Europe Travel Insurance Market Size, Share, Trends & Growth Research Report By Insurance Coverage (Single-trip Travel Insurance, Annual Multi-trip Travel Insurance, Long-stay Travel Insurance; Largest Segment: Single-Trip Travel Insurance) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Travel Insurance Market Size

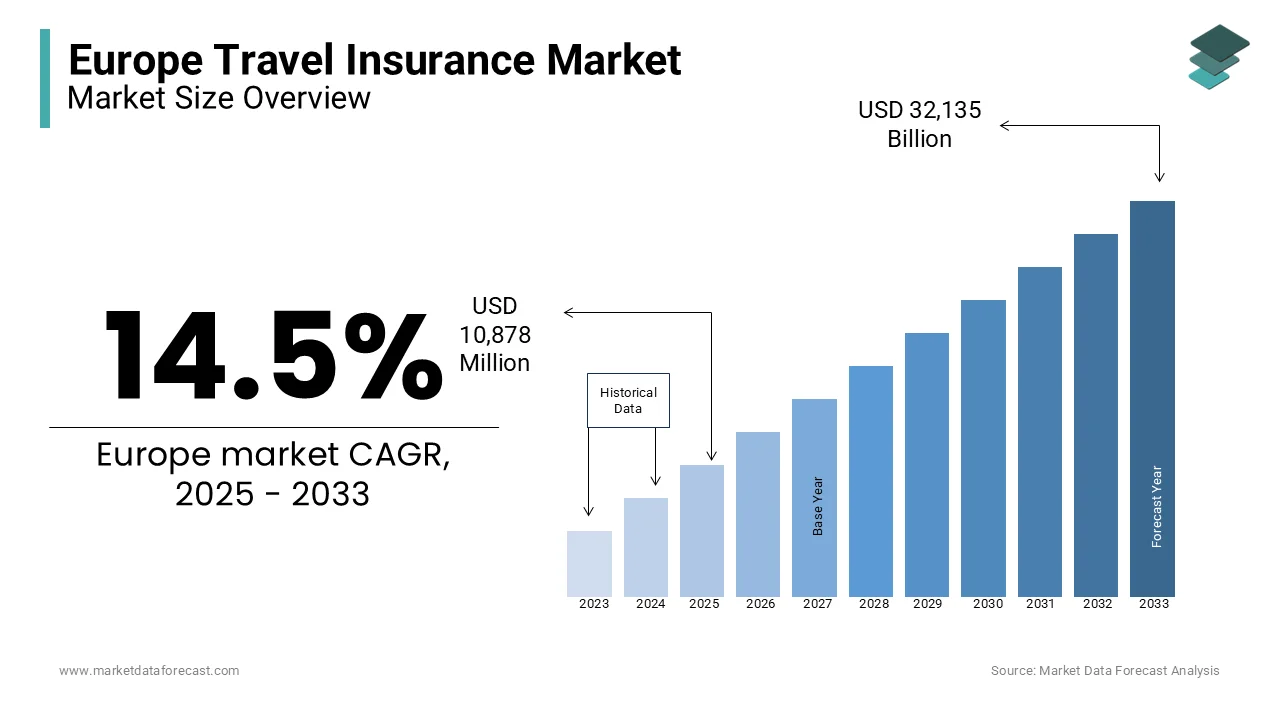

The travel insurance market size in Europe was valued at USD 9,500 million in 2024. The European market is estimated to be worth USD 32,135 million by 2033 from USD 10,878 million in 2025, growing at a CAGR of 14.5% from 2025 to 2033.

Travel insurance is a dynamic and rapidly evolving sector. Travel insurance provide financial protection and risk mitigation for travelers against unforeseen events such as medical emergencies, trip cancellations, lost luggage, and travel delays. As international and domestic travel continues to rebound post-pandemic, the demand for comprehensive travel insurance policies has surged due to the increasing awareness of health and safety concerns. According to the data of the European Travel Commission, more than 60% of European travelers now consider travel insurance a necessity, particularly during COVID-19. The United Kingdom, Germany, and France are dominating the travel insurance market in Europe. The UK, in particular, has seen a significant uptick in demand, with the Association of British Insurers reporting a 25% increase in policy sales in 2022 compared to pre-pandemic levels. Additionally, the integration of advanced technologies, such as AI and blockchain, is transforming the market by enabling personalized policies and streamlined claims processing.

MARKET DRIVERS

Increasing International Travel and Tourism in Europe

The resurgence of international travel post-pandemic is a significant driver of the Europe travel insurance market. According to the European Travel Commission, international tourist arrivals in Europe reached 85% of pre-pandemic levels in 2023, with over 700 million travelers visiting the region. This recovery has heightened the demand for travel insurance, as travelers seek protection against trip cancellations, medical emergencies, and other uncertainties. The United Nations World Tourism Organization reports that 65% of travelers now prioritize purchasing insurance, particularly for long-haul trips. This trend is further supported by the easing of travel restrictions and the growing popularity of destinations such as Spain, France, and Italy, which are among the most visited countries globally.

Rising Awareness of Health and Safety Risks

The COVID-19 pandemic has significantly increased awareness of health and safety risks, driving the demand for travel insurance across Europe. The European Centre for Disease Prevention and Control highlights that 70% of travelers now consider health coverage a critical factor when planning trips. This shift in consumer behavior has led to a surge in policies covering medical expenses, quarantine costs, and emergency evacuations. The Association of British Insurers reports a 40% increase in sales of policies with comprehensive health coverage in 2023 compared to pre-pandemic levels. This heightened awareness, coupled with the unpredictability of global health crises, continues to propel the growth of the travel insurance market.

MARKET RESTRAINTS

High Cost of Comprehensive Policies

One of the primary restraints in the Europe travel insurance market is the high cost of comprehensive policies, which can deter price-sensitive travelers. The European Insurance and Occupational Pensions Authority reports that premiums for policies covering medical emergencies, trip cancellations, and other risks have increased by 15-20% since 2020 due to rising claim costs. This upward trend is particularly challenging for budget-conscious travelers, as the European Travel Commission notes that 30% of travelers opt out of purchasing insurance due to affordability concerns. The high cost of policies limits market penetration, especially among younger demographics and low-income groups, who prioritize cost savings over risk mitigation.

Complexity and Lack of Transparency in Policy Terms

The complexity and lack of transparency in travel insurance policy terms often act as a barrier to adoption. The European Consumer Centre Network highlights that 25% of travelers find policy documents difficult to understand, leading to confusion about coverage limits and exclusions. This lack of clarity can result in dissatisfaction and mistrust, as the European Commission reports that 20% of insurance-related complaints are related to denied claims due to unclear terms. Additionally, the absence of standardized policy formats across countries further complicates the purchasing process, discouraging potential customers from buying travel insurance and hindering market growth.

MARKET OPPORTUNITIES

Adoption of Digital Platforms and Insurtech Innovations

The integration of digital platforms and insurance solutions presents a significant opportunity for the Europe travel insurance market. The European Insurance and Occupational Pensions Authority highlights that over 60% of consumers now prefer purchasing insurance online due to convenience and faster processing. Insurtech innovations, such as AI-driven policy customization and blockchain-enabled claims management, are transforming the industry by enhancing customer experience and operational efficiency. According to a report by the European Commission, the adoption of digital tools has reduced policy issuance times by 40%, making travel insurance more accessible. This shift toward digitalization is expected to drive market growth, particularly among tech-savvy younger travelers.

Expansion of Niche Insurance Products

The growing demand for specialized travel insurance products, such as policies for adventure travel, senior citizens, and business travelers, offers a lucrative opportunity for market expansion. The European Travel Commission reports that niche travel segments, including adventure tourism, have grown by 25% annually since 2021. Similarly, the aging population in Europe, which constitutes over 20% of the total population according to Eurostat, has increased the need for tailored policies covering pre-existing medical conditions. Additionally, the rise in business travel, as highlighted by the Global Business Travel Association, has spurred demand for corporate travel insurance. Catering to these niche segments allows insurers to tap into underserved markets and diversify their product offerings.

MARKET CHALLENGES

Regulatory Complexity Across European Countries

The Europe travel insurance market faces significant challenges due to varying regulatory frameworks across different countries. The European Insurance and Occupational Pensions Authority notes that compliance with diverse national regulations increases operational costs and complexity for insurers. For instance, consumer protection laws and claim settlement processes differ widely, creating inefficiencies. The European Commission reports that 30% of insurers struggle with adapting policies to meet local requirements, which can delay market entry and expansion. This regulatory fragmentation not only hampers cross-border operations but also limits the ability to offer standardized products, ultimately affecting customer satisfaction and market growth.

Increasing Frequency of Natural Disasters and Pandemics

The rising frequency of natural disasters and global health crises poses a significant challenge to the Europe travel insurance market. The European Environment Agency states that climate-related events, such as floods and wildfires, have increased by 40% in the past decade, leading to higher claim volumes. Additionally, the COVID-19 pandemic highlighted the vulnerability of the travel industry, with the World Health Organization emphasizing the ongoing risk of future pandemics. These uncertainties force insurers to recalibrate risk models and increase premiums, which can deter customers. The Association of British Insurers reports a 20% rise in premiums for policies covering natural disasters and pandemics, further straining market affordability and adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.5% |

|

Segments Covered |

By Insurance Coverage, Distribution Channel, End Use, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Country's Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leaders Profiled |

Allianz SE, American International Group Inc, AXA SA, Assicurazioni Generali, USI Insurance Services, battleface, Seven Corners, Travel Insured International, Zurich Insurance Group AG, Ping An Insurance (Group) Co. of China Ltd ADR, InsureandGo, EbixCash World Money, and Others. |

SEGMENTAL ANALYSIS

By Insurance Coverage Insights

The single-trip travel insurance segment dominated the market and accounted for 46.1% of the European market share in 2023. This dominance is attributed to its affordability and suitability for occasional travelers. The European Travel Commission highlights that 60% of leisure travelers opt for single-trip policies due to their flexibility and lower upfront costs. Additionally, the European Insurance and Occupational Pensions Authority notes that these policies are particularly popular for short vacations, with over 70% of summer travelers purchasing single-trip coverage. Its widespread adoption underscores its importance in catering to the needs of infrequent travelers.

The annual multi-trip travel insurance segment is the fastest-growing segment due to the increasing number of frequent travelers, particularly business professionals and leisure travelers taking multiple trips annually. The Association of British Insurers reports that multi-trip policies are cost-effective for individuals traveling more than twice a year, saving up to 30% compared to purchasing separate single-trip policies. The European Insurance and Occupational Pensions Authority emphasizes that the rise of hybrid work models and affordable air travel has further fueled demand. This segment’s growth highlights its importance in meeting the needs of modern, mobile lifestyles.

By Distribution Channel Insights

The insurance companies segment led the market by accounting 35.8% of the European market share in 2023. This leadership is driven by their ability to offer customized policies, exclusive benefits, and direct customer engagement. The Association of British Insurers highlights that insurers leverage their established brand trust and comprehensive coverage options to attract customers. Additionally, the European Commission notes that insurers are increasingly enhancing their digital platforms to improve accessibility and customer experience. Their dominance underscores the importance of direct sales in providing reliable and tailored travel insurance solutions to a broad consumer base.

The insurance aggregators segment is predicted to grow rapidly during the forecast period. This growth is fueled by the increasing preference for online comparison platforms, particularly among younger, tech-savvy travelers. The European Insurance and Occupational Pensions Authority reports that aggregators account for 20% of travel insurance sales, offering transparency and competitive pricing. The Association of British Insurers emphasizes that these platforms simplify the purchasing process, enabling consumers to compare multiple policies quickly. However, the European Commission cautions that aggregators may prioritize cost over coverage quality. Their rapid growth highlights their importance in meeting the demand for convenient and efficient insurance solutions.

By End Use Insights

The family travelers held 30.8% of European market share in 2023 owing to the increasing popularity of family vacations and group travel, with policies often covering multiple members under a single plan. The Association of British Insurers highlights that family travelers prioritize comprehensive coverage, including child-specific medical benefits and trip cancellation protection. Eurostat reports that family travel accounts for a significant portion of leisure trips, underscoring its importance. However, the European Insurance and Occupational Pensions Authority notes that affordability remains a key concern, particularly for larger families seeking adequate coverage.

The senior citizens segment is estimated to register a promising CAGR during the forecast period. This growth is fueled by an aging population and increased travel among retirees. Eurostat states that individuals aged 65 and above constitute over 20% of Europe’s population, with many actively engaging in leisure travel. Senior travelers require specialized policies covering pre-existing medical conditions and emergency evacuations. The Association of British Insurers emphasizes that insurers are increasingly offering tailored products for this demographic. However, higher premiums due to age-related risks can limit adoption, highlighting the need for balanced pricing strategies.

REGIONAL ANALYSIS

The UK led the market in Europe and captured 25.4% of the European market share in 2023. The domination of the UK in Europe is majorly driven by high travel frequency, stringent consumer protection regulations, and a strong culture of insurance awareness. The UK government’s emphasis on post-Brexit travel preparedness has further boosted demand. The European Travel Commission reports that the UK market is growing at a CAGR of 8%, supported by the increasing adoption of digital insurance platforms. The country’s robust insurance infrastructure and focus on comprehensive coverage options solidify its leading position in the region.

Germany is anticipated to account for a prominent European market share over the forecast period. The growth of the German travel insurance market is majorly attributed to its large outbound travel market, with Germans taking over 70 million trips annually, according to the European Travel Commission. Germany’s strong regulatory framework and high disposable income levels further contribute to its dominance. The European Insurance and Occupational Pensions Authority notes that German insurers are increasingly offering tailored policies, particularly for senior travelers and long-stay trips, enhancing their market appeal.

France is predicted to a key role in the European market during the forecast period. France has a status as one of the world’s most visited destinations and attracts over 90 million tourists annually, according to the European Travel Commission. The French government’s focus on promoting sustainable tourism has also spurred demand for comprehensive travel insurance. The Association of British Insurers highlights that French insurers are leveraging digital tools to offer personalized policies, further strengthening their competitive edge in the region.

KEY MARKET PLAYERS

Some of the notable companies dominating the Europe travel insurance market profiled in this report are Allianz SE, American International Group Inc, AXA SA, Assicurazioni Generali, USI Insurance Services, battleface, Seven Corners, Travel Insured International, Zurich Insurance Group AG, Ping An Insurance (Group) Co. of China Ltd ADR, InsureandGo, EbixCash World Money, and Others.

MARKET SEGMENTATION

This research report on the Europe travel insurance market is segmented and sub-segmented into the following categories.

By Insurance Coverage

- Single-trip Travel Insurance

- Annual Multi-trip Travel Insurance

- Long-stay Travel Insurance

- Largest Segment: Single-Trip Travel Insurance

By Distribution Channel Insights

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

By End Use Insights

- Education Travelers

- Business Travelers

- Senior Citizens

- Family Travelers

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the europe travel insurance market growth rate during the projection period?

The Europe travel insurance market is expected to grow 14.5% between 2025 and 2033.

2. What can be the total europe travel insurance market value?

The europe travel insurance market size is expected to reach a revised size of USD 32,135 million by 2033

3. What are the top 5 key players in the europe travel insurance market?

Allianz SE, American International Group Inc, AXA SA, Assicurazioni Generali, and USI Insurance Services are top key players in the europe travel insurance market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]