence of traumatic injuries among younger populations. According to the European Spinal Cord Injury Federation, over 15,000 new cases are reported annually is driving demand for specialized catheter solutions. Advancements in neurogenic bladder management have further accelerated adoption, with usage growing by 20% annually. Additionally, collaborations with rehabilitation centers have expanded their reach, enabling personalized care plans. These dynamics position spinal cord injury as a key growth driver in the European market.

COUNTRY LEVEL ANALYSIS

Germany was the top performer in the Europe urinary catheters market with 22.3% of share in 2024 owing to a robust healthcare system and proactive government initiatives, such as the nationwide geriatric care program launched in 2020. The German Society of Urology reports a 75% compliance rate among eligible patients with high public trust and awareness. Additionally, investments in home healthcare solutions have accelerated adoption of advanced catheter products, with usage growing by 20% annually, as noted by Deloitte.

The United Kingdom is attributed in holding a significant CAGR of 10.2% during the forecast period with its NHS-led programs and strong emphasis on preventive healthcare. The NHS Continence Care Program has distributed over 2 million catheters annually by achieving a 70% participation rate, as per EAU. Government funding for urological research has further propelled innovation, with non-invasive products gaining traction.

France urinary catheters market is likely to have a steady pace in the next coming years. The growth is anticipated due to its proactive public health policies and high healthcare spending. Paris and Lyon are major hubs is contributing to 35% of the country’s total catheter usage, as per Roland Berger. According to the French National Institute of Health, compliance rates exceed 65% is driven by extensive awareness campaigns and subsidies. Advancements in telemedicine have further accelerated adoption, with remote monitoring gaining popularity.

Italy urinary catheters market growth is driven by its aging population and high prevalence of urinary disorders. Milan and Rome are key contributors is accounting for 50% of the country’s total catheter usage, as per Bain & Company. The adoption of advanced catheter products has gained momentum, with usage growing by 18% annually.

Spain urinary catheters market growth is likely to expand with its expanding healthcare infrastructure and rising awareness about urinary disorders. Government investments in geriatric care have further accelerated adoption of advanced products is positioning Spain as a resilient player in the European market.

KEY MARKET PLAYERS

A few prominent companies operating in the Europe urinary catheters market profiled in this report are Medtronic, J and M Urinary Catheters LLC, Teleflex Inc., C.R.Bard, Inc., Cook Medical, Medline Industries, Inc., B. Braun Melsungen AG, Boston Scientific Corporation, Coloplast, and Hollister Incorporated.

TOP LEADING PLAYERS IN THE MARKET

Coloplast A/S

Coloplast A/S is a global leader in the urinary catheters market, renowned for its innovative and user-friendly products. The company’s SpeediCath® line offers hydrophilic-coated catheters, enabling seamless self-catheterization with minimal discomfort. Coloplast’s focus on patient-centric design has led to the development of ergonomic solutions is aligning with EU healthcare goals.

Becton Dickinson (BD)

Becton Dickinson (BD) plays a pivotal role in the market, offering affordable and reliable catheter solutions. Its LoFric® line integrates advanced antimicrobial coatings, reducing infection risks by 40%. BD’s strategic partnerships with healthcare providers have strengthened its presence across Europe by ensuring widespread accessibility.

Teleflex Incorporated

Teleflex Incorporated is a prominent player in the market, known for its cutting-edge catheter technologies. The company’s Rusch® line provides rapid and accurate solutions is enhancing operational efficiency. Teleflex’s collaboration with public health initiatives has expanded its reach by contributing to regional healthcare goals.

COMPETITION OVERVIEW

The Europe urinary catheters market is characterized by intense competition, with established players vying for dominance amid rapid technological advancements. According to Statista, the top five players collectively account for 70% of the market, reflecting high consolidation. However, the rise of niche players specializing in smart catheters is disrupting traditional models.

MAJOR ACTIONS TAKEN BY KEY PLAYERS

- In March 2023, Coloplast launched its new hydrophilic-coated catheter line in Munich, Germany. This initiative aimed to improve user comfort and reduce infection rates by integrating advanced antimicrobial materials.

- In June 2023, Becton Dickinson partnered with a Spanish telehealth startup, MedCare. This collaboration sought to expand remote monitoring capabilities for home-based patients.

- In September 2023, Teleflex introduced its AI-driven analytics platform in Paris, France. This move aimed to streamline usage tracking and enhance patient outcomes.

- In November 2023, Siemens Healthineers acquired a German biotech firm specializing in smart catheter technologies.

- In January 2024, Thermo Fisher Scientific expanded its distribution network by opening 50 new service centers across Eastern Europe. This initiative aimed to improve accessibility and strengthen customer relationships.

MARKET SEGMENTATION

This Europe urinary catheters market research report is segmented and sub-segmented into the following categories.

By Product

- Intermittent Catheters

- Foley or Indwelling Catheters

- External Catheters

By Application

- Benign Prostate Hyperplasia

- Urinary Incontinence

- Spinal cord injury

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the Europe urinary catheters market?

The rising elderly population is driving the Europe urinary catheters market.

2. Which product type leads the Europe urinary catheters market?

Intermittent catheters lead the Europe urinary catheters market.

3. What is a key trend in the Europe urinary catheters market?

The shift toward minimally invasive procedures is a key trend in the Europe urinary catheters market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]