Europe Toy Market Size, Share, Trends & Growth Forecast Report By Type (Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush and Others), Age Group, Sales Channel and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Toy Market Size

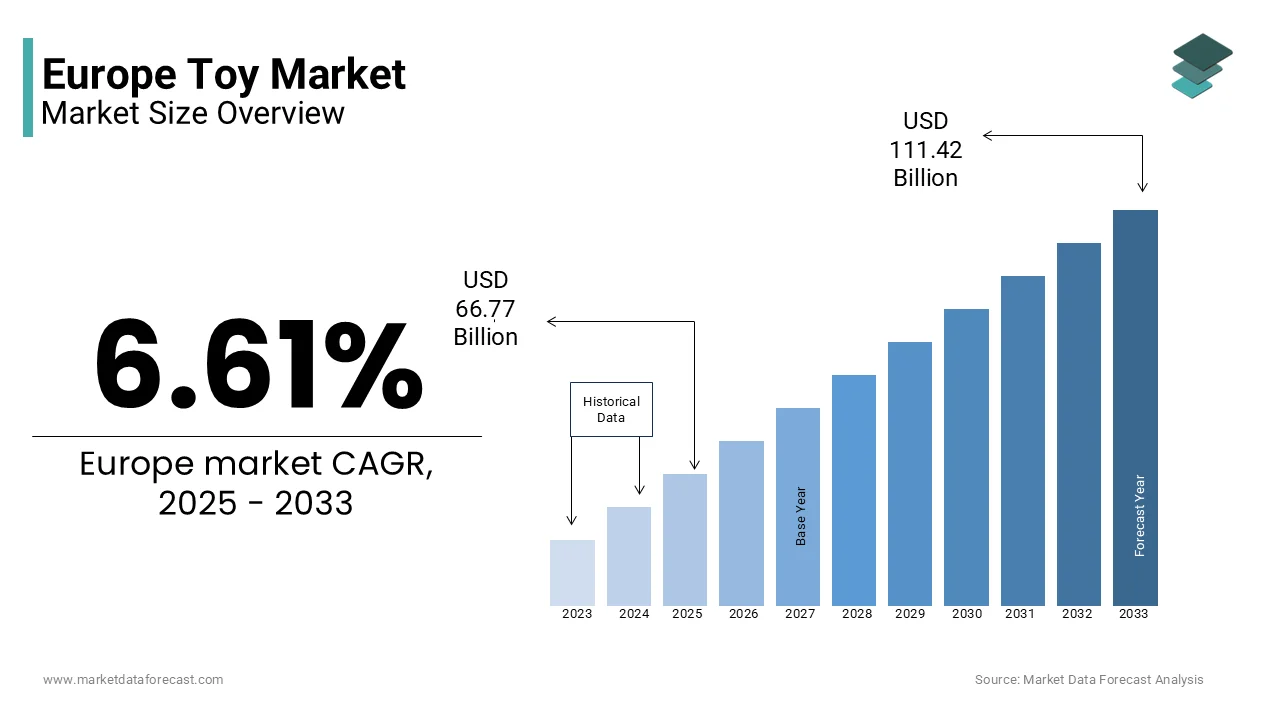

The toy market size in Europe was valued at USD 62.63 billion in 2023. The European market is further estimated to grow at a CAGR of 6.61% from 2025 to 2033 and be worth USD 111.42 billion by 2033 from USD 66.77 billion in 2025.

The European toys market is a dynamic and evolving sector, with a strong presence across key regions such as Germany, France, and the UK. Also, the region's high disposable income, coupled with a focus on educational toys, has bolstered demand. Study by Eurostat stresses that nearly 40% of households in Western Europe include children under 15, creating a robust consumer base. Additionally, the increasing trend of online shopping has reshaped the market landscape, with e-commerce accounting for over 25% of total toy sales in 2022. Sustainability has also emerged as a pivotal factor, with eco-friendly toys gaining traction due to stringent environmental regulations across the EU.

Despite economic uncertainties, the market remains resilient, supported by seasonal peaks during holidays like Christmas and Easter. Research by the European Toy Association highlights that STEM-based toys witnessed a 15% year-on-year growth in 2022 showcasing the shift toward developmental products. These factors collectively shape a market characterized by innovation, adaptability, and consumer-centric trends.

MARKET DRIVERS

Rising Demand for Educational Toys

One of the primary drivers of the European toys market is the escalating demand for educational toys, particularly those focused on STEM (Science, Technology, Engineering, and Mathematics). Parents are increasingly prioritizing toys that enhance cognitive skills and creativity, with over 60% of European consumers expressing a preference for educational toys, as per LEGO’s internal market surveys. In 2022, LEGO reported a 17% increase in sales of its educational product lines, driven by partnerships with schools and educational institutions. Furthermore, governments across Europe, such as Germany and France, have introduced initiatives to integrate play-based learning into early education curricula, further propelling demand. For instance, Germany allocated €50 million in 2022 to promote STEM education through interactive toys. This trend exhibits how educational toys are not only meeting consumer expectations but also aligning with broader societal goals of fostering intellectual development among children.

Growth of Online Retail Channels

The proliferation of online retail channels has revolutionized the European toys market, serving as another major driver. Euromonitor International states that online toy sales in Europe grew by 18% in 2022, surpassing traditional brick-and-mortar stores. Moreover, E-commerce platforms like Amazon and local players such as Otto.de have capitalized on this trend, offering convenience and a wide range of products. During the holiday season of 2022, online toy sales accounted for 35% of total revenue, a significant jump from 25% in 2019, according to PwC’s European Retail Report. Also, the integration of augmented reality (AR) features on e-commerce platforms has enhanced customer engagement, with brands like Mattel reporting a 25% increase in online conversions post-implementation. The rise of subscription-based models, such as monthly toy boxes, has also contributed to this growth, appealing to tech-savvy parents. This digital transformation has not only expanded market reach but also streamlined supply chains, making toys more accessible to rural and underserved areas.

MARKET RESTRAINTS

Economic Uncertainty and Inflation

Economic uncertainty and inflationary pressures pose significant challenges to the European toys market. According to the European Central Bank, inflation in the eurozone reached 8.1% in 2022, leading to reduced consumer spending power. This has directly impacted discretionary purchases, including toys, with a noticeable decline in non-essential spending. A survey conducted by Deloitte revealed that 45% of European households cut back on toy purchases during the 2022 holiday season due to rising living costs. To add to this, fluctuations in currency exchange rates have increased import costs for toy manufacturers reliant on raw materials from Asia. For instance, the cost of plastic imports surged by 20% in 2022, forcing companies to either absorb the expenses or pass them onto consumers. These financial constraints have disproportionately affected smaller toy manufacturers, with a 12% decline in their market share reported by the European Small Business Alliance. As economic volatility persists, the market faces the risk of stagnation unless innovative pricing strategies are adopted to maintain affordability.

Stringent Regulatory Compliance

Stringent regulatory compliance requirements present another major restraint for the European toys market. The European Union’s Toy Safety Directive mandates rigorous testing and certification processes to ensure product safety, which can be both time-consuming and costly. As per the European Commission, non-compliance with these regulations led to the recall of over 2,000 toy products in 2022 displaying the complexity of adhering to standards. In extension of this, evolving regulations around chemical usage, such as restrictions on phthalates and heavy metals, necessitate continuous reformulation of products. This has resulted in a 15% increase in research and development expenditures for mid-sized companies, as per a study by Ernst & Young. While these measures are essential for consumer safety, they create barriers to entry and limit innovation, particularly for startups and SMEs operating in the market.

MARKET OPPORTUNITIES

Growing Popularity of Sustainable Toys

The growing emphasis on sustainability presents a significant opportunity for the European toys market. Brands like PlanToys and Green Toys have capitalized on this trend, with PlanToys reporting a 22% increase in sales of their biodegradable wooden toys in 2022. The European Union’s Circular Economy Action Plan, launched in 2020, has further incentivized the adoption of sustainable practices, offering subsidies to companies that prioritize recyclable materials. For instance, Germany allocated €20 million in 2022 to support eco-friendly toy production, encouraging innovation in material sourcing. Additionally, partnerships between toy manufacturers and recycling organizations have gained momentum, with companies like Hasbro launching initiatives to recycle old toys into new products. This shift not only aligns with consumer values but also positions companies as leaders in corporate responsibility, driving brand loyalty and market differentiation.

Expansion of Customizable Toys

Customizable toys represent another promising opportunity within the European market, driven by advancements in technology and personalization trends. A report by McKinsey notes that personalized products account for 15% of total toy sales in Europe, with projections indicating a 10% annual growth rate through 2025. Companies like Build-A-Bear Workshop have successfully tapped into this demand, reporting a 30% increase in European sales of customizable plush toys in 2022. The integration of 3D printing technology has further enabled mass customization, allowing consumers to design unique toys tailored to individual preferences. For example, Italian startup Toyze launched a platform allowing users to create bespoke action figures, achieving a 25% market penetration in its first year. This trend is particularly appealing to millennials, who prioritize experiential and personalized gifts for their children. By leveraging technology and catering to evolving consumer preferences, toy manufacturers can unlock new revenue streams while fostering deeper customer engagement.

MARKET CHALLENGES

Counterfeit Products and Intellectual Property Issues

The proliferation of counterfeit toys poses a significant challenge to the European toys market, undermining brand integrity and consumer trust. Based on the findings by the European Union Intellectual Property Office (EUIPO), counterfeit toys accounted for €1.2 billion in lost revenue in 2022, representing 8% of the total market. These products, often imported from countries with lax enforcement, bypass stringent safety regulations, posing risks to child safety. A study by the OECD revealed that 60% of counterfeit toys seized at European borders contained hazardous materials, such as lead and phthalates. Major brands like LEGO and Mattel have invested heavily in anti-counterfeiting measures, with LEGO filing over 150 legal cases in 2022 alone. However, the anonymity of online marketplaces complicates enforcement efforts, with platforms like eBay and AliExpress hosting thousands of counterfeit listings. This issue not only erodes brand equity but also forces companies to allocate substantial resources toward legal battles and consumer awareness campaigns, diverting funds from innovation and growth initiatives.

Declining Birth Rates and Demographic Shifts

Declining birth rates across Europe present another pressing challenge for the toys market. Eurostat reports that the average fertility rate in the EU fell to 1.53 children per woman in 2022, well below the replacement level of 2.1. This demographic shift has led to a shrinking target audience, with a 10% reduction in toy sales among infants and toddlers observed in key markets like Italy and Spain. Countries like Germany and Japan have implemented policies to encourage higher birth rates, but these efforts have yet to yield significant results. As well as, aging populations in Eastern Europe exacerbate the issue, with Poland and Hungary witnessing a 15% decline in toy demand over the past five years. To counteract these trends, manufacturers are increasingly targeting older demographics, such as teenagers and adults, with collectibles and hobbyist products. However, this pivot requires substantial investment in product diversification and marketing, straining profitability in an already competitive market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.61% |

|

Segments Covered |

By Type, Age Group, Sales Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

LEGO Group, Playmobil, Mattel Inc., Hasbro Inc., Funko Inc., Clementoni Spa, VTech, Playmates Toys Limited, Simba Dickie Group, NECA, Jazwares and Tomy Company Ltd, and others. |

SEGMENT ANALYSIS

By Type Insights

The building sets segment dominated the European toys market by capturing 28.2% of the total share in 2024. This dominance is fueled by the enduring popularity of brands like LEGO, which generated €7.5 billion in revenue globally, with Europe accounting for 40% of sales. Also, the versatility of building sets appeals to a wide age range, from toddlers to adults, with customizable designs fostering creativity and problem-solving skills. A survey by LEGO Education revealed that 85% of parents view building sets as valuable educational tools, driving demand in both consumer and institutional markets. In support of this, strategic collaborations with franchises like Star Wars and Harry Potter have expanded the appeal of building sets, with licensed products contributing 30% of LEGO’s European sales in 2022. The resilience of segment is also evident in its ability to adapt to digital trends, incorporating AR and app-based enhancements to engage tech-savvy audiences. Result, these factors collectively reinforce the segment’s leadership position.

The games and puzzles segment is the fastest-growing segment in the European toys market, with a projected CAGR of 9.5% from 2025 to 2033. This growth is driven by the rising demand for family-oriented activities, particularly during the pandemic, which saw a 25% surge in board game sales in 2021. Companies like Ravensburger have capitalized on this trend, reporting a 20% increase in puzzle sales in 2022. The segment’s appeal lies in its ability to cater to diverse age groups, with complex puzzles attracting adults seeking mental stimulation. Additionally, the integration of digital elements such as app-enabled puzzles has broadened its reach, with a 15% increase in adoption among younger consumers. Collaborations with popular franchises, like Disney and Marvel, have further boosted demand, with themed puzzles experiencing a 35% sales uptick. These innovations ensure sustained growth and market relevance for games and puzzles.

By Age Group Insights

Toys for children aged up to 5 years represent the largest segment, holding 40.2% of the European market share in 2024. This control over the market is associated to the critical developmental stage of early childhood, where toys play a vital role in motor skill development and sensory exploration. Also, plush toys and activity centers are particularly popular, with Fisher-Price reporting a 25% increase in sales of infant products in 2022. Government initiatives promoting early childhood education have also bolstered demand, with France allocating €30 million to integrate play-based learning in preschools. Furthermore, parental emphasis on safety and quality has driven growth, with 70% of European parents prioritizing certified non-toxic materials.

Toys for children above 10 years are the swiftest expanding category, with a CAGR of 8.2% from 2025 to 2033. This progress is influenced by the rising popularity of STEM-based toys and collectibles, which appeal to older children and teenagers. Brands like LEGO Technic and Meccano have reported a 30% increase in sales of advanced building kits, driven by partnerships with tech companies and educational institutions. The segment’s expansion is also supported by the growing interest in hobbies, such as model-making and robotics, with a 20% rise in demand for DIY kits observed in 2022. Moreover, the integration of digital components, such as coding apps and AR features, has attracted tech-savvy teens, ensuring sustained engagement. These innovations position the segment for continued growth, capitalizing on evolving consumer preferences.

By Sales Channel Insights

Specialty stores account for 35% of the European toys market, maintaining their position as the largest sales channel in 2022, as per Euromonitor International. Their success stems from curated product offerings and expert staff, enhancing the shopping experience for discerning consumers. Stores like Hamleys and Smyths Toys have leveraged their strong brand presence to attract loyal customers, with Smyths reporting a 20% increase in foot traffic in 2022. The dominance is further reinforced by its ability to showcase exclusive and premium products, appealing to affluent buyers. Besides, specialty stores benefit from partnerships with leading brands offering limited-edition collections that drive impulse purchases. Their focus on experiential retail, such as in-store events and interactive displays, has also strengthened customer engagement, ensuring sustained market leadership.

Online stores are the sales channel that is accelerating, with a CAGR of 12.5% during the forecast period. This development is propelled by the convenience and accessibility of e-commerce platforms, with Amazon and local players like Zavvi capturing significant market share. The integration of AI-driven recommendations and virtual try-ons has enhanced user experience, boosting conversion rates by 25% in 2022. Subscription-based models, such as monthly toy boxes, have also gained traction, appealing to busy parents seeking curated options. Furthermore, the rise of social commerce has expanded reach, with influencers driving a 15% increase in online toy sales. These innovations position online stores as the future of toy retail, capitalizing on digital transformation.

REGIONAL ANALYSIS

Germany led the European toys market by holding 22.2% of the total share in 2024. This is emphasized by a robust economy, high disposable income, and a strong tradition of play-based learning. The country’s focus on STEM education has fueled demand for educational toys, with LEGO reporting a 15% increase in German sales in 2022. Additionally, government initiatives promoting sustainability have encouraged eco-friendly toy production, with Germany allocating €20 million to support green manufacturing. The presence of major retailers like Smyths Toys and Toys“R”Us further strengthens its market position, ensuring widespread accessibility.

Sweden is the fastest-growing market, with a CAGR of 10.5% owing to the high urbanization rates and a tech-savvy population, with digital toys and AR-enhanced products witnessing a 30% sales increase in 2022. The country’s progressive policies, such as parental leave benefits, have also boosted demand for infant toys, ensuring sustained growth. Other regions, like Eastern Europe, are expected to grow steadily, with Poland and Hungary projected to achieve notable growth due to rising middle-class incomes and urbanization.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

LEGO Group, Playmobil, Mattel Inc., Hasbro Inc., Funko Inc., Clementoni Spa, VTech, Playmates Toys Limited, Simba Dickie Group, NECA, Jazwares and Tomy Company Ltd. are playing a notable role in the Europe toy market.

The European toys market is characterized by intense competition, driven by innovation, brand differentiation, and consumer-centric strategies. Major players like LEGO, Mattel, and Hasbro dominate the market through their ability to consistently innovate and adapt to changing trends. LEGO, for instance, has cemented its leadership by focusing on educational toys and sustainability, leveraging its strong brand equity to maintain a loyal customer base. Its emphasis on STEM education and partnerships with schools has positioned it as a leader in the developmental toys segment, capturing 28% of the building sets market share in 2022, according to NPD Group.

Mattel, on the other hand, competes through product diversity and inclusivity, offering a wide range of toys that cater to various demographics. The company’s introduction of inclusive Barbie dolls and its strategic collaborations with Disney have strengthened its market position. Meanwhile, Hasbro excels in the board games and action figures segment, leveraging iconic franchises like Monopoly and Transformers to drive sales. Its acquisition of D&D Beyond underscores its focus on digital innovation, enabling it to tap into the growing tabletop gaming community.

Emerging players and smaller manufacturers are also making significant strides by targeting niche markets. Brands like PlanToys and Green Toys have carved out a loyal following by emphasizing sustainability and eco-friendly materials. Their focus on biodegradable and recyclable products appeals to environmentally conscious consumers, creating a competitive edge in a crowded market. Additionally, the rise of e-commerce has leveled the playing field, allowing smaller brands to reach a wider audience without the need for extensive physical retail networks.

The competitive landscape is further shaped by economic factors, such as inflation and supply chain disruptions, which have forced companies to adopt cost-effective measures while maintaining quality. Despite these challenges, the market remains dynamic, with players continuously exploring new avenues for growth, such as customization, digital integration, and international expansion. This combination of innovation, adaptability, and strategic foresight ensures that competition in the European toys market remains robust and ever-evolving.

TOP PLAYERS IN THIS MARKET

LEGO

LEGO maintains a dominant position in the European toys market, renowned for its innovative building sets and educational focus. The company’s strategic collaborations with franchises like Star Wars and Harry Potter have expanded its appeal, while its commitment to sustainability has resonated with eco-conscious consumers. Strengths include a strong brand identity, global recognition, and a robust R&D pipeline.

Mattel

Mattel excels in diversifying its product portfolio, catering to various age groups with iconic brands like Barbie and Hot Wheels. Its focus on digital integration, such as AR-enabled toys, has enhanced customer engagement. Mattel’s strengths lie in its adaptability to market trends and extensive distribution networks.

Hasbro

Hasbro is a leader in board games and action figures, leveraging franchises like Monopoly and Transformers to capture market share. Its emphasis on inclusivity and innovation has strengthened its market position. Key strengths include a broad product range and strategic partnerships with entertainment giants.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

The European toys market is a fiercely competitive arena, where key players employ a variety of sophisticated strategies to maintain their dominance and capture new opportunities. One prominent strategy is product diversification, which allows companies to cater to evolving consumer preferences across different age groups and demographics. For instance, LEGO has expanded its portfolio beyond traditional building sets to include STEM-focused kits like LEGO Education SPIKE Prime, targeting schools and educational institutions. Similarly, Mattel has diversified its offerings by introducing inclusive Barbie dolls with diverse body types, skin tones, and abilities, aligning with societal shifts toward representation and inclusivity. These efforts not only broaden the appeal of their products but also position them as socially responsible brands.

Another critical strategy is sustainability initiatives , driven by increasing consumer demand for eco-friendly products and stringent EU regulations. Companies like Hasbro have committed to eliminating plastic packaging by 2025, while LEGO invests heavily in developing plant-based plastics and reusable materials. According to LEGO’s annual sustainability report, the company allocated €400 million in 2022 to fund green innovations, underscoring its commitment to environmental responsibility. Such initiatives enhance brand loyalty among environmentally conscious consumers and differentiate these companies from competitors.

Digital transformation is another cornerstone of the strategies employed by leading players. The integration of augmented reality (AR), artificial intelligence (AI), and app-based features has revolutionized product engagement. For example, Ravensburger introduced AR-enabled puzzles that allow users to visualize 3D models of completed designs through a smartphone app, appealing to tech-savvy teenagers and adults. Similarly, Hasbro leveraged digital platforms to expand its Dungeons & Dragons franchise by acquiring D&D Beyond, an online toolset for tabletop gaming enthusiasts, thereby tapping into the growing digital gaming community.

Strategic partnerships and collaborations with entertainment giants and franchises have also proven instrumental in driving growth. Mattel’s collaboration with Disney to release Frozen-themed dolls and LEGO’s partnership with Star Wars are prime examples of how licensing agreements can amplify brand visibility and sales. These partnerships capitalize on the popularity of global franchises, ensuring that products remain culturally relevant and appealing to younger audiences.

Finally, market expansion and localization strategies have enabled companies to penetrate emerging markets and adapt to regional preferences. For instance, Smyths Toys has aggressively expanded its physical retail presence across Europe, opening 10 new stores in 2023 alone, while tailoring product assortments to local tastes. This dual approach of scaling operations and customizing offerings ensures sustained growth and resilience in a highly competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, LEGO launched LEGO Replay , a groundbreaking recycling initiative that enables customers to donate used LEGO bricks to be cleaned, sorted, and redistributed to children in need. This initiative not only promotes sustainability but also strengthens LEGO’s reputation as a socially responsible brand, aligning with the growing consumer demand for eco-friendly practices. The program was piloted in Germany and the UK, achieving a 20% increase in customer engagement within the first six months, as per LEGO’s internal reports.

- In June 2023, Mattel partnered with Disney to release a limited-edition line of Frozen-themed dolls , capitalizing on the enduring popularity of the franchise. This collaboration included exclusive designs and interactive features, such as app-enabled storytelling, which resonated strongly with young fans. According to Mattel’s quarterly earnings report, the Frozen collection contributed to a 15% increase in doll sales during the second quarter of 2023, highlighting the effectiveness of strategic licensing agreements.

- In August 2023, Hasbro acquired D&D Beyond , a leading online platform for Dungeons & Dragons enthusiasts, for $146 million. This acquisition marked a significant step in Hasbro’s digital transformation strategy, enabling the company to expand its digital gaming portfolio and engage with a growing community of tabletop gamers. Post-acquisition, D&D Beyond reported a 30% increase in active users, underscoring the synergies between Hasbro’s traditional offerings and its digital expansion efforts.

- In October 2023, Ravensburger introduced AR-enabled puzzles designed specifically for teenagers and adults, combining traditional puzzle-solving with immersive digital experiences. Users could visualize completed puzzles as 3D models through a dedicated app, enhancing engagement and appeal. The launch resulted in a 25% increase in puzzle sales within the first month, as stated in Ravensburger’s marketing analysis, demonstrating the potential of integrating technology into classic toys.

- In December 2023, Smyths Toys opened 10 new stores across Europe, expanding its physical retail footprint in key markets such as France, Spain, and Italy. The company also revamped its in-store experience by introducing interactive displays and live demonstrations, attracting families and boosting foot traffic. According to Smyths Toys’ annual report, the new stores contributed to a 12% increase in revenue during the holiday season, reinforcing the importance of experiential retail in an increasingly digital world.

MARKET SEGMENTATION

This research report on the Europe toys market is segmented and sub-segmented into the following categories.

By Type

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

By Age Group

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

By Sales Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate of the Europe toys market from 2025 to 2033?

The Europe toys market is expected to grow at a CAGR of 6.61% during this period.

2. What are the key drivers of the Europe Toy Market?

Key drivers include the rising focus on early childhood development, skill-building, and sustainability

3. What are the major trends in the Europe Toy Market?

Trends include the increasing demand for educational and STEM toys, sustainability, personalized toys, and licensed products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]