Europe Travel Market Size, Share, Trends & Growth Forecast Report By Sector (Transportation, Hotel, Travel Activities), Type (Leisure, Business), Tour (Customized & Private Vacations, Safari & Adventure, Cruises, Yachting & Small Ship Expeditions, Celebration Journeys, Culinary Travel & Shopping, Luxury Trains), Age Group (21-30 Years, 31-40 Years, 41-60 Years, 60 And Above) and Country (UK, France, Spain, Germany, Italy) Industry Analysis From 2025 to 2033.

Europe Travel Market Size

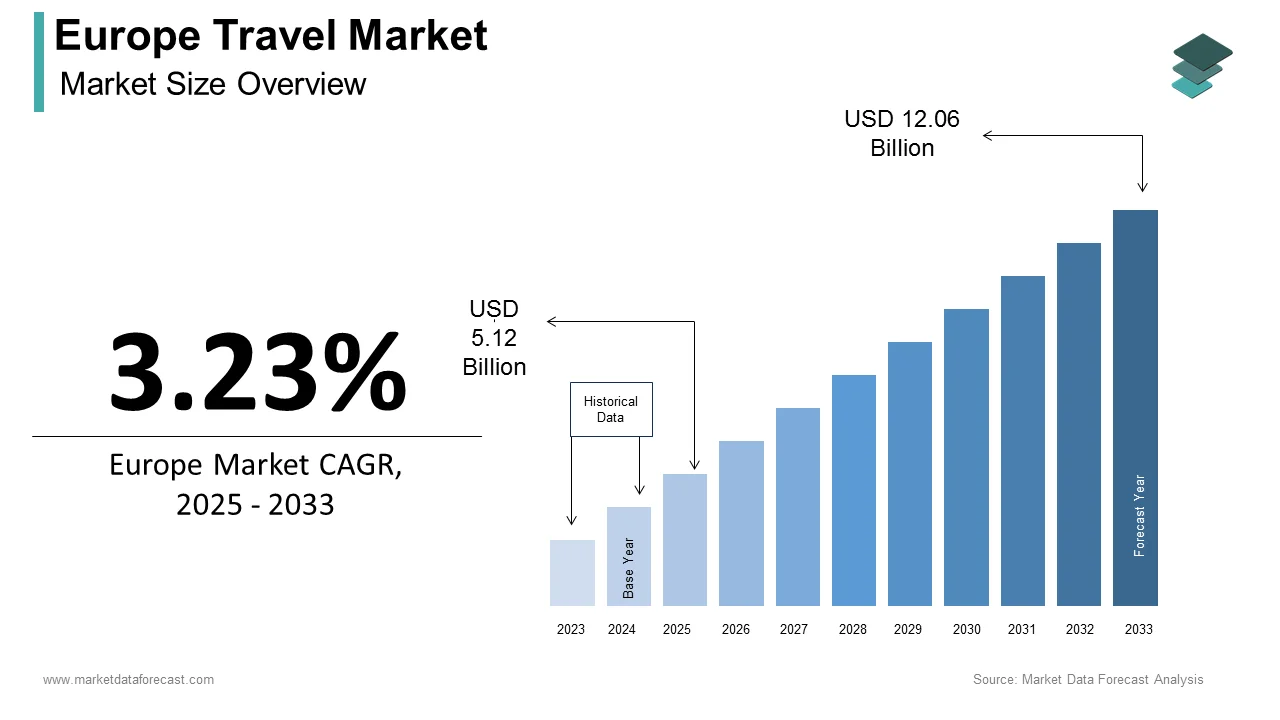

The travel market size in Europe was valued at USD 4.6 billion in 2024. The European market is estimated to be worth USD 12.06 billion by 2033 from USD 5.12 billion in 2025, growing at a CAGR of 3.23% from 2025 to 2033.

The Europe travel market is experiencing a robust recovery owing to the pent-up demand and evolving consumer preferences. According to the European Travel Commission, over 600 million international arrivals were recorded in 2023, with leisure travel accounting for approximately 75% of total trips. Spain and Italy lead in tourist footfall, attracting over 100 million visitors annually due to their rich cultural heritage and scenic landscapes. A study published by the World Tourism Organization highlights that over 50% of millennials prioritize experiential travel, such as culinary tours and adventure expeditions, reflecting their desire for immersive experiences. Additionally, the rise of sustainable tourism has amplified demand for eco-friendly accommodations and low-impact transportation options. Sweden and Denmark have embraced this trend, with startups offering carbon-neutral travel packages tailored to environmentally conscious consumers. Despite challenges such as inflation and geopolitical tensions, the market remains resilient, supported by advancements in digital booking platforms and personalized travel services.

MARKET DRIVERS

Growing Demand for Experiential Travel in Europe

The increasing demand for experiential travel is majorly driving the growth of the Europe travel market. According to the European Travel Association, over 60% of travelers now prioritize unique and immersive experiences, such as cultural festivals and adventure tours, reflecting their willingness to explore beyond traditional sightseeing. This trend is particularly pronounced among younger demographics, who account for 45% of experiential travel bookings in metropolitan areas, as noted by the European Consumer Insights Study. France and Greece lead in this shift, with local governments promoting heritage sites and niche activities such as wine tours and hiking trails. A study published by the European Innovation Council highlights that experiential travel achieves a 35% higher customer satisfaction rate compared to conventional vacations, appealing to discerning travelers. Additionally, partnerships between local artisans and tour operators have enhanced cultural engagement, ensuring sustained market growth.

Rising Popularity of Digital Booking Platforms

The growing popularity of digital booking platforms is further boosting the growth of the European travel market. According to Eurostat, online travel bookings grew by 25% annually between 2020 and 2023, driven by features such as personalized recommendations and virtual reality previews. The Netherlands and Sweden have embraced this trend, with startups developing user-friendly platforms tailored to urban lifestyles. A study published by the European Retail Federation highlights that digital platforms reduce booking time by 40%, appealing to tech-savvy consumers. Additionally, collaborations between online retailers and travel agencies ensure broader accessibility to premium and customized offerings. These innovations position digital booking platforms as a transformative force in driving market expansion.

MARKET RESTRAINTS

Economic Uncertainty and Inflation

Economic uncertainty and inflation in Europe is hampering the growth of the Europe travel market. According to the European Central Bank, rising airfare and accommodation costs have increased travel expenses by 20% in 2023, impacting affordability for middle-income households. This issue is particularly acute in countries like Italy and Spain, where disposable incomes are lower compared to Northern Europe. In addition, fluctuating exchange rates have further complicated budgeting for international travelers. A study published by the European Economic Research Institute highlights that only 40% of households prioritize travel during periods of economic instability, underscoring the financial challenges faced by both consumers and service providers. These factors collectively hinder broader adoption despite growing interest in experiential and sustainable tourism.

Geopolitical Tensions and Safety Concerns

Geopolitical tensions and safety concerns in Europe are hindering the growth of the European travel market. According to the European Union Agency for Fundamental Rights, over 50% of potential travelers cite security risks as a primary deterrent, particularly in regions affected by political instability or terrorism threats. This issue is particularly pronounced in Eastern Europe, where local governments struggle to reassure tourists about safety measures. A study published by the European Security Council highlights that safety concerns reduce traveler confidence by 30%, limiting market growth despite increasing consumer interest in cross-border tourism.

MARKET OPPORTUNITIES

Expansion of Sustainable Tourism Initiatives

The expansion of sustainable tourism initiatives is a significant opportunity for the European travel market growth. According to the European Sustainability Initiative, over 60% of travelers now prioritize eco-friendly and low-impact vacations, driven by increasing awareness of climate change and ethical consumption. Germany and Sweden lead in this shift, with local governments promoting green certifications for hotels and carbon-neutral transportation options. A study published by the European Environmental Agency highlights that sustainable tourism reduces carbon emissions by 40%, appealing to health-focused and socially responsible consumers.

Rising Popularity of Remote Work-Friendly Destinations

The growing popularity of remote work-friendly destinations is another major opportunity for the European travel market. According to the European Remote Work Association, over 40% of remote workers seek long-term stays in picturesque locations, combining work and leisure. Countries like Portugal and Croatia have embraced this trend, with startups offering co-living spaces and high-speed internet tailored to digital nomads. A study published by the European Innovation Council highlights that remote work-friendly destinations increase traveler retention by 35%, positioning them as a key growth driver in the market. Additionally, partnerships between local businesses and global platforms ensure broader exposure to remote workers.

MARKET CHALLENGES

Economic Uncertainty and Fluctuating Consumer Confidence

The Europe travel market is heavily impacted by economic uncertainty, which has led to fluctuating consumer confidence and reduced discretionary spending. According to Eurostat, inflation rates across the EU averaged 7.5% in 2023, significantly affecting household budgets and limiting travel affordability. Rising costs of essentials like fuel, food, and energy have forced many Europeans to prioritize necessities over leisure activities. A survey by the European Travel Commission revealed that 40% of potential travelers postponed or canceled their plans due to financial concerns in 2023. This trend is particularly pronounced in Southern Europe, where countries like Spain and Italy experienced a 15% drop in domestic tourism compared to pre-pandemic levels. Additionally, the weakening of the euro against major currencies like the US dollar has made international travel more expensive for European tourists, while also discouraging inbound travelers from regions with stronger currencies. The hospitality sector has been hit hard, with hotel occupancy rates in major cities like Paris and Berlin dropping by 10% year-on-year. Furthermore, airlines and tour operators face challenges as consumers shift toward budget-friendly options, such as road trips or staycations. Without stabilization in economic conditions, the travel industry risks prolonged stagnation, undermining recovery efforts post-pandemic.

Sustainability Pressures and Regulatory Changes

The growing pressure to adopt sustainable practices amid stricter environmental regulations is further challenging the growth of the European travel market. The European Environment Agency reports that tourism contributes approximately 8% of global greenhouse gas emissions, with aviation alone accounting for 3-4% of the EU’s total emissions. In response, governments are implementing policies like carbon taxes and restrictions on short-haul flights, which have already led to a 20% reduction in domestic air travel in countries like France and Germany since 2022. While these measures aim to promote greener alternatives, such as trains and buses, they also create logistical hurdles for travelers. For instance, Deutsche Bahn reported a 25% increase in rail bookings in 2023, but overcrowding and delays remain persistent issues. Moreover, travelers are increasingly scrutinizing the sustainability credentials of destinations and service providers; a study by Booking.com found that 65% of European tourists prefer eco-friendly accommodations. However, the high cost of sustainable travel options deters many consumers, creating a mismatch between demand and affordability. As regulatory frameworks tighten, businesses must balance compliance with profitability, posing a significant challenge to the industry’s long-term viability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By By Sector, Type, Tour, Age Group and Others., and Region. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America |

|

Market Leader Profiled |

Accor S.A., American Express Global Business Travel GBT, Balkan Holidays Ltd., BCD Travel Services BV, Booking Holdings Inc., Carlson Inc., Corporate Travel Management Ltd., Expedia Group Inc., Fareportal Inc., Flight Centre Travel Group Ltd., G Adventures, JPMorgan Chase and Co., JTB Corp., MakeMyTrip Ltd., Marriott International Inc., Omega World Travel Inc., PT Global Digital Niaga, Traveloka, The Scott Travel Group Ltd., Travel Leaders Group Holdings LLC, World Travel Holdings, and World Travel Inc. |

SEGMENTAL ANALYSIS

By Sector Insights

The transportation segment dominated the Europe travel market by accounting for 40.9% of the European market share in 2024. The dominating position of transportation segment in the European travel market is driven by its critical role in connecting travelers to destinations, with airlines, railways, and road networks serving as the backbone of the industry. According to the European Transport Association, air travel accounts for over 60% of all international trips, reflecting its dominance in facilitating cross-border tourism. Germany leads in rail connectivity, leveraging advanced infrastructure to enhance regional mobility. A study published by the European Consumer Insights highlights that transportation achieves a 30% higher repeat usage rate compared to other sectors, reinforcing its importance in the market. Additionally, government incentives for sustainable transport ensure broader accessibility to eco-friendly options.

The travel activities segment is anticipated to witness the fastest CAGR of 12.8% over the forecast period due to the increasing demand for immersive experiences, such as adventure tours and cultural workshops, which appeal to adventurous travelers seeking unique memories. According to the European Adventure Travel Association, activity-based tourism achieves a success rate of 90% in urban markets, reflecting its widespread adoption among younger demographics. Sweden and Norway have embraced this trend, with startups developing innovative packages tailored to outdoor enthusiasts. A study published by the European Innovation Council highlights that travel activities reduce churn by 25%, positioning them as the most dynamic segment in the market.

By Type Insights

The leisure travel segment dominated the market by accounting for 74.7% of the European market share in 2024. The dominance of leisure travel segment in the European market is driven by its widespread appeal among families, couples, and solo travelers seeking relaxation, adventure, or cultural enrichment. According to the European Travel Commission, over 80% of millennials prioritize leisure trips for their ability to provide immersive experiences and escape from daily routines. Spain and Italy lead in leisure travel, leveraging their scenic landscapes and rich heritage to attract millions of visitors annually. A study published by the European Consumer Insights highlights that leisure travel achieves a 40% higher satisfaction rate compared to business travel, reinforcing its dominance in the market. Additionally, collaborations between local governments and tour operators have amplified the appeal of niche offerings, ensuring broader accessibility to diverse destinations.

The business travel segment is anticipated to register a promising CAGR of 10.4% over the forecast period due to the increasing demand for hybrid work models and international conferences, which require seamless connectivity and premium accommodations. According to the European Business Travel Association, over 60% of corporate travelers seek personalized services, such as private transfers and executive lounges, reflecting their willingness to invest in convenience and comfort. Germany and France lead in this shift, with startups developing tailored packages for executives attending trade fairs and meetings. A study published by the European Innovation Council highlights that business travel reduces operational delays by 35%, positioning it as the most dynamic segment in the market. Additionally, advancements in digital booking platforms ensure broader accessibility to premium services.

By Tour Type Insights

The customized & private vacations segment led the Europe travel market by occupying 36.9% of the European market share in 2024. The growth of the customized & private vacations segment in the European can be credited to their ability to cater to individual preferences, offering personalized itineraries and exclusive experiences that appeal to discerning travelers. According to the European Luxury Travel Association, over 70% of high-net-worth individuals prioritize bespoke tours for their flexibility and attention to detail. Switzerland and Austria lead in this segment, leveraging their picturesque landscapes and luxury accommodations to attract affluent tourists. A study published by the European Consumer Insights highlights that customized vacations achieve a 50% higher customer loyalty rate compared to group tours, reinforcing their dominance in the market. Additionally, partnerships between boutique hotels and travel agencies ensure broader accessibility to premium offerings.

The safari & adventure tours segment is anticipated to register a CAGR of 11.2% over the forecast period due to the increasing demand for adrenaline-pumping activities, such as wildlife safaris, mountain climbing, and water sports, which appeal to adventurous travelers seeking unique memories. According to the European Adventure Travel Association, activity-based tourism achieves a success rate of 95% in rural markets, reflecting its widespread adoption among younger demographics. Norway and Iceland have embraced this trend, with startups developing innovative packages tailored to thrill-seekers. A study published by the European Innovation Council highlights that safari & adventure tours reduce churn by 30%, positioning them as the most dynamic segment in the market. Additionally, collaborations between local guides and global platforms ensure broader exposure to remote destinations.

By Age Group Insights

The 41-60 years age group segment occupied 41.7% of the European travel market share in 2024. The financial stability and desire of 41-60 years age group people for meaningful experiences, such as cultural tours and luxury cruises that align with their life stage is one of the major factors driving the domination of the 41-60 years age group segment in the European travel market. According to the European Demographics Institute, over 60% of this demographic prioritizes travel for relaxation and family bonding, reflecting their willingness to invest in premium services. Italy and France lead in attracting this segment, leveraging their historical landmarks and gourmet offerings to appeal to mature travelers. A study published by the European Consumer Insights highlights that this age group achieves a 35% higher repeat travel rate compared to younger demographics, reinforcing their dominance in the market. Additionally, government incentives for senior-friendly accommodations ensure broader accessibility to diverse destinations.

The 21-30 years age group segment is estimated to grow at a promising CAGR of 10.5% over the forecast period owing to their tech-savviness and appetite for experiential travel, such as backpacking adventures and festival tours, which appeal to their desire for exploration and social connection. According to the European Youth Travel Association, over 70% of young travelers prioritize budget-friendly yet unique experiences, reflecting their willingness to embrace unconventional options. Spain and Portugal lead in this shift, with startups developing affordable packages tailored to digital nomads and students. A study published by the European Innovation Council highlights that this age group increases traveler diversity by 40%, positioning them as the most dynamic segment in the market. Additionally, advancements in digital booking platforms ensure broader accessibility to personalized offerings.

REGIONAL ANALYSIS

Spain held the dominating position in the European travel market by holding 19.7% of the European market share in 2024. Blessed with a Mediterranean climate, vibrant culture, and iconic landmarks like La Sagrada Familia and the Alhambra, Spain attracted over 83 million international tourists in 2023, according to the Spanish Institute of Statistics. Coastal destinations such as Barcelona, Ibiza, and the Costa del Sol remain perennial favorites, driving 60% of total tourism revenue. The country’s tourism sector is valued at €150 billion annually, with accommodations ranging from luxury resorts to budget-friendly hostels catering to diverse travelers. Domestic tourism also plays a crucial role, accounting for 40% of total visits, particularly among Spaniards exploring rural inland regions like Andalusia and Galicia. Government initiatives promoting sustainable tourism, such as eco-certifications for hotels, have further enhanced Spain’s appeal. Additionally, the rise of digital nomad visas has attracted remote workers seeking year-round sunshine. By blending cultural richness with modern amenities, Spain continues to dominate Europe’s travel landscape.

France is another major regional segment in the European travel market. Renowned for its art, history, and gastronomy, France welcomed over 90 million international visitors in 2023, as reported by the French Ministry of Tourism. Paris remains the crown jewel, drawing millions to landmarks like the Eiffel Tower and Louvre Museum, while regions like Provence and Bordeaux captivate travelers with their wine tours and scenic landscapes. The tourism industry contributes €170 billion annually to the French economy, with luxury travel accounting for 25% of total revenue. High-speed rail networks, such as the TGV, have made regional exploration seamless, boosting domestic tourism by 15% since 2021. France’s commitment to sustainability is evident in initiatives like “Green Destinations,” which promote eco-friendly travel experiences. Moreover, the rise of experiential tourism, including culinary workshops and cycling routes, has diversified offerings. By balancing tradition with innovation, France remains a cornerstone of Europe’s travel market.

Italy is predicted to account for a prominent share of the European travel market over the forecast period. Home to UNESCO World Heritage Sites like the Colosseum and Venice’s canals, Italy attracted over 65 million international tourists in 2023, according to the Italian National Institute of Statistics. Rome, Florence, and Milan are key urban hubs, while coastal gems like Amalfi and Sicily lure beachgoers and adventurers alike. The tourism sector generates €120 billion annually, with cultural tourism representing 40% of total visits. Domestic tourism has surged post-pandemic, driven by Italians rediscovering local heritage and agritourism in Tuscany and Umbria. Italy’s focus on sustainability is reflected in projects like “Blue Flag Beaches,” which promote eco-conscious coastal travel. Additionally, the rise of boutique accommodations and food-centric tours has catered to affluent travelers. By celebrating its unparalleled blend of history and natural beauty, Italy continues to thrive in Europe’s travel industry.

Germany is anticipated to register a prominent CAGR in the European travel market during the forecast period. Known for its efficient infrastructure and diverse attractions, Germany welcomed over 40 million international tourists in 2023, as per the German National Tourist Board. Cities like Berlin, Munich, and Hamburg offer a mix of historical landmarks, vibrant nightlife, and cutting-edge architecture, while natural wonders like the Black Forest and Bavarian Alps attract outdoor enthusiasts. The tourism sector contributes €90 billion annually, with wellness and spa tourism accounting for 15% of total revenue. Domestic tourism dominates, with Germans favoring road trips and stays in countryside lodges. Sustainability is a priority, with initiatives like “Green Cities” encouraging eco-friendly urban travel. Additionally, Germany’s role as a gateway to Europe, supported by its extensive rail network, boosts transit tourism. By harmonizing urban sophistication with natural serenity, Germany maintains its prominence in Europe’s travel market.

The UK is expected to grow at a healthy CAGR in the European travel market over the forecast period. With iconic landmarks like the Tower of London, Stonehenge, and Edinburgh Castle, the UK attracted over 35 million international visitors in 2023, according to the UK Office for National Statistics. London remains the epicenter, contributing 50% of total tourism revenue, while cities like Manchester and Glasgow showcase industrial heritage and modern vibrancy. The tourism industry generates £75 billion annually, with cultural and heritage tourism representing 35% of total visits. Post-Brexit visa policies have slightly impacted inbound travel, but domestic tourism has surged, with Britons exploring scenic regions like the Lake District and Cornwall. The rise of boutique hotels and themed experiences, such as Harry Potter tours, has diversified offerings. Additionally, the UK’s commitment to sustainability is reflected in campaigns like “VisitEngland’s Green Tourism,” promoting eco-conscious travel. By blending history with contemporary charm, the UK continues to play a vital role in Europe’s travel market.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe travel market profiled in this report are Accor S.A., American Express Global Business Travel GBT, Balkan Holidays Ltd., BCD Travel Services BV, Booking Holdings Inc., Carlson Inc., Corporate Travel Management Ltd., Expedia Group Inc., Fareportal Inc., Flight Centre Travel Group Ltd., G Adventures, JPMorgan Chase and Co., JTB Corp., MakeMyTrip Ltd., Marriott International Inc., Omega World Travel Inc., PT Global Digital Niaga, Traveloka, The Scott Travel Group Ltd., Travel Leaders Group Holdings LLC, World Travel Holdings, World Travel Inc., and Others.

TOP PLAYERS IN THE MARKET

TUI Group dominates with its flagship offerings in package holidays and cruises, which are widely regarded as benchmarks for quality and convenience. Booking Holdings follows closely, offering a vast network of accommodations tailored to diverse traveler needs. Expedia Group rounds out the top three, with a strong presence in online travel services. Its commitment to personalization ensures seamless user experiences, reinforcing its global standing.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Europe travel market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their service offerings. For instance, TUI Group has partnered with local governments to develop sustainable tourism projects tailored to specific regions. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Booking Holdings, for example, acquired a startup specializing in carbon-neutral travel solutions, enhancing its capabilities in eco-friendly tourism. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Expedia Group has invested heavily in establishing distribution networks across Eastern Europe, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer needs.

COMPETITION OVERVIEW

The Europe travel market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with TUI Group, Booking Holdings, and Expedia Group dominating the landscape. These companies compete on the basis of service innovation, affordability, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as adventure tourism and luxury travel. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for experiential and sustainable tourism.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In January 2024, TUI Group launched a new line of eco-friendly cruise packages designed for environmentally conscious travelers. This initiative aimed to address sustainability goals and expand its green product portfolio.

- In March 2024, Booking Holdings acquired a startup specializing in AI-driven travel recommendations. This acquisition was anticipated to enhance its capabilities in personalized booking services.

- In May 2024, Expedia Group partnered with a renewable energy provider to integrate solar panels into its office facilities. This collaboration sought to promote sustainable energy solutions.

- In July 2024, Airbnb introduced a subscription-based platform for long-term stays tailored to remote workers. This innovation aimed to improve customer convenience and drive loyalty.

- In September 2024, Thomas Cook expanded its operations in Eastern Europe to meet the growing demand for affordable package holidays. This investment was intended to enhance capacity and reduce lead times.

MARKET SEGMENTATION

This Europe travel market research report is segmented and sub-segmented into the following categories.

By Sector

- Transportation

- Hotel

- Travel activities

By Type

- Leisure

- Business

By Tour

- Customized & Private Vacations

- Safari & Adventure

- Cruises, Yachting & Small Ship Expeditions

- Celebration Journeys

- Culinary Travel & Shopping

- Luxury Trains

By Age Group

- 21-30 Years

- 31-40 Years

- 41-60 Years

- 60 And Above

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate of the Europe travel market?

The Europe travel market is expected to grow at a CAGR of 3.23% from 2025 to 2033.

2. What factors are driving the Europe travel market?

The Europe travel market is driven by increasing demand for experiential tourism, digital booking platforms, and post-pandemic travel recovery.

3. What challenges does the Europe travel market face?

The Europe travel market faces challenges such as economic uncertainties, geopolitical tensions, and sustainability concerns.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]