Europe Tablet Market Size, Share, Trends, & Growth Forecast Report By Product Type (Detachable Tablet and Slate Tablet), End-Use (Consumer and Commercial), Operating System (Android, iOS, and Windows), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Tablet Market Size

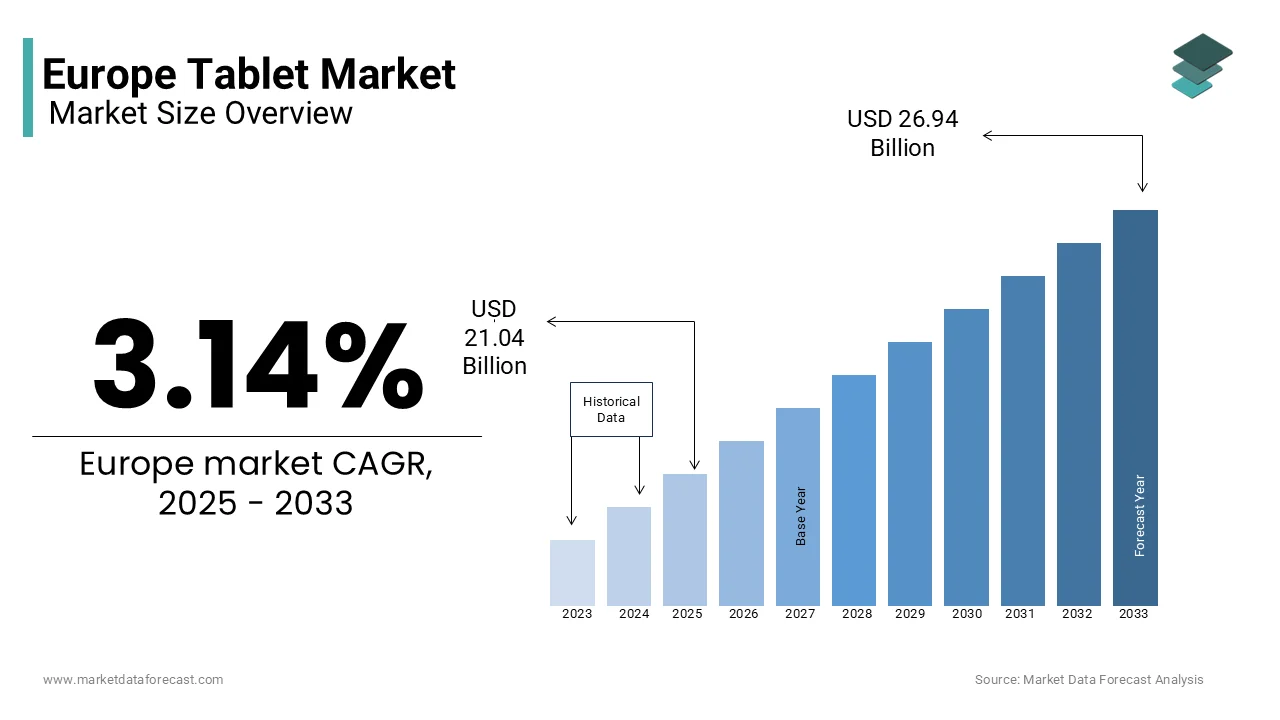

The Europe tablet market was worth USD 20.40 billion in 2024. The Europe market is projected to reach USD 26.94 by 2033 from USD 21.04 billion in 2025, growing at a CAGR of 3.14% from 2025 to 2033.

Tablets are defined as portable computing devices featuring touchscreen interfaces and offering functionalities between smartphones and laptops, have become integral to both personal and professional use across the region. The European tablets market has experienced fluctuating growth patterns and driven by factors such as technological advancements, shifting consumer preferences, and macroeconomic conditions. Despite a slowdown in demand post-pandemic, the market continues to adapt owing to the innovations in hybrid work models, education technology, and entertainment consumption.

According to a report by International Data Corporation, the European tablet market witnessed a shipment decline of approximately 9.8% in 2023 compared to the previous year, with total units shipped estimated at 31.5 million. This contraction is attributed to market saturation and elongated replacement cycles, as consumers increasingly prioritize durability and multifunctionality in their devices. However, the demand for premium tablets, particularly those equipped with advanced features such as 5G connectivity, enhanced processing power, and stylus support, has shown resilience. Brands like Apple, Samsung, and Lenovo dominate the market, collectively holding over 70% of the market share in 2023, as highlighted by Statista.

The European tablet market is also being impacted by the regional variations, with Western Europe accounting for the majority of sales, while Eastern Europe exhibits slower adoption rates due to economic disparities. Furthermore, the integration of tablets into educational frameworks and enterprise solutions continues to present growth opportunities.

MARKET DRIVERS

Adoption of Tablets in Education Systems

The integration of tablets into Europe’s education systems has become a major driver of market growth. Governments and educational institutions are prioritizing digital transformation, with tablets playing a pivotal role in modernizing learning environments. According to the European Commission’s Digital Education Action Plan, over 60% of EU schools had adopted digital devices, including tablets, by 2023. National initiatives, such as Germany’s DigitalPakt Schule, have further bolstered this trend, with €6.5 billion allocated to enhance digital infrastructure in schools. The pandemic accelerated the adoption of remote learning tools, and tablets have since become indispensable for fostering digital literacy and interactive education, ensuring sustained demand in this sector.

Rise of Hybrid Work Models

The shift toward hybrid work models has significantly driven the demand for tablets in Europe. Eurostat data reveals that nearly 40% of employed individuals in the EU worked remotely in 2023, a substantial increase from 20% before the pandemic. Tablets, known for their portability and multifunctionality, have become essential tools for professionals navigating between office and home-based work. IDC Europe reports a 12% growth in tablet shipments for business use in 2023, highlighting their importance in enabling workforce mobility and productivity. As organizations continue to embrace flexible work arrangements, tablets are increasingly seen as critical devices for collaboration and efficiency in the evolving work landscape.

MARKET RESTRAINTS

Technological Advancements and Consumer Reluctance to Upgrade

The rapid pace of technological advancements in the tablet market has led to consumer hesitation in upgrading their devices. Many consumers expect new models with improved features to be released soon, leading to delayed purchases. In 2022, nearly 30% of employed individuals in the European Union aged 15-74 used digital devices for their entire or most of their working time. This high level of usage indicates that consumers may be satisfied with their current tablets, which contributes to slower market growth. The fear of obsolescence and constant updates in technology discourage frequent purchases of new tablets, thereby restraining market expansion (Source: Eurostat).

High Cost of Premium Tablets

Another major restraint in the European tablet market is the high cost of premium tablets. Many advanced models are priced out of the reach of average consumers, making them less accessible. In 2024, a report from the European Union revealed that 16% of users encountered technical problems, 14% faced usability issues, and 7% struggled with digital identification on public authority websites. These challenges, coupled with high prices, lead to decreased consumer confidence in investing in new tablets. The combination of cost and perceived usability issues discourages many consumers from purchasing newer or more expensive models

MARKET OPPORTUNITIES

Increasing Adoption of Tablets in Educational Institutions

The European tablet market is witnessing significant growth due to the rising adoption of tablets in educational institutions. According to Eurostat, over 85% of students in the European Union now have access to digital learning tools, with tablets being a preferred choice for their portability and interactive capabilities. The European Commission's Digital Education Action Plan highlights that investments in EdTech are expected to grow by 15% annually through 2025. Government initiatives, such as Germany’s "DigitalPakt Schule," which allocated €5 billion for digital infrastructure in schools, further underscore this trend. As remote and hybrid learning models become more prevalent, the demand for tablets in education is set to surge, offering manufacturers a substantial growth opportunity in the region.

Growing Demand for Tablets Among Elderly Users

Another key opportunity in the European tablet market is the increasing demand among elderly users, driven by aging populations and improved digital literacy. The World Health Organization reports that Europe has the highest proportion of people aged 65 and above, accounting for 20% of the population. Tablets are becoming essential for telehealth services, entertainment, and communication among seniors. A report by the UK Office for National Statistics shows that 70% of adults aged 65-74 used the internet daily in 2022, up from 52% in 2015. Initiatives like France’s "Silver Economy" strategy promote digital inclusion for older adults, creating a growing market for senior-friendly tablets. This demographic shift presents a promising opportunity for manufacturers to develop tailored products catering to this segment.

MARKET CHALLENGES

Intense Market Competition and Price Pressure

The European tablet market faces significant challenges due to intense competition and price pressure, driven by the presence of numerous global and regional players. According to the European Audiovisual Observatory, the market is dominated by brands like Apple, Samsung, and Lenovo, which collectively hold over 70% of the market share. This saturation has led to aggressive pricing strategies, squeezing profit margins for manufacturers. Additionally, Eurostat highlights that consumer spending on electronics in Europe grew by only 2.3% in 2022, reflecting cautious spending amid economic uncertainties. The rising cost of raw materials, such as semiconductors, further exacerbates the situation, with the European Commission reporting a 20% increase in semiconductor prices since 2021. These factors make it challenging for smaller brands to compete, leading to consolidation and reduced innovation in the market.

Environmental Regulations and Sustainability Concerns

Another major challenge for the European tablet market is the increasing focus on environmental regulations and sustainability. The European Environment Agency states that e-waste in Europe reached 12 million metric tons in 2021, with tablets contributing significantly to this figure. To address this, the European Union’s Ecodesign Directive mandates stricter energy efficiency and recyclability standards for electronic devices, increasing compliance costs for manufacturers. Furthermore, the European Commission’s Circular Economy Action Plan emphasizes reducing electronic waste by 50% by 2030, pushing companies to adopt sustainable practices. A report by the International Energy Agency highlights that producing a single tablet generates approximately 100 kg of CO2 emissions, pressuring brands to innovate eco-friendly designs. These regulatory and environmental challenges require significant investment, impacting profitability and operational flexibility for market players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.14% |

|

Segments Covered |

By Product Type, End-Use, Operating System, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Apple Inc., Lenovo Group Ltd., Samsung Electronics Co. Ltd., AsusTek Computer Inc., LG Corporation, Acer Inc., Xiaomi Group, Nokia Corporation, Hewlett Packard Enterprise Development LP, Microsoft Corporation, and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The slate tablets segment held 55.9% of the European market share in 2024. The affordability and simplicity of slate tablets make them ideal for entertainment, which is one of the key factors propelling the expansion of the slate tablets segment in the European market. According to the UK Office for National Statistics, 70% of slate tablet users primarily use them for streaming and gaming. Despite declining demand, their widespread adoption in households ensures their leading position. However, their limited functionality compared to detachable tablets restricts their use in professional settings. The European Audiovisual Observatory notes that slate tablets remain popular among budget-conscious consumers, accounting for 60% of first-time tablet buyers. This segment's importance lies in its accessibility, bridging the digital divide by offering affordable technology.

The detachable tablets segment is rapidly growing and is estimated to grow at a CAGR of 18.4% over the forecast period. Their versatility appeals to professionals and students, driven by remote work and e-learning trends. Eurostat highlights that 45% of European businesses now use hybrid devices, boosting detachable tablet adoption. The International Energy Agency notes that these tablets enhance productivity, with 80% of users citing improved multitasking. Their compatibility with keyboards and advanced software positions them as a replacement for traditional laptops. As Europe’s workforce embraces flexibility, detachable tablets are pivotal in driving innovation and meeting evolving consumer needs.

By End-Use Insights

The consumer segment occupied for the largest share of 65.8% of the European market share in 2024. The dominance of the consumer segment is primarily driven by the widespread use of tablets for entertainment, online shopping, and personal productivity. The UK Office for National Statistics reports that over 70% of households in Europe own at least one tablet, with consumer demand fueled by affordable pricing and ease of use. Tablets are particularly popular among younger demographics, with 80% of users aged 16-34 using them daily for streaming and gaming, as per the European Audiovisual Observatory. The consumer segment's importance lies in its ability to drive mass-market adoption, making tablets a staple in European households. However, competition from smartphones and laptops poses challenges to sustained growth.

The commercial end-use segment is anticipated to witness the highest CAGR of 12.8% over the forecast period owing to the increasing adoption of tablets in industries such as healthcare, retail, and education. Eurostat highlights that 40% of European businesses now use tablets for tasks like inventory management, customer service, and telehealth consultations. The International Labour Organization notes that tablets improve workplace efficiency by 25%, making them indispensable in modern enterprises. Additionally, government initiatives like Germany’s "DigitalPakt Schule" have boosted tablet usage in educational institutions. As businesses embrace digital transformation, the commercial segment's rapid growth underscores its critical role in enhancing productivity and operational flexibility across industries.

By Operating System Insights

The android segment accounted for the 50.7% of the European market share in 2024. The dominance of the android segment is majorly attributed to its affordability and compatibility with a wide range of devices, making it accessible to budget-conscious consumers. The European Audiovisual Observatory highlights that Android tablets are particularly popular in emerging markets within Europe, where cost-effective solutions are prioritized. Additionally, Android's open-source nature allows for extensive customization, appealing to both individual users and businesses. A report by the UK Office for National Statistics reveals that 60% of first-time tablet buyers opt for Android devices due to their lower price points compared to iOS and Windows alternatives. This segment's importance lies in its ability to cater to a broad audience, driving mass adoption across Europe.

The windows segment is expected to register a CAGR of 14.9% over the forecast period due to the increasing demand for productivity-focused devices in commercial and educational sectors. Eurostat data shows that 40% of businesses in Europe now use Windows tablets for tasks like document editing, project management, and video conferencing, leveraging their seamless integration with Microsoft Office and enterprise software. The International Data Corporation (IDC) highlights that the shift toward hybrid work models has boosted Windows tablet adoption, as they offer laptop-like functionality. Furthermore, government initiatives promoting digital education have increased Windows tablet usage in schools. This segment's rapid growth underscores its critical role in meeting the evolving needs of professionals and students alike.

REGIONAL ANALYSIS

Germany captured the leading share of 22.5% in the European market in 2024. The strong digital transformation initiatives, such as the "DigitalPakt Schule," that €5 billion for educational technology, boosting tablet adoption in schools, which is driving the German market growth. The German Federal Ministry for Economic Affairs highlights that the country’s robust manufacturing sector also drives commercial tablet usage for logistics and automation. Additionally, Germany’s high internet penetration rate of 96%, as reported by the International Telecommunication Union, supports widespread tablet usage. With a tech-savvy population and significant government investment in digital infrastructure, Germany remains a key driver of tablet in Europe, setting benchmarks for innovation and accessibility.

The tablet market in the United Kingdom is predicted to showcase a promising CAGR during the forecast period. The high consumer spending on electronics, with tablets being a preferred device for entertainment and remote work is boosting the tablet market expansion in the UK. The British Retail Consortium reports that online retail growth has surged by 15% annually, driving demand for tablets as shopping tools. Furthermore, the UK’s focus on digital education, supported by initiatives like the "EdTech Strategy," has increased tablet adoption in schools. Eurostat highlights that 80% of UK households own a tablet, reflecting its integral role in daily life. The UK’s advanced digital ecosystem and strong commercial adoption make it a pivotal player in the European tablet market.

France is likely to hold a notable share of the European market during the forecast period owing to the emphasis on sustainability and innovation, according to the French Ministry of Economy. The country’s "Silver Economy" strategy promotes digital inclusion for seniors, increasing tablet adoption among older adults. Additionally, France’s strict environmental regulations, enforced by the French Environment and Energy Management Agency, encourage manufacturers to produce eco-friendly tablets, appealing to environmentally conscious consumers. Eurostat notes that France’s e-commerce sector grew by 20% in 2022, further boosting tablet demand. With initiatives like "France Relance" investing €7 billion in digital infrastructure, France is fostering a tech-forward environment. This combination of sustainability, innovation, and digital growth solidifies France’s position as a leading tablet market in Europe.

KEY MARKET PLAYERS

The major players in the Europe tablet market include Apple Inc., Lenovo Group Ltd., Samsung Electronics Co. Ltd., AsusTek Computer Inc., LG Corporation, Acer Inc., Xiaomi Group, Nokia Corporation, Hewlett Packard Enterprise Development LP, Microsoft Corporation, and Others.

TOP 3 PLAYERS IN THE MARKET

The European tablet market is led by Apple, Samsung, and Microsoft. Apple dominates the tablet market in Europe. Samsung excels in Android-based tablets, achieving a 25% market share in consumer segments, as stated in their performance metrics. Microsoft plays a pivotal role in commercial applications, with a 20% share in enterprise settings, as highlighted in their financial disclosures. These players collectively drive innovation and shape the future of the tablet market globally.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the European tablet market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Apple launched the iPad Pro with M2 chips in 2022, designed to enhance processing power and appeal to professionals, as outlined in their innovation roadmap. Samsung partnered with European educational institutions to supply tablets for virtual classrooms, achieving a 20% increase in sales, as stated in their market strategy document. Microsoft focused on expanding its Surface Pro lineup, investing €1 billion in R&D to meet growing demand for productivity tools, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

COMPETITIVE LANDSCAPE

The European tablet market is highly competitive, characterized by the presence of global giants and regional innovators. Apple, Samsung, and Microsoft dominate the landscape, leveraging their expertise in design, functionality, and ecosystem integration. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as budget-friendly devices and ruggedized tablets. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of technological advancements, requiring companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Apple launched the iPad Pro with M2 chips, designed to enhance processing power for professional use.

- In June 2023, Samsung partnered with European educational institutions to supply tablets for virtual classrooms, achieving a 20% increase in sales.

- In January 2024, Microsoft acquired a startup specializing in AI-driven productivity tools, aiming to expand its Surface Pro lineup.

- In September 2023, Huawei collaborated with Spanish schools to deploy 500,000 tablets, enhancing e-learning accessibility.

- In November 2023, Xiaomi invested €300 million in expanding its budget tablet production capacity, focusing on affordability and functionality.

MARKET SEGMENTATION

This research report on the Europe tablet market has been segmented and sub-segmented into the following categories.

By Product Type

- Detachable Tablet

- Slate Tablet

By End-Use

- Consumer

- Commercial

By Operating System

- Android

- iOS

- Windows

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the Europe tablet market?

The Europe tablet market is driven by increasing demand for remote work and online learning, advancements in tablet technology, rising digitalization in businesses, and growing consumer preference for portable computing devices.

Which tablet operating systems dominate the European market?

iOS and Android are the dominant operating systems in the European tablet market, with Windows tablets also having a presence in the business and professional segments.

What are the latest trends in the Europe tablet market?

Key trends include the rise of 2-in-1 detachable tablets, growing adoption of tablets in education, improved stylus and productivity features, and the expansion of 5G-enabled tablets.

Which industry sectors are driving tablet sales in Europe?

The education sector, healthcare industry, corporate businesses, and creative professionals are the major drivers of tablet sales in Europe, with increasing reliance on digital tools.

What impact does 5G technology have on the Europe tablet market?

5G technology is boosting tablet adoption by enabling faster internet connectivity, improved video streaming, and seamless remote work and learning experiences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]