Europe Tractor Market Size, Share, Trends & Growth Forecast Report by Horsepower (Below 40 HP, 40 HP - 100 HP, and Above 100 HP), by Drive Type (Two-Wheel Drive and Four-Wheel Drive/All-Wheel Drive), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Tractor Market Size

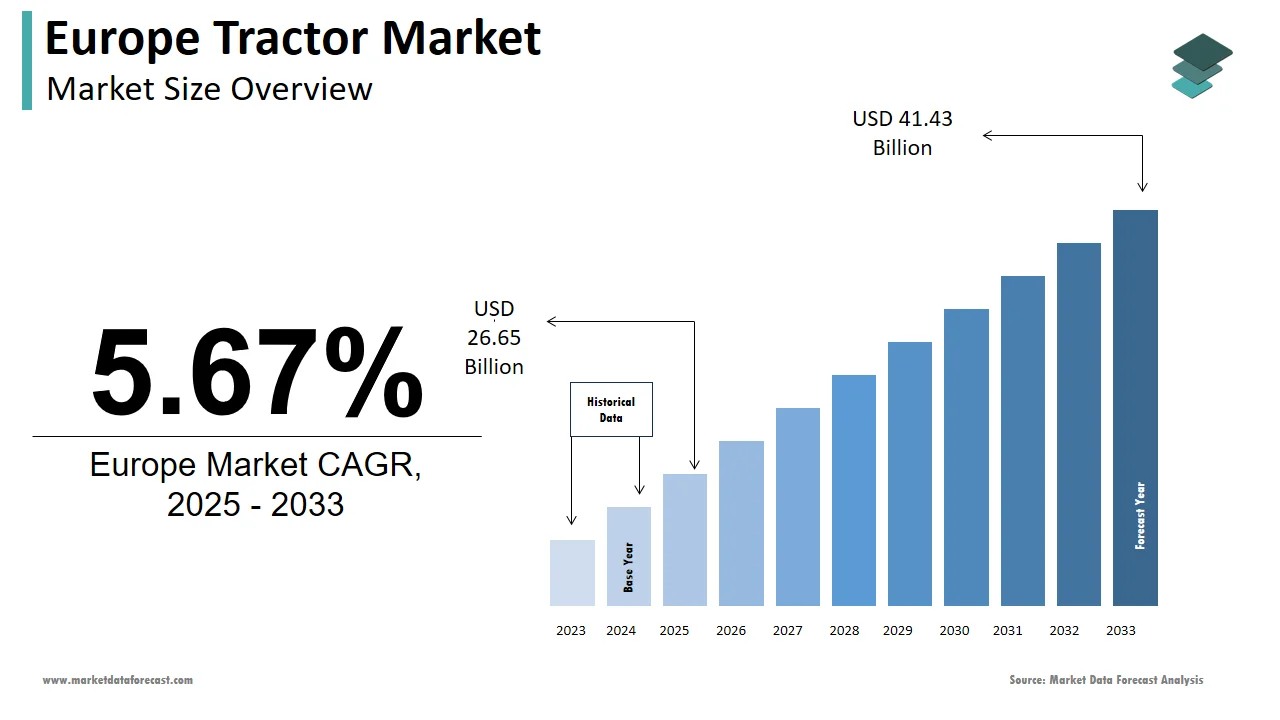

The tractor market size in Europe was valued at USD 25.22 billion in 2024. The European market is estimated to be worth USD 41.43 billion by 2033 from USD 26.65 billion in 2025, growing at a CAGR of 5.67% from 2025 to 2033.

The growth of the Europe tractor market due to its deeply intertwined with agricultural modernization and mechanization trends. According to Eurostat, agriculture remains a vital economic activity in Europe is contributing over €178 billion annually to the EU economy. The tractor market benefits from this robust agricultural base in countries like Germany, France, and Italy, where farming practices are highly mechanized. As per the European Agricultural Machinery Association (CEMA), the demand for tractors in Europe reached approximately 200,000 units in 2023.

The government subsidies are promoting sustainable farming practices and the integration of advanced technologies like GPS and IoT in tractors. For instance, the EU’s Common Agricultural Policy (CAP) allocates significant funds to support farmers in adopting efficient machinery. Additionally, the rise in small-scale farming operations has fueled demand for compact tractors, particularly those below 40 HP. Despite these positive indicators, challenges such as fluctuating raw material prices and stringent emission regulations under Euro VI standards have tempered market growth.

MARKET DRIVERS

Government Initiatives Promoting Mechanization

Government policies aimed at enhancing agricultural productivity have significantly driven the Europe tractor market. Programs under the EU’s CAP provide financial incentives for farmers to adopt modern machinery, including tractors equipped with precision farming technologies. For example, the French government allocated €1.2 billion in 2023 to subsidize the purchase of energy-efficient tractors, as per the French Ministry of Agriculture. This initiative has spurred demand for mid-range tractors (40 HP - 100 HP) that is ascribed to bolster the growth of the market. Furthermore, the emphasis on reducing carbon footprints has encouraged the adoption of eco-friendly tractors powered by alternative fuels, such as biodiesel or electricity.

Increasing Adoption of Precision Farming Technologies

Precision farming has emerged as a transformative trend in European agriculture, directly boosting tractor demand. According to a study by the European Commission, precision farming adoption grew by 20% between 2020 and 2023, with tractors serving as the backbone of this technology-driven approach. Advanced tractors equipped with GPS, sensors, and automated steering systems enable farmers to optimize resource use and increase yields. For instance, Germany witnessed a 30% rise in sales of high-horsepower tractors (above 100 HP) designed for large-scale precision farming operations, as reported by the German Agricultural Society (DLG). These innovations not only enhance efficiency but also align with the EU’s sustainability goals is propelling market growth.

MARKET RESTRAINTS

High Initial Costs and Financial Constraints

One of the primary restraints in the Europe tractor market is the high upfront cost associated with purchasing advanced machinery. Modern tractors equipped with precision farming technologies can cost upwards of €100,000 is making them unaffordable for small-scale farmers. According to a survey conducted by the European Farmers' Association, nearly 40% of farmers cited financial barriers as a major obstacle to upgrading their equipment. While subsidies exist, they often do not cover the full expense by leaving many farmers reliant on outdated machinery. This issue is particularly pronounced in Eastern Europe, where smaller farms dominate. For example, in Romania, the average farm size is just 3.6 hectares is limiting the ability of farmers to invest in high-cost tractors.

Stringent Emission Regulations

The implementation of stringent emission standards under Euro VI has posed significant challenges for tractor manufacturers. Compliance with these regulations requires substantial investment in research and development to create low-emission engines, which increases production costs. According to the European Environment Agency, tractor manufacturers face penalties of up to €5,000 per non-compliant unit sold. This regulatory pressure has led to a slowdown in production timelines, affecting market supply. Additionally, smaller manufacturers struggle to compete with larger firms that have greater resources to adapt to these changes. According to a report by the Italian Agricultural Machinery Manufacturers' Association, nearly 15% of local manufacturers experienced delays in launching new models due to compliance issues.

MARKET OPPORTUNITIES

Rising Demand for Compact Tractors in Urban Farming

Urban farming initiatives across Europe have created a burgeoning demand for compact tractors, particularly those below 40 HP. Cities like Berlin and Paris are increasingly adopting urban agriculture projects to promote local food production and sustainability. According to the European Urban Agriculture Network, the number of urban farms in Europe grew by 25% between 2020 and 2023. These farms require smaller, versatile tractors capable of navigating confined spaces and performing multiple tasks. For instance, the UK’s Department for Environment, Food & Rural Affairs reported a 35% increase in sales of compact tractors for urban farming applications in 2023. This trend presents a lucrative opportunity for manufacturers to develop specialized models tailored to urban environments.

Expansion into Emerging Markets within Europe

Eastern European countries, such as Poland and Hungary, represent untapped potential for the tractor market. These regions are witnessing rapid agricultural modernization owing to driven by EU funding and increased mechanization efforts. According to the Polish Chamber of Agricultural Machinery, tractor sales in Poland surged by 22% in 2023, with a particular focus on mid-range models (40 HP - 100 HP). Similarly, Hungary’s Ministry of Agriculture noted a 15% annual growth in tractor adoption, supported by government-backed loans for farmers. Manufacturers can capitalize on this trend by establishing localized distribution networks and offering region-specific financing options, thereby strengthening their foothold in these emerging markets.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions have emerged as a critical challenge for the Europe tractor market, exacerbated by geopolitical tensions and global trade restrictions. According to the European Association of Automotive Suppliers, shortages of essential materials like steel and semiconductors caused a 12% decline in tractor production in 2023. For instance, semiconductor shortages delayed the delivery of advanced tractors equipped with IoT capabilities, impacting customer satisfaction. Additionally, rising raw material costs have forced manufacturers to increase prices, further straining affordability for farmers. The Swedish Agricultural University reported that nearly 30% of farmers postponed tractor purchases due to inflated costs with the severity of this challenge.

Environmental Concerns and Sustainability Pressure

The growing emphasis on environmental sustainability has placed additional pressures on the tractor market. While the adoption of eco-friendly technologies is an opportunity, it also poses challenges for manufacturers. According to the European Commission, tractors account for approximately 15% of agricultural emissions is prompting stricter regulations to reduce their carbon footprint. Compliance with these standards requires significant R&D investments, which smaller manufacturers struggle to afford. Moreover, consumer skepticism about the practicality of electric tractors has slowed their adoption. A study by the Danish Agricultural Advisory Service revealed that only 10% of farmers were willing to switch to electric models due to concerns about battery life and charging infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Horsepower, Drive Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Deere and Company, Kubota Corporation, Mahindra Tractors, CNH Industrial, AGCO Corporation, and others. |

SEGMENTAL ANALYSIS

By Horsepower Insights

The below 40 HP segment dominated in the Europe tractor market by capturing 50.6% of the total share in 2024 owing to the prevalence of small-scale farming operations across Europe in Southern and Eastern regions. According to the Italian National Institute of Statistics, over 70% of farms in Italy are smaller than 10 hectares is necessitating compact tractors for efficient land management. Additionally, the rise of urban farming has further bolstered demand for smaller tractors, which are versatile and easy to maneuver. For instance, France’s Ministry of Agriculture documented a 25% increase in the sale of compact tractors for vineyards and orchards in 2023.

The above 100 HP segment is projected to grow at a CAGR of 8.5% during 2025-2033. This rapid growth is fueled by the increasing adoption of precision farming technologies and the expansion of large-scale agricultural enterprises. Germany, for instance, witnessed a 40% rise in demand for high-horsepower tractors in 2023, driven by the need for enhanced productivity in cereal and oilseed production. According to the German Federal Ministry of Food and Agriculture, farms exceeding 100 hectares accounted for 60% of total agricultural output with the importance of powerful tractors in achieving economies of scale.

By Drive Type Insights

The two-wheel drive tractors segment dominated the Europe tractor market with significant share if in 2024 due to their affordability and suitability for small-scale farming operations. According to Spain’s Ministry of Agriculture, two-wheel drive tractors are preferred by nearly 80% of olive growers due to their cost-effectiveness and ease of maintenance. Additionally, government subsidies targeting small farmers have further boosted their adoption. For instance, Portugal’s National Agricultural Support Fund provided grants covering 50% of the cost for two-wheel drive tractors by leading to a 20% sales increase in 2023.

The four-wheel drive/all-wheel drive segment is growing at a CAGR of 9.2% with the demand for enhanced traction and performance in challenging terrains. According to the Swedish Board of Agriculture, sales of four-wheel drive tractors surged by 35% in 2023, particularly in mountainous regions like Norway and Switzerland. These tractors are ideal for large-scale operations requiring heavy-duty capabilities, such as forestry and livestock farming. The Netherlands’ Wageningen University reported that 65% of dairy farms now prefer four-wheel drive models for their superior handling and durability.

COUNTRY LEVEL ANALYSIS

Germany was the largest contributor to the Europe tractor market by accounting for 25.4% of total share in 2024 due to the country’s highly mechanized agricultural sector, with over 90% of farms utilizing advanced machinery. According to the German Agricultural Society, the nation’s focus on precision farming has driven demand for high-performance tractors in cereal and potato cultivation.

The Poland tractor market is expected to grow with a CAGR of 10.5% in the next coming years. EU funding and modernization initiatives have fueled tractor adoption among small-scale farmers. For instance, Poland’s Ministry of Agriculture allocated €500 million in 2023 to support mechanization projects by resulting in a 22% sales increase.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe tractor market profiled in this report are Deere and Company, Kubota Corporation, Mahindra Tractors, CNH Industrial, AGCO Corporation, and others.

TOP LEADING PLAYERS IN THE MARKET

John Deere

John Deere holds a prominent position in the Europe tractor market, renowned for its innovative technologies and robust product portfolio. The company’s strengths lie in its commitment to sustainability is offering tractors equipped with low-emission engines and precision farming tools.

CNH Industrial

CNH Industrial is a key player, leveraging its diverse range of tractors tailored to various agricultural needs. The company excels in providing durable and high-performance models for large-scale farming operations.

AGCO Corporation

AGCO Corporation stands out for its focus on digitalization, integrating advanced IoT solutions into its tractors. Its Fendt brand is highly regarded for premium quality and cutting-edge features.

KEY STRATEGIES USED BY KEY PLAYERS IN THE MARKET

The Europe tractor market is highly dynamic, with key players employing a variety of strategies to strengthen their foothold and gain a competitive edge. One of the most prominent strategies is product innovation, where manufacturers focus on integrating cutting-edge technologies into their offerings. For instance, John Deere has consistently invested in developing tractors equipped with advanced precision farming tools such as GPS-guided steering systems, automated seeding mechanisms, and real-time data analytics platforms. These innovations not only enhance operational efficiency for farmers but also align with the EU’s stringent sustainability goals. In 2023, the company launched its Gen 4 Precision Ag Technology suite, which includes AI-driven insights to optimize crop yields while reducing resource wastage.

Another critical strategy is strategic partnerships and collaborations. CNH Industrial, for example, partnered with leading technology firms to integrate IoT and machine learning capabilities into its tractor models. This collaboration enabled the company to offer predictive maintenance features, allowing farmers to monitor tractor performance remotely and reduce downtime. Similarly, AGCO Corporation has collaborated with agricultural research institutions to develop region-specific solutions tailored to the unique needs of European farmers. The company’s partnership with Wageningen University in the Netherlands led to the development of specialized tractors designed for sustainable dairy farming practice.

COMPETITION OVERVIEW

The Europe tractor market is characterized by intense competition, driven by the presence of global giants, regional players, and niche manufacturers striving to capture market share. The competitive landscape is shaped by factors such as technological advancements, regulatory compliance, and customer-centric product offerings. Leading companies like John Deere, CNH Industrial, and AGCO Corporation dominate the market through their extensive R&D capabilities, robust distribution networks, and strong brand equity. One of the defining aspects of competition in this market is the emphasis on differentiation through innovation. Companies are investing heavily in developing next-generation tractors equipped with features like autonomous driving, IoT connectivity, and AI-powered analytics. For instance, John Deere’s autonomous tractor prototypes have set a new benchmark in the marketplace, compelling competitors to accelerate their own R&D efforts. Similarly, AGCO’s Fendt brand has carved out a niche for itself by offering premium, high-performance tractors that appeal to large-scale commercial farms.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In April 2024, John Deere unveiled its Gen 4 Precision Ag Technology suite , a groundbreaking advancement in tractor automation. This suite integrates AI-driven analytics, GPS-guided steering systems, and real-time crop monitoring tools, empowering farmers to achieve unprecedented levels of precision and efficiency.

- In June 2024, CNH Industrial acquired a robotics firm specializing in autonomous vehicle technologies. This acquisition marked a significant step toward integrating artificial intelligence and machine learning into CNH’s tractor lineup. The move not only enhances the company’s technological capabilities but also positions it as a leader in the development of autonomous farming solutions, a rapidly growing segment in the European market.

- In August 2024, AGCO Corporation launched a new line of eco-friendly tractors powered by alternative fuels. These tractors comply with the latest Euro VI emission standards and feature energy-efficient engines designed to reduce carbon footprints. The launch aligns with AGCO’s broader sustainability goals and addresses the increasing demand for environmentally responsible agricultural machinery across Europe.

- In October 2024, Claas partnered with a German startup specializing in autonomous farming technologies. Together, they developed prototypes of fully autonomous tractors capable of performing tasks such as plowing, seeding, and harvesting without human intervention. This collaboration highlights Claas’s focus on innovation and its ambition to lead the autonomous farming revolution in Europe.

- In December 2024, Same Deutz-Fahr expanded its production facilities in Romania, marking a strategic move to tap into the burgeoning agricultural machinery market in Eastern Europe. The expansion allows the company to produce tractors locally, reducing costs and improving accessibility for farmers in the region. This initiative strengthens Same Deutz-Fahr’s presence in emerging markets and reinforces its position as a key player in the Europe tractor market.

MARKET SEGMENTATION

This Europe tractor market research report is segmented and sub-segmented into the following categories.

By Horsepower

- Below 40 HP

- 40 HP - 100 HP

- Above 100 HP

By Drive Type

- Two-wheel Drive

- Four-wheel Drive/All-wheel Drive

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current trend driving the Europe Tractor Market?

The Europe Tractor Market is driven by rising demand for mechanized farming and advanced tractors.

2. Which tractor type holds the largest share in the Europe Tractor Market?

Utility tractors lead the Europe Tractor Market due to their versatility and widespread use.

3. What is the growth outlook for the Europe Tractor Market?

The Europe Tractor Market is expected to grow at a CAGR of 5.67% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]