Europe 3D Printing Market Size, Share, Trends & Growth Forecast Report, Segmented By Offering, Technology, Process, and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe 3D Printing Market Size

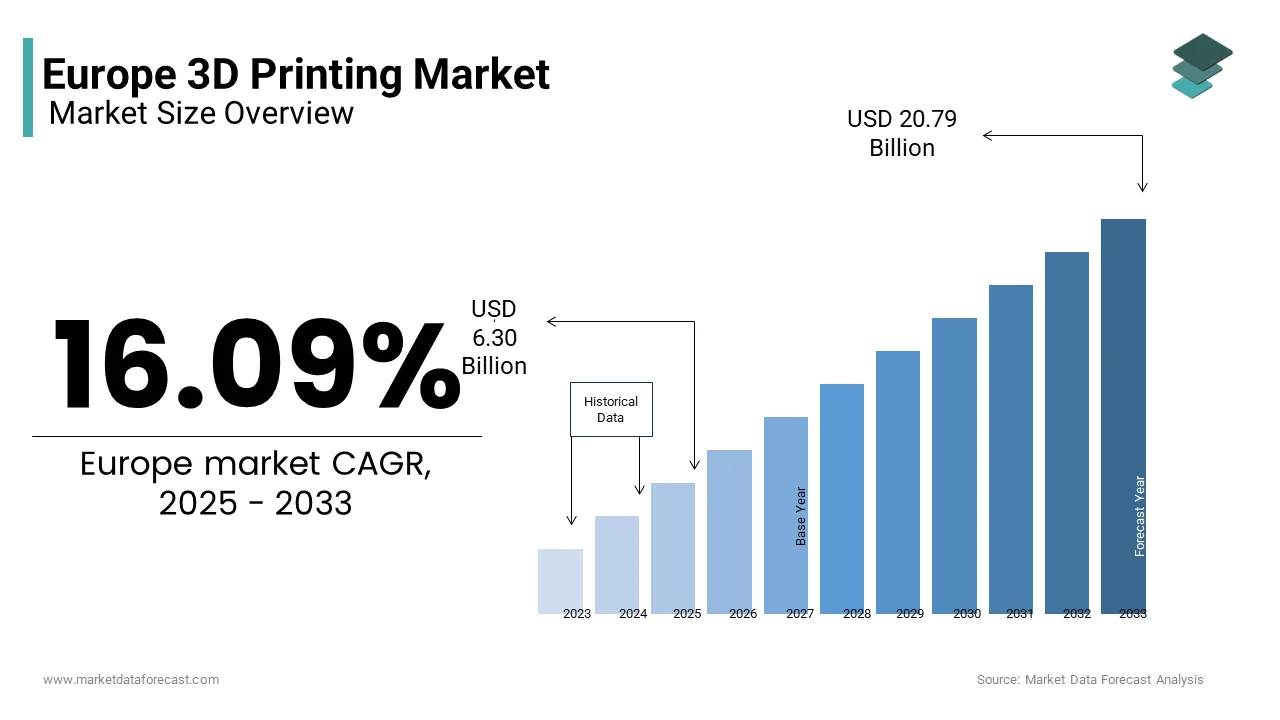

The European 3D printing market was valued at USD 5.43 billion in 2024 and is anticipated to reach USD 6.30 billion in 2025 from USD 20.79 billion by 2033, growing at a CAGR of 16.09% during the forecast period from 2025 to 2033.

The European 3D printing market has emerged as a pivotal hub for innovation. This growth is fueled by widespread industrial adoption, particularly in sectors such as aerospace, automotive, and healthcare. Also, the region's growth is caused by its robust infrastructure and favorable regulatory frameworks that promote advanced manufacturing technologies. Germany is a key contributor in the region with a significant market share, attributed to its strong manufacturing base and R&D investments, as per the European Commission. The UK and France follow closely, driven by their focus on digital transformation and sustainability goals. A major trend shaping the market is the increasing demand for customized products, which has led to a surge in localized production. Moreover, the European Union’s Horizon Europe initiative has allocated over €1 billion for additive manufacturing research, fostering innovation.

MARKET DRIVERS

Industrial Adoption Across Key Sectors

One of the primary drivers of the European 3D printing market is its extensive adoption across critical industries such as aerospace, automotive, and healthcare. According to a report by the European Association of the Machine Tool Industries, the aerospace sector is a significant user of the 3D printing applications. This demand is escalated by the technology's ability to produce lightweight components with complex geometries, reducing material waste and enhancing performance. For instance, Airbus has integrated 3D-printed parts into its aircraft, attained a notable decrease in production time for certain components. Similarly, the automotive industry leverages 3D printing for rapid prototyping and tooling. These advancements shows how industrial applications are propelling the market forward.

Government Support and Funding Initiatives

Government initiatives and funding programs significantly bolster the growth of 3D printing in Europe. The European Commission's Horizon Europe program has earmarked over €1 billion for additive manufacturing projects between 2021 and 2027. This financial backing accelerates R&D efforts and fosters collaboration between academia and industry. Additionally, national governments, such as Germany, have introduced tax incentives for companies investing in 3D printing technologies. These measures collectively create a conducive environment for market expansion, ensuring sustained growth and technological advancement.

MARKET RESTRAINTS

High Initial Investment Costs

A key restraint hindering the broader adoption of 3D printing in Europe is the high initial investment required for setting up infrastructure. This cost barrier is particularly challenging for small and medium-sized enterprises (SMEs), which constitute a substantial portion of Europe's manufacturing sector. For instance, a survey revealed that many SMEs cited capital expenditure as a major obstacle to adopting 3D printing technologies. The need for additional investments in software, materials, and skilled personnel further compounds the financial burden, limiting market penetration.

Limited Material Compatibility

A further critical restraint is the limited availability of compatible materials for 3D printing. While polymers dominate the material segment, accounting for a significant share of the market, metals and ceramics remain underutilized due to technical and economic challenges. The high cost of metal powders, coupled with stringent quality requirements, restricts their use to niche applications. Furthermore, the lack of standardized testing procedures for new materials hampers innovation. This limitation stifles the technology's potential, particularly in sectors like construction and consumer goods, where material diversity is crucial.

MARKET OPPORTUNITIES

Expansion into Healthcare Applications

The healthcare sector presents a lucrative opportunity for the European 3D printing market, driven by the growing demand for personalized medical solutions. Also, this growth is fueled by advancements in bioprinting, which enables the creation of patient-specific implants and prosthetics. For instance, Dutch company Xilloc Medical has successfully developed 3D-printed cranial implants, reducing surgery times. Apart from these, the rise of telemedicine and remote diagnostics complements 3D printing’s ability to deliver customized solutions, further expanding its application scope.

Advancements in Sustainable Manufacturing

Sustainability is another key prospect as Europe increasingly prioritizes eco-friendly manufacturing practices. Additive manufacturing has the potential to reduce carbon emissions in traditional manufacturing processes by minimizing material waste and enabling more efficient production methods. Companies like HP and Ultimaker are developing recyclable materials and energy-efficient printers, aligning with the EU’s Green Deal objectives. This shift not only addresses environmental concerns but also enhances market competitiveness, attracting environmentally conscious consumers and businesses.

MARKET CHALLENGES

Intellectual Property Concerns

A pressing challenge facing the European 3D printing market is the issue of intellectual property (IP) protection. As per a study by the European Patent Office, the number of IP disputes related to 3D printing has increased by 26.3% between 2013 and 2020. The ease of replicating designs using digital files raises concerns about unauthorized reproduction, particularly in industries like fashion and consumer goods. For instance, luxury brands have reported significant losses due to counterfeit products created using 3D printing. This lack of robust IP frameworks hinders innovation and discourages companies from fully embracing the technology.

Workforce Skill Gaps

Another challenge is the shortage of skilled professionals capable of operating and maintaining 3D printing systems. Manufacturing companies in Europe face challenges in recruiting qualified personnel due to skills shortages, particularly in roles requiring specialized technical expertise. This skill gap is exacerbated by the rapid pace of technological advancements, which outstrip traditional educational curricula. For example, Manufacturing firms in Germany encounter problems in hiring employees with specialized skills, including proficiency in CAD software and additive manufacturing techniques. Addressing this issue requires targeted training programs and industry-academia partnerships.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.09% |

|

Segments Covered |

By Offering, Technology, Process, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

3D Systems Corp, Autodesk Inc, Canon Inc, Dassault Systemes SE, EnvisionTEC, ExOne, GE Additive, HP Inc, Redwire Corp, Materialise NV ADR, Optomec, Organovo Holdings Inc, Proto Labs Inc, Shapeways Holdings Inc, Stratasys Ltd, Voxeljet AG ADR. |

SEGMENTAL ANALYSIS

By Offering Insights

The services segment dominated the European 3D printing market and accounted for 45.3% of the overall share in 2024. This rise over the years is driven by the growing demand for end-to-end solutions, including design, prototyping, and post-processing services. Industries such as healthcare and aerospace rely heavily on these services to streamline their production processes. For instance, Siemens leverages 3D printing services to produce spare parts on demand, reducing inventory costs. Also, the expansion of service bureaus has democratized access to 3D printing technologies, enabling SMEs to adopt additive manufacturing without significant upfront investments. The scalability and flexibility offered by these services further strengthen their place position.

The software segment is likely to advance at a CAGR of 22.1% from 2025 to 2033. This rapid growth is fueled by advancements in design software that enhance the precision and efficiency of 3D printing processes. For example, Autodesk’s Fusion 360 has integrated AI-driven tools that reduce design errors, accelerating adoption across industries. Moreover, the increasing complexity of printed objects necessitates sophisticated software solutions, driving demand. A significant percentage of companies investing in 3D printing also prioritize software upgrades. This synergy between hardware and software innovation ensures sustained expansion in this segment.

By Technology Insights

Fused Deposition Modeling (FDM) holds the largest market share. The pre-eminence is attributed to its cost-effectiveness and ease of use, making it ideal for prototyping and small-scale production. FDM’s popularity is further bolstered by its compatibility with a wide range of thermoplastics, which are readily available and affordable. For instance, Ultimaker’s FDM printers are widely adopted in educational institutions and startups due to their low maintenance requirements. Also, the technology’s ability to produce functional prototypes quickly aligns with Europe’s emphasis on agile manufacturing practices, reinforcing its leading position.

Stereolithography (SLA) is the fastest-growing technology segment, with a highest CAGR of 24.1% in the coming years. SLA’s high resolution and surface finish make it indispensable for applications like dental prosthetics and jewelry design. For example, Formlabs’ SLA printers have gained traction in the dental sector, enabling the production of precise crowns and bridges. The technology’s ability to work with biocompatible resins further expands its application scope. As industries increasingly demand superior quality and customization, SLA’s growth trajectory is poised to accelerate.

By Process Insights

The segment of Powder Bed Fusion (PBF) accounted for a controlling share of the European 3D printing market in 2024. PBF’s authority is linked to its suitability for producing high-strength metal components, which are critical in aerospace and automotive applications. For instance, GE Additive utilizes PBF to manufacture turbine blades, achieving an improvement in fuel efficiency. The process’s ability to handle complex geometries with minimal material waste aligns with Europe’s sustainability goals. Furthermore, advancements in laser technology have enhanced PBF’s precision, reinforcing its leadership in industrial applications.

The fastest-growing process segment is Binder Jetting, with a CAGR of 28.1%. This forward movement of the category is credited by its ability to produce large-scale components at a lower cost compared to traditional methods. For example, Desktop Metal’s binder jetting systems are increasingly used in the automotive industry to create lightweight engine parts. The process’s compatibility with a variety of materials, including ceramics and metals, broadens its appeal. As industries seek scalable and cost-effective solutions, binder jetting is set to gain further traction.

COUNTRY ANALYSIS

Germany had the biggest share of European 3D printing market and contributed 30% to the regional revenue, as reported by the German Mechanical Engineering Industry Association. This leadership is underpinned by the country’s robust manufacturing base and strong R&D ecosystem. The German government’s Industry 4.0 initiative has accelerated the integration of 3D printing into industrial workflows, enhancing productivity. For instance, BMW and Siemens have established advanced additive manufacturing facilities, setting benchmarks for innovation. Germany’s strategic investments ensure its continued dominance.

France witnesses the fastest growth rate, with a CAGR of 23.1% from 2025 to 2033. This growth is fueled by the country’s focus on digital transformation and green technologies. Companies like Safran leverage 3D printing to develop lightweight aircraft components, reducing carbon emissions. France’s commitment to fostering startups through initiatives like “La French Tech” further propels market expansion. Other countries like the UK and Italy are expected to follow suit, driven by similar industrial and environmental priorities.

KEY MARKET PLAYERS

3D Systems Corp, Autodesk Inc, Canon Inc, Dassault Systemes SE, EnvisionTEC, ExOne, GE Additive, HP Inc, Redwire Corp, Materialise NV ADR, Optomec, Organovo Holdings Inc, Proto Labs Inc, Shapeways Holdings Inc, Stratasys Ltd, Voxeljet AG ADR. are the market players that are dominating the Europe 3D printing market.

Top 3 Players In The Europe 3D Printing Market

Stratasys

Stratasys has established itself as a leader in the European 3D printing market, leveraging its expertise in delivering advanced additive manufacturing solutions. The company is highly regarded for its PolyJet and Fused Deposition Modeling (FDM) technologies, which cater to industries such as healthcare, automotive, and aerospace. Stratasys’s strength lies in its ability to provide end-to-end solutions, including hardware, software, and materials, enabling customers to transition seamlessly from prototyping to production. Its partnerships with leading European universities and industrial giants have positioned it as a pioneer in innovation. By focusing on customer-centric approaches and expanding its material portfolio, Stratasys continues to address complex manufacturing challenges while maintaining its leadership position.

EOS

EOS is a dominant player in the European 3D printing market, particularly known for its expertise in metal and polymer additive manufacturing. The company’s Direct Metal Laser Sintering (DMLS) technology has become indispensable in sectors like aerospace, medical devices, and tooling, where precision and durability are critical. EOS’s market position is bolstered by its focus on scalable production systems and sustainability-driven solutions. Its comprehensive ecosystem, which integrates hardware, software, and services, empowers businesses to achieve efficient and cost-effective production. EOS’s commitment to R&D and collaboration with global leaders ensures it remains at the cutting edge of technological advancements in additive manufacturing.

3D Systems

3D Systems is a key innovator in the European 3D printing landscape, recognized for its Stereolithography (SLA) and Selective Laser Sintering (SLS) technologies. The company excels in delivering high-resolution printing solutions for applications ranging from dental prosthetics to aerospace components. Its strengths include a diverse range of materials, advanced software capabilities, and a strong emphasis on customization. By continuously expanding its product offerings and entering new verticals, such as healthcare and consumer goods, 3D Systems has solidified its reputation as a versatile and reliable partner. Through strategic collaborations and a focus on innovation, 3D Systems continues to drive the adoption of additive manufacturing across Europe.

Top Strategies Used By Key Market Participants

Key players in the European 3D printing market have adopted innovative strategies to strengthen their positions and expand their influence. One prominent strategy is the acquisition of specialized companies to enhance technological capabilities. For instance, EOS acquired Advanced Laser Materials to bolster its material development expertise, ensuring it remains competitive in the evolving market. Another strategy is forming strategic partnerships with industry leaders to co-develop solutions tailored to specific applications. Stratasys, for example, has collaborated with aerospace companies like Boom Supersonic to create lightweight and durable components using 3D printing. Additionally, companies like 3D Systems have focused on expanding their software ecosystems and entering untapped verticals, such as healthcare, through targeted investments. These strategies highlight the players’ commitment to driving innovation, addressing emerging customer demands, and fostering sustainable growth in the additive manufacturing sector.

COMPETITION OVERVIEW

The European 3D printing market is characterized by intense competition, driven by the presence of both established players and emerging startups striving to innovate and capture market share. Leading companies such as Stratasys, EOS, and 3D Systems have positioned themselves as pioneers through their cutting-edge technologies, robust product portfolios, and strategic collaborations with industrial giants and research institutions. These firms leverage their expertise in hardware, software, and materials to offer comprehensive solutions that cater to diverse industries, including aerospace, healthcare, and automotive. Meanwhile, smaller players and startups are increasingly gaining traction by focusing on niche applications, such as bioprinting and sustainable manufacturing, thereby introducing disruptive innovations.

The competitive landscape is further intensified by the rapid pace of technological advancements, which compel companies to continuously invest in R&D to stay ahead. Partnerships with government bodies, participation in EU-funded initiatives like Horizon Europe, and alliances with academic institutions are common strategies adopted to foster innovation. Additionally, the emphasis on sustainability and digital transformation has created new avenues for differentiation, with companies vying to develop eco-friendly materials and energy-efficient systems. This dynamic environment ensures that the European 3D printing market remains highly innovative, with players constantly pushing boundaries to address evolving customer needs and industry challenges.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, EOS’s AMCM division advanced custom 3D printing solutions, enhancing tailored manufacturing capabilities.

- In October 2023, SLM Solutions introduced its NXG XII 600 printer, targeting aerospace applications.

- In January 2021, Desktop Metal acquired Envision TEC to enhance its polymer printing capabilities, strengthening its market position

MARKET SEGMENTATION

This research report on the Europe 3D printing market is segmented and sub-segmented into the following categories.

By Offering

- Printer

- Material

- Software

- Service

By Technology

- Stereolithography

- Fused Deposition Modeling

- Selective Laser Sintering

- Electron Beam Melting

- Digital Light Processing

- Others

By Process

- Binder Jetting

- Directed Energy Deposition

- Material Extrusion

- Material Jetting

- Power Bed Fusion

- Sheet Lamination

- Vat Photopolymerization

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the 3D printing market in Europe?

The main drivers are increased adoption in automotive, aerospace, and healthcare sectors, along with strong R&D support and government initiatives promoting Industry 4.0.

Which countries in Europe are leading the 3D printing market?

Germany, the UK, and France are the frontrunners, thanks to their advanced manufacturing bases and strong innovation ecosystems.

What are the key applications of 3D printing in Europe?

Key applications include prototyping, tooling, custom medical implants, and end-use parts in industries like automotive, aerospace, and healthcare.

Who are the major players in the European 3D printing market?

Key players include EOS GmbH, Materialise NV, Stratasys Ltd., and Ultimaker, among others.

What are the main challenges facing the 3D printing market in Europe?

Challenges include high initial costs, lack of skilled labor, and slow standardization across industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]