Europe Ultra Thin Glass Market Size, Share, Trends & Growth Forecast Report By Manufacturing Process (Float Process, Fusion Process, Down-Draw Process, Others), Application, End Use Industry, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Ultra Thin Glass Market Size

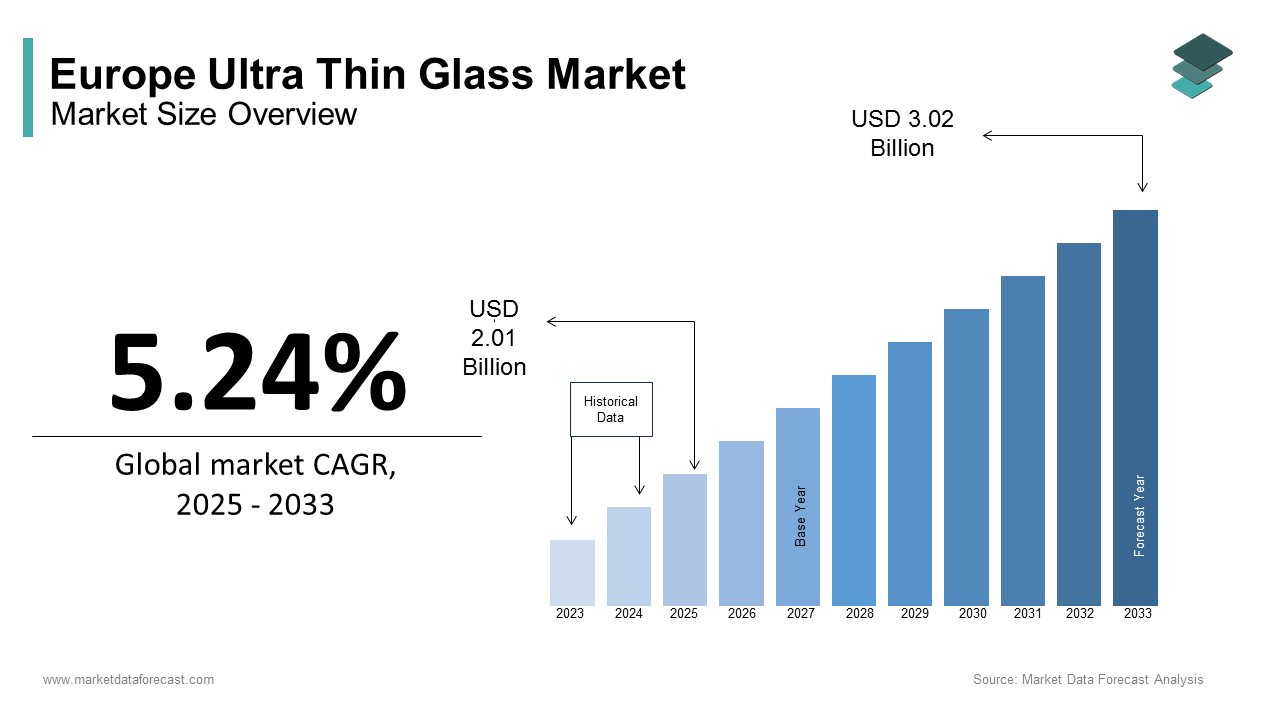

The Europe ultra thin glass market size was calculated to be USD 1.91 billion in 2024 and is anticipated to be worth USD 3.02 billion by 2033 from USD 2.01 billion In 2025, growing at a CAGR of 5.24% during the forecast period.

The Europe ultra thin glass market has established a strong presence, driven by its widespread application in advanced technologies such as touch panel displays, semiconductors, and automotive sensors. The rise of smart devices and IoT-enabled systems has further fueled consumption, with over 60% of the market tied to consumer electronics. Regulatory support for sustainable manufacturing practices also propels growth, as ultra thin glass is lightweight and recyclable by aligning with EU environmental goals.

MARKET DRIVERS

Growing Demand for Touch Panel Displays

The proliferation of smartphones, tablets, and wearable devices has significantly increased the demand for ultra thin glass, which serves as a key component in touch panel displays. Ultra thin glass offers superior optical clarity, durability, and flexibility by making it ideal for high-resolution screens. Additionally, the rise of foldable devices has spurred innovation, with companies investing in ultra thin glass that can withstand repeated bending without compromising performance. This trend is particularly evident in Germany, where electronics manufacturers are integrating advanced materials into their products. The shift toward remote work and digitalization post-pandemic has further amplified demand by creating a lucrative opportunity for ultra thin glass suppliers.

Expansion of Semiconductor Manufacturing

Semiconductor fabrication represents another major driver of ultra thin glass adoption in Europe. Ultra thin glass is increasingly used as a substrate material due to its thermal stability, chemical resistance, and ability to facilitate miniaturization. The EU’s Chips Act, aimed at doubling semiconductor production by 2030, has incentivized investments in cutting-edge technologies, including ultra thin glass. Nations like France and the Netherlands are emerging as hubs for semiconductor R&D, driving regional demand. Furthermore, the rise of AI and 5G technologies has necessitated faster and smaller chips, where ultra thin glass plays a pivotal role. This convergence of technological advancements and policy support underscores the material's importance in the semiconductor ecosystem.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints in the Europe ultra thin glass market is the high cost associated with production. Manufacturing ultra thin glass requires precision engineering and advanced machinery, which significantly increases operational expenses. This financial barrier limits entry for smaller players and constrains supply chain scalability. Moreover, the raw materials used, such as specialty coatings and substrates, are expensive. While larger companies like Schott AG and Corning Inc. have the resources to absorb these expenses, SMEs struggle to compete.

Fragility and Handling Challenges

Another significant restraint is the inherent fragility of ultra thin glass, which poses challenges during handling, transportation, and integration into end-use applications. The delicate nature of ultra thin glass necessitates specialized packaging solutions and controlled environments by adding to operational complexities. Furthermore, improper handling during assembly can compromise product quality, particularly in industries like automotive sensors and semiconductors, where precision is paramount. These logistical hurdles not only increase costs but also delay project timelines, deterring some industries from adopting ultra thin glass despite its advantages. Addressing these challenges requires significant investment in infrastructure and workforce training, which remains a barrier for many stakeholders.

MARKET OPPORTUNITIES

Adoption in Automotive Sensors

The automotive industry presents a promising opportunity for ultra thin glass in the development of advanced driver-assistance systems (ADAS) and autonomous vehicles. Ultra thin glass is integral to sensors, cameras, and LiDAR systems by offering exceptional transparency and durability. Its lightweight properties also contribute to fuel efficiency by aligning with the EU’s stringent emission standards. Countries like Germany and Sweden, home to leading automotive manufacturers such as BMW and Volvo, are at the forefront of integrating ultra thin glass into vehicle designs.

Growth in Foldable Devices

The emergence of foldable devices represents another significant opportunity for ultra thin glass in Europe. According to Counterpoint Research, shipments of foldable smartphones in Europe are expected to grow by 40% annually over the next five years. Ultra thin glass is essential for these devices, providing the flexibility and resilience required for repeated folding without cracking. Companies like Samsung and Huawei are already leveraging this technology, and European manufacturers are following suit. The UK and France are witnessing increased investments in R&D to develop ultra thin glass variants capable of withstanding extreme stress. Additionally, the growing popularity of foldable laptops and tablets further expands the addressable market.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the Europe ultra thin glass market by impacting both production and distribution. The global semiconductor shortage, exacerbated by geopolitical tensions and the pandemic, has highlighted vulnerabilities in the supply chain. According to Deloitte, 45% of European manufacturers reported delays in sourcing critical materials for ultra thin glass production in 2022. This issue is compounded by the reliance on imported raw materials, particularly from Asia, which accounts for over 60% of global supply. Such dependencies create bottlenecks by leading to increased lead times and costs. Furthermore, logistical challenges, such as port congestion and customs delays, hinder timely delivery. These disruptions not only affect profitability but also erode customer trust by making it imperative for companies to diversify their supplier base and invest in local manufacturing capabilities.

Stringent Environmental Regulations

While sustainability is a driver for ultra thin glass adoption, stringent environmental regulations also present challenges for manufacturers. The European Union’s REACH and RoHS directives impose strict limits on hazardous substances and energy consumption during production. According to a study by PwC, compliance costs for these regulations can account for up to 10% of total manufacturing expenses. Ultra thin glass producers must invest in eco-friendly processes, such as low-emission furnaces and recyclable materials, to meet these standards. However, smaller firms often lack the resources to implement such measures that is limiting their competitiveness. Additionally, frequent updates to regulatory frameworks require continuous adaptation by increasing administrative burdens. Balancing innovation with compliance remains a persistent challenge for companies aiming to scale operations while adhering to Europe’s rigorous environmental policies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.24% |

|

Segments Covered |

By Manufacturing process, Application, End Use Industry, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

SCHOTT AG, Corning Incorporated, Nippon Electric Glass Co., Ltd., AGC Inc., CSG Holding Co., Ltd., Nippon Sheet Glass Co., Ltd., Luoyang Glass Co., Ltd., Asahi Glass Co., Ltd., LG Display Co., Ltd., Plan Optik AG |

SEGMENTAL ANALYSIS

By Manufacturing Process Insights

The float process dominated the Europe ultra thin glass market with a dominant share of 60.2% in 2024. This dominance stems from its cost-effectiveness and ability to produce uniform, high-quality glass sheets suitable for diverse applications. The process involves floating molten glass on a bed of molten tin by ensuring excellent surface flatness and optical clarity. Industries such as touch panel displays and semiconductors rely heavily on float glass due to its versatility. Another driving factor is the widespread availability of raw materials, which reduces production costs. For instance, the abundance of silica sand in regions like Scandinavia supports uninterrupted supply chains. The adaptability of this process to varying thicknesses also makes it indispensable for emerging applications like foldable devices.

The fusion process is projected to witness a CAGR of 14.2% throughout the forecast period. The growth of the segment is attributed to its ability to produce ultra thin glass with superior dimensional accuracy and minimal defects. Unlike the float process, fusion does not involve contact with molten metals, resulting in pristine surfaces ideal for high-precision applications like semiconductors and medical devices. The rising demand for flexible electronics in Germany and France, is a key driver. Additionally, the process’s compatibility with lightweight materials aligns with the EU’s focus on reducing carbon footprints. Investments in automation and AI-driven quality control systems have further enhanced production efficiency is lowering costs and boosting adoption. The fusion process is set to outpace traditional methods as industries prioritize precision and sustainability.

By Application Insights

The touch panel displays segment was the largest in the Europe ultra thin glass market by occupying 55.4% of the share in 2024. The growth of the segment can be driven by the exponential growth of consumer electronics like smartphones and tablets. The UK and Germany are key contributors, with their robust electronics manufacturing sectors integrating ultra thin glass into high-resolution displays. Another factor is the shift toward interactive technologies in public infrastructure, such as kiosks and digital signage, which rely on durable yet aesthetically pleasing materials. Ultra thin glass offers unmatched optical clarity and scratch resistance by making it indispensable for these applications. Furthermore, the rise of remote work has increased demand for laptops and monitors, further bolstering consumption. The segment’s dominance is also supported by advancements in anti-glare and anti-reflective coatings by enhancing user experience and driving adoption.

The semiconductor application is likely to exhibit a CAGR of 13.8% during the forecast period. The growth of the segment is driven by the Europe’s expanding semiconductor industry with initiatives like the EU Chips Act. Ultra thin glass is increasingly used as a substrate material due to its thermal stability and chemical resistance, enabling the production of smaller, faster chips. The Netherlands, home to ASML, a global leader in lithography systems, is at the forefront of this trend. Additionally, the proliferation of AI and IoT devices has created a surge in demand for high-performance semiconductors, where ultra thin glass plays a critical role. Investments in R&D have led to innovations such as thinner substrates with enhanced electrical properties, further accelerating adoption.

By End-Use Industry Insights

The electrical and electronics industry segment was the largest by accounting for 45.3% of the Europe ultra thin glass market share in 2024. This dominance is driven by the widespread use of ultra thin glass in smartphones, tablets, and wearables, which are ubiquitous in Europe. Germany, with its advanced manufacturing capabilities, is a key contributor by producing high-tech devices that rely on ultra thin glass for displays and sensors. Another factor is the growing trend of smart homes, where ultra thin glass is used in appliances, lighting systems, and security devices. The material’s lightweight and durable properties make it ideal for these applications by ensuring longevity and aesthetic appeal. Furthermore, the rise of 5G technology has spurred demand for advanced electronic components. Continuous innovation in coatings and finishes also enhances its suitability for diverse applications.

The automotive industry segment is expected to witness a fastest CAGR of 12.7% during the forecast period. This growth is fueled by the increasing adoption of ADAS and autonomous driving technologies, which rely on sensors and cameras made from ultra thin glass. France and Sweden are leading this trend, with manufacturers like Renault and Volvo integrating advanced materials into their vehicles. The EU’s stringent emission standards have also encouraged the use of lightweight materials, improving fuel efficiency and reducing carbon footprints. Additionally, the growing popularity of electric vehicles (EVs) has created new opportunities, as ultra thin glass is used in EV displays and battery management systems. Investments in R&D have led to innovations such as impact-resistant glass.

REGIONAL ANALYSIS

Germany held a prominent position in the Europe ultra thin glass market by capturing 25.3% of share in 2024. The growing scale of electrical and electronics sector, with companies like Siemens and Bosch driving demand is anticipate to fuel the growth of the market. The nation’s focus on innovation and sustainability has also propelled adoption in semiconductor manufacturing. Government incentives for green technologies further support growth, as ultra thin glass aligns with eco-friendly initiatives. Additionally, Germany’s robust R&D ecosystem fosters advancements in materials science by ensuring a steady pipeline of cutting-edge products.

France ultra thin glass market is likely to achieve a significant CAGR of 12.3% during the forecast period owing to its thriving automotive and semiconductor industries. As per a report by IHS Markit, the French automotive sector is investing heavily in ADAS and autonomous technologies by creating significant demand for ultra thin glass. Companies like Renault and PSA Group are incorporating advanced materials into their vehicles by enhancing safety and performance. The semiconductor industry is equally vibrant, with STMicroelectronics leading innovations in chip design. France’s strategic location and well-developed infrastructure also make it a hub for exports, further boosting consumption. Government policies promoting digital transformation and sustainability provide additional impetus, solidifying France’s position in the market.

The UK ultra thin glass market is estimated to have a prominent growth opportunities in the next coming years. According to Tech Nation, the UK’s tech industry attracted £29.4 billion in investments in 2022. Ultra thin glass is widely used in touch panel displays and foldable devices by catering to a tech-savvy population. London and Cambridge serve as innovation hubs is fostering collaborations between academia and industry. The rise of smart cities has also increased demand for interactive technologies, where ultra thin glass plays a critical role. Furthermore, Brexit-related trade agreements have opened new avenues for domestic production by reducing dependency on imports and strengthening the local market.

Italy ultra thin glass market growth is driven by its expertise in luxury goods and high-end electronics. Milan and Turin are key centers for innovation, with companies like Ferrari and Prada leveraging ultra thin glass for automotive displays and premium packaging. According to Confindustria, Italy’s manufacturing sector grew by 4% in 2022. The country’s focus on craftsmanship and design has positioned it as a leader in niche applications, such as curved glass for wearable devices. Additionally, Italy’s commitment to sustainability aligns with the eco-friendly attributes of ultra thin glass, further boosting adoption.

LEADING PLAYERS IN THE EUROPE ULTRA THIN GLASS MARKET

Schott AG

Schott AG is a global leader in ultra thin glass manufacturing, renowned for its innovative solutions in electronics and healthcare. The company’s portfolio includes specialized glass for foldable devices and semiconductors, catering to Europe’s growing demand for advanced materials. Schott’s commitment to sustainability is evident in its eco-friendly production processes, aligning with EU environmental goals. Its collaborations with leading tech firms ensure cutting-edge product development is reinforcing its global reputation.

Corning Inc.

Corning Inc. is a pioneer in ultra thin glass technology, offering products like Gorilla Glass, widely used in smartphones and wearables. The company’s focus on R&D has enabled breakthroughs in durability and flexibility, meeting the needs of Europe’s dynamic electronics industry. Corning’s strategic partnerships with automotive manufacturers also position it as a key player in ADAS and autonomous vehicle technologies is driving growth across multiple sectors.

Asahi Glass Co. Ltd. (AGC)

AGC specializes in high-performance ultra thin glass, serving diverse applications from touch panel displays to solar panels. The company’s emphasis on customization allows it to cater to niche markets, such as luxury automotive and medical devices. AGC’s investments in sustainable manufacturing and advanced coatings enhance its competitiveness is ensuring consistent growth in Europe’s evolving market landscape.

TOP STRATEGIES USED BY KEY PLAYERS

Product Innovation

Companies like Schott AG and Corning Inc. are investing heavily in R&D to develop ultra thin glass variants tailored for emerging applications like foldable devices and autonomous vehicles.

Sustainability Initiatives

Adopting eco-friendly manufacturing processes to comply with EU regulations and appeal to environmentally conscious consumers.

Strategic Collaborations

Partnering with automotive and electronics manufacturers to integrate ultra thin glass into next-generation products, ensuring long-term demand.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe ultra thin glass market include SCHOTT AG, Corning Incorporated, Nippon Electric Glass Co., Ltd., AGC Inc., CSG Holding Co., Ltd., Nippon Sheet Glass Co., Ltd., Luoyang Glass Co., Ltd., Asahi Glass Co., Ltd., LG Display Co., Ltd., Plan Optik AG

The Europe ultra-thin glass market is highly competitive, characterized by innovation, sustainability, and strategic alliances. Key players like Schott AG, Corning Inc., and AGC dominate the landscape, leveraging their expertise in materials science to meet diverse industrial needs. The market benefits from advancements in manufacturing technologies, enabling high-performance products for applications like touch panel displays and semiconductors. Competition is intensified by the entry of niche players focusing on specialized segments, such as medical devices and luxury automotive. Additionally, government initiatives promoting digitalization and green technologies provide a conducive environment for growth. Companies are also investing in local production facilities to reduce dependency on imports and enhance supply chain resilience. Overall, the competitive dynamics are shaped by innovation, regulatory compliance, and efforts to address evolving customer demands.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Schott AG launched a new line of ultra thin glass for foldable smartphones in Germany. This initiative aimed to capitalize on the growing demand for flexible electronics.

- In May 2023, Corning Inc. partnered with a French automotive manufacturer to develop ultra thin glass for ADAS sensors. This collaboration sought to enhance safety features in autonomous vehicles.

- In July 2023, AGC expanded its production facility in Belgium to increase capacity for semiconductor substrates. This move aimed to meet rising demand from Eope’s electronics industry.

- In September 2023, Nippon Electric Glass introduced a lightweight ultra-thin glass variant for electric vehicle displays. This launch aimed to support the transition to sustainable mobility.

- In December 2023, Saint-Gobain acquired a Swedish startup specializing in eco-friendly glass coatings. This acquisition was designed to strengthen its sustainability initiatives and market leadership.

DETAILED SEGMENTATION OF EUROPE ULTRA THIN GLASS MARKET INCLUDED IN THIS REPORT

This research report on the Europe ultra thin glass market has been segmented and sub-segmented based on manufacturing process, application, end use industry & region.Top of Form

By Manufacturing Process

- Float Process

- Fusion Process

- Down-Draw Process

- Others

By Application

- Consumer Electronics (e.g., smartphones, tablets)

- Flat Panel Displays

- Touch Panels

- Solar Panels

- Semiconductor Substrates

- Automotive Glazing

- Medical Devices

- Others

By End Use Industry

- Consumer Electronics

- Automotive & Transportation

- Medical & Healthcare

- Construction

- Energy

- Aerospace

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the main factors driving the growth of the ultra thin glass market in Europe?

Key drivers include the increasing demand for lightweight and flexible electronic devices, advancements in display technologies, rising use in automotive applications, and growth in solar energy installations.

2. Which countries in Europe are major contributors to the ultra thin glass market?

Germany, France, the UK, and Italy are among the leading contributors due to their strong electronics, automotive, and renewable energy sectors.

3. Who are the key players in the Europe ultra thin glass market?

Leading players include SCHOTT AG, Corning Incorporated, Nippon Electric Glass Co., AGC Inc., and Plan Optik AG.

4. How does the demand in Europe compare to other regions?

Europe shows steady demand, driven by the growth of advanced electronics, automotive innovations, and renewable energy sectors, though Asia-Pacific currently dominates the global market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]