Europe Telemedicine Market Size, Share, Trends & Growth Forecast Report By Type ( Technology, Service), Application, End User and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Telemedicine Market Size

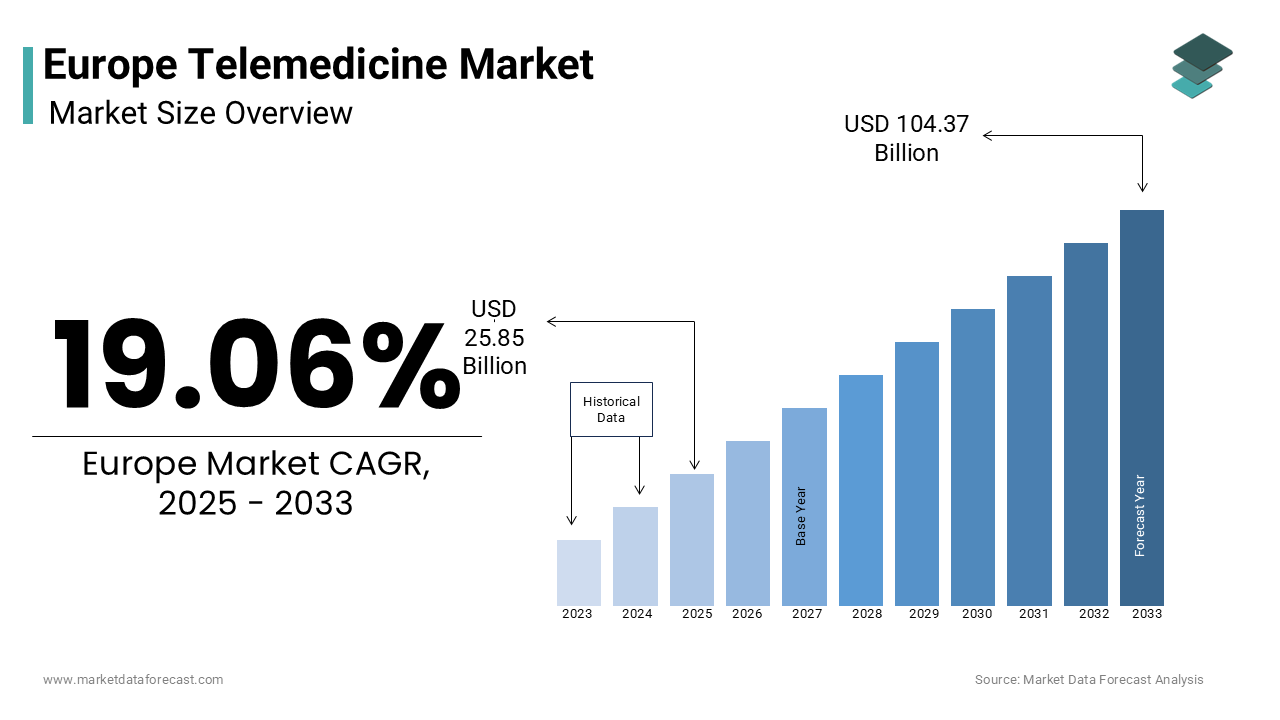

The telemedicine market size in Europe was worth USD 21.71 billion in 2024 and is expected to reach USD 104.37 billion by 2033 from USD 25.85 billion in 2025, growing at a CAGR of 19.06% from 2025 to 2033.

The Europe telemedicine market has experienced exponential growth owing to the advancements in digital healthcare and the increasing need for remote medical services. This surge is attributed to the widespread adoption of telehealth technologies during the post-pandemic era, as patients and providers recognize its convenience and efficiency.

Key cities like London, Berlin, and Paris have emerged as hubs for telemedicine innovation, supported by robust healthcare infrastructure and favorable regulatory frameworks. According to a study by McKinsey, 70% of European patients expressed satisfaction with telemedicine services, citing reduced travel time and improved access to specialists as key benefits. Additionally, government initiatives promoting digital health solutions have further amplified adoption by positioning Europe as a leader in telemedicine innovation globally.

MARKET DRIVERS

Rising Demand for Remote Healthcare

The escalating demand for remote healthcare is a cornerstone driving the Europe telemedicine market. According to Deloitte, over 65% of European patients now prefer virtual consultations for non-emergency conditions by creating a fertile ground for telemedicine adoption. This trend is particularly evident in rural and underserved areas, where access to healthcare facilities remains limited.

A key factor amplifying this growth is the aging population across Europe. As per Eurostat, the region’s elderly population (aged 65+) is projected to reach 30% of the total population by 2030 by necessitating scalable healthcare solutions. Telemedicine platforms offer cost-effective and convenient alternatives is enabling seniors to receive timely care without physical visits.

Integration of AI and IoT Technologies

The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies has significantly bolstered the Europe telemedicine market. According to Frost & Sullivan, AI-driven diagnostic tools accounted for 40% of telemedicine applications in 2023 by enabling accurate and real-time analysis of patient data. These innovations are particularly valuable in managing chronic conditions like diabetes and cardiovascular diseases.

Additionally, IoT-enabled wearables have transformed patient monitoring is allowing continuous tracking of vital signs such as heart rate and blood pressure. A study by Accenture reveals that 50% of European healthcare providers adopted IoT devices in 2023 by improving early detection of health issues. These advancements not only enhance operational efficiency but also align with the EU’s Digital Health Strategy is fostering innovation and sustainability in healthcare delivery.

MARKET RESTRAINTS

Data Privacy Concerns

Data privacy concerns pose a significant restraint for the Europe telemedicine market. According to a report by Kaspersky, cyberattacks targeting telehealth platforms increased by 35% in 2023 is raising fears about unauthorized access to sensitive patient information. These vulnerabilities stem from the decentralized nature of telemedicine systems, which rely on cloud storage and multiple access points.

Moreover, stringent regulations like the General Data Protection Regulation (GDPR) have complicated compliance efforts for telemedicine providers. According to a study by Capgemini, 45% of European healthcare organizations cited GDPR compliance as a barrier to adopting telemedicine solutions. Addressing these concerns requires significant investments in advanced encryption technologies and threat detection systems, which may not be feasible for all stakeholders, impeding broader adoption.

Limited Reimbursement Policies

Limited reimbursement policies represent another pressing challenge for the Europe telemedicine market. According to a report by Ernst & Young, only 30% of European countries have comprehensive insurance coverage for telemedicine services is creating financial barriers for patients and providers alike.

For instance, a study by the European Health Insurance Card (EHIC) reveals that out-of-pocket expenses for teleconsultations deterred 25% of patients from utilizing these services in 2023. While some nations like Germany and France have introduced pilot programs to expand coverage, disparities persist across the region. These inconsistencies hinder equitable access to telemedicine is slowing market progress and limiting its potential impact on healthcare delivery.

MARKET OPPORTUNITIES

Expansion into Mental Health Services

The expansion into mental health services presents a transformative opportunity for the Europe telemedicine market. According to a report by the World Health Organization (WHO), over 100 million Europeans suffer from mental health disorders, yet only 30% receive adequate treatment. Telemedicine platforms offer accessible and stigma-free solutions is bridging the gap between demand and supply.

For example, a study by Mind reveals that teletherapy sessions grew by 50% in 2023 owing to the anonymity and convenience of virtual consultations. Additionally, partnerships with mental health organizations have enabled brands to introduce specialized programs, such as cognitive behavioral therapy (CBT) apps. These innovations not only attract new customers but also position telemedicine as a holistic healthcare solution.

Growth of mHealth Applications

The rapid growth of mobile health (mHealth) applications offers another promising avenue for expansion in the Europe telemedicine market. For instance, a report by App Annie highlights that fitness and wellness apps accounted for 60% of total mHealth downloads, catering to younger demographics. Additionally, collaborations with wearable manufacturers have amplified functionality by enabling features like medication reminders and symptom tracking. These developments not only drive revenue but also reinforce telemedicine’s role in preventive healthcare.

MARKET CHALLENGES

Resistance to Technological Adoption

Resistance to technological adoption among healthcare providers and patients represents a significant challenge for the Europe telemedicine market. Over 40% of European physicians expressed reluctance to adopt telemedicine due to concerns about technical proficiency and workflow disruptions.

Additionally, older demographics remain skeptical about virtual consultations is preferring traditional in-person interactions. According to a report by Age UK, only 20% of seniors aged 70+ utilized telemedicine services in 2023 with the need for user-friendly interfaces and educational initiatives. Bridging this gap requires significant investments in training and awareness campaigns, which may

Fragmented Regulatory Frameworks

Fragmented regulatory frameworks across European countries pose another pressing challenge for the telemedicine market. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), inconsistencies in licensing and approval processes have delayed the rollout of telehealth solutions in regions like Eastern Europe.

For instance, a study by Deloitte reveals that cross-border telemedicine services face significant hurdles due to varying national standards and legal requirements. While the EU aims to harmonize regulations through initiatives like the European Health Data Space (EHDS), bureaucratic delays persist by complicating market entry for multinational providers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, Delivery Mode, End-Users and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

Germany, the U.K., France, Spain, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic and Rest of Europe. |

|

Key Market Players |

AMD Global Telemedicine, CISCO Systems, Inc., Medtronic, Inc., GE Healthcare (U.K.), Honeywell Lifesciences, Philips Healthcare, McKesson Corp, Aerotel Medical Systems, CardioComm, and Cerner Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

The service segment dominated the Europe telemedicine market and held 60.1% of the share in 2024. The segment growth is driven by the growing demand for virtual consultations, remote monitoring, and diagnostic services among patients with chronic conditions.

A key factor fueling this dominance is the cost-effectiveness of telemedicine services compared to traditional in-person care. According to McKinsey, virtual consultations reduced healthcare costs by 25% in 2023 by making them an attractive option for both providers and patients. Additionally, partnerships with insurance companies have expanded reimbursement coverage that further escalates the growth of the market. For instance, as per a study by PwC, over 70% of European insurers now offer telemedicine benefits by enhancing accessibility and affordability for patients.

Another driving factor is the aging population across Europe. As per Eurostat, the region’s elderly population (aged 65+) is projected to reach 30% of the total population by 2030. Telemedicine services, such as remote monitoring and chronic disease management, cater specifically to this demographic by ensuring timely care without physical visits. These innovations not only improve patient outcomes but also alleviate pressure on healthcare facilities.

The technology segment is projected to grow with a CAGR of 18.2% during the forecast period. This growth is fueled by the increasing adoption of AI-driven diagnostic tools and IoT-enabled devices, which enhance patient monitoring and data collection.

For example, a report by Accenture highlights that sales of smartwatches and fitness trackers grew by 40% in 2023 owing to their integration with telemedicine platforms. These devices enable real-time tracking of vital signs such as heart rate, blood pressure, and glucose levels by providing actionable insights for healthcare providers. Additionally, advancements in blockchain technology have improved data security and interoperability by addressing concerns about privacy and compliance with GDPR regulations. These innovations not only drive revenue but also position telemedicine as a cornerstone of modern healthcare delivery.

The tele-cardiology segment was the largest in the Europe telemedicine market by capturing 225.4% of the share in 2024. The segment’s growth is driven by the rising prevalence of cardiovascular diseases (CVDs) and the need for scalable solutions to manage these conditions remotely.

A key factor fueling this dominance is the high incidence of CVDs across Europe. According to the European Society of Cardiology, CVDs account for 45% of all deaths in the region, creating a critical demand for specialized telehealth services. Tele-cardiology platforms enable remote monitoring of heart conditions through wearable devices by reducing hospital readmissions by 30%, as reported by Philips Healthcare. Additionally, partnerships with hospitals and cardiology clinics have expanded access to diagnostic tools like ECG monitoring and echocardiography.

Another driving factor is the integration of AI-driven analytics into tele-cardiology platforms. A study by Capgemini reveals that AI-powered tools improved diagnostic accuracy by 20% in 2023 by enabling early detection of heart abnormalities. These innovations not only enhance patient outcomes but also align with the EU’s push for preventive healthcare solutions.

The tele-dermatology segment is likely to have a prominent CAGR of 20.5% during the forecast period. This growth is fueled by the increasing prevalence of skin conditions and the convenience of virtual consultations for dermatological care. For instance, a report by App Annie, downloads of dermatology-focused telemedicine apps grew by 50% in 2023, driven by features like photo-based diagnosis and personalized skincare plans. These platforms cater to younger demographics, who prioritize accessible and stigma-free solutions for managing conditions like acne and eczema. Additionally, collaborations with pharmacies and skincare brands have enabled seamless prescription deliveries by enhancing the overall patient experience. These developments not only drive adoption but also position tele-dermatology as a future-proof segment.

By Delivery Mode Insights

The Cloud-based delivery segment was accounted in holding a prominent share of the Europe telemedicine market in 2024. The growth of the segment is attributed due to the scalability, flexibility, and ability to support real-time data sharing across multiple locations.

A key factor fueling this dominance is the growing emphasis on interoperability and data accessibility. As per a study by PwC, 80% of European healthcare providers adopted cloud-based platforms in 2023 by enabling seamless integration with electronic health records (EHRs). Additionally, advancements in encryption technologies have addressed data privacy concerns, further solidifying the segment’s position as the largest in the market. For instance, a report by Kaspersky highlights that cloud-based systems reduced data breaches by 15% in 2023 by enhancing trust among patients and providers.

Another driving factor is the cost-effectiveness of cloud-based solutions. According to Deloitte, healthcare institutions saved up to 40% on IT infrastructure costs by transitioning to cloud platforms by allowing them to allocate resources toward patient care. These innovations not only improve operational efficiency but also align with the EU’s Digital Health Strategy that is fostering innovation and sustainability.

Web-based delivery is the fastest-growing category, with a projected CAGR of 16.7% between 2022 and 2027, according to Frost & Sullivan. This growth is fueled by the increasing demand for user-friendly and accessible telemedicine platforms among small clinics and independent practitioners. These platforms require minimal setup and maintenance by making them ideal for smaller healthcare providers with limited IT resources. Additionally, partnerships with local health authorities have expanded access to underserved regions is ensuring equitable healthcare delivery. These factors collectively propel the segment’s rapid expansion.

By End-Users Insights

The tele-hospitals segment dominated the Europe telemedicine market share in 2024. The growth of this segment is attributed to be driven by the growing need for scalable healthcare solutions in hospital settings for managing chronic conditions and emergency care. A key factor fueling this dominance is the increasing burden on hospital infrastructure. According to Eurostat, hospital overcrowding remains a persistent issue, with occupancy rates exceeding 90% in major cities like London and Berlin. Tele-hospital platforms enable remote consultations and diagnostics by reducing the strain on physical facilities. For instance, a study by Philips Healthcare reveals that tele-hospital solutions reduced emergency room wait times by 25% in 2023 is improving patient satisfaction and outcomes. Another driving factor is the integration of advanced technologies like AI and IoT into hospital workflows. According to a report by Accenture, 60% of European hospitals adopted AI-driven diagnostic tools in 2023 by enhancing operational efficiency and accuracy. These innovations not only streamline processes but also align with the EU’s push for digital transformation in healthcare.

The tele-homes segment is likely to grow with a CAGR of 19.3% during the forecast period. This growth is fueled by the increasing preference for home-based healthcare solutions among elderly and chronically ill patients. According to a study by Mind, telehome services grew by 45% in 2023 is driven by features like remote monitoring and virtual consultations. These platforms cater to seniors by enabling them to receive timely care without physical visits. Additionally, government subsidies supporting home healthcare have amplified adoption by positioning tele-homes as a future-proof segment. These factors collectively propel the segment’s rapid expansion.

REGIONAL ANALYSIS

Germany was the top performer in the Europe telemedicine market with 22.3% of share in 2024. The country’s growth is driven by its robust healthcare infrastructure and favorable regulatory frameworks, supported by initiatives like the Digital Healthcare Act (DVG). A pivotal factor fueling this dominance is the widespread adoption of telemedicine in rural areas. According to Eurostat, teleconsultations reduced travel time for patients in underserved regions by 30% in 2023.

The UK Europe telemedicine market is estimated to have a CAGR of 9.7% during the forecast period. London and Manchester have emerged as critical hubs, supported by robust investments in digital health technologies. The rise of mHealth applications has significantly bolstered demand. According to App Annie, downloads of telemedicine apps in the UK grew by 50% in 2023, driven by features like virtual GP consultations and prescription deliveries. Additionally, partnerships with private insurers have expanded reimbursement options, further enhancing accessibility.

The French telemedicine market is likely to hold the prominent growth opportunities throughout the forecast period. Paris has emerged as a key player by hosting major telehealth startups and innovation hubs.

A major driver of this growth is the integration of AI-driven diagnostic tools. As per a study by Capgemini, 60% of French healthcare providers adopted AI-powered platforms in 2023 is improving diagnostic accuracy and efficiency. Additionally, government initiatives promoting telemedicine reimbursement have accelerated adoption by positioning France as a leader in digital healthcare.

KEY MARKET PLAYERS

A few of the prominent companies playing an active role in the European telemedicine market include AMD Global Telemedicine, CISCO Systems, Inc., Medtronic, Inc., GE Healthcare (U.K.), Honeywell Lifesciences, Philips Healthcare, McKesson Corp, Aerotel Medical Systems, CardioComm, and Cerner Corporation.

The Europe telemedicine market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like Teladoc Health, Babylon Health, and KRY International dominate the landscape, leveraging their extensive expertise in digital healthcare solutions. However, the market also features niche players specializing in mental health and chronic disease management, creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in AI, IoT, and blockchain to differentiate themselves. According to McKinsey, over 60% of European enterprises prioritize secure and scalable telemedicine solutions, intensifying competition among providers to offer cutting-edge technologies. Additionally, stringent EU regulations mandating data privacy have forced companies to innovate responsibly, further raising the stakes.

Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common in saturated markets like Germany and the UK. Despite these challenges, the market remains ripe for growth, with opportunities in emerging segments such as mental health and mHealth driving future competition.

Top Players in the Europe Telemedicine Market

Teladoc Health

Teladoc Health is a global leader in the telemedicine market, playing a pivotal role in shaping the Europe segment. The company offers comprehensive virtual care solutions, including mental health services and chronic condition management. Its focus on AI-driven diagnostics and scalable platforms has positioned it as a trusted partner for healthcare providers.

Babylon Health

Babylon Health specializes in AI-powered telemedicine platforms, offering services such as virtual consultations and remote monitoring. The company’s emphasis on preventive care and data analytics has earned it a loyal customer base. Babylon’s partnerships with NHS England and other national health systems have amplified its reach is reinforcing its dominance in digital healthcare innovation.

KRY International

KRY International is renowned for its user-friendly telemedicine app, which connects patients with licensed physicians via video consultations. The company’s focus on expanding access to underserved regions has made it a leader in rural healthcare delivery. KRY has ensured compliance with regional regulations while maintaining high standards of care by integrating with local health systems.

Top Strategies Used by Key Market Participants

Strategic Partnerships

Leading players in the Europe telemedicine market have embraced strategic partnerships to expand their reach and enhance service offerings. For instance, collaborations with insurance providers enable companies to offer comprehensive reimbursement options, fostering broader adoption. These alliances not only foster innovation but also ensure compliance with EU regulations by strengthening their competitive edge.

Investment in R&D

Investments in research and development are a cornerstone strategy for staying ahead in the market. Companies are focusing on developing AI-driven diagnostic tools and IoT-enabled devices that cater to evolving patient needs. This approach allows them to address challenges such as interoperability and scalability while maintaining its domianance in technological advancements.

Geographic Expansion

Expanding into emerging markets within Europe, such as Eastern Europe and Scandinavia, has become a priority for key players. By establishing localized services and partnerships, companies can better serve regional demands while capitalizing on favorable regulatory frameworks. This strategy ensures sustained growth amid intensifying competition.

RECENT MARKET DEVELOPMENTS

- In March 2024, Teladoc Health partnered with NHS Scotland to expand its virtual care services in rural areas. This initiative aims to enhance accessibility and reduce hospital overcrowding.

- In June 2023, Babylon Health launched an AI-driven mental health platform in France, designed to provide personalized therapy sessions. This move underscores the company’s commitment to addressing mental health challenges.

- In September 2023, KRY International introduced a multilingual telemedicine app in Switzerland, targeting expatriates and cross-border workers. This launch seeks to capitalize on the growing demand for accessible healthcare solutions.

- In January 2024, Philips Healthcare acquired a Dutch startup specializing in IoT-enabled wearables, enhancing its remote monitoring capabilities. This acquisition strengthens Philips’ position in the telemedicine market.

- In November 2023, Siemens Healthineers unveiled its cloud-based telemedicine platform in Germany, designed to support real-time data sharing between hospitals. This initiative positions Siemens as a leader in interoperable healthcare solutions.

MARKET SEGMENTATION

This research report on the Europe telemedicine market is segmented and sub-segmented based on type, application, delivery mode, end-users and region.

By Type

- Technology

- Hardware

- Software

- Telecommunications

- Service

- Remote Patient Monitoring

- Store-and-Forward

- Real-Time Interactive

By Application

- Tele-Cardiology

- Tele-Radiology

- Tele-Pathology

- Tele-Dermatology

- Tele-Neurology

- Emergency Care

- Home Health

- Others

By Delivery Mode

- Web-Based

- Cloud-Based

- Others

By End-Users

- Tele-Hospitals

- Tele-Homes

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the future outlook for the Europe Telemedicine Market?

The Europe Telemedicine Market is expected to continue growing, with increased adoption, technological advancements, and evolving regulations. It will likely play a crucial role in the future of healthcare delivery in the region.

Is telemedicine in Europe covered by health insurance?

Telemedicine coverage by health insurance varies. Many insurance providers in Europe are beginning to include telemedicine services in their policies, but the extent of coverage may differ.

Are there regulatory barriers to telemedicine in Europe?

Telemedicine in Europe is subject to various regulations that vary from country to country. While some regions have well-established regulatory frameworks, others are still evolving.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]