Europe Train Seat Market Size, Share, Trends & Growth Forecast Report By Train Type (Passenger Train, High Speed Trains, Light Rapid Transit Trains, Monorail, Trams), Material, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Train Seat Market Size

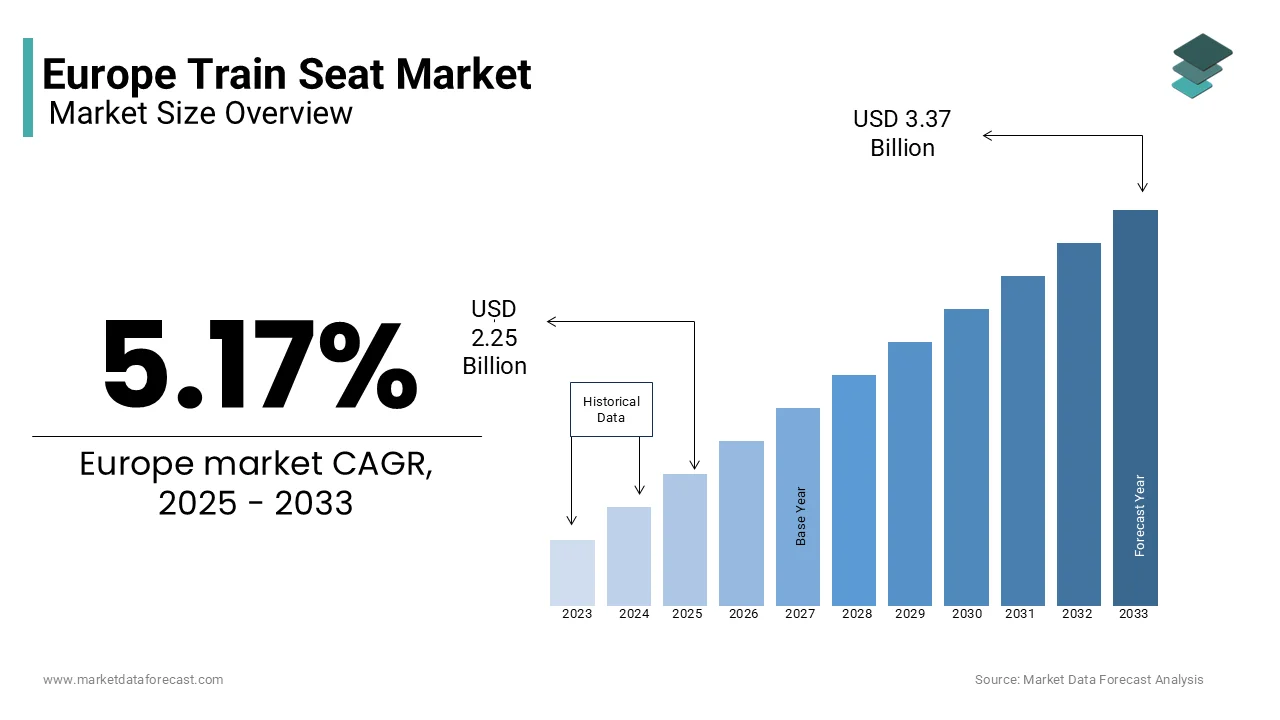

The train seat market size in Europe was valued at USD 2.14 billion in 2024. The European market is estimated to be worth USD 3.37 billion by 2033 from USD 2.25 billion in 2025, growing at a CAGR of 5.17% from 2025 to 2033.

The Europe train seat market is driven by the increasing demand for efficient, comfortable, and sustainable public transportation solutions across the continent. As urbanization accelerates and environmental concerns grow, rail transport has emerged as a preferred mode of travel is further propelling the need for advanced seating systems that enhance passenger experience while adhering to stringent safety and ergonomic standards.

This growth is fueled by rising investments in high-speed rail networks, particularly in countries like Germany, France, and Spain, which collectively account for over 60% of the region’s rail infrastructure development. Additionally, the European Union’s Green Deal initiative, aimed at achieving carbon neutrality by 2050, has prioritized rail transport as a sustainable alternative to road and air travel, indirectly boosting the demand for innovative train seating solutions.

A notable trend in this market is the integration of lightweight materials such as aluminum alloys and advanced polymers, which not only reduce the overall weight of trains but also improve fuel efficiency. Furthermore, manufacturers are increasingly incorporating smart features like adjustable headrests, USB charging ports, and antimicrobial fabrics to cater to evolving passenger expectations.

MARKET DRIVERS

Expansion of High-Speed Rail Networks

The proliferation of high-speed rail networks across Europe serves as a major driver for the train seat market. Countries such as France, Germany, and Spain have heavily invested in expanding their high-speed rail infrastructure, with the European Commission reporting that over 20,000 kilometers of high-speed rail lines are operational as of 2023. These projects are part of the Trans-European Transport Network (TEN-T) initiative, which aims to enhance connectivity and reduce travel times. High-speed trains require specialized seating solutions that prioritize comfort, safety, and durability, thereby increasing demand for advanced train seats. According to Eurostat, passenger traffic on high-speed trains has grown by 15% annually in key regions is reflecting rising reliance on this mode of transport. This expansion not only boosts seat procurement but also drives innovation in ergonomic designs tailored for long-distance travel.

Rising Focus on Sustainable Public Transportation

Europe’s commitment to sustainability is another key factor propelling the train seat market’s growth. According to the European Environment Agency, rail transport accounts for just 2% of total transport emissions by making it one of the most environmentally friendly modes of travel. Governments are incentivizing rail usage through policies like the European Green Deal, which seeks to double high-speed rail traffic by 2030. As a result, manufacturers are focusing on eco-friendly seating materials, such as recyclable polymers and bio-based fabrics, to align with these goals. According to the International Union of Railways (UIC), rail passenger numbers are projected to increase by 40% by 2030 is driven by green initiatives. This surge leverages the need for modernized seating systems that cater to growing ridership while adhering to sustainability benchmarks.

MARKET RESTRAINTS

High Costs of Advanced Seating Technologies

The adoption of advanced seating technologies in the Europe train seat market is significantly hindered by their high costs, which pose a challenge for manufacturers and operators alike. Innovations such as lightweight materials, smart features, and antimicrobial coatings require substantial investment in research and development, driving up the overall cost of production. According to the European Investment Bank, the initial capital expenditure for integrating modern seating systems can increase project budgets by up to 20%. This financial burden is particularly challenging for smaller rail operators with limited budgets. According to the Eurostat, public transport subsidies have decreased by 10% in certain regions due to post-pandemic fiscal constraints, limiting the ability of operators to invest in premium seating solutions. These factors collectively slow down the widespread adoption of advanced train seats, despite their long-term benefits.

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages represent another major restraint impacting the Europe train seat market. The COVID-19 pandemic exposed vulnerabilities in global supply chains, leading to delays in the procurement of critical raw materials such as aluminum alloys and specialized polymers. A study by European Commission reveals that over 60% of manufacturers faced significant delays in sourcing materials during 2022, directly affecting production timelines. Additionally, geopolitical tensions and trade restrictions have further exacerbated the availability of essential components, with the International Transport Forum reporting a 15% increase in material costs over the past two years.

MARKET OPPORTUNITIES

Growing Demand for Smart and Connected Seating Solutions

The integration of smart and connected features in train seats presents a significant opportunity for the Europe train seat market. Passengers are increasingly seeking enhanced travel experiences, with amenities such as USB charging ports, adjustable lumbar support, and real-time seat availability updates becoming key expectations. According to a report by the European Railway Agency, over 75% of rail passengers prioritize connectivity and comfort during their journeys, driving manufacturers to innovate in this space. This trend creates a lucrative opportunity for seat manufacturers to capitalize on the demand for technologically advanced seating systems. Companies can tap into this growing by aligning with digital transformation initiatives.

Rising Investments in Urban Mobility and Commuter Rail Networks

Rapid Urbanization and the expansion of commuter rail networks across Europe offer another promising opportunity for the train seat market. According to the European Commission, urban populations are expected to increase by 15% by 203 is intensifying the need for efficient public transport solutions. To address this, governments are investing heavily in urban mobility projects, with over €500 billion earmarked for rail infrastructure under the EU’s Sustainable and Smart Mobility Strategy. According to the International Union of Railways (UIC), commuter rail usage has grown by 25% in major metropolitan areas over the past decade. This surge in demand necessitates the procurement of durable, cost-effective seating systems tailored for short-distance travel. Manufacturers can leverage this opportunity by developing scalable solutions that cater to the unique needs of urban commuters while supporting sustainable mobility goals.

MARKET CHALLENGES

Balancing Cost Efficiency with Sustainability Goals

The striking a balance between cost efficiency and sustainability goals is posing a challenge for the growth rate of the Europe train seat market. While there is a growing emphasis on using eco-friendly materials, such as recyclable polymers and bio-based fabrics, these options often come at a premium price. According to the European Environment Agency, sustainable materials can increase production costs by up to 30% by making it difficult for manufacturers to maintain competitive pricing. Additionally, rail operators are under pressure to reduce operational expenses due to fluctuating subsidies. As per Eurostat, public funding for rail infrastructure has decreased by 12% in some regions since 2020, further complicating investments in green seating solutions. This financial strain creates a significant challenge for stakeholders aiming to meet both environmental standards and budgetary constraints without compromising quality.

Addressing Customization Needs Across Diverse Rail Networks

Another critical challenge is addressing the diverse customization needs of Europe’s fragmented rail networks, which vary significantly in terms of infrastructure, passenger demographics, and regulatory requirements. According to the International Transport Forum, over 40 different rail operators exist across Europe, each with unique specifications for seating systems. For instance, high-speed trains demand lightweight, ergonomic designs, while regional commuter trains prioritize durability and cost-effectiveness. This diversity complicates standardization efforts is leading to increased production timelines and costs. According to the European Railway Agency, compliance with varying national safety and design regulations adds another layer of complexity, requiring manufacturers to invest heavily in adaptable production processes. These challenges hinder scalability and efficiency is posing a significant barrier to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.17% |

|

Segments Covered |

By Train Type, Material, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

FISA Srl, Freedman Seating Co., KTK Group Co. Ltd., JINYO Transport Facilities Co., Ltd., Transcal Ltd., GRAMMER AG, Franz Kiel GmbH, and Lazzerini Srl, and others. |

SEGMENTAL ANALYSIS

By Train Type Insights

Passenger trains dominated the market and held 65% of Europe train seat market share in 2024. The growing use in regional and long-distance travel with over 700 million annual journeys. According to Eurostat, 10% growth in regional rail usage over the past five years which is driven by urbanization and affordable public transport options. The segment's importance lies in its ability to cater to diverse demographics, ensuring consistent demand for versatile seating solutions. With governments investing heavily in commuter rail networks, passenger trains remain pivotal to the market’s stability and growth.

High-speed trains segment is anticipated to exhibit a CAGR of 7.2% during the forecast period. This rapid growth is fueled by expanding high-speed rail networks, with the European Commission projecting a 40% increase in lines by 2030. The segment’s focus on premium seating innovations, such as ergonomic designs and lightweight materials with rising passenger expectations for comfort and sustainability. High-speed rail traffic has surged by 25% over the past decade is making it a key driver of technological advancements and market expansion in the Europe train seat industry.

By Material Insights

Metal segment was the largest and held 45% of Europe train seat market share in 2024 owing to its durability, fire resistance, and lightweight properties by making it ideal for modern rail systems. Aluminum alloys, widely used in seat frames, enhance fuel efficiency, with Eurostat reporting a 20% rise in metal-based seating adoption over the past five years. Metal's compliance with stringent safety standards further elevates its importance. Metal remains critical for meeting performance and regulatory needs by ensuring its continued dominance in the market.

Fabric segment is likely to experience a CAGR of 6.8% during the forecast period. This growth is fueled by innovations in sustainable textiles, such as antimicrobial and eco-friendly fabrics, which align with EU Green Deal objectives. According to the European Environment Agency, 60% of new projects now incorporate sustainable fabrics. Fabric's versatility, comfort, and cost-effectiveness make it ideal for urban transit systems. Fabric's role in enhancing passenger experience while supporting sustainability ensures its rapid expansion in the train seat market.

REGIONAL ANALYSIS

Germany led the Europe train seat market with 28% of the total market share in 2024. Its extensive rail network, which is one of the most developed in Europe, and significant investments in high-speed rail projects under the Trans-European Transport Network (TEN-T) initiative are significantly to boost the growth rate of the marekt. According to the European Commission, Germany has allocated over €100 billion to rail infrastructure by 2030 by emphasizing modernization and sustainability. Additionally, the country’s focus on lightweight and ergonomic seating solutions aligns with its commitment to energy efficiency and passenger comfort by making it a dominant player in the market.

France is esteemed to achieve a fastest CAGR of 5.1% from 2025 to 2033. The country’s robust high-speed TGV network, which spans over 2,700 kilometers, has been pivotal in driving demand for advanced train seating systems. According to the International Union of Railways (UIC), France is also prioritizing sustainable public transport, with initiatives aimed at reducing carbon emissions through rail travel. The integration of innovative seating designs, such as adjustable headrests and eco-friendly materials, has further strengthened its position in the market, catering to both domestic and international travelers.

Spain train seat market is anticipated to fuel the growth rate in the next coming years with rapid expansion of high-speed rail lines. As per Eurostat, Spain’s high-speed rail network has grown by over 30% in the past decade is making it the second largest in the world after China. This growth has created substantial demand for modernized seating systems that prioritize comfort, safety, and durability. Furthermore, Spain’s commitment to green mobility, which is supported by EU funding has accelerated the adoption of lightweight and recyclable materials in train seats.

KEY MARKET PLAYERS

The major key players in Europe home appliances market are FISA Srl, Freedman Seating Co., KTK Group Co. Ltd., JINYO Transport Facilities Co., Ltd., Transcal Ltd., GRAMMER AG, Franz Kiel GmbH, and Lazzerini Srl, and others.

MARKET SEGMENTATION

This research report on the Europe train seat market is segmented and sub-segmented into the following categories.

By Train Type

- Passenger Train

- High Speed Trains

- Light Rapid Transit Trains

- Monorail

- Trams

By Material

- Metal

- Fabric

- Leather

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the size of Europe Train Seat Market?

As of 2024, the Europe Train Seat Market is valued at approximately USD 2.14 billion and is projected to reach USD 3.37 billion by 2033, growing at a CAGR of 5.17% from 2025 to 2033.

2. What are the key factors driving the growth of the Europe Train Seat Market?

Key factors include increasing investments in railway infrastructure, rising demand for passenger comfort, the expansion of high-speed rail networks, and advancements in lightweight and ergonomic seating technologies.

3. Who are the key players in the Europe Train Seat Market?

Major companies in the market include Franz Kiel GmbH, FISA Srl, Lazzerini Srl, Freedman Seating Co., GRAMMER AG, KTK Group Co. Ltd., Transcal Ltd., and JINYO Transport Facilities Co., Ltd., among others.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]