Europe Transfection Technologies Market Size, Share & Growth Forecast By Product Type (Reagent, Instrument), Application (Therapeutic Delivery, Bio-Medical Research, Protein Production), Transfection Method (Lipofection, Electroporation, Nucleofection, Cotransfection), Technology (Physical, Biochemical, Viral-Vector), End User (Research Institutes, Hospitals, Pharma & Biotech Companies), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Transfection Technologies Market Size

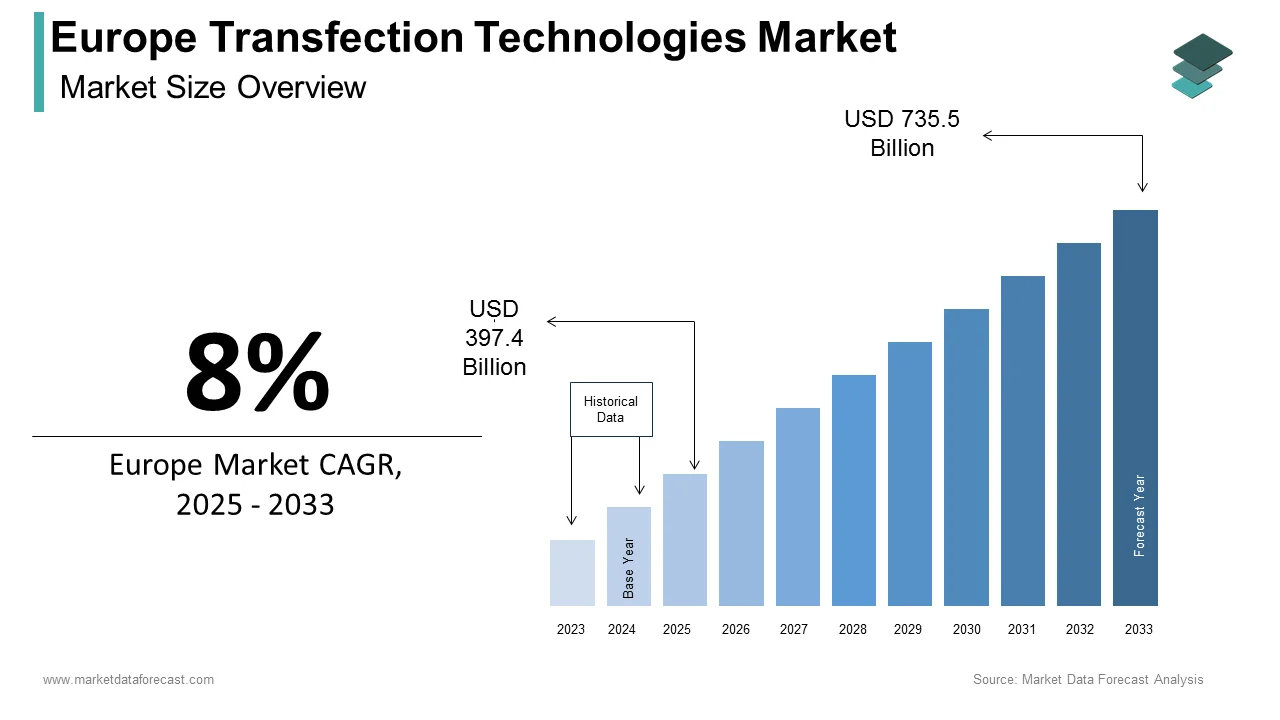

The transfection technologies market size in Europe was valued at USD 368 billion in 2024. The European market is estimated to be worth USD 735.5 billion by 2033 from USD 397.4 billion in 2025, growing at a CAGR of 8% from 2025 to 2033.

Transfection is defined as the process of deliberately introducing nucleic acids into eukaryotic cells and is crucial for genetic research, therapeutic development, and biopharmaceutical production. In Europe, the transfection technologies market has witnessed significant growth due to the increasing investments in genomic research, rising demand for personalized medicine, and advancements in non-viral delivery systems such as lipid nanoparticles and electroporation.

Europe accounted for a substantial share of the global market in 2024 due to its robust healthcare infrastructure and strong emphasis on innovation. Over the forecast period, the European market is anticipated to continue to showcase promising growth. Key factors propelling this growth include the rising prevalence of chronic diseases, increased funding for cancer research, and stringent regulatory frameworks supporting advanced therapies. Additionally, the European Federation of Pharmaceutical Industries and Associations underscores the region's leadership in clinical trials for gene therapies, further bolstering demand for efficient transfection tools. As technological innovations continue to emerge, Europe remains at the forefront of adopting cutting-edge solutions.

MARKET DRIVERS

Increasing Prevalence of Chronic Diseases and Genetic Disorders

The rising burden of chronic diseases and genetic disorders in Europe has significantly driven the demand for transfection technologies. According to the European Commission’s Directorate-General for Health and Food Safety, chronic diseases account for approximately 77% of the disease burden across the continent. Conditions such as cancer, cardiovascular diseases, and rare genetic disorders have created an urgent need for advanced therapeutic solutions like gene therapy and personalized medicine, both of which rely on transfection techniques. The International Agency for Research on Cancer reports that Europe accounts for nearly 23% of global cancer cases, underscoring the critical role of innovative treatments. Transfection tools are essential for delivering therapeutic genes into target cells, enabling breakthroughs in CAR-T cell therapies and CRISPR-based gene editing. With increasing investments in oncology research and genetic engineering, the adoption of transfection technologies is expected to grow, solidifying their importance in addressing Europe's healthcare challenges.

Robust Funding and Supportive Regulatory Framework

Europe’s strong financial commitment to biotechnology research and its supportive regulatory environment serve as another major driver for the transfection technologies market. The European Investment Bank notes that over €5 billion was invested in biotech startups and research initiatives in 2022, reflecting the region’s dedication to fostering innovation. Furthermore, the European Medicines Agency has implemented streamlined approval processes for advanced therapies, including those utilizing transfection techniques, encouraging their rapid development and commercialization. A report by the European Biopharmaceutical Enterprises highlights that the biopharmaceutical sector contributes over €100 billion annually to the European economy, with transfection playing a pivotal role in drug discovery and production. Additionally, the Horizon Europe program, which has allocated €95.5 billion for scientific projects between 2021 and 2027, prioritizes genetic engineering and cell-based therapies. This combination of substantial funding and favorable policies ensures sustained growth in the adoption of transfection technologies across academic and industrial sectors.

MARKET RESTRAINTS

High Costs Associated with Transfection Technologies

One of the significant restraints in the Europe transfection technologies market is the high cost associated with these tools and their applications. The European Federation of Pharmaceutical Industries and Associations highlights that developing a single gene therapy can cost over €1 billion, with transfection systems being a critical component of the process. These costs are further compounded by the need for specialized equipment, reagents, and skilled personnel to execute transfection procedures effectively. According to Eurostat, healthcare expenditure across Europe averages around 9.9% of GDP, but the affordability of advanced therapies remains a concern for smaller biotech firms and academic institutions. Additionally, the European Commission’s Joint Research Centre notes that small and medium-sized enterprises (SMEs) face financial barriers in adopting cutting-edge technologies like transfection due to limited access to funding. This economic burden restricts the widespread adoption of transfection technologies, particularly among smaller players, hindering overall market growth.

Ethical and Regulatory Challenges in Genetic Research

Ethical concerns and stringent regulatory requirements pose another major restraint for the Europe transfection technologies market. The European Group on Ethics in Science and New Technologies emphasizes that genetic modifications, including those enabled by transfection, often raise ethical debates regarding safety, equity, and potential misuse. These concerns lead to prolonged approval processes for clinical trials and therapeutic applications. Furthermore, the European Medicines Agency mandates rigorous testing and validation protocols for gene therapies, which can delay product launches. A report by the European Parliamentary Research Service reveals that approximately 40% of gene therapy projects face delays due to regulatory hurdles. Such challenges not only increase development timelines but also inflate costs, discouraging innovation. While these measures ensure patient safety, they inadvertently slow the pace of technological advancements, limiting the scalability and accessibility of transfection technologies across Europe’s biotechnology landscape.

MARKET OPPORTUNITIES

Expansion of Gene Therapy Applications

The growing adoption of gene therapies presents a significant opportunity for the Europe transfection technologies market. The European Medicines Agency reports that over 1,200 clinical trials involving advanced therapies, including gene therapies, were registered in Europe as of 2022, reflecting the rapid expansion of this field. Transfection technologies are integral to the development of these therapies, enabling precise delivery of genetic material into target cells. According to the European Investment Bank, the demand for gene therapies is growing remarkably worldwide, with Europe playing a leading role due to its robust research infrastructure. Additionally, the European Commission’s Horizon Europe program has allocated €5.3 billion specifically for health-related research, including gene editing and regenerative medicine. This focus on innovation creates a fertile ground for transfection technologies to address unmet medical needs and expand their applications across diverse therapeutic areas.

Advancements in Non-Viral Delivery Systems

Another major opportunity lies in the advancements of non-viral delivery systems, which are gaining traction as safer and more cost-effective alternatives to viral vectors. The European Directorate for the Quality of Medicines & HealthCare highlights that non-viral methods, such as lipid nanoparticles and electroporation, are increasingly being adopted due to their reduced immunogenicity and scalability. A report by the European Biopharmaceutical Enterprises estimates that non-viral delivery systems could capture up to 40% of the gene therapy market by 2030, driven by ongoing research and technological breakthroughs. Furthermore, the European Commission’s Joint Research Centre notes that investments in nanotechnology-based delivery platforms have surged, with over €2 billion allocated to related projects in 2022. These advancements not only enhance the efficiency and safety of transfection but also open new avenues for applications in drug delivery, vaccine development, and agricultural biotechnology, positioning Europe as a hub for next-generation transfection innovations.

MARKET CHALLENGES

Limited Accessibility for Small-Scale Research Institutions

A significant challenge in the Europe transfection technologies market is the limited accessibility of these advanced tools for small-scale research institutions and startups. The European Commission’s Directorate-General for Research and Innovation highlights that nearly 60% of small and medium-sized enterprises (SMEs) in the biotech sector face financial constraints when adopting cutting-edge technologies like transfection systems. High costs associated with reagents, equipment, and maintenance create barriers to entry, particularly for underfunded academic labs and smaller organizations. Eurostat reports that public funding for biotechnology research accounts for only 2.5% of total R&D expenditure across Europe, leaving many institutions reliant on competitive grants. Additionally, the European Federation of Biotechnology notes that the complexity of transfection protocols often requires specialized training, further limiting adoption among smaller entities. This disparity in access hinders innovation at the grassroots level, slowing the overall progress of genetic research and development in the region.

Complexity of Transfection Protocols and Variability in Outcomes

Another major challenge is the inherent complexity of transfection protocols and the variability in outcomes, which can impede the reliability of results. The European Medicines Agency emphasizes that achieving consistent transfection efficiency remains a critical hurdle, particularly in primary cells and hard-to-transfect cell lines. A report by the European Science Foundation reveals that up to 30% of experiments involving transfection fail to meet desired efficacy thresholds due to factors such as cell type, nucleic acid quality, and delivery method. Furthermore, the European Molecular Biology Organization notes that optimizing transfection conditions often requires extensive trial-and-error processes, increasing time and resource consumption. These challenges are compounded by the lack of standardized protocols, leading to inconsistent data across studies. Such variability not only undermines research reproducibility but also delays the translation of findings into clinical applications, posing a significant obstacle to the broader adoption of transfection technologies in Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Application, Transfection Method, Technology, End User, and country. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Agilent Technologies Inc., Bio-Rad Laboratories Inc., Lonza Group AG, MaxCyte Inc., Mirus Bio LLC, Polyplus Transfection, Promega Corporation, Roche Holding AG, Sigma-Aldrich Corporation, Thermo Fisher Scientific Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

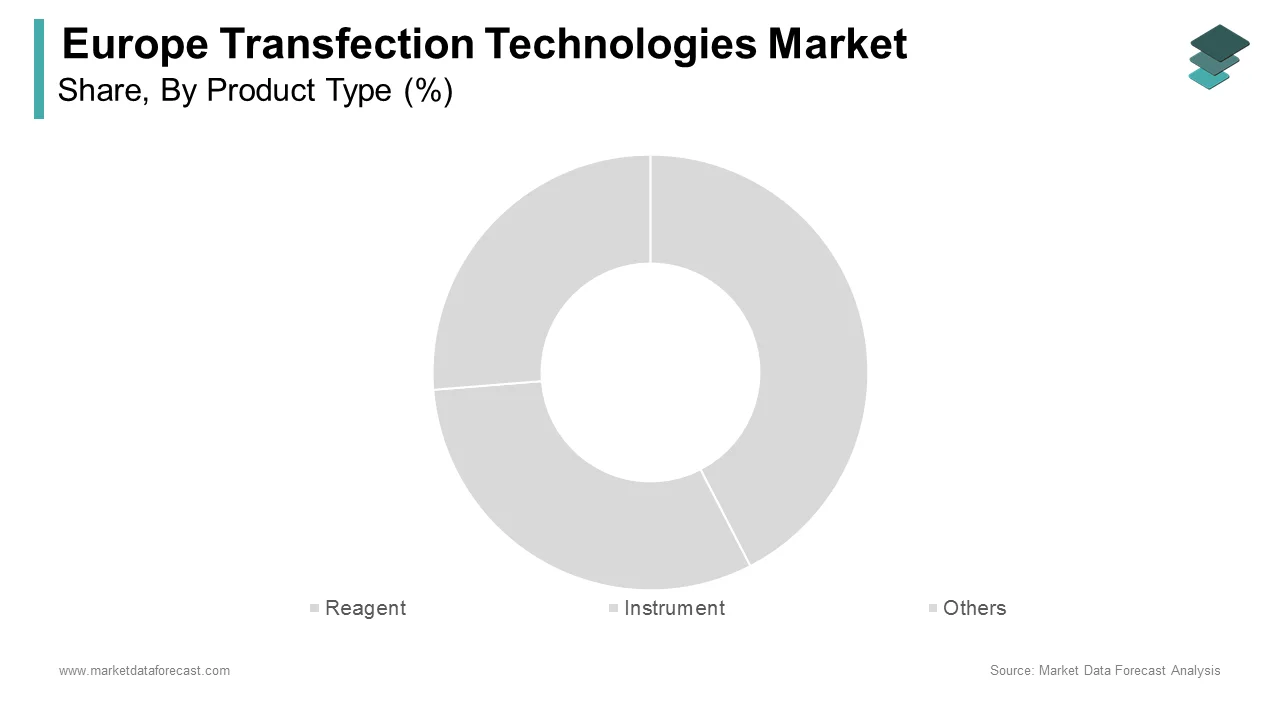

The reagents segment dominated the Europe transfection technologies market by capturing 60.8% of the European market share in 2024. The important role reagent plays in delivering nucleic acids into cells for applications like mRNA vaccines and gene therapies is majorly propelling the domination of the segment in the European market. As per the European Medicines Agency, lipid-based reagents alone are projected to grow at a promising CAGR due to their use in advanced therapies. This segment's importance lies in its versatility and compatibility with diverse cell types, making it indispensable for genetic research. However, high costs and optimization challenges limit accessibility, underscoring the need for cost-effective innovations.

The instrument segment is anticipated to be the fastest growing segment and showcase a CAGR of 8.5% over the forecast period owing to the advancements in automation and high-throughput screening technologies, essential for industrial-scale applications like biopharmaceutical production. The European Federation of Pharmaceutical Industries and Associations notes that electroporators and CRISPR-compatible tools are driving demand. Instruments ensure precision and scalability, addressing the limitations of manual methods. Despite high initial costs, their ability to enhance efficiency and reproducibility makes them vital for modern labs, positioning this segment as a key enabler of technological progress in transfection workflows.

By Application Insights

The therapeutic delivery segment accounted for the dominating share of 45.8% of the Europe transfection technologies market in 2024. The domination of therapeutic delivery segment in Europe is driven by the rising adoption of gene therapies and mRNA-based treatments. Transfection technologies are critical for delivering nucleic acids into target cells, enabling breakthroughs in treating genetic disorders and chronic diseases like cancer. The European Commission highlights that over €5 billion was invested in advanced therapies in 2022, underscoring the segment's pivotal role in modern medicine and its importance in addressing unmet clinical needs.

The bio-medical research segment is anticipated to witness the fastest CAGR of 9.5% over the forecast period due to the increased funding for genomic and proteomic studies, alongside advancements in CRISPR-Cas9 and other gene-editing tools. The European Science Foundation notes that over 1,200 clinical trials involving gene editing were registered in Europe in 2022, driving demand for transfection solutions. This segment's importance lies in its ability to accelerate drug discovery and enhance understanding of disease mechanisms. As Europe prioritizes innovation in life sciences, bio-medical research is set to play a transformative role, making it a key growth driver in the transfection technologies market.

By Transfection Method Insights

The lipofection segment had the leading share of 35.3% of the European market share in 2024. The versatility and compatibility with various cell types are making it indispensable for applications like mRNA vaccines and gene therapies, which is primarily contributing to the domination of the lipofection segment in the European market. According to the European Medicines Agency, lipid nanoparticles, a key component of lipofection, are likely to promising demand in the European market over the forecast period owing to their role in therapeutic delivery. Lipofection's importance lies in its ability to deliver nucleic acids efficiently, addressing unmet clinical needs. However, challenges such as cytotoxicity and variability in efficiency across cell lines persist, necessitating further innovation.

The in-vivo transfection segment is predicted to register a CAGR of 14.4% over the forecast period owing to the advancements in nanoparticle delivery systems and the increasing demand for systemic gene therapies. The European Biopharmaceutical Enterprises notes that in-vivo transfection is critical for applications like cancer immunotherapy and rare disease treatments, where direct genetic material delivery into living organisms is required. Its transformative potential in addressing complex diseases positions it as a key driver of innovation. However, challenges such as immune responses and off-target effects remain barriers to broader adoption.

By Technology Insights

The biochemical-based transfection captured the dominating share of 50.8% of the European market share in 2024. The growth of the biochemical-based infection segment is driven by its versatility and compatibility with various cell types, making it indispensable for applications like mRNA vaccines and gene therapies. This method's importance lies in its ability to deliver nucleic acids efficiently while maintaining cell viability. However, challenges such as cytotoxicity and variability across cell lines necessitate further innovation.

The viral-vector based transfection is anticipated to account for the fastest CAGR in the European market over the forecast period owing to the increasing adoption of viral vectors in gene therapies. Its importance lies in its high efficiency and specificity, enabling breakthroughs in treating genetic disorders and infectious diseases. Despite its potential, challenges such as high production costs and immunogenicity concerns remain barriers, driving demand for safer and cost-effective vector designs.

By End User Insights

The pharmaceutical and biotechnology companies segment occupied the leading share of 41.2% of the European market share in 2024. The domination of the segment is driven by the critical role of transfection in drug development, vaccine production, and biopharmaceutical manufacturing. The European Investment Bank highlights that over €5 billion was invested in gene and cell therapy development in 2022, underscoring the segment's importance. Transfection technologies enable scalable solutions for treating chronic diseases and genetic disorders, making them indispensable. However, high R&D costs and stringent regulatory requirements remain challenges, necessitating continuous innovation to sustain growth.

The research centers and academic institutes segment is anticipated to register the fastest CAGR of 10.2% over the forecast period owing to the increasing investments in genomic research, with over €20 billion allocated to life sciences research in 2022, as per the European Commission. These institutions are pivotal in advancing CRISPR-Cas9 and other gene-editing tools, driving demand for transfection technologies. Their importance lies in fostering innovation and addressing unmet medical needs. However, limited funding and the high cost of advanced tools remain barriers, highlighting the need for affordable and accessible solutions.

REGIONAL ANALYSIS

Germany is one of the top-performing countries in the Europe transfection technologies market and holds the leading share of the European market in 2024. The robust biotechnology ecosystem of Germany with over 1,000 biotech firms driving innovation in gene therapy and drug discovery, is driving the domination of Germany in the European market. According to the Federal Ministry of Education and Research of Germany, the government invested over €5 billion in life sciences R&D in 2022, which is fostering advancements in transfection technologies. Additionally, the presence of leading pharmaceutical giants like Bayer and Merck ensures significant adoption of cutting-edge tools. The strong academic-industrial collaborations and rising focus on precision medicine of Germany are anticipated to continue to drive the market growth in Germany.

The UK is anticipated to account for a substantial share of the European market over the forecast period. The prominent position of the UK in the European market is driven by its world-class research institutions and a thriving biotech sector, with investments exceeding £3 billion annually. The Medicines and Healthcare products Regulatory Agency highlights that the UK is a global leader in clinical trials for advanced therapies, many of which rely on transfection techniques. Furthermore, initiatives like the Life Sciences Vision 2030 aim to bolster innovation in gene editing and therapeutic delivery. The UK is expected to continue to do well in the European market due to its supportive regulatory framework and emphasis on translational research.

France is another key performer in the European market. The strong healthcare infrastructure and increasing focus on personalized medicine of France are propelling the French market growth. The French National Research Agency allocated over €4 billion to biotechnology projects in 2022, emphasizing gene therapy and vaccine development. France also hosts prominent biopharmaceutical companies like Sanofi, which leverage transfection technologies for innovative treatments. According to Eurostat, France’s biotech sector is expected to grow at a CAGR of 9% through 2030, driven by advancements in non-viral delivery systems and government support for genetic research. These factors position France as a critical hub for transfection innovations in Europe.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe transfection technologies market profiled in this report are Agilent Technologies Inc., Bio-Rad Laboratories Inc., Lonza Group AG, MaxCyte Inc., Mirus Bio LLC, Polyplus Transfection, Promega Corporation, Roche Holding AG, Sigma-Aldrich Corporation, Thermo Fisher Scientific Inc., and Others.

MARKET SEGMENTATION

This Europe transfection technologies market research report is segmented and sub-segmented into the following categories.

By Product Type

- Reagent

- Instrument

- Others

By Application

- Therapeutic Delivery

- Bio-Medical Research

- Protein Production

- Others

By Transfection Method

- Lipofection

- Electroporation

- Nucleofection

- Cotransfection

- Cationic Lipid Transfection

- In-Vivo Transfection

- Others

By Technology

- Physical Transfection

- Biochemical Based Transfection

- Viral-Vector Based Transfection

By End User

- Research Centers and Academic Institutes

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]