Europe Tannin Market Size, Share, Trends & Growth Forecast Report By Source, Product, Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Tannin Market Size

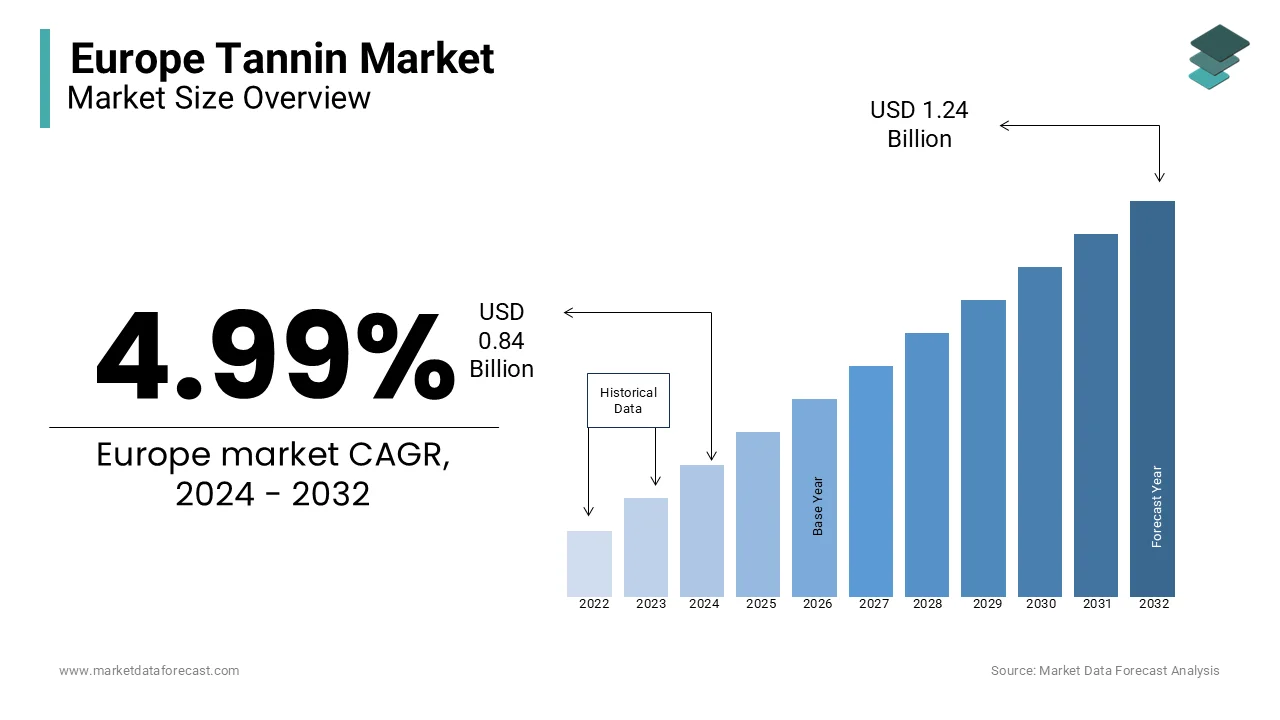

The tannin market size in Europe was valued at USD 839.92 million in 2024. The European market is expected to grow at a CAGR of 4.99% from 2025 to 2033 and be worth USD 1.30 billion by 2033 from USD 881.83 billion in 2025.

Tannins are natural polyphenolic compounds extracted from plant sources, including tree bark, fruits, and leaves. Due to their astringent properties, Tannins are widely used in leather tanning as they stabilize animal hides and enhance durability. The robust leather and wine industries of Europe significantly contribute to the European tannin market. According to the European Commission, the EU leather sector is valued at approximately €50 billion. Similarly, the European wine industry produces nearly 60% of the world’s wine and relies heavily on tannins for quality enhancement.

MARKET DRIVERS

The Growing Leather Industry in Europe

The robust leather industry in Europe is a primary driver of the tannin market. Tannins are essential in leather tanning processes. According to the European Commission, the EU leather sector contributes approximately €50 billion annually to Europe's economy. The demand for high-quality leather products, including footwear, automotive interiors, and luxury goods, is fuelling the use of tannins to enhance leather durability and texture. Additionally, sustainable practices are encouraging the adoption of plant-derived tannins, which aligns with the shift of industry toward eco-friendly leather processing methods.

Growing Wine Production and Consumption

The reliance of the wine industry on tannins for flavor, aging, and preservation is another significant market driver. According to the data from the International Organization of Vine and Wine, Europe produces nearly 60% of the world’s wine. France, Italy, and Spain dominate global wine production and contribute over 50% together. Tannins are naturally present in grape skins and seeds and are vital in improving the taste, texture, and longevity of wine. The increasing global demand for European wines, especially premium varieties, further promotes the demand for tannin in Europe and propels the regional market growth.

MARKET RESTRAINTS

High Costs of Tannin Extraction and Processing

The extraction and processing of tannins from plant sources, such as oak, chestnut, and quebracho, involve labor-intensive and time-consuming procedures and result in high production costs. According to the European Commission, the cost of sustainably sourcing raw materials and complying with stringent environmental regulations adds to the financial burden on manufacturers. This expense limits the adoption of tannins, particularly among small-scale producers in the leather and wine industries. Furthermore, competition from synthetic substitutes that are often more cost-effective and potentially reduces the competitiveness of tannin-based products in certain applications.

Availability of Alternative Solutions

The availability of synthetic and alternative compounds poses a challenge to the tannin market in Europe. In the leather industry, synthetic tanning agents, such as chromium salts, offer faster and more economical solutions despite their environmental drawbacks. As per the reports of the European Chemicals Agency, chromium-based tanning still dominates over 80% of the global leather tanning process and creates stiff competition for plant-based tannins. Similarly, advancements in chemical stabilizers and flavor enhancers in the wine industry can reduce the reliance on natural tannins. These alternatives and their lower costs pose a significant hurdle to the widespread adoption of tannins in Europe.

MARKET OPPORTUNITIES

Rising Demand for Eco-Friendly Leather Alternatives

The increasing emphasis on sustainable practices in the leather industry creates opportunities for plant-derived tannins as eco-friendly alternatives to synthetic tanning agents. The European Green Deal aims to make Europe climate-neutral by 2050 by promoting sustainable and environmentally responsible industrial practices. According to the European Commission, consumer demand for sustainable leather products has surged and is driving the adoption of natural tanning methods. Plant-based tannins that reduce reliance on harmful chemicals such as chromium align with this shift and offer manufacturers a competitive edge while meeting regulatory and consumer expectations for green solutions.

Expanding Use in Nutraceuticals and Pharmaceuticals

The health benefits of tannin present a growing opportunity for their use in nutraceutical and pharmaceutical applications. Tannins are being explored for cardiovascular health, digestive support, and cancer prevention due to their antioxidant, anti-inflammatory, and antimicrobial properties. According to the European Food Safety Authority, the interest in tannin-based supplements is growing due to their natural origin and therapeutic potential. The European nutraceutical market exceeded €45 billion in 2022 and is providing a lucrative avenue for tannin manufacturers to diversify beyond traditional applications by leveraging health-conscious consumer trends and the demand for plant-based, functional ingredients.

MARKET CHALLENGES

Limited Availability of High-Quality Raw Materials

The availability of premium raw materials for tannin extraction, such as oak, chestnut, and quebracho, is constrained by deforestation concerns and sustainable sourcing challenges. According to the European Environment Agency, forest cover in Europe has been under pressure due to increased logging activities and land-use changes, and this is reducing the availability of natural resources. Sustainable forestry practices are essential and often result in higher raw material costs, which limits the production capacity of tannin manufacturers. This scarcity and cost escalation can hinder the consistent supply of tannins for industries like leather and wine production and pose a bottleneck for market expansion in Europe.

Competition from Synthetic Alternatives

Synthetic alternatives continue to challenge the adoption of natural tannins across various applications. Chromium-based tanning agents dominate due to their faster processing times and lower costs in the leather industry, despite environmental concerns. As per the reports of the European Chemicals Agency, more than 80% of global leather production relies on chromium tanning. Similarly, chemical stabilizers and artificial flavoring agents offer cost-effective solutions that rival the functionality of natural tannins in the wine industry. These synthetic options create significant barriers for tannin producers to capture market share and promote their products as viable substitutes.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.99% |

|

Segments Covered |

By Source, Product, Application, and Country |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Countries Covered |

The UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Kerry Group PLC, Ajinomoto Co., Inc., ADM Company, Givaudan, Koninklijke DSM N.V, Tate & Lyle PLC, Lesaffre Group, AngelYeast Co., Ltd, Cargill Inc., and Sensient Technologies Corp. |

REGIONAL ANALYSIS

Italy dominated the tannin market in Europe in 2023. Italy is the leader in the leather and wine industries among the European countries. According to the statistics of the International Organization Vine and Wine, Italy is the largest wine producer globally and accounts for 18% of global wine output. Italian wines heavily rely on tannins to enhance flavor and aging properties. Additionally, Italy's leather sector is a significant contributor to the EU’s €50 billion leather market. The strong focus of Italy on sustainable practices in these industries is further strengthening Italy's position in the European market.

France holds a prominent position in the European tannin market. According to the International Organisation of Vine and Wine, France accounts for 17% of global wine production and heavily uses tannins for aging and flavor profiles in wine. Additionally, the French pharmaceutical and nutraceutical sectors are expanding and incorporating tannins for their antioxidant and therapeutic properties. The commitment of France to sustainability and eco-friendly manufacturing practices further drives demand for natural tannins, particularly in replacing synthetic chemicals.

Spain ranks among the top countries in the European tannin market. As the world’s third-largest wine producer, Spain relies on tannins to meet domestic and international demand for quality wines. According to the Spanish Leather Centre, the leather industry of Spain contributes significantly to the production of the EU.

KEY MARKET PLAYERS

Tannin Corporation, Forestal Mimosa Ltd, S.A. Ajinomoto OmniChem W. Ulrich GmbH, Tanac S.A, Ever s.r.l., Silvateam SpA, Polson Ltd, and Laffort S.A. are a few of the promising companies in the Europe tannin market.

RECENT DEVELOPMENTS IN THE MARKET

- In May 2018, Rehap collaborated with the Bio Base Europe (BBEPP) pilot plant in Belgium to develop and expand the extraction of hot water from tannin.

MARKET SEGMENTATION

This research report on the European tannin market is segmented and sub-segmented into the following categories.

By Source

- Plants

- Brown Algae

By Product

- Hydrolyzable

- Non-Hydrolyzable

- Florotannins

By Application

- Leather Tanning

- Wine Production

- Wood Adhesives

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]