Europe Two-Wheeler Market Size, Share, Trends & Growth Forecast Report By Propulsion Type (Internal Combustion Engine (ICE), Electric Two-Wheelers), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Two-Wheeler Market Size

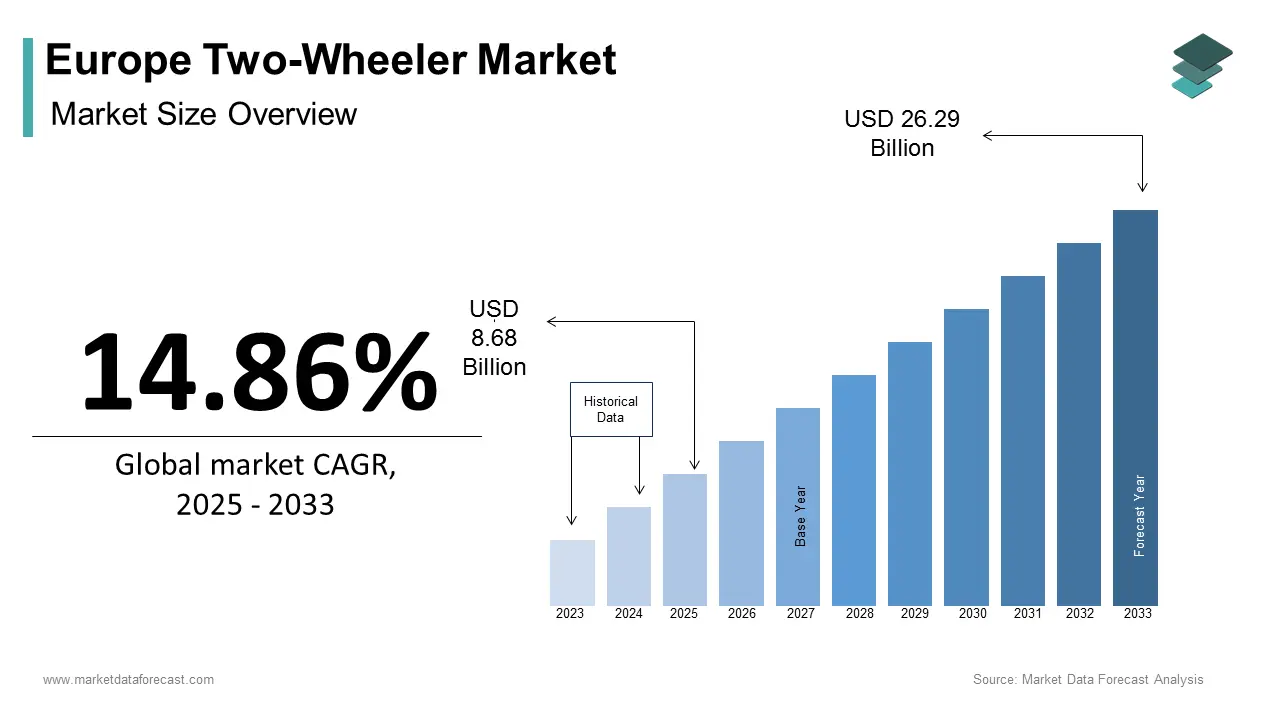

The European two-wheeler market size was calculated to be USD 7.56 billion in 2024 and is anticipated to be worth USD 26.29 billion by 2033 from USD 8.68 billion in 2025, growing at a CAGR of 14.86% during the forecast period.

The European two-wheeler market has witnessed steady growth, driven by urbanization, environmental concerns, and evolving consumer preferences. Germany, Italy, and France dominate the market share due to their robust automotive infrastructure and supportive policies. A key trend shaping the market is the increasing adoption of electric two-wheelers, with sales surging. The market is also witnessing a shift toward sustainable commuting solutions, supported by government incentives such as tax rebates and subsidies. Urban congestion and rising fuel costs further bolster demand for two-wheelers.

MARKET DRIVERS

Rising Urbanization and Traffic Congestion

Urbanization remains a pivotal driver for the two-wheeler market in Europe. Cities like Paris, Berlin, and Milan are grappling with severe traffic congestion, prompting commuters to seek efficient alternatives. A report by Eurostat indicates that over 75% of Europeans reside in urban areas, where two-wheelers offer a practical solution for last-mile connectivity. Urban mobility accounted for a significant portion of total two-wheeler demand. Additionally, governments are investing heavily in cycling infrastructure, with cities like Copenhagen notably allocating annually for bike-friendly pathways. These initiatives reduce reliance on cars, driving two-wheeler adoption. Furthermore, shared mobility services like Lime and Bird have expanded their fleets, contributing to a rise in e-scooter usage in metropolitan areas. This trend exhibits the growing preference for compact, eco-friendly vehicles amid urban challenges.

Environmental Regulations and Sustainability Goals

Environmental regulations are propelling the two-wheeler market forward. The European Green Deal mandates a 55% reduction in carbon emissions by 2030, pushing automakers to innovate. Data from the European Environment Agency suggest that transportation accounts for 25% of the EU’s greenhouse gas emissions, creating urgency for cleaner alternatives. Electric two-wheelers, which produce zero emissions, are gaining traction. Governments are incentivizing this shift through subsidies; for instance, France offers financial help for scrapping old petrol bikes and purchasing electric models. Such factors collectively drive the market’s upward trajectory.

MARKET RESTRAINTS

High Initial Costs of Electric Two-Wheelers

Despite their popularity, electric two-wheelers face resistance due to high upfront costs. This price gap deters cost-sensitive consumers, particularly in regions with lower disposable incomes. Although subsidies exist, they often fail to bridge the affordability gap entirely. For example, in Spain, only a few of the eligible buyers utilize government incentives. Additionally, the lack of widespread charging infrastructure exacerbates concerns about range anxiety. Information provided by the European Alternative Fuels Observatory shows that only some of the urban areas have adequate charging stations, limiting the practicality of electric two-wheelers. These financial and infrastructural barriers hinder broader adoption.

Stringent Safety Regulations

Stringent safety standards pose another significant restraint. The European Union mandates rigorous crash tests and emission checks, which increase manufacturing costs. Research conducted by the European Commission reveals that compliance expenses can raise production costs. Smaller manufacturers struggle to meet these requirements, leading to reduced competition and higher prices for consumers. Moreover, accidents involving two-wheelers remain a concern, with a significant portion of fatalities reported annually across Europe. This statistic fuels public apprehension, deterring potential buyers. While safety measures improve reliability, they also slow innovation cycles, as companies focus on meeting regulatory benchmarks rather than developing cutting-edge designs. These factors collectively impede market expansion.

MARKET OPPORTUNITIES

Expansion of Shared Mobility Services

Shared mobility services present a lucrative opportunity for the two-wheeler market. Companies like Tier Mobility and Voi Technology are rapidly expanding their fleets. This surge is fueled by urban residents seeking affordable and flexible transportation options. In cities like Amsterdam and Stockholm, shared e-scooters make up a notable share of short-distance trips, reducing reliance on cars and public transport. Governments are also supporting this trend by designating dedicated lanes and parking zones. For instance, the UK invested considerably in micro-mobility infrastructure in 2023, finding from the Department for Transport.

Advancements in Battery Technology

Battery technology advancements offer transformative potential for the two-wheeler market. Lithium-ion batteries, which dominate the segment, are becoming more efficient and affordable. Studies from the International Energy Agency have shown that battery costs have decreased by 89% over the past decade, making electric two-wheelers more accessible. Innovations like solid-state batteries promise longer ranges and faster charging times, addressing consumer concerns about performance. Besides, recycling initiatives are gaining momentum, with companies like Northvolt aiming to recycle a substantial share of used batteries. These developments enhance product appeal and sustainability, unlocking new growth avenues for manufacturers.

MARKET CHALLENGES

Infrastructure Gaps for Electric Vehicles

The lack of robust charging infrastructure remains a significant challenge for electric two-wheelers. Evidence from the European Alternative Fuels Observatory supports the idea that only some of urban areas have sufficient charging stations, leaving rural regions underserved. This disparity limits the practicality of long-distance travel and discourages adoption. In countries like Greece and Portugal. Furthermore, existing stations often face overcrowding during peak hours, causing inconvenience for users. While governments are investing in infrastructure, progress is slow. These gaps hinder the seamless integration of electric two-wheelers into daily life.

Consumer Resistance to Behavioral Change

Consumer resistance to behavioral change poses another challenge. Many Europeans remain accustomed to traditional modes of transport, such as cars and public transit, creating inertia against adopting two-wheelers. Insights from a survey by Ipsos note that a major number of respondents cited unfamiliarity with electric models as a barrier to purchase. Additionally, cultural perceptions about safety and prestige associated with cars deter potential buyers. In Southern Europe, for example, motorcycles are often viewed as secondary vehicles, limiting their appeal as primary modes of transport. Efforts to educate consumers about the benefits of two-wheelers, including cost savings and environmental impact, have had limited success.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.86% |

|

Segments Covered |

By Propulsion Type, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Yamaha, Piaggio, BMW Motorrad, KTM, Honda, Suzuki, Kawasaki, Harley-Davidson, Triumph, Zero Motorcycles |

SEGMENTAL ANALYSIS

By Propulsion Type Insights

The ICE segment was the top performer in the European two-wheeler market with a 65.8% share in 2024. This control over the market is linked to the widespread availability of affordable models and established refueling infrastructure. Consumers in rural areas, where electric charging stations are scarce, prefer ICE vehicles for their reliability. Additionally, ICE bikes offer superior performance in terms of speed and torque, appealing to enthusiasts. Another factor is the emotional attachment to traditional designs, which resonates with older demographics. These elements collectively sustain the position this segment despite the rise of electric alternatives.

The electric two-wheelers segment is the fastest-growing segment, with a CAGR of 23.2%. This rapid expansion is fueled by stringent emission regulations and consumer demand for sustainable options. Government policies like tax exemptions and subsidies, further augment growth. For instance, the Netherlands offers monetary support for trading in petrol bikes for electric models, boosting sales. Technological advancements including improved battery efficiency also enhance appeal. These factors position electric two-wheelers as the future of the market, outpacing traditional segments in growth potential.

REGIONAL ANALYSIS

Germany led the European two-wheeler market with a commanding 25.1% share in 2024. The dominance of this nation is due to a robust automotive industry and strong consumer demand for premium motorcycles. The country's GDP per capita surpasses €40,000, enabling higher spending on recreational vehicles. Additionally, Germany's extensive road network supports two-wheeler usage, with over 650,000 kilometers of paved roads.

France sees the maximum growth rate, with a CAGR of 8.9%. Government initiatives, such as subsidies for electric bikes, drive adoption. Urban centers like Paris prioritize micro-mobility, with new bike lanes added.

Italy and Spain show moderate growth, driven by tourism and urbanization. The UK lags slightly due to Brexit-related supply chain disruptions but remains a key player in electric scooter innovation.

LEADING PLAYERS IN THE EUROPEAN TWO-WHEELER MARKET

BMW Motorrad has established itself as a leader in the premium motorcycle segment, known for its innovative engineering and high-performance models. BMW Motorrad’s global contributions include pioneering advancements in electric mobility with models like the CE 04 scooter, which aligns with Europe’s sustainability goals. Its focus on integrating cutting-edge technology, such as adaptive cruise control and advanced connectivity features, enhances user experience and strengthens its position as a global innovator.

Piaggio Group, renowned for its Vespa brand. The company’s strategy revolves around offering lightweight, stylish, and affordable two-wheelers tailored to urban commuters. Globally, Piaggio has expanded its footprint by targeting emerging markets while maintaining its stronghold in Europe. Its commitment to sustainability is evident in the launch of electric models like the Vespa Elettrica, which appeals to environmentally conscious consumers. Piaggio’s emphasis on design and accessibility has made it a household name worldwide.

KTM AG specializes in off-road and adventure motorcycles. Known for its bold design and rugged performance, KTM caters to enthusiasts seeking versatility and durability. Its global contributions include introducing lightweight, high-performance engines and expanding into electric mobility with prototypes like the Freeride E-XC. KTM’s strategic partnerships with racing teams have enhanced its reputation for reliability and innovation, making it a key player in both regional and international markets.

TOP STRATEGIES USED BY KEY PLAYERS

The European two-wheeler market is highly competitive, prompting key players to adopt diverse strategies to strengthen their positions. One prominent approach is product diversification, where companies like BMW Motorrad and Piaggio expand their portfolios to include electric and hybrid models. For instance, BMW launched the CE 04 electric scooter to cater to urban professionals, while Piaggio introduced the Vespa Elettrica to align with eco-friendly trends.

Digital marketing and customer engagement are also critical strategies. Companies leverage social media platforms and virtual showrooms to reach tech-savvy consumers. KTM, for example, uses immersive digital campaigns to shed light on the performance capabilities of its off-road bikes, appealing to younger demographics.

Collaborations with governments and tech firms further enhance competitiveness. Piaggio partnered with Enel X to develop charging infrastructure, addressing a key barrier to electric vehicle adoption. Similarly, BMW collaborates with software developers to integrate AI-driven navigation systems into its vehicles, enhancing user convenience.

Finally, mergers and acquisitions play a pivotal role. Harley-Davidson’s acquisition of StaCyc, an electric balance bike manufacturer, demonstrates a strategic move to tap into the growing demand for youth-oriented electric vehicles. These multifaceted strategies ensure that key players remain agile and responsive to evolving market dynamics.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the European two-wheeler market include Yamaha, Piaggio, BMW Motorrad, KTM, Honda, Suzuki, Kawasaki, Harley-Davidson, Triumph, Zero Motorcycles

The European two-wheeler market is characterized by intense competition, with premium brands vying for dominance through innovation, sustainability, and consumer-centric offerings. BMW Motorrad leads the premium segment, leveraging its reputation for high-performance motorcycles and cutting-edge technology. Meanwhile, Piaggio Group focuses on affordability and style, capturing urban commuters with its iconic Vespa scooters. KTM AG differentiates itself with rugged off-road models, appealing to adventure enthusiasts.

Price wars and technological advancements further intensify rivalry. For instance, Yamaha and Ducati frequently introduce mid-range models to undercut competitors while maintaining quality standards. Sustainability is another battleground, with companies racing to develop efficient electric models. BMW’s CE 04 and Piaggio’s Vespa Elettrica exemplify this trend, showcasing how electrification drives differentiation.

Additionally, smaller manufacturers face challenges due to stringent EU regulations and the financial muscle of larger players. This dynamic creates a dual-tier market: established giants dominate premium and mass segments, while niche players focus on specialized offerings. Overall, the market thrives on innovation, regulatory compliance, and consumer preferences, ensuring a vibrant and competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BMW Motorrad launched the CE 04 electric scooter, targeting urban professionals.

- In June 2023, Piaggio partnered with Enel X to expand charging infrastructure.

- In March 2023, KTM unveiled the LC8c engine, enhancing performance capabilities.

- In July 2023, Yamaha introduced the E01 scooter, emphasizing sustainability.

- In February 2024, Harley-Davidson acquired StaCyc, strengthening its electric portfolio.

MARKET SEGMENTATION

This research report on the European two-wheeler market has been segmented and sub-segmented based on propulsion type and region.

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Two-Wheelers

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe two-wheeler market?

The growth is driven by rising urban congestion, increased demand for affordable personal transportation, advancements in electric two-wheelers, and growing environmental awareness among consumers.

2. Which countries in Europe have the highest demand for two-wheelers?

Key countries with high two-wheeler demand include Italy, France, Germany, and Spain, due to favorable weather conditions, high urban population density, and supportive government policies for electric mobility.

3. Who are the major players in the Europe two-wheeler market?

Prominent players include Yamaha, Piaggio, BMW Motorrad, KTM, Honda, Suzuki, Kawasaki, Harley-Davidson, Triumph, and Zero Motorcycles.

4. How are electric two-wheelers shaping the future of the market?

Electric two-wheelers are gaining popularity due to government incentives, emission regulations, and consumer preference for sustainable transport, leading to increased investments and product launches in this segment.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]